|

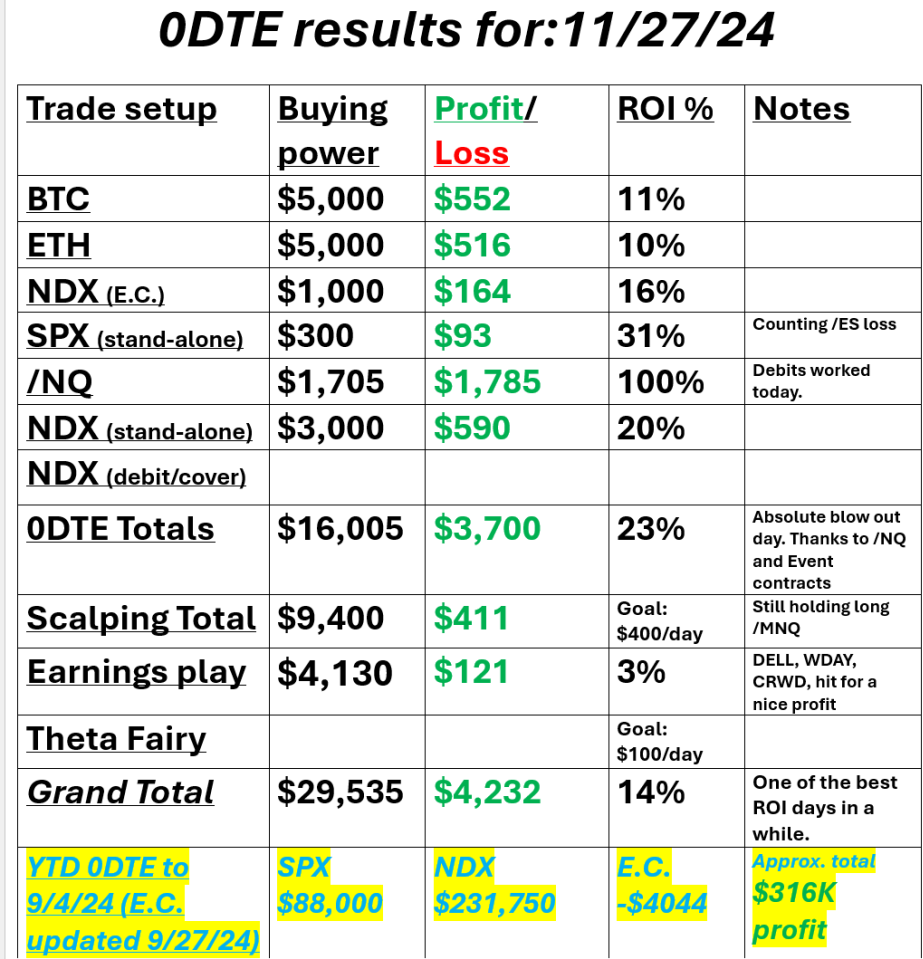

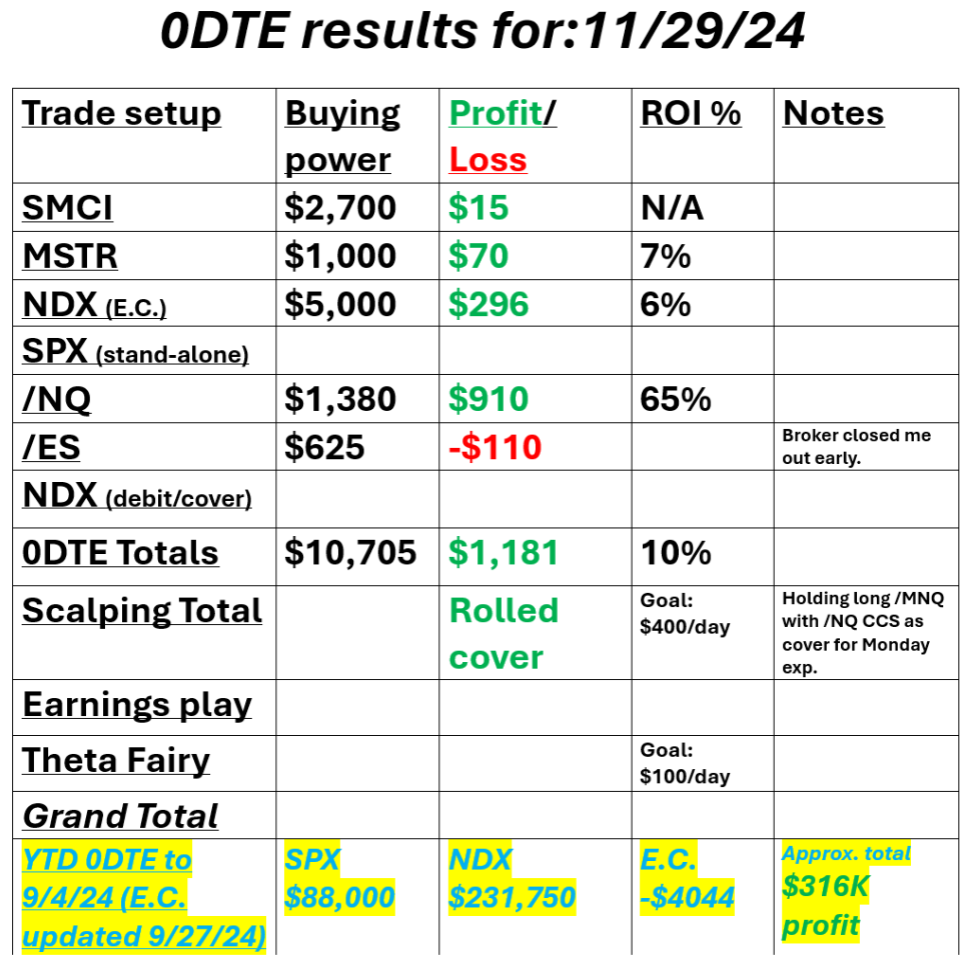

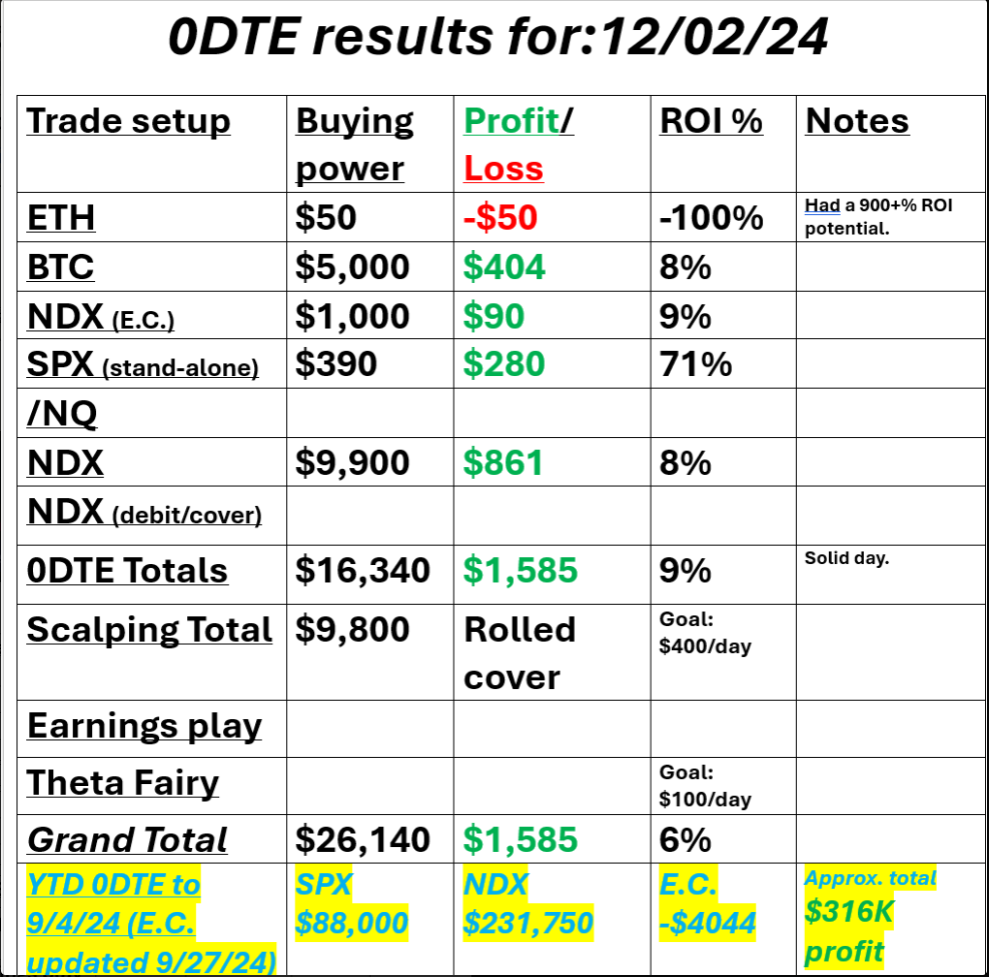

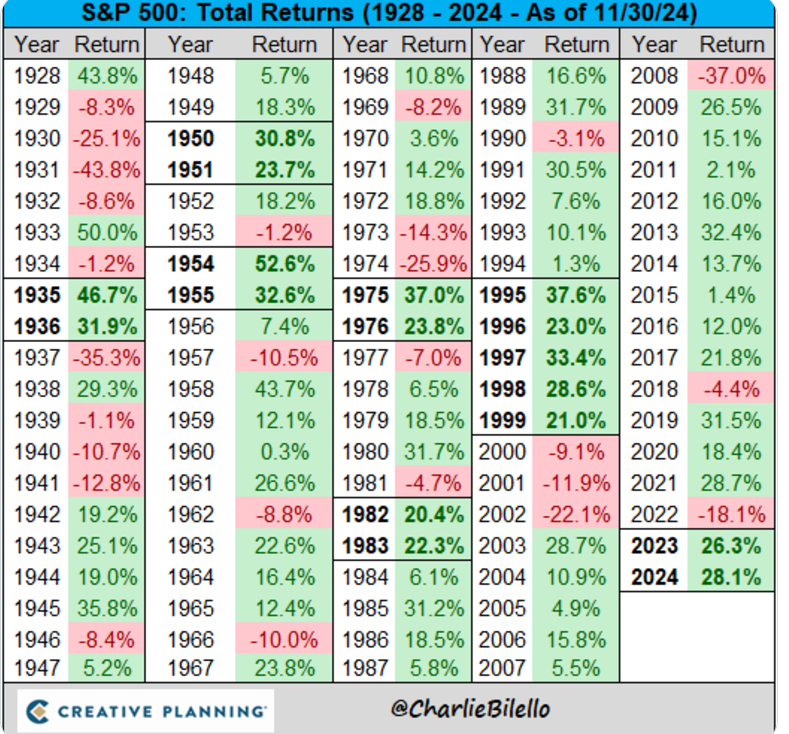

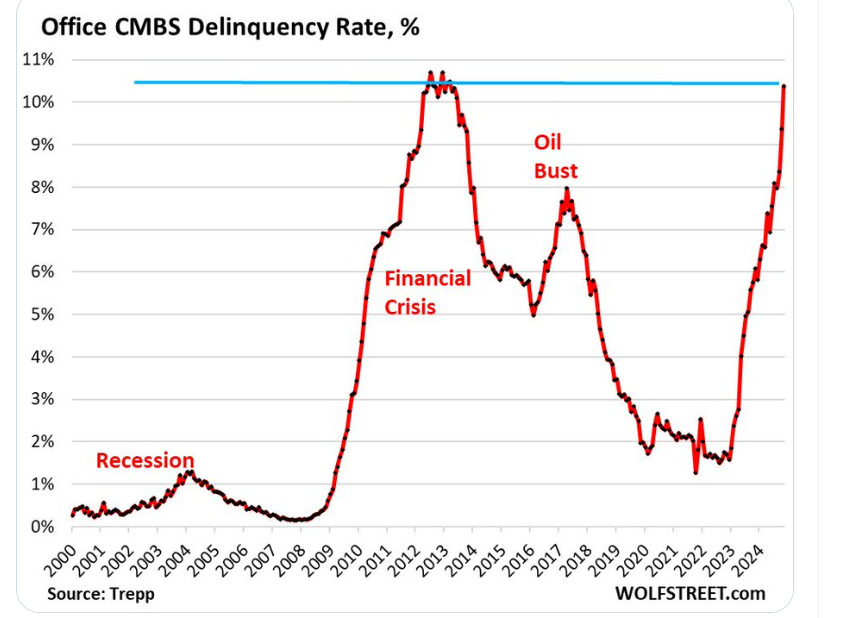

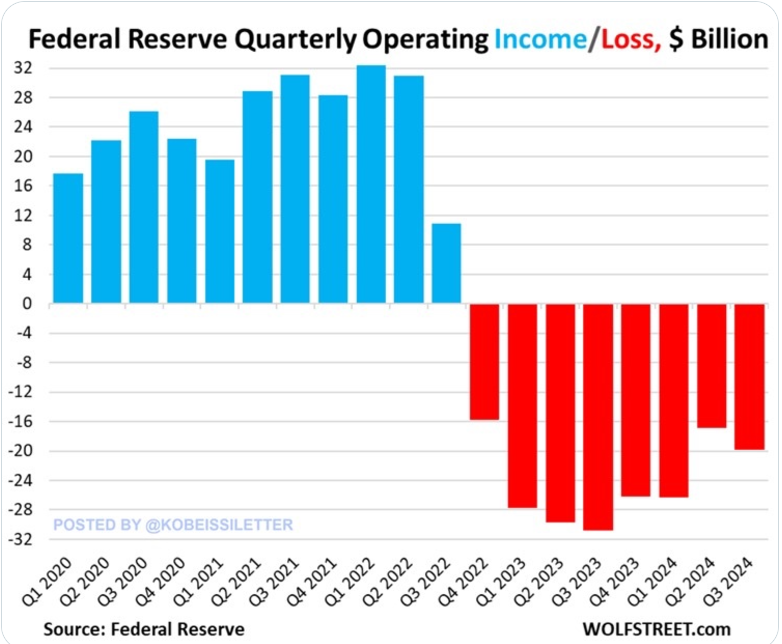

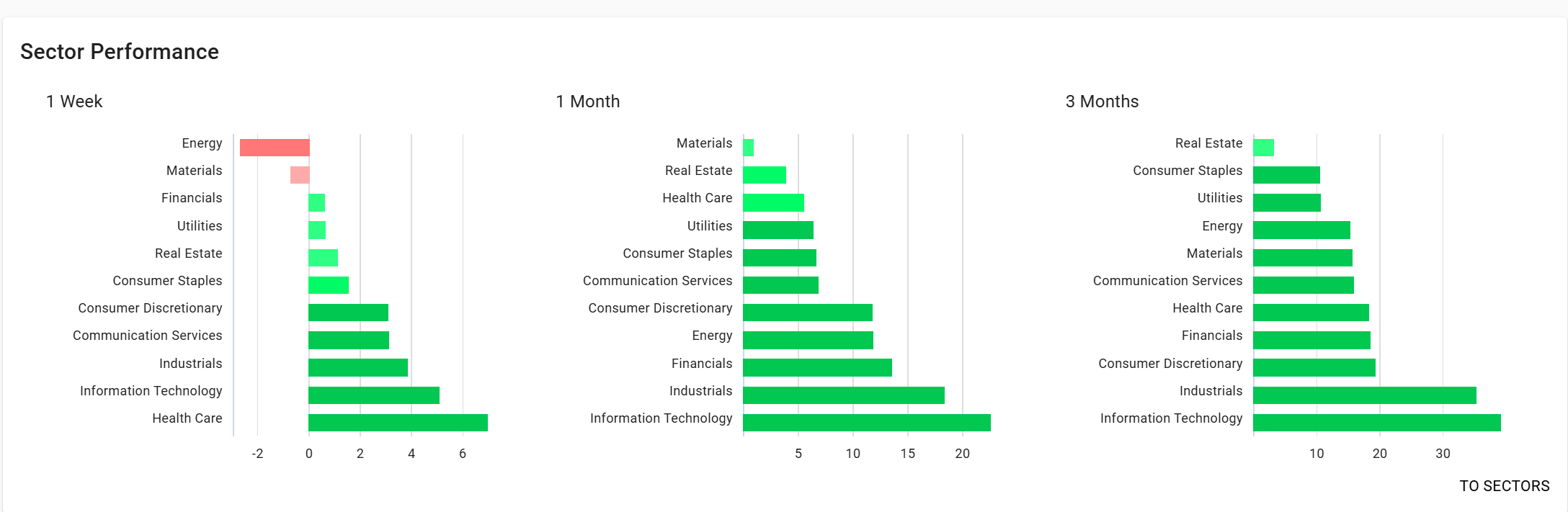

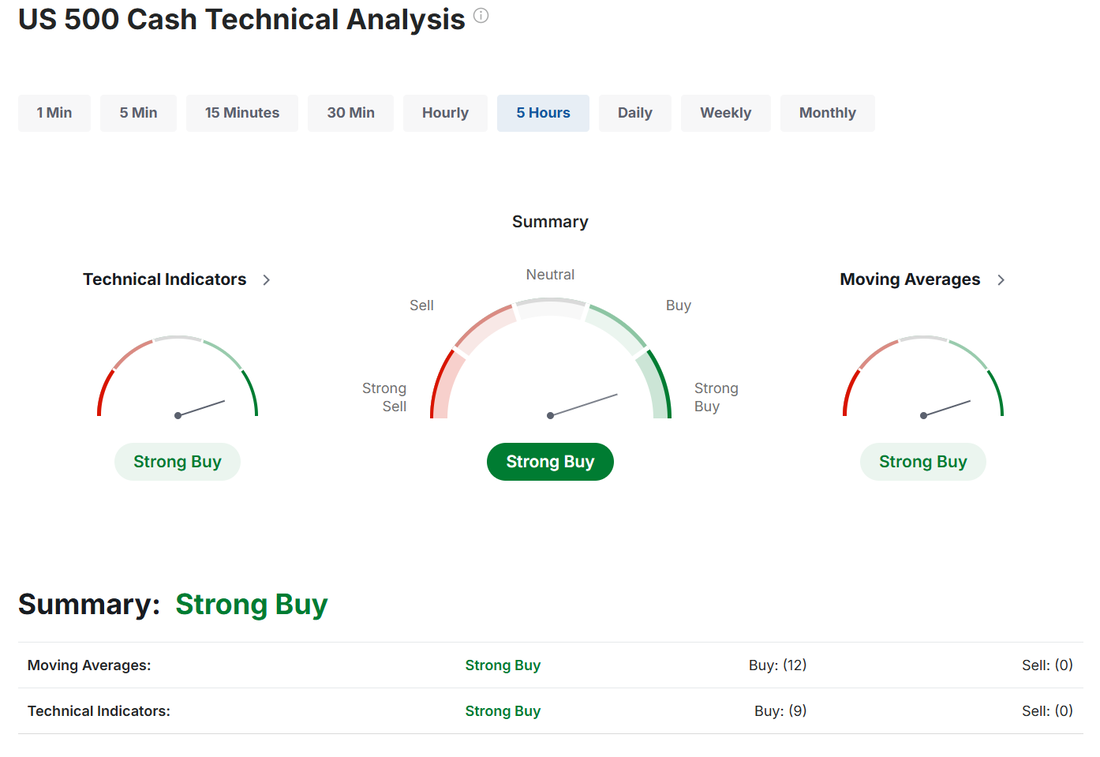

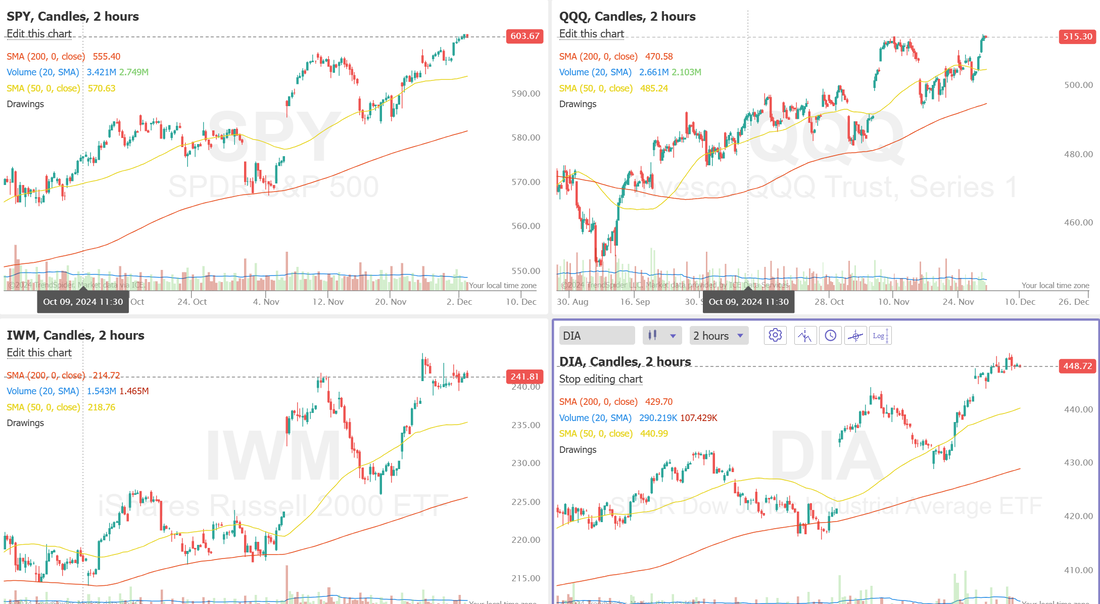

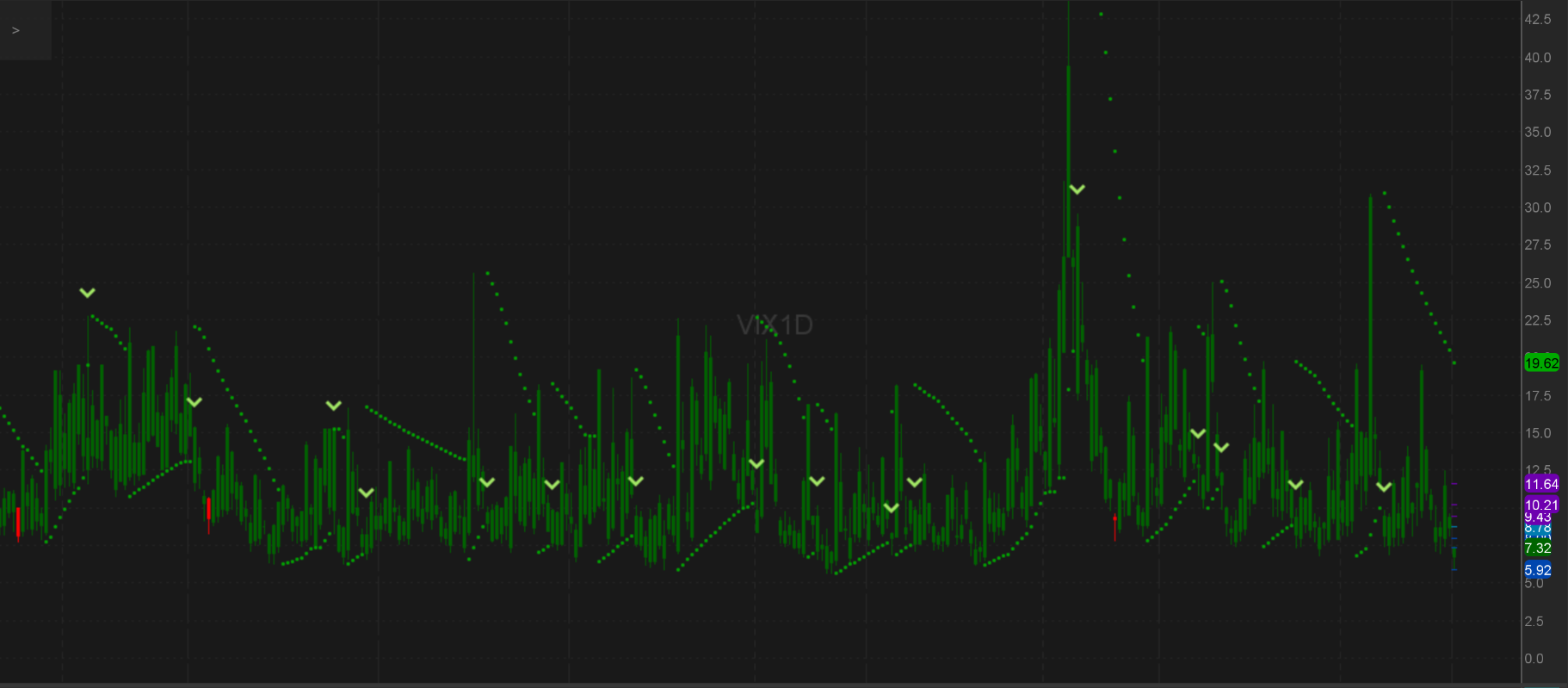

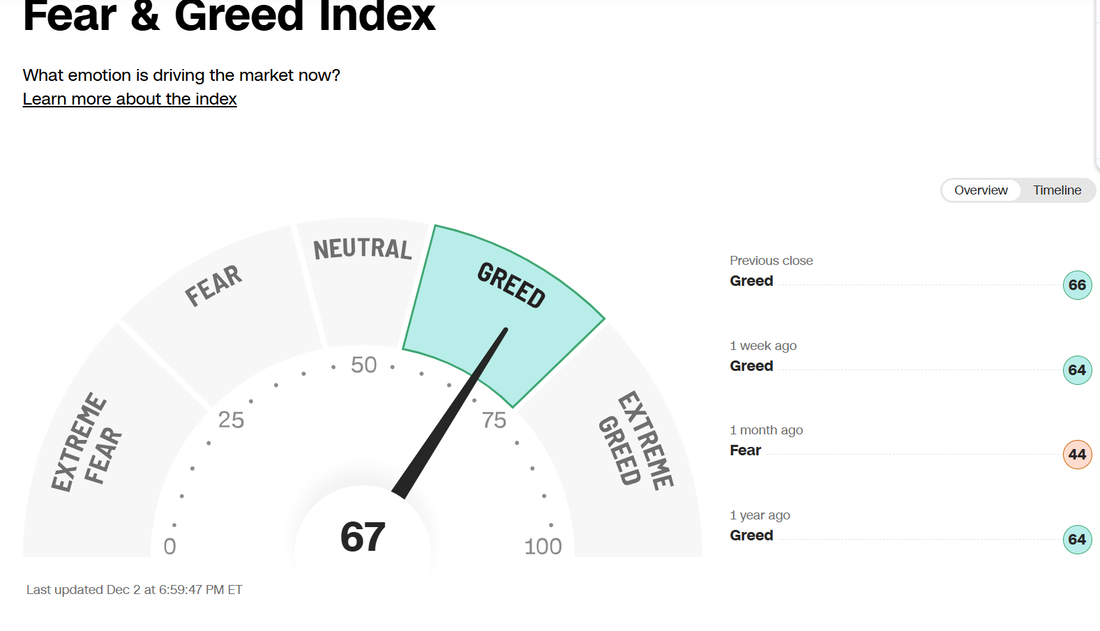

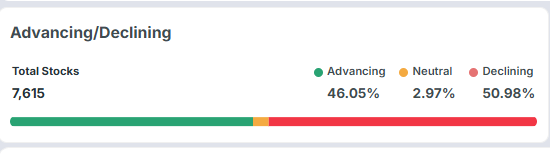

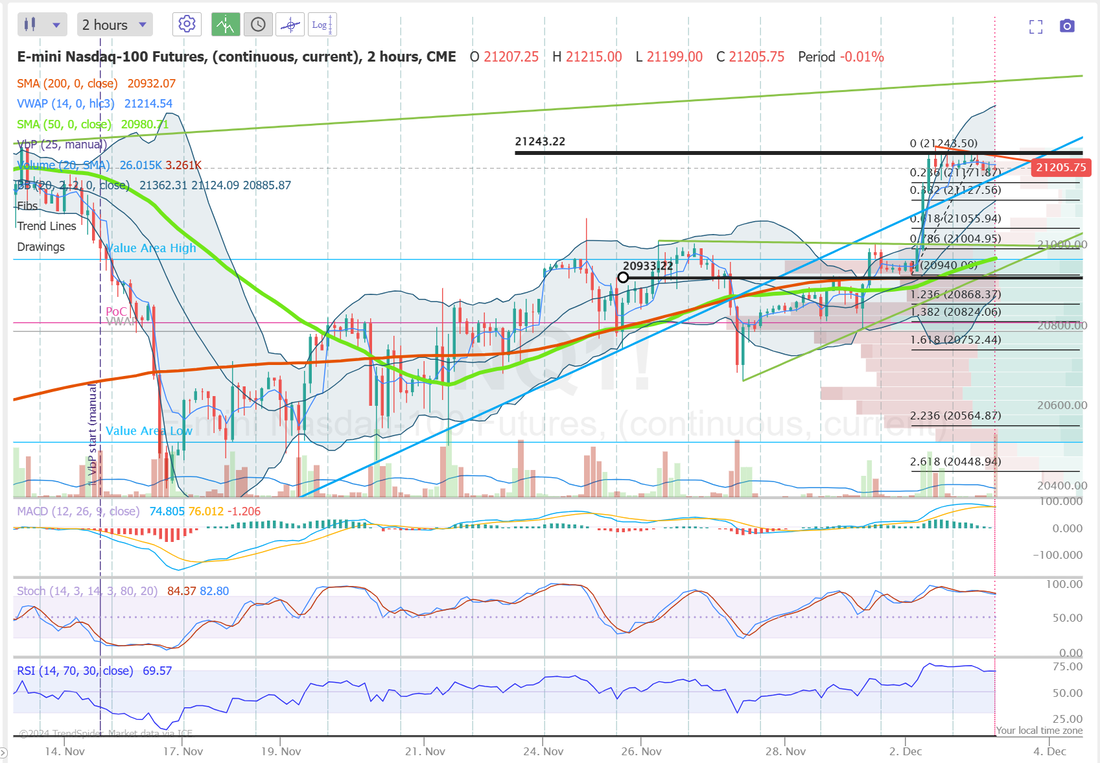

Welcome back! I've had some technical issues that were finally resolved by just removing an ad blocker! I've got some catching up to to. Here's our last Thursday, Friday results. All in all I'm pretty impressed and happy with our holiday light trading schedule. Here's our results from yesterday. Markets seem to be at nose bleed levels but economics look good. The S&P 500 is currently on pace for back-to-back years with a total return above 20%. The last time that happened: 1998-1999 The delinquency rate on US commercial mortgage-backed securities (CMBS) for offices SURGED to 10.7%, the highest in 11 YEARS. Office CMBS delinquencies have risen even faster than during the Great Financial Crisis. Commercial real estate crisis is getting worse. The Federal Reserve just reported a $19.9 BILLION operating loss in Q3 2024 up from $16.9 billion in Q2. This marks the 8th consecutive quarter of operating losses for the central bank. As a result, cumulative operating losses reached a massive $210 billion over the last 2 years. This comes as the Fed has been paying hundreds of billions in interest to banks and money market funds. At the same time, income the Fed has earned on Treasuries and Mortgage-Backed-Securities has declined. Even the Fed is losing money. It's been pretty much up, up and away for every market sector. Buy mode is still solidly in place. We are starting to get some divergence. While the SPY continues to charge onward and upward, the QQQ looks like its stalling out and the IWM and DIA are in a holding pattern. I.V. for this week is basically non-exsistent. And the one day VIX is not giving much hope. A one day VIX below 8? That's rare indeed. Yesterdays price action was not really meaningful in terms of providing directional bias. My bias or lean today is neutral. We seem to be treading water here just under the ATH's. Trade docket for today: /MNQ, /NQ scalping, BBY?, IWM, LEVI?, ZS, CRM, MRVL, CHWY, DLTR, FL, 0DTE's and...we'll be working on 10 new pairs setups today. 10 short and 10 long. I'll detail each in the chat room with charts and position sizing. December S&P 500 E-Mini futures (ESZ24) are up +0.01%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.01% this morning as market participants braced for the latest reading on U.S. job openings while also awaiting comments from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching new all-time highs. Super Micro Computer (SMCI) soared over +28% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the server maker said that a review by a special committee found “no evidence of misconduct on the part of management or the board of directors and that the audit committee acted independently.” Also, Tesla (TSLA) advanced more than +3% after Roth Capital Partners upgraded the stock to Buy from Neutral with a price target of $380. In addition, The Gap (GAP) climbed over +6% after JPMorgan Chase upgraded the stock to Overweight from Neutral with a price target of $30. On the bearish side, PG&E (PCG) slid about -5% after launching concurrent public offerings of $1.2 billion of common stock and $1.2 billion of mandatory convertible preferred stock. Economic data released on Monday showed that the U.S. ISM manufacturing index rose to a 5-month high of 48.4 in November, stronger than expectations of 47.7. Also, the U.S. November S&P Global manufacturing PMI was revised upward to 49.7, beating the consensus of 48.8. In addition, U.S. construction spending rose +0.4% m/m in October, stronger than expectations of +0.2% m/m. “This week is the last truly important economic data week of 2024,” said Tom Essaye at The Sevens Report. “If results are Goldilocks, then investors will expect a soft landing and a December rate cut. That will keep positive seasonals in place for a year-end grind higher.” Atlanta Fed President Raphael Bostic stated Monday that he is uncertain about the need for an interest rate cut this month but believes policymakers should continue reducing rates in the coming months. Also, New York Fed President John Williams said, “I expect it will be appropriate to continue to move to a more neutral policy setting over time,” adding that “the path for the policy will depend on the data.” At the same time, Fed Governor Christopher Waller expressed his inclination to support another rate cut at the December meeting. However, he noted that data to be released before then might justify keeping interest rates unchanged. Meanwhile, U.S. rate futures have priced in a 72.5% probability of a 25 basis point rate cut and a 27.5% chance of no rate change at the December FOMC meeting. On the earnings front, notable companies like Salesforce (CRM), Marvell (MRVL), and Okta Inc. (OKTA) are set to report their quarterly figures today. Today, all eyes are on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the October JOLTs Job Openings will arrive at 7.510M, compared to the September figure of 7.443M. Market participants will also focus on speeches from Fed Governor Adriana Kugler and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.217%, up +0.57%. Let's take a look at our intra-day levels: /ES; 6069 is new resistance with 6037 acting as new support. /NQ: Yesterdays move created a new trading zone and a bit of a volume gap to the downside. 21243 was pretty strong resistance yesterday and 20933 is new support. BTC: Bitcoin scored for us again yesterday. It's been a good profit center for us lately. 100,060 seems like a very solid resistance and will likely be what we trade off today. 94,384 is the first support to the downside. Let's get going! I'm excited to get the new pairs trades working today! See you all in the trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |