|

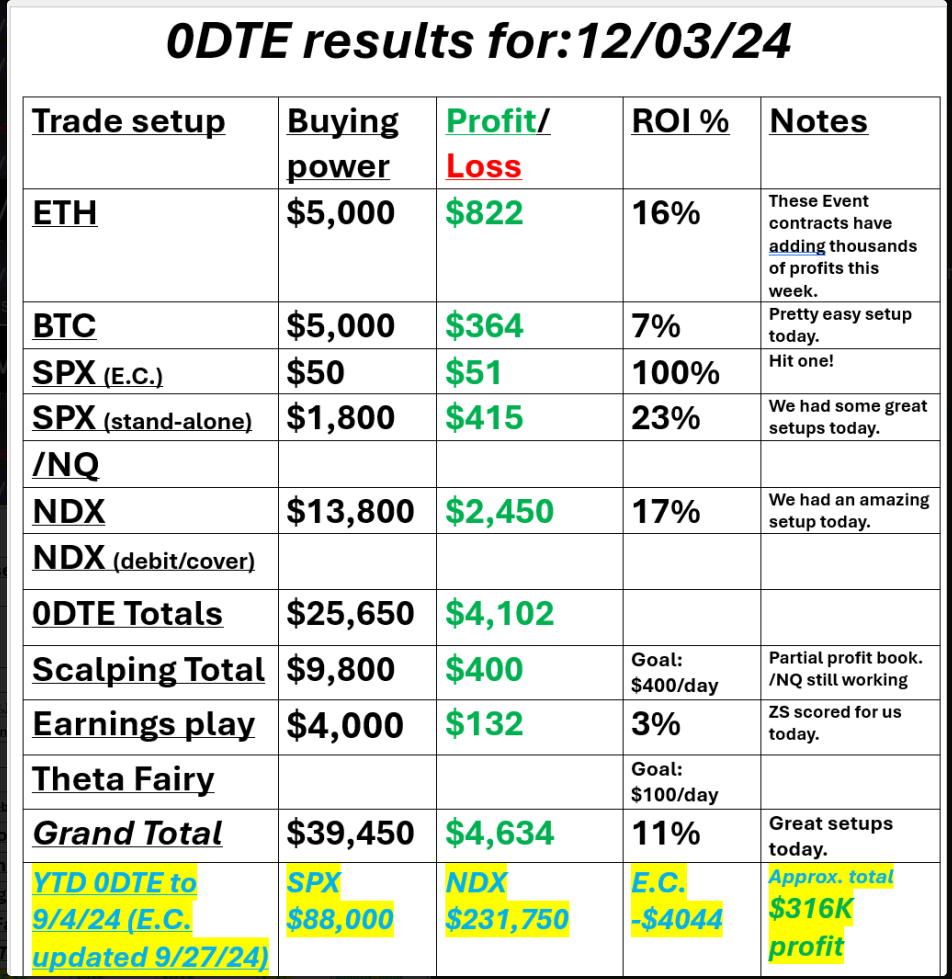

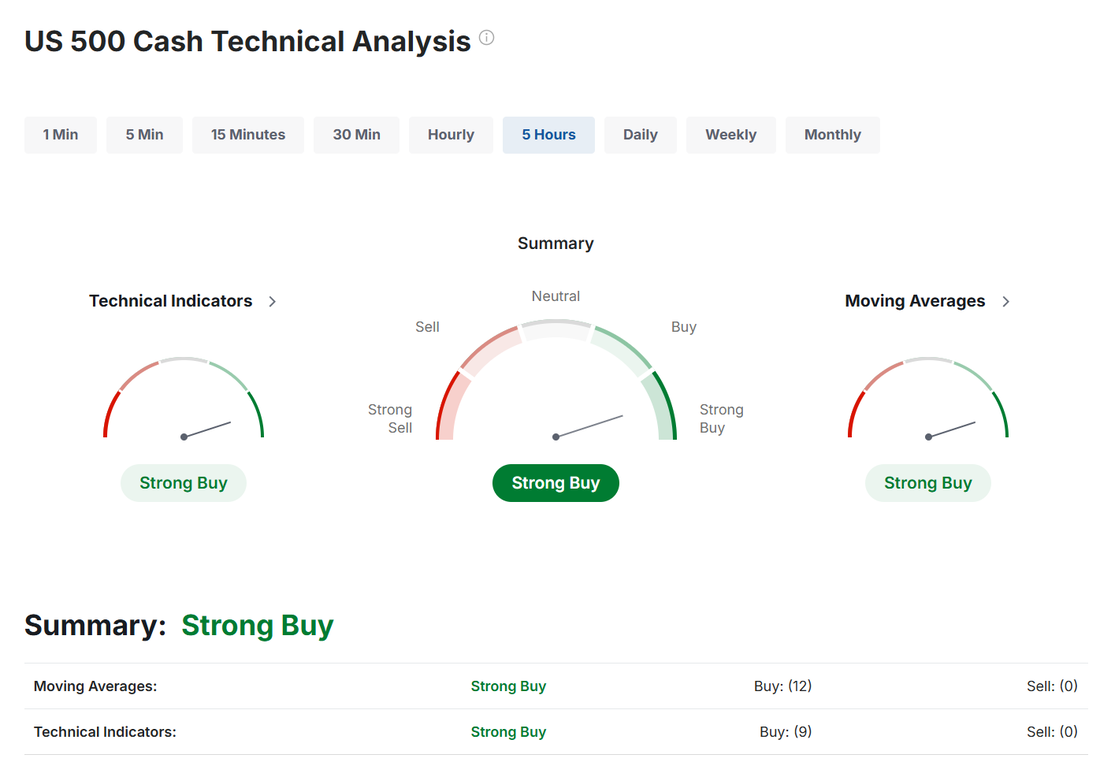

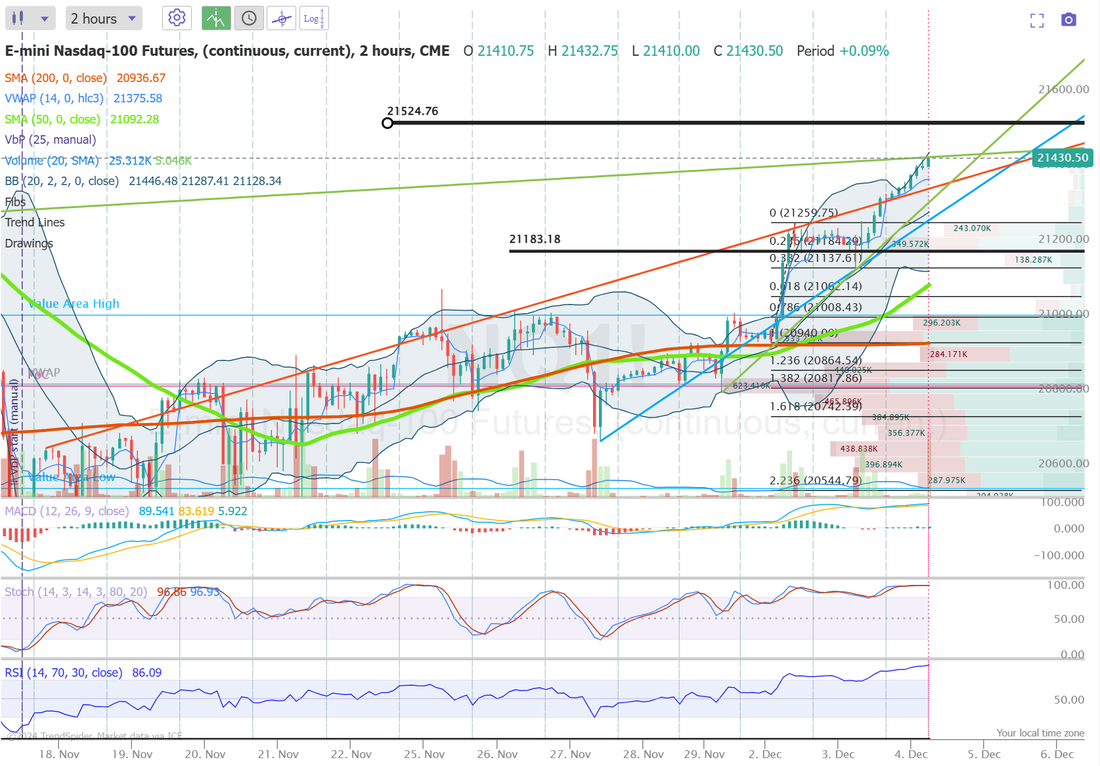

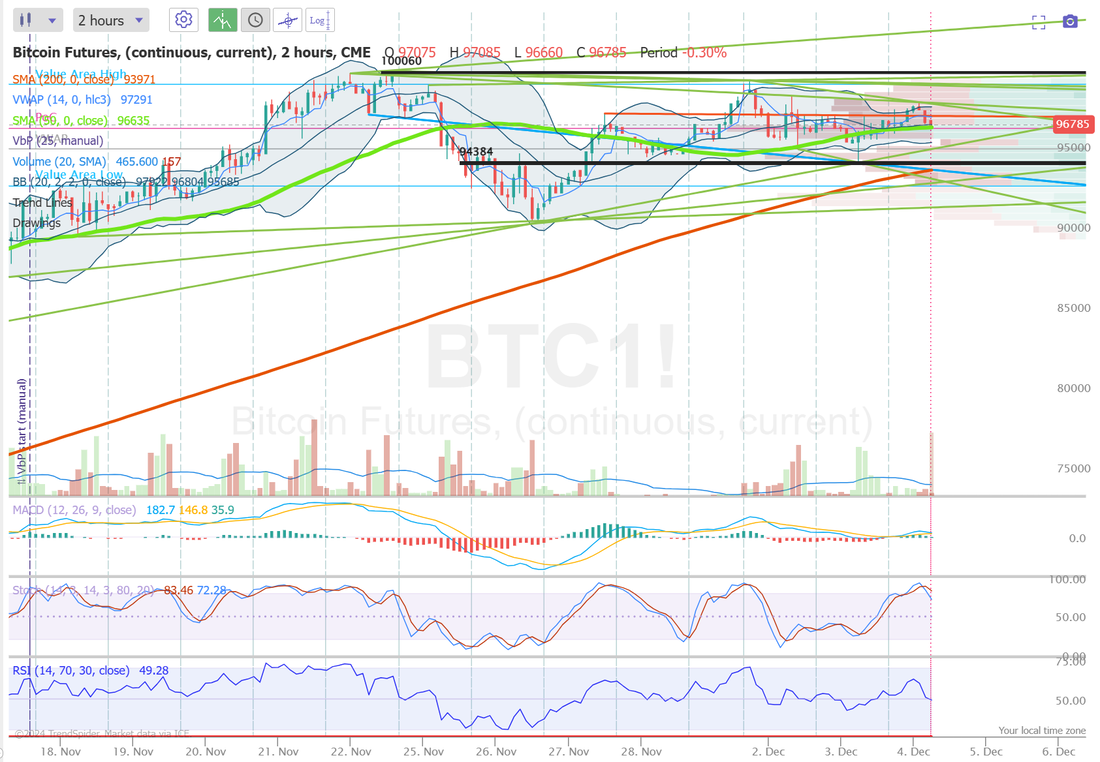

Welcome back traders to Wednesday! We had a really nice result yesterday and it was all in the setups. It's been very challenging in this low I.V. world we are currently living in but we made it work. I will also say that the event contracts 0DTES...when the setup is there, and its not always there, man...they are tremendous in terms of risk/reward. Check out our results below: Let's take a look at the market: My bias or lean is bullish. Surprise surprise! Really, what else can you be right now. Are we overstretched to the upside? Are we due for a pullback after continually ripping to the upside for the past week? Probably but...there's no sign of it happening quite yet. December S&P 500 E-Mini futures (ESZ24) are trending up +0.24% this morning as investors awaited a fresh batch of U.S. economic data and remarks from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the tech-heavy Nasdaq 100 notching a new all-time high. Palantir Technologies (PLTR) climbed over +6% and was the top percentage gainer on the S&P 500 after announcing it was granted FedRAMP High Authorization for two of its cloud-based services. Also, AT&T (T) advanced more than +4% after unveiling its three-year strategy. In addition, Credo Technology (CRDO) jumped over +47% after the technology company posted upbeat FQ2 results and issued strong FQ3 revenue guidance. On the bearish side, Microchip Technology (MCHP) slumped -7% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company lowered its FQ3 revenue forecast and said it would close a plant in Arizona. Also, Zscaler (ZS) slid more than -4% after the cloud-based cybersecurity platform provided a soft FQ2 forecast. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings increased to 7.744M in October, stronger than expectations of 7.510M. “In the context of a gradually cooling labor market on the cusp of a soft landing, [Tuesday’s] JOLTS report is about as good as can reasonably be expected. Layoffs remained low and openings ticked up alongside quits - signs that employer and job seeker confidence, respectively, are improving,” said Cory Stahle, an economist at Indeed Hiring Lab. Fed Governor Adriana Kugler on Tuesday voiced confidence in the direction of inflation and broader economic conditions, while emphasizing that the Fed’s policy decisions remain data-dependent. “The labor market remains solid, and inflation appears to be on a sustainable path to our 2% goal, even if there have been some bumps along the way,” Kugler said. Also, San Francisco Fed President Mary Daly stated that an interest rate cut this month is not guaranteed but remains on the table. “Whether it’ll be in December or sometime later, that’s a question we’ll have a chance to debate and discuss in our next meeting, but the point is we have to keep policy moving down to accommodate the economy,” Daly said. In addition, Chicago Fed President Austan Goolsbee said, “Over the next year it feels to me like rates come down a fair amount from where they are now.” U.S. rate futures have priced in a 73.8% chance of a 25 basis point rate cut and a 26.2% chance of no rate change at the conclusion of the Fed’s December meeting. Meanwhile, Fed Chair Jerome Powell is scheduled to participate in a moderated discussion at the New York Times DealBook Summit later in the day. Market participants will look for any hints about whether the central bank will cut rates in December. Also, St. Louis Fed President Alberto Musalem will speak today. On the earnings front, notable companies like Chewy (CHWY), Campbell Soup (CPB), Dollar Tree (DLTR), Foot Locker (FL), Hormel Foods (HRL), Five Below (FIVE), and Synopsys (SNPS) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the November ADP Nonfarm Employment Change will stand at 152K, compared to the October figure of 233K. Investors will also focus on the U.S. ISM Non-Manufacturing PMI and the S&P Global Services PMI. Economists foresee the November ISM Non-Manufacturing PMI to arrive at 55.7 and the S&P Global Services PMI to be 57.0, compared to the previous values of 56.0 and 55.0, respectively. U.S. Factory Orders data will come in today. Economists forecast this figure to be +0.2% m/m in October, compared to the previous number of -0.5% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.6M, compared to last week’s value of -1.8M. Later today, the Federal Reserve will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Federal Reserve districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.254%, up +0.74%. Trade docket for today: CAVA?, CHWY, CRM, DLTR, FDX?, IWM , MRVL, FIVE, 0DTE's Let's take a look at the intra-day levels for our 0DTE's today: /ES: Range is tightening up. Indicators look stretched to the upside with overbought readings abundant. 6080 would be the first upward target with 6095 being the top of the expected range for today. 6048 is support now. /NQ: The Nasdaq finally had it's break out move and hit new ATH's. It also caught up with the momentum of the SPX. 21,525 is the upper expected move today on the resistance side with 21,183 acting as new support. BTC: We've had some tremendous results with Bitcoin lately. We went almost two weeks without finding a setup and lately it's just been wonderful. Patience and sitting on your hands when the trade isn't there is hard to do but pays off...eventually. Our range today is exactly the same as yesterday. 100,080 resistance with 94,384 support. Yesterday was incredibly active with putting on trades all day. Today will be a bit more mild. I look forward to seeing you all in the trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |