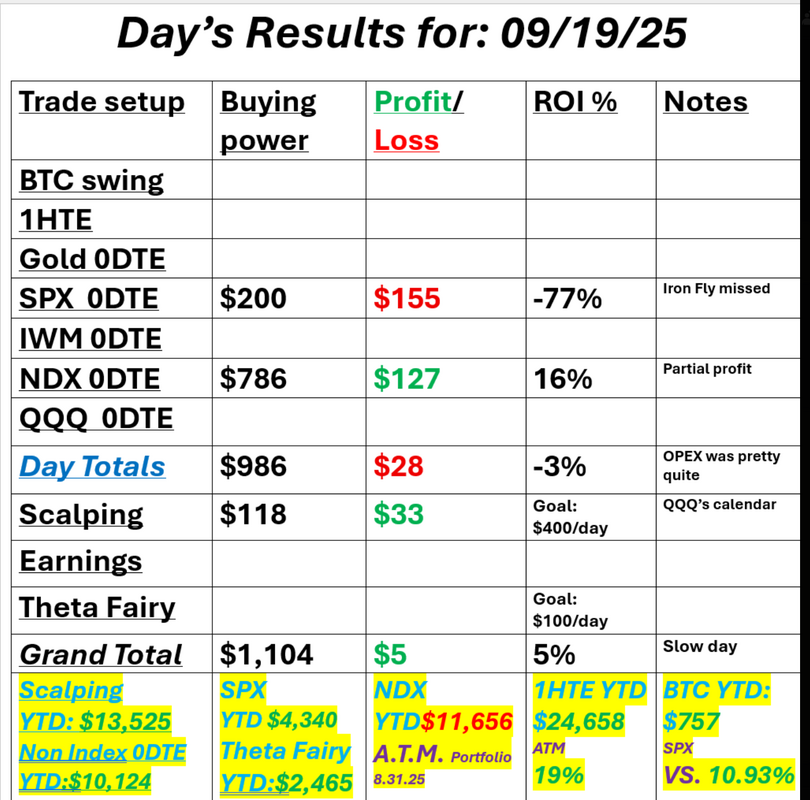

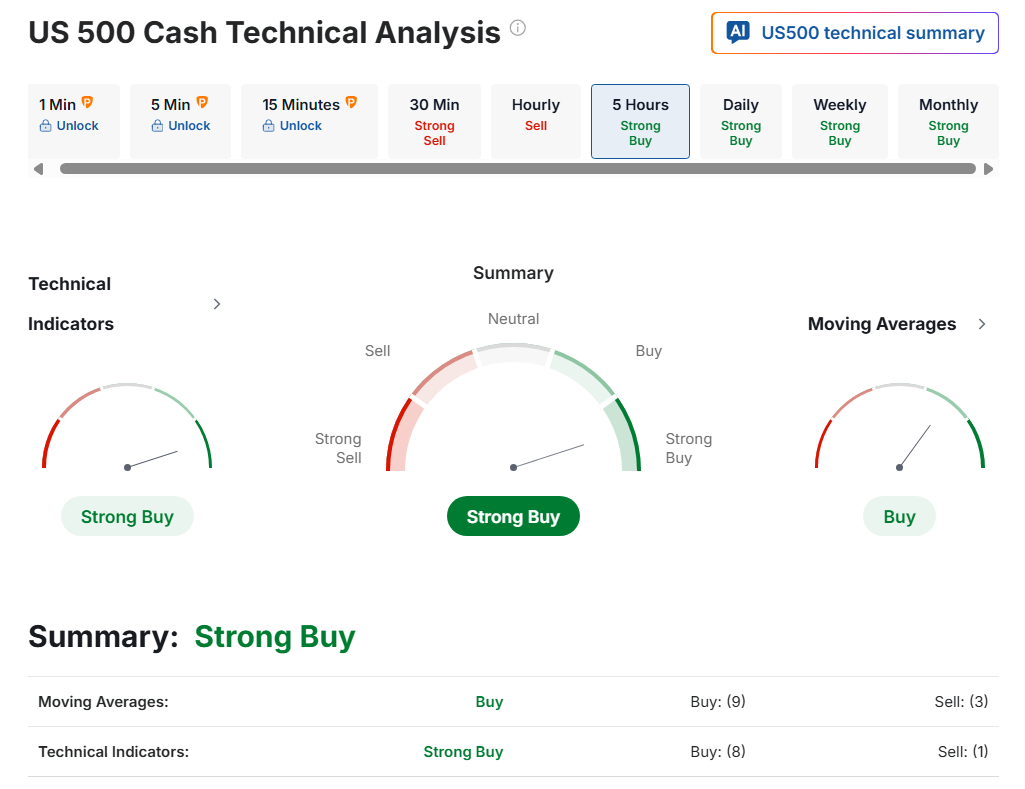

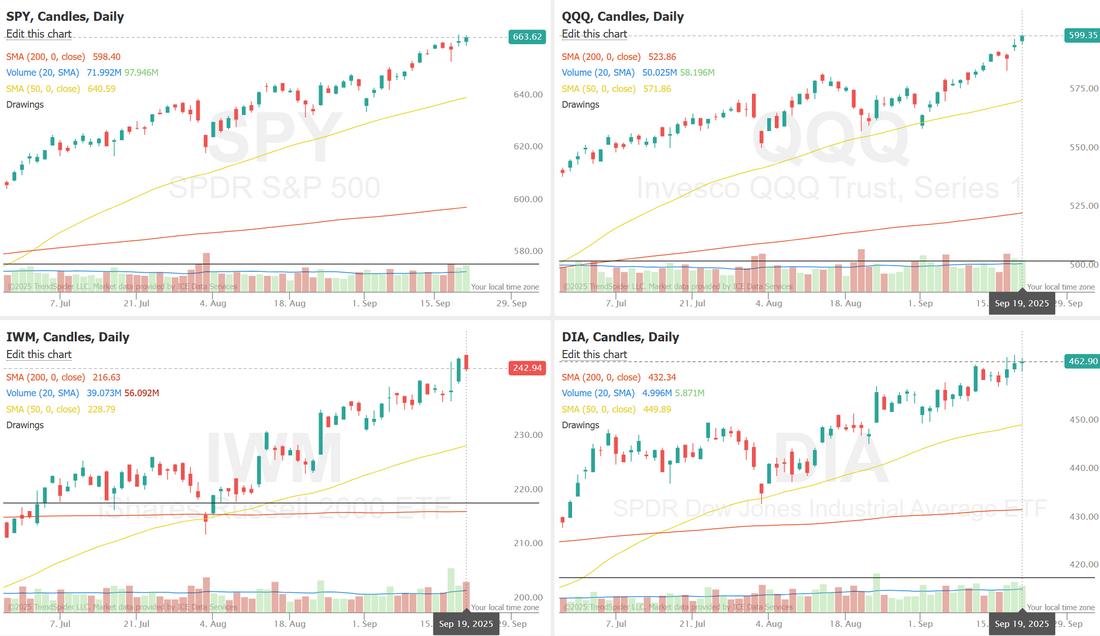

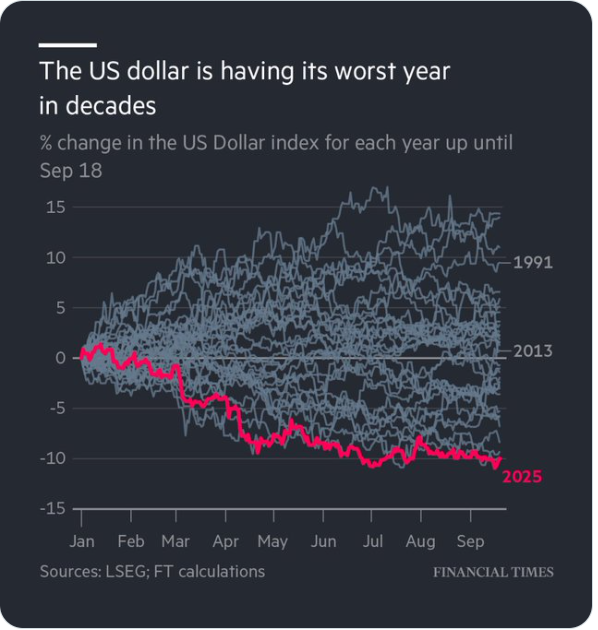

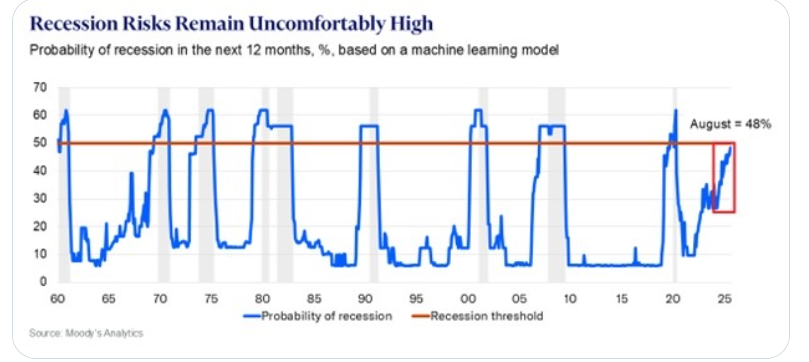

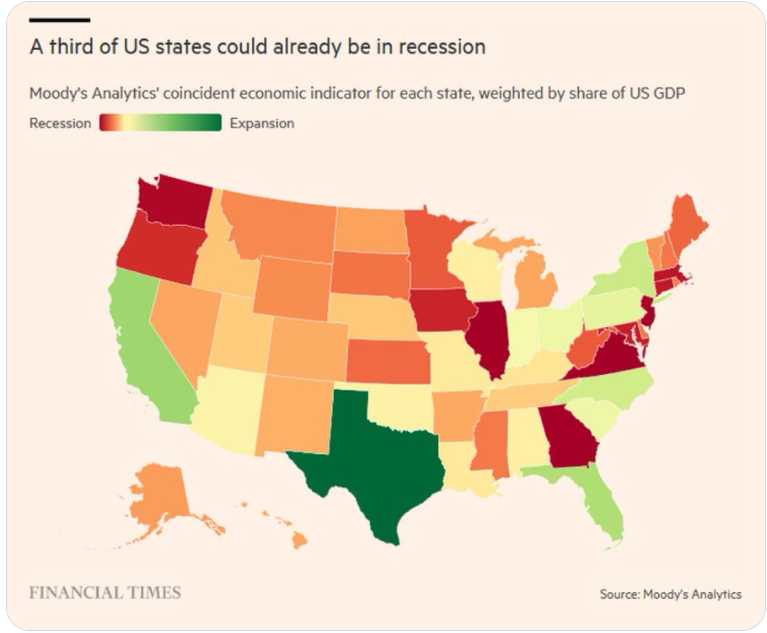

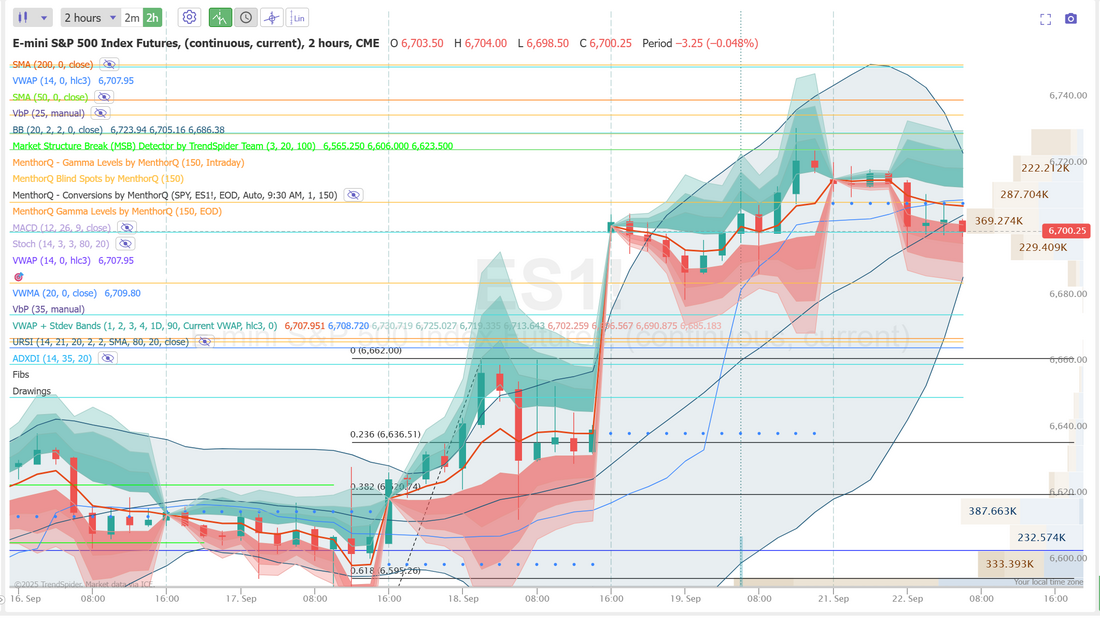

PMI, GDP, PCE all incoming this week.We've got an alphabet soup of economic reports incoming this week. Not to mention Jobless claims. We've also got lots of FED speak in the next couple days including Powell on Tues. Futures are pointing to a 92% probability of another 25 bp cut next time around. This weeks readings should add a bit more clarity (or confusion) to the potential of more rate cuts. Friday was pretty quite for me. With no movement in the morning I put on an Iron fly on SPX. It was the right trade but I left it on too long and ended up in the red on it. Scalping and NDX were small trades. I think today may finally offer us up a trend day which would be very welcome. Here's a look at my Friday. Let's take a look at the market and what we are looking for in this new week: Technicals are leaning bullish but the 1 hour timeframe has turned bearish. Watch for a potential reversal today. Strong may not be the word to use for the recent price action. It's been almost relentless in it's climb higher. We are 14 trading days now into this current run up on SPX and NDX. It seems every day is a new ATH. The SPX continues to edge higher toward fresh highs, but the seasonality score has recently slipped back into negative territory after holding neutral-to-positive for much of early September. This shift suggests that short-term seasonal patterns may be less supportive over the coming sessions, even as price action remains firm. In the near term, traders may want to watch whether the index can sustain its upward momentum against this seasonal headwind, as further weakness in the score could signal a period of consolidation or slower gains. SPY ended the week at a record $663.70 (+0.62%). The RSI Ensemble shows slightly oversold conditions, a setup that has often preceded brief pullbacks. The Polymarket Indicator is showing 65% odds of two additional cuts before year-end, raising the question of whether easing can push toward $700 or if consolidation comes first. QQQ led the major indexes, closing at a new high of $599.35 (+1.85%). The RSI Ensemble is now leaning overbought, suggesting that internals may be becoming stretched even as price grinds higher. Tech leadership is intact, but extended readings could make the next phase of the rally more volatile. IWM climbed to $242.98 (+1.58%), its first record close in nearly a year. The breakout follows the Fed’s 25bps cut, a meaningful tailwind for rate-sensitive small caps. If the move holds, the group may continue to outpace larger peers into year-end. Let's take a look at the implied moves for the week. "DEAD" is the word I'd use to describe this weeks I.V. Maybe this week is a good one to put on your weekly Iron condor and then come back on Friday? December S&P 500 E-Mini futures (ESZ25) are down -0.30%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.35% this morning, pointing to a slightly lower open on Wall Street as investors look for fresh catalysts to drive equities already trading at record highs. This week, investors will focus on remarks from Federal Reserve Chair Jerome Powell and other Fed officials as well as the release of the Fed’s preferred inflation gauge and other key economic data. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500, Dow, and Nasdaq 100 notching new record highs. The Magnificent Seven stocks advanced, with Apple (AAPL) rising over +3% and Tesla (TSLA) gaining more than +2%. Also, Oracle (ORCL) climbed over +4% after Bloomberg reported that the company was in talks with Meta Platforms for a cloud computing deal worth about $20 billion. In addition, FedEx (FDX) rose more than +2% after the logistics giant posted better-than-expected FQ1 results and reinstated its full-year guidance. On the bearish side, Lennar (LEN) fell over -4% after the homebuilder reported downbeat FQ3 results and issued below-consensus FQ4 home deliveries guidance. “A Fed easing cycle in a non-recessionary environment has historically helped support stocks, and we see further gains underpinned by AI, earnings, and consumption,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. Minneapolis Fed President Neel Kashkari said on Friday that he supported the FOMC’s decision to cut interest rates and penciled in two more cuts this year. Separately, Fed Governor Stephen Miran told CNBC that his decision to dissent from fellow policymakers’ rate move was based on his view that tariffs have not had a significant impact on inflation. Meanwhile, U.S. rate futures have priced in a 91.9% chance of a 25 basis point rate cut and an 8.1% chance of no rate change at the conclusion of the Fed’s October meeting. A highly anticipated phone call on Friday between U.S. President Donald Trump and Chinese leader Xi Jinping ended with both leaders agreeing to continue discussions. President Trump said he made progress on many key issues and will meet Xi on the sidelines of the Asia-Pacific Economic Cooperation Summit in South Korea next month. This week, the August reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as investors continue to assess the extent to which tariffs have driven up inflation. If evidence continues to indicate that the impact is limited, this could be seen as clearing the way for additional rate cuts. Preliminary purchasing managers’ surveys for September will also be closely monitored, as they will provide updates on activity in the manufacturing and services sectors. Other noteworthy data releases include U.S. GDP (third estimate), the Richmond Fed Manufacturing Index, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Wholesale Inventories (preliminary), Existing Home Sales, Personal Income, Personal Spending, and the University of Michigan’s Consumer Sentiment Index. Fed Chair Jerome Powell will deliver a speech on the economic outlook in Rhode Island on Tuesday. A host of other Fed officials will also be making appearances throughout the week, including Williams, Barkin, Musalem, Hammack, Miran, Bowman, Bostic, Daly, Goolsbee, Barr, and Logan. In addition, several notable companies, including chipmaker Micron Technology (MU), bulk retailer Costco (COST), advisory firm Accenture (ACN), and auto parts seller AutoZone (AZO), are set to report their quarterly figures this week. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.131%, down -0.22%. The collapse of the U.S. dollar (and how it's affecting gold) is unprecedented. This trend is not getting a lot of media attention. It should. My wife and I outfitted our house with solar last year. Honestly the return or ROI on it is not great. Maybe 5% a year? For us it's more of a hedge against future price hikes. Does anyone think electricity will be cheaper in a decade? Moody's on a US recession: The probability of a recession within the next 12 months jumped to 48% in August, the highest since the 2020 pandemic. This is according to Moody’s Analytics’ leading economic indicator, which uses extensive economic data and a machine learning model. Historically, such a high probability has never occurred outside of recessions. This comes as US job market conditions have deteriorated significantly over the last few months. Additionally, the BLS revised non-farm payrolls down by -911,000 for the 12 months ending March 2025, marking the largest annual downward revision on record. Moody’s also said that a third of U.S. states are now in recession, accounting for 33% of the economy. That means the national data is masking deep local pain in key regions. For now, California, Texas, and New York are keeping the broader economy from sliding further. The "heavy truck" indicator has generally been pretty darn accurate. Look. I don't want to be "that guy" that screams "crash" from the rooftops for a decade and then when if finally comes claims he was right! I do, however think that there are plenty of signs for us to be cautious here. Todays training session will focus on the difference between ATR and ADX. Many traders think of them as similar but they are in fact, very different. We use ADX daily in our scalping efforts. Let's take a look at the intra-day levels on /ES: 6709, 6725, 6730, 6736, 6751 are resistance zones. 6700, 6685, 6674, 6664, 6650 are support zones. My lean or bias today in bearish. When we start going into week three of a continuous run (this time to the upside) I think the odds are good we take a pause or retrace. Futures seem to imply it as well. I look forward to seeing you all in the live trading room for our setups today as well as our training session.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |