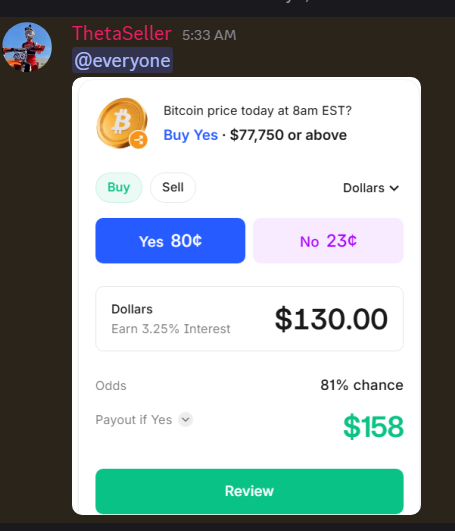

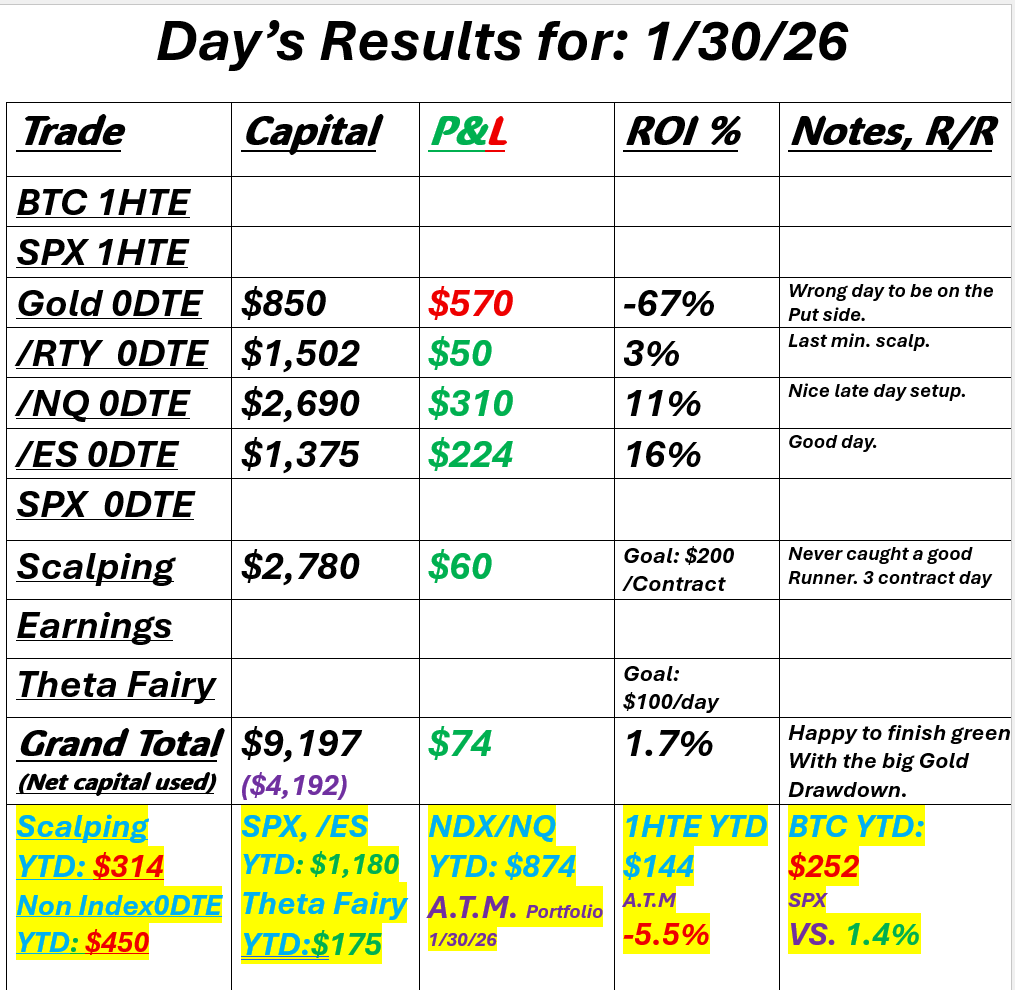

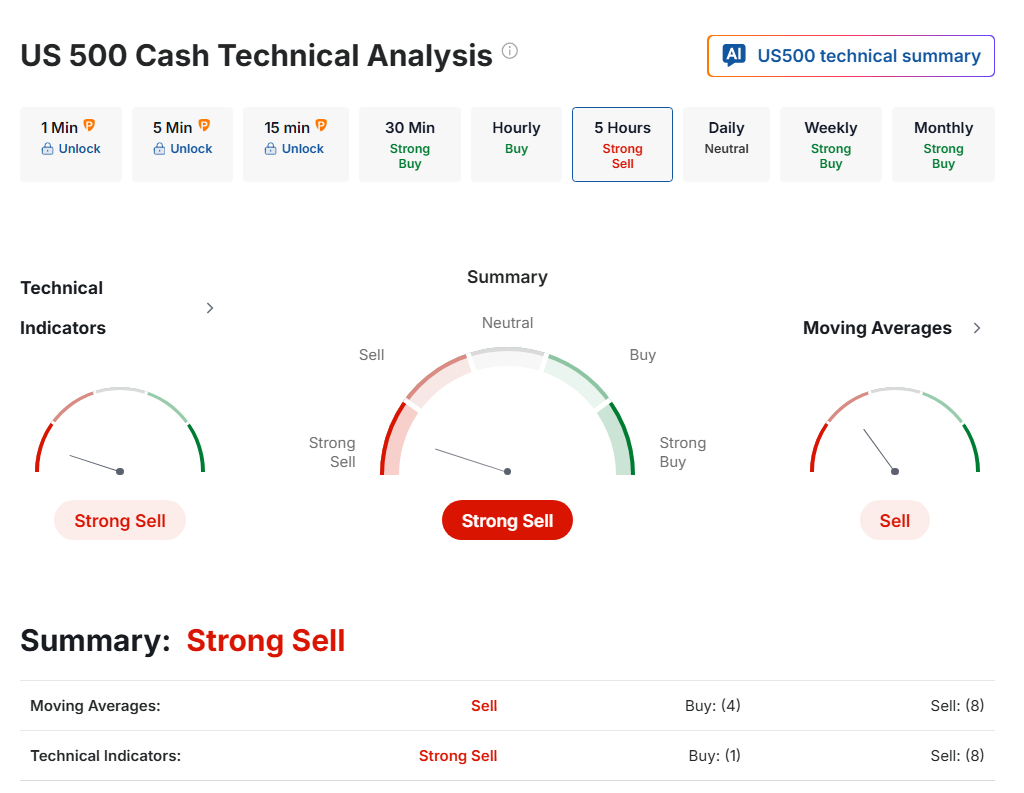

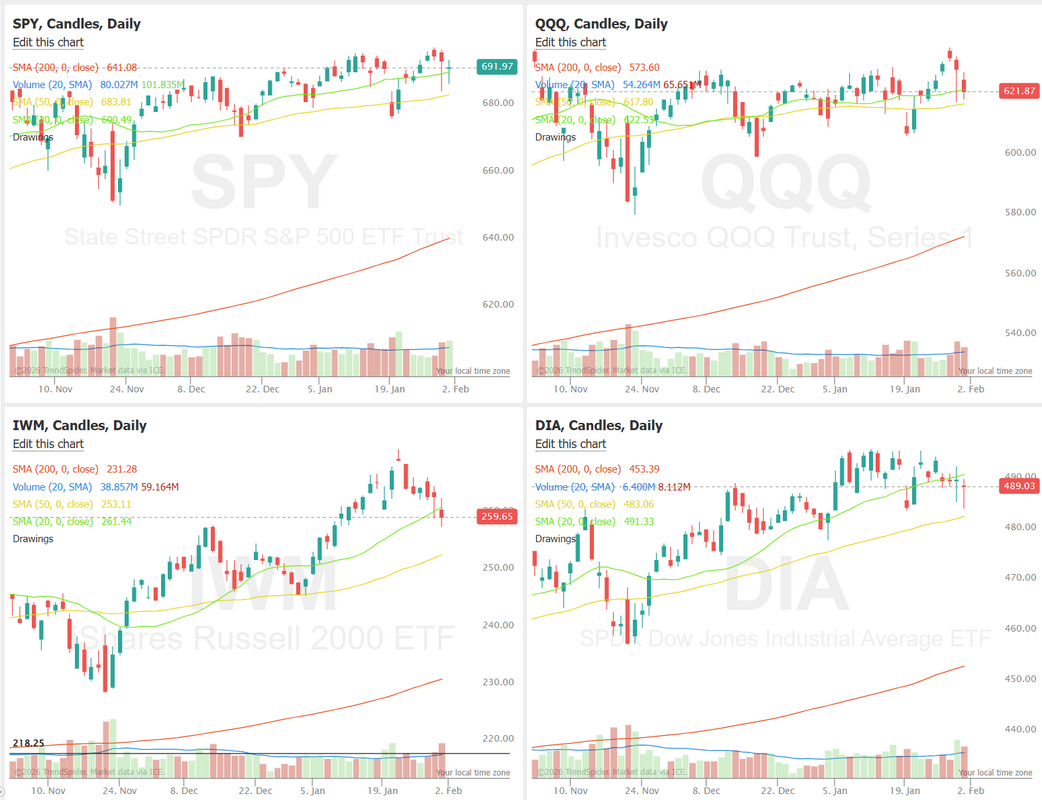

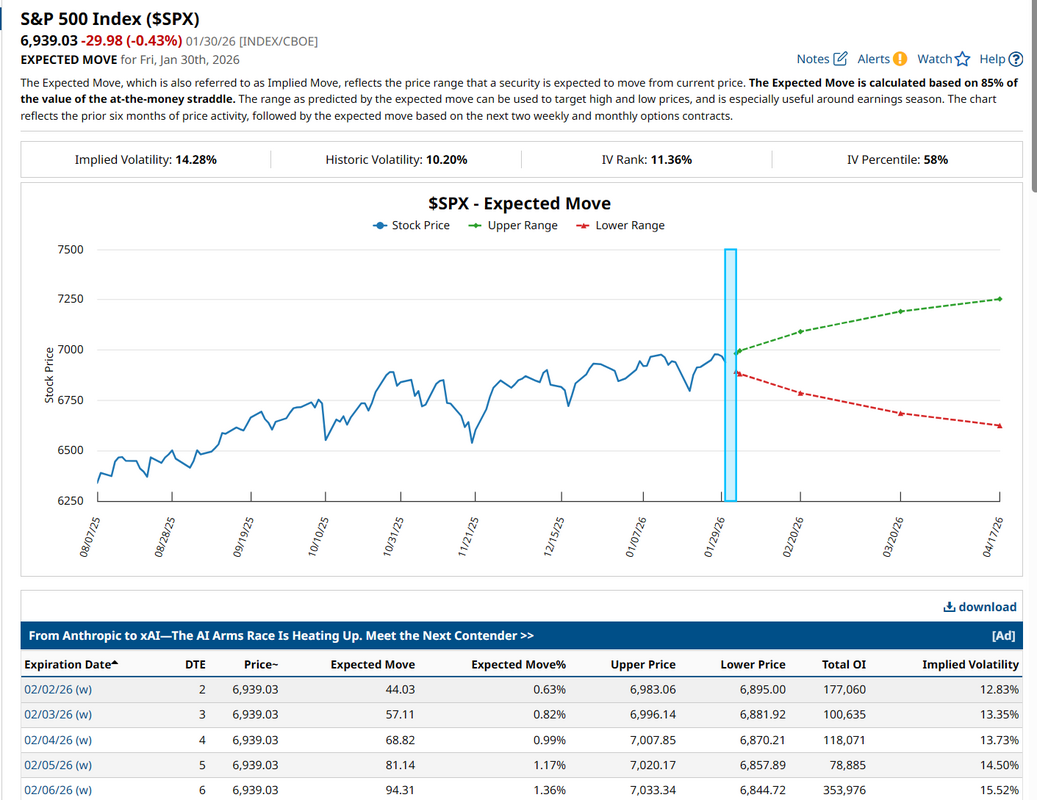

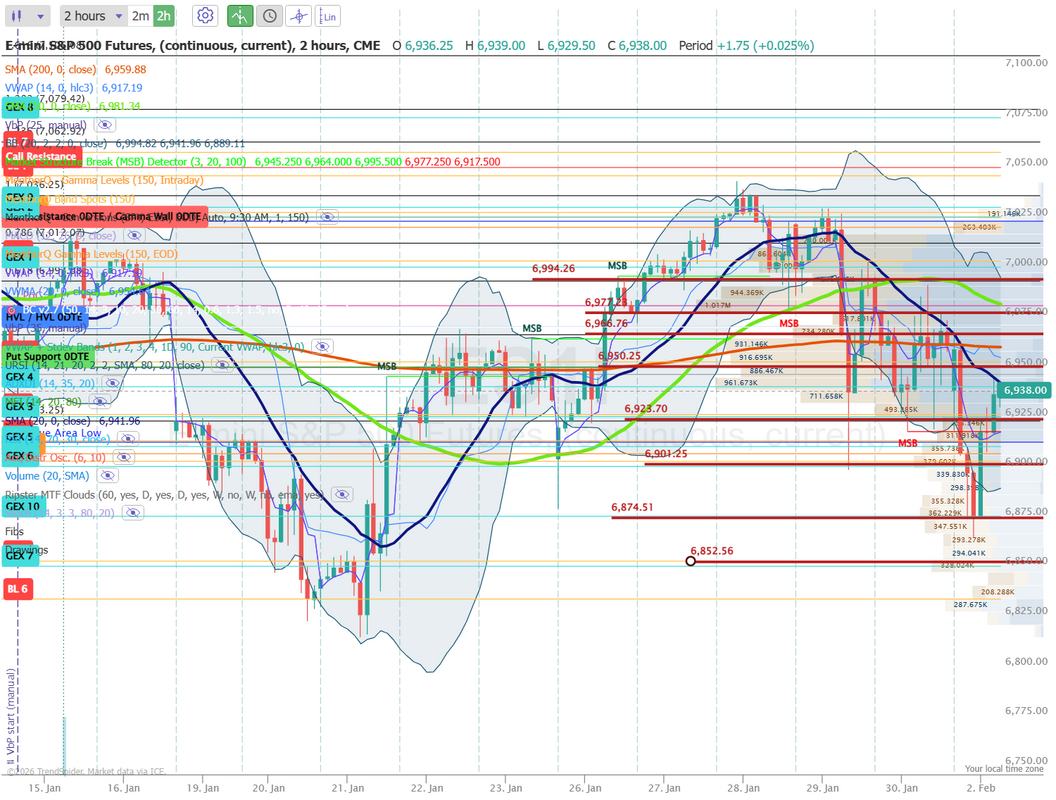

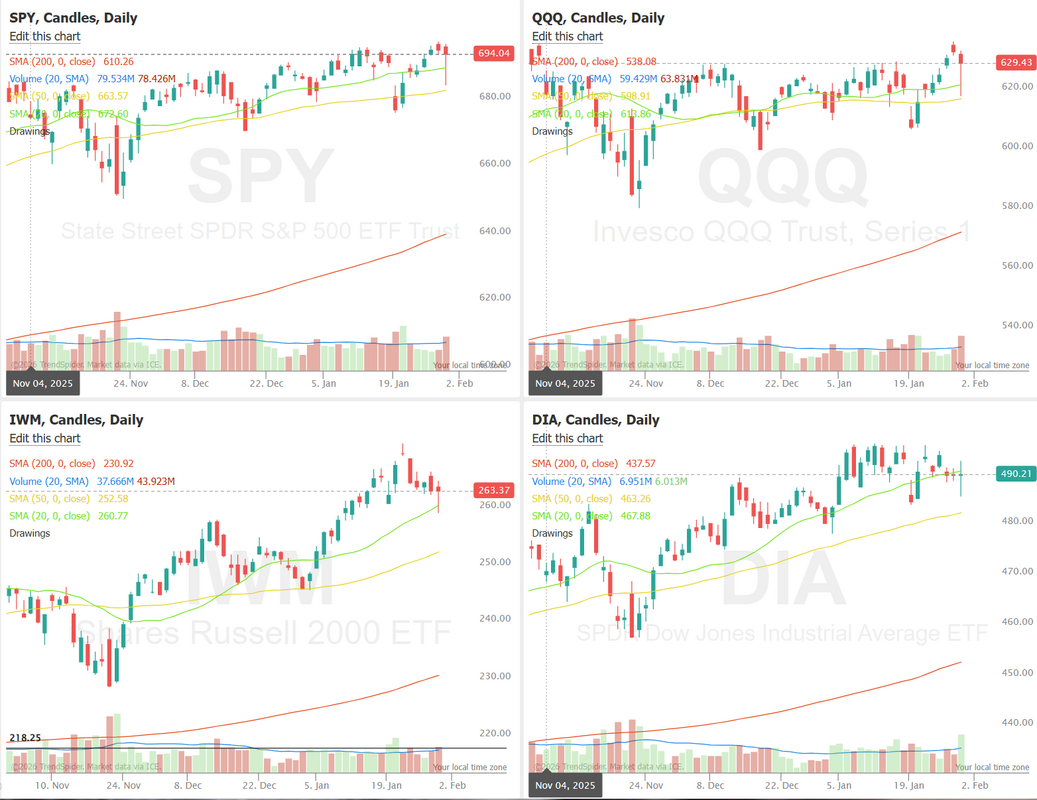

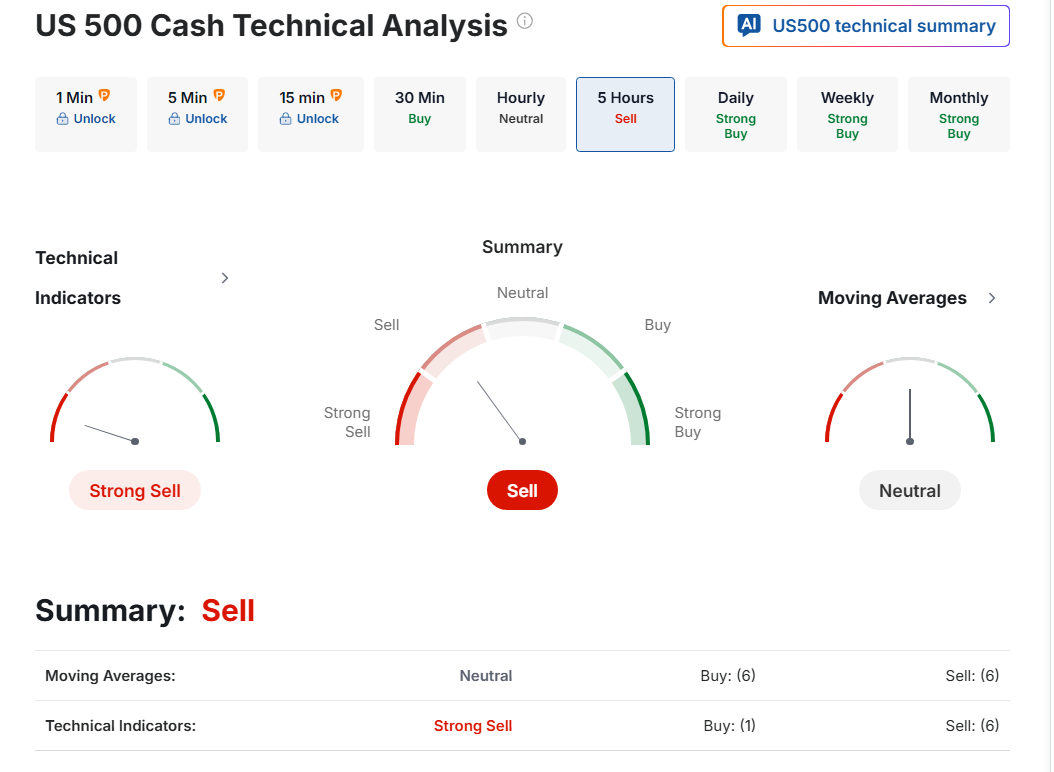

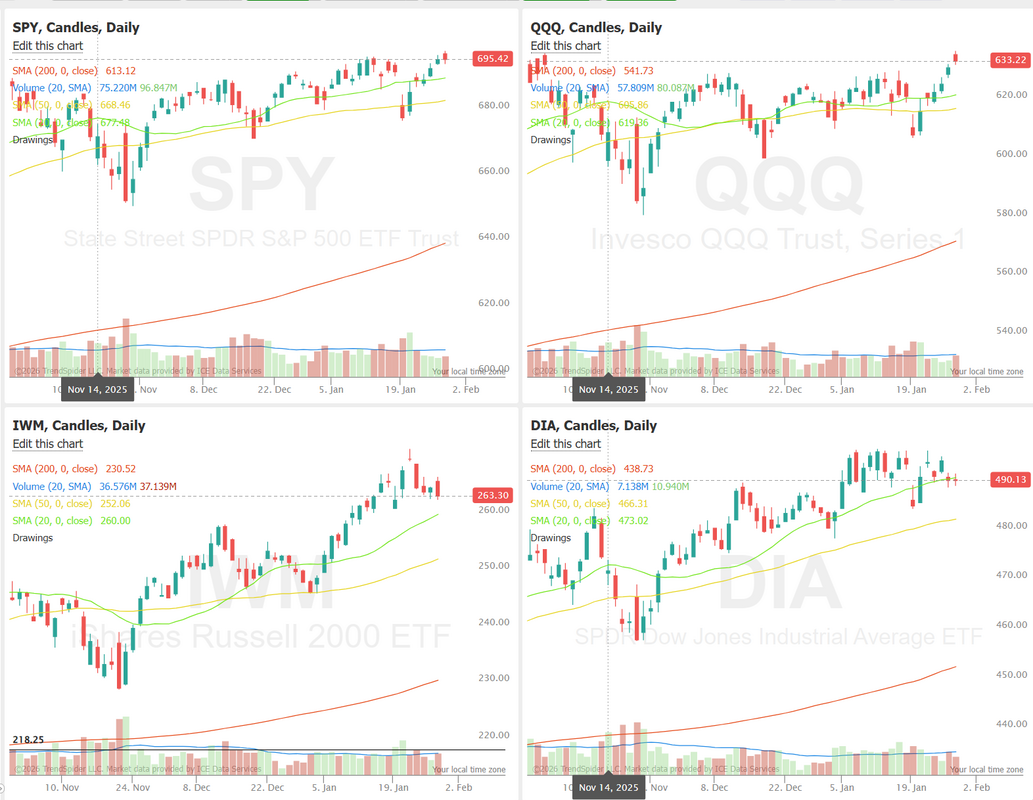

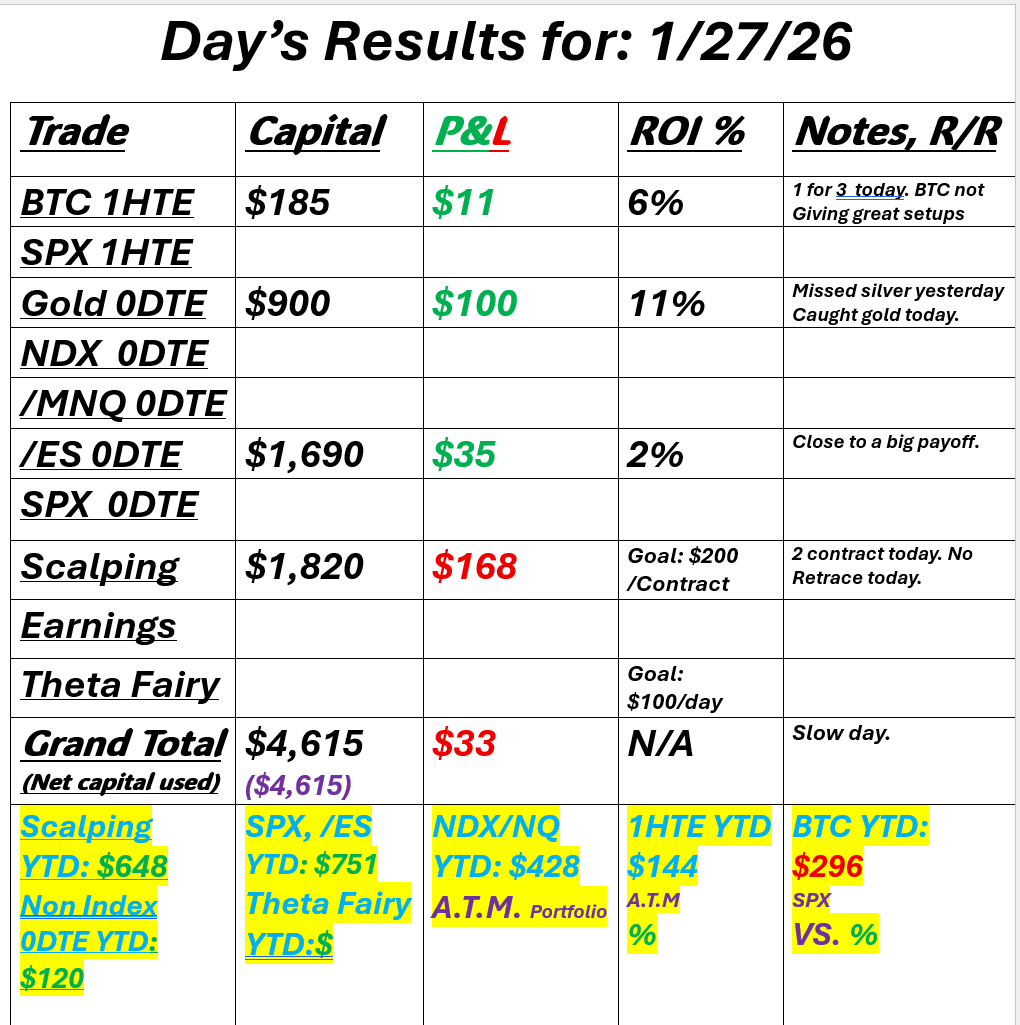

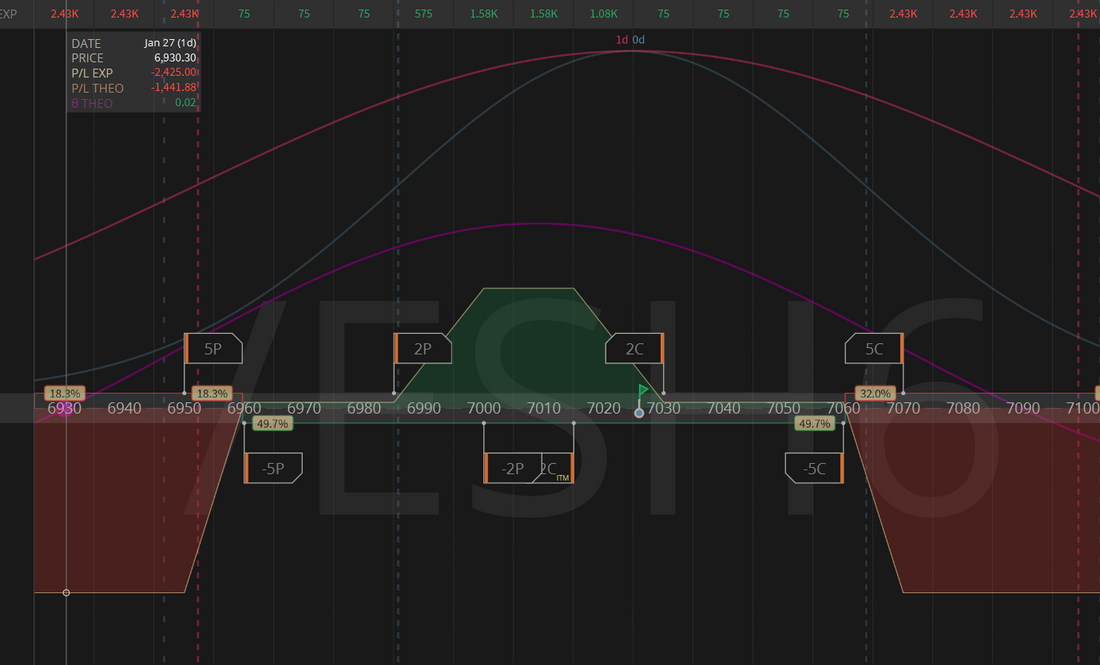

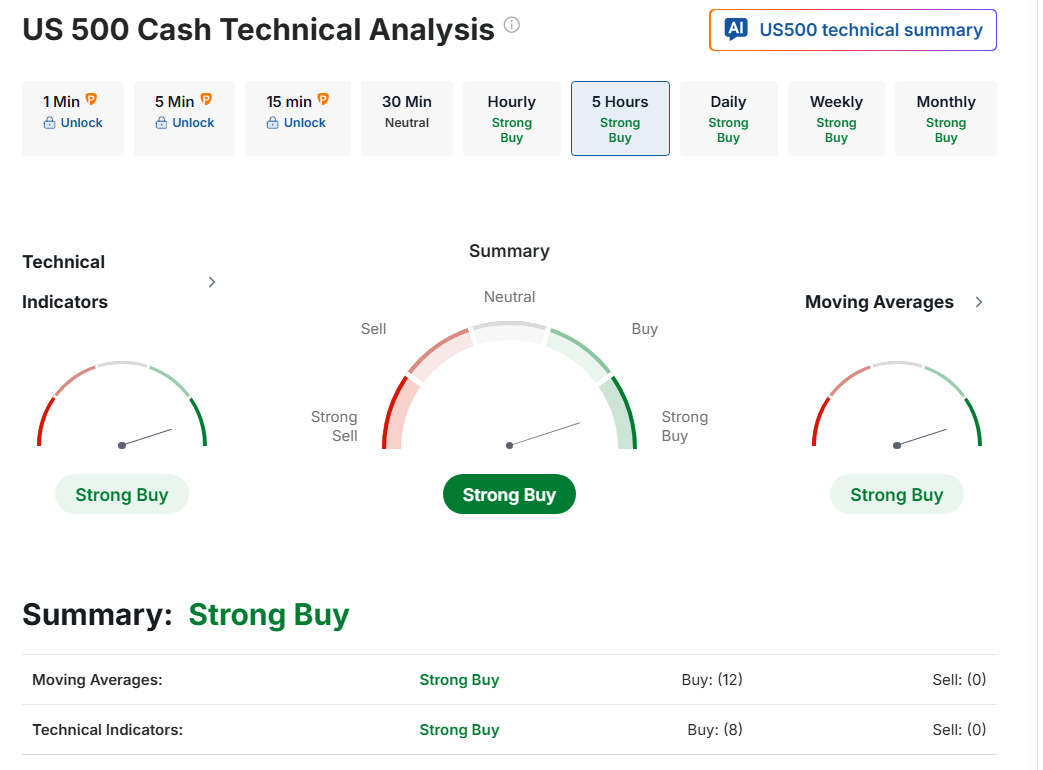

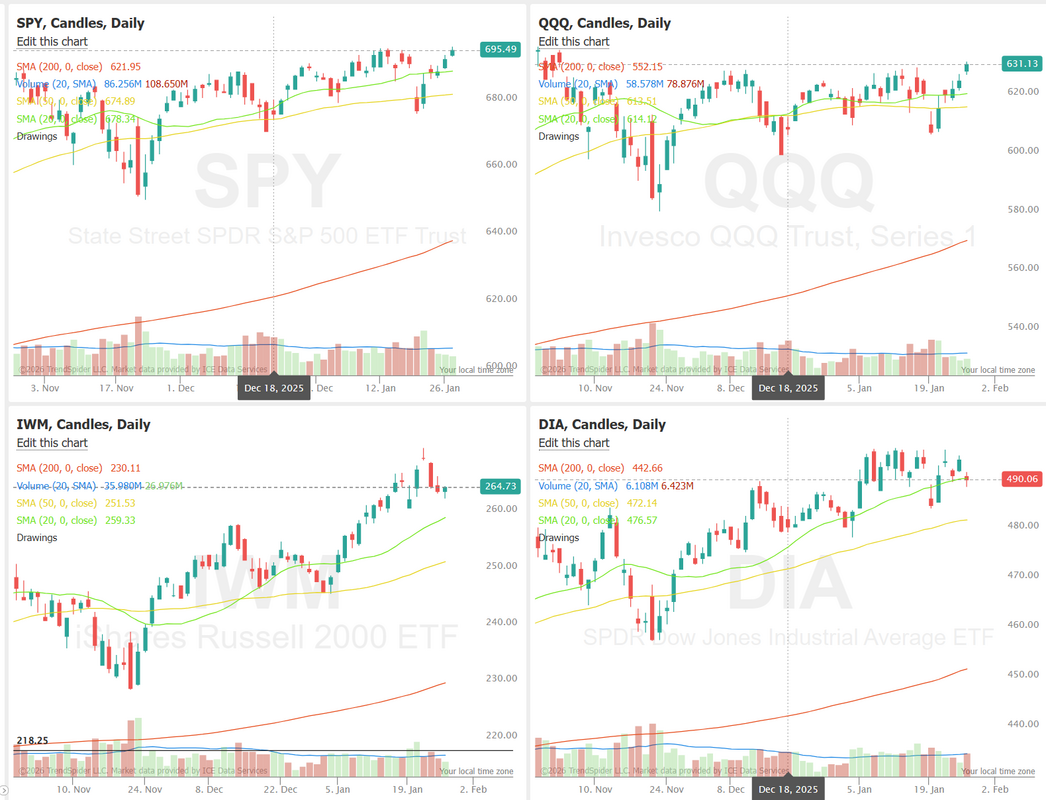

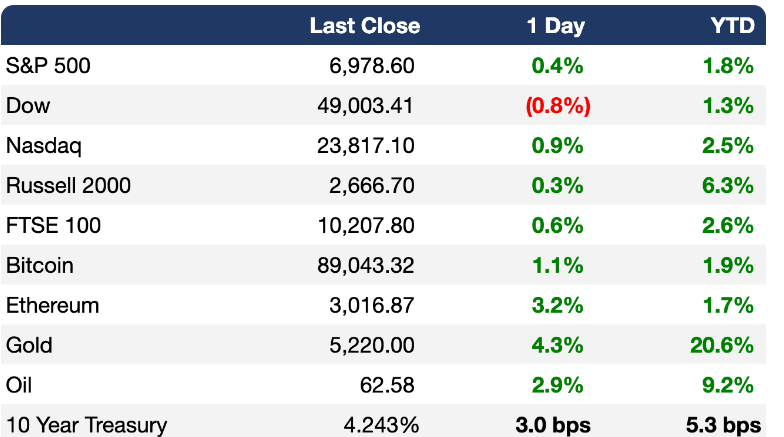

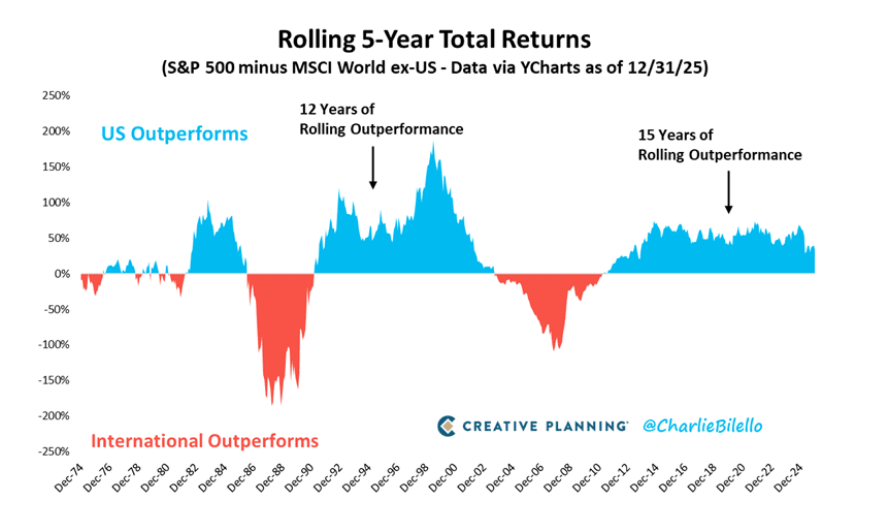

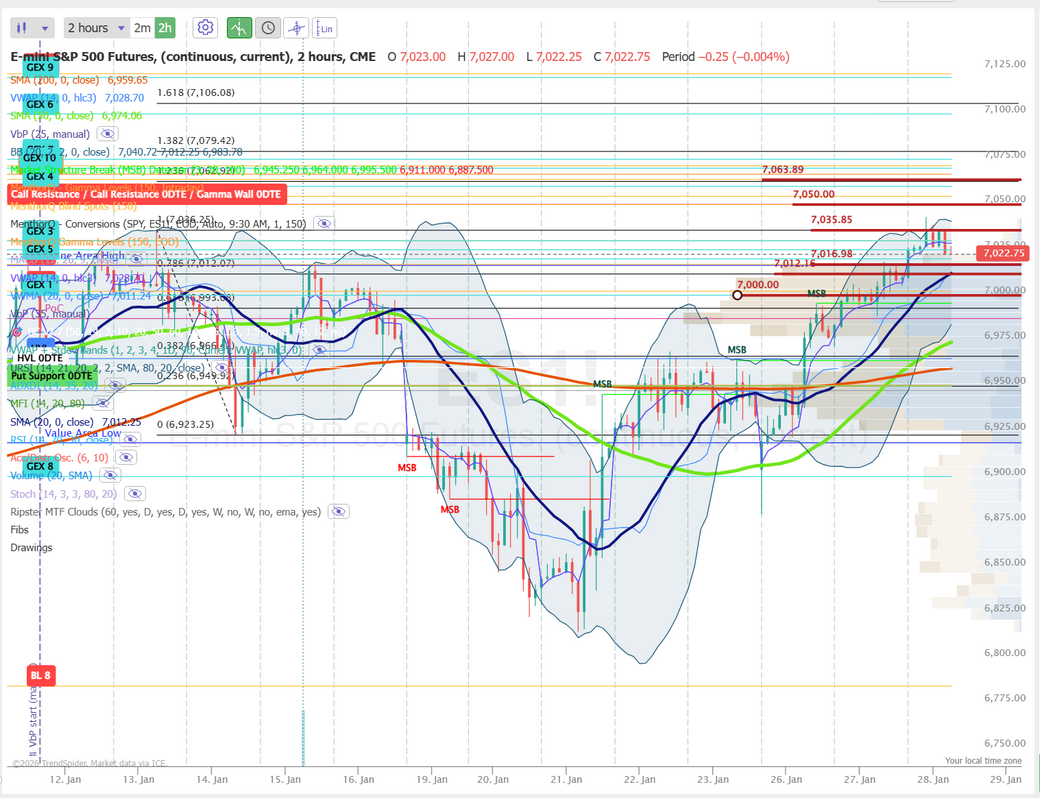

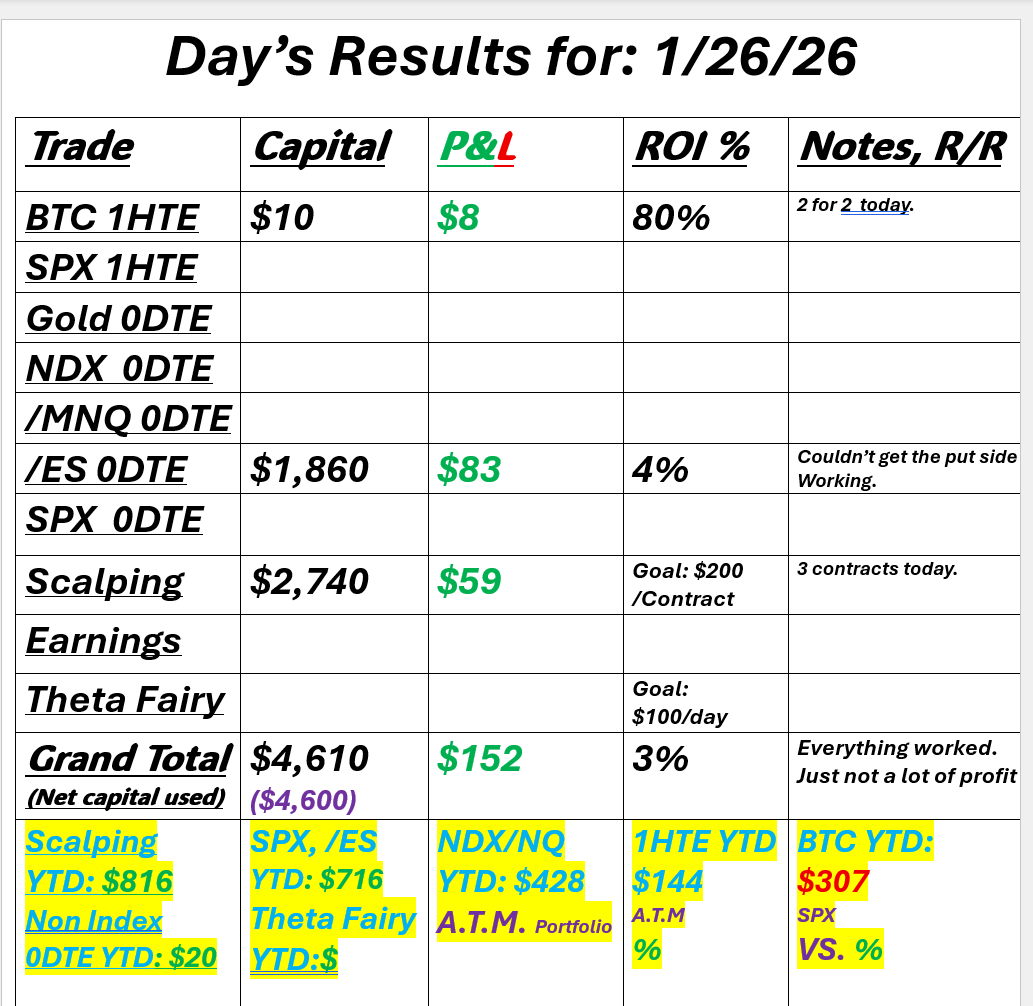

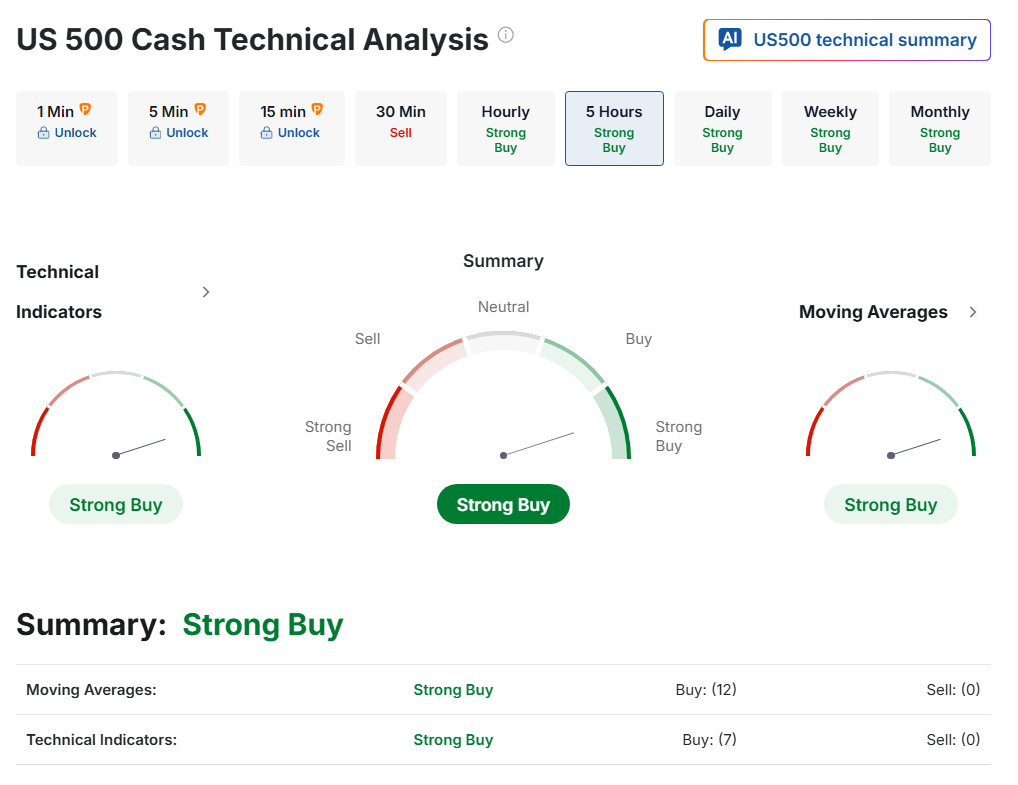

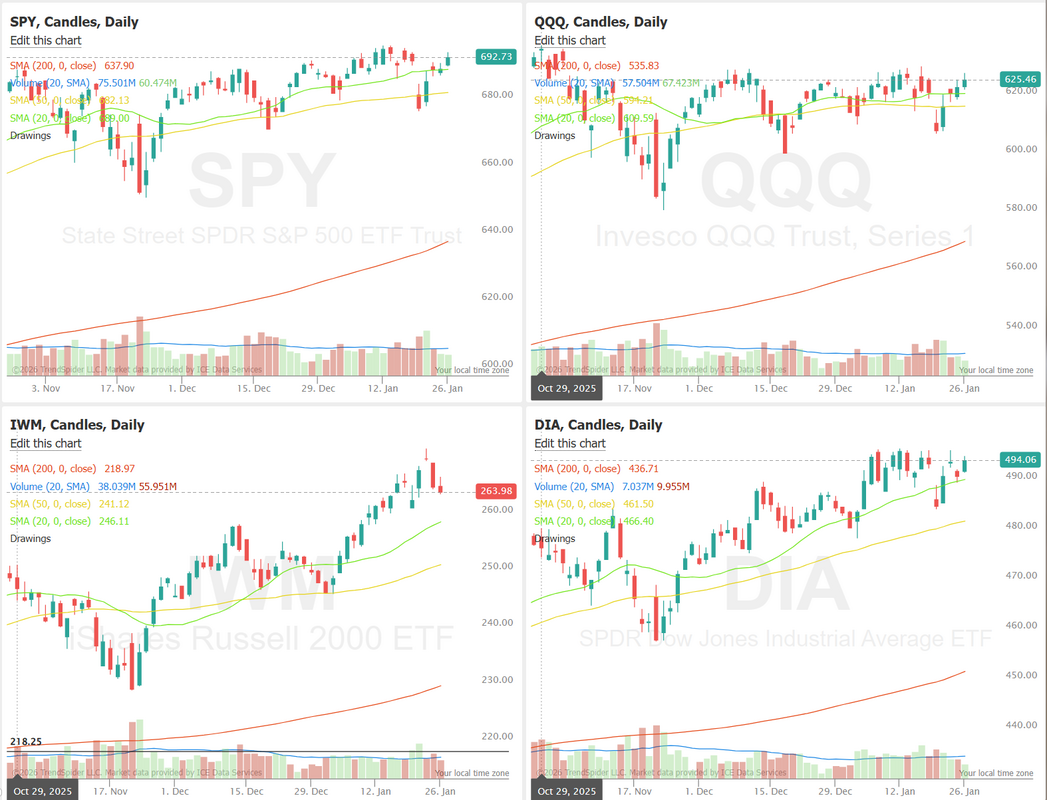

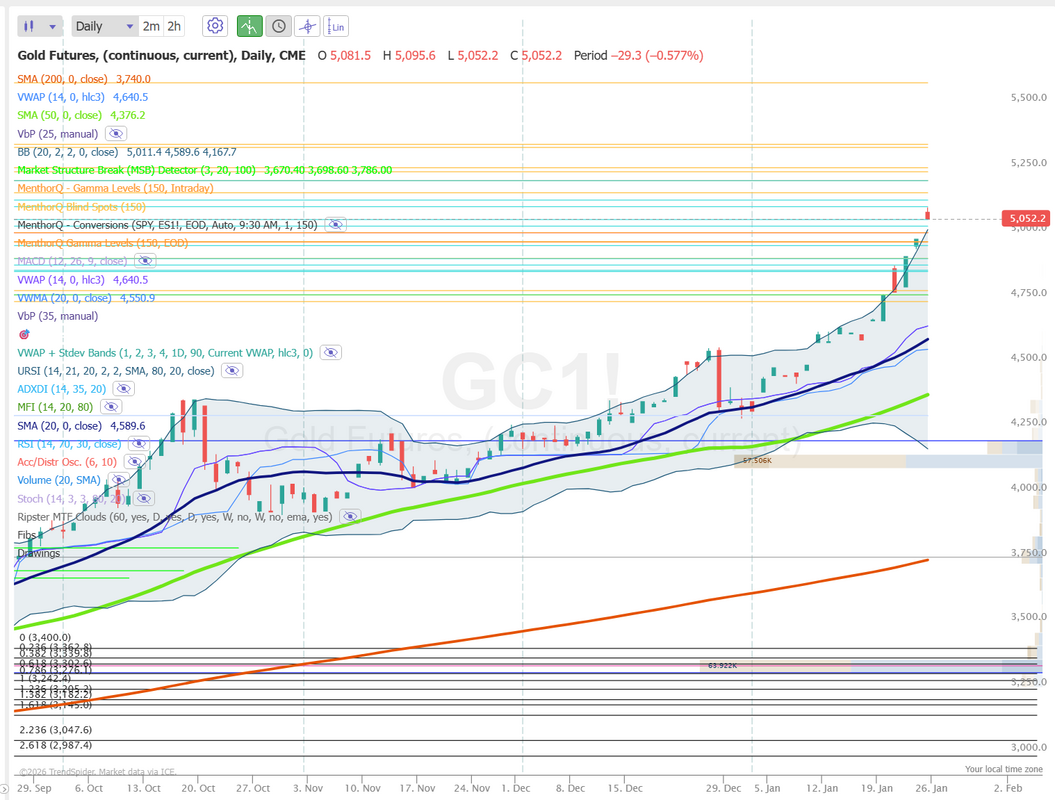

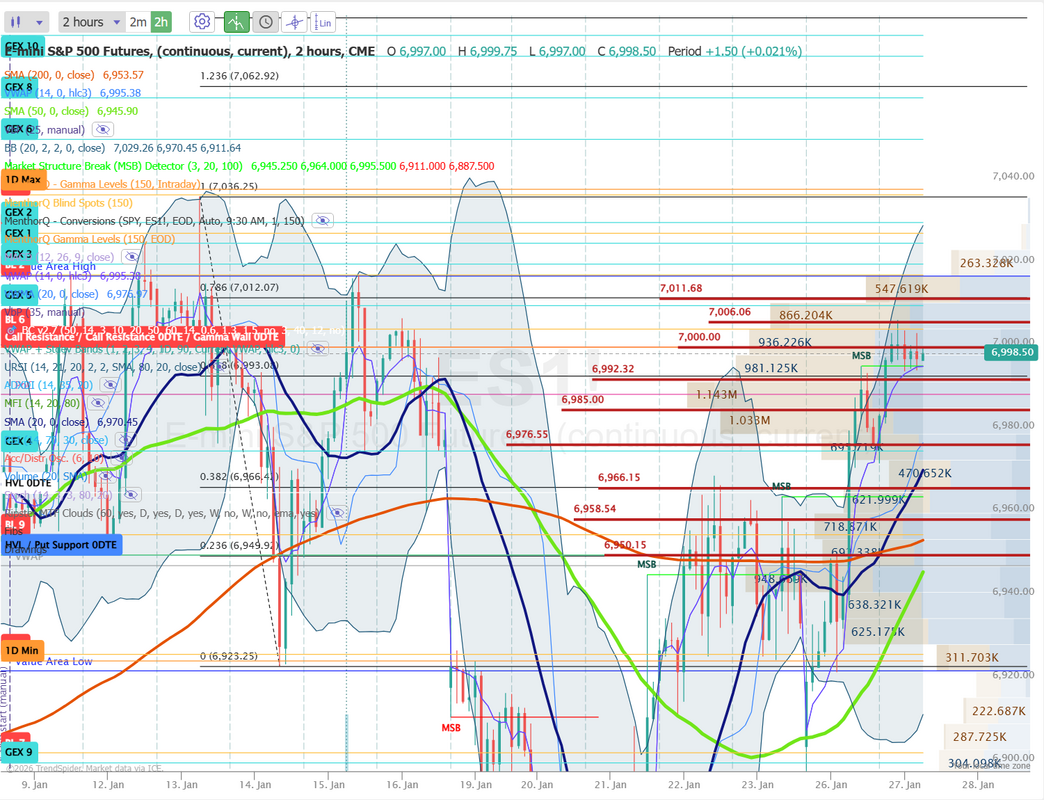

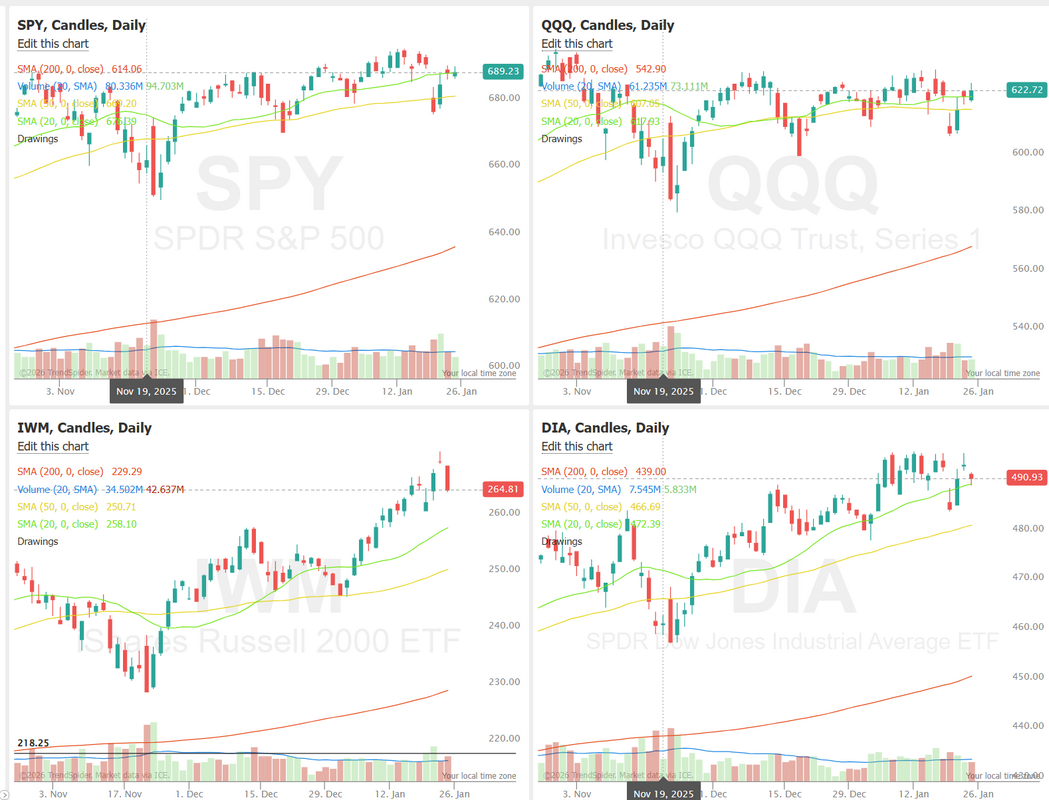

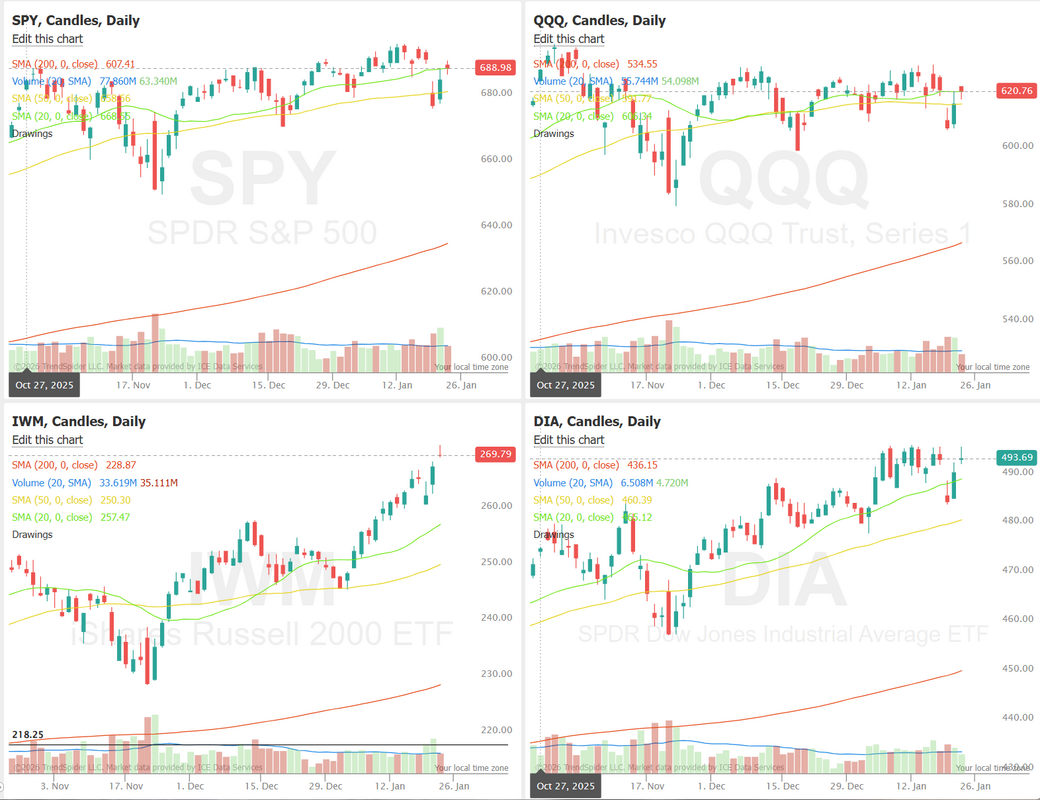

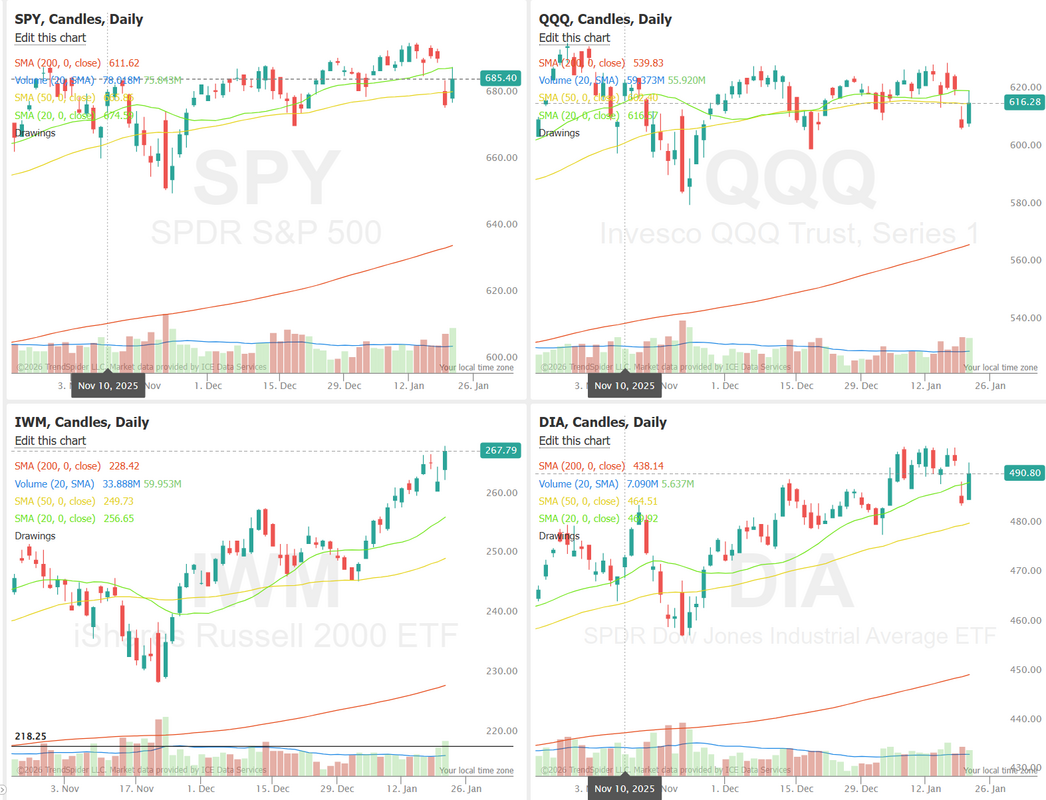

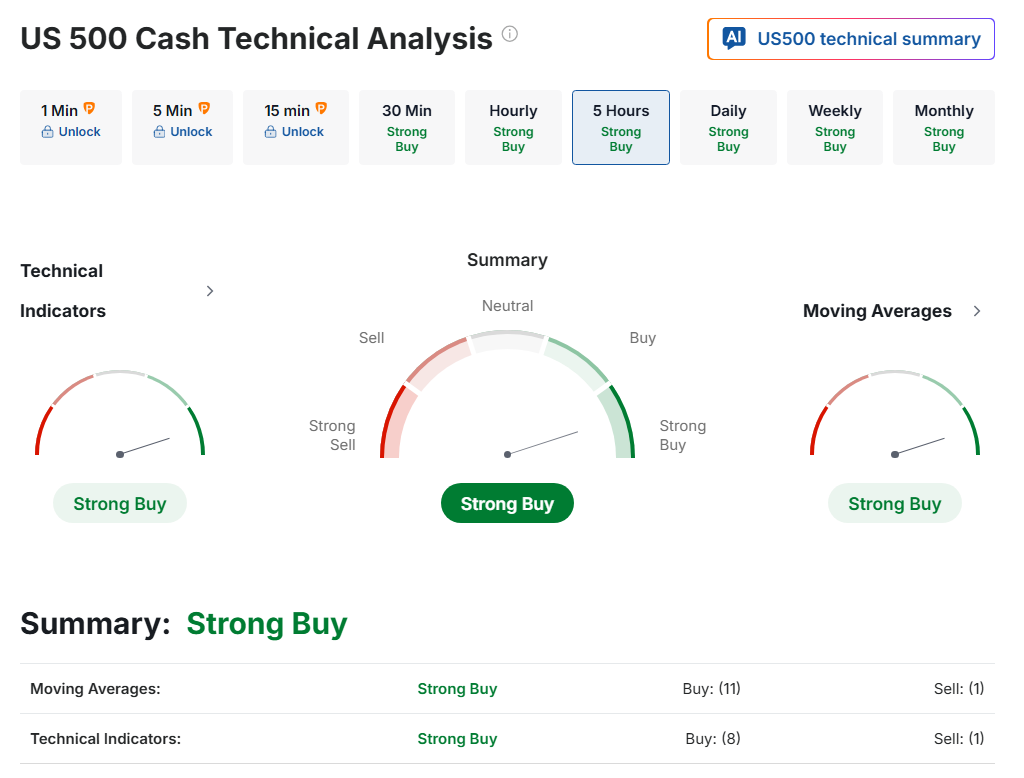

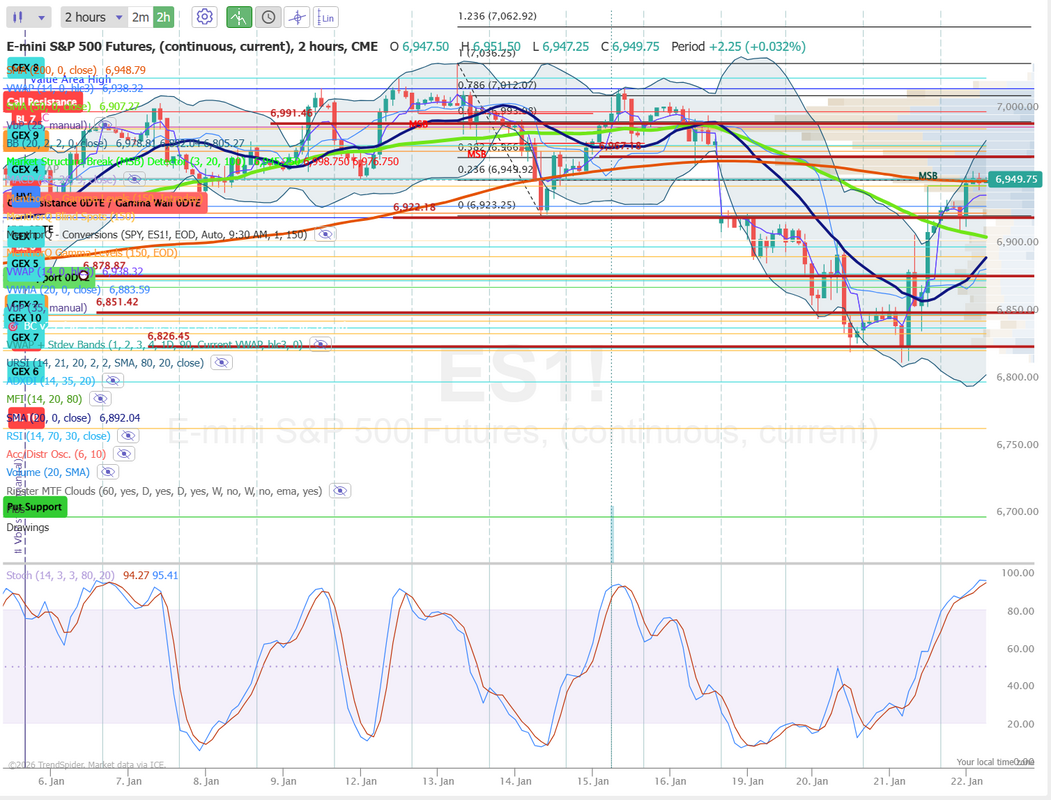

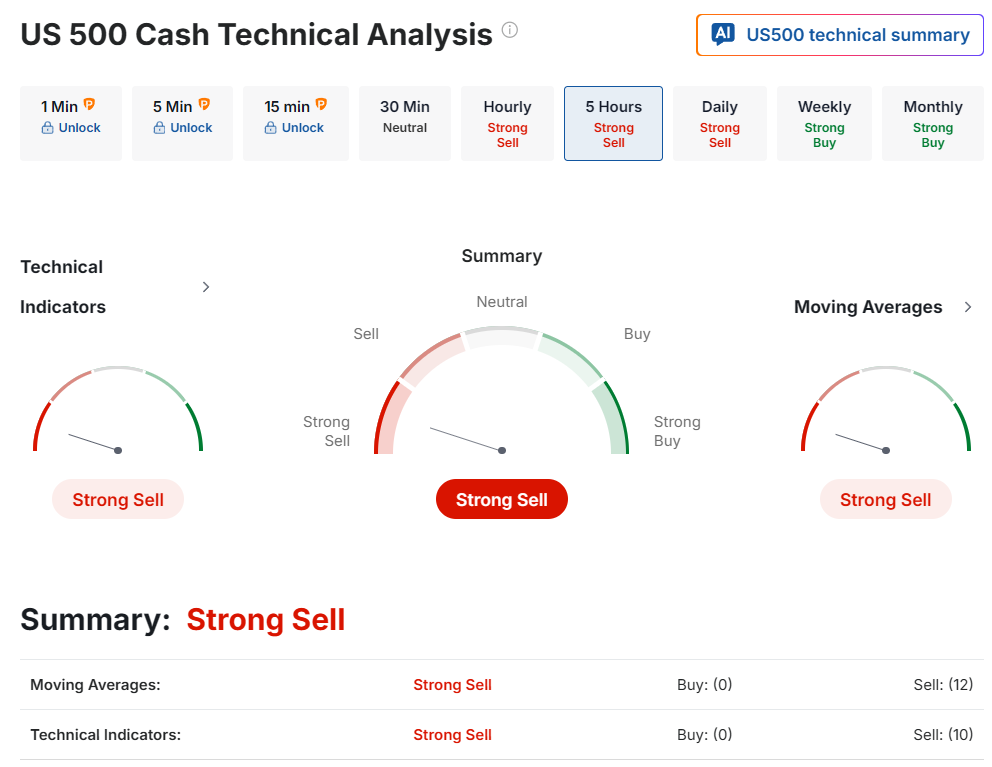

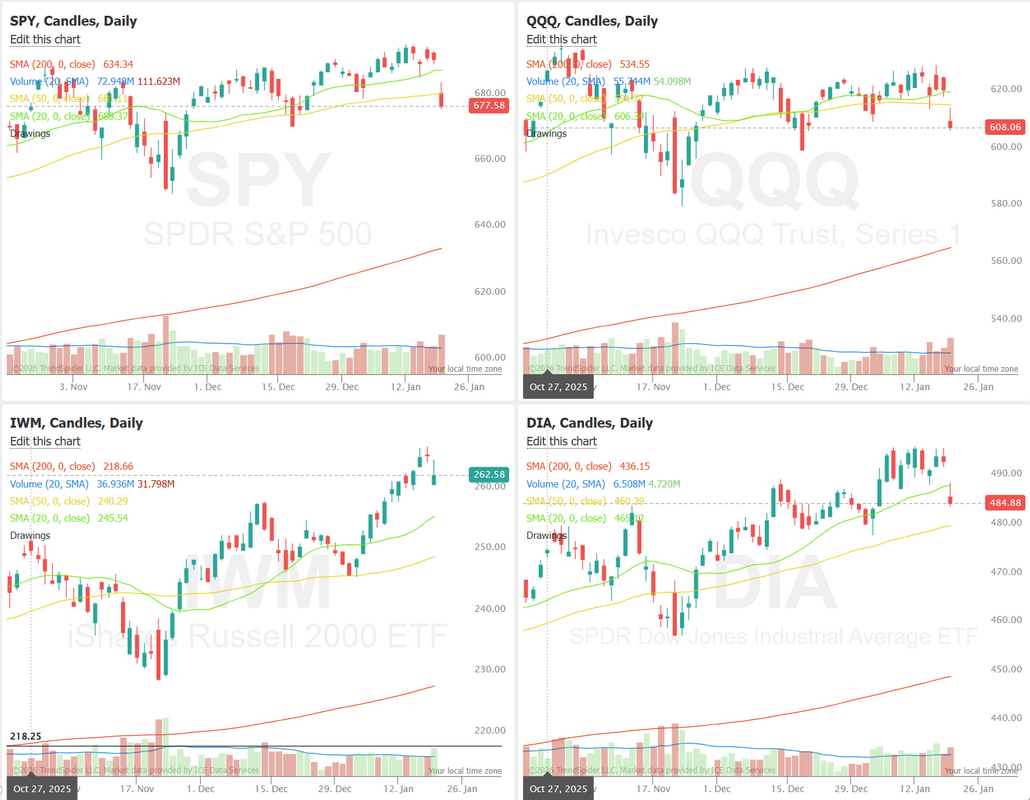

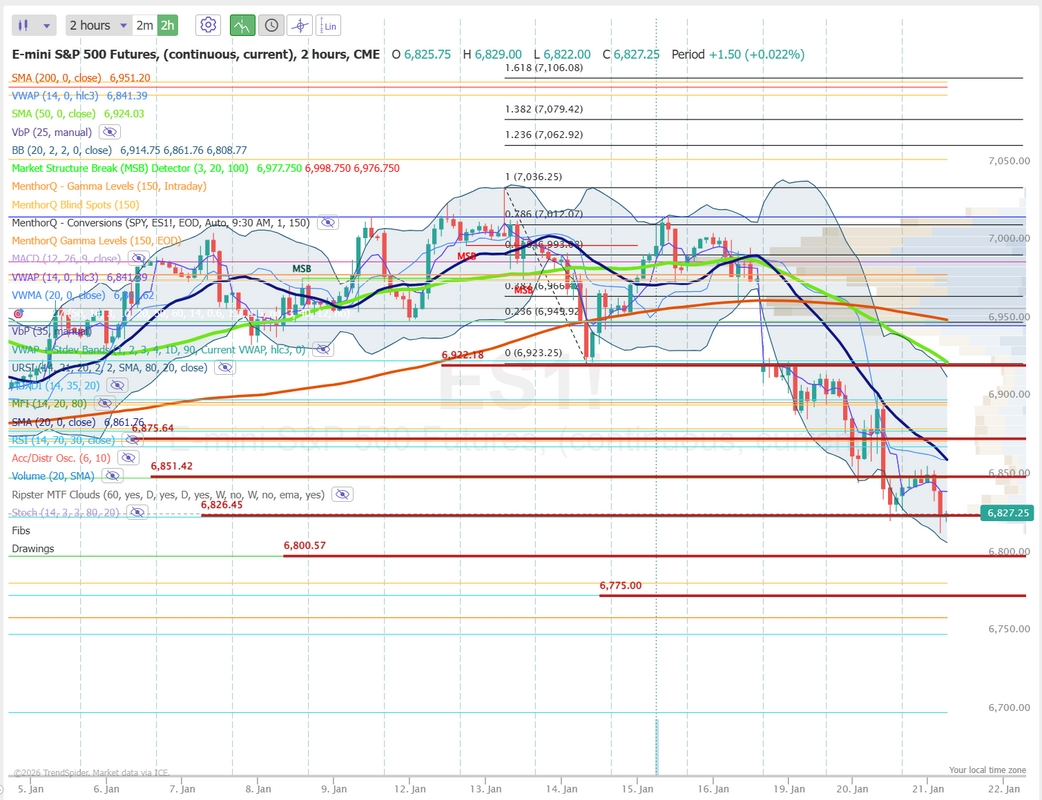

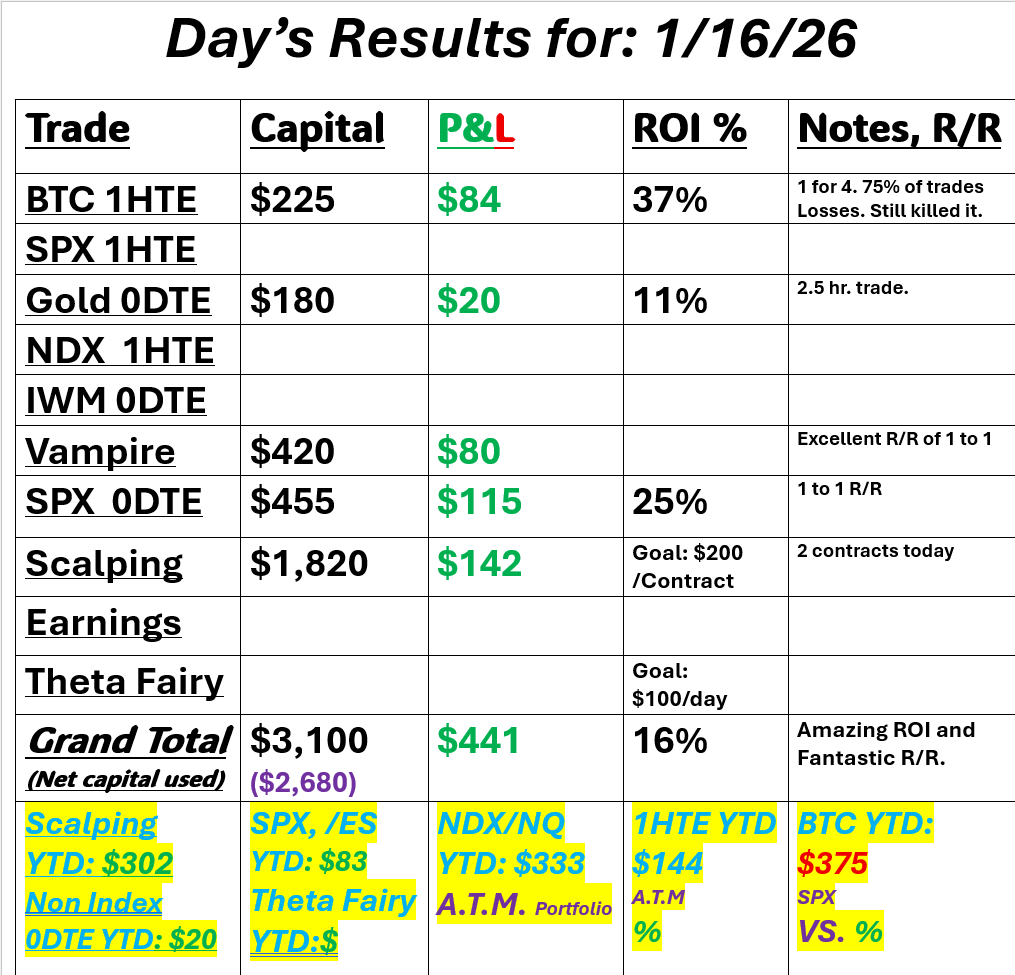

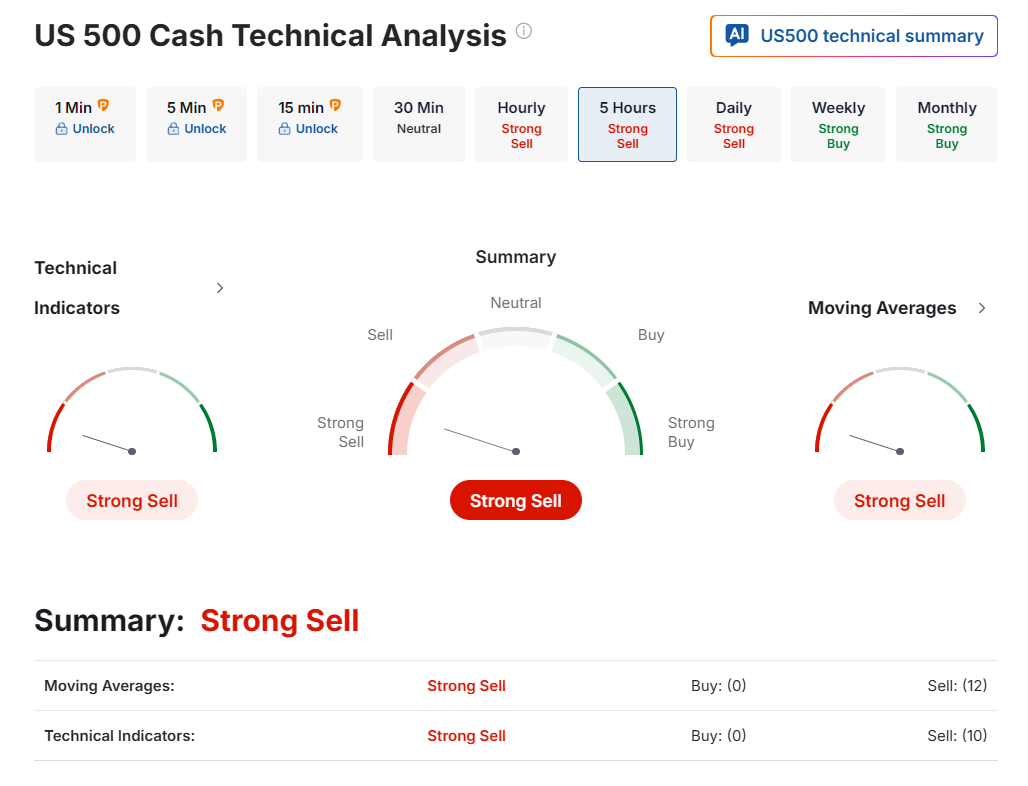

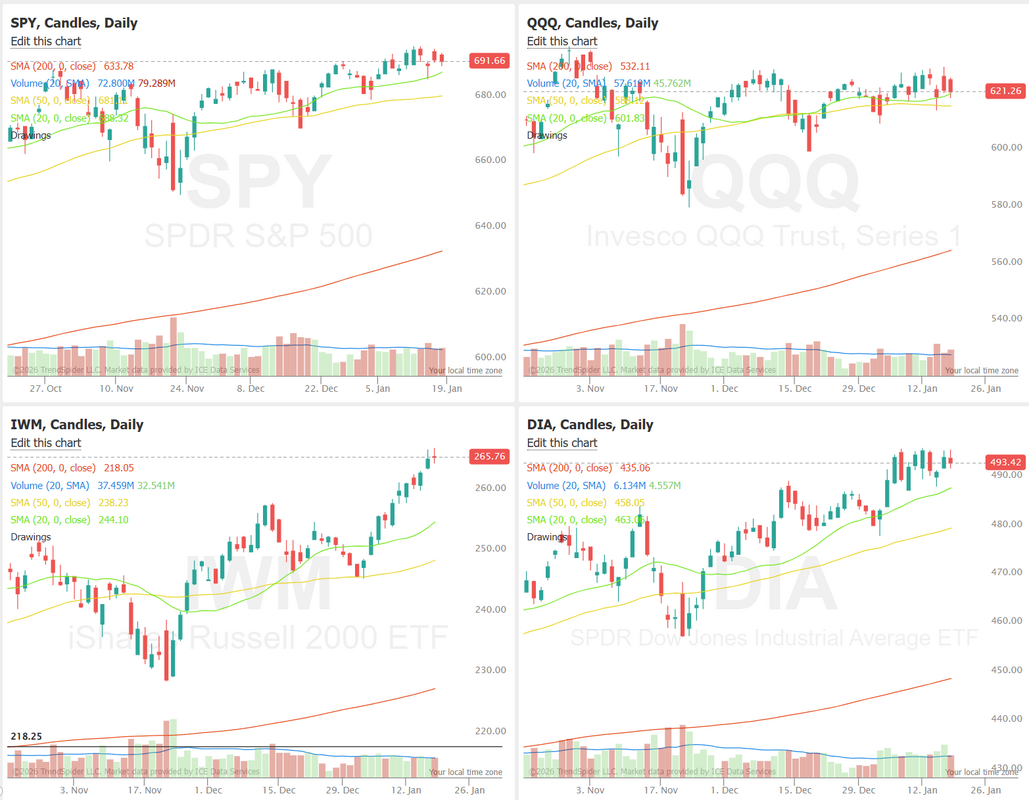

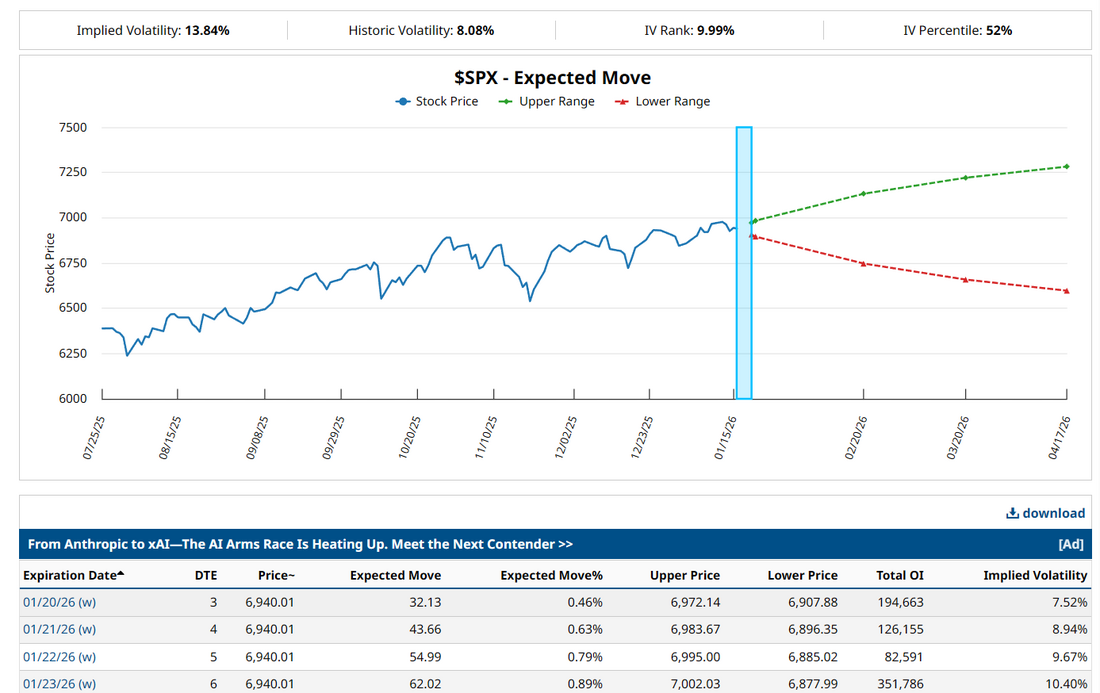

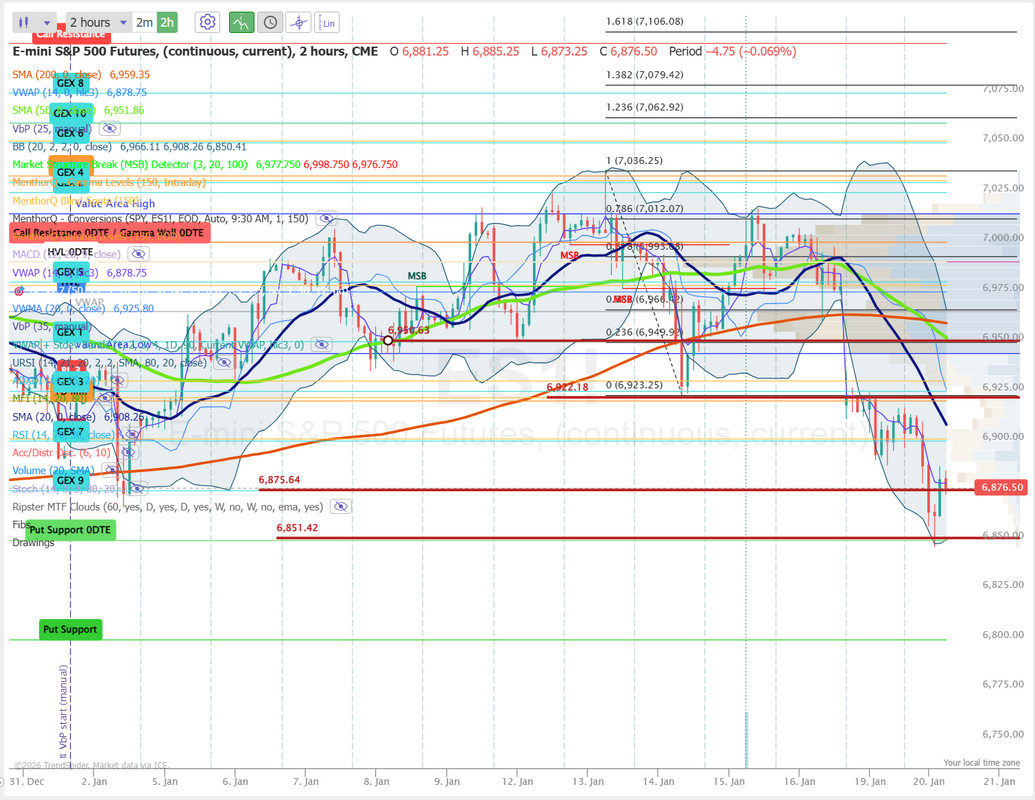

BTC crashes. Bank implodes in Illinois. CME raises margin requirements on gold & silver.Welcome back to a new week of trading! One thing is clear about day trading. There are certainly pros and cons but one big pro that always rises to the top is no overnight risk. Futures are weak again this morning, although they are fighting back as I type. Things are getting interesting in the market. The 1HTE BTC setups may offer some opportunities today. We just finished our first of the day with a $130 trade making $28 dollars (21%) in less than 30 min. Keep an eye on these today. We had a busy day on Friday and nailed four out of five trade setups. Unfortunately I added the put side to our Gold trade and of course, that was the day gold decided to collapse. All in all, I'm happy we were able to escape the day profitable. There were so many opportunities with scalping but I was always just a bit behind on catching the runners. Here's a full look at my day. Let's take a look at the markets. We've had a bit of a shake up lately. It's a tricky technical look to start the day. Futures are down and flashing a sell signal but they have also come roaring back from their overnight lows. Today could be decisive. Is this just another "buy the dip" opportunities or have bears finally showed up to take command? Friday certainly looked like the start of a break down with that pesky 20DMA acting as some key support. March S&P 500 E-Mini futures (ESH26) are down -0.57%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.92% this morning, pointing to a lower open on Wall Street as investors continue to sell risky assets amid a rout in precious metals. Gold and silver prices fell on Monday as increased CME margin requirements compounded selling pressure following last week’s selloff triggered by Kevin Warsh’s nomination as the next Fed chair. Gold and silver are down more than -3% after sliding as much as -10% and -16%, respectively, earlier on Monday. Also weighing on sentiment on Monday were renewed concerns around the AI trade. Oracle (ORCL) slid over -3% in pre-market trading after announcing plans to raise $45 billion to $50 billion this year to expand its cloud infrastructure, stoking investor concerns about its growing debt burden. Separately, Nvidia (NVDA) fell about -2% in pre-market trading after CEO Jensen Huang said the company’s proposed $100 billion investment in OpenAI was “never a commitment” and that it would consider any funding rounds “one at a time.” This week, investors look ahead to a new round of corporate earnings reports, remarks from Federal Reserve officials, and a slew of U.S. labor market data, assuming there is no prolonged government shutdown. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Chip stocks sank, with KLA Corp. (KLAC) plunging over -15% and Advanced Micro Devices (AMD) slumping more than -6%. Also, mining stocks cratered as gold and silver prices plummeted, with Coeur Mining (CDE) tumbling over -16% and Hecla Mining (HL) sliding more than -14%. In addition, PennyMac Financial Services (PFSI) plummeted over -33% after the company posted downbeat Q4 results. On the bullish side, Deckers Outdoor (DECK) jumped more than +19% and was the top percentage gainer on the S&P 500 after the owner of shoe brands Ugg and Hoka reported better-than-expected FQ3 results and raised its full-year guidance. Economic data released on Friday showed that the U.S. producer price index for final demand rose +0.5% m/m and +3.0% y/y in December, stronger than expectations of +0.2% m/m and +2.7% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.7% m/m and +3.3% y/y in December, stronger than expectations of +0.2% m/m and +2.9% y/y. In addition, the U.S. January Chicago PMI rose to 54.0, stronger than expectations of 43.5. “The unemployment rate has stabilized, and inflation remains sticky with uncertainty lingering around tariff policy,” said Eric Teal, chief investment officer at Comerica Wealth Management. “There is justification for the wait-and-see approach given the potential for a second wave of higher prices as the tariff pass-through rate increases.” St. Louis Fed President Alberto Musalem said on Friday that policymakers should refrain from cutting interest rates further for now to avoid reigniting inflationary pressures. “Aside from risking higher or more persistent inflation, easing could be counterproductive for the labor market by raising inflation expectations and long-term interest rates, thus slowing the economy and hurting employment,” Musalem said. Also, Atlanta Fed President Raphael Bostic said elevated inflation means officials should wait before cutting interest rates again. “We are still too high in inflation, so I think we need to be somewhat restrictive,” Bostic said. In addition, Fed Vice Chair for Supervision Michelle Bowman said there is merit in waiting to cut rates further, citing elevated inflation and uncertainty over possible distortions in economic data caused by last year’s record-long government shutdown. At the same time, Fed Governor Christopher Waller said, “Monetary policy is still restricting economic activity, and economic data make it clear to me further easing is needed.” U.S. rate futures have priced in an 87.2% chance of no rate change and a 12.8% chance of a 25 basis point rate cut at the March FOMC meeting. Meanwhile, the U.S. government partially shut down early Saturday, even though the Senate had passed a funding deal hours earlier. That’s because the House of Representatives must also vote to approve the final version of the deal. The shutdown is expected to be short, with the House returning from a week-long break on Monday and President Trump fully backing the spending package. House Speaker Mike Johnson said on Sunday that he believes he has enough votes to end the partial shutdown by Tuesday. Fourth-quarter corporate earnings season continues, and investors await new reports from prominent companies this week, including Alphabet (GOOGL), Amazon.com (AMZN), Advanced Micro Devices (AMD), Qualcomm (QCOM), Arm Holdings (ARM), Palantir Technologies (PLTR), Walt Disney (DIS), PepsiCo (PEP), Pfizer (PFE), Eli Lilly (LLY), AbbVie (ABBV), and Uber Technologies (UBER). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. Market watchers will also be awaiting the U.S. January Nonfarm Payrolls report this week for fresh insight into the health of the jobs market and the potential implications for monetary policy. Notably, the report will include revisions to job growth for the year through March 2025, which are expected to show a significant markdown in the pace of hiring. It remains unclear whether the Bureau of Labor Statistics could delay the report’s release due to the shutdown, even if it is expected to be short. “The market remains wary of what is happening in the jobs market and was unmoved by the Fed’s positive spin, continuing to price two 25 basis-point rate cuts this year,” said James Knightley, economist at ING. Other noteworthy data releases include the JOLTs Job Openings, ADP Nonfarm Employment Change, the S&P Global Services PMI, the S&P Global Composite PMI, the ISM Non-Manufacturing PMI, Initial Jobless Claims, Average Hourly Earnings, the Unemployment Rate, Consumer Credit, and the University of Michigan’s Consumer Sentiment Index (preliminary). In addition, several Fed officials will be making appearances throughout the week, including Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Lisa Cook, and Fed Vice Chair Philip Jefferson. Today, investors will focus on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. The survey will be closely watched for insights into the state of the economy and for clues on inflation and employment trends. Economists expect the January ISM manufacturing index to be 48.5, compared to the previous value of 47.9. The U.S. S&P Global Manufacturing PMI will also be released today. Economists forecast that the final January figure will be unrevised at 51.9. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.214%, down -0.71%. SPY closed the week slightly higher at $691.97 (+0.39%) as January comes to a close. On the monthly chart, price has reached a key 1.618 Fibonacci extension level, an area where trends often pause or reverse. Meanwhile, the monthly RSI remains in overbought territory, raising the stakes for bulls. Will momentum persist into February, or is a pullback imminent? With several major tech earnings last week, QQQ closed flat on the week at $621.87 (-0.14%). Price continues to face resistance near the 1.618 Fibonacci extension and has yet to print a new all-time high, unlike SPY. With more tech earnings set to report this week, traders may finally see a break from the recent consolidation range. Small-caps took some heat last week, with IWM closing at $259.65 (-1.95%). However, the monthly chart remains constructive, as the ETF sits at an all-time high and still well below its 1.618 Golden Fibonacci extension. The monthly RSI also remains below 70, giving momentum room to run. Even with rates left unchanged last week, small-caps continue to look bullish on a larger timeframe. Despite its reputation as digital gold, Bitcoin has recently diverged from the precious metals sector, sliding lower while shiny rocks staged a historic rally. A broken bear flag and drift toward $80,000 echo the 2021-2022 price action that preceded a 75% drawdown, while the Multi Length Alignment Oscillator reinforces bearish momentum as downside pressures mount. Let's take a look at the weekly expected move in SPX. A healthy 1.36% expected move for the week should provide a good base for credit premiums. We'll finish our part II training today on PPC (Performance process cycle) this is a good one to download. Come join us today on our zoom feed. Let's take a look at the intraday levels we'll work off today. 6950, 6966, 6977, 6994 are resistance. 6923, 6901, 6874, 6852 are support. Today could be another day of good opportunities. Let's see how the morning firms up. See you shortly!

0 Comments

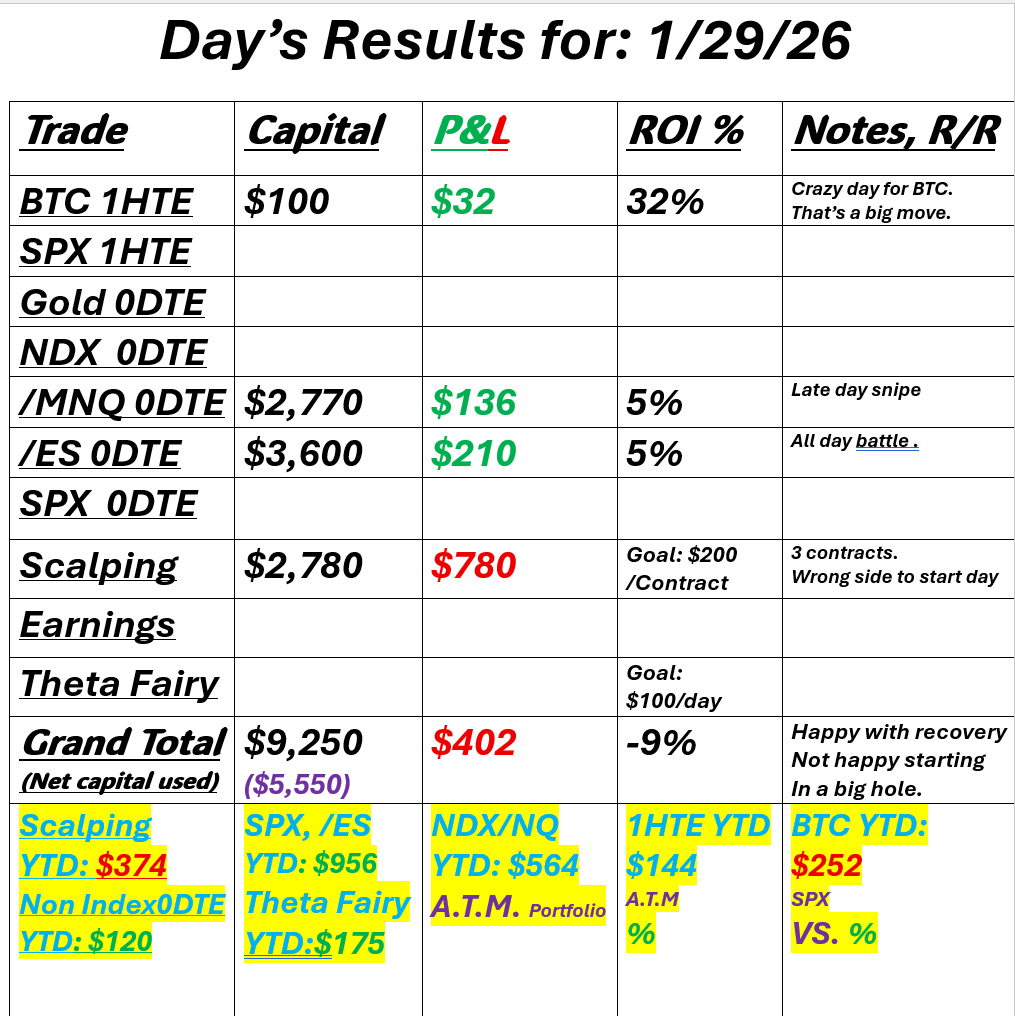

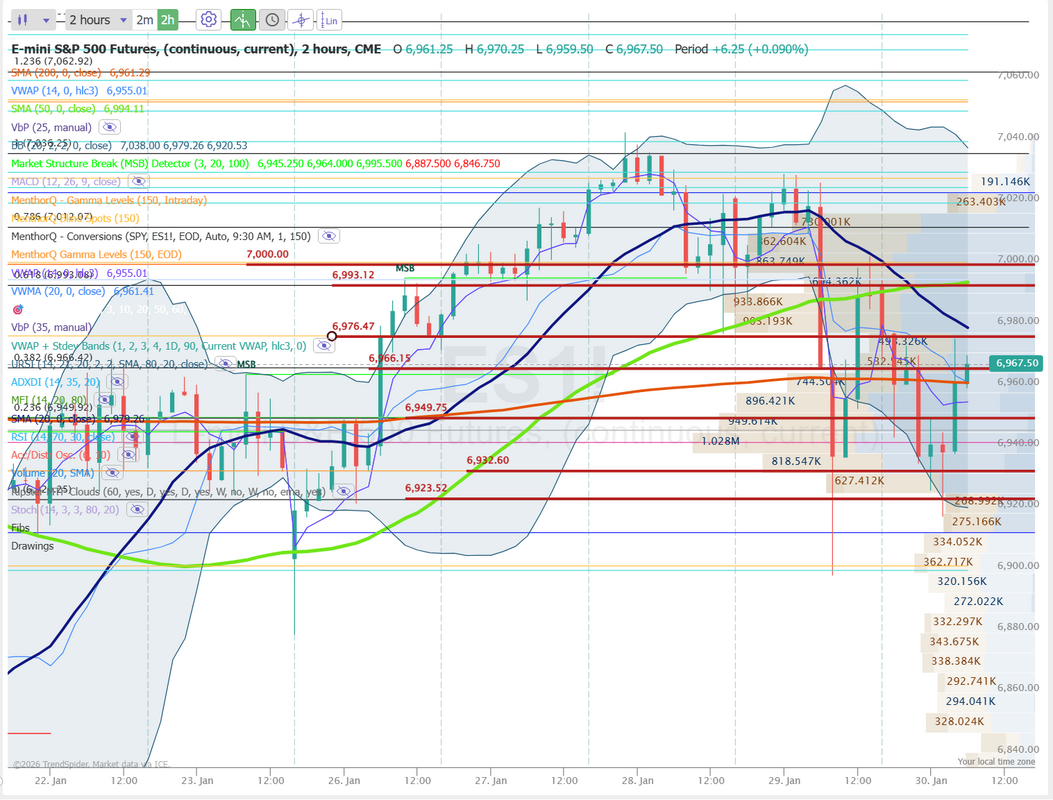

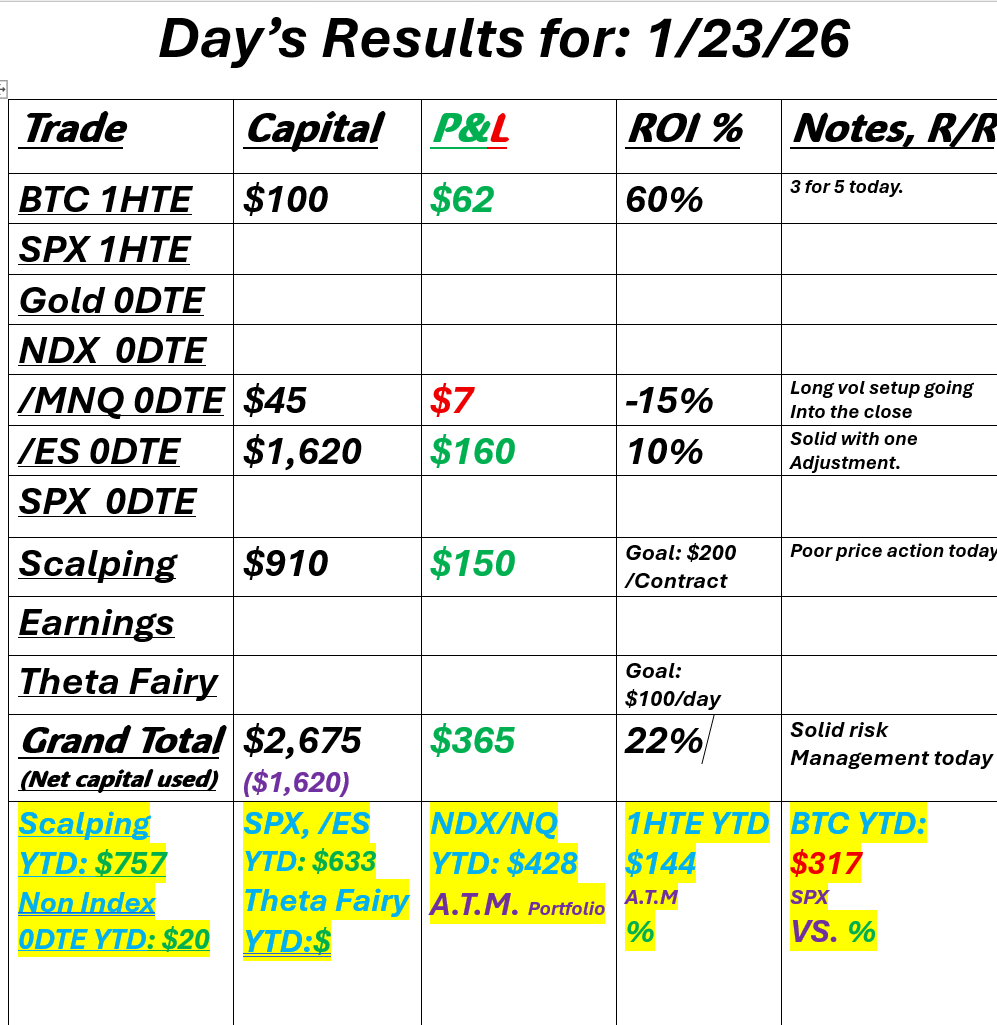

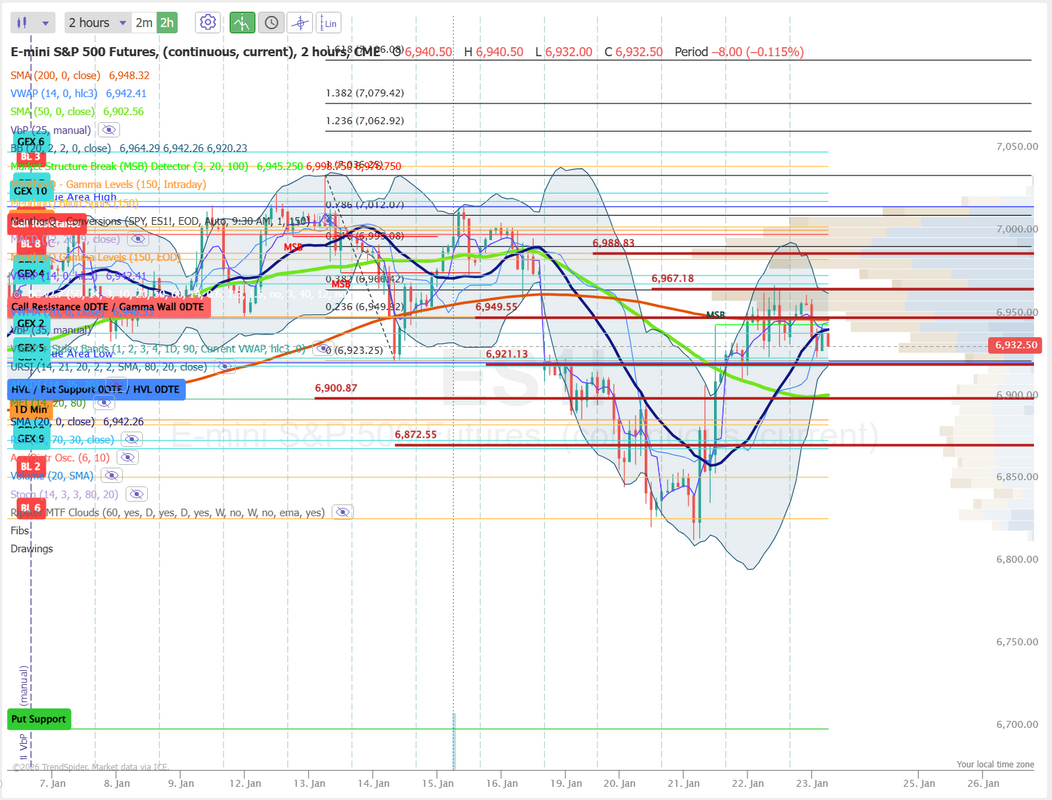

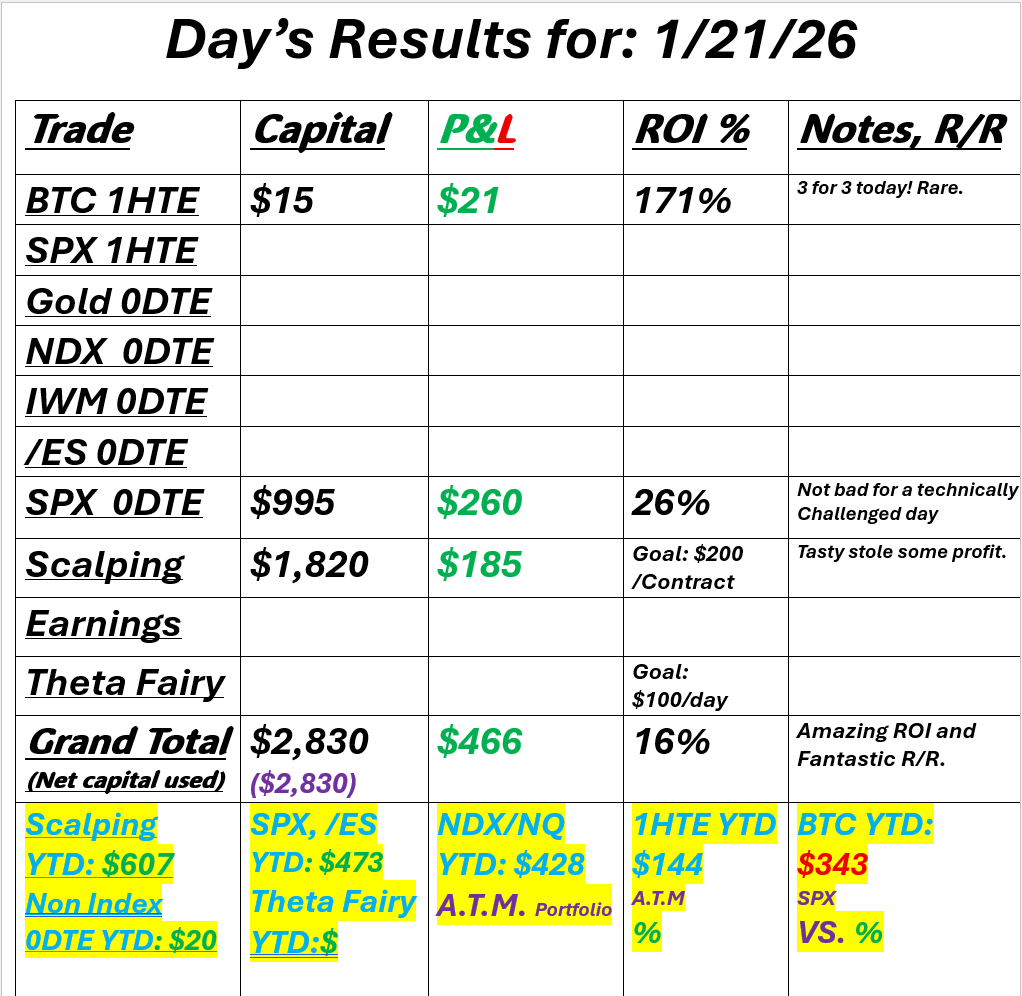

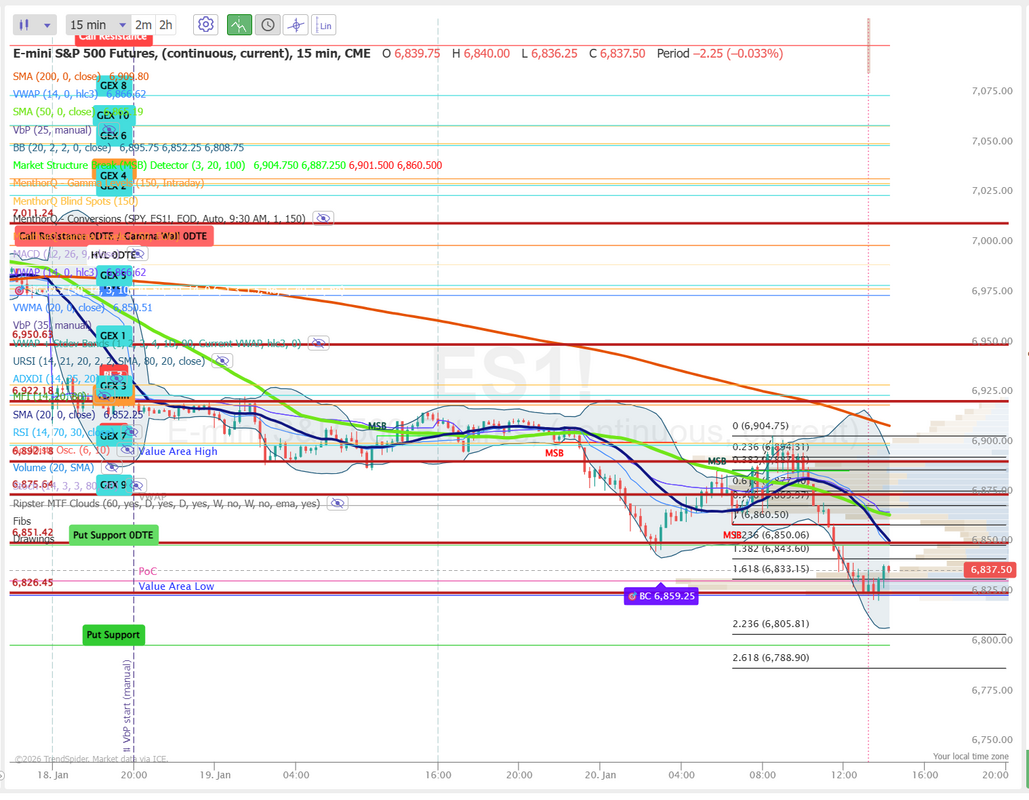

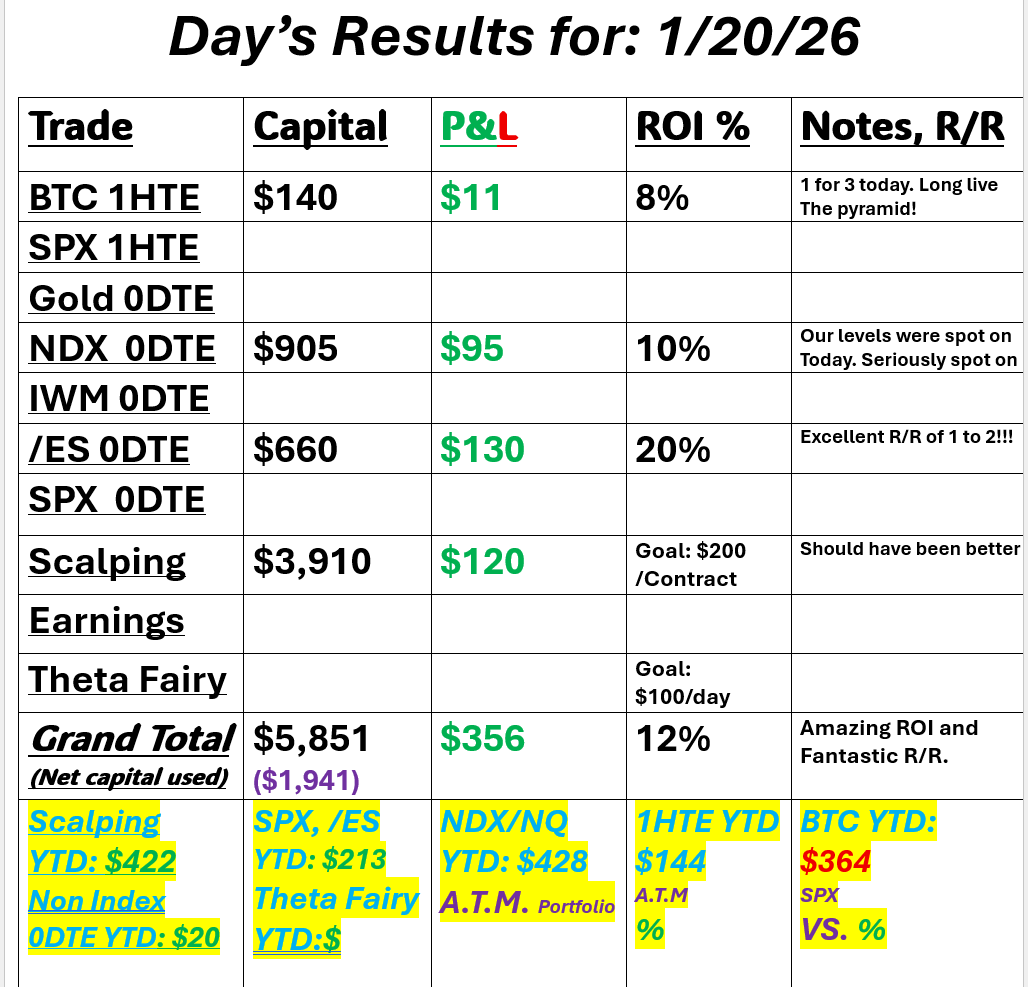

Was that a flush I heard?That was a pretty big flush to start the day yesterday. We usually love these days. Unfortunately, I already had two bullish trades on when it happened! That put me in a big hole that I had to spend the rest of the day trying to dig out of. I made some solid progress, but not all the way to an overall green day. Here's a look at the battlefield for me yesterday. I'm super happy with our ability to climb back (at one point, I was down $2,300), but still frustrating to start in a hole like that. Let's take a look at the markets. Most of yesterday morning's flush was absorbed later in the day. In spite of how red the candles were yesterday those long tails are a bullish sign. We've got a slight sell signal technically to start the day. Most of the major averages were able to claw back above their respective 50DMA yesterday so it will be interesting to see if buyers set in and "buy the dip" today like they have for, what seems like forever. The "buy the dip" trade has been remarkably reliable. Is today another opportunity to establish longs? For trade setups today, I've got a couple of ideas. #1. The 1HTE BTC early day setups don't look great right now. We may get something there later in the day. #2. I'd like to start our 0DTE off with Gold, then into /NQ. and possibly /RTY as well. #3. Scalping could offer up some good opportunities today as well. Let's take a look at the intraday /ES levels. 6966 seems to be the current inflection point. Above that, 6976, 6993, and 7000 are working as resistance levels. 6949, 6932, 6923 are support levels. March S&P 500 E-Mini futures (ESH26) are down -0.40%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.47% this morning after U.S. President Donald Trump nominated Kevin Warsh as the next Federal Reserve chair. “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is “central casting,” and he will never let you down,” Trump said on Truth Social. U.S. equity futures and Treasuries pared earlier losses following the announcement, with investors weighing how aggressively Warsh might cut interest rates. Earlier on Friday, Bloomberg reported that the Trump administration is preparing for the president to nominate Warsh as the next Fed chair. Warsh, who served as a policymaker from 2006 to 2011, frequently highlighted inflation risks even as others focused on supporting growth and employment during the financial crisis. In yesterday’s trading session, Wall Street’s major indices closed mixed. Microsoft (MSFT) plunged about -10% and was the top percentage loser on the Dow after the technology behemoth’s spending climbed to a record high and cloud sales growth slowed in FQ2, fueling concerns that it may take longer than anticipated for the company’s AI investments to pay off. Also, Las Vegas Sands (LVS) tumbled more than -13% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q4 Macau profit. In addition, United Rentals (URI) slumped over -12% after the equipment rental company posted downbeat Q4 results. On the bullish side, Meta Platforms (META) surged over +10% and was the top percentage gainer on the Nasdaq 100 after the social media giant posted upbeat Q4 results and issued strong Q1 revenue guidance. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell by -1K to 209K, compared with the 206K expected. Also, U.S. Q3 nonfarm productivity and unit labor costs were unrevised at +4.9% q/q and -1.9% q/q, respectively, in line with expectations. In addition, the U.S. November trade deficit widened to -$56.8 billion, weaker than expectations of -$43.4 billion. Finally, U.S. factory orders rose +2.7% m/m in November, stronger than expectations of +1.7% m/m. Meanwhile, President Trump and Senate Democrats have struck a tentative agreement to avert a U.S. government shutdown, as the White House continues talks with Democrats over imposing new limits on immigration raids that have sparked a national outcry. In tariff news, President Trump on Thursday threatened to slap Canada with a 50% tariff on any aircraft sold in the U.S. and also signed an executive order that would impose tariffs on goods from countries that sell or supply oil to Cuba. Today, investors will focus on the U.S. Producer Price Index for December, which is set to be released in a couple of hours. The December reading was originally scheduled for release on January 14th, but was delayed due to the fallout from the longest-ever government shutdown. Economists, on average, forecast that the U.S. December PPI will stand at +0.2% m/m and +2.7% y/y, compared to the previous figures of +0.2% m/m and +3.0% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect December figures to be +0.2% m/m and +2.9% y/y, compared to November’s numbers of no change m/m and +3.0% y/y. The U.S. Chicago PMI will be released today as well. Economists forecast the January figure at 43.5, the same as in December. In addition, market participants will be anticipating speeches from Fed Vice Chair for Supervision Michelle Bowman and St. Louis Fed President Alberto Musalem. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), American Express (AXP), Verizon (VZ), and SoFi Technologies (SOFI) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. U.S. rate futures have priced in an 82.6% probability of no rate change and a 17.4% chance of a 25 basis point rate cut at the next central bank meeting in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.251%, up +0.54%. Yesterdays price action presented ample opportunities and today could be similar. Let's see if we can capitalize on them and finish the week strong! See you all shortly.

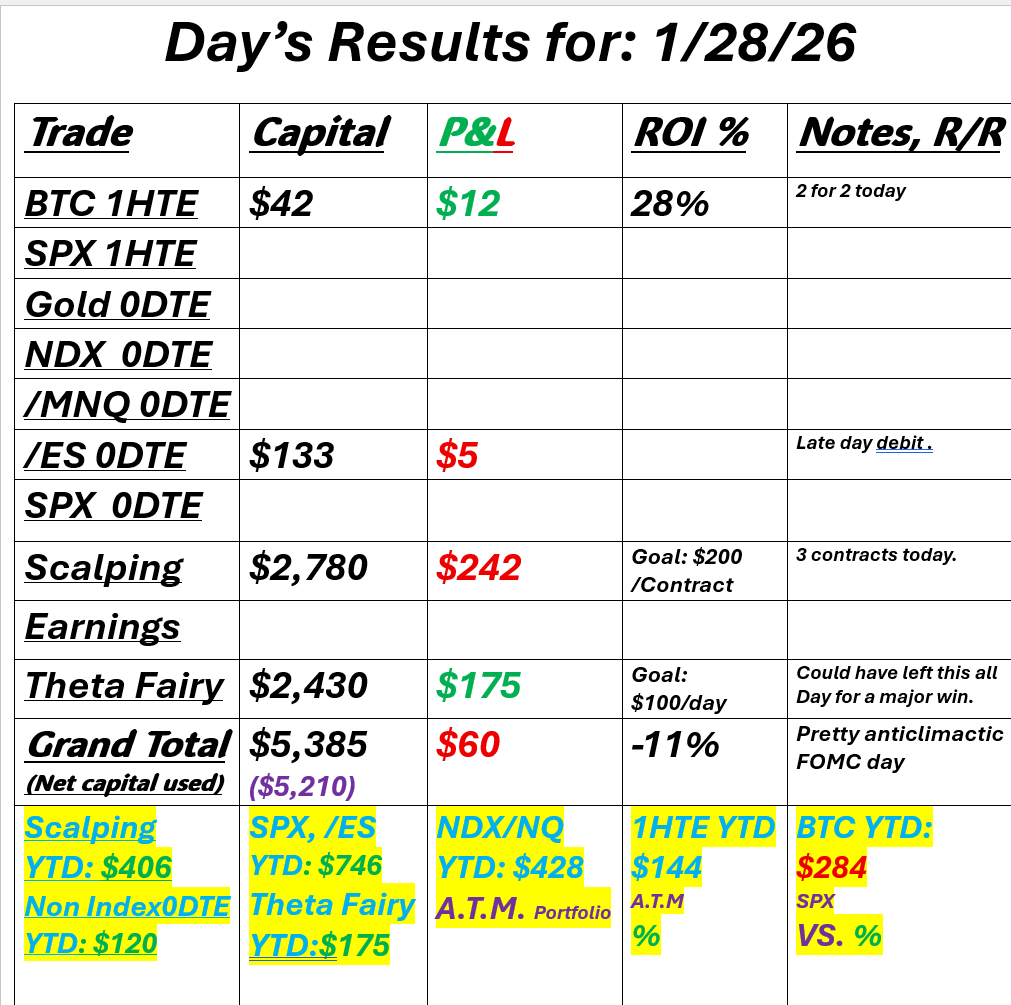

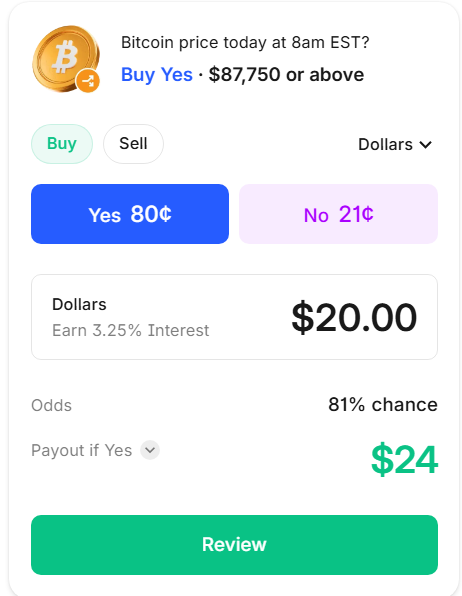

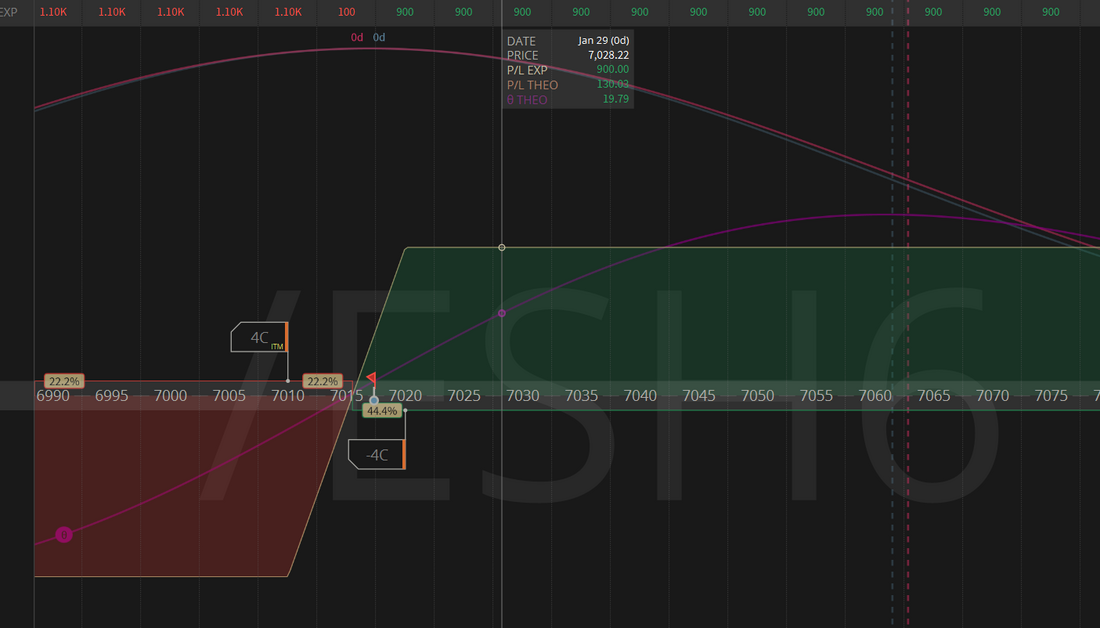

FOMC day was a bit tame.We usually look forward to FOMC day with anticipation of some nice moves that we can potentially capture. That certainly wasn't the case yesterday. Talk about a dud of a day. We pulled a nice profit on our first Theta fairy of the year but we could have just let it sit all day and scored a massive win. It's been a while since we had an FOMC day like this. It really was a day of no opportunity. I got chopped up on scalps with 3 contracts. Here's a look at my day. We've already got our day started with a 1HTE on BTC and a 0DTE on /ES Speaking of 0DTE's... I'll share some news on this. Credit Matthew Tuttle. effectively getting pulled deeper into the “0DTE world” — not with daily expirations yet, but with a major step in that direction: Monday and Wednesday expirations layered on top of the already-dominant Friday weeklies. MIAX has flagged AAPL, AMZN, AVGO, GOOGL, META, MSFT, NVDA, TSLA — and IBIT as Qualifying Securities for these new Monday/Wednesday short-dated listings, with the first expirations hitting Feb 2 and Feb 4. Here’s why this matters: this isn’t about “more products.” It’s about how markets trade now. 0DTE options already became the center of gravity in major indices — in some months, 0DTE has been more than 60% of S&P 500 options volume. Exchanges don’t expand expirations because it’s fun… they do it because demand is pulling the whole ecosystem toward shorter, cheaper, more frequent hedging and speculation. The SEC filings around these Monday/Wednesday expirations basically admit the direction of travel: expand short-term series in the most liquid names, then broaden over time. The real punchline: this is a preview of “0DTE on anything with liquid weeklies” Once you give the market Monday and Wednesday expirations in the biggest tickers on earth, you’re training investors to think in daily decision loops. Today it’s M/W/F. Tomorrow it’s every day for anything with enough volume and tight spreads. That’s the product roadmap hiding in plain sight. And if you’re an investor (not a day trader), there’s a way to look at this that’s almost the opposite of the usual “0DTE panic” narrative… The edge: why 0DTE covered calls can be structurally better than weekly/monthly overwrites The biggest advantage of 0DTE covered calls is simple: you can stop giving away the overnight return stream. Traditional overwrite strategies (weekly/monthly/quarterly) force you into a bad tradeoff:

0DTE flips the control back to you. With Monday/Wednesday expirations added to Friday weeklies, you can run an overwrite that’s closer to:

In plain English: you get to separate “owning” from “renting.”

The trap: perils of weekly/monthly/quarterly overwrite strategies (the stuff nobody puts in the brochure) 1) You’re short volatility at the worst times (whether you realize it or not). Weekly/monthly calls span macro landmines: CPI, FOMC weeks, tariff headlines, geopolitics, CEO “surprises,” regulatory shocks, and of course earnings season. You’re often collecting a known, limited premium while underwriting unknown, unlimited path dependency. 2) The income looks stable… until it isn’t. Overwrite performance can look “smooth” in calm regimes, then suddenly lag badly when markets trend higher or gap violently. The strategy doesn’t just cap upside — it can change your whole return profile at exactly the wrong moment (when dispersion and upside volatility return). 3) You create a “decision vacuum.” A monthly overwrite is basically saying: “I’m making one decision for the next 30–90 days.” That’s fine in a sleepy market. It’s terrible in a market like 2026 where the regime can flip in 48 hours. 4) You’re not just selling calls — you’re selling timing. Earnings don’t hit at noon. Policy headlines don’t wait for your roll date. Weekly/monthly overwrites force you to be short optionality during the periods where optionality is most valuable. The new playbook Starting Feb 2, the practical shift is this: three expirations a week creates three “clean decision points.” A disciplined investor can now ask, every day:

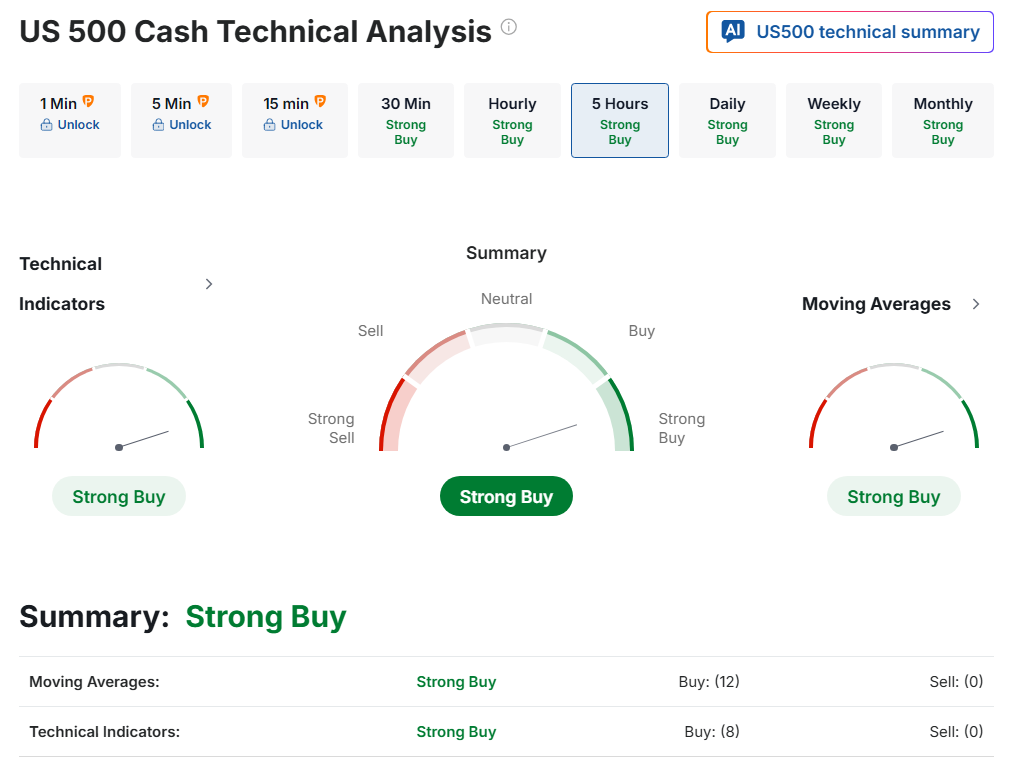

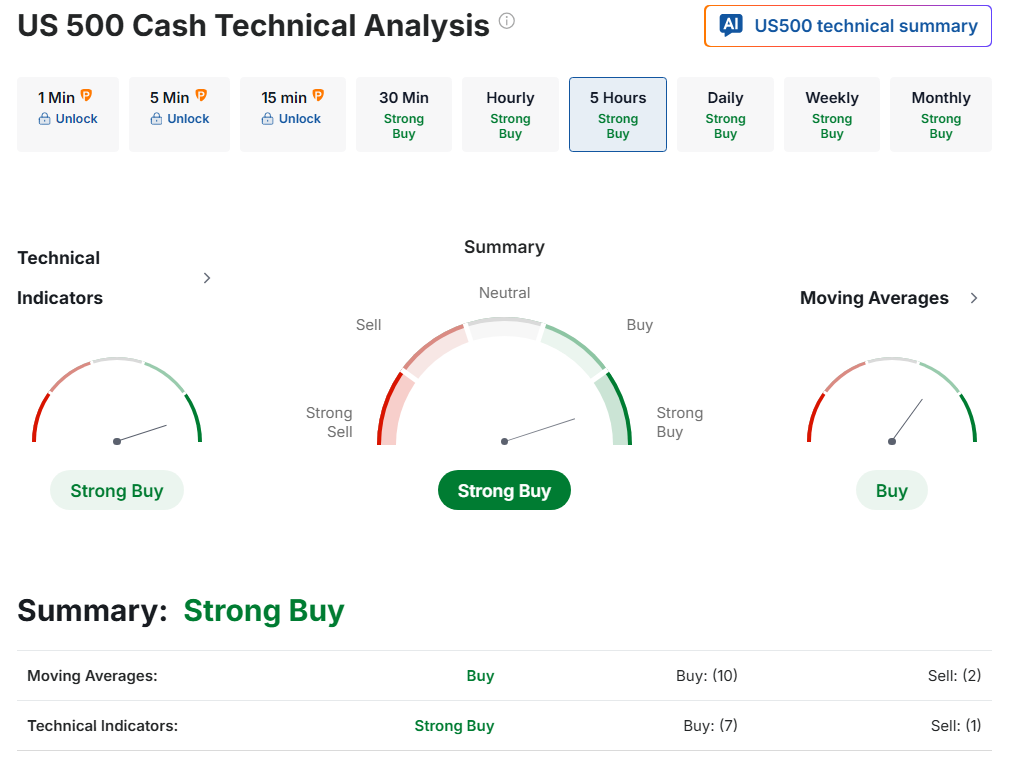

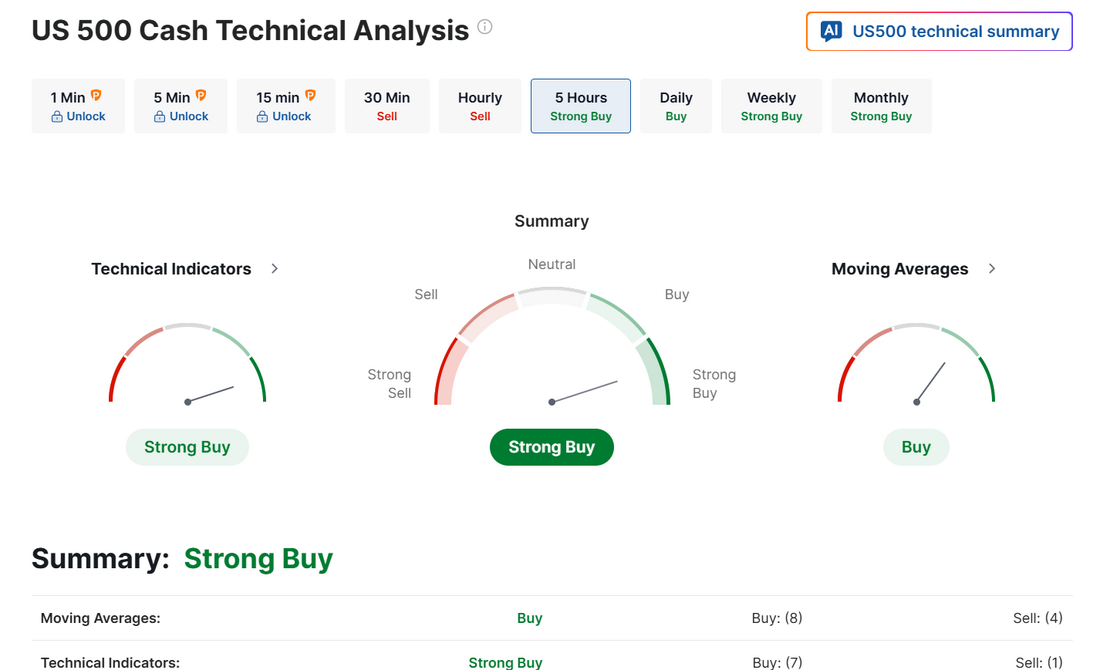

That is a very different mindset from “sell the monthly and forget it.” Quick reality check (important to say out loud) 0DTE covered calls are not magic. The premium is smaller, turnover is higher, and execution matters (spreads, liquidity, assignment mechanics, taxes, and transaction costs). Also: the closer you sell to the money, the more you’re basically trading away your upside. The “edge” isn’t the existence of 0DTE — it’s having the discretion to only sell when the compensation is worth the cap. Bottom line Feb 2 isn’t just a calendar tweak. It’s a signal. The options market is moving from “weekly hedging” to “daily positioning” — first in the biggest stocks and the biggest crypto proxy, and then outward from there. If you’ve been running call overwrite strategies the same way for years — weekly, monthly, quarterly, set it and forget it — this is your wake-up call: the game is shifting toward daily choice, daily risk management, and daily pricing of optionality. And the investors who adapt early won’t just “collect premium.” They’ll preserve the upside windows that actually move portfolios. Let's take a look at the markets: The bullish bias continues to hold tight. This question now is, how much juice do the bulls still have? We continue to play the weakness in the IWM in our ATM portfolio. Today we'll finish part two on the PPC. (Performance process cycle). This is another good one. Please join us on our live zoom feed. SPX continues to grind higher toward recent highs, but the volatility backdrop is becoming less supportive in the very short term. The volatility risk premium remains positive at ~0.9%, signaling implied volatility is still priced above realized levels, though it has been compressing and sits near the middle of its recent range. That setup often aligns with steady price action rather than sharp upside acceleration. Near-term, price strength is intact, but momentum looks more incremental, with pullbacks being shallow rather than impulsive. If volatility continues to drift lower, the index may stay supported but could see slower follow-through unless a new catalyst emerges. As always, this is market observation only and not financial advice. QQQ’s 1-month skew is showing a clear call bias, but it sits in the lower end of its recent range with a 3-month percentile near 19%, suggesting upside demand exists without extreme positioning. The 25-day risk reversal remains above its recent lows, indicating calls are still being favored over puts, yet the lack of extension toward prior highs points to measured optimism rather than aggressive chasing. In the short term, this skew profile typically aligns with continued upside follow-through or consolidation, while leaving room for skew to expand if momentum accelerates. At the same time, muted skew extremes suggest downside hedging demand is contained for now. Let's take a look at our intraday levels. As I mentioned yesterday, I'd desperately love to get another gold 0DTE working, but the price has pushed so much that we don't have the strikes on the options chain to work with. That may change today, so stay posted in the chat room. On the /ES . We already have a bullish position on. 7029, 7035, 7042 are resistance levels. 7011, 7000, and 6993 are support levels. March S&P 500 E-Mini futures (ESH26) are up +0.17%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.19% this morning as investors digest earnings reports from big U.S. tech companies. Technology stocks led the gains in U.S. equity futures as the sector’s megacaps ramped up spending to expand the infrastructure underpinning AI. Meta Platforms said it plans to invest up to $135 billion this year, well above expectations. Meta Platforms (META) climbed over +7% in pre-market trading after the social media giant posted upbeat Q4 results and issued strong Q1 revenue guidance. Also, Tesla (TSLA) gained more than +3% in pre-market trading after the EV maker reported better-than-expected Q4 results and said it would invest $2 billion in xAI. At the same time, Microsoft (MSFT) slumped over -6% in pre-market trading after the technology behemoth’s spending climbed to a record high and cloud sales growth slowed in FQ2, fueling concerns that it may take longer than anticipated for the company’s AI investments to pay off. Investors now await a fresh batch of U.S. economic data and a raft of corporate earnings reports, with a particular focus on results from Magnificent Seven member Apple. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended mixed. Seagate Technology Holdings (STX) jumped over +19% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the hard-disk-drive maker posted upbeat FQ2 results, issued above-consensus FQ3 guidance, and CEO Dave Mosley highlighted a spike in demand from AI data centers. Also, Texas Instruments (TXN) surged more than +9% after the semiconductor company provided solid Q1 guidance. In addition, F5 Inc. (FFIV) climbed over +8% after the cloud software company reported stronger-than-expected FQ1 results and raised its full-year guidance. On the bearish side, Carvana (CVNA) plunged over -14% and was the top percentage loser on the S&P 500 after activist short seller Gotham City Research released a detailed report on the company, raising concerns that its earnings were “overstated.” As widely expected, the Federal Reserve left interest rates unchanged yesterday. The Federal Open Market Committee voted 10-2 to keep the federal funds rate in a range of 3.50%-3.75%. Governors Christopher Waller and Stephen Miran dissented in favor of a quarter-point cut. In a post-meeting statement, officials said “job gains have remained low, and the unemployment rate has shown some signs of stabilization.” Policymakers also removed language referring to heightened downside risks to employment that had appeared in the previous three statements. At a press conference, Fed Chair Jerome Powell highlighted a “clear improvement” in expectations for the U.S. economy in the year ahead. “The outlook for economic activity has improved, clearly improved since the last meeting, and that should matter for labor demand and for employment over time,” Powell said. He demurred when asked what it would take for the Fed to cut again. “The Fed song remains the same — lower interest rates may be coming, but investors will have to remain patient,” said Ellen Zentner at Morgan Stanley Wealth Management. “With signs of stabilization in the labor market and inflation holding steady, the Fed is in a position to play the wait-and-see game.” Meanwhile, U.S. rate futures have priced in an 86.5% chance of no rate change and a 13.5% chance of a 25 basis point rate cut at the next FOMC meeting in March. Fourth-quarter corporate earnings season continues in full flow, and investors look forward to fresh reports from high-profile companies today, including Apple (AAPL), Visa (V), Mastercard (MA), Caterpillar (CAT), Thermo Fisher Scientific (TMO), KLA Corp. (KLAC), Lockheed Martin (LMT), and Altria (MO). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 206K, compared to last week’s number of 200K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast final Q3 Unit Labor Costs to drop -1.9% q/q and Nonfarm Productivity to rise +4.9% q/q, compared to the revised second-quarter numbers of -2.9% q/q and +4.1% q/q, respectively. U.S. Trade Balance data will be released today. Economists anticipate that the trade deficit will widen to -$43.4 billion in November from -$29.4 billion in October. U.S. Factory Orders data will come in today. Economists expect this figure to rise +1.7% m/m in November, following a -1.3% m/m drop in October. U.S. Wholesale Inventories data will be released today as well. Economists forecast that the final November figure will come in at +0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.260%, up +0.21%. I'll see you all shortly in the live trading room!

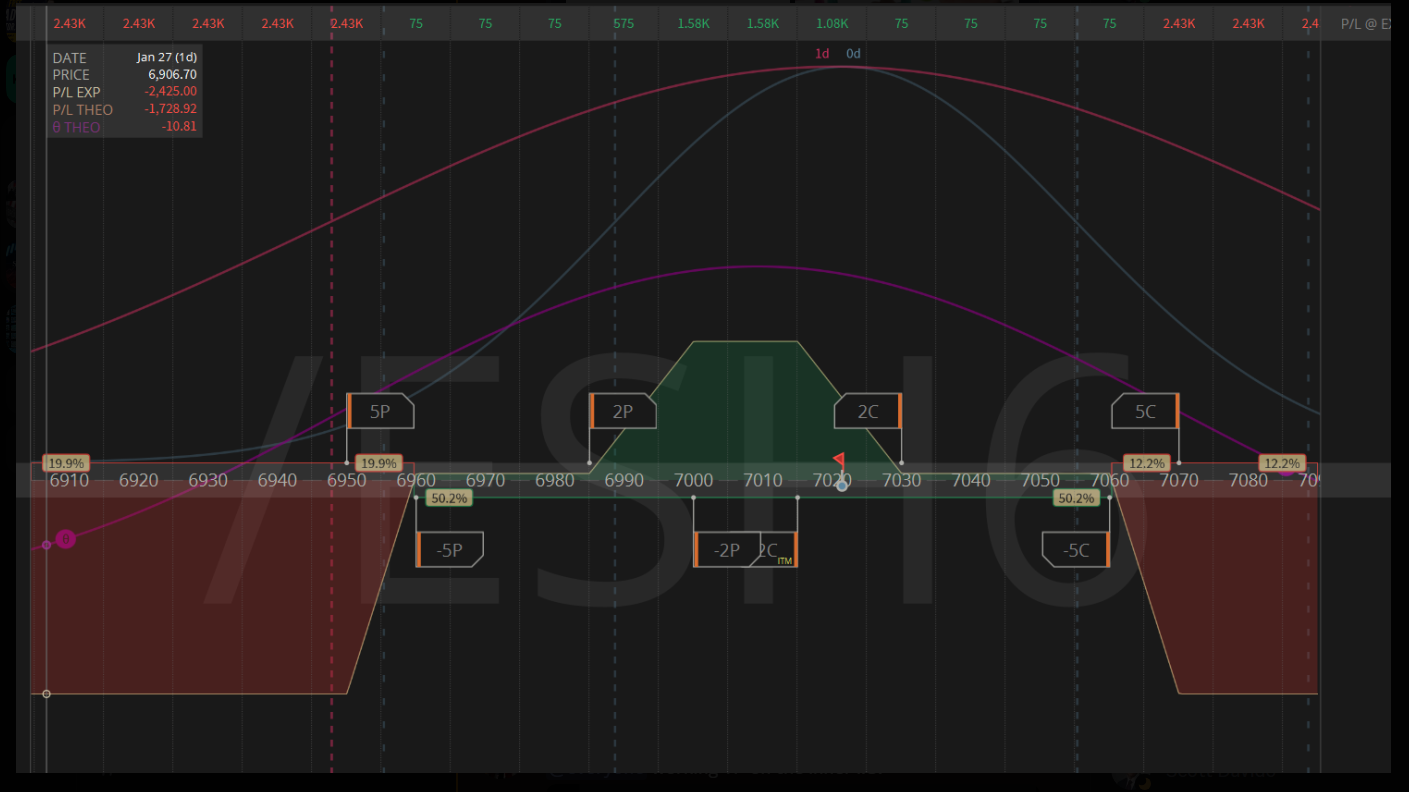

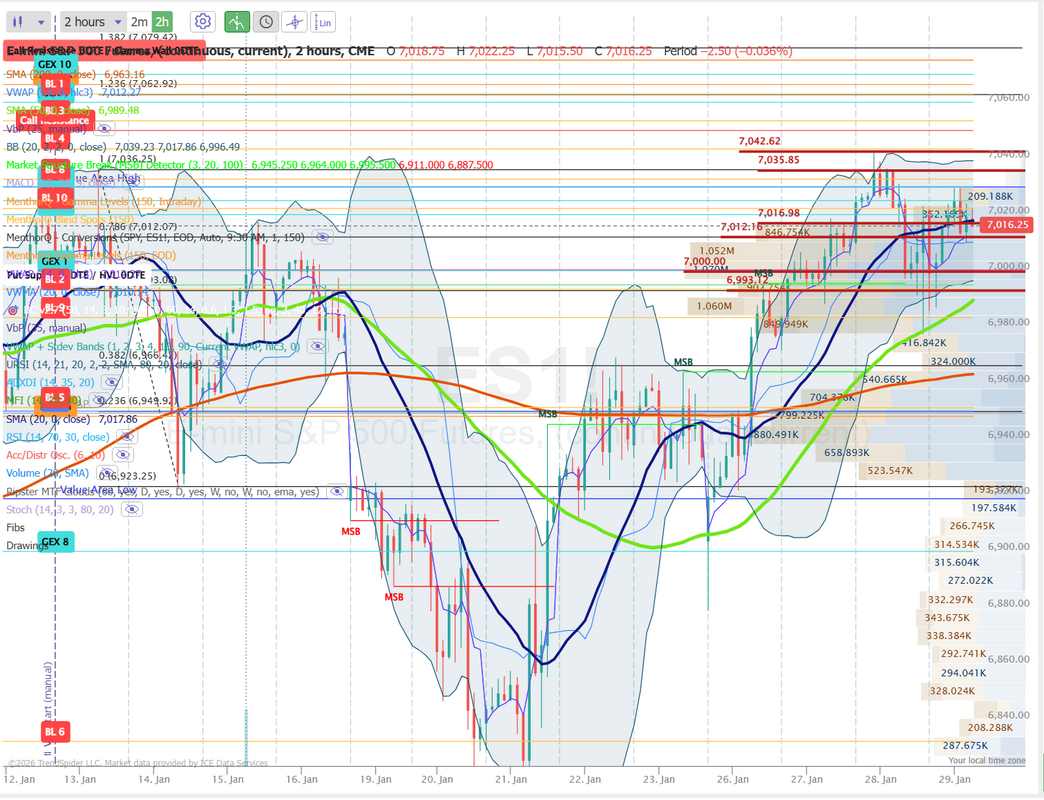

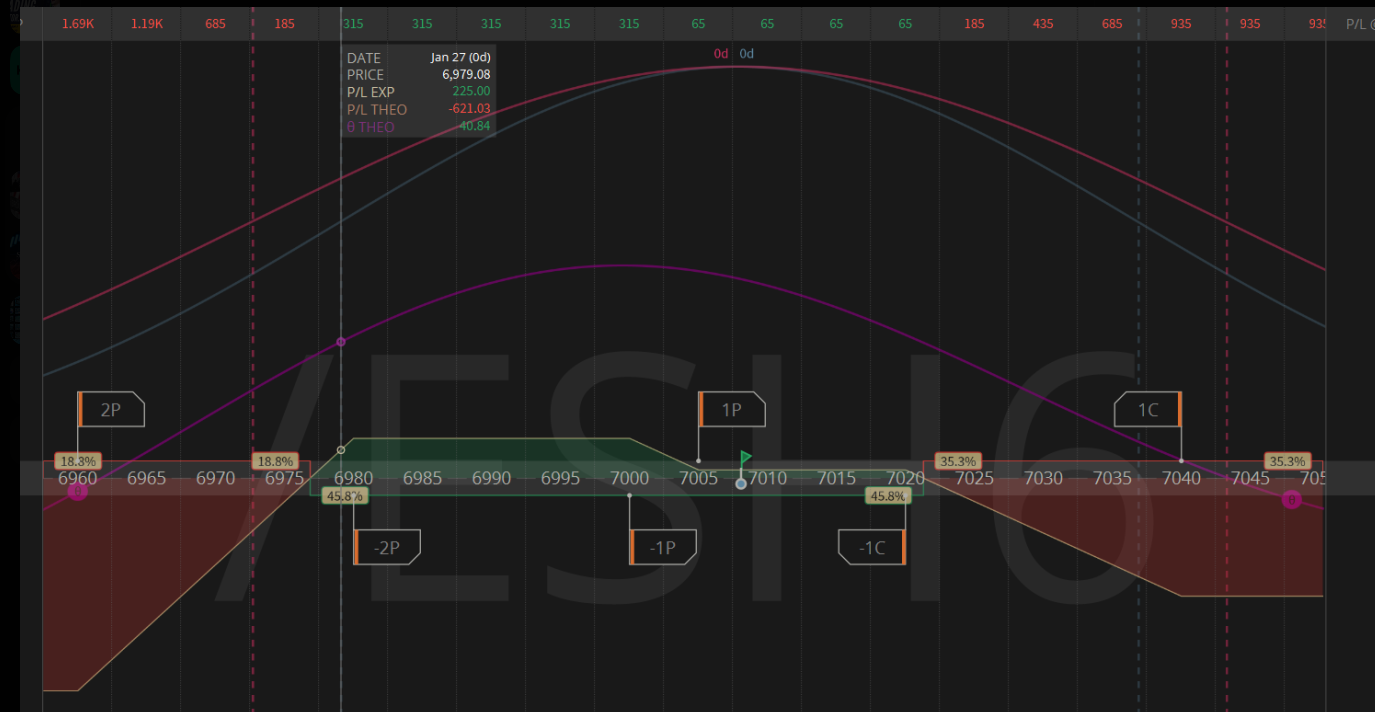

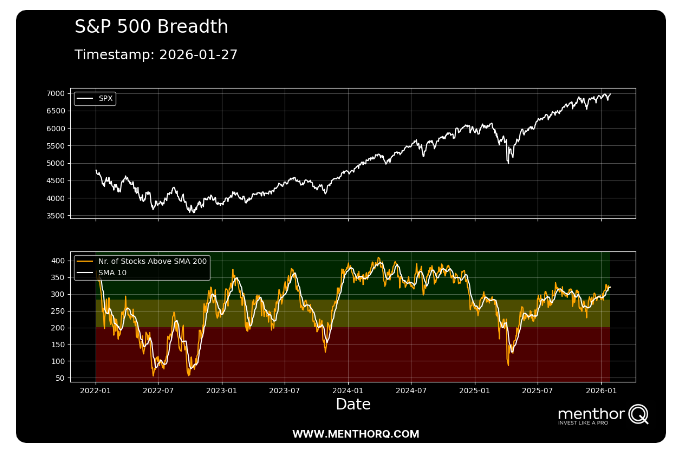

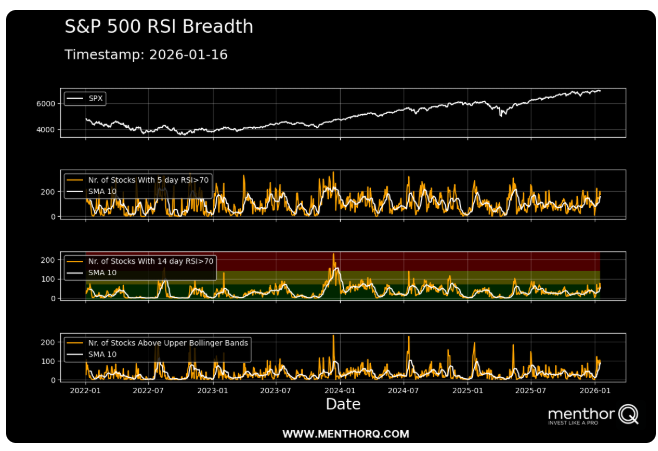

Trading and fishing=Same thing?Yesterday was a low vol, low premium day (more on that in a bit). We talk a lot about trading and fishing being similar. Many times you just don't know if there are any fish in the pond and you just need to cast your line and hope something hits. If there are fish and you catch a big one it's because you had the foresight to cast that line. If nothing hits it fills like a waste of time but to use a cross metaphor, you can't hit the ball unless you step up to the plate. Such have been the last couple days for us. We've had success. They've been profitable days but not profits we can brag about. Look at our /ES 0DTE from yesterday. I had $1820 capital in it with $315 max profit potential. This would be a 17% ROI in one day, and we consider that a home run. Unfortunately, the retrace didn't come, and we made $35 dollars. Still green. Still profitable, but not what we wanted. Scalping was the same. Looking for a retrace that just never came. Ultimately, though, these are the types of setups we like. They yield a great reward IF they hit, but risk little if they miss. Today we have FOMC. As such, we've already got our morning trade working with a modified Theta fairy. We'll target this setup until we get our desired profit or until just before the FOMC drop. Gold is continuing to push and we may be able to get another 0DTE working on that today. Yesterdays worked well. Let's take a look at the markets. Technicals remain bullish going into FOMC today. SPY hit a another new ATH. IWM and DIA are in a holding pattern. QQQ is not far behind the SPY with three strong bullish days in a row. March Nasdaq 100 E-Mini futures (NQH26) are trending up +0.88% this morning as a sharp increase in orders at ASML provided fresh momentum to the AI trade. U.S.-listed shares of ASML Holding (ASML) climbed over +6% in pre-market trading after the Dutch chip-equipment maker reported Q4 net bookings that were nearly double analysts’ forecasts and said it expects solid sales growth this year. Chip stocks rallied in pre-market trading following ASML’s results, with Intel (INTC) rising over +6% and Micron Technology (MU) gaining more than +4%. News that China had begun approving purchases of Nvidia’s H200 AI chip by Alibaba and other firms also lifted sentiment. Investors now look ahead to the Federal Reserve’s interest rate decision and U.S. megacap tech earnings. In yesterday’s trading session, Wall Street’s major indexes closed mixed, with the S&P 500 notching a new record high. Corning (GLW) jumped over +15% and was the top percentage gainer on the S&P 500 after the company announced a multiyear deal worth up to $6 billion to supply Meta Platforms with materials for data center construction. Also, chip stocks climbed, with Micron Technology (MU) rising more than +5% after the company said it will invest an additional $24 billion in Singapore over the next decade to expand its manufacturing capacity. In addition, General Motors (GM) advanced over +8% after the automaker posted better-than-expected Q4 adjusted EPS and provided solid FY26 adjusted EPS guidance. On the bearish side, UnitedHealth Group (UNH) cratered more than -19% and was the top percentage loser on the Dow after the insurer projected a drop in 2026 revenue and as the U.S. government proposed keeping payments to private Medicare plans almost flat next year. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to an 11-1/2-year low of 84.5 in January, weaker than expectations of 90.6. Also, the U.S. November S&P/CS HPI Composite - 20 n.s.a. rose +1.4% y/y, stronger than expectations of +1.2% y/y. In addition, the U.S. Richmond Fed manufacturing index rose to -6 in January, slightly weaker than expectations of -5. “Given this latest data, expect the unemployment rate to rise. This will weigh on retail sales in [the] coming months,” said Jeff Roach at LPL Financial. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 3.50% to 3.75% following three consecutive cuts at the end of 2025. This is likely to intensify President Trump’s frustration, as he is pushing for interest rates to be cut. Investors will closely watch Chair Jerome Powell’s post-policy meeting press conference for any signals on when rates could be cut again. “We expect Fed Chair Jerome Powell to emphasize that future rate moves will depend on how the economic data evolve,” HSBC economists said in a note. U.S. rate futures currently fully price in a 25-basis-point rate cut in July, with a meaningful chance of another reduction by the end of the year. Fourth-quarter corporate earnings season kicks into full gear. Investors will be closely monitoring earnings reports today from a trio of the Magnificent Seven companies—Microsoft (MSFT), Meta Platforms (META), and Tesla (TSLA). The Magnificent Seven companies are expected to deliver 20% profit growth in Q4, which would be the slowest pace since early 2023, adding pressure on the members of the group to demonstrate that the massive capital expenditures they’ve committed are beginning to generate more meaningful returns. Prominent companies like Lam Research (LRCX), International Business Machines (IBM), GE Vernova (GEV), AT&T (T), ServiceNow (NOW), and Starbucks (SBUX) are also scheduled to release their quarterly results today. On the economic data front, investors will focus on the EIA’s weekly crude oil inventories report, set to be released in a couple of hours. Economists expect this figure to be -0.2 million barrels, compared to last week’s value of 3.6 million barrels. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.248%, up +0.59%. In the very short term, SPX remains in a constructive trend, but breadth is sending a more nuanced message. The index itself is holding near recent highs, while the number of stocks above their 200-day moving average has rebounded into the mid-to-upper range rather than pushing into extreme participation. That suggests underlying support is improving, but not yet at “all-clear” levels. Tactically, continued strength in breadth above its rising short-term average would favor consolidation-to-higher behavior, while any rollover in participation back toward the mid-zone could signal a pause or shallow pullback rather than outright trend damage. Near-term price action is likely to be dictated by whether breadth can expand meaningfully from here or stalls as SPX tests overhead levels. Gold continues to "outshine" all others. It might be time to start looking for non US asset allocations to your long term portfolios. Todays training session will focus on the three stages of development for trades. Taken from the book " Mastering the Mental game of trading". Join us early today for this as we await Powells testimony. On FOMC days, I don't like to try to get too specific on a trend bias or levels, as the Algos are going to do what they like with whatever Powell says. We want to stay open-minded and reactive. That being said, we can look at the major support/resistance levels going into today. 7035, 7050, and 7063 all appear to be major resistance levels. 7017, 7012, and 7000 are support levels. I look forward to seeing you all in the live trading room shortly. We should have a good training today and FOMC is always exciting.

How big of a deal is Iran?Welcome back, traders! Does it seem like we've got more geopolitical headlines now than ever? I'm waiting for the Iran situation to resolve...whatever that means. Trump said we've sent naval vessels to the region. The question is, do we use them? Our question, of course, is how this affects the markets. We had a "perfect" day yesterday, meaning everything we touched worked. They just didn't yield much in terms of actual profit. That's all right. I can't get upset anytime we make money. Would we have liked more? Sure. I was very focused yesterday on putting on a silver reversal trade. We were patient and waited for the setup. We nailed the entry time and then wham!...margin requirements shot up threefold. I'll try again today with gold. Here's a look at the day. Let's take a look at the markets. Technicals are still locked in buy mode. We do have a bit of a reversal on the interest sensitive IWM (we've got a trade on that in the ATM portfolio) but otherwise we are attempting to push those ATH's. $SPY volume closed the cash session near 54M. That’s not “extremely low volume”. The higher it gets in price, the volume drops. When $SPY traded in the 80s and 90s in Oct of 2008, we’d see 500M days often. Under 40M volume for $SPY catches my attention. Volume is low, though. At some point, all bulls get exhausted. March S&P 500 E-Mini futures (ESH26) are up +0.26%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.60% this morning, buoyed by gains in technology stocks, while investors await the start of the Federal Reserve’s two-day policy meeting, as well as a new round of U.S. economic data and corporate earnings reports. Futures on the Nasdaq 100 outperformed as chip stocks advanced in pre-market trading, led by a more than +5% gain in Micron Technology (MU) after the company said it will invest an additional $24 billion in Singapore over the next decade to expand manufacturing capacity amid an AI-driven memory chip shortage. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Most members of the Magnificent Seven stocks advanced, with Apple (AAPL) rising nearly +3% and Meta Platforms (META) gaining more than +2%. Also, Arista Networks (ANET) climbed over +5% and was the top percentage gainer on the S&P 500 after Wells Fargo analyst Aaron Rakers said he sees Microsoft’s launch of its second-generation Maia 200 AI chips as a “derivative positive” for the company. In addition, Baker Hughes (BKR) rose over +4% after the company posted better-than-expected Q4 results and said it plans to double its data center equipment order target to $3 billion over three years. On the bearish side, Revolution Medicines (RVMD) plunged over -16% after The Wall Street Journal reported that Merck is no longer in talks to acquire the company. Economic data released on Monday showed that U.S. durable goods orders climbed +5.3% m/m in November, stronger than expectations of +3.1% m/m, and core durable goods orders, which exclude transportation, rose +0.5% m/m, stronger than expectations of +0.3% m/m. On the trade front, President Trump on Monday threatened to raise tariffs on goods imported from South Korea to 25% from 15%, citing what he described as the failure of the country’s legislature to formalize the trade deal agreed last year. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 3.50% to 3.75% following three consecutive cuts at the end of 2025. Investors will closely watch Chair Jerome Powell’s post-policy meeting press conference for any signals on when rates could be cut again. “We expect Fed Chair Jerome Powell to emphasize that future rate moves will depend on how the economic data evolve,” HSBC economists said in a note. U.S. rate futures currently fully price in a 25-basis-point rate cut in July, with a meaningful chance of another reduction by year-end. Fourth-quarter corporate earnings season is in full swing, with investors looking ahead to fresh reports from prominent companies today, including UnitedHealth Group (UNH), RTX Corporation (RTX), Boeing (BA), NextEra Energy (NEE), Texas Instruments (TXN), Union Pacific (UNP), HCA Healthcare (HCA), Northrop Grumman (NOC), United Parcel Service (UPS), and Seagate Technology Holdings (STX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the January CB Consumer Confidence index will stand at 90.6, compared to last month’s figure of 89.1. The U.S. S&P/CS HPI Composite - 20 n.s.a. will also be reported today. Economists expect the November figure to ease to +1.2% y/y from +1.3% y/y in October. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -5 in January, compared to the previous value of -7. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.223%, up +0.21%. SPX remains in a short-term uptrend, holding near recent highs after a shallow pullback, but the option score has cooled into the low-to-mid range, signaling less supportive near-term options dynamics. This combination often points to slower upside follow-through unless participation or volatility re-expands. In the very short term, price holding above the recent consolidation lows keeps the trend intact, while failure to reclaim momentum quickly could invite range-bound trade or a brief mean-reversion move. Tactically, this is a spot where price strength needs confirmation from improving option conditions; otherwise, patience around support and reaction levels may matter more than chasing extensions. QQQ’s 1-month skew remains modestly call-biased, with the risk reversal sitting near the middle of its recent range and a 3-month percentile around the low-50s. From a q-option perspective, this suggests upside participation is still being favored, but without the kind of aggressive call demand that typically signals crowded bullish positioning. In practice, options markets appear to be pricing balanced outcomes: some willingness to pay for upside exposure, while still maintaining protection against pullbacks. This configuration often aligns with a market that expects continued grind higher, but with enough uncertainty to keep downside insurance relevant rather than dismissed. Let's take a look at our intraday levels for both gold and /ES. We'll try again for a 0DTE on Gold. It's been quite a run but we did get a pause yesterday. On /ES I'm watching 7000, 7006, 7011, 7017 are resistance levels with 6992, 6985, 6976, 6966 are support. I'll see you all in the live trading room shortly. Let's see what we can get going with Gold, /ES, /MNQ and possibly some 1HTE's on BTC.

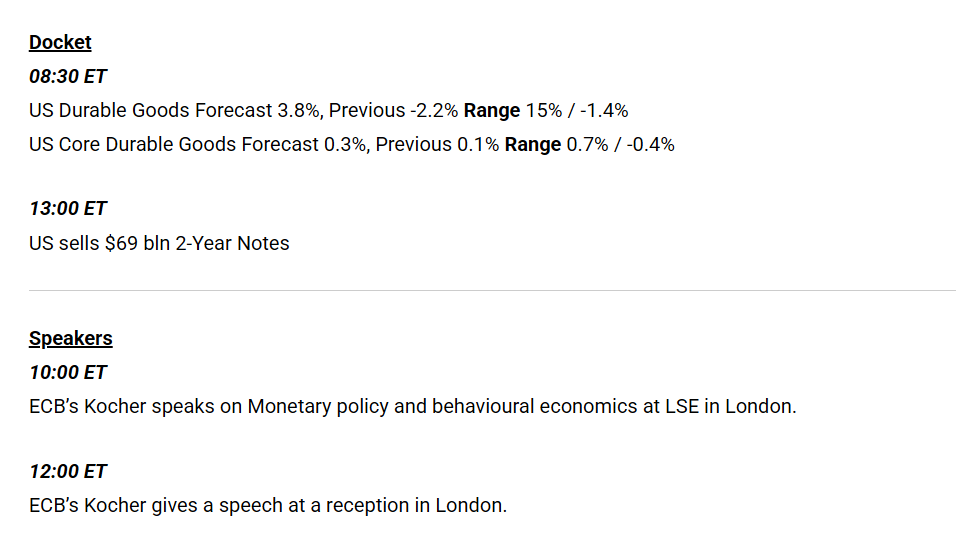

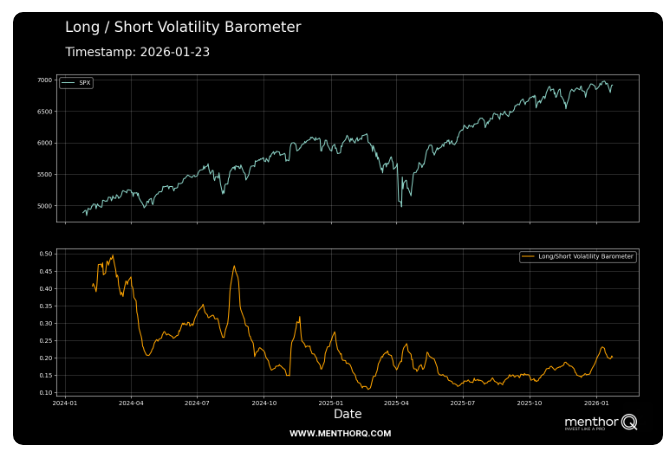

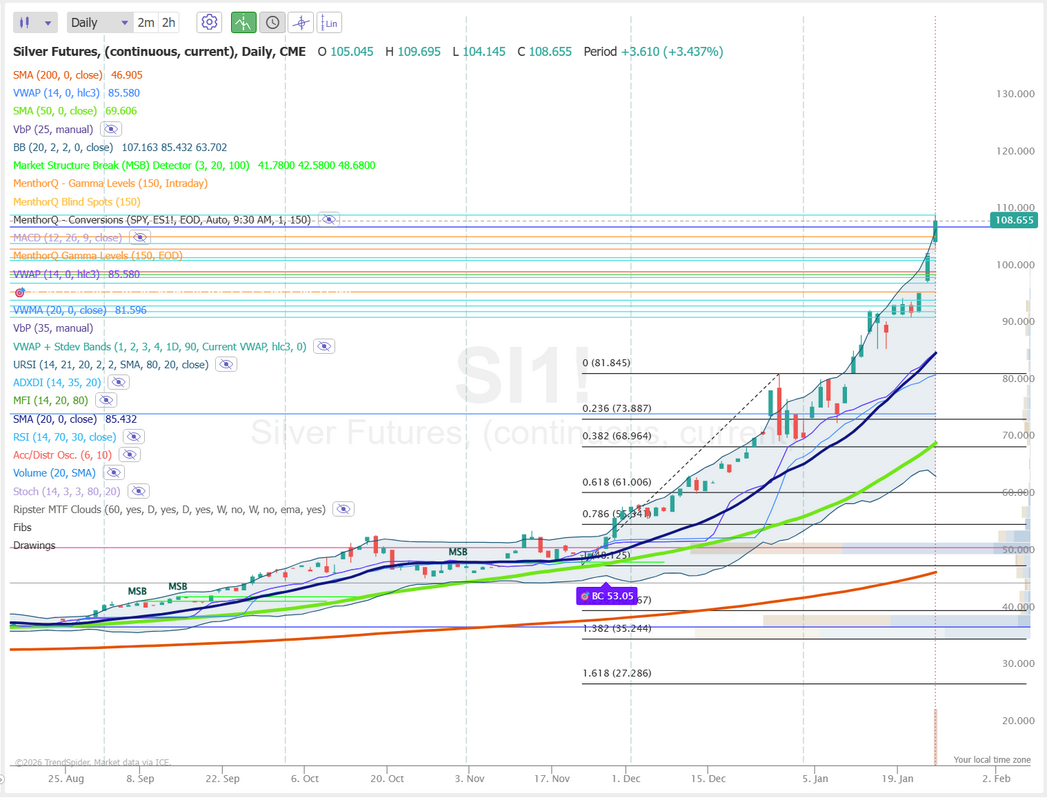

Big earnings. FOMC. Govt. Shutdown.Welcome back, traders, to a new week. I hope your weekend was relaxing. This week is busy. We've got some big names reporting along with a FED decision and statement on Weds. We've also got a deja vu happening with another potential Government shutdown looming. Didn't we just do this? Add the threat of new tariffs to Canada, and we've got a lot to watch this week. Fridays resuls were solid for us. We did quite well on scalping, even though it wasn't necessarily a great day for that. Here's a look at our day. Here are the planned news items that may be market movers today: Let's take a look at the markets to start the new week. Futures are a bit soft, as I type, still absorbing the tariff talk but technicals still point bullish. The SPY and QQQ are both coiled tightly around their respective 50DMA's. It's just guesswork right now as to the next directional move. Keep an eye on that 50DMA. On the IWM, we are close to initiating a short on that in our ATM portfolio. IMHO it's a bit stretched to the upside. Powell's comments this coming Weds. on future interest rates could be a catalyst for this rate sensitive index. March S&P 500 E-Mini futures (ESH26) are down -0.18%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.32% this morning as President Trump’s tariff threats against Canada and the looming risk of a partial U.S. government shutdown weighed on sentiment at the start of a busy week. U.S. President Donald Trump on Saturday threatened Canada with 100% tariffs on all its exports to the U.S. if it strikes a trade deal with China. Trump said in a social media post that if Canadian Prime Minister Mark Carney “thinks he is going to make Canada a ‘Drop Off Port’ for China to send goods and products into the United States, he is sorely mistaken.” He added, “China will eat Canada alive, completely devour it, including the destruction of their businesses, social fabric, and general way of life.” Meanwhile, worries about a partial U.S. government shutdown intensified over the weekend after Senate Democratic leader Chuck Schumer pledged to block a sweeping spending package unless Republicans remove funding for the Department of Homeland Security. Schumer’s announcement followed an incident in which a Border Patrol agent shot and killed an American intensive care unit nurse in Minnesota during protests over the state’s immigration crackdown. Without Senate approval of the funding package by Friday, the federal government will enter a partial shutdown this weekend. This week, market participants look ahead to earnings reports from major tech names, the Federal Reserve’s interest rate decision, and a slew of U.S. economic data. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Most members of the Magnificent Seven stocks climbed, with Microsoft (MSFT) rising over +3% and Amazon.com (AMZN) gaining more than +2%. Also, gold mining stocks advanced after gold prices climbed to a record high, with Newmont Mining (NEM) and Freeport-McMoran (FCX) rising over +2%. In addition, Fortinet (FTNT) surged more than +5% and was the top percentage gainer on the Nasdaq 100 after TD Cowen upgraded the stock to Buy from Hold with a price target of $100. On the bearish side, Intel (INTC) tumbled over -17% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chipmaker issued disappointing Q1 guidance. “Stocks are consolidating. The laggards are catching up, and the winners are giving back a little,” said Louis Navellier at Navellier & Associates. Economic data released on Friday showed that the University of Michigan’s U.S. January consumer sentiment index was revised upward to a 5-month high of 56.4, stronger than expectations of no change at 54.0. Also, the U.S. S&P Global manufacturing PMI rose to 51.9 in January, in line with expectations. At the same time, the U.S. January S&P Global services PMI came in at 52.5, unchanged from the prior month and below expectations of 52.9. Fourth-quarter corporate earnings season hits full throttle, and investors await fresh reports from major companies this week, including Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA), Apple (AAPL), Lam Research (LRCX), Texas Instruments (TXN), KLA Corp. (KLAC), International Business Machines (IBM), Visa (V), Mastercard (MA), UnitedHealth Group (UNH), RTX Corporation (RTX), Boeing (BA), Lockheed Martin (LMT), AT&T (T), Verizon (VZ), Caterpillar (CAT), Exxon Mobil (XOM), Chevron (CVX), and American Express (AXP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. Market participants will also keep a close eye on the Fed’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 3.50% to 3.75% following three consecutive cuts at the end of 2025. Focus will center on the number of dissenting votes and the Fed’s accompanying comments as investors assess the likely timing and pace of further rate cuts. Mr. Powell is likely to signal that policy is well-positioned for now. “We expect Fed Chair Jerome Powell to emphasize that future rate moves will depend on how the economic data evolve,” HSBC economists said in a note. U.S. rate futures currently fully price in a 25-basis-point rate cut in July, with a meaningful chance of another reduction by year-end. In addition, market watchers will monitor a fresh batch of U.S. economic data. A delayed report on December wholesale inflation will be the main highlight this week. Other noteworthy data releases include the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., the Richmond Fed Manufacturing Index, Initial Jobless Claims, Nonfarm Productivity, Unit Labor Costs, Trade Balance, Factory Orders, Wholesale Inventories, and the Chicago PMI. On Friday, the Fed’s blackout period ends, with Fed officials Bowman and Musalem set to deliver remarks. Today, investors will focus on U.S. Durable Goods Orders and Core Durable Goods Orders data, set to be released in a couple of hours. Economists expect November Durable Goods Orders to climb +3.1% m/m and Core Durable Goods Orders to rise +0.3% m/m, compared to the prior numbers of -2.2% m/m and +0.2% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.205%, down -0.83%. Today's training will focus on the 6/20 MA setup that closely mimics the same feedback we get from the audible order flow tickstrike. For those of you who don't use TickStrike, this is a good alternative. SPX continues to grind higher while the long/short volatility barometer remains compressed, signaling a market still leaning toward volatility selling rather than protection. In the short term, this combination typically supports range-bound strength and shallow pullbacks, as lower realized volatility keeps dips contained. However, the recent uptick in the barometer suggests sensitivity is starting to rise, making the index more reactive to shocks. Near-term price action looks constructive as long as volatility stays subdued, but a sharper turn higher in the barometer would be an early signal that short-term risk is shifting toward wider intraday swings rather than smooth upside follow-through. Silver: The story today is silver. Really it's been the story all month. The move has been absolutely parabolic. Futures on silver are screaming higher this morning by another 8.3%!!!! It's been absolutely incredible to watch. We've have some good positions on it lately in our ATM portfolio. /SI only has monthly options. The Jan. cycle expires tomorrow. I'm looking at focusing our trades today on that expiraton. Implied volatility is over 100%! Take a look at how that compares over time. Key Historical Trends in Silver Futures IV

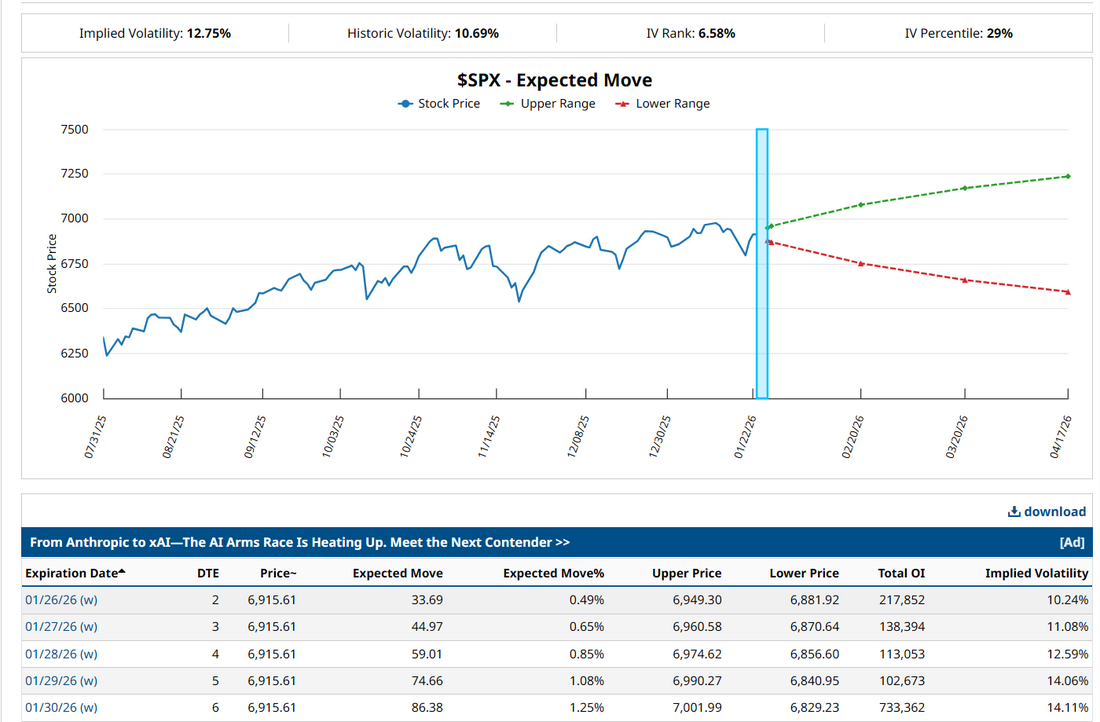

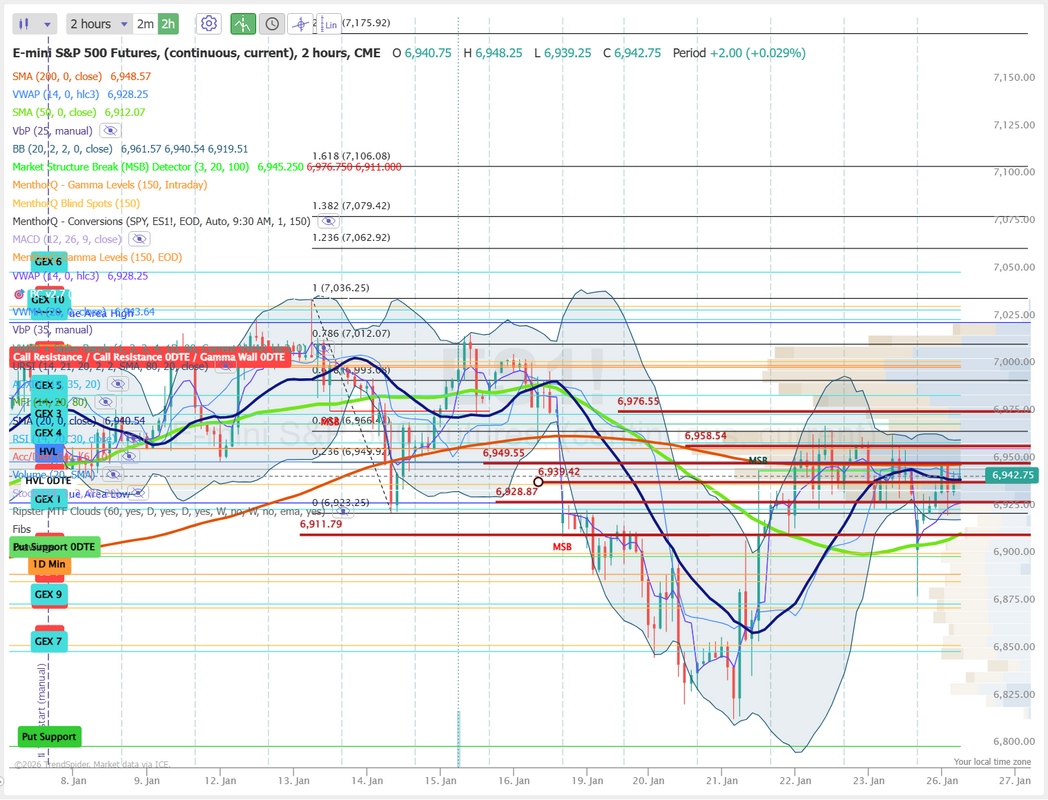

This looks like the right time to attempt another silver entry. SPY closed the week slightly lower at $689.23 (-0.35%), with support at the LinkLine indicator continuing to hold. However, each bounce off this level has coincided with a bearish divergence on the RSI Divergences lower indicator, suggesting momentum may be fading. This week’s earnings should offer clearer direction as traders assess whether support holds or cracks under pressure. The Nasdaq-100 outperformed the S&P 500 slightly last week, with QQQ closing up at $622.72 (+0.24%). The index remains in a choppy range but has bounced cleanly off LinkLine support. As a result, momentum remains muted, with no bearish RSI divergences being flagged due to the lack of new highs. With several major tech names reporting this week, earnings could be the catalyst that determines whether the Nasdaq-100 regains upside traction or stays range-bound. The IWM ETF slipped slightly last week, closing at $264.81 (-0.36%), marking the end of its recent streak of outperformance versus large caps. After hitting a new all-time high on Thursday, a bearish RSI divergence emerged, followed by a sharp sell-off into Friday’s close. With the FOMC meeting ahead and markets pricing in a 98% chance of no rate change, this rate-sensitive ETF may have already fully priced in prior rate cut expectations. Let's take a look at the expected move this week. Coming in at 1.25% it's better than we've had lately. Premium looks decent to start the week. Let's take a look at the levels we'll be watching today on the /ES. Levels have tightened up since Friday. Resistance sits at 6949, 6958, 6976. Support levels sit at 6939, 6928, 6911. These levels are all tight. There's a good chance we'll move outside these ranges. We'll look at some expanded ranges in our Zoom session. I'll see you all in the live trading room shortly! Keep your eye of silver. That's our likely go to today.

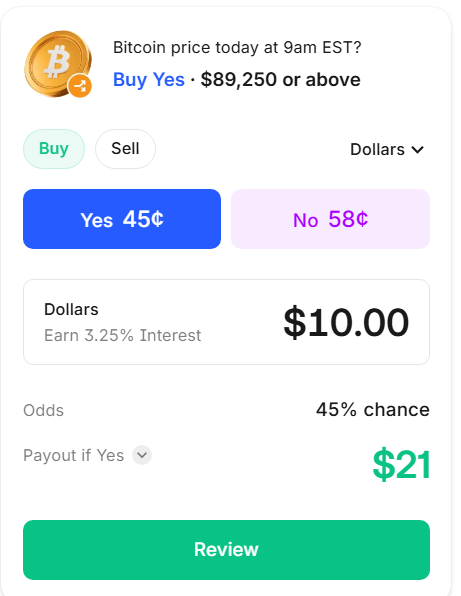

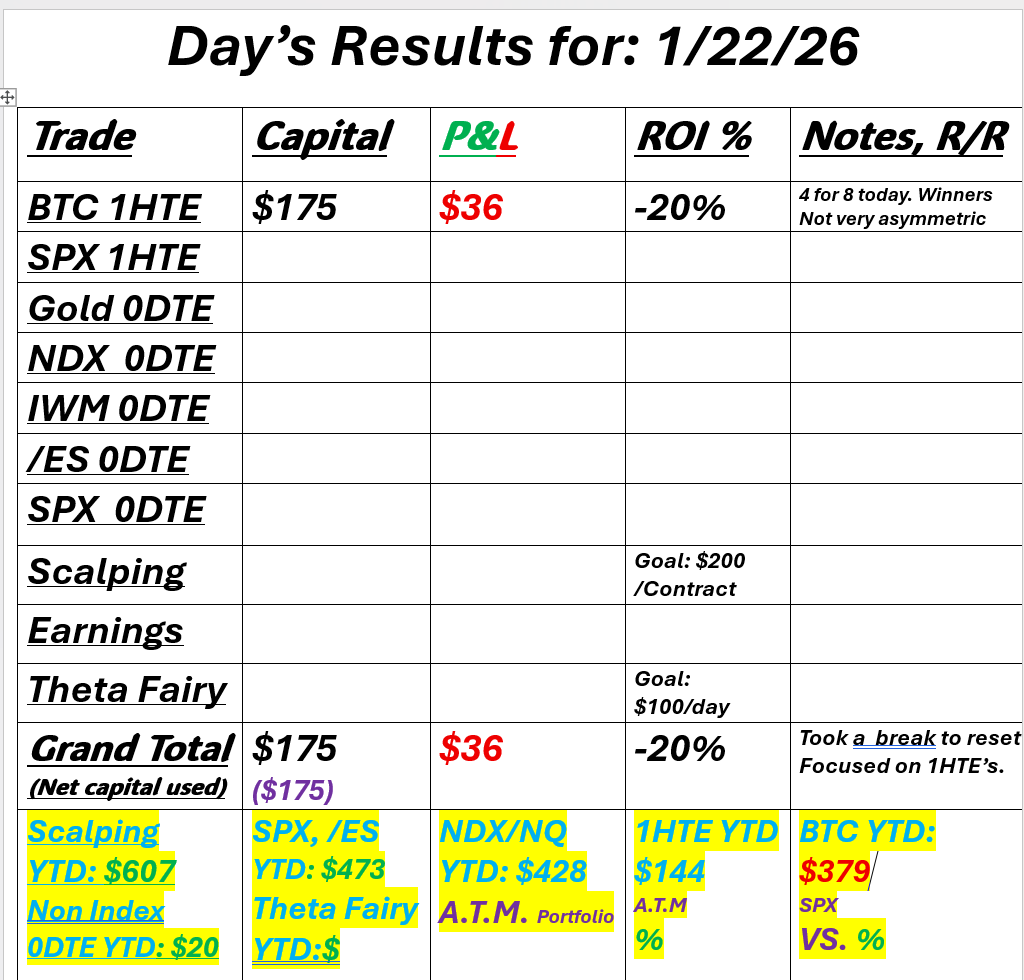

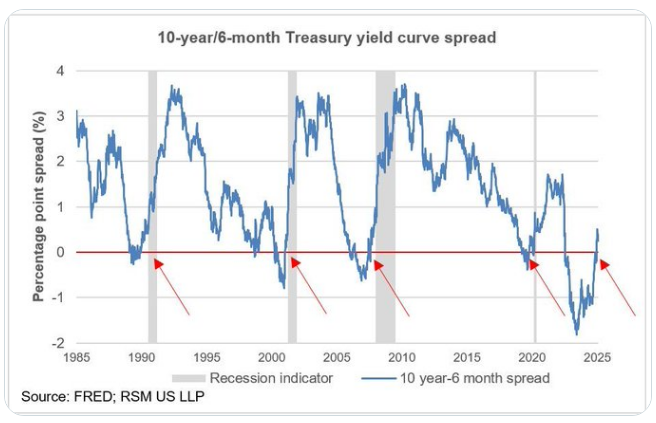

Intel finally disappoints.Futures are a bit weaker this morning as Intel finally looks to stop its rocket ride higher. I was very active yesterday, but not really. After Tasty's meltdown the previous day, I wanted to take it slow and make sure I was only focusing on prime setups. I didn't see anything to get excited about. I did spend the day doing eight 1HTE BTC setups. We hit four out of eight, which is pretty good, but the last winners weren't very asymmetric and couldn't get us into the green. We've already started this morning with our new batch. Here's a look at our first one. Here's a look at my day yesterday. As I said...not much action. Let's take a look at the markets this Friday morning. Both the SPY and QQQ are battling to get and stay above their 50DMA. In spite of the Intel hit to futures, the technicals are still slightly bullish to start the day. March Nasdaq 100 E-Mini futures (NQH26) are trending down -0.20% this morning as a lackluster forecast from semiconductor giant Intel weighed on sentiment. Intel (INTC) sank more than -13% in pre-market trading after the chipmaker issued disappointing Q1 guidance and Chief Executive Officer Lip-Bu Tan cautioned that the company continues to face manufacturing challenges. Investor focus now turns to U.S. business activity data, which will offer fresh insight into the health of the world’s largest economy. In yesterday’s trading session, Wall Street’s major indices ended in the green. The Magnificent Seven stocks advanced, with Meta Platforms (META) rising over +5% and Tesla (TSLA) gaining more than +4%. Also, most chip stocks climbed, with ARM Holdings (ARM) surging over +4% and Advanced Micro Devices (AMD) rising more than +1%. In addition, Datadog (DDOG) jumped over +6% and was the top percentage gainer on the Nasdaq 100 after Stifel upgraded the stock to Buy from Hold with a price target of $160. On the bearish side, Abbott Laboratories (ABT) slumped more than -10% and was the top percentage loser on the S&P 500 after the medical devices maker posted weaker-than-expected Q4 net sales. Data from the U.S. Department of Commerce released on Thursday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.2% m/m and +2.8% y/y in November, in line with expectations. Also, the U.S. Bureau of Economic Analysis said Q3 GDP growth was revised higher to +4.4% (q/q annualized) in its final estimate, stronger than expectations of no change at +4.3%. In addition, U.S. November personal spending rose +0.5% m/m, in line with expectations, while personal income grew +0.3% m/m, weaker than expectations of +0.4% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose by +1K to 200K, compared with the 209K expected. “[Thursday’s] data should reassure the Fed that the economy remains on a solid footing, despite a cooler labor market,” said James McCann, an economist at Edward Jones. “Indeed, there looks to be little urgency to cut rates at next week’s meeting, and the central bank could stay on hold for longer should growth remain robust into 2026 and inflation continue to run at above target rates.” Meanwhile, U.S. rate futures have priced in a 97.2% probability of no rate change and a 2.8% chance of a 25 basis point rate cut at next week’s monetary policy meeting. Today, investors will focus on preliminary U.S. purchasing managers’ surveys, set to be released in a couple of hours. Economists expect the January S&P Global Manufacturing PMI to be 51.9 and the S&P Global Services PMI to be 52.9, compared to the previous values of 51.8 and 52.5, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will also be released today. Economists anticipate that the final January figure will be unrevised at 54.0. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.239%, down -0.28%. The #1 metric that predicted every recession since 1970 just flashed red. The Yield Curve. Normal curve (10Y > 2Y) → Economy healthy, stay long Inverted 1-3 months → Early warning, watch closely Inverted 6+ months → Recession within 12-18 months The 2Y/10Y has been inverted since July 2022—longest inversion in history. Every recession since 1970 was preceded by an inverted curve. No false signals. Ever. Watch the curve. Ignore the talking heads. SPX remains in a short-term uptrend but momentum has become choppier, with the momentum score repeatedly cycling between strong (4–5) and corrective (2) regimes over recent sessions. This pattern suggests buyers are still defending dips, yet follow-through has been less consistent near recent highs. In the near term, sustained momentum back above the prior 5-score zone would signal renewed upside traction, while another rollover toward the lower momentum band would point to consolidation or a shallow pullback rather than trend failure. For the short horizon, price action looks more tactical than directional, with momentum acting as a key tell for whether strength can extend or if the market needs time to reset. Let's take a look at our intraday levels. They haven't shifted too much from yesterday. 6949, 6967, 6988 are resistance with 6921, 6900, 6872 working as support. I think we've got a better shot at some good setups today. I'll see you all shortly in the live trading room!

Technology is awesome...when it works.Good golly Miss Molly! Yesterday was a massive exercise in frustration. The day started off badly with our trades going the wrong way. No biggie. We can adjust them. We went to adjust and, boom! Nothing. Tastytrade was either down or doing weird things. We were super, super lucky that our trades all came into the profit zone, and I was able to get an execution via the online version. It's such a bummer because I feel like we could have gotten much more out of the day, but I am very grateful we didn't get too messed up. I gave back $140 profit on our scalp because the entry didn't process, but overall, we need to count our blessings on the shortened day. Here's a look at what we got done before I gave up. BTW, I also placed a long /NQ put position that lost money in the wrong account and now the ATM portfolio balance is messed up! Let's take a look at these crazy markets. Markets roared back yesterday but stopped short of recapturing their 50DMA's. The IWM hit a new ATH. Technicals are back to solid buy mode. March S&P 500 E-Mini futures (ESH26) are up +0.66%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.89% this morning, pointing to further gains on Wall Street after U.S. President Donald Trump walked back his threats to impose tariffs on a group of European countries over Greenland. President Trump said on Wednesday that he would not impose tariffs on eight European countries, citing a framework for a deal on Greenland and the Arctic. “Based upon a very productive meeting that I have had with the Secretary General of NATO, Mark Rutte, we have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region,” Trump said in a post on Truth Social. “Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st.” NATO’s chief said on Thursday that the compromise did not involve discussions about the territory’s sovereignty. “The framework of the Greenland deal takes down the temperature a lot, given the happenings over the weekend,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “Less tariffs are unequivocally a positive for markets.” Futures on the Nasdaq 100 outperformed as AI-related stocks climbed in pre-market trading amid a wave of activity across the AI space. OpenAI Chief Executive Officer Sam Altman was holding meetings with Middle East investors for a funding round that could value the ChatGPT developer at up to $830 billion. Also, Nvidia CEO Jensen Huang said at Davos that the global AI buildout will require trillions of dollars in spending on computing infrastructure. In addition, Bloomberg reported that Alibaba Group was preparing to list its chipmaking unit. Investors now await a raft of U.S. economic data, with particular attention on the Fed’s favorite inflation gauge and the final estimate of third-quarter GDP, as well as a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher. Chip stocks rallied, with Intel (INTC) surging over +11% to lead gainers in the Nasdaq 100 and Advanced Micro Devices (AMD) climbing more than +7%. Also, shares of data storage companies advanced, with Sandisk (SNDK) rising over +10% and Western Digital (WDC) gaining more than +8%. In addition, Moderna (MRNA) jumped over +15% and was the top percentage gainer on the S&P 500 after the company, together with Merck, announced positive results from a five-year follow-up study of their skin cancer vaccine. On the bearish side, Kraft Heinz (KHC) slid more than -5% after the company disclosed in a regulatory filing that its largest shareholder, Berkshire Hathaway, could sell nearly all of its shares. Economic data released on Wednesday showed that U.S. pending home sales slumped -9.3% m/m in December, weaker than expectations of -0.3% m/m. At the same time, U.S. October construction spending rose +0.5% m/m, stronger than expectations of +0.1% m/m. Fourth-quarter corporate earnings season picks up pace, and investors await new reports from prominent companies today, including Intel (INTC), Procter & Gamble (PG), GE Aerospace (GE), Abbott Laboratories (ABT), Intuitive Surgical (ISRG), and CSX Corporation (CSX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. The core PCE price index for November was originally scheduled for release on December 19th, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the October figures. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.8% y/y in November. The U.S. Commerce Department’s final estimate of third-quarter gross domestic product will also be closely monitored today. Economists expect the U.S. economy to expand at an annual rate of 4.3% in the third quarter. U.S. Personal Spending and Personal Income data will be released today. Economists expect November Personal Spending to rise +0.5% m/m and Personal Income to grow +0.4% m/m. U.S. Initial Jobless Claims data will be reported today. Economists estimate this figure will come in at 209K, compared to last week’s number of 198K. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1 million barrels, compared to last week’s value of 3.4 million barrels. U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.240%, down -0.26%. I don't have a lot more to say this morning. I'm still super frustrated with yesterday. I should have just taken the day off when I saw the technical issues Tasty was having. Let's see if we can make it a happier day today. We've got our extended training on 0DTE setup rules today. That will take some time. Please come join us. Let's look at the intraday levels on /ES for todays setups. 6967 and 6992 are the major resistance zones. There are a few pivot points between them. We'll map those out in our zoom session. 6922, 6878, 6851 are support. Big ranges today after yesterdays big move. I'll see you all shortly! Let's make it a great day!

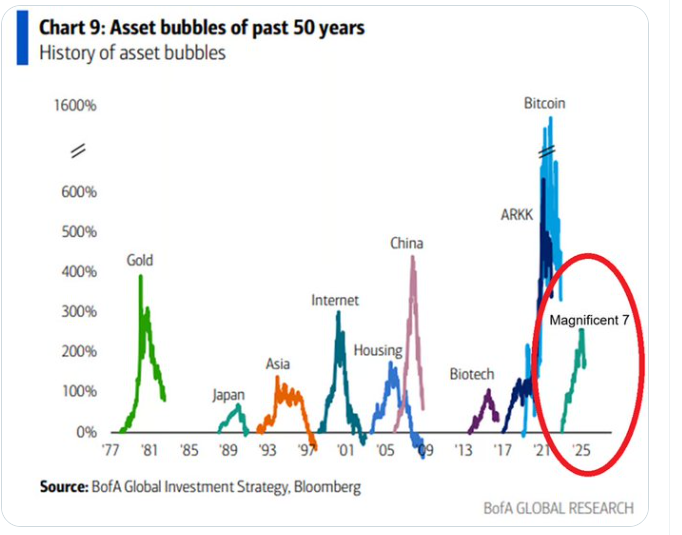

Market red (usually) = Portfolio Green for us.What an awesome day for us traders yesterday. Our ATM portfolio made money (it loves down markets) and our trading levels were spot on. I mean, spot on! We nailed every move yesterday. It was scary good. Look at a trader you need an edge or it's just not going to work out for you. I don't care what your edge is but get one! We use levels and they serve us very well. Here's a look at our day. We are continuing to have great success with our pyramiding approach to low prop/high asymmetry 1HTE setups. This irony of this approach is that the more losers we have before getting to a winner, the bigger the payout. Yesterday we got to our winner a bit too early! Todays setups look great. We've already got the first one working for you early risers. Let's take a look at the markets. Technicals are bearish after yesterdays selloff. That was a beautiful gap down day yesterday. Futures are weak this morning. Can we get some more selling? We can only hope! March S&P 500 E-Mini futures (ESH26) are trending down -0.17% this morning as investors cautiously await U.S. President Donald Trump’s address at the World Economic Forum in Davos, as well as a new round of economic data and corporate earnings reports. Lower bond yields today are helping limit losses in S&P 500 futures. The 10-year T-note yield fell 1 basis point to 4.29% after long-dated Japanese bonds rebounded sharply from yesterday’s selloff. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. The Magnificent Seven stocks slid, with Nvidia (NVDA) and Tesla (TSLA) falling over -4%. Also, cryptocurrency-exposed stocks sank after Bitcoin fell more than -3%, with MARA Holdings (MARA) slumping over -8% and Strategy (MSTR) dropping over -7% to lead losers in the Nasdaq 100. In addition, 3M Co. (MMM) slid over -6% and was the top percentage loser on the Dow after the industrial company issued soft FY26 adjusted EPS guidance. On the bullish side, SanDisk (SNDK) surged over +9% and was the top percentage gainer on the S&P 500 after Citi raised its price target on the stock to $490 from $280. “Headlines out of Washington partially overshadowed the start of earnings season, and this week is looking like it could be a similar story,” said Chris Larkin at E*Trade from Morgan Stanley. Market participants are looking ahead to U.S. President Donald Trump’s address at the World Economic Forum in Davos, Switzerland, later in the day. President Trump was scheduled to speak in Davos at 2:30 p.m. local time, but his appearance will be delayed after his aircraft experienced technical issues. Investors are waiting to see whether he will dial back days of heightened tensions with Europe over Greenland. Fourth-quarter corporate earnings season is gathering pace, with investors awaiting reports from notable companies today, including Johnson & Johnson (JNJ), Charles Schwab (SCHW), Truist Financial (TFC), Kinder Morgan (KMI), and The Travelers Companies (TRV). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on the National Association of Realtors’ pending home sales data, set to be released in a couple of hours. Economists expect the December figure to drop -0.3% m/m following a +3.3% m/m climb in November. The U.S. Construction Spending report for October will also be released today. The report was originally scheduled for release on December 1st, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the September figure. Economists expect construction spending to rise +0.1% m/m in October. U.S. rate futures have priced in a 95.0% probability of no rate change and a 5.0% chance of a 25 basis point rate cut at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.286%, down -0.21%. Are we in a bubble? If we are, is this the start of the correction? Take a look at past bubbles. Todays training will focus on our 0DTE setups. This is one you'll want to bookmark and keep for future reference. Let's look at our intraday levels. From a macro standpoint the sell signal seems pretty solid, looking at the daily on the VTI. The 50DMA will be the test today. On the /ES 6851, 6875, 6922 are resistance. 6826, 6800, 6776 are support. We pushed down through the BB's yesterday and look a tad bit overstretched to the downside. I wouldn't be surprised to see a bounce today. See you all shortly in the live trading room!