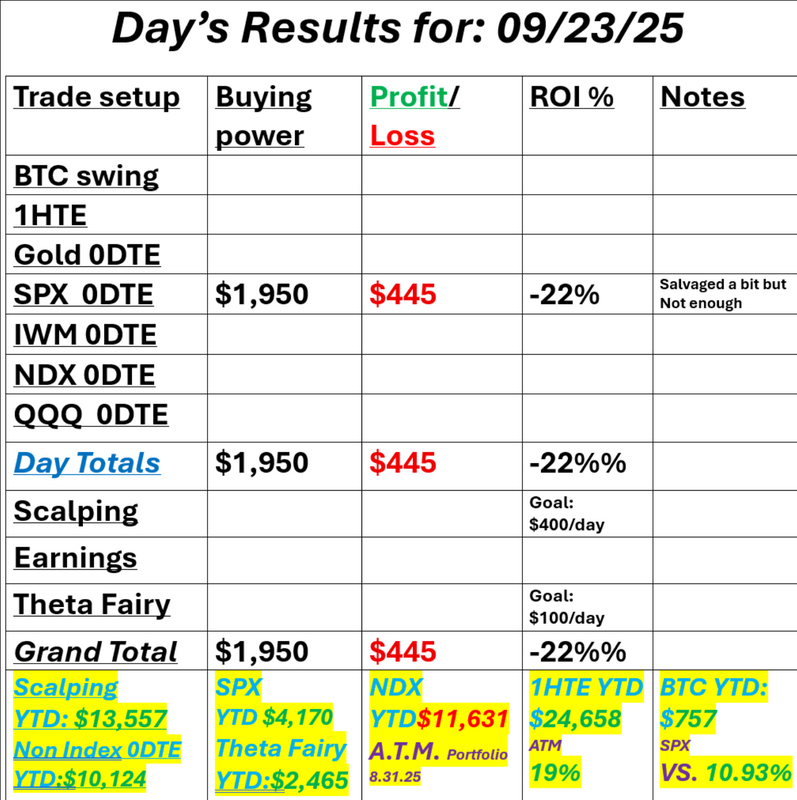

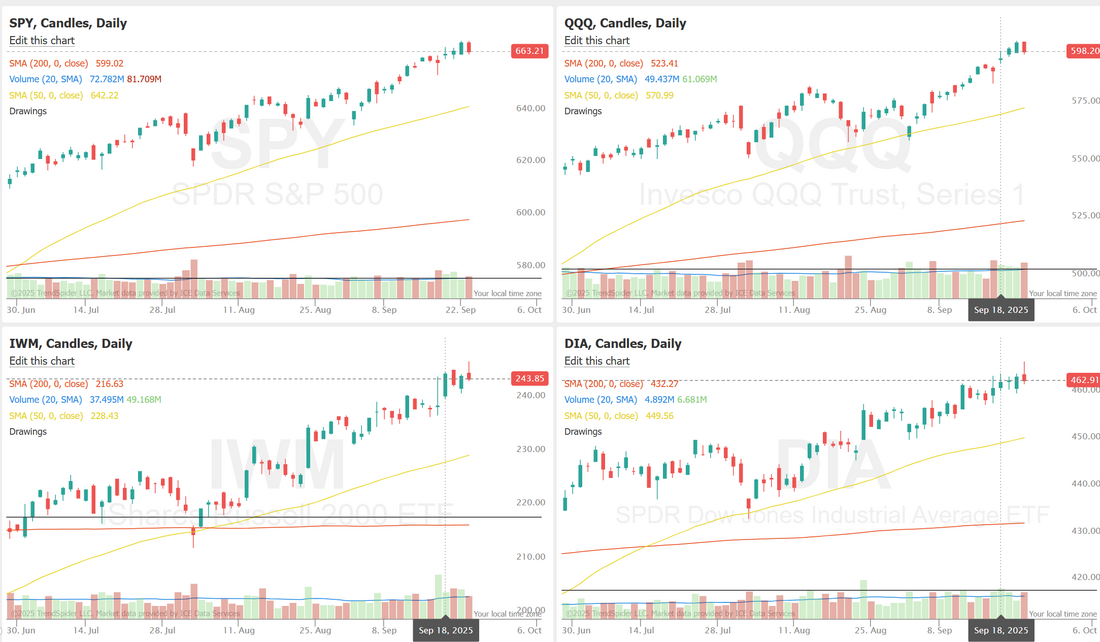

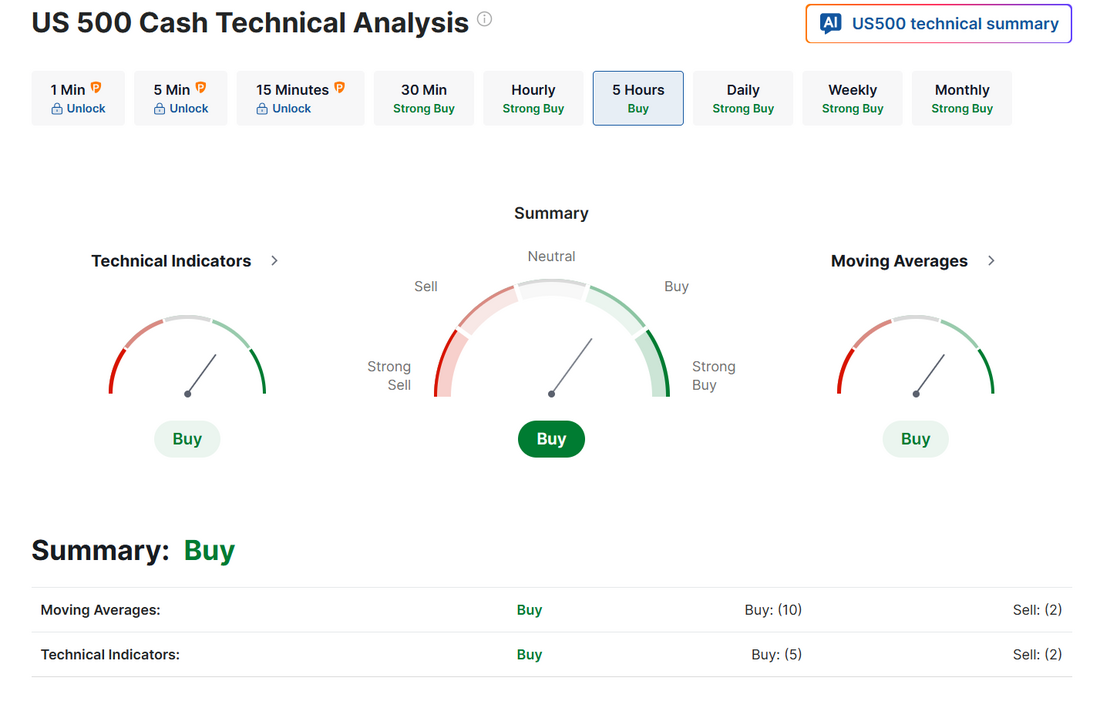

"Fairly highly valued"Well...thanks for that Mr. Powell. We had our day all mapped out yesterday. We waited through the first two FED speakers. We waited through the PMI release. I calculated that Powell would stick to the same script as his FOMC testimony and we'd get a rally. I put on a bullish debit in anticipation. I should have waited. He DID largely stick to the script UNTIL it got the the Q&A. Powell is asked about the stock market nearly every time he speaks and he ALWAYS says, "we don't comment on the stock market". Well, he certainly did yesterday! Calling it "fairly highly valued". That's an indirect way of saying it's over priced and needs to come down. Come down it did. I had about $1,300 at risk and was able to scale another bullish debit into the setup before the close to cut the loss but it still finished red. Overall I'm happy I was able to mitigate the risk but upset I didn't just wait it out. Today is a new day. Here's a look at my day. Let's take a look at the markets. It felt like a big drawdown in the moment but that's only because we haven't gone down in a while. All that really happened yesterday was a give back of the previous days gains. Could this be a turning point in the market? Sure. For me, unless we get some confirmed additional weakness today I'd say it's back to business as usual for the bulls. Technicals moved to neutral after yesterdays selloff but are back to a slight buy signal to start the morning. It will be interesting to see if bears can make something out of yesterdays price action today. We will be going 108 consecutive days without having back to back closes below the 20 day moving average on SPX. I don't think that's a record but it is a rare feat. How much longer can the bulls hold court? December Nasdaq 100 E-Mini futures (NQZ25) are trending up +0.30% this morning as optimism over artificial intelligence was reinforced by Alibaba’s pledge to boost spending and an upbeat forecast from Micron Technology. U.S.-listed shares of Alibaba Group (BABA) surged over +9% in pre-market trading after the Chinese e-commerce giant announced it would boost AI spending beyond its initial $53 billion target and released its largest AI language model to date. Also, Micron Technology (MU) rose over +1% in pre-market trading after the largest U.S. maker of computer memory chips posted upbeat FQ4 results and issued above-consensus FQ1 guidance. In yesterday’s trading session, Wall Street’s major indexes closed lower. The Magnificent Seven stocks retreated, with Amazon.com (AMZN) sliding over -3% to lead losers in the Dow and Nvidia (NVDA) falling more than -2%. Also, Vistra Corp. (VST) dropped over -6% and was among the top percentage losers on the S&P 500 after Jefferies downgraded the stock to Hold from Buy. In addition, Firefly Aerospace (FLY) plunged more than -15% after the rocket developer posted weaker-than-expected Q2 results. On the bullish side, McKesson (MCK) climbed over +6% after the healthcare services company raised its FY26 adjusted EPS guidance. Economic data released on Tuesday showed that the U.S. S&P Global manufacturing PMI fell to 52.0 in September, weaker than expectations of 52.2. Also, the U.S. September S&P Global services PMI fell to 53.9, weaker than expectations of 54.0. In addition, the U.S. Richmond Fed manufacturing index unexpectedly fell to -17 in September, weaker than expectations of -5. Fed Chair Jerome Powell said on Tuesday that risks remain for both the labor market and inflation, reiterating that policymakers likely face a difficult path ahead as they consider additional rate cuts. “Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation,” Powell said. The Fed chief did not indicate whether he might support a rate cut at the central bank’s next meeting. “Powell doesn’t want to antagonize the White House, but he’s not rolling over either,” said David Russell at TradeStation. “He’s keeping his options open in case price pressures increase. Powell’s not trying to sound hawkish, but he’s trying to dodge some of the forceful demand for aggressive cuts.” Also speaking on Tuesday, Chicago Fed President Austan Goolsbee said policymakers should remain cautious about further rate cuts as inflation is above the central bank’s target and rising. Atlanta Fed President Raphael Bostic echoed remarks from his Chicago counterpart, saying he anticipates more inflation coming. At the same time, Fed Governor Michelle Bowman said, “Now that we have seen many months of deteriorating labor market conditions, it is time for the FOMC to act decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility.” Meanwhile, U.S. rate futures have priced in a 94.1% chance of a 25 basis point rate cut and a 5.9% chance of no rate change at the October FOMC meeting. Today, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that August new home sales will stand at 650K, compared to 652K in July. U.S. Crude Oil Inventories data will also be released today. Economists expect this figure to be 0.8 million, compared to last week’s value of -9.3 million. In addition, market participants will be anticipating a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.110%, down -0.24%. Today we'll have our training class on ADX and ATR that we missed on Monday. Come join us around 12:00 pm MDT. The SPX continues to grind higher toward fresh highs, with volatility risk premium (VRP) climbing to 5.6%, placing implied volatility in the “overvalued” zone relative to realized moves. The elevated VRP suggests options markets are pricing in more risk than spot action has delivered, which can sometimes precede periods of consolidation or choppier trading. In the short term, keeping an eye on whether VRP remains stretched or begins to compress will be important for gauging if momentum can extend cleanly higher or if markets pause to digest recent gains. Let's take a look at our intra-day /ES levels. Levels are tightly clustered this morning. 6730, 6732, 6734, 6750, 6753 are all resistance zones with 6734 being a big trigger zone for bulls. Resistance zones are 6723, 6718, 6715, 6700, 6695. I'll see you all in our live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |