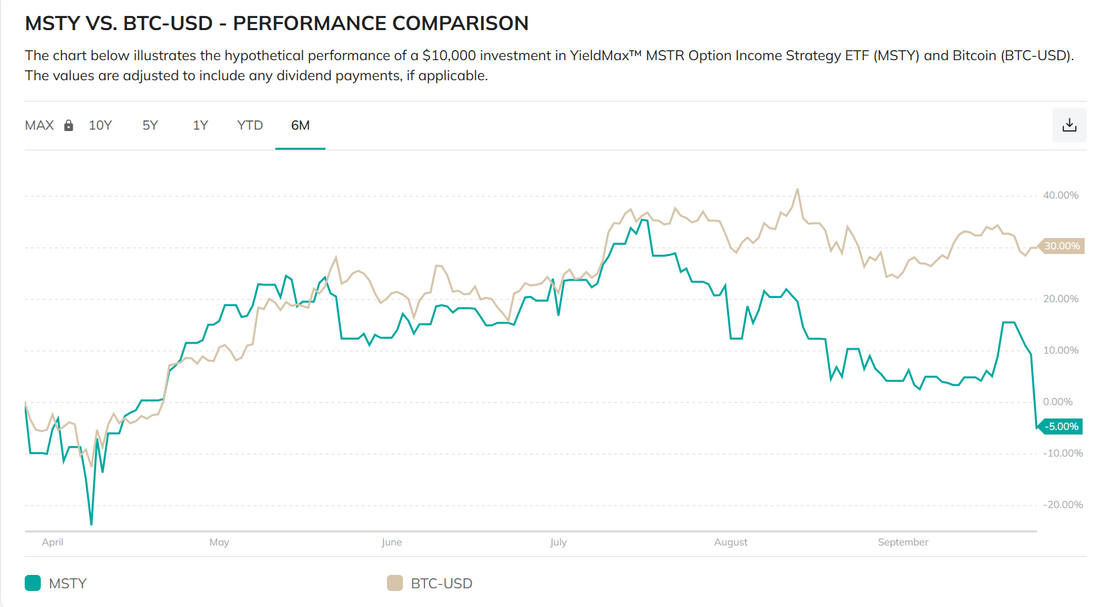

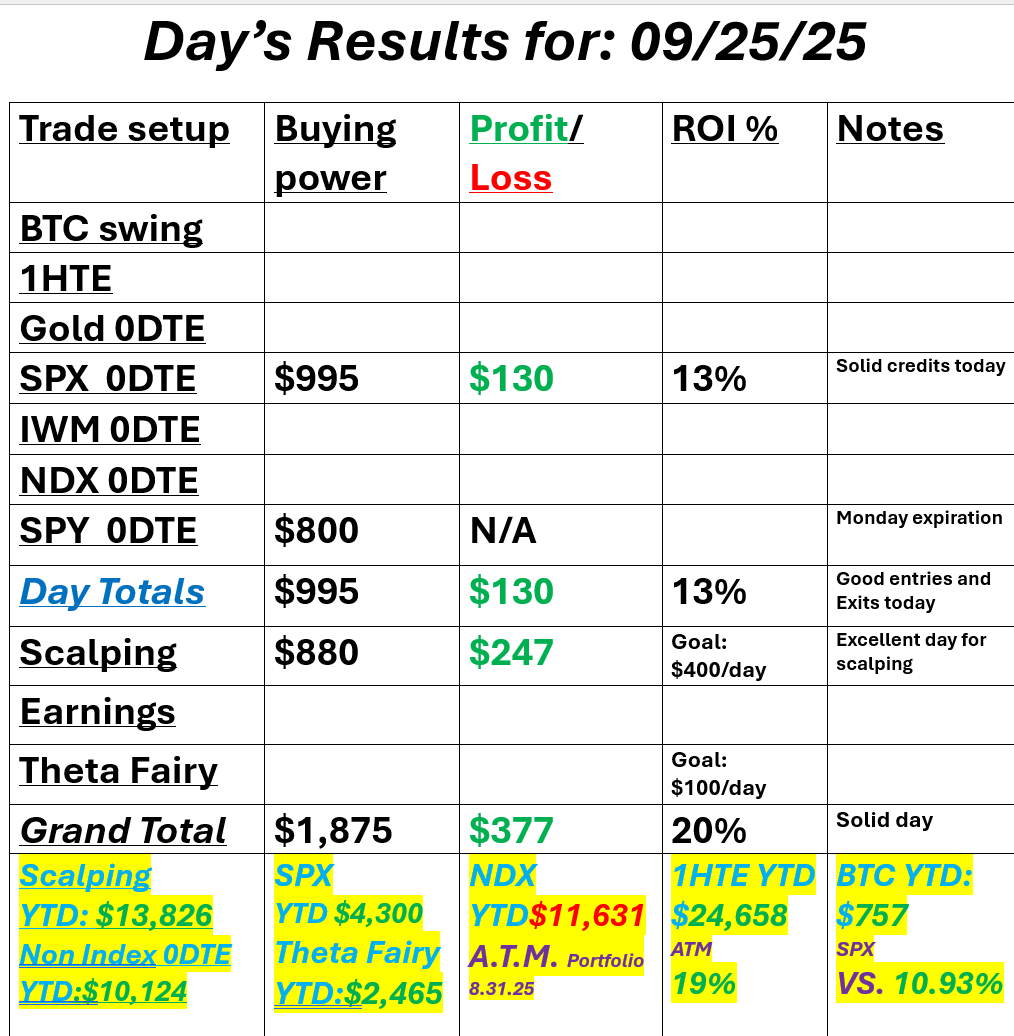

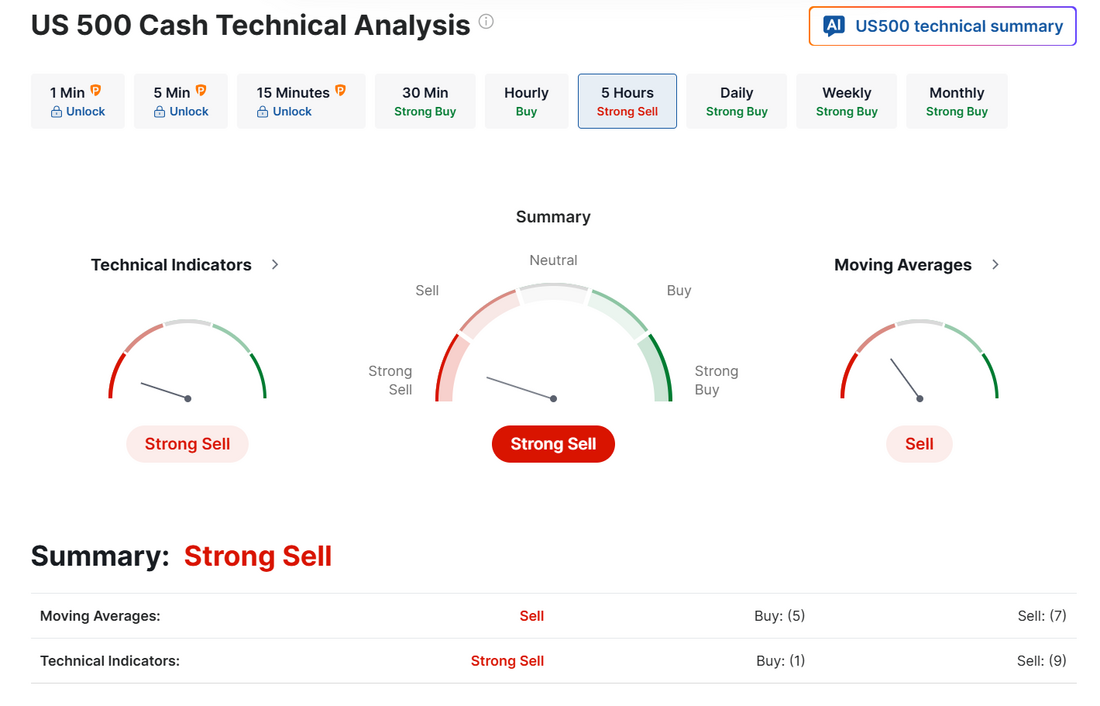

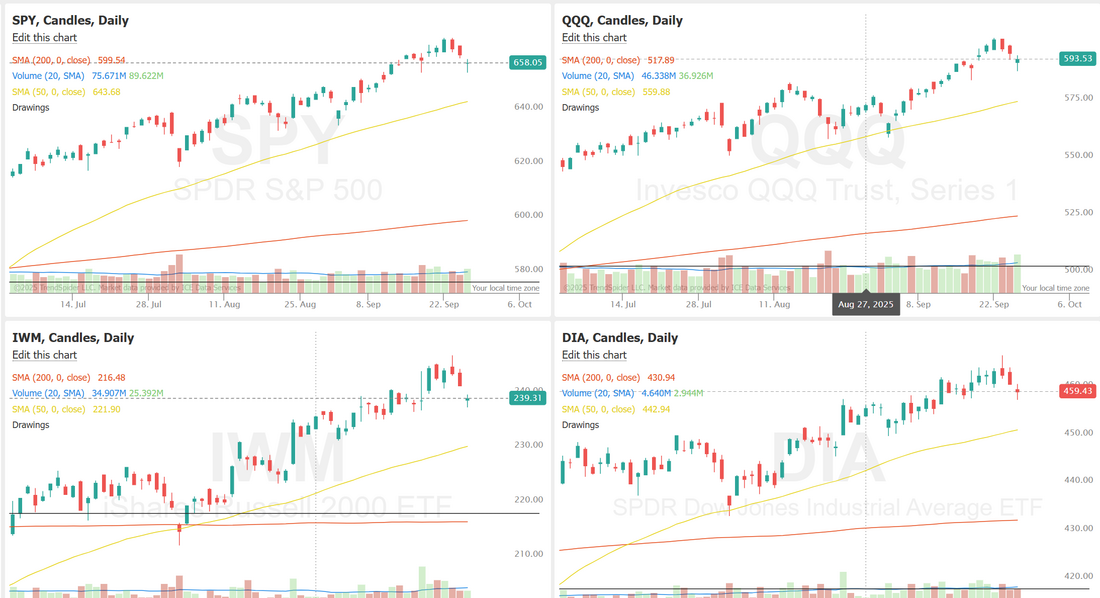

What leads us up, leads us down.Cracks are starting to show in the market. They're not big. Nothing major but it's starting. Will it build into something bigger? Who knows but what leads us up leads us down. A.I., Tech. All the stuff that's held us higher is now carrying us lower. My favorite trade of the last six months, that I've shared many, many times with our trading room members is the "Short MYST, Long BTC" trade. Was there ever a better short than the ponzi scheme MSTY? It's been easy money. Junk like MSTY can't survive in sane markets. It's needs to be frothy. When you see scams like this perpetrated on gullible retail investors it's usually a sign were at a top. We had a picture perfect day yesterday. I've always said a perfect day contains #1. Big moves. #2. Preferably down. The best markets are down ones. Bigger moves. Better premium. Let's take a look at the markets: We've had three glorious days to the downside. 6615 is really where bears need to take us to really make something of this. Otherwise its just a blip in an otherwise clean bull run. We are still holding to a slight sell signal, but just barely. The bears are trying. We've got PCE today which could determine todays outcome. December S&P 500 E-Mini futures (ESZ25) are trending up +0.03% this morning as investors weigh U.S. President Donald Trump’s latest tariff salvo and await the release of the Federal Reserve’s first-line inflation gauge for clues on the central bank’s next policy move. After a stretch of calm on the tariff front, U.S. President Donald Trump announced a fresh round of sectoral tariffs set to take effect on October 1st. President Trump said pharmaceutical companies would face a 100% tariff on branded or patented drugs. “Starting October 1st, 2025, we will be imposing a 100% Tariff on any branded or patented Pharmaceutical Product, unless a Company IS BUILDING their Pharmaceutical Manufacturing Plant in America,” Trump posted on Truth Social. Also, imported heavy trucks will face a 25% tariff, kitchen cabinets and bathroom vanities will be hit with a 50% duty, and upholstered furniture imports will be taxed at 30%. In yesterday’s trading session, Wall Street’s major indices closed lower. CarMax (KMX) tumbled over -20% and was the top percentage loser on the S&P 500 after the used-car seller posted downbeat Q2 results. Also, chip stocks lost ground, with Arm Holdings (ARM) and ON Semiconductor (ON) falling more than -2%. In addition, Oracle (ORCL) slumped over -5% after Rothschild & Co. Redburn initiated coverage of the stock with a Sell rating and $175 price target. On the bullish side, Intel (INTC) surged over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 following reports that Apple and TSMC were among the companies the chipmaker had approached about investments or manufacturing partnerships. The U.S. Bureau of Economic Analysis said on Thursday that Q2 GDP growth was revised higher to +3.8% (q/q annualized) in its third estimate, stronger than expectations of no change at +3.3%. Also, U.S. durable goods orders unexpectedly rose +2.9% m/m in August, stronger than expectations of -0.3% m/m, while core durable goods orders, which exclude transportation, unexpectedly rose +0.4% m/m, stronger than expectations of -0.1% m/m. In addition, U.S. existing home sales fell -0.2% m/m to 4.00 million in August, stronger than expectations of 3.96 million. Finally, the number of Americans filing for initial jobless claims in the past week fell by -14K to a 2-month low of 218K, compared with the 233K expected. “We agree that the economy is strong and growing, but a lot of that good news is already priced in. Where we have our largest concern is with valuations,” said Chris Zaccarelli at Northlight Asset Management. Fed Governor Stephen Miran said on Thursday that the central bank risks harming the economy if it does not act quickly to cut interest rates. Also, Fed Governor Michelle Bowman said that inflation is close enough to the central bank’s 2% target to justify additional rate cuts given the weakening labor market. At the same time, Chicago Fed President Austan Goolsbee voiced continued concerns about tariff-driven inflation and opposed any push for “front-loading” multiple interest rate cuts. In addition, Kansas City Fed President Jeff Schmid indicated that policymakers may not need to cut interest rates again in the near term. Meanwhile, U.S. rate futures have priced in an 87.7% chance of a 25 basis point rate cut and a 12.3% chance of no rate change at the October FOMC meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.9% y/y in August, compared to the previous figures of +0.3% m/m and +2.9% y/y. “If we were to see an uptick, that could worry investors that the Fed’s rate cut expectations are too ambitious, and that they may need to establish more of a wait-and-see approach on rates,” said Paul Stanley at Granite Bay Wealth Management. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate August Personal Spending to rise +0.5% m/m and Personal Income to grow +0.3% m/m, compared to the July figures of +0.5% m/m and +0.4% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists expect the final September figure to be revised slightly higher to 55.5 from the preliminary reading of 55.4. In addition, market participants will parse comments today from Richmond Fed President Tom Barkin, Fed Governor Michelle Bowman, and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.170%, down -0.10%. Let's look at our intra-day levels on /ES. 6678, 6690, 6701 are resistance zones. 6661, 6651, 6636 are support zones. Let's have a good day folks! See you in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |