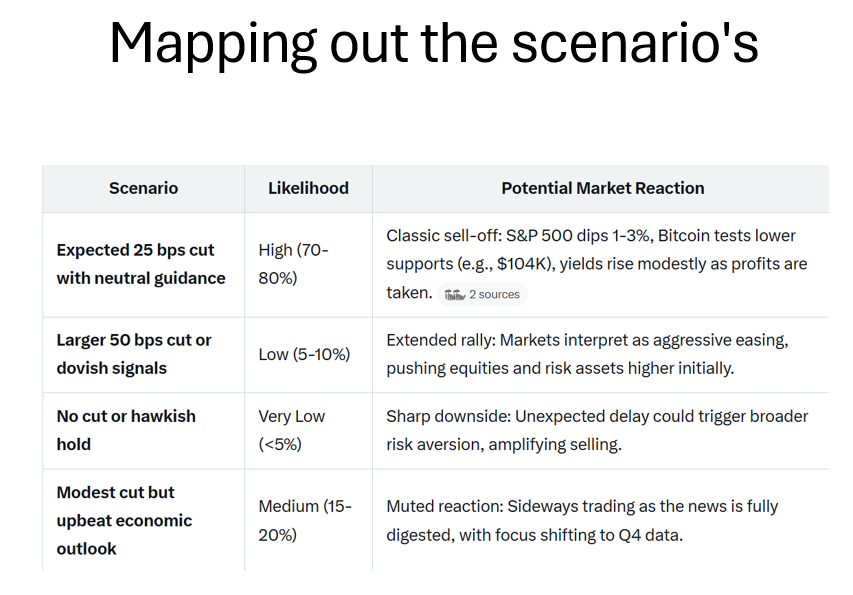

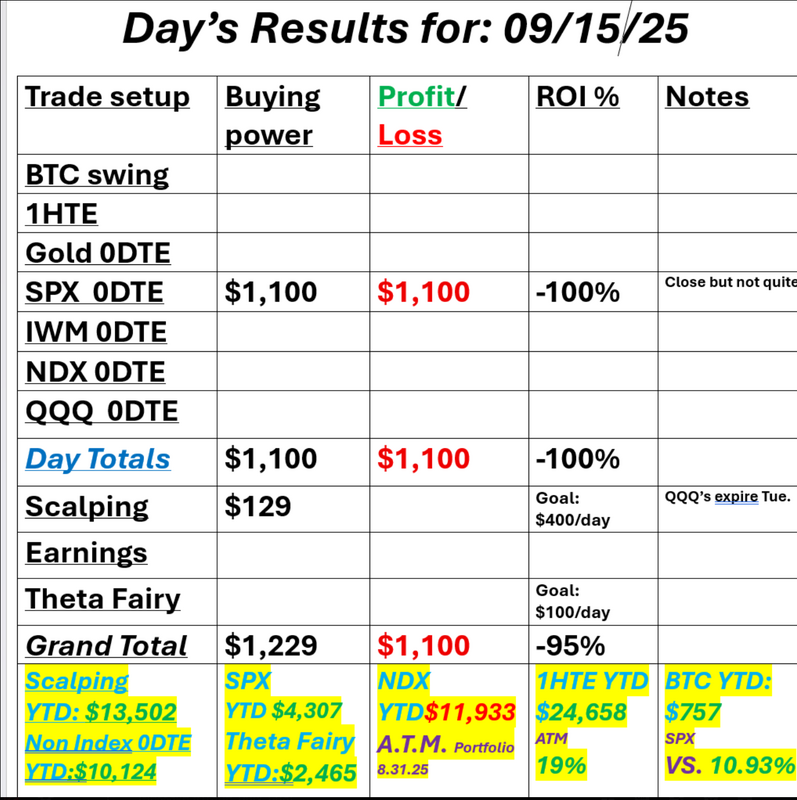

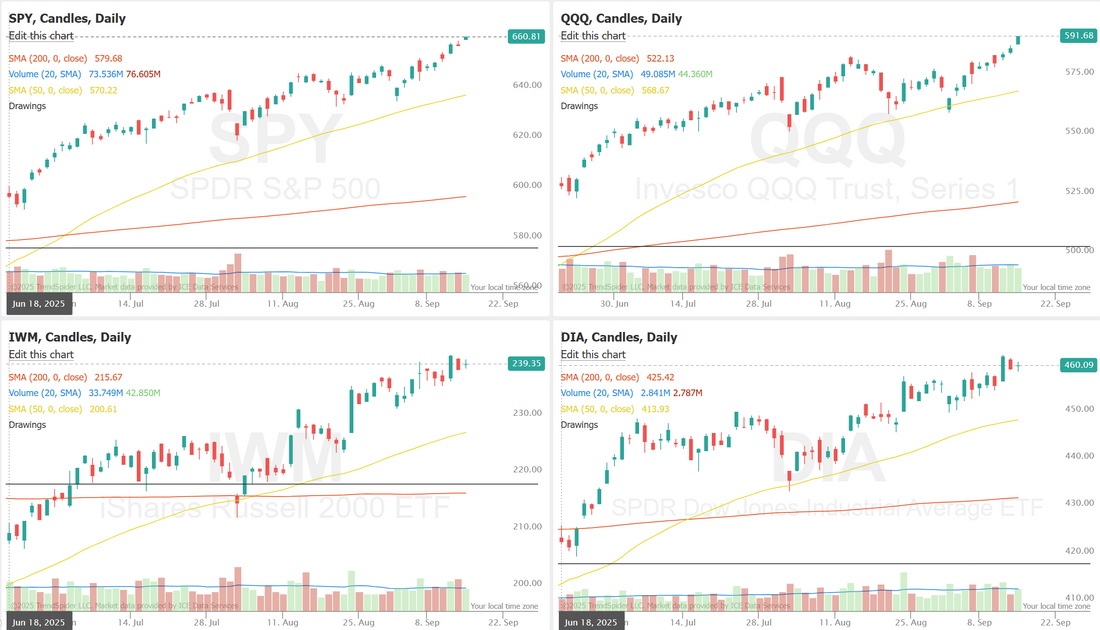

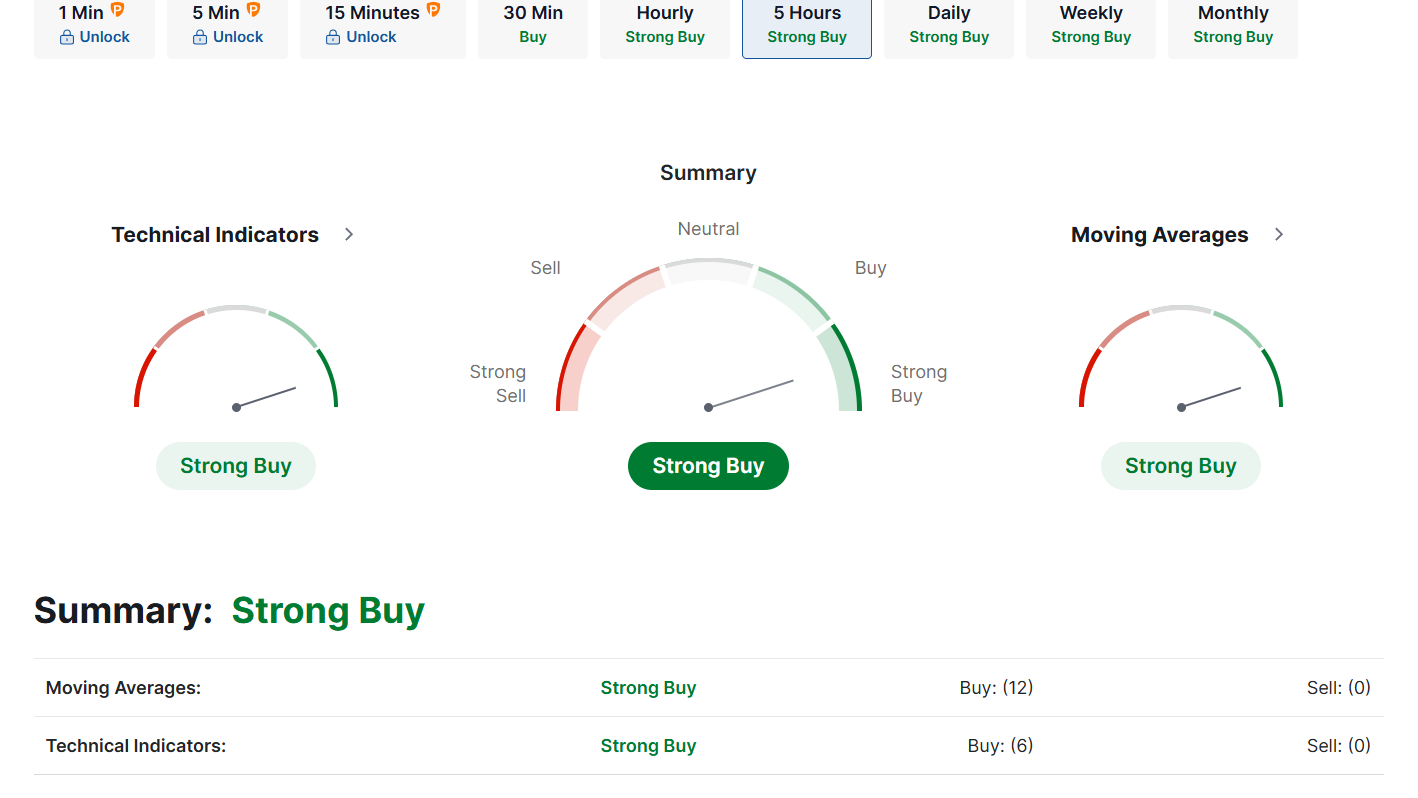

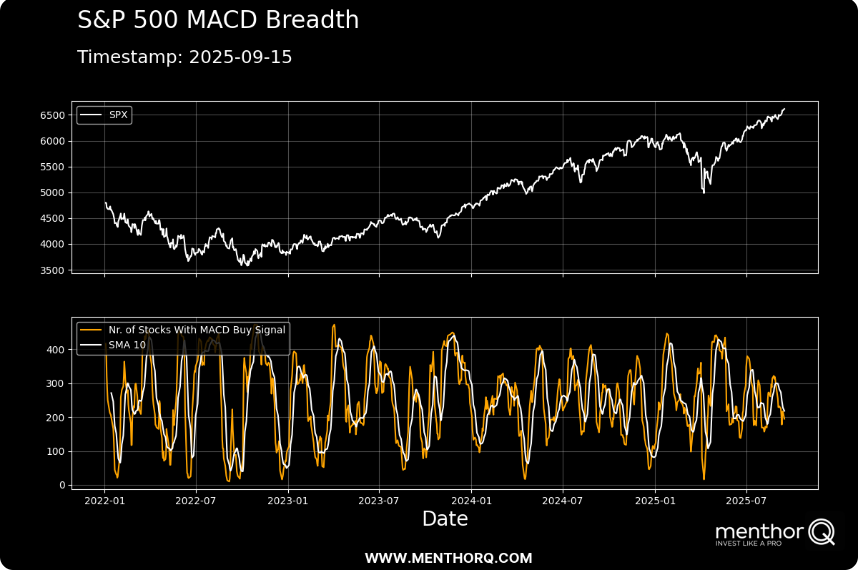

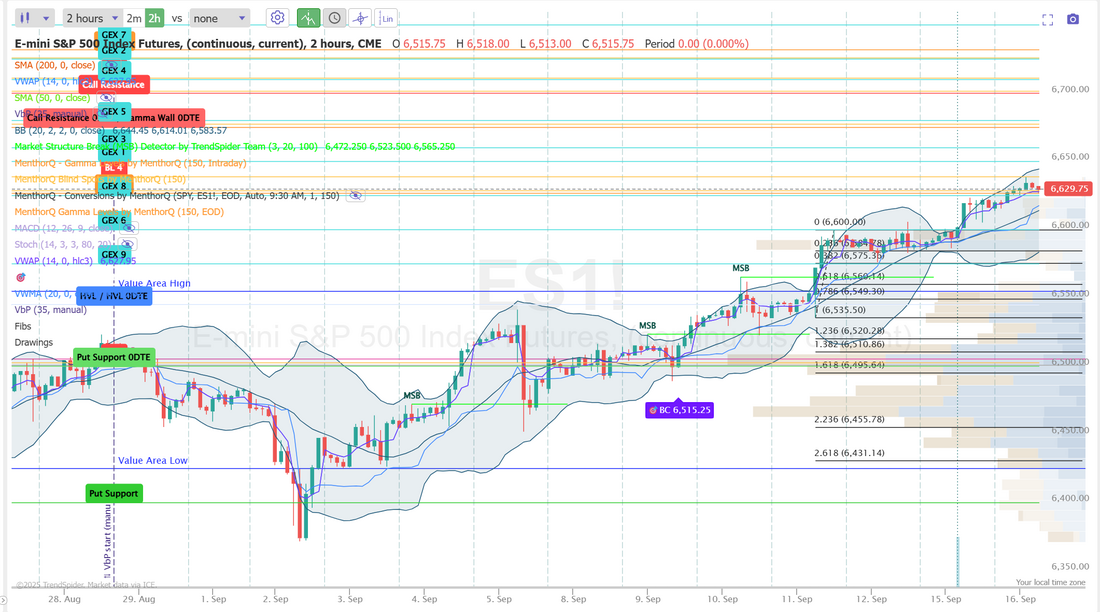

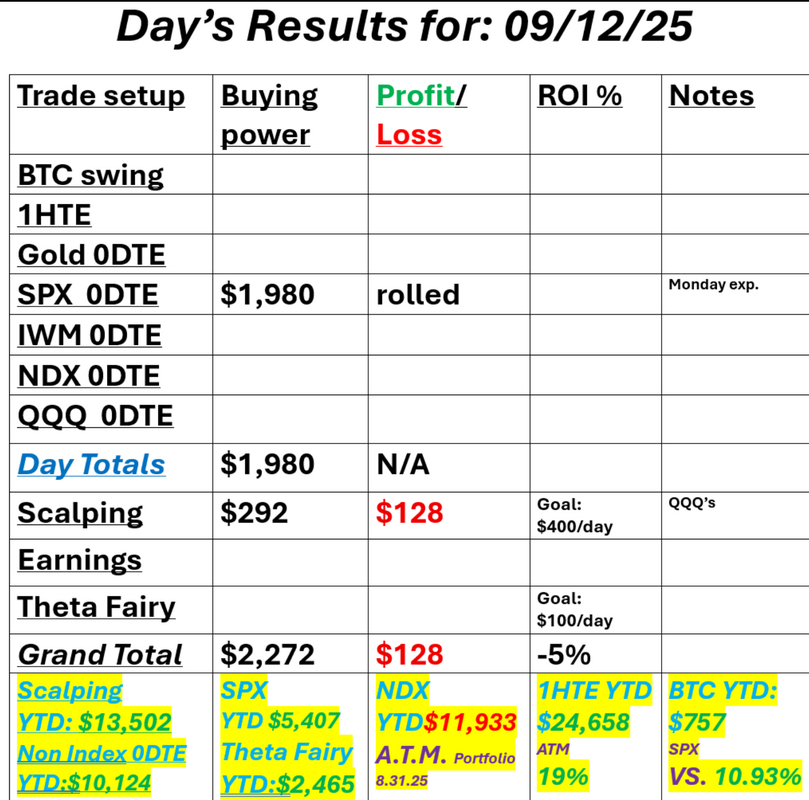

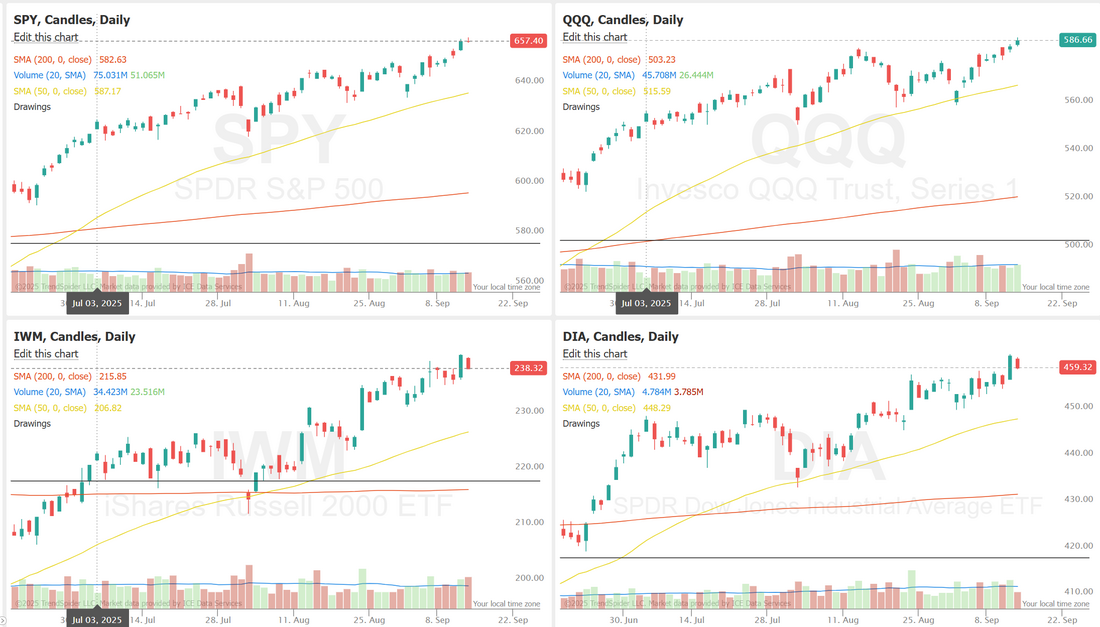

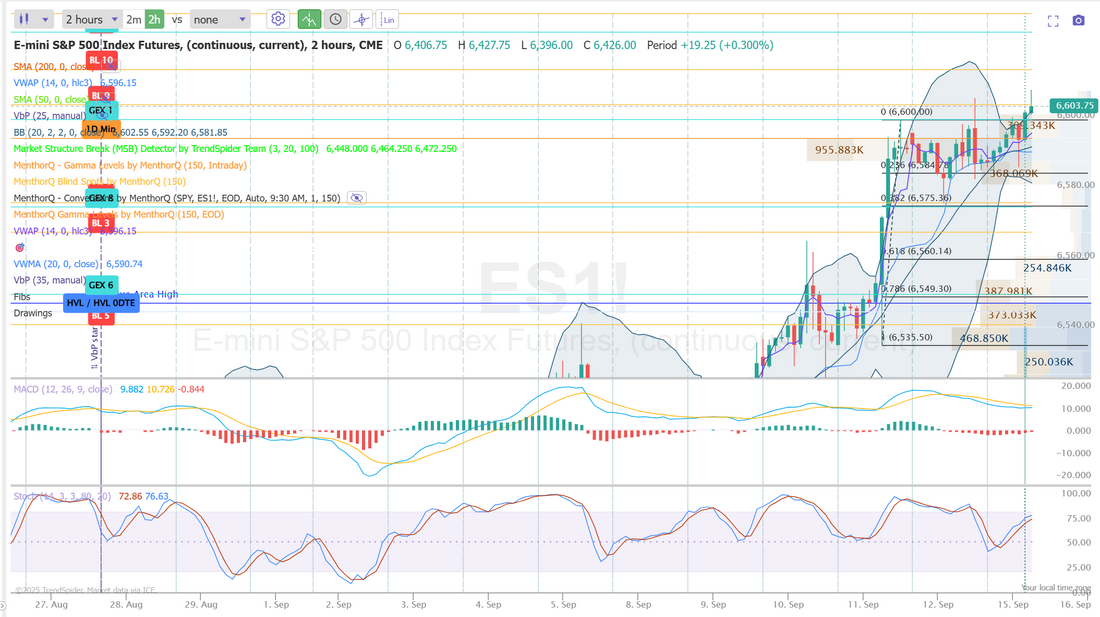

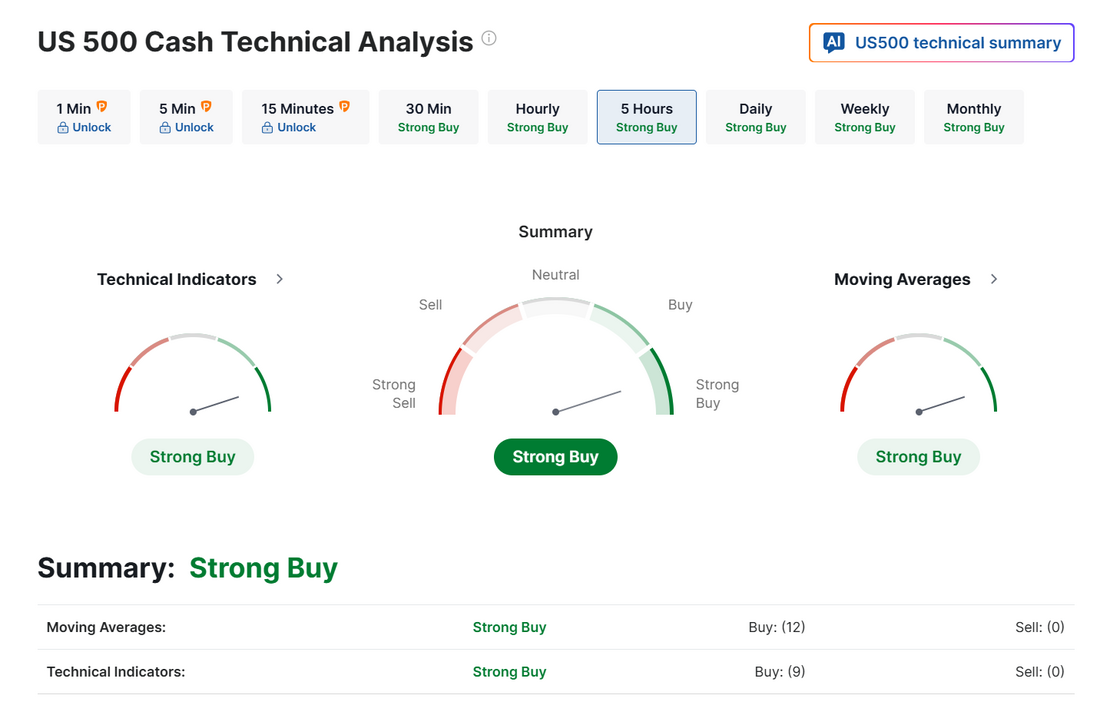

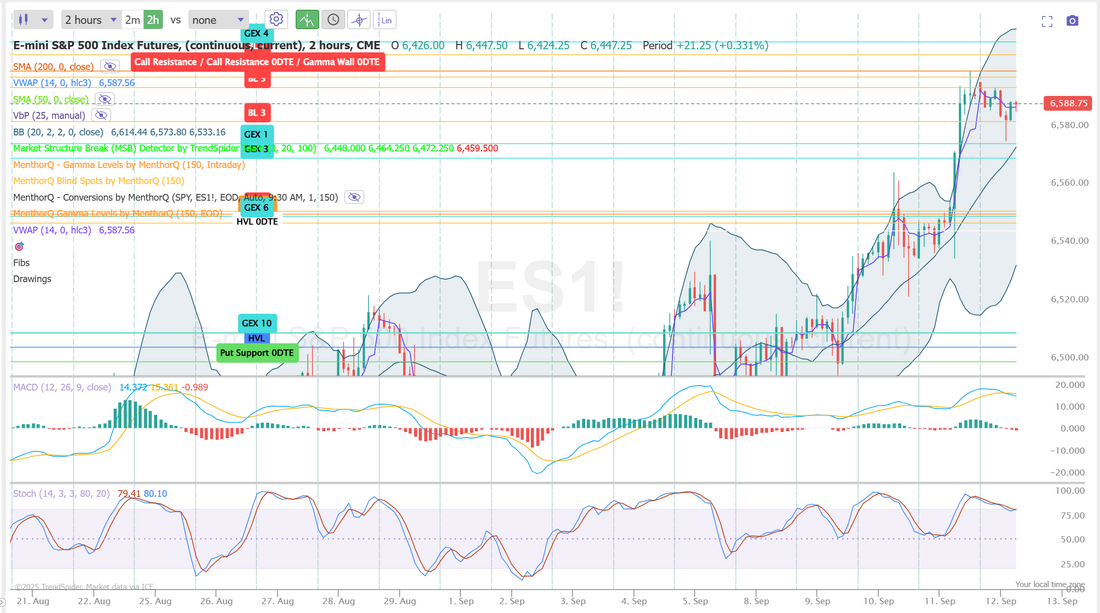

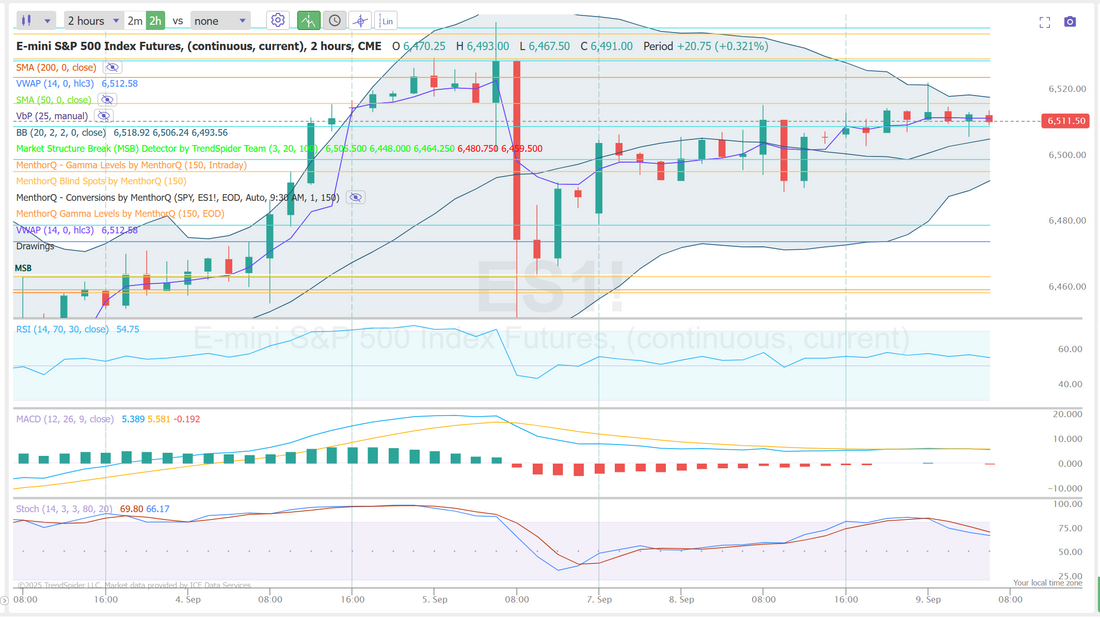

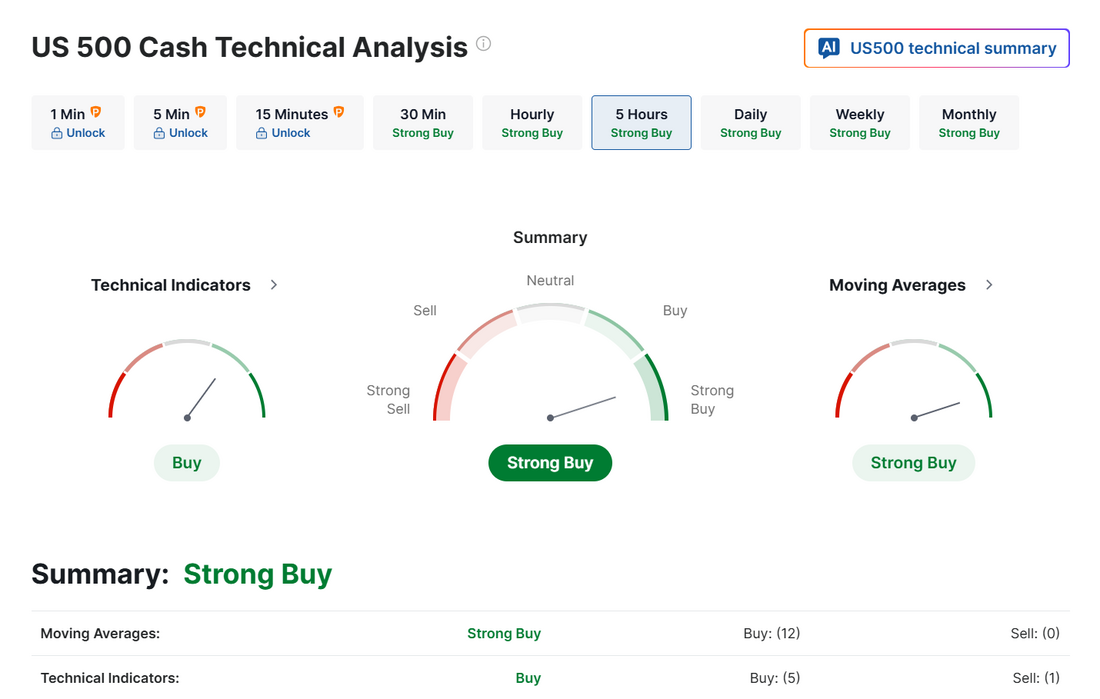

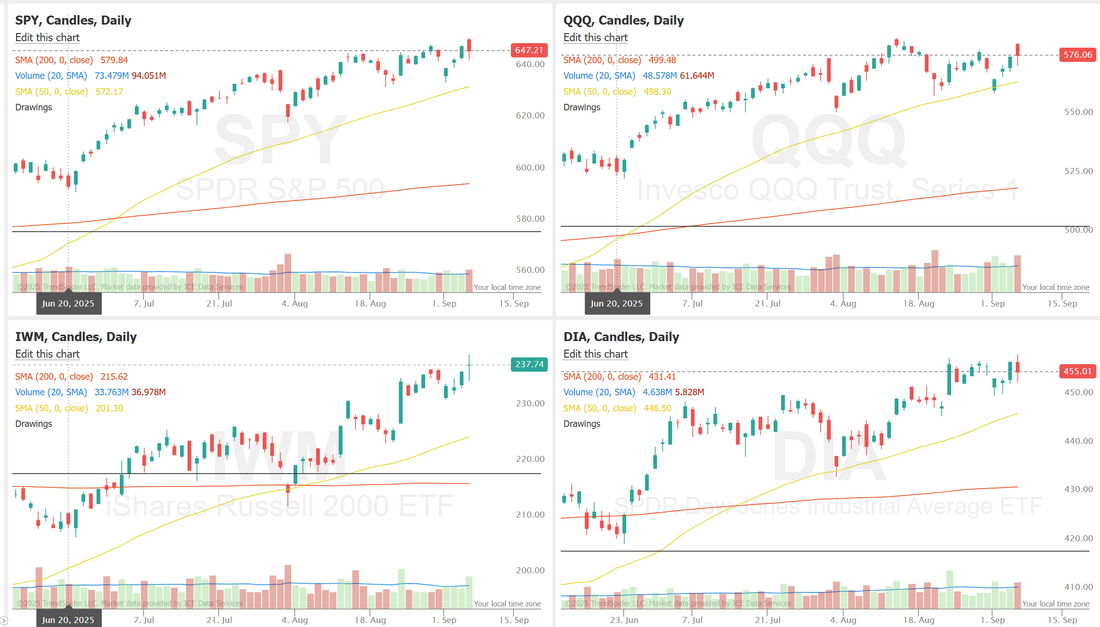

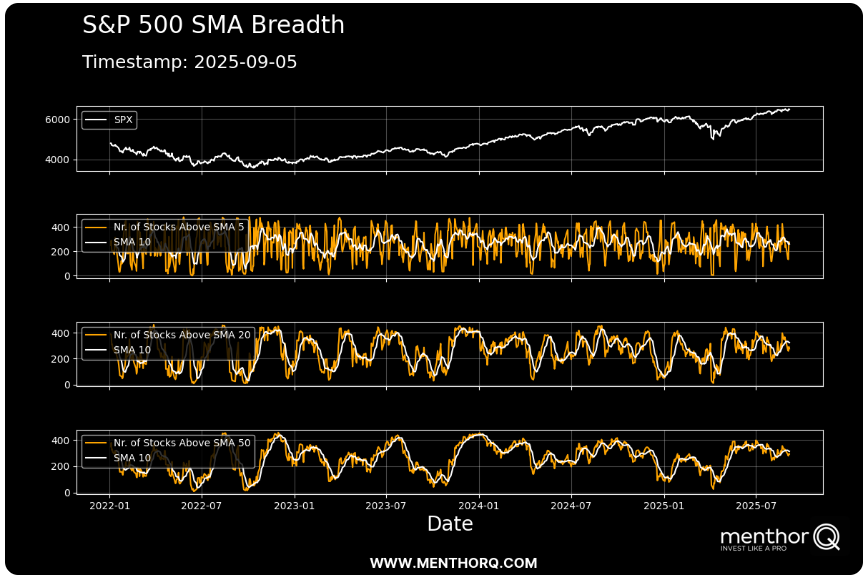

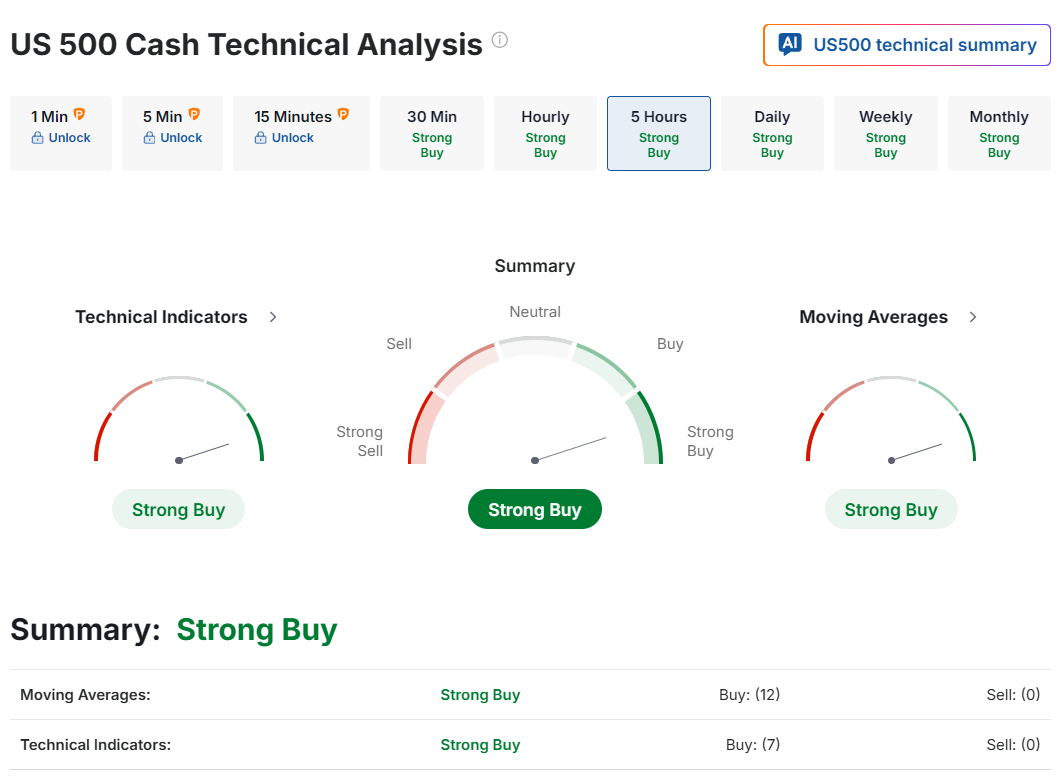

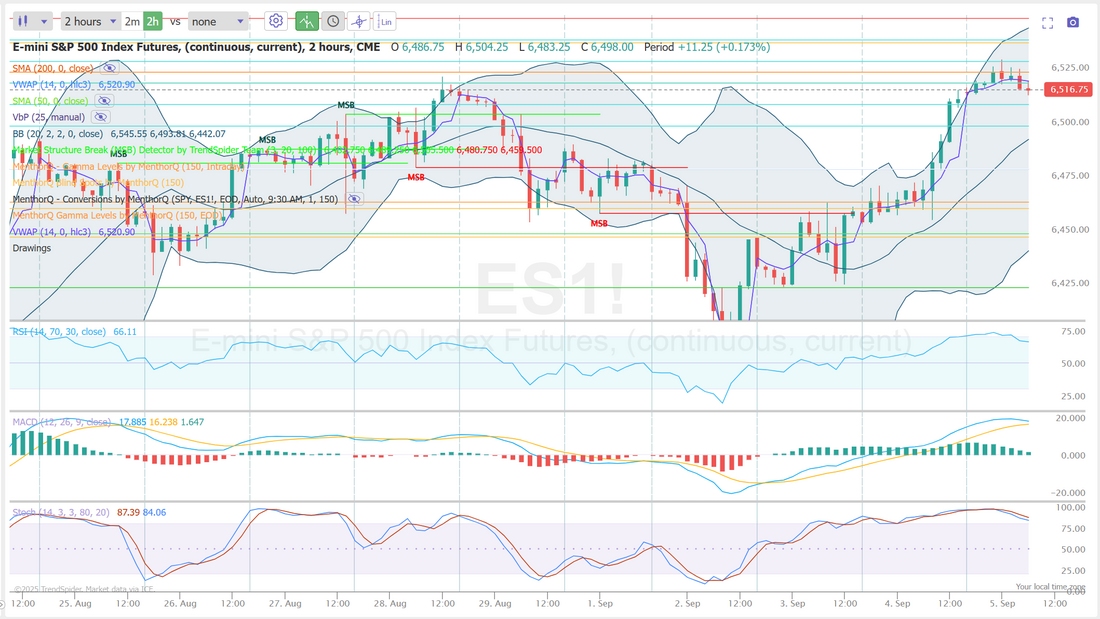

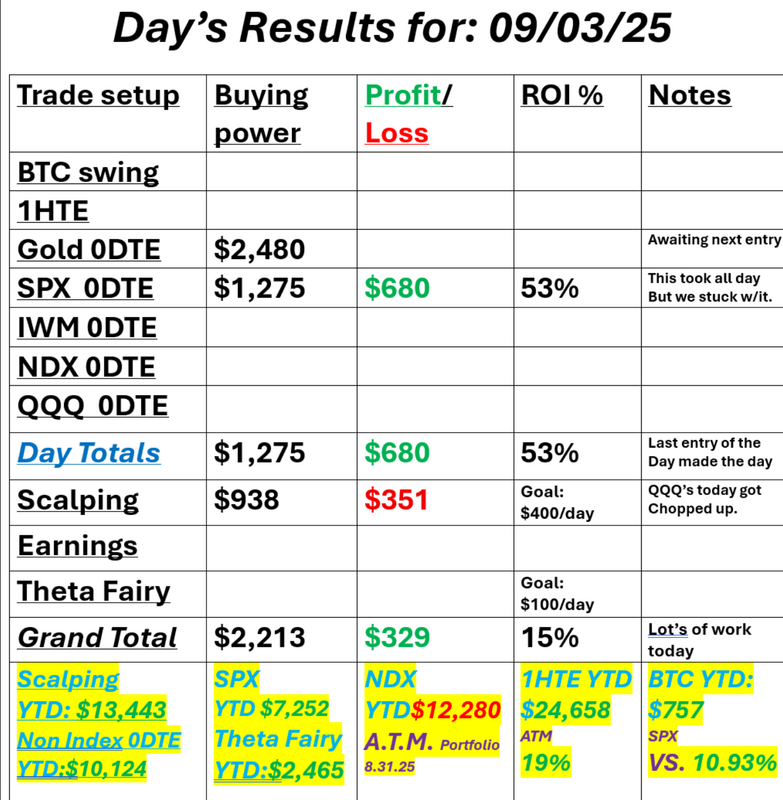

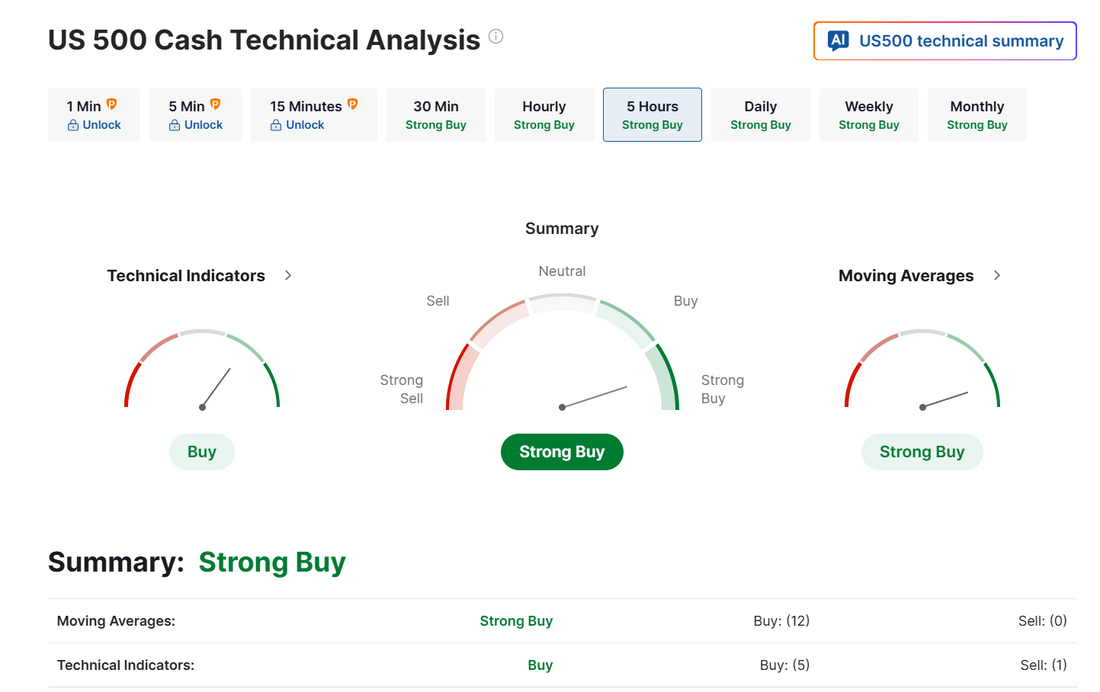

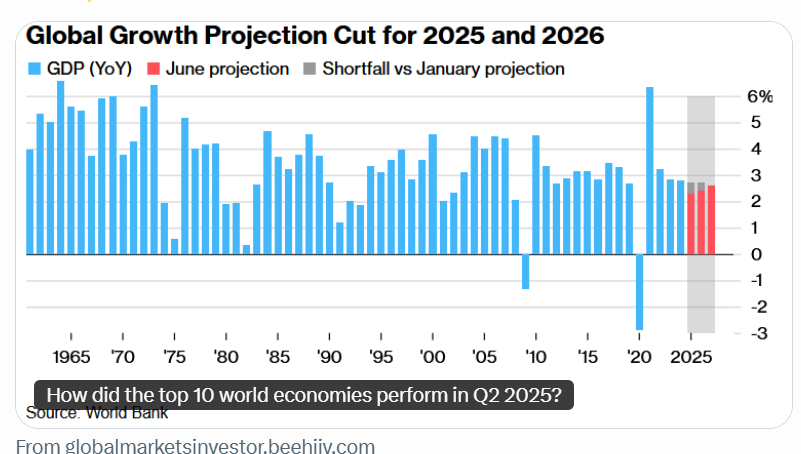

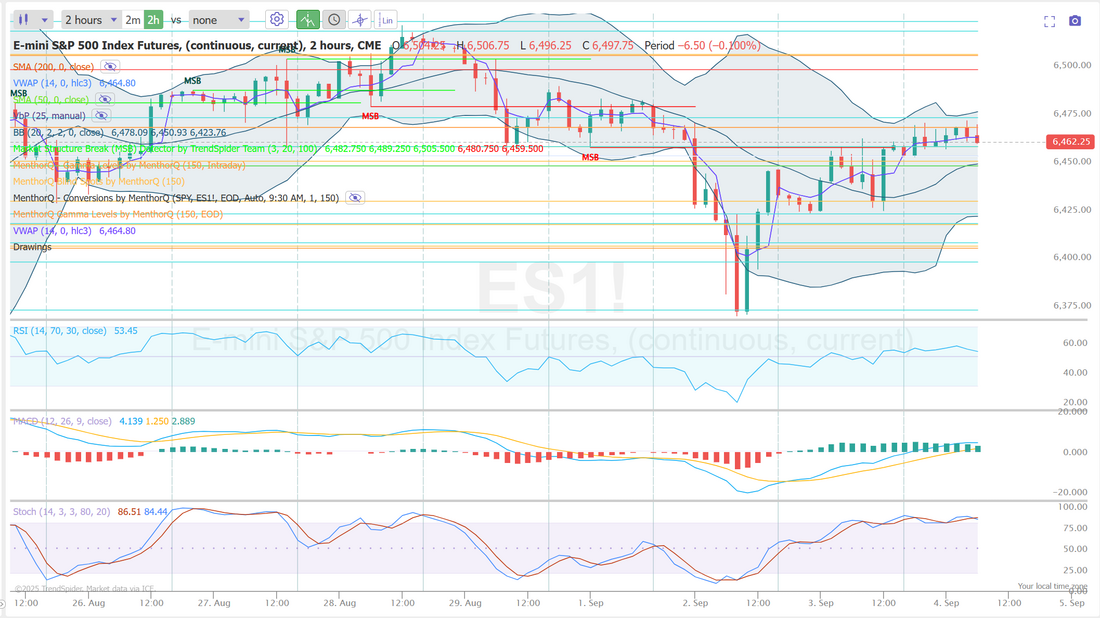

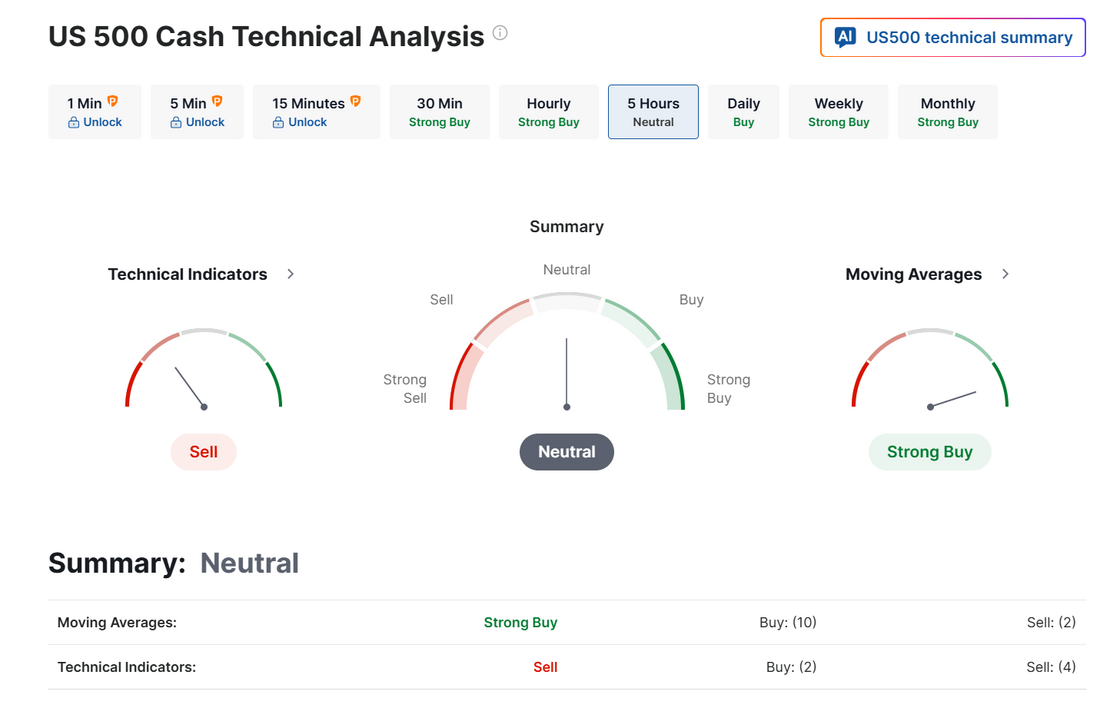

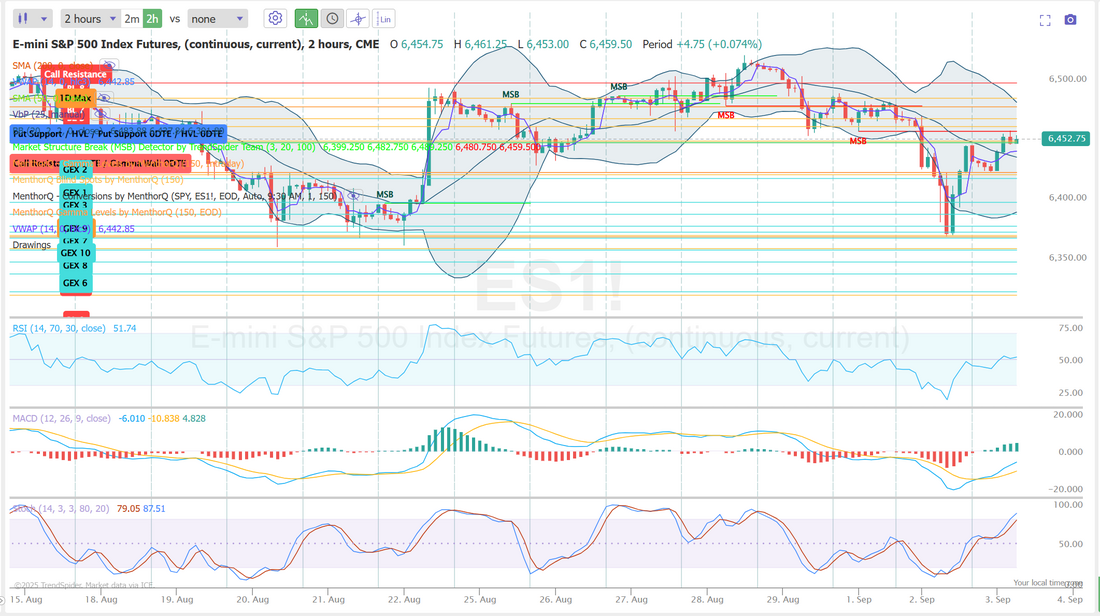

Here come the rate cut(s)The FED meets today, and we'll see Weds. What is the result? The questions are: #1. What size will the cut be? #2. What will that mean for the rest of the year and our next two decisions? #3. What will Powell say and how will he guide? It's certainly the big news item for this week's trading. We had a training session yesterday where we went over the data and what the past has taught us. Here's my projection for potential moves. This is obviously just one man's opinion (mine), but I do see some real potential for a "buy the rumor, sell the news" as a possible market reaction. I was looking for a retrace yesterday and while we got close and the risk/reward was quite good never the less, it didn't hit. Here's a look at my day. Let's take a look at the markets. Those ATH's just keep getting higher. Technicals are still firmly bullish, as you would imagine. Much like yesterday, I'm looking for more of a neutral day as traders prepare for FOMC tomorrow. September S&P 500 E-Mini futures (ESU25) are trending up +0.23% this morning as investors brace for the start of the Federal Reserve’s two-day policy meeting, where it is widely expected to cut interest rates, while also awaiting U.S. retail sales data. In yesterday’s trading session, Wall Street’s main stock indexes closed higher, with the S&P 500 and Nasdaq 100 notching new record highs. Seagate Technology (STX) climbed over +7% and was the top percentage gainer on the S&P 500 after Bank of America raised its price target on the stock to $215 from $170. Also, Alphabet (GOOGL) gained more than +4% after Citi raised its price target on the stock to $280 from $225. In addition, Tesla (TSLA) rose over +3% after CEO Elon Musk bought about $1 billion worth of the EV maker’s shares. On the bearish side, Corteva (CTVA) slumped more than -5% and was the top percentage loser on the S&P 500 after several analysts questioned the merits of a potential breakup of the agriculture company’s seed and pesticide businesses. Economic data released on Monday showed that the Empire State manufacturing index fell to a 3-month low of -8.70 in September, weaker than expectations of 4.30. The Fed kicks off its two-day meeting later in the day. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 4.00% to 4.25% on Wednesday. Investors will be watching Chair Jerome Powell’s post-policy meeting press conference for any indications on how quickly rates may fall from here. Following recent data painting a picture of a slowing labor market, U.S. money markets have almost fully priced in follow-up rate cuts in October and December. Market watchers will also closely parse the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer key guidance on how policymakers expect the interest-rate path to unfold over the next few years. “Now the discussion will turn to how aggressively the Fed will act. The Fed may remind everyone that it may be focused on jobs now, but it hasn’t forgotten about the other half of its mandate,” said Chris Larkin at E*Trade from Morgan Stanley. In other Fed news, a federal appeals court ruled on Monday that Fed Governor Lisa Cook can continue serving at the central bank while her legal case proceeds, upholding a lower court’s decision. Also, President Trump’s economic adviser Stephen Miran is set to join the Fed’s board after the Senate confirmed him to the post on Monday night. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.2% m/m increase in August following a +0.5% m/m climb in July. Investors will also focus on U.S. Core Retail Sales data, which rose +0.3% m/m in July. Economists expect the August figure to climb +0.4% m/m. U.S. Industrial Production and Manufacturing Production data will be released today. Economists expect Industrial Production to drop -0.1% m/m and Manufacturing Production to be unchanged m/m in August, compared to the July figures of -0.1% m/m and no change m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to drop -0.1% m/m and the import price index to fall -0.2% m/m in August, compared to the previous figures of +0.1% m/m and +0.4% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.040%, up +0.12%. The SPX continues to hold near record highs, but MACD breadth signals show mixed short-term momentum. The number of stocks generating MACD buy signals has pulled back from recent peaks, with the 10-day average trending lower, suggesting participation in the rally has thinned. In the short term, this divergence could point to a need for consolidation if breadth doesn’t improve. Watching whether buy signals expand again or continue to contract will be key in gauging if the index can sustain upward momentum or faces a pause. Let's take a look at the intra-day levels I'm focused on today on /ES (still on Sept. exp) 6635, 6650, 6659, 6674 are resistance. 6624, 6600, 6585, 6576 are support. Note: The delta between the support vs. resistance levels is a lot larger. I'm not sure we get a retrace today but there certainly seems to be more potential for a big move downside vs. upside. I'll see you all in the live trading room shortly!

0 Comments

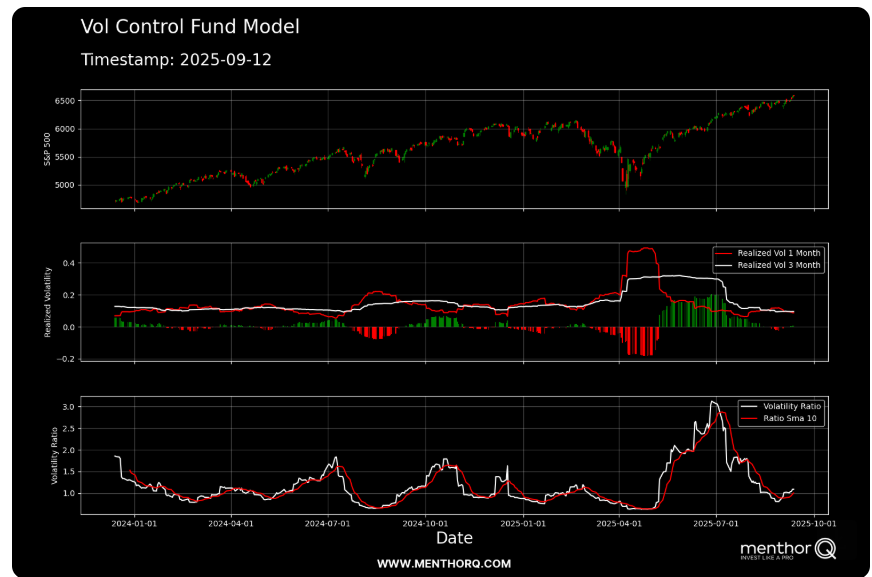

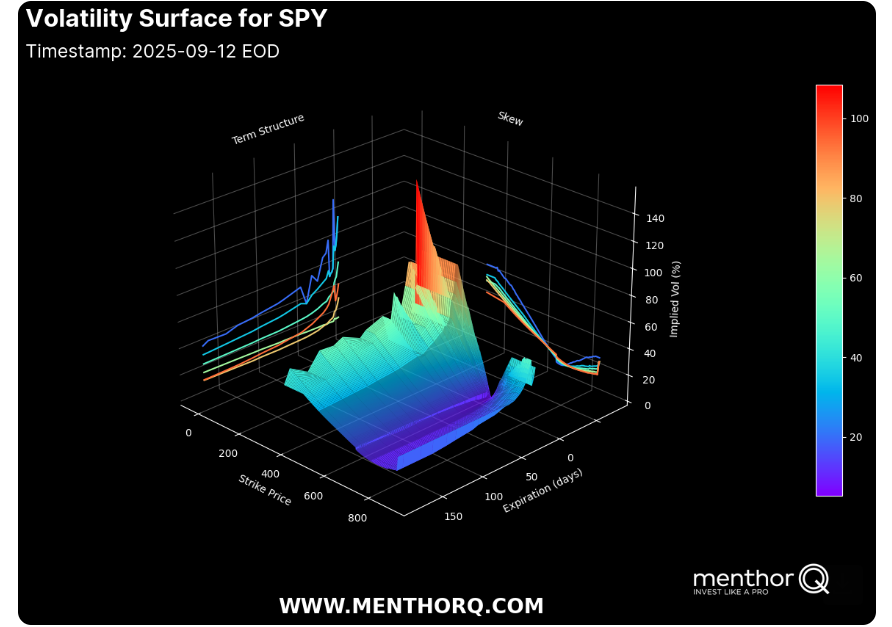

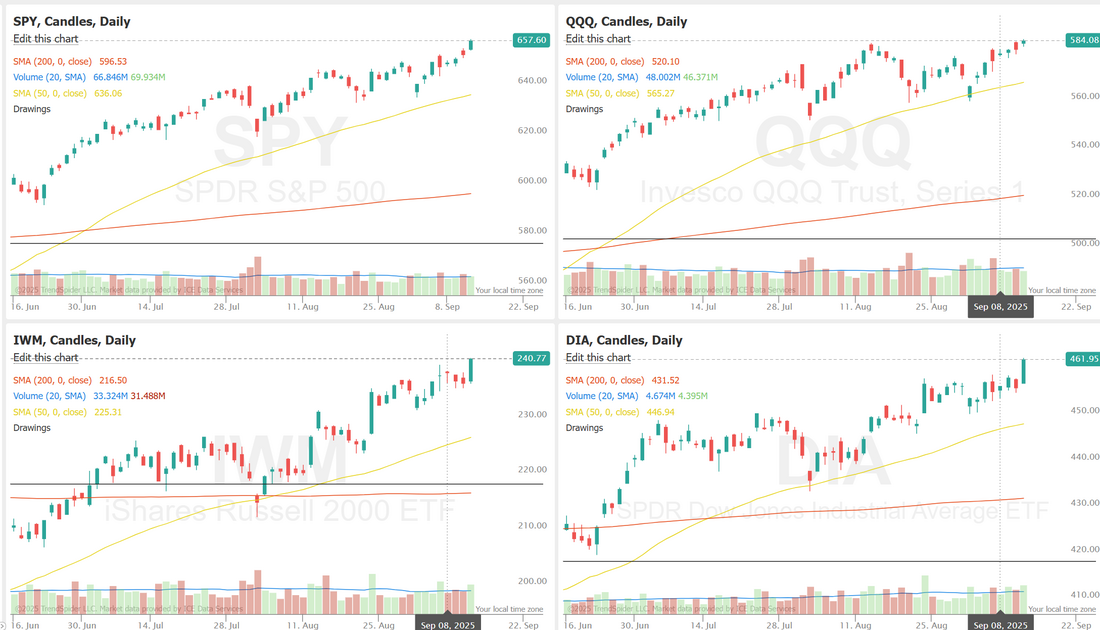

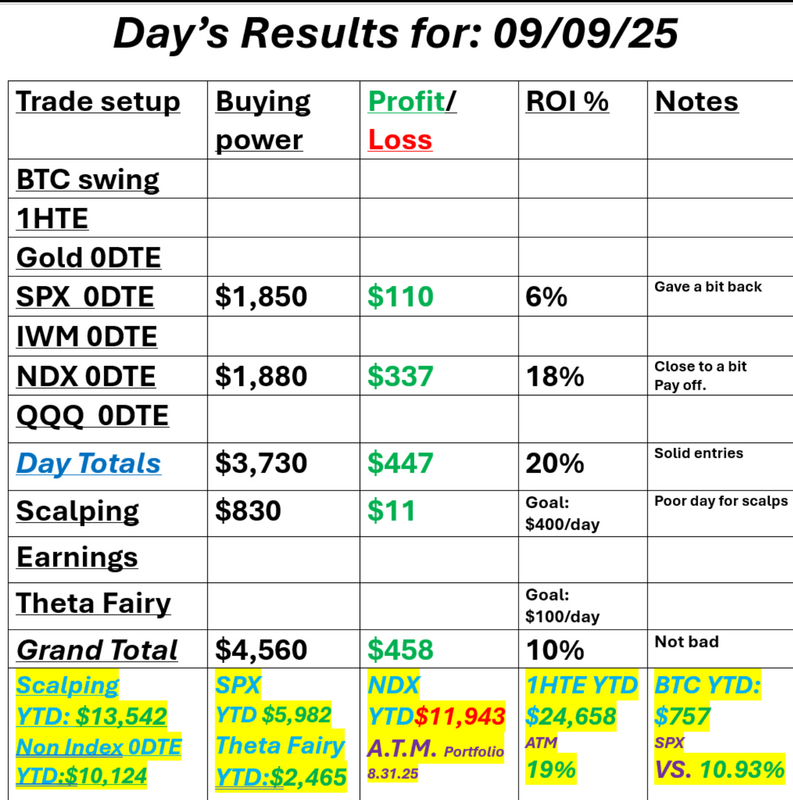

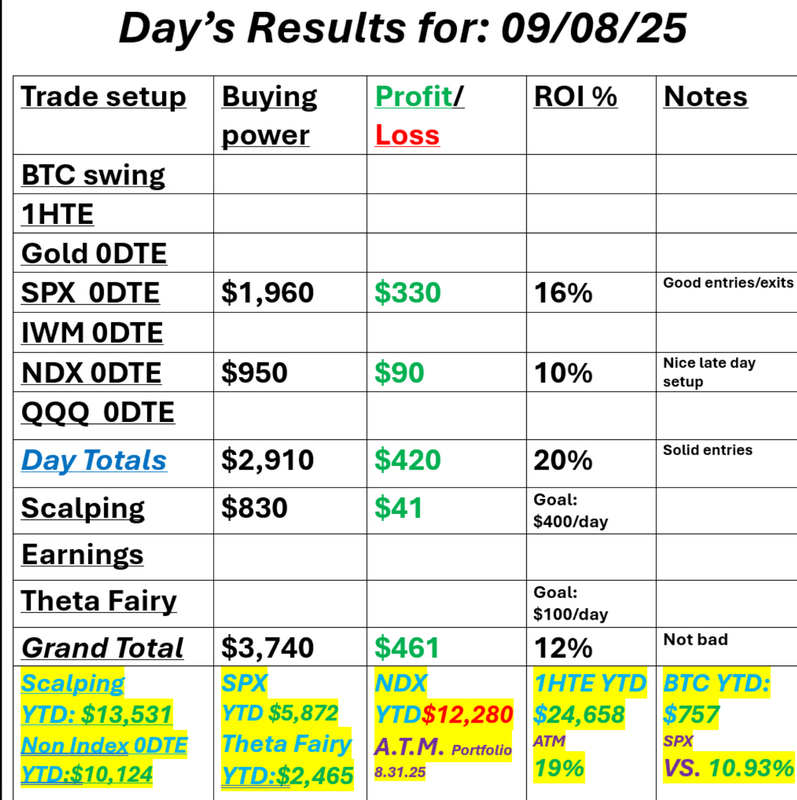

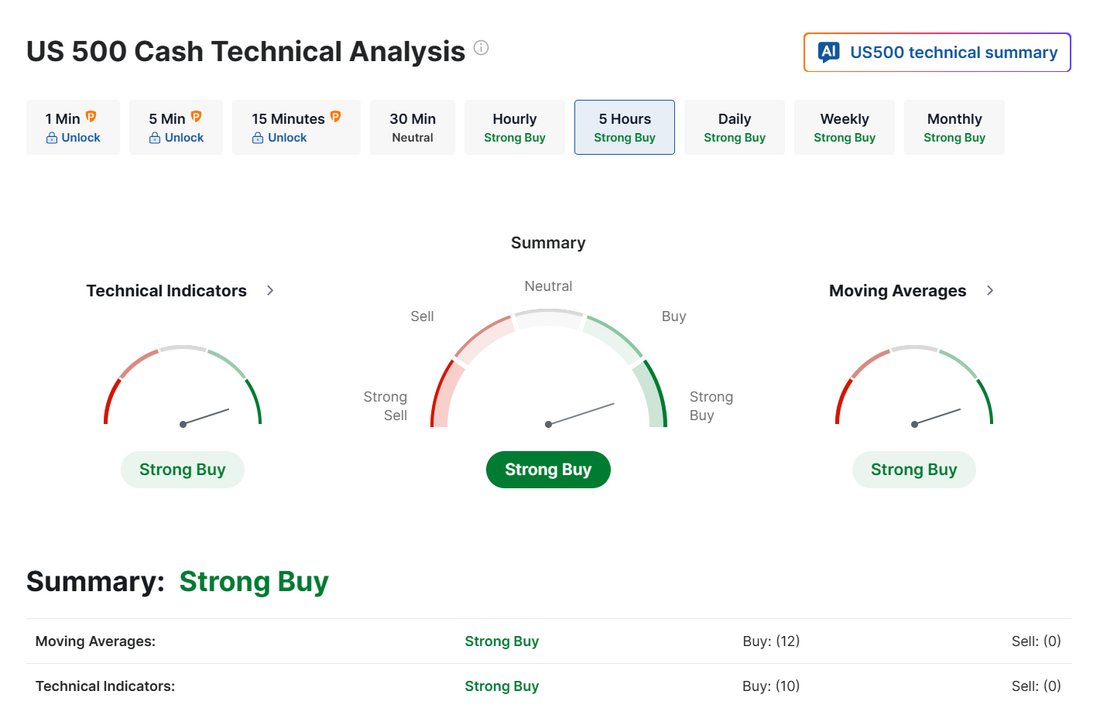

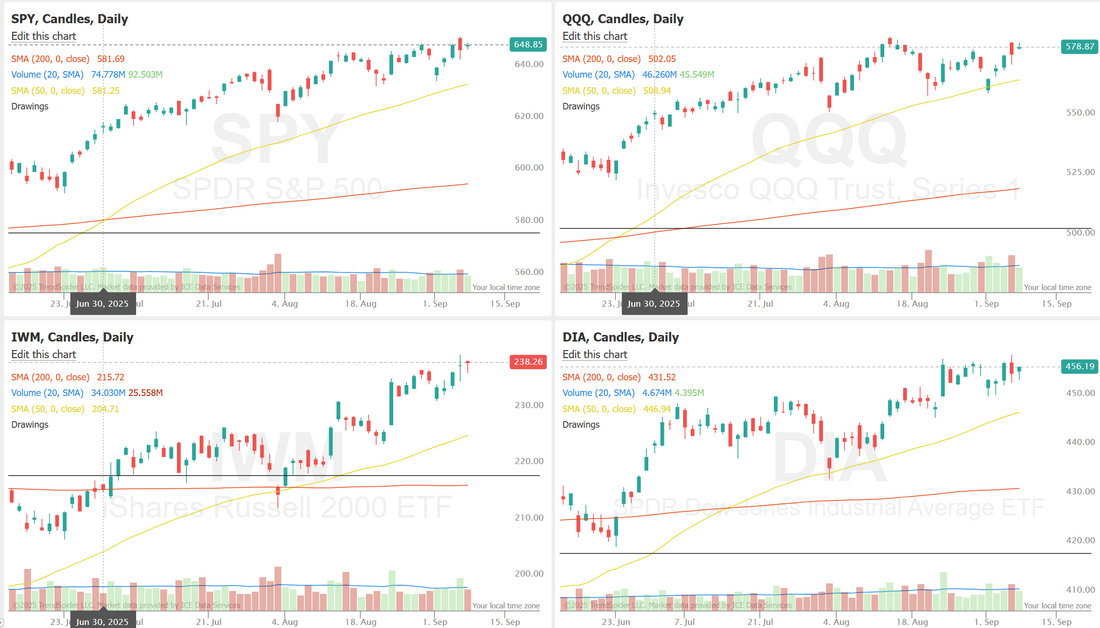

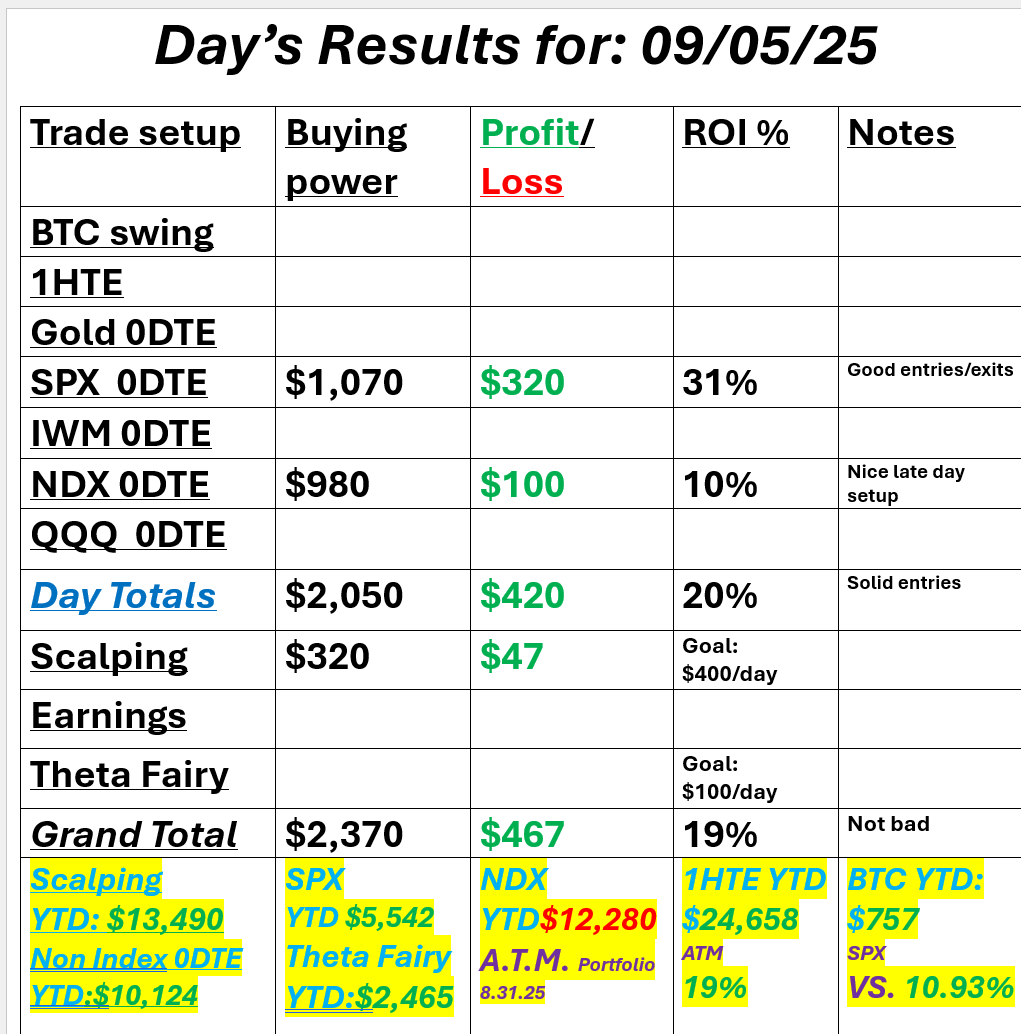

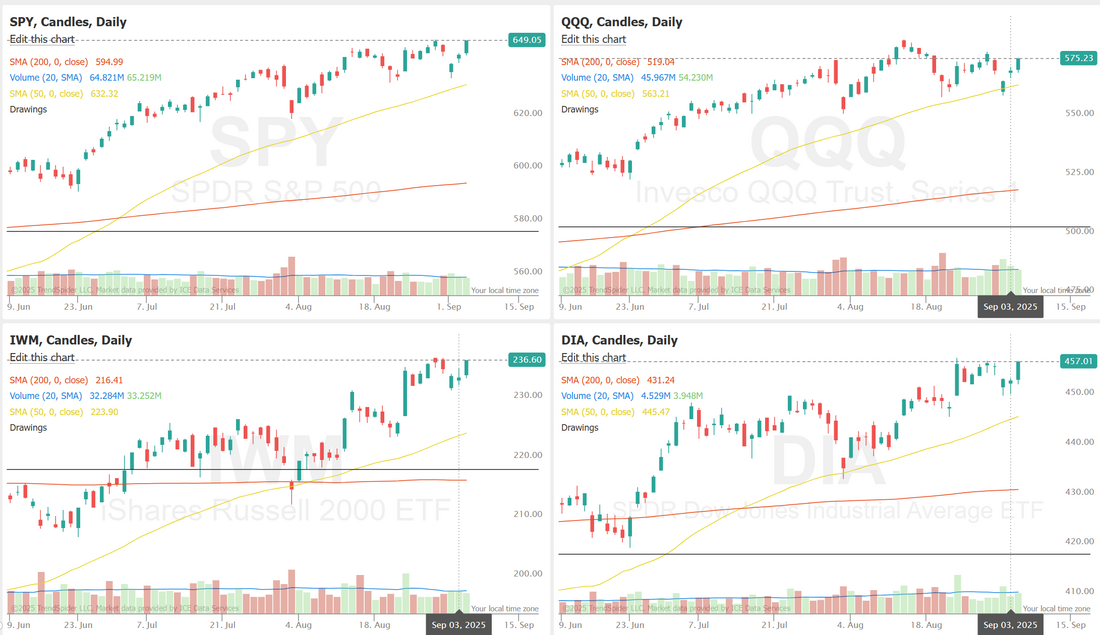

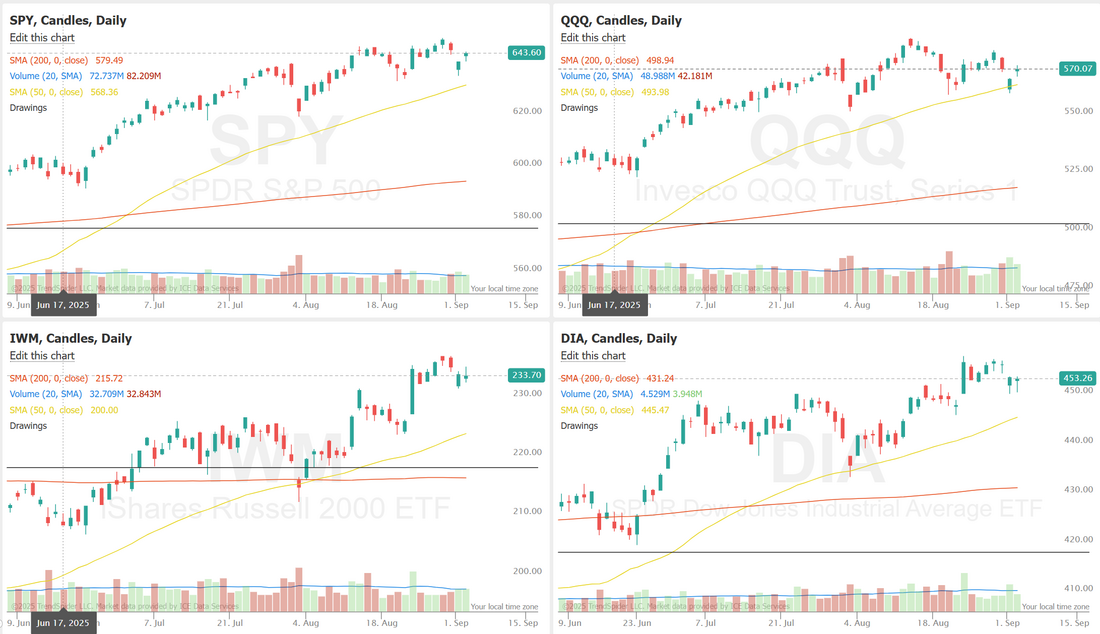

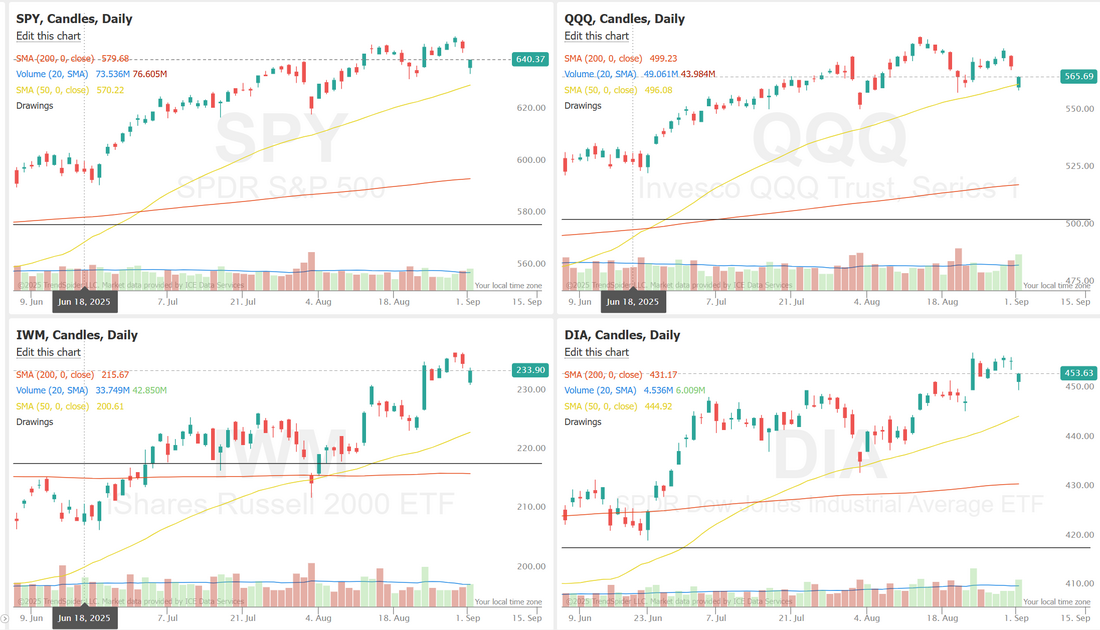

Rate cut incoming this week?Today we'll do a deep dive training of some FED data and market reaction over a big historical period. Will it be a 25bp or 50bp cut and how will the market react both short term and long term? Come join us for a live training session today. Our Friday was pretty quiet. Our SPX position rolled into today (Monday) and a few scalps on QQQ did not deliver. Here's a look at our day. Let's take a look at the market coming into an FOMC week. Markets are mostly sitting right on those ATH's. The SPX continues to press higher, but the volatility framework shows some short-term shifts worth monitoring. One-month realized volatility has eased back toward the three-month measure, reflecting calmer trading after the spring spike. However, the volatility ratio, while well off its peak, has started to curl upward from recent lows suggesting that near-term fluctuations could resurface. In the short term, the index’s ability to hold momentum while this ratio edges higher will be key, as a sustained pickup could challenge the current grind toward new highs. The SPY volatility surface as of September 12, 2025, shows a pronounced spike in implied volatility concentrated around shorter-dated expiries and near-the-money strikes, pointing to elevated hedging demand in the front end. The skew remains tilted, with higher implied vol levels on downside strikes relative to upside, reflecting persistent demand for protective positioning. Term structure analysis highlights a steeper curve, as longer-dated expiries remain more anchored while near-term options trade at a premium. In the short term, this setup suggests markets are pricing in event-driven uncertainty, with positioning clustered around the front-month maturities. Let's take a look at expected range for this week. It's a little surprising with FOMC this week that I.V. is still low. September S&P 500 E-Mini futures (ESU25) are up +0.19%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.08% this morning, pointing to a slightly higher open on Wall Street amid optimism ahead of a widely expected interest rate cut from the Federal Reserve later this week. Futures on the Nasdaq 100 underperformed as Nvidia (NVDA) fell over -2% in pre-market trading after China’s market regulator said in a preliminary probe that the chipmaker had violated the country’s anti-monopoly laws. Also, Texas Instruments (TXN) and Analog Devices (ADI) slid about -3% in pre-market trading after China over the weekend launched an anti-dumping investigation into some U.S.-made analog chips, including those produced by the two companies. Investors also await a fresh batch of U.S. economic data this week, with a particular focus on the retail sales report. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Arista Networks (ANET) slumped over -8% and was the top percentage loser on the S&P 500 after the company’s long-term projections failed to impress investors. Also, shares of vaccine makers retreated after the Washington Post reported that U.S. health officials plan to link Covid shots to the deaths of 25 children, with Moderna (MRNA) and BioNTech SE (BNTX) sliding more than -7%. In addition, RH (RH) fell over -4% after the home furnishings retailer reported downbeat Q2 results and cut its full-year revenue growth guidance. On the bullish side, Warner Bros. Discovery (WBD) surged more than +16% and was the top percentage gainer on the S&P 500 and Nasdaq 100, extending Thursday’s gains after the Wall Street Journal reported that Paramount Skydance was preparing a majority cash bid for the entertainment giant. Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index unexpectedly fell to a 4-month low of 55.4 in September, weaker than expectations of 58.2. Also, the University of Michigan’s U.S. September year-ahead inflation expectations were unchanged from August at 4.8%, in line with expectations, while 5-year implied inflation expectations unexpectedly increased to 3.9%, higher than expectations of 3.4%. “The Fed is pulled in opposite directions by rising inflation on the one hand and a weak job market on the other. The Fed can be expected to cut rates further in the coming months; the question is how much, not if,” said Bill Adams at Comerica Bank. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 4.00% to 4.25%. However, there’s also a small chance that a larger 50 basis point cut could occur. Investors will scrutinize remarks from Mr. Powell for any indications on how quickly rates may fall from here. Following recent data painting a picture of a slowing labor market, U.S. money markets have almost fully priced in follow-up rate cuts in October and December. Market watchers will also closely parse the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer key guidance on how policymakers expect the interest-rate path to unfold over the next few years. “Despite inflation running above the Fed’s 2% target, [recent] weaker-than-expected nonfarm payroll figures, coupled with revised data showing 911,000 fewer jobs created in the 12 months to March, have strengthened the likelihood of monetary policy easing,” said Richard Flax, chief investment officer at Moneyfarm. Investors will also keep an eye on U.S. economic data this week. The retail sales report for August will be the main highlight, as it will provide insight into the state of consumer spending. Other noteworthy data releases include U.S. Industrial Production, Manufacturing Production, the Export Price Index, the Import Price Index, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. In addition, several notable companies, including shipping giant FedEx (FDX), homebuilder Lennar (LEN), and cereal maker General Mills (GIS), are scheduled to release their quarterly results this week. Meanwhile, Meta CEO Mark Zuckerberg will open the company’s annual Meta Connect conference on Wednesday evening, where the Facebook parent is expected to highlight product offerings such as its AI glasses. On the trade front, U.S.-China talks on trade, the economy, and the status of ByteDance’s TikTok began on Sunday in Madrid. U.S. Treasury Secretary Scott Bessent said that the U.S. is nearing a deal with China regarding TikTok. The talks resumed on Monday. Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists foresee the September figure coming in at 4.30, compared to 11.90 in August. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.064%, up +0.12%. Let's take a look at the intra-day levels we'll be focusing on today on /ES. 6605, 6614, 6624, 6630 are resistance zones. 660, 6594, 6585, 6577 are support zones. My lean or bias today: Futures are up as I type. The news docket is pretty light. Technicals are all bullish. All that being said, I think we could be flat today, waiting on Weds.results. Trade docket today: We'll focus on getting an exit on our SPX we rolled from Friday as well as scalping. QQQ's may be the preferred method again today. I look forward to seeing you all in our live trading room today and don't forget to tune into zoom for our weekly training session.

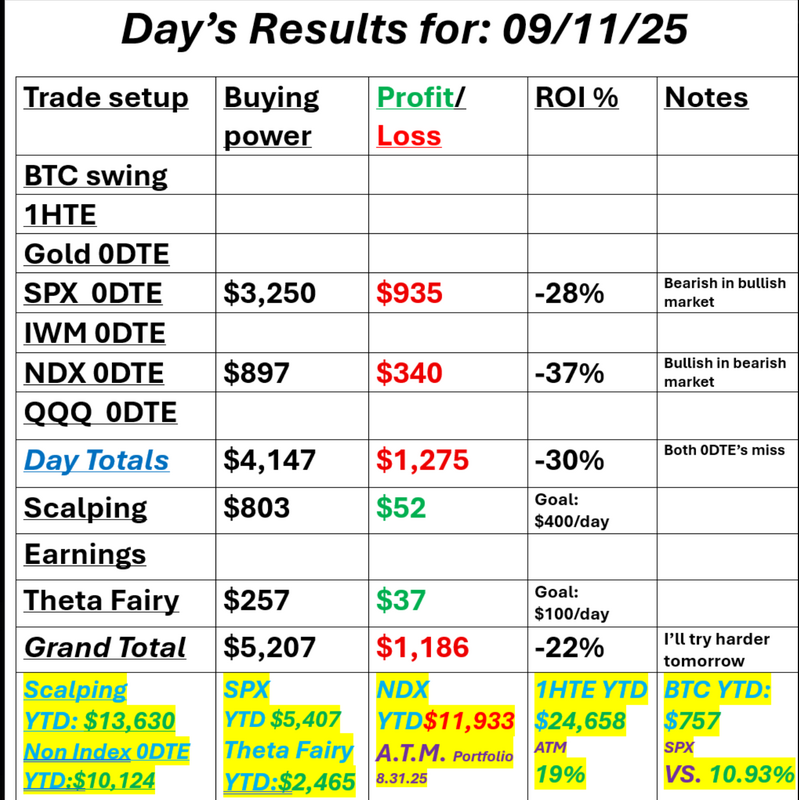

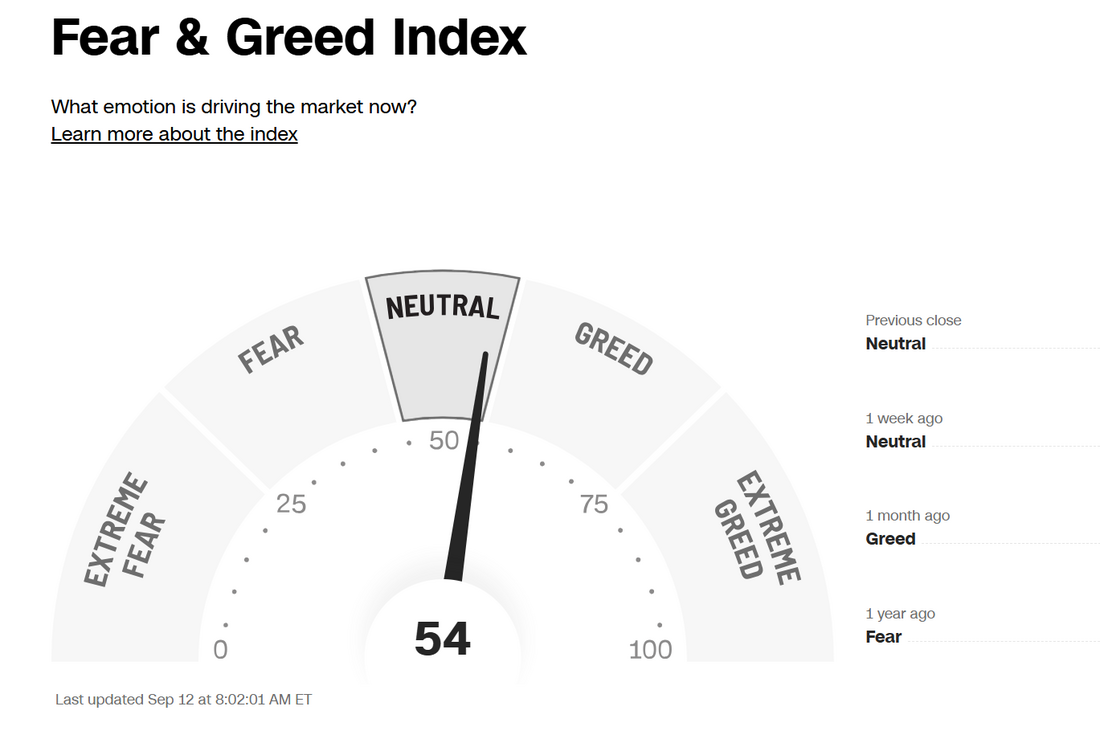

New ATH's reachedMarkets are holding at incremental new highs. We had two days of solid inflation numbers and it all seems like a lock that we'll get a rate cut. The question is, will it be a "buy the rumor, sell the news" situation? The market sure seems stretched to me. We'll see soon enough. I had a bad day yesterday with both my 0DTE's missing. Our Thetafairy and scalping made money but not enough to offset. Here's a look at my day. Let's look at the markets. That's a pretty solid up trend. New ATH's. Is there any resistance in sight? Not yet. Technicals are bullish as you'd think they should be with a trend like we currently have. The fear and greed index is not overly optimistic here, which is a bit surprising. September S&P 500 E-Mini futures (ESU25) are down -0.11%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.04% this morning, taking a breather as investors assess how much further the record rally fueled by expectations of Federal Reserve rate cuts can continue. Higher bond yields today are also weighing on stock index futures. Investors now await the University of Michigan’s preliminary reading on U.S. consumer sentiment due later in the day. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green, with the S&P 500, Dow, and Nasdaq 100 notching new record highs. Warner Bros. Discovery (WBD) jumped over +28% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the Wall Street Journal reported that Paramount Skydance was preparing a majority cash bid for the entertainment giant. Also, Centene (CNC) surged about +9% after the healthcare company reiterated its full-year adjusted EPS guidance. In addition, Micron Technology (MU) climbed over +7% after Citi raised its price target on the stock to $175 from $150. On the bearish side, Netflix (NFLX) slid more than -3% and was the top percentage loser on the Nasdaq 100 after Chief Product Officer Eunice Kim announced her departure from the company. The U.S. Bureau of Labor Statistics report released on Thursday showed that consumer prices rose +0.4% m/m in August, stronger than expectations of +0.3% m/m. On an annual basis, headline inflation picked up to +2.9% in August from +2.7% in July, in line with expectations. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.3% m/m and +3.1% y/y in August, in line with expectations. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly rose by +27K to a 3-3/4-year high of 263K, compared with the 235K expected. “[Thursday’s] CPI report has been trumped by the jobless claims report,” said Seema Shah at Principal Asset Management. “If anything, the jump in jobless claims will inject a bit more urgency in the Fed’s decision-making, with Powell likely signaling a sequence of rate cuts is on the way.” Meanwhile, U.S. rate futures have priced in a 100% probability of a 25 basis point rate cut and a 7.5% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. In tariff news, the Financial Times reported on Thursday that the U.S. will push G7 countries to impose higher tariffs on India and China over their purchases of Russian oil. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary September figure will stand at 58.2, the same as in August. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.044%, up +0.82%. We've got a new training module for you coming up on our next Monday zoom session. Mark your calendar for that. I don't have a lean or bias today. The trend is bullish so I lean that direction but a pause or even a retrace today could make sense. Let's let the morning develop. Let's take a look at the intra-day levels I'll be watching today. 6595, 6600, 6606, 6610 are resistance levels. 6583, 6575, 6569, 6552 are support zones. I look forward to seeing you all in the live trading room shortly. Let's see f we can finish the week strong!

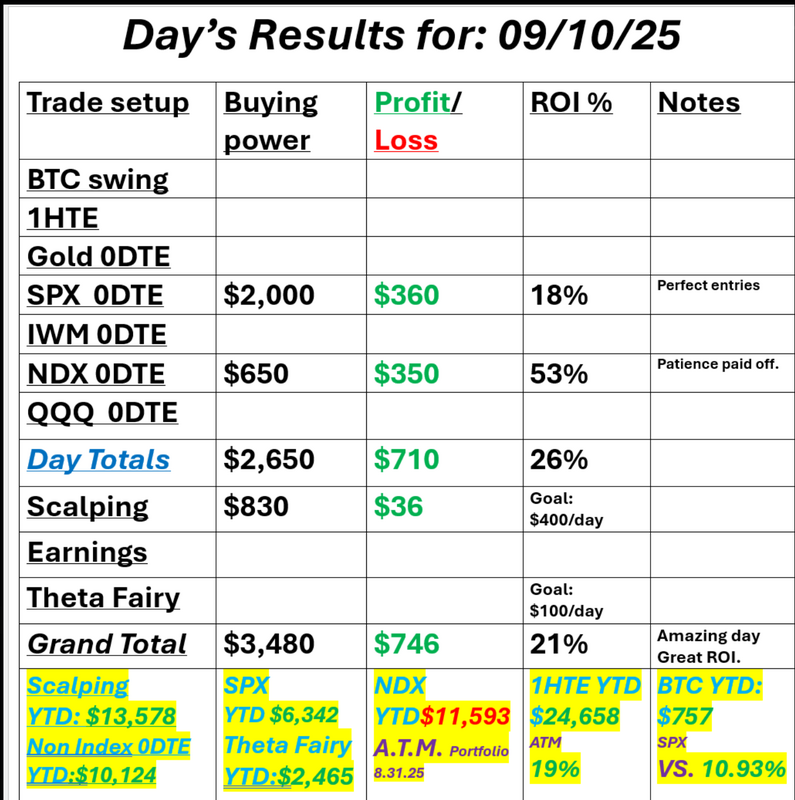

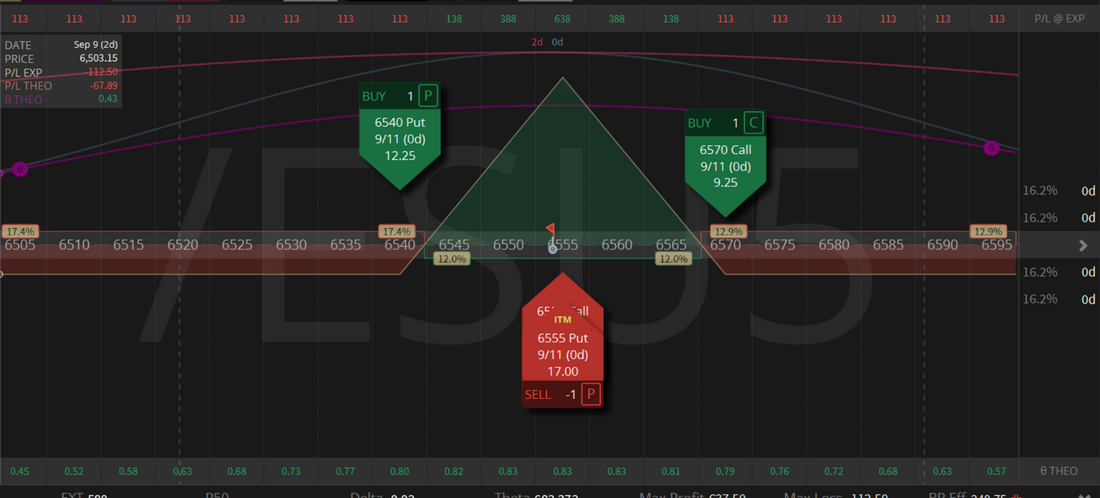

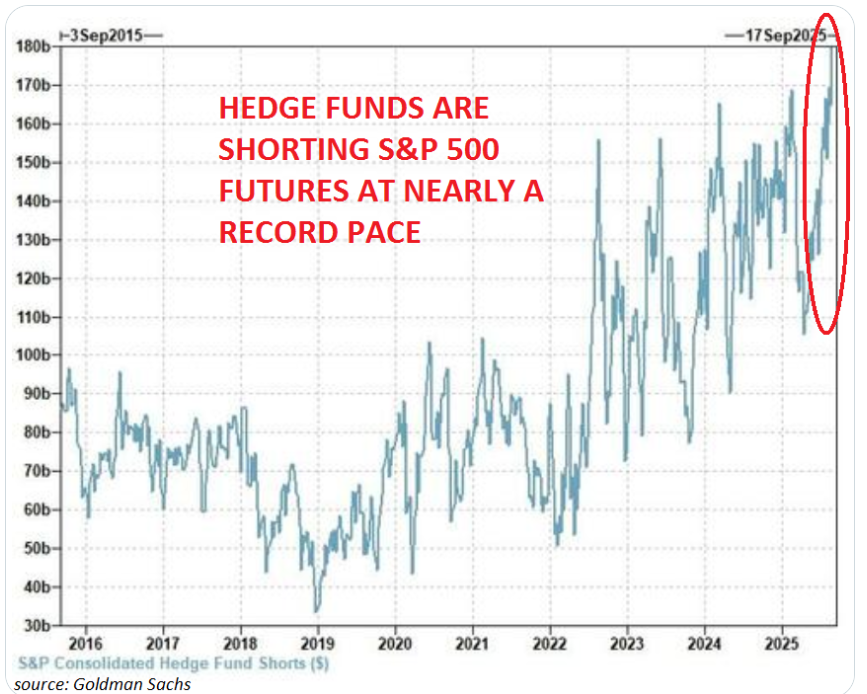

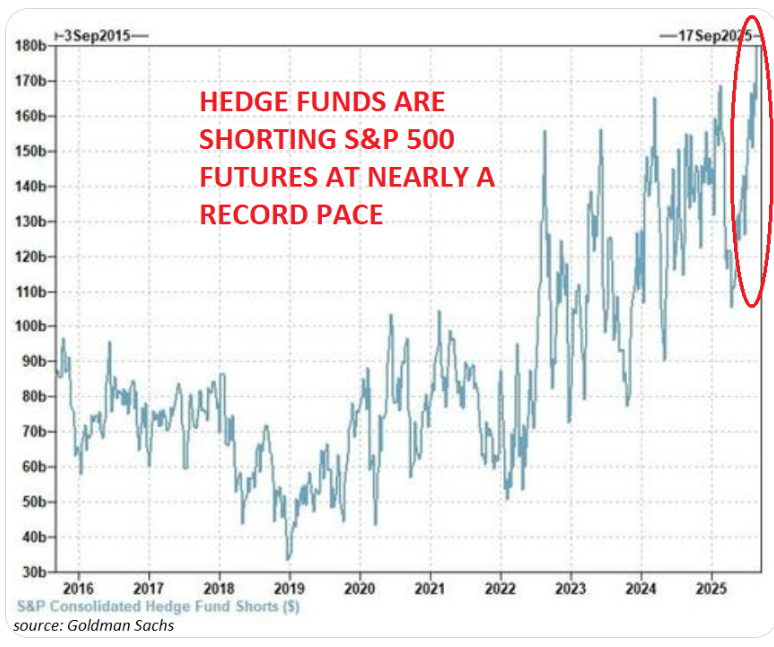

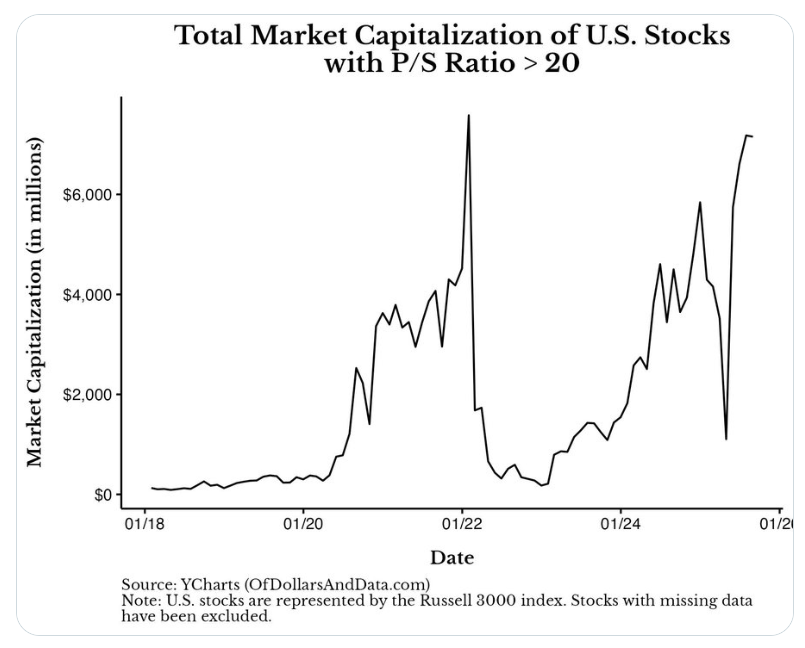

CPI dayWe had a good day yesterday but it was a slow burn and a "full work day". Sometimes our workdays are only an hour and sometimes we need the full 6.5 hrs. to make it happen. Have you ever noticed that the things in life that are hard are usually the things that are most important? Going to the gym is hard but the benefits are amazing. Sitting our our hands. Waiting for trades to materialize. Begging for the market to hit one of our levels so we can start hitting that enter button on our computers. These are all hard things, but we know that with discipline we usually get rewarded. We had a solid day yesterday but our last NDX trade came down to the last 30 min. of the day. Here's a look at our results. Today is a copy/paste from yesterday. We move on from PPI to CPI today. Just like yesterday, we'll forgo looking at levels and creating bias until we get into our zoom session and see how the market reacts. September S&P 500 E-Mini futures (ESU25) are up +0.16%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.15% this morning as investors refrain from making any big bets ahead of key U.S. inflation data that is expected to shape expectations for the Federal Reserve’s interest rate path this year. In yesterday’s trading session, Wall Street’s major indices ended mixed, with the S&P 500 notching a new record high. Oracle (ORCL) jumped over +35% and was the top percentage gainer on the S&P 500 after the enterprise software giant gave an aggressive forecast for its cloud business. Also, stocks tied to AI computing infrastructure soared on Oracle’s upbeat outlook, with CoreWeave (CRWV) surging more than +16% and Broadcom (AVGO) climbing over +9% to lead gainers in the Nasdaq 100. In addition, GameStop (GME) rose over +3% after the videogame retailer reported stronger-than-expected Q2 results. On the bearish side, Synopsys (SNPS) plummeted more than -35% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chip design software company reported downbeat FQ3 results and issued below-consensus FQ4 guidance. Economic data released on Wednesday showed that the U.S. producer price index for final demand fell -0.1% m/m and rose +2.6% y/y in August, weaker than expectations of +0.3% m/m and +3.3% y/y. Also, the core PPI, which excludes volatile food and energy costs, fell -0.1% m/m and rose +2.8% y/y in August, weaker than expectations of +0.3% m/m and +3.5% y/y. “The worst-case scenario on inflation isn’t playing out,” said David Russell at TradeStation. “The doves will be happy to see the year-over-year number back below 3%. Combined with the weak jobs data recently, this keeps us on track for rate cuts. However, the speed and intensity might depend more on the big consumer index.” Meanwhile, U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut and an 8.0% chance of a 50 basis point rate cut at next week’s monetary policy meeting. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Market watchers will assess the extent to which hefty U.S. tariffs are passing through to consumers. Slower price growth could reinforce expectations for a series of rate cuts after a likely move next week, while hotter-than-expected inflation may lead investors to price in a more cautious pace of easing. Economists, on average, forecast that the U.S. August CPI will come in at +0.3% m/m and +2.9% y/y, compared to the previous numbers of +0.2% m/m and +2.7% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.1% y/y in August, unchanged from July’s figures of +0.3% m/m and +3.1% y/y. A survey conducted by 22V Research revealed that investors anticipate an in-line inflation report, with most respondents saying that the core CPI is on a Fed-friendly glide path. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 235K, compared to last week’s number of 237K. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ3 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.042%, up +0.35%. We've got a modified Theta fairy working with an Iron fly going into CPI release. We'll be looking to pull it after the vol crush after CPI release. Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace: Hedge funds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. CPI prepThe Consumer Price Index (CPI), released monthly by the Bureau of Labor Statistics (BLS), measures the change in prices paid by consumers for a representative basket of goods and services. Key components include: Headline CPI: Includes all items—food, energy, and others. Core CPI: Excludes volatile categories like food and energy, offering a clearer view of underlying inflation trends. YoY – Forecast: 2.9% | Prior: 2.7% | Range: 3% / 2.7% MoM – Forecast: 0.3% | Prior: 0.2% | Range: 0.5% / 0.1% Core YoY – Forecast: 3.1% | Prior: 3.1% | Range: 3.1% / 3% Core MoM – Forecast: 0.3% | Prior: 0.3% | Range: 0.4% ./ 0.2% Our levels were pretty spot on yesterday. 6560 and 6535 are the main resistance/support levels coming into CPI. We'll drill down on all the levels in our zoom session. I'll see you all in the live trading room shortly!

PPI numbers incomingWe are entering a couple potential big days with PPI release this morning and CPI tomorrow. Inflation official numbers are running around 3.3% annually. Quite a bit higher than the FED's goal of 2% but that isn't stopping the CME futures from predicting a 100% probability of a rate cut next week. Markets should react today so we'll be prepared for movement. Yesterday was another absolutely perfect, or near perfect day for us, execution wise. We really did everything right...again but, with such little movement over the last couple of days our profits are smaller than we'd like. I know I'm repetitive here but our challenge remains the same. Low I.V. make credit trades poor risk/reward and lack of directional movement makes debit trades ineffective. As I said, I'm sure that will change today and tomorrow. Here's a look at our "perfect" day yesterday. September S&P 500 E-Mini futures (ESU25) are up +0.25%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.15% this morning as a blowout outlook from Oracle buoyed sentiment, while investors geared up for crucial U.S. producer inflation data. Oracle (ORCL) surged over +29% in pre-market trading after the enterprise software giant projected that booked revenue from its core cloud business would surpass half a trillion dollars in the coming months, stunning Wall Street and boosting optimism that the AI infrastructure rollout is accelerating. Chip stocks also climbed in pre-market trading on Oracle’s upbeat outlook, with Nvidia (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO) up more than +2%. In yesterday’s trading session, Wall Street’s major indexes closed higher. UnitedHealth Group (UNH) surged over +8% and was the top percentage gainer on the S&P 500 and Dow after the insurer said it expects about 78% of its Medicare Advantage members to be enrolled in top-rated Medicare plans next year. Also, Atlassian Corp. (TEAM) climbed more than +5% and was the top percentage gainer on the Nasdaq 100 after announcing plans to end its data center product over the next three years and move customers to its cloud platform. In addition, Nebius (NBIS) jumped over +49% after securing a deal worth up to $19.4 billion to provide Microsoft with AI infrastructure through 2031. On the bearish side, Albemarle (ALB) slumped more than -11% following a report that China’s CATL would soon restart its Yichun lithium mine. A preliminary report from the Bureau of Labor Statistics on Tuesday showed that employers added 911,000 fewer jobs in the year through March than previously indicated in the monthly payroll data. The final figures will be released early next year. “The labor market appears weaker than originally reported,” said Jeff Roach at LPL Financial. “A deteriorating labor market will allow the Fed to highlight the need to ease rates. Investors should expect the Fed to officially start the rate-cutting campaign at the next meeting.” JPMorgan CEO Jamie Dimon told CNBC in an interview on Tuesday that the record revision to U.S. payrolls data underscores that the U.S. economy is contending with a slowdown. “The economy is weakening,” Dimon said. “Whether that is on the way to recession or just weakening, I don’t know.” U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut and a 10.2% chance of a 50 basis point rate cut at the Fed’s monetary policy committee meeting next week. Meanwhile, a federal judge on Tuesday night blocked U.S. President Donald Trump from removing Lisa Cook from the Federal Reserve Board of Governors while a lawsuit challenging her dismissal proceeds. In tariff news, the U.S. Supreme Court agreed on Tuesday to review the legality of President Trump’s sweeping global tariffs. The court placed the case on a fast track, setting oral arguments for the first week of November. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. August PPI will stand at +0.3% m/m and +3.3% y/y, compared to the previous figures of +0.9% m/m and +3.3% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect August figures to be +0.3% m/m and +3.5% y/y, compared to July’s numbers of +0.9% m/m and +3.7% y/y. U.S. Wholesale Inventories data will be released today. Economists anticipate that the final July figure will be unrevised at +0.2% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.900M, compared to last week’s value of 2.415M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.082%, up +0.25%. No bias or levels today or tomorrow with PPI and CPI. They should be the drivers and we'll look at the levels as they develop intra-day inside our trading room.

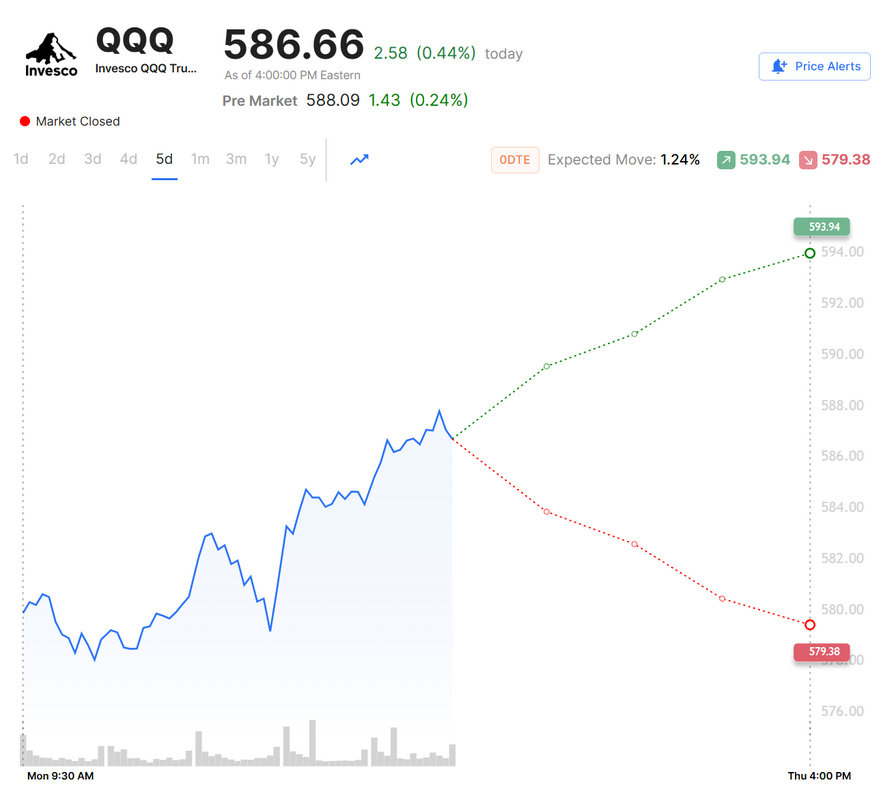

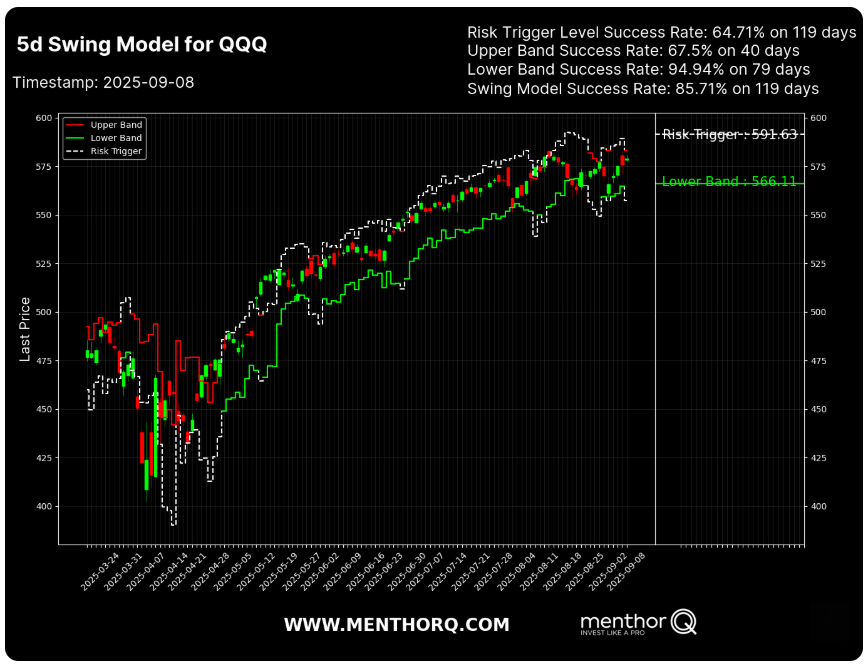

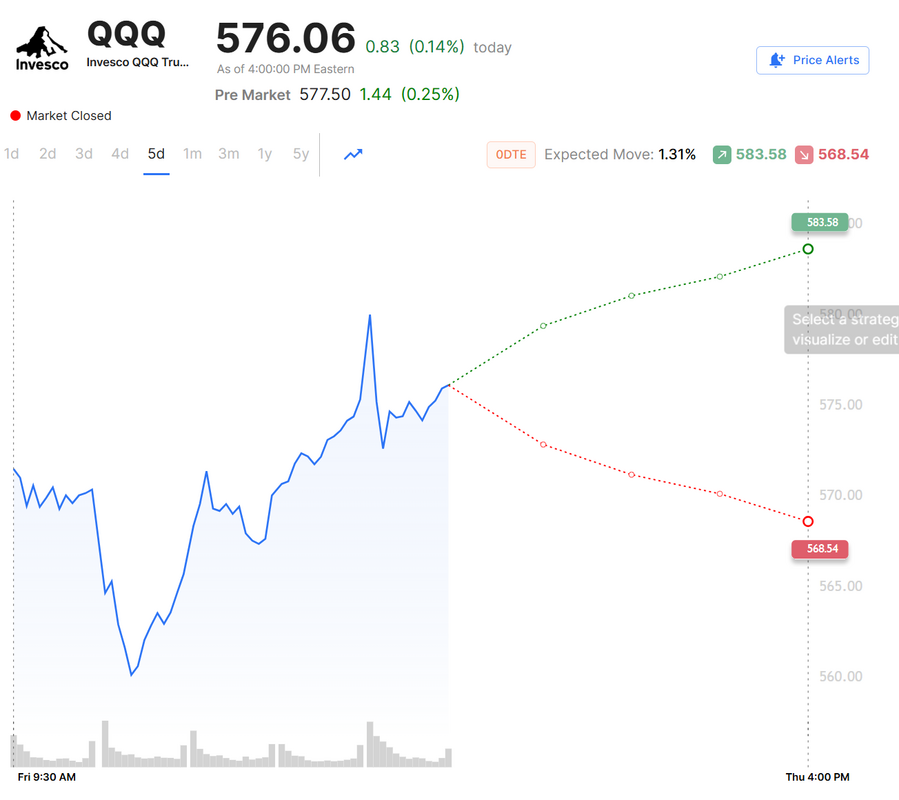

I look forward to seeing you all shortly! Job revisions...how bad?We get the job revision numbers today. It's generally assumed it will be revised down. the question is how much? I think it's big and that should solidify a rate cut come next week. We had a perfect day yesterday. Our entries and exits were about as well timed as can possibly be but the moves were small all day and it just wasn't enough to get our daily profit goal of $1,000+ dollars. Still, it was a solid day with everything we touched working well. See our results below: Let's take a look at the market. Bullish sentiment is holding. The SPX momentum score chart as of September 8, 2025 shows the index trading near the upper end of its recent range, with spot prices holding steady around the 6,400–6,500 zone. Momentum scores have stabilized at 4, following a brief dip to 3 in late August. This stabilization suggests that while upward strength has moderated compared to the early summer rally, there’s still enough support in the short term to maintain current levels rather than a sharp reversal. Looking at the short-term setup, the chart reflects a steady but less aggressive trend, where momentum remains constructive but not at peak levels seen in July. The key takeaway here is that the index appears to be consolidating gains while retaining enough momentum to keep the bias tilted upward in the near term, unless a new catalyst shifts sentiment. The QQQ 5-day swing model chart highlights a short-term setup where price is hovering near the upper end of its recent range. The risk trigger sits around 591.63, while the lower band support is at 566.11, which has historically shown high reliability (94.94% success rate). The swing model itself holds an overall success rate of 85.71% on 119 days, suggesting this framework has been effective in gauging directional moves. In the short term, the focus will likely be on whether QQQ can sustain momentum above the risk trigger, or if it begins pulling back toward the lower band where buyers have often stepped in. This keeps attention on volatility around these levels as the model points to a tactical inflection zone. We continue to just hang out around the ATH's. With CPI and PPI incoming we should finally get some movement. September S&P 500 E-Mini futures (ESU25) are trending up +0.17% this morning, buoyed by hopes for multiple interest rate cuts from the Federal Reserve this year, while investors await an annual review of U.S. jobs data. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Applovin (APP) surged over +11% and was the top percentage gainer on the Nasdaq 100 after S&P Dow Jones Indices announced that the stock would be added to the S&P 500 index on September 22nd. Also, chip stocks advanced, with Marvell Technology (MRVL) rising more than +4% and Broadcom (AVGO) gaining over +3%. In addition, EchoStar (SATS) jumped more than +19% after SpaceX agreed to acquire wireless spectrum from the company for about $17 billion. On the bearish side, Summit Therapeutics (SMMT) plummeted over -25% after the company released new data that raised concerns about the future of its closely-watched lung cancer drug, ivonescimab. Monday showed that U.S. consumer credit rose by $16.01 billion in July, stronger than expectations of $10.40 billion. “While the Sept. 5 report showed job growth had slowed, it doesn’t appear to be signaling a recession,” according to Invesco Global Market Strategy Office. “Slower growth, anchored inflation expectations, falling yields, and anticipated rate cuts point to an optimistic outlook for stocks.” U.S. rate futures have priced in a 100% probability of a 25 basis point rate cut and an 11.8% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. Today, investors will closely monitor the Bureau of Labor Statistics’ release of its preliminary benchmark revision to payrolls for the year through March. The figure is expected to show another downward revision to March payrolls, suggesting the labor market was weakening well before the recent spell of sluggish job growth. Wells Fargo, Comerica Bank, and Pantheon Macroeconomics economists expect the revision to show that the March payroll count was nearly 800,000 lower than currently estimated, or about 67,000 fewer per month on average. Nomura Securities, Bank of America, and Royal Bank of Canada estimate that the downgrade could be closer to one million. “A big downward revision to job growth through March 2025 would have less implications for monetary policy than a downward revision to job growth in the most recent months, but it does set the stage for the broader context of how the economy has been doing. And all things equal, downward revisions to job growth increase pressure on the Fed to ease policy,” said Bill Adams, chief economist at Comerica. Market participants will also focus on earnings reports from several notable companies, with Oracle (ORCL), Synopsys (SNPS), Rubrik (RBRK), AeroVironment (AVAV), and GameStop Corp. (GME) set to release their quarterly figures today. Meanwhile, Apple (AAPL) hosts its biggest product launch event of the year today. The tech giant is expected to unveil four new iPhones at the gathering, including a new iPhone 17 Air. The Air will likely be slimmer and lighter than the base iPhone models. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.065%, up +0.49%. Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace: Hedge funds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. Let's take a look at our key intra-day levels on /ES for our 0DTE today. 6517, 6525, 6538, 6550, are all the resistance zones. 6509, 6499, 6496, 6480 are support zones. My lean or bias yesterday was begrudgingly bullish. It's the same today. Job revisions should boost futures and they are green right now as I type. We had a good training yesterday on inverting charts to change our view and understanding of price action. We'll have another training session next Monday. Mark it on your calendar.

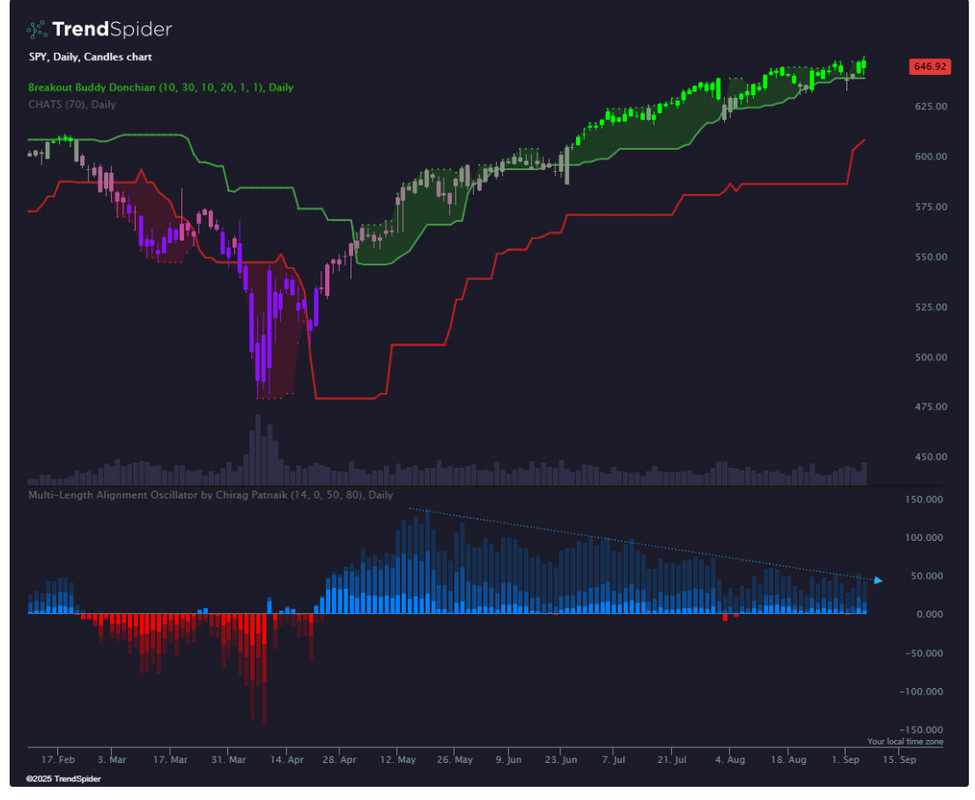

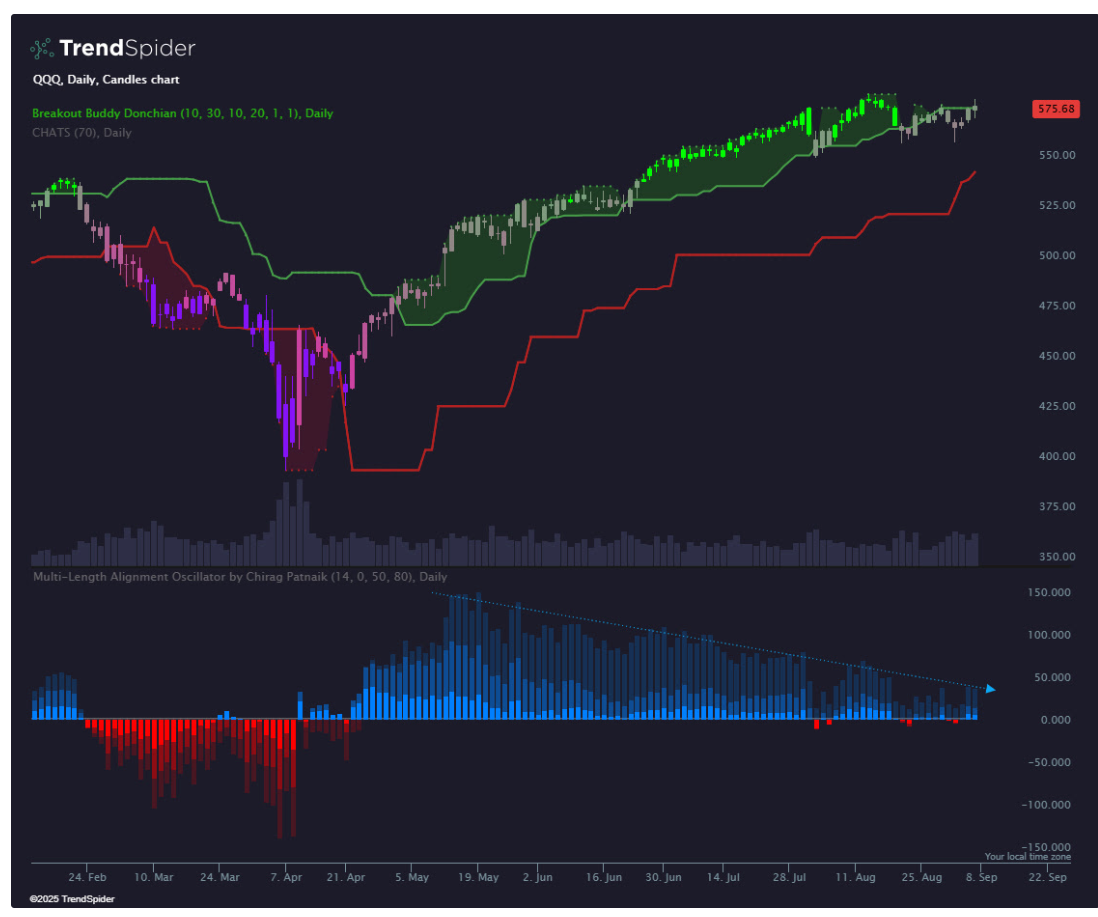

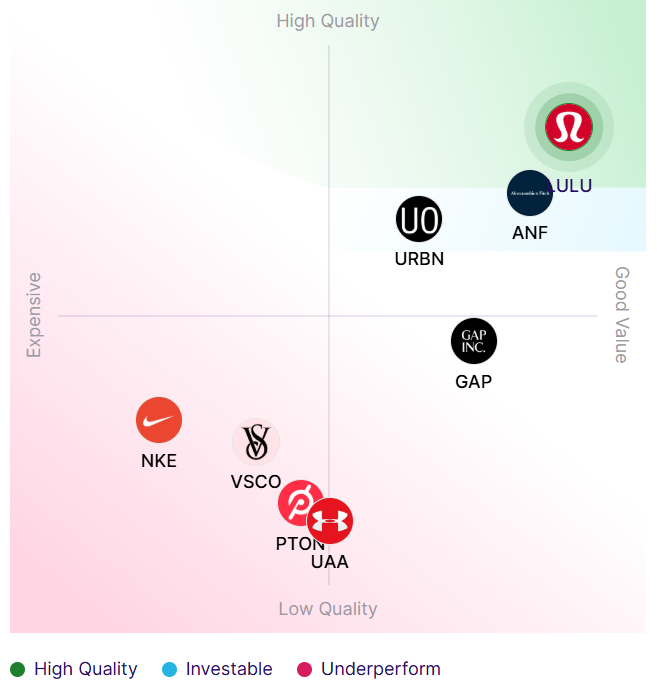

I'll see you all shortly in the live trading room! Invert...always invert - Charlie Munger Welcome to a new trading week! We've got another exciting training module for you today based on the great Charlie Munger. We have a trading mantra "Hope for the best, expect the worst". It's based on Charlie Mungers call to "Invert, always invert". We'll apply this today to some of the top favored stocks in todays market. We had a good day Friday with our 0DTE's and scalping. I finally cut bait on our LULU trade after a disappointing reaction to earnings. We continue to cash flow it in our ATM portfolio. Here's a look at our day trades. Let's check on market statistics. Bullish sentiment looks strong here. ATH's were not able to hold on Friday. We continue to look a little "toppy" here. The S&P 500 SMA breadth chart highlights how broad participation is shaping the current rally. The top panel shows the index steadily climbing toward fresh highs, while the breadth measures below track how many individual stocks are trading above their short-, medium-, and longer-term moving averages (SMA 5, 20, and 50). In the short term, the SMA 5 breadth looks choppy, showing frequent reversals a sign of near-term noise and rapid rotations. The SMA 20 and 50 breadths are holding in the mid-range, suggesting that while not all stocks are trending strongly, participation remains relatively healthy compared to previous dips. For traders watching breadth as a confirmation tool, the takeaway is that short-term fluctuations are active, but the medium-term trend still shows enough support to sustain market momentum, provided breadth doesn’t roll over sharply in the coming days. Let's take a look at the I.V. for the week and expected moves. I.V. is still in the dumps. It continues to make debit trades more attractive. The SPY hit another new all-time high last week, closing modestly higher at $647.24 (+0.32%). Price remains above the upper channel of the Chande Breakout Buddy, signaling that bullish momentum is still in play. However, the Multi-Length Alignment Oscillator is trending lower, suggesting signs of internal weakness as the rally grinds higher with diminishing strength. QQQ climbed to $576.06 (+0.99%) last week, as Broadcom’s blowout earnings gave the Nasdaq-100 a lift. Still, the index failed to reclaim green bullish candles on the Chande Breakout Buddy, and a new short-term red column emerged on the Multi-Length Alignment Oscillator. Among the major indexes, big tech is showing the most pronounced loss of momentum. Let's look at our intra-day levels on /ES: 6509, 6517, 6530, 6537 are resistance areas. 6496, 6488, 6479, 6475, 6450 are support zones. September S&P 500 E-Mini futures (ESU25) are up +0.26%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.34% this morning, pointing to a higher open on Wall Street as investors boosted their expectations for how much the Federal Reserve will cut interest rates this year. This week, investor focus is squarely on the release of key U.S. inflation data. In Friday’s trading session, Wall Street’s major equity averages closed in the red. Lululemon Athletica (LULU) tumbled over -18% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the athleisure company cut its full-year guidance for the second time in a row. Also, Kenvue (KVUE) slumped more than -9% after the Wall Street Journal reported that the Department of Health and Human Services plans to release a report linking autism to pregnant women’s use of the company’s Tylenol painkiller. In addition, Copart (CPRT) fell over -2% after reporting weaker-than-expected FQ4 revenue. On the bullish side, Broadcom (AVGO) surged over +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the semiconductor and software company posted upbeat FQ3 results and issued above-consensus FQ4 revenue guidance. Bloomberg also reported that the chipmaker partnered with OpenAI to make AI accelerators. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose by 22K in August, weaker than expectations of 75K. Also, the U.S. unemployment rate ticked up to a 3-3/4-year high of 4.3% in August, in line with expectations. In addition, U.S. August average hourly earnings rose +0.3% m/m and +3.7% y/y, in line with expectations. “Bad news for employment is good news for investors wanting lower rates. A September cut is a near certainty, and October is increasingly in play,” said David Russell at TradeStation. Chicago Fed President Austan Goolsbee said on Friday that he remains undecided about what stance to take at the September meeting, pointing to upcoming inflation data. “I want to get more information. I’m still undecided as we’re going into this,” Goolsbee told Bloomberg Television. “We’ve got to look at the inflation side too.” U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut and a 9.9% chance of a 50 basis point rate cut at next week’s monetary policy meeting. Meanwhile, U.S. President Donald Trump said late on Friday that White House economic adviser Kevin Hassett, Fed Governor Christopher Waller, and former Fed Governor Kevin Warsh are the finalists to replace Jerome Powell as the central bank’s chair. “You could say those are the top three,” Trump told reporters. The U.S. consumer inflation report for August will be the main highlight this week. Slower price growth could reinforce expectations for a series of rate cuts after a likely move in September, while hotter-than-expected inflation may lead investors to price in a more cautious pace of easing. Market watchers will assess the extent to which hefty U.S. tariffs are passing through to consumers. HSBC economists said, “As reciprocal tariffs finally took effect in early August, markets will be keen to see if the August data reflect any uptick in prices from higher tariffs.” Other noteworthy data releases include the U.S. PPI, the Core PPI, Wholesale Inventories, Initial Jobless Claims, and the University of Michigan’s Consumer Sentiment Index (preliminary). Market participants will also closely monitor the Bureau of Labor Statistics’ release of its preliminary benchmark revision to payrolls for the year through March. The figure is expected to show another downward revision to March payrolls, suggesting the labor market was weakening well before the recent spell of sluggish job growth. Fed Governor Christopher Waller recently projected that monthly job creation will be reduced by an average of about 60,000. In addition, several notable companies like Oracle (ORCL), Adobe (ADBE), Synopsys (SNPS), Kroger (KR), and Chewy (CHWY) are scheduled to release their quarterly results this week. U.S. central bankers are in a media blackout period before the September 16-17 policy meeting, so they are prohibited from making public comments this week. Apple (AAPL) is expected to unveil the new iPhone 17 at its Tuesday event, with other models likely to be introduced, including a slimmer “Air” version and other “Pro” models. Also, several major tech companies are set to deliver presentations at the annual Goldman Sachs Communacopia + Technology Conference, with Nvidia (NVDA) scheduled for Monday, Meta (META) and Broadcom (AVGO) for Tuesday, and Microsoft (MSFT) for Wednesday. Today, investors will focus on U.S. Consumer Credit data. Economists expect this figure to be $10.40 billion in July, compared to the previous figure of $7.37 billion. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.084%, up +0.05%. My lean or bias today is a very non committal buillishness. We seem to have support here. Futures are up, as I type so I'll start my day with a bullish lean. I'll see you all in the live trading room shortly. I'm looking forward to our training today!

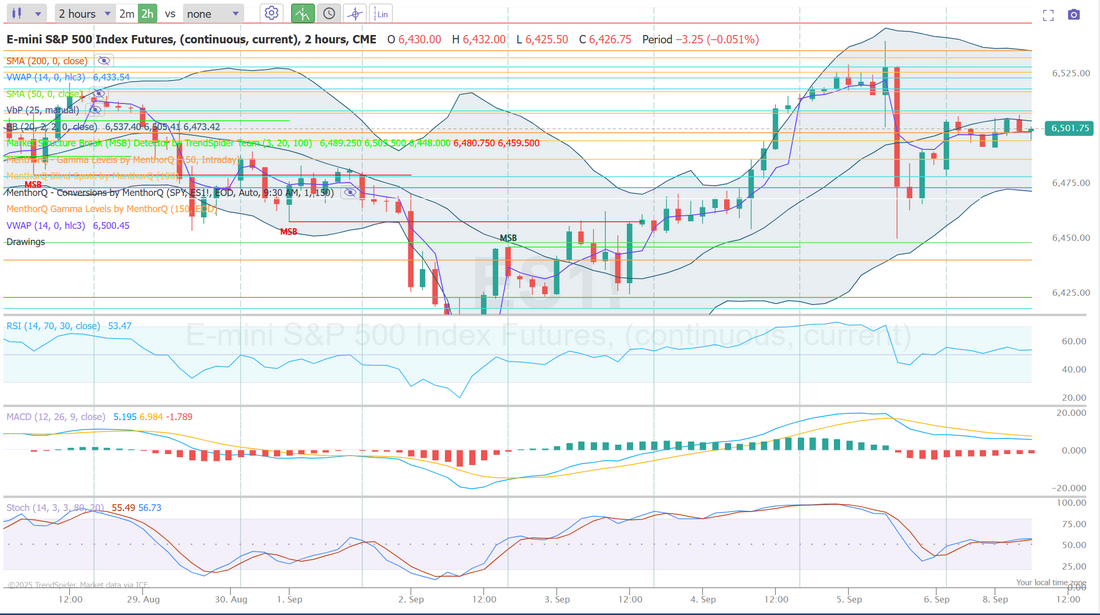

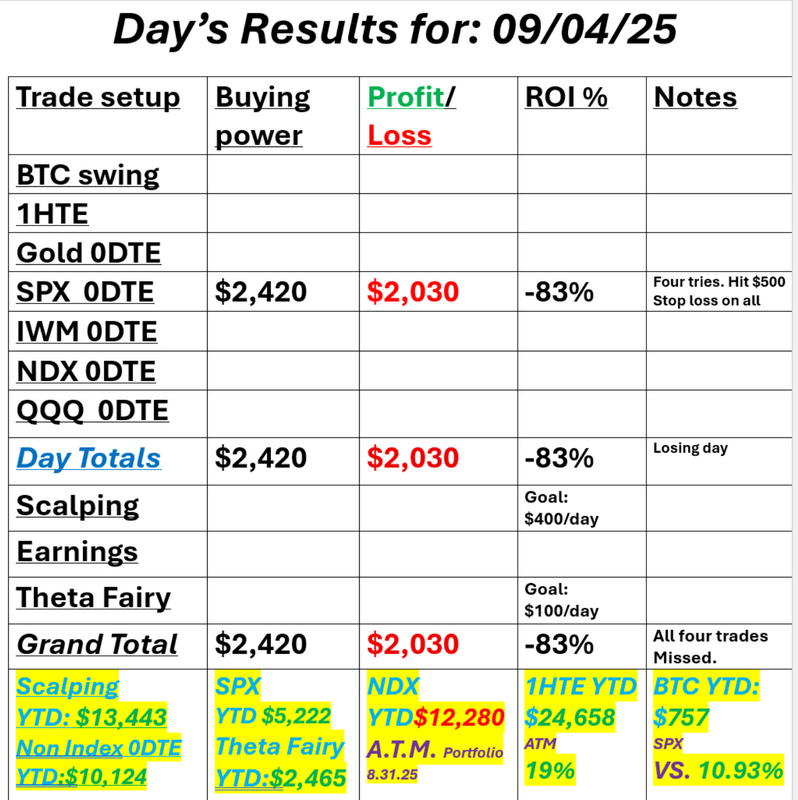

Bulls are back?The last two trading days have had a strong finish to the end of the trading sessions. Are the bulls back? Most of the indices are back to ATH levels. The Nasdaq being the slight laggard. It certainly looks like the bulls are back. NFP is out this morning and should be our main driver for the day. I had a bad day yesterday. We try to keep our risk to $500 dollars on each SPX setup and I went through four setups in the day, hitting the stop loss on all of them. Looking for a retrace that never came. I'm going to extend my wait time in the morning before jumping in. Let's see if we can get a trend to establish before getting in. Our LULU trade looks doomed as well. I was truly hopeful that earnings would show a turn around. The results were in line with expectations but the market doesn't like what it's seeing. Time to cut that trade and wait for a better entry. Here's a look at my day yesterday. Let's take a look at the markets. Those ATH's look like they are going to become new ATH's. September S&P 500 E-Mini futures (ESU25) are trending up +0.18% this morning as optimism grows that the U.S. payrolls report will pave the way for the Federal Reserve to resume cutting interest rates later this month. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. T. Rowe Price Group (TROW) climbed over +5% and was the top percentage gainer on the S&P 500 after Goldman Sachs announced plans to invest up to $1 billion in the company and partner with the asset manager to sell private-market products to retail investors. Also, most chip stocks gained ground, with Micron Technology (MU) rising more than +4% to lead gainers in the Nasdaq 100 and KLA Corp. (KLAC) advancing over +3%. In addition, Amazon.com (AMZN) rose over +4% and was the top percentage gainer on the Dow after announcing several positive business updates, including a new partnership for its Project Kuiper and favorable news regarding its investment in AI startup Anthropic. On the bearish side, Salesforce (CRM) slid more than -4% and was the top percentage loser on the Dow after the cloud software company provided disappointing Q3 guidance. The ADP National Employment report released on Thursday showed that U.S. private nonfarm payrolls rose by 54K in August, weaker than expectations of 73K. Also, the number of Americans filing for initial jobless claims in the past week rose by +8K to a 10-week high of 237K, compared with the 230K expected. At the same time, U.S. Q2 nonfarm productivity was revised upward to +3.3% q/q, stronger than expectations of +2.8% q/q, while unit labor costs were revised lower to +1.0% q/q, weaker than expectations of +1.2% q/q. In addition, the U.S. ISM services index rose to 52.0 in August, stronger than expectations of 50.9. “The Federal Reserve’s free pass on the labor market has ended. You can expect the Fed to tilt its balance of risks to cut rates in September,” said Jamie Cox at Harris Financial Group. New York Fed President John Williams stated on Thursday that his forecast is that it will “become appropriate” to lower interest rates “over time,” while refraining from specifying the timing or pace of the reductions. Also, Chicago Fed President Austan Goolsbee said he is uncertain whether a rate cut will be appropriate at the Fed’s upcoming meeting, citing ongoing uncertainty over how much tariffs might accelerate inflation and how much they might be weighing on the labor market. “It’s a live meeting for me, but I haven’t, I haven’t made-up my mind on that,” Goolsbee said. Meanwhile, U.S. rate futures have priced in a 99.4% probability of a 25 basis point rate cut at September’s monetary policy meeting. In tariff news, U.S. President Donald Trump said on Thursday he would impose tariffs on semiconductor imports “very shortly” but exempt goods from companies like Apple that have pledged to increase their U.S. investments. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. The report will serve as a key consideration for Fed officials ahead of their September policy meeting. Economists, on average, forecast that August Nonfarm Payrolls will come in at 75K, compared to the July figure of 73K. A survey conducted by 22V Research revealed that investor attention has shifted sharply to payrolls after last month’s weak figure and large revisions. According to the tally, 36% of respondents expect a “risk-off” market reaction to the key jobs report, 35% anticipate a “mixed/negligible” response, and 29% expect “risk-on.” “The most relevant question for the August payrolls report is: did June see the bottoming for job creation or is there still further downside yet to be realized?” said Vail Hartman at BMO Capital Markets. “In the event that Friday’s data shows an improvement from the recent lull in hiring, then the Fed would have grounds for a patient approach to rate cuts over the balance of the year. Conversely, if NFP disappoints, the Fed could choose to express its dovishness by dropping the year-end dot in the SEP, signaling that it expects to cut in October and December,” he said. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect August figures to be +0.3% m/m and +3.7% y/y, compared to the previous numbers of +0.3% m/m and +3.9% y/y. The U.S. Unemployment Rate will be reported today as well. Economists forecast that the August figure will creep up a tick to 4.3%, the highest level since 2021, from 4.2% in the prior month. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.158%, down -0.43%. Bullish technical bias is getting stronger. Sole focus today is LULU and SPX. Scalping /MNQ or QQQ if we get a trend move. Let's look at our intra-day levels on /ES. 6525, 6531, 6539, 6550 are resistance zones. 6510, 6500, 6481, 6464 are support. 6481 is a big level. If bears can break that then 6464 is next on the list and below that the bears have room to run. Let's finish the week with some green! Focus on SPX today. See you all in the live trading room shortly!

Ratio trade review todayWe had a good training session yesterday on the H.E.A.T. approach and we'll follow it up today with a review of the ratio trades. We had an O.K. day yesterday. I should have held off on scalping as it was just a chop fest. Our SPX was just O.K. most of the day. I think we had 6 total entries throughout the day and four were losers but the last setup really paid off. Here's a look at the day. Let's take a look at the markets. We continue to be stalled out here. We need a catalyst to either get us to new ATH's or really get a bearish move entrenched. Technicals are bullish. September S&P 500 E-Mini futures (ESU25) are up +0.19%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.33% this morning as Treasury yields extended their decline after the latest jobs report made it all but certain that the Federal Reserve will cut interest rates this month. Investors now await a fresh batch of U.S. economic data, comments from Fed officials, and an earnings report from semiconductor and software giant Broadcom. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Alphabet (GOOGL) jumped over +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after a judge ruled in an antitrust case that Google won’t be forced to sell its Chrome browser. Also, Apple (AAPL) rose more than +3% and was the top percentage gainer on the Dow after a court ruling allowed Alphabet to maintain an agreement under which Google pays Apple more than $20 billion annually to remain the default search engine on the Safari browser. In addition, The Campbell’s Company (CPB) climbed over +7% after the packaged food maker posted better-than-expected FQ4 adjusted EPS. On the bearish side, Dollar Tree (DLTR) slumped more than -8% and was the top percentage loser on the S&P 500 after the discount retailer issued disappointing Q3 guidance. A Labor Department report released on Wednesday showed that U.S. JOLTs job openings fell to a 10-month low of 7.181 million in July, weaker than expectations of 7.380 million. Also, U.S. factory orders fell -1.3% m/m in July, in line with expectations. “[The JOLTs report] does confirm the slowing pace of hirings being seen in a variety of stats in the aggregate, but something we’re well aware of — and why the Fed is cutting rates by 25 basis points in two weeks,” said Peter Boockvar at The Boock Report. Fed Governor Christopher Waller said on Wednesday that the central bank should start cutting interest rates this month and proceed with multiple reductions in the months ahead, noting that officials may debate the exact pace of easing. Also, Minneapolis Fed President Neel Kashkari said, “Inflation is still too high, but at the same time, the labor market is showing some signs of cooling, so it’s, we’re getting into a tricky position now for the Fed.” At the same time, St. Louis Fed President Alberto Musalem said, “The current modestly restrictive setting of the policy rate is consistent with today’s full-employment labor market and core inflation nearly one percentage point above the Fed’s 2% target.” In addition, Atlanta Fed President Raphael Bostic reiterated that he views one rate cut as appropriate for this year, though he noted that could change depending on the trajectory of inflation and the labor market. U.S. rate futures have priced in a 97.6% chance of a 25 basis point rate cut and a 2.4% chance of no rate change at the Fed’s monetary policy committee meeting later this month. Meanwhile, the Fed said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity showed “little or no change” in recent weeks. “Across districts, contacts reported flat to declining consumer spending because, for many households, wages were failing to keep up with rising prices,” according to the Beige Book. The report also said that every region reported price increases, with 10 of the 12 citing “moderate or modest” inflation and two noting “strong input price growth.” “Nearly all districts noted tariff-related price increases, with contacts from many districts reporting that tariffs were especially impactful on the prices of inputs,” according to the report. Today, investors will monitor earnings reports from several high-profile companies, with Broadcom (AVGO), Copart (CPRT), Lululemon Athletica (LULU), and Samsara (IOT) set to release their quarterly results. On the economic data front, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the August ADP Nonfarm Employment Change will stand at 73K, compared to the July figure of 104K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the August ISM services index to be 50.9 and the S&P Global services PMI to be 55.3, compared to the previous values of 50.1 and 55.7, respectively. U.S. Unit Labor Costs and Nonfarm Productivity data will be released today. Economists forecast final Q2 Unit Labor Costs to rise +1.2% q/q and Nonfarm Productivity to rise +2.8% q/q, compared to the first-quarter numbers of +6.9% q/q and -1.8% q/q, respectively. U.S. Trade Balance data will come in today. Economists anticipate the trade deficit will widen to -$77.70 billion in July from -$60.20 billion in June. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 230K, compared to last week’s number of 229K. In addition, market participants will be anticipating speeches from New York Fed President John Williams and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.193%, down -0.43%. The Conference Board LEI index has dropped in 38 of the last 41 months to its lowest in 11 years. In July, the LEI flashed a recession signal. Versus the Coincident Economic Index (CEI), it’s now at the weakest since 2008 How does this end well? Trade docket today: We've got a focus on our LULU trade after the close as it reports earnings. Just a small 249% I.V.! SPX 0DTE with /MNQ scalping today. Market breadth slipped notably on September 2, 2025, with just 27.3% of stocks advancing against 70.6% declining. This marks a sharp deterioration from Friday’s more balanced session (39.2% advancers), and resembles the weak structure seen on August 25. The number of new highs fell to 2.8%, while new lows stayed modest at 1.1%, suggesting limited leadership at the top. Short-term momentum clearly faltered: only 56% of stocks remain above their 20-day SMA, down sharply from nearly 75% just a week ago. While the 50-, 100-, and 200-day readings (63.9%, 71.2%, and 59.3% respectively) still show longer-term support, the steady erosion at the shorter time frames hints at increasing fragility. Forward-looking indicators turned less favorable as well. The weekly advance/decline balance slipped to 40.7% vs. 57.7% decliners, a noticeable reversal compared to last week’s strong weekly breadth. Monthly and 3-month measures still lean constructive, but they are gradually softening, particularly on the monthly side where advancing breadth fell back to 65% from over 75% at the end of August. Compared with the previous breadth update, the data confirm that Friday’s bounce was only temporary. Weakness has reasserted itself, especially at the short-term level, with fewer stocks managing to hold above their faster-moving averages. The underlying trend is therefore tilting back toward the negative side. Current breadth trend rating: 2 (negative). On the topic of LULU. If nothing else, we are in the company of the great Michael Burry who has a large call option position on LULU ahead of earnings. This is a quality company compared to it's peers. The SPX option score chart as of September 3, 2025, shows that the index continues to hold near the upper end of its recent range, with spot prices consolidating around the 6,350–6,450 zone. The option score, however, highlights a volatile short-term sentiment, swinging between stronger readings and sudden dips, suggesting traders are actively repositioning. In the immediate term, the score’s recovery off recent lows points to stabilizing sentiment, but the repeated fluctuations hint at caution. Near-term momentum will likely depend on whether the index can maintain strength above the recent high range or if pressure from option flows sparks another short-lived pullback. My bias or lean yesterday was looking for a retrace, which we got but we did power into the close to erase most of the damage. Futures are up this morning but once again, I think we get a muted day. I'm more neutral today. Let's take a look at the intra-day levels. Some have gotten more pronounced after yesterday's bound trading. Levels are clustered tightly. 6470, 6475, 6481, 6489, 6499 are resistance zones. 6459, 6452, 6448, 6432, 6424 are support zones. I look forward to trading with you all and reviewing the ratio trades training today!

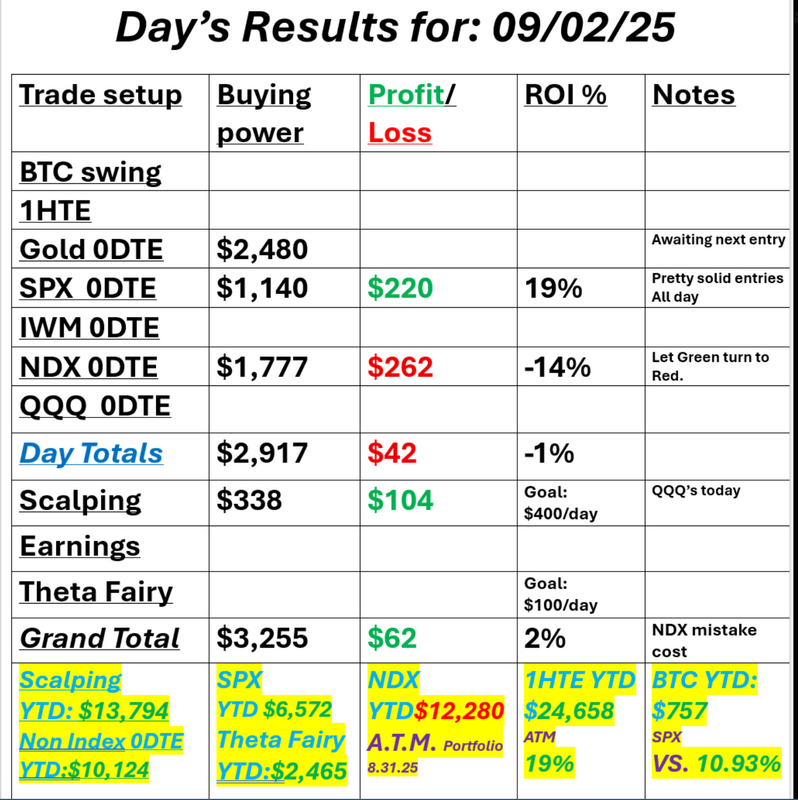

GOOG reprieve saves the market? Google squeaked out a nice antitrust victory late yesterday that could have been costly, if lost. That pushed both GOOG and AAPL ( a secondary benefactor) up and with it, the futures markets. Is it enough to stop the bearish momentum that was building? We'll see. Today could be telling. If we give up the futures gains then I think it's right back to more bearish action. We had a mixed day yesterday. We are still waiting on Gold to level out. It keeps hitting new ATH's. With the dollar continuing to fall it may be a while. My NDX was profitable and I just didn't pull it fast enough. That was operator error on my part. I scalped with the QQQ's yesterday and that may be a good approach again today. Our ATM portfolio hit another ATH. Here's a look at my day. Let's take a look at the markets. Even though the trend was bearish yesterday, the market fought back going into the close. We're sitting on a neutral rating to start the morning. That means we can get anything. Futures are still up near their highs of the morning. September Nasdaq 100 E-Mini futures (NQU25) are trending up +0.69% this morning, buoyed by a jump in Alphabet stock following a ruling that Google won’t be forced to sell its Chrome browser, while investors await the latest reading on U.S. job openings. Alphabet (GOOGL) jumped over +5% in pre-market trading after Google escaped major antitrust penalties for its conduct in the U.S. internet search market. A U.S. district judge permitted the tech giant to retain its Chrome browser and maintain an agreement under which Google pays Apple more than $20 billion annually to remain the default search engine on the Safari browser. Apple (AAPL) also benefited from the ruling, with the stock up over +2% in pre-market trading. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. The Magnificent Seven stocks fell, with Nvidia (NVDA) sliding nearly -2% and Amazon.com (AMZN) dropping more than -1%. Also, chip stocks lost ground, weighed down by a more than -3% decline in Lam Research (LRCX) after Morgan Stanley downgraded the stock to Underweight from Equal Weight with a price target of $92. In addition, Kraft Heinz (KHC) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the packaged-food company announced plans to split into two separate companies. On the bullish side, Ulta Beauty (ULTA) rose more than +8% and was the top percentage gainer on the S&P 500 after Barclays raised its price target on the stock to $617 from $589. Economic data released on Tuesday showed that the U.S. ISM manufacturing index rose to 48.7 in August, weaker than expectations of 49.0. Also, the U.S. August S&P Global manufacturing PMI was unexpectedly revised lower to 53.0, weaker than expectations of no change at 53.3. In addition, U.S. construction spending fell -0.1% m/m in July, in line with expectations. “The ISM manufacturing report indicated that companies are largely managing headcount rather than actively hiring. This may be a clue ahead of Friday’s jobs numbers. New jobs are likely slowing, but meaningful revisions to data over the prior months could mean that the report, good or bad, may not influence investors much,” said Scott Helfstein at Global X. Meanwhile, U.S. President Donald Trump said on Tuesday that his administration would seek an expedited Supreme Court ruling in an effort to overturn a federal court decision that found many of his tariffs were illegally imposed. Today, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the July JOLTs Job Openings will arrive at 7.380 million, compared to the June figure of 7.437 million. U.S. Factory Orders data will also be released today. Economists expect this figure to drop -1.3% m/m in July following a -4.8% m/m slump in June. In addition, market participants will parse comments today from St. Louis Fed President Alberto Musalem and Minneapolis Fed President Neel Kashkari. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. On the earnings front, notable companies like Salesforce (CRM), Figma (FIG), Hewlett Packard Enterprise (HPE), and Dollar Tree (DLTR) are slated to release their quarterly results today. U.S. rate futures have priced in a 91.7% probability of a 25 basis point rate cut and an 8.3% chance of no rate change at the conclusion of the Fed’s September meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.291%, up +0.33%. Trade docket today: Focus on SPX and either the /MNQ for scalping or possibly back to the QQQ's...depending on how much movement we get. My lean or bias today is still a bit bearish. Futures are up solidly on the strength of GOOG and AAPL and that may be enough to push us higher but the short term trend is bearish and I think there's a good chance we give up some of these gains. Let's look at the intra-day levels on /ES that I'll be focusing on today. There are a lot of tight levels today. 6459, 6463, 6469, 6480, 6488 are resistance levels with 6441, 6425, 6419, 6399 working as support. We'll have a training today on the H.E.A.T. approach to trading and investing around the 2:00PM EDT hour. Make sure to tune in! I'll see you all shortly in the live trading room and zoom feed.

|

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |