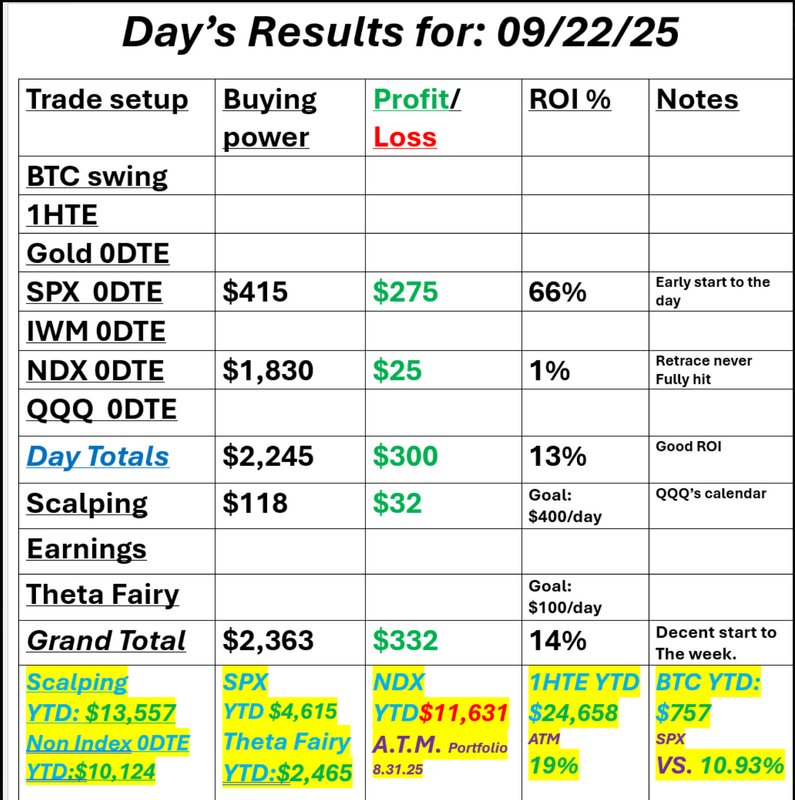

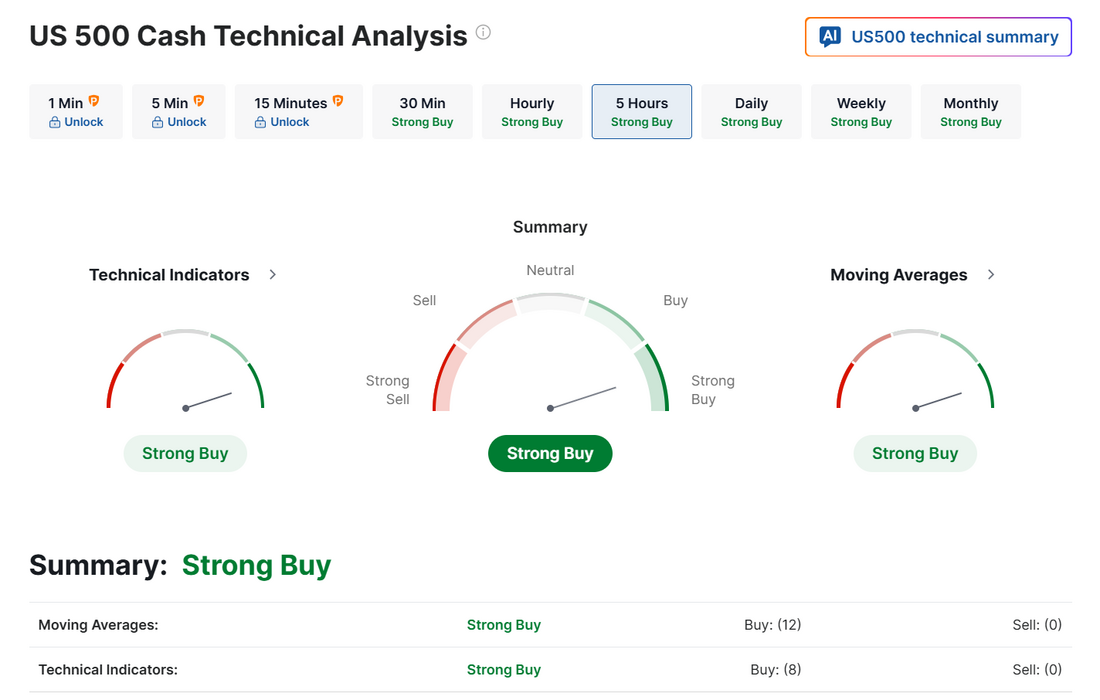

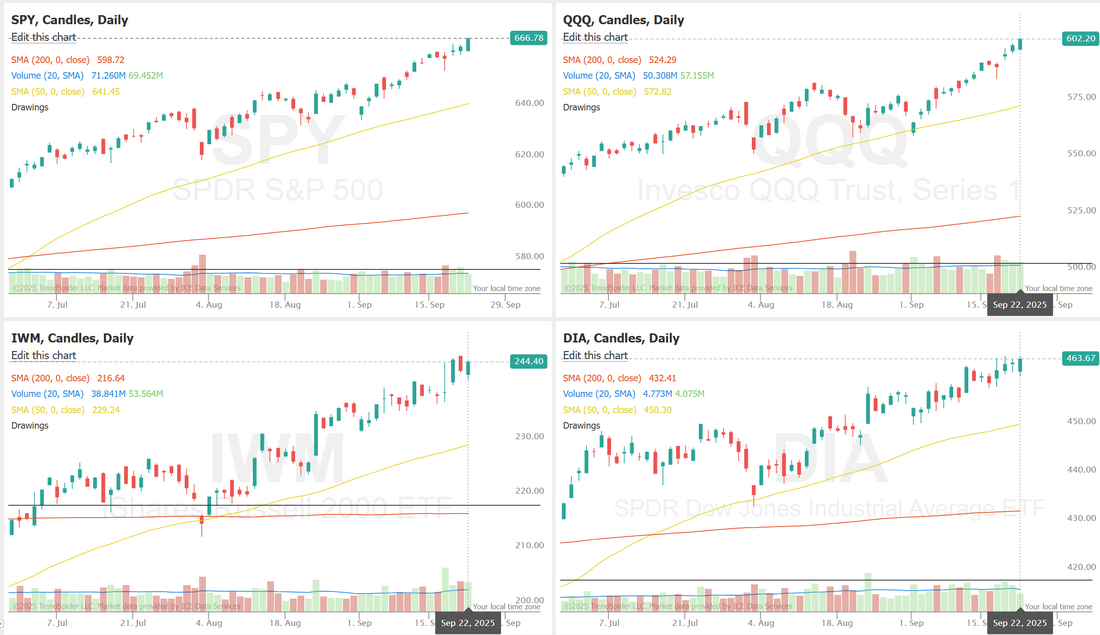

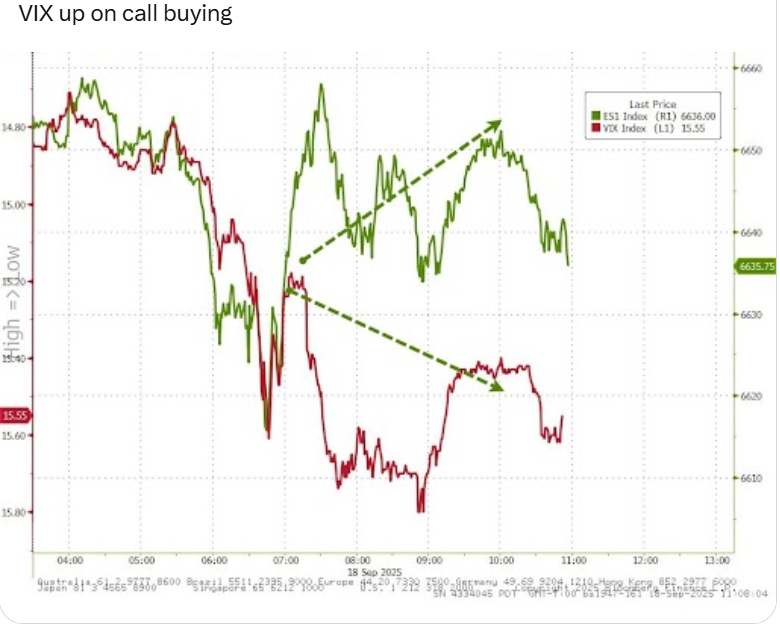

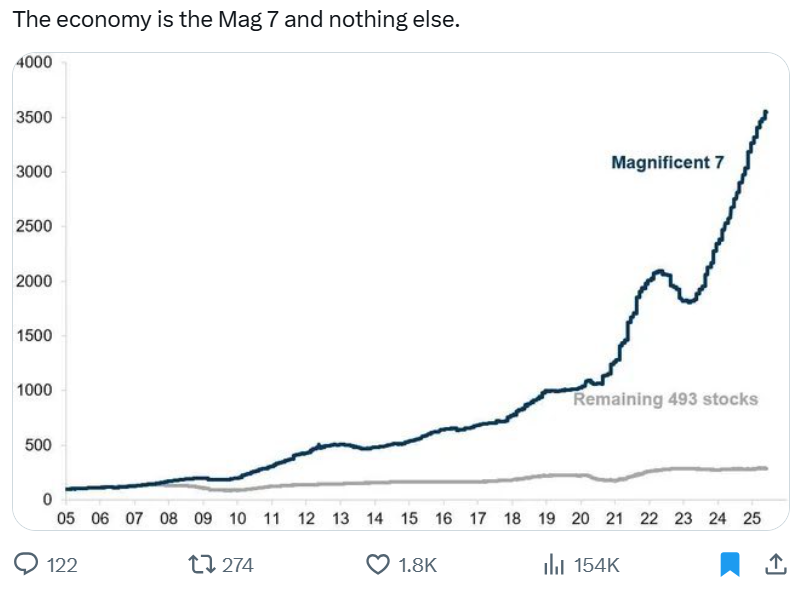

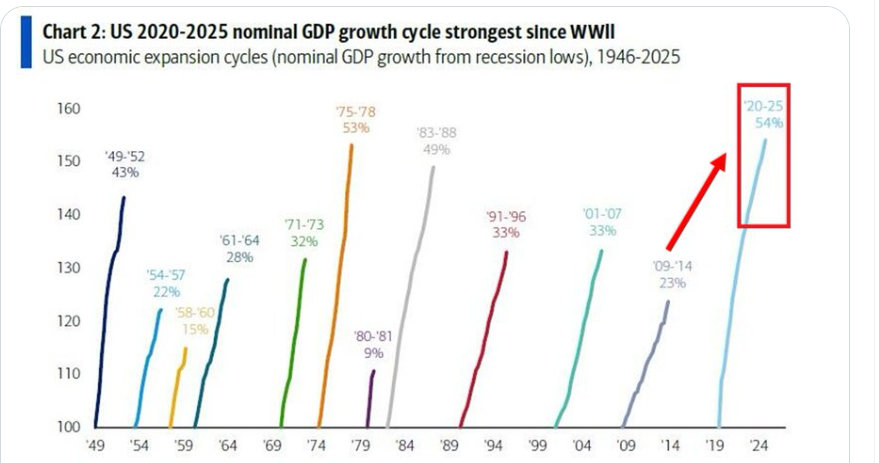

FED speak dayA couple FED members as well as Powell will be speaking this morning. That might add some spice to the day. We've also got PMI data incoming. I don't expect we'll see any change in Powells stance than what he laid out during his FOMC speech. We had a good day yesterday. We worked an NDX bearish retracement that "kinda" worked but we never really got a retrace. We bailed on it before we got too close to the close. Yesterday in our live trading room we talked about a documentary on trading and the idea that it's harder to make $50-$100 dollars a day consistently every day for the rest of your life than it is to make $10,000 dollars in one day! Consistency is hard! Our goal this week is to be green every day. It's a big goal. Let's take a look at the market: Technicals are still bullish. New ATH's again anyone? December S&P 500 E-Mini futures (ESZ25) are down -0.04%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.06% this morning as investors remain on the sidelines ahead of a speech from Federal Reserve Chair Jerome Powell and U.S. business activity data. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green, with the S&P 500, Dow, and Nasdaq 100 posting new record highs. Nvidia (NVDA) rose over +3% after the chipmaker announced plans to invest up to $100 billion in OpenAI to support new data centers and other AI infrastructure. Also, Teradyne (TER) surged more than +12% and was the top percentage gainer on the S&P 500 after Susquehanna raised its price target on the stock to $200 from $133. In addition, Applied Materials (AMAT) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after Morgan Stanley upgraded the stock to Overweight from Equal Weight with a price target of $209. On the bearish side, Kenvue (KVUE) slumped more than -7% and was the top percentage loser on the S&P 500 after the Washington Post reported that the Trump administration plans to link the active ingredient in Tylenol to autism. Fed Governor Stephen Miran said on Monday that interest rates are currently too high and argued for cutting them aggressively in the coming months to safeguard the labor market. At the same time, St. Louis Fed President Alberto Musalem said he supported last week’s rate cut but sees limited scope for further reductions amid elevated inflation. Also, Atlanta Fed President Raphael Bostic said he was comfortable with last week’s rate cut but sees little justification for further easing this year. In addition, Cleveland Fed President Beth Hammack said she remains firmly focused on inflation and that policymakers should be careful with interest rate cuts to avoid overheating the economy. U.S. rate futures have priced in an 89.8% probability of a 25 basis point rate cut and a 10.2% chance of no rate change at the next FOMC meeting in October. Meanwhile, the Organization for Economic Cooperation and Development said on Tuesday that the U.S. and global economies are expected to slow less sharply this year than previously forecast, but will continue to lose momentum in 2026 as higher tariffs increasingly weigh on activity. The U.S. economy is now projected to expand by 1.8% this year, up from the 1.6% forecast in June, and 1.5% next year, unchanged from the previous forecast. The global economy is projected to grow by 3.2% this year, up from the 2.9% projected in June, and 2.9% next year, unchanged from the previous forecast. Today, investors will focus on a speech from Fed Chair Jerome Powell. Mr. Powell is set to speak on the economic outlook at an event at the Greater Providence Chamber of Commerce. Also, Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, and Fed Governor Michelle Bowman will speak today. “Fedspeak this week will highlight the wide dispersion of views on the Committee,” said Oscar Munoz at TD Securities. “We do not expect Powell to change his tone from his FOMC press conference.” On the economic data front, investors will monitor preliminary U.S. purchasing managers’ surveys, as they will provide updates on activity in the manufacturing and services sectors. Economists expect the September S&P Global Manufacturing PMI to be 52.2 and the S&P Global Services PMI to be 54.0, compared to the previous values of 53.0 and 54.5, respectively. The U.S. Richmond Fed Manufacturing Index will also be released today. Economists foresee this figure coming in at -5 in September, compared to last month’s value of -7. On the earnings front, chipmaker Micron Technology (MU) and auto parts seller AutoZone (AZO) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.127%, down -0.48%. Oh boy. VIX is climbing on bullish market price action! This is pretty rare. Market concentration continues. I know most of my thoughts lately have been focused on a market being vastly overvalued. Here's some good economic news. US nominal GDP has grown 54% since the 2020 low, marking the strongest economic expansion since World War 2. This surpasses the 53% growth recorded in 1975-1978. It also corresponds to an average annual nominal GDP increase of 6%, indicating rapid expansion. By comparison, the post-2008 Financial Crisis recovery saw ~23% nominal growth until 2014. In other words, in Dollar terms, the US economy has grown twice as fast as it did after emerging from 2008. The US economy is experiencing a historic run. It's tough right now for me to have a lean or bias today. Futures are flat. FED speak and PMI could create some directional movement today. Let's be patient today and see how the morning develops. Let's take a look at our intra-day levels. No, the chart is not broken. We've been flatlining since yesterday. 6750 seems to be the resting point. An upward move has 6759, 6765, 6775, as resistance zones. 6730, 6717, 6700 are support zones. Patience is the key today. Bowman speaking kicks us off the PMI then Bostic speaks then Powell. We may need to wait quite a bit before jumping in. As always, price action will dictate. I'll see you all shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |