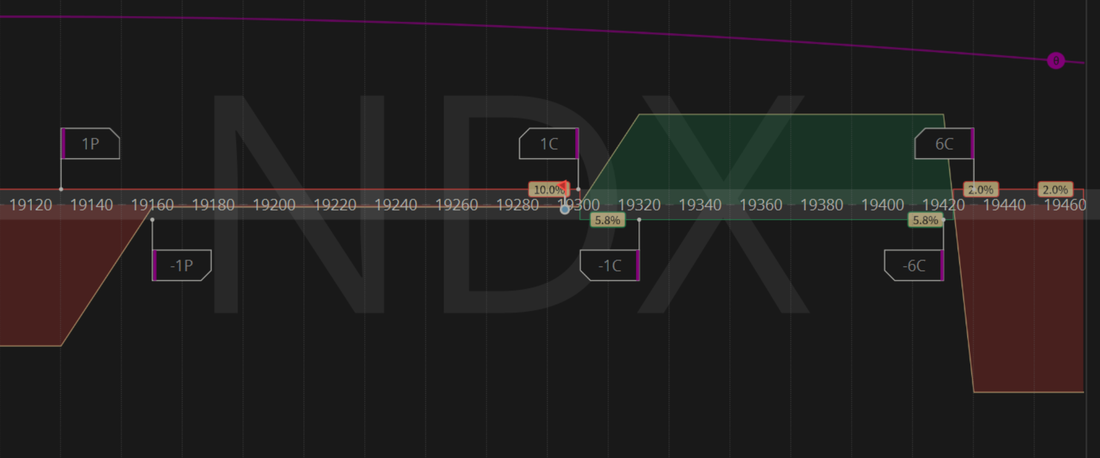

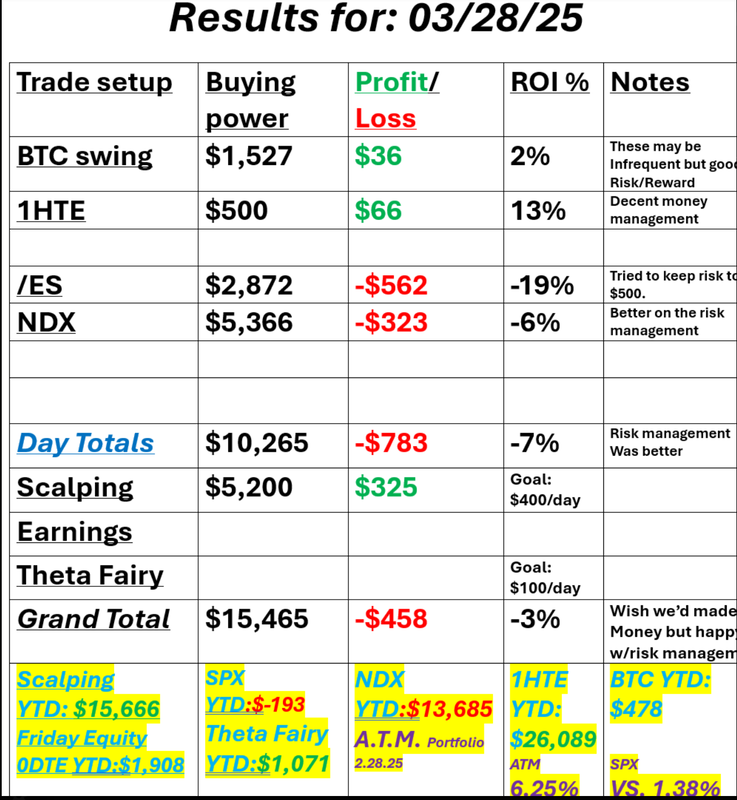

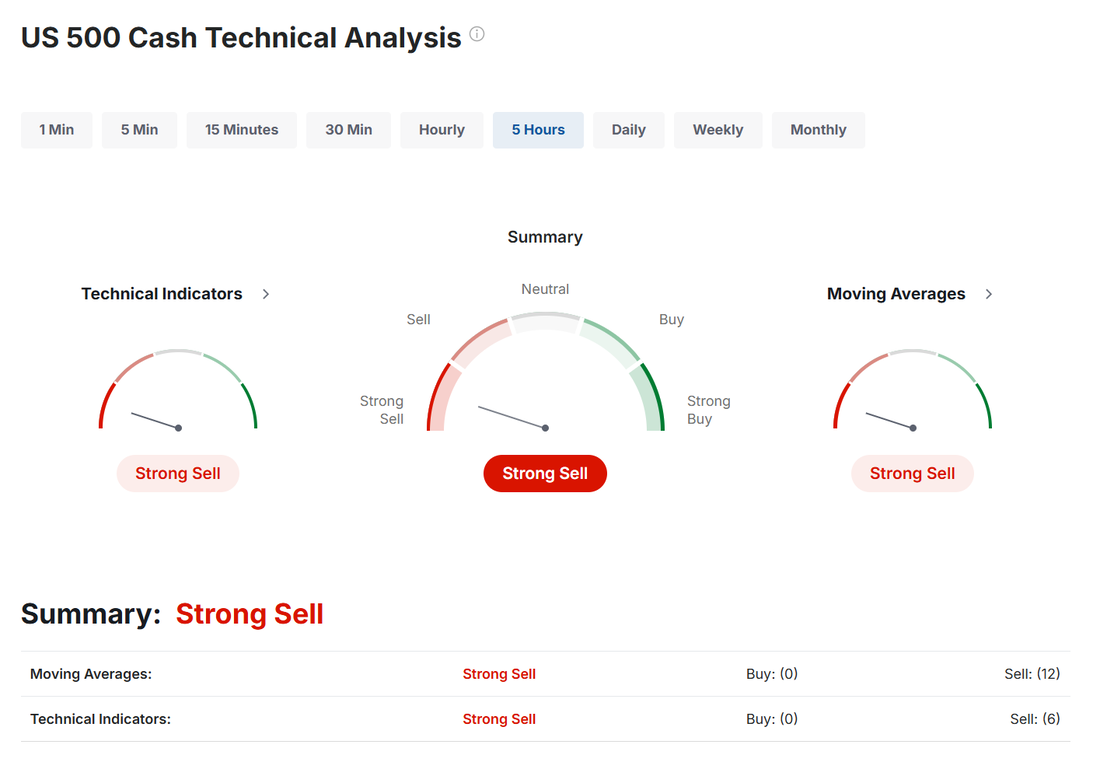

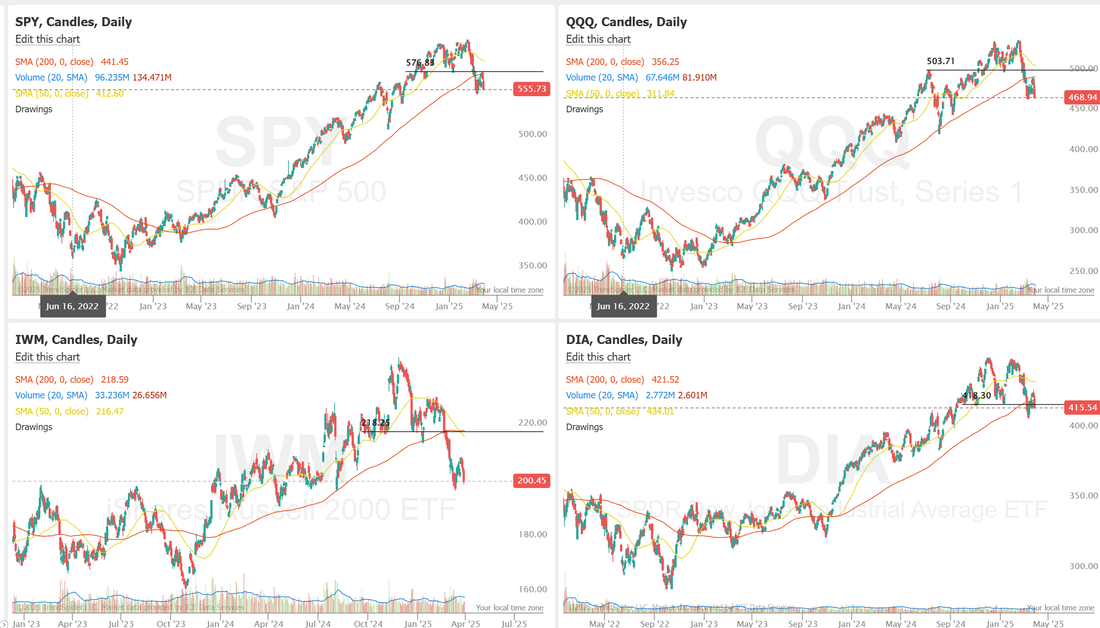

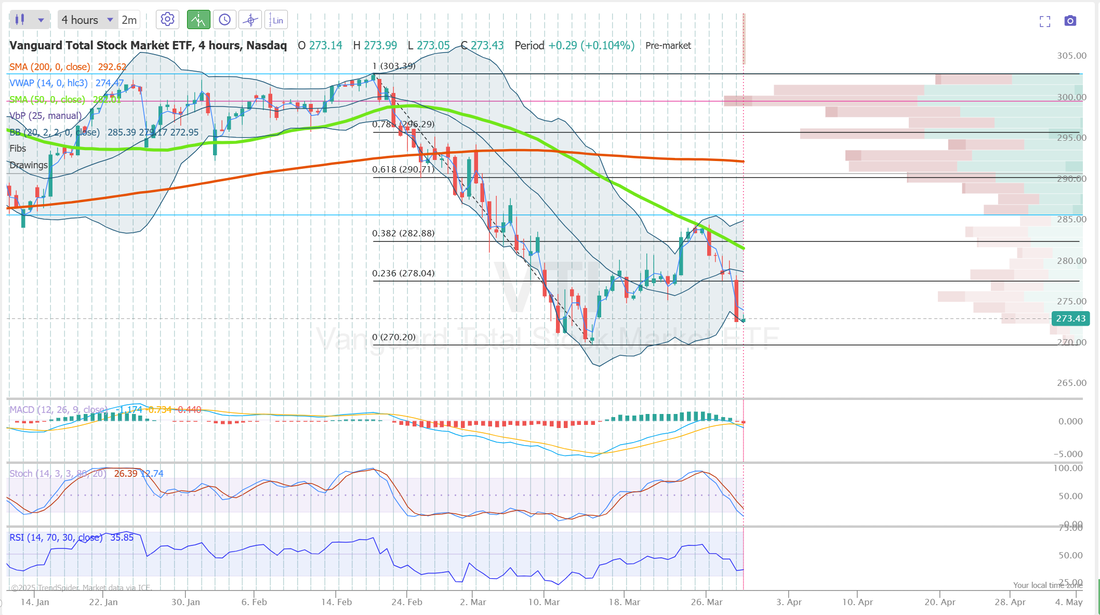

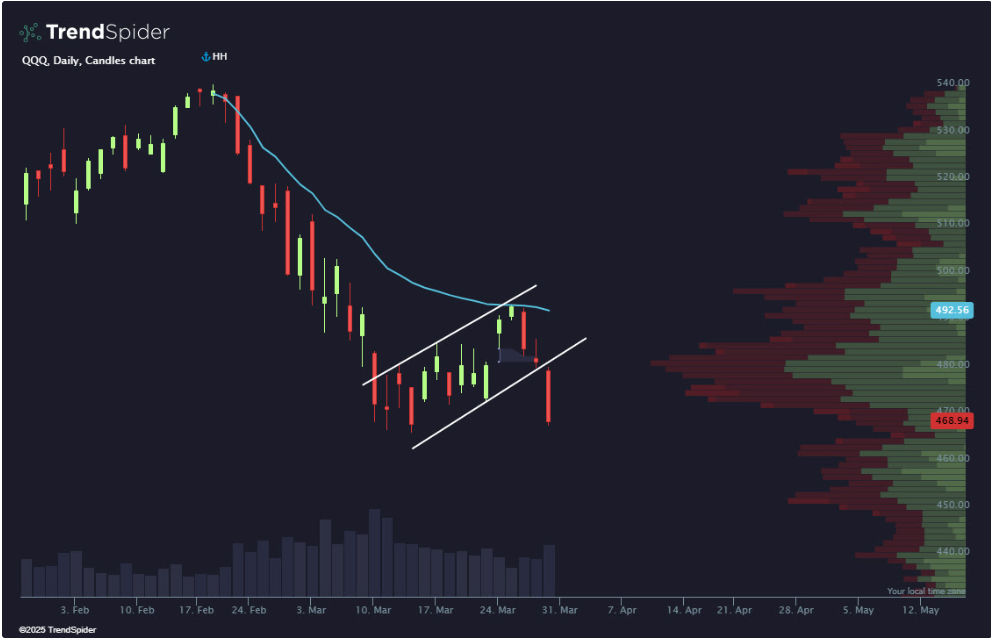

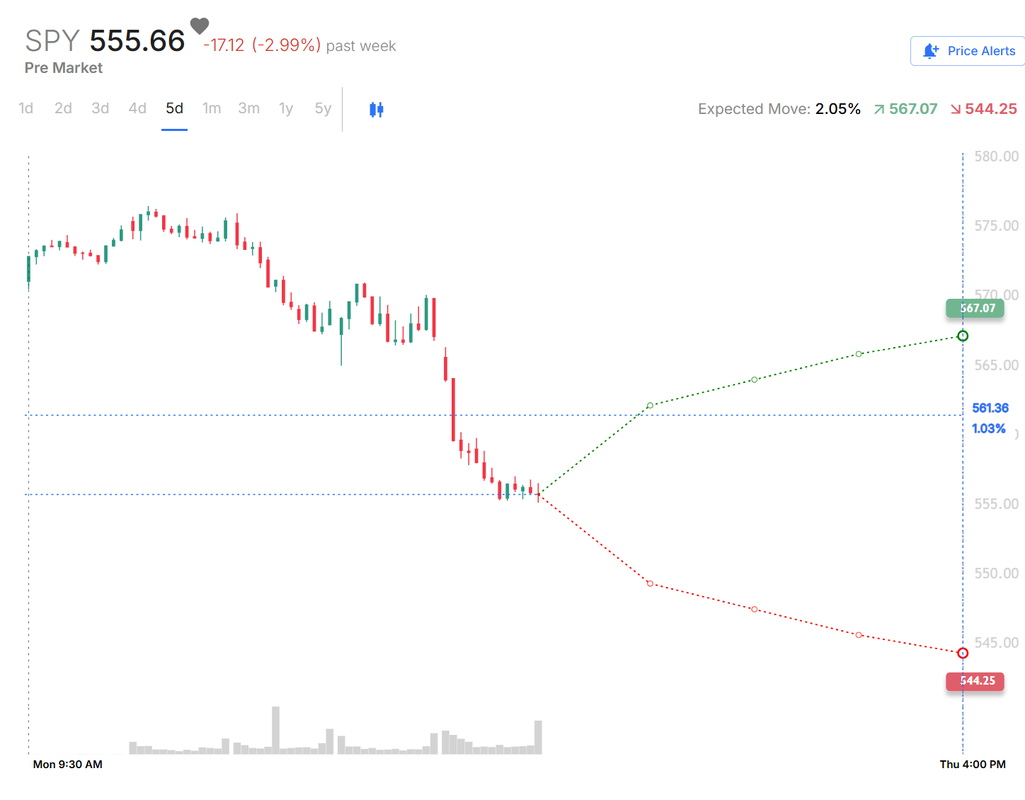

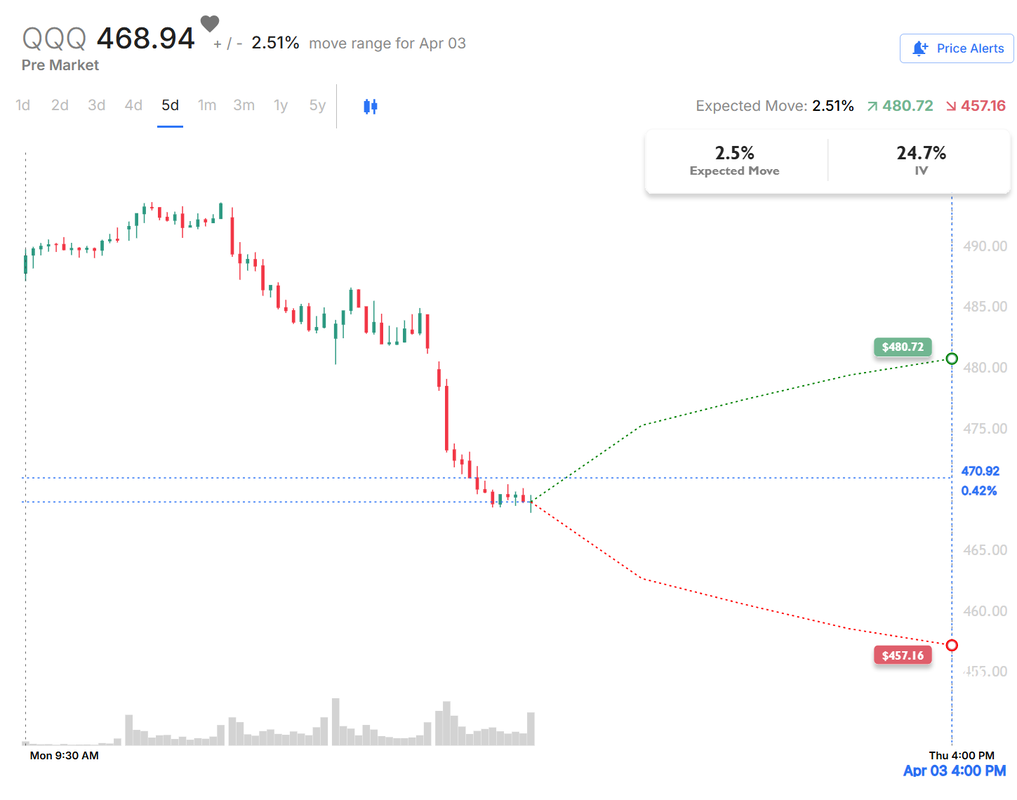

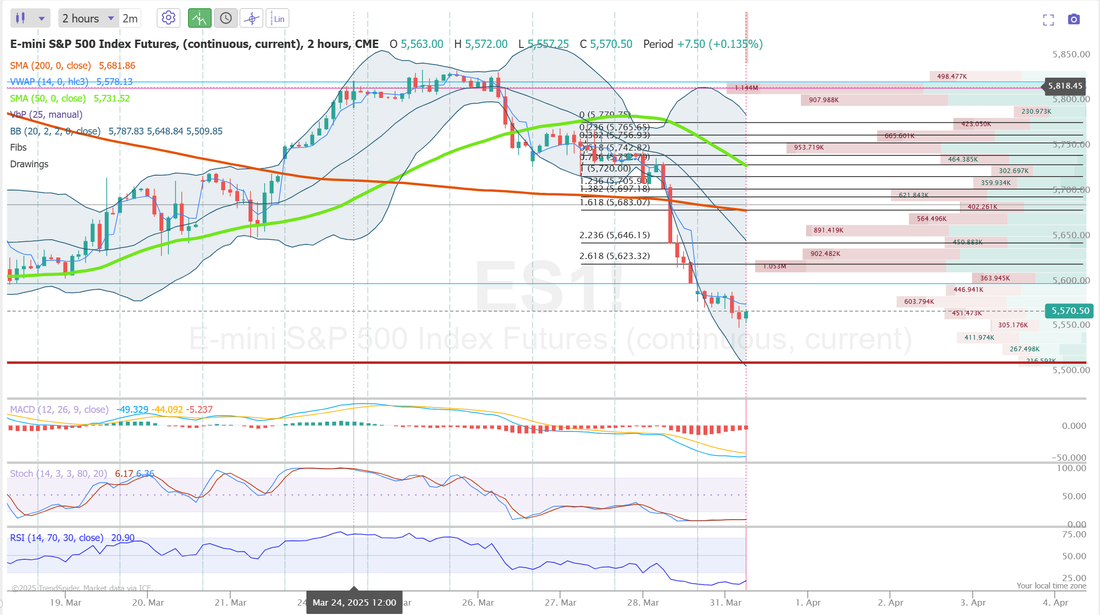

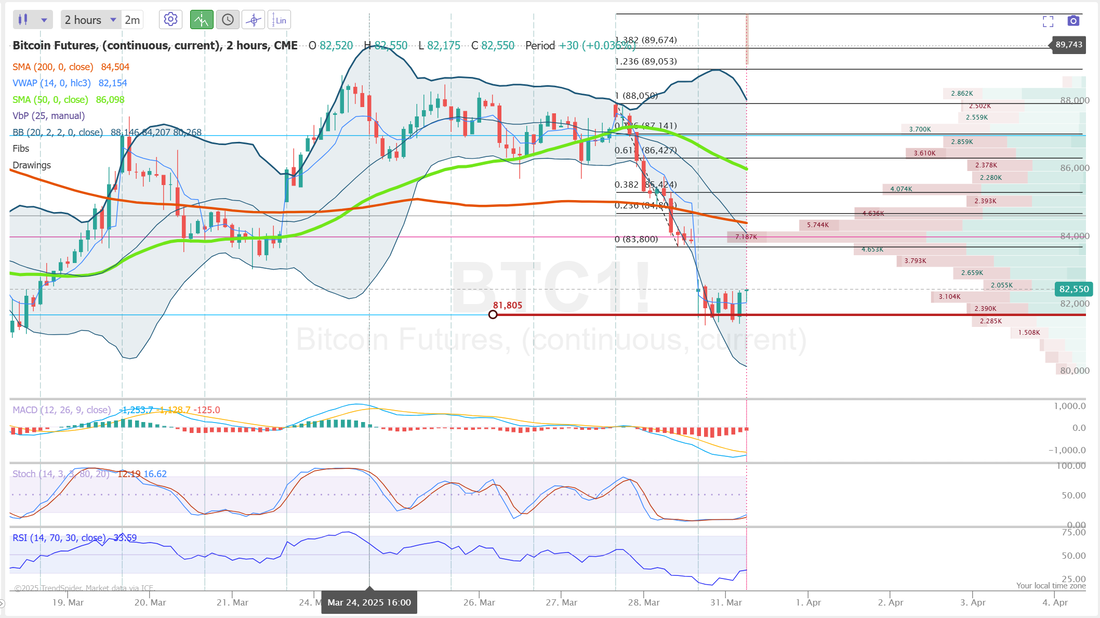

Risk...how much is just right?Welcome back traders! Markets are looking weak again. Lots of uncertainty right now. That brings up the topic of risk. We talked about this a lot last week in the trading room. How much risk is acceptable? The knee jerk reaction is "none!" Of course we need (even want) risk. Without it there is no reward. The question is, what is the sweet spot with regards to a 0DTE? It seems for our setups and approach $500 dollars risk is the sweet spot. Any less and you'll be stopping out too much and get chopped up with fees and commissions. Any more and it gets hard to overcome it with the follow up adjustment. I did a good job on the risk management Friday with our NDX. It had almost $2,000 of profit potential with minimal downside. It didn't hit for a profit but the risk/reward was good. I couldn't quite keep the risk on the SPX below $500 but I was close. We'll focus on this same target today. Here's a look at my day Friday. Let's jump right in and look at the markets as we start a new week. Technicals are in sell mode. Futures are down, once again this morning. Most of the indices are sitting on the cliff we formed a few weeks ago with the last big downturn. A break below this current level could offer up substantial downside. One of the downside triggers I'm watching is the 270 level on VTI. A break below that could signal an increased inflow of selling. Looking ahead, this week brings a packed lineup of Fed speakers, including Chair Powell, alongside key employment data. Powell is scheduled to speak Friday afternoon, just hours after the bulk of the numbers are released. Traders will be watching closely to gauge how the market digests the data and whether Powell’s tone signals any shift in the Fed’s policy outlook. Let’s see what the charts are telling us. The SPY closed the week at $555.73 (-1.46%), retreating sharply after an early bullish gap up. That move was quickly reversed as price rejected the top of a bear flag, putting bears back in control. Selling accelerated midweek, triggering a breakdown from the pattern and driving SPY toward its year-to-date lows, leaving bulls on the ropes. QQQ closed the week at $468.97 (-2.47%), finishing on a weak note after rejecting its all-time high anchored VWAP, which represents the average price paid since the market’s peak. A rejection here indicates trapped longs are selling into strength at breakeven to reduce exposure. It also broke below a key high-volume node, leaving the index with little support below. With bearish momentum building, the bears head into the week holding the upper hand. IWM closed the week at $200.45 (-1.63%), continuing to underperform as small caps struggle for traction. Unlike its large-cap counterparts, it never even reached its all-time high anchored VWAP and now clings to the bottom of a key high-volume node. With support thinning out, a test of the 52-week low appears increasingly likely as IWM remains the weakest link among major indexes. Let's take a look at the expected moves for this week. VIX1D is up. That should be good for premium collection. It's not often we see a 2% weekly expected move in the SPY. My lean or bias today is neutral. They may sound off with all the bearishness and with futures being down this morning but I'm basing off of current futures levels. As I type /ES is down -60 and /NQ down -285. It's (Obviously) likely that the indices finish in the red today but I think a lot of the downside is already reflected in the futures. Our trade docket will be light and focused through Weds. (Tariff day). I continue to scalp using the /MNQ and covering with the /NQ. There's good premium there. BITO cash flow trade again for this week. 1HTE BTC trades, We'll look at our LULU setup as well as our next Nat gas setup that worked so well. 0DTE's on SPX and NDX as well as a possible SPY 0DTE. Let's take a look at some key levels in the market. /ES: On the daily chart 5509 is the key "cliff" level. It was the low we hit on Mar. 13th, on our previous downturn. We bounced hard at the level then. Will we get there again? If so, do we bounce? Intra-day on /ES: 5599 is first resistance with 5623 next. 5513 is support. /NQ: 19,487 is resistance with support sitting just below us right now at 19,158. I think we've got a fair shot that level holds today. BTC: The most important level for me today on Bitcoin is 81,805 which is VWAP and strong support on the 2hr. chart. I'll play the support level again today, much like we did on Friday with the 1HTE's. I look forward to seeing you all in the live trading room. Let's keep the focus on risk first...profit second and we should have a good day.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |