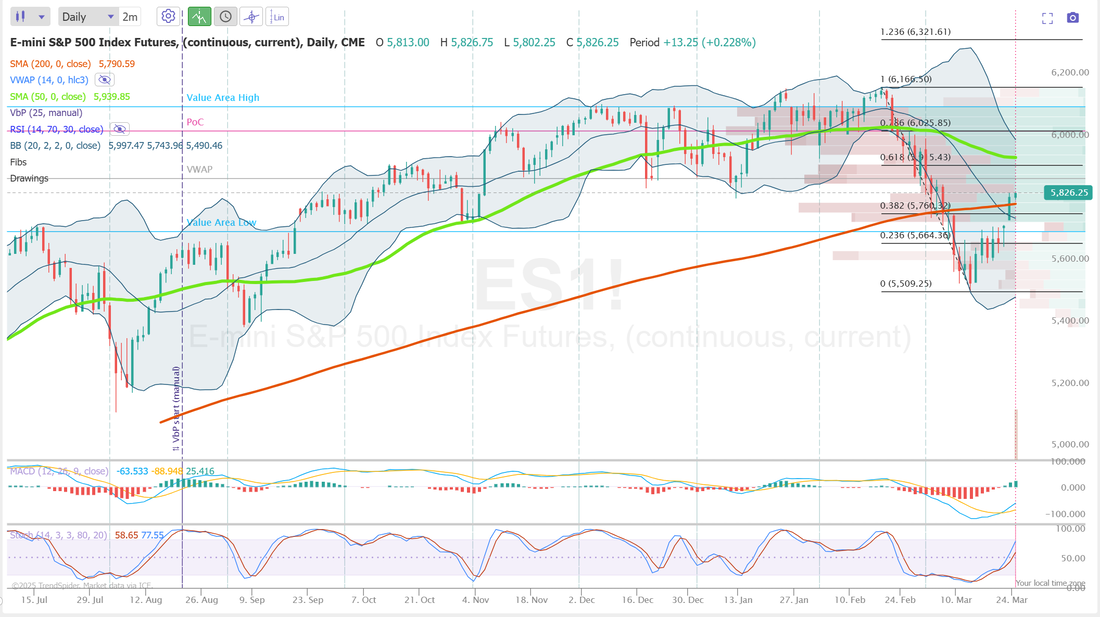

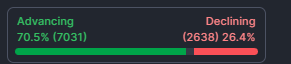

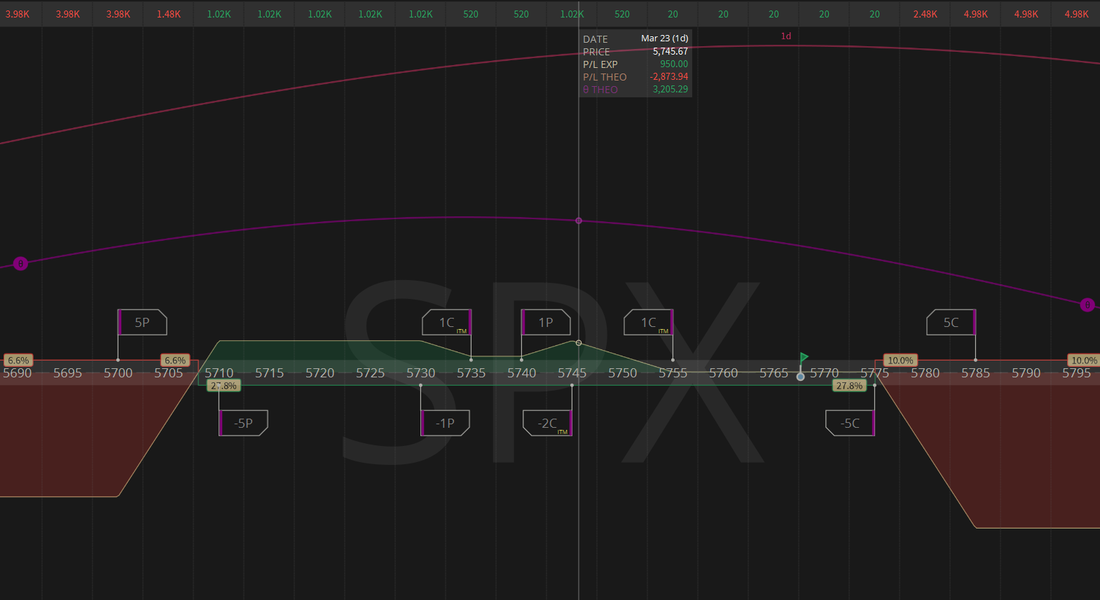

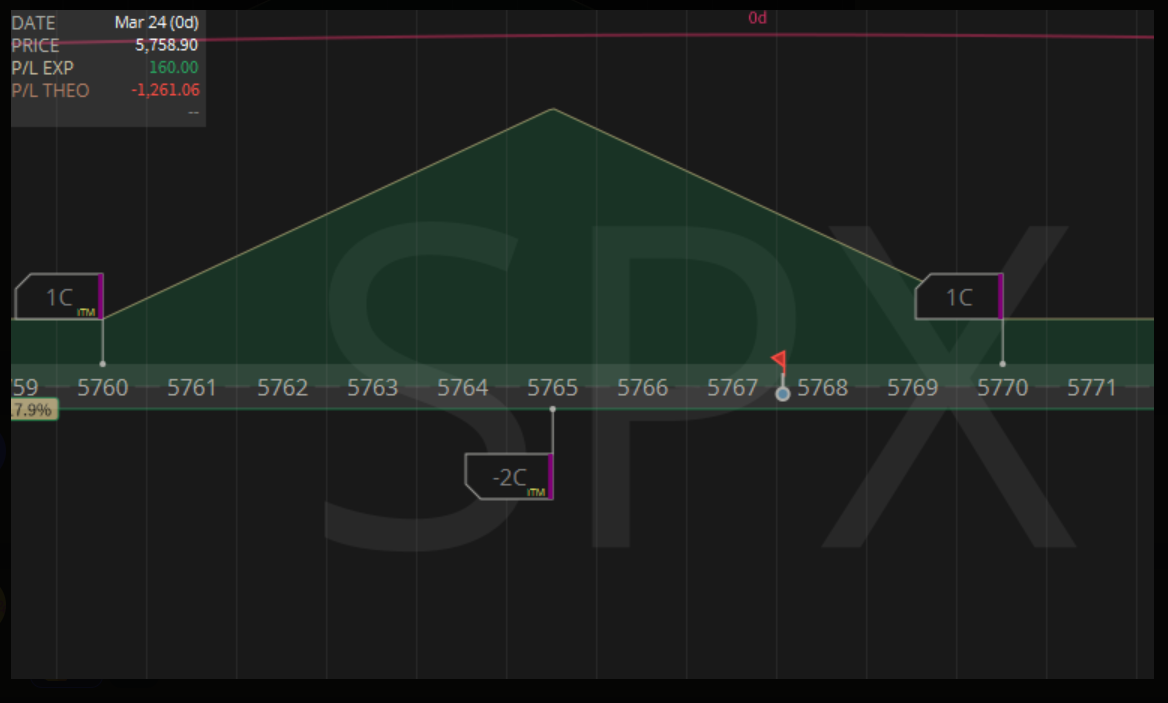

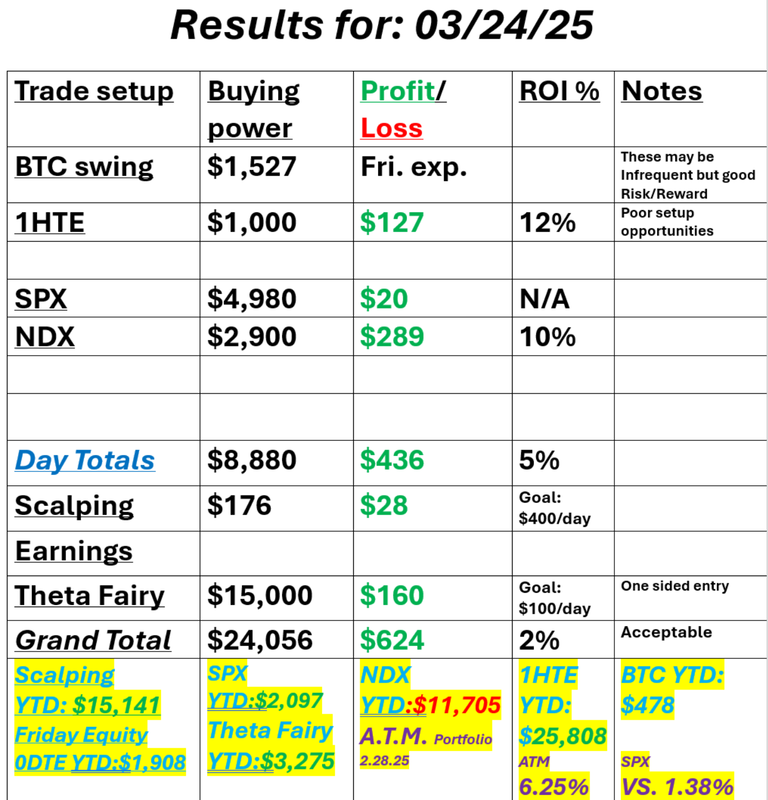

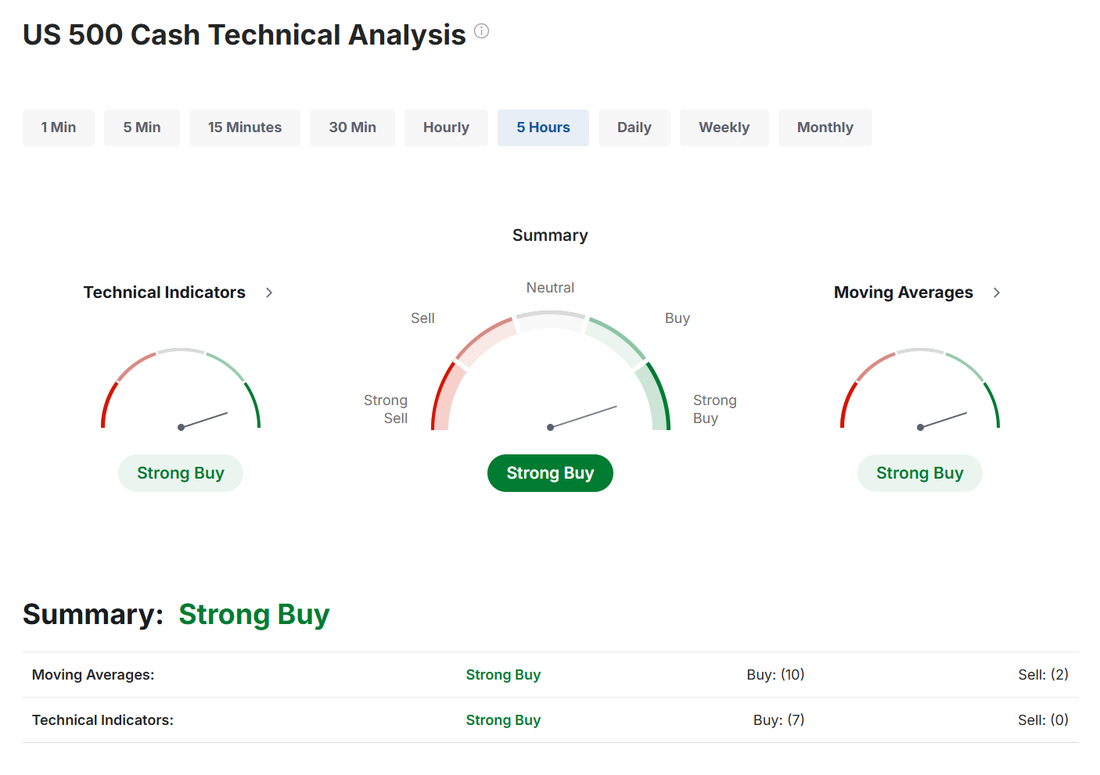

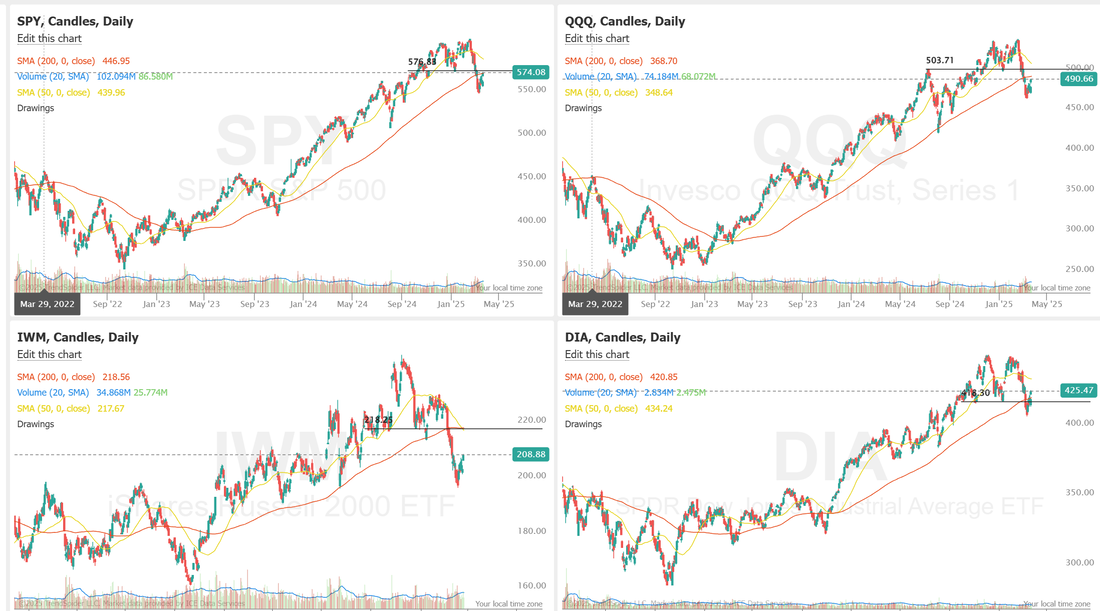

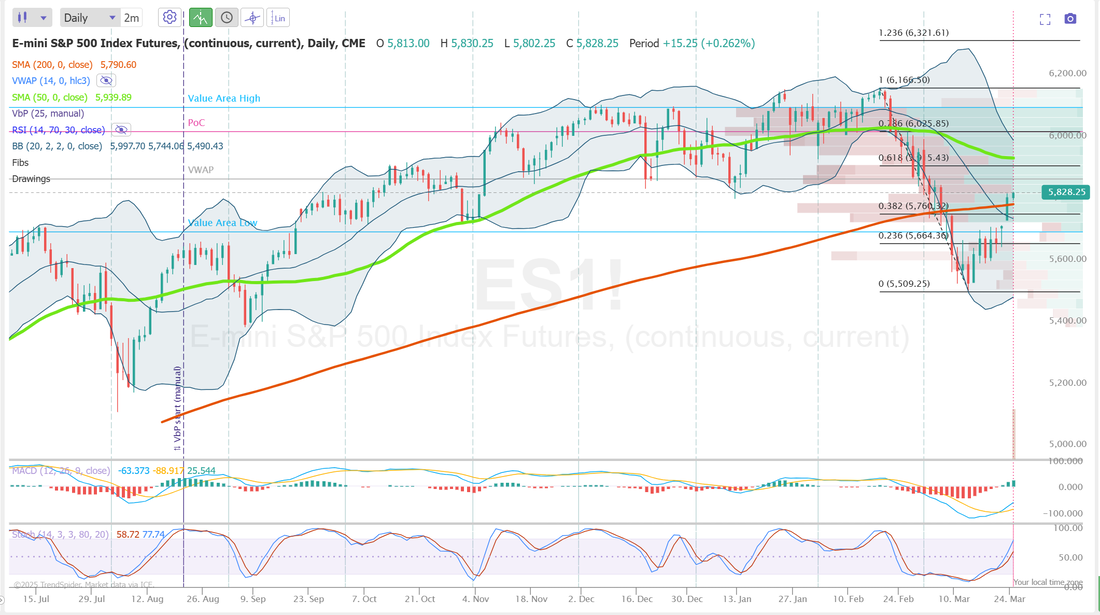

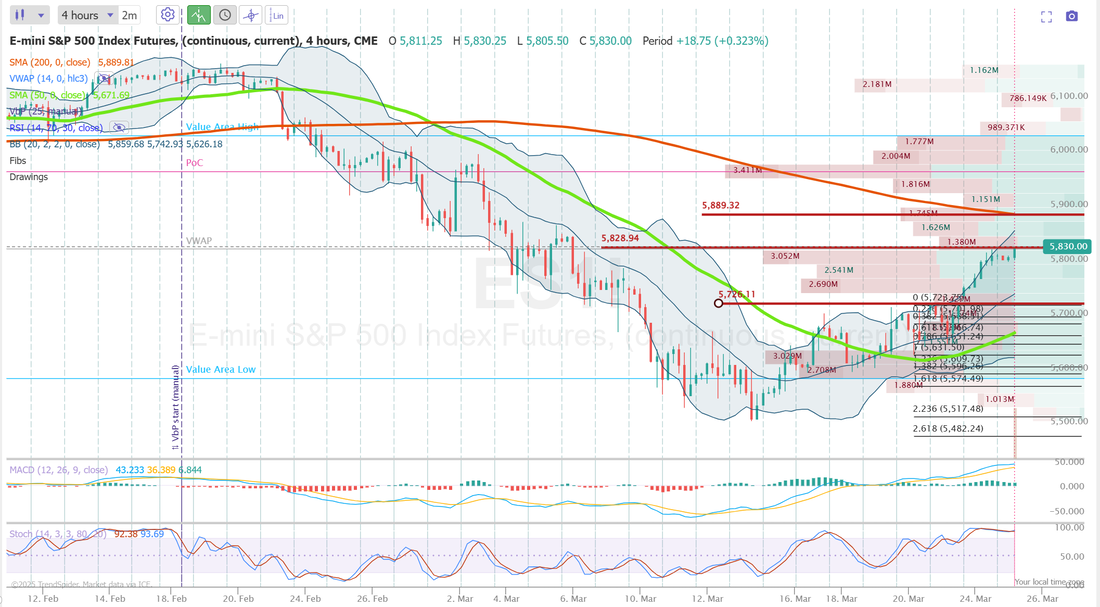

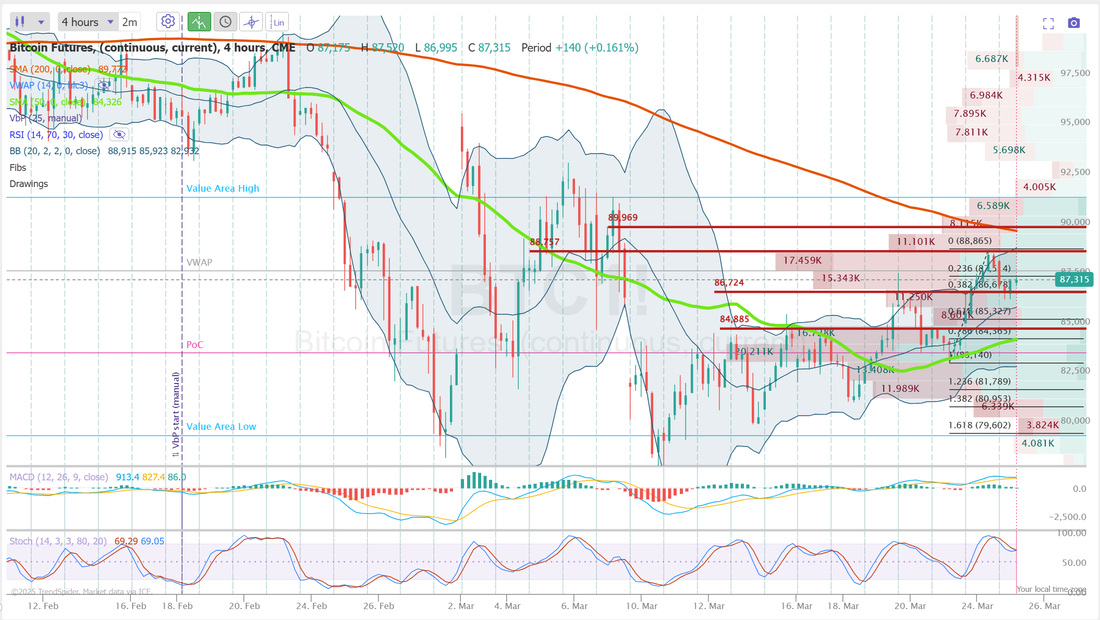

Zones, zones and more zones.Welcome back traders! Well...yesterday was impressive for the bulls. Two things caught my eye. #1. The /ES was able to break above the 200DMA. That's big. #2. The rally was broad based. While the NDX and VTI have not broken back above their respective 200DMA's yet, they are also looking much better. The bulls may be back! We've got two synthetic longs on with SPY and VTI in our ATM portfolio. Those could benefit greatly in the next week if the bulls can maintain this pace. Let's talk about our day yesterday. We had what I'd call an "acceptable" day. We made over $600 dollars. I think anytime you have a profitable day it's a good day however, we missed a profit zone in our SPX trade which left a lot of profit on the table. Is that O.K.? I think it is. Here's what our final SPX position looked like going into the close. We had a couple profit "zones" built with butterflies that would have yielded us over $1,000 profit. They didn't hit (as you can see) and we ended up with twenty bucks. We've had several of our big profit zones miss lately and we end up with quite a bit less than we could have made. Is that a problem? No. I think it's the right way to manage risk. If risk management is our first priority and profits our second then we need to have some form of asymmetric setups working. Something with low risk/high reward. That takes care of the risk management aspect but...those trades come with low probablities. We did have one of our trading members who got a better level for his butterfly. Nice job Gentry! The markets are every changing and with the 200DMA now looking more like support than resistance they could be changing back to bullish. That will change our I.V. and likely our approach...once again, but for now, the butterflies and broken wing butterflies seem to offer the best risk/reward. I'll focus a bullish broken wing setup today on the SPX and likely skip the NDX. Make sure to tune in to the trading room today as we'll be building a 0DTE on Nat gas for tomorrows expiration that I think you'll all like. Here's a look at our results from yesterday: We are nearing the end of the month. We'll update our A.T.M. results. If you want a little preview, let's just say we are crushing the SP500! This could be a banner year for that portfolio. Let's take a look at this changing market. Technicals are firmly bullish. We certainly don't have an "all clear" signal if you are a bull but the DIA and SPY are now back above the 200DMA. That's bullish. We do need to give the market some time to verify if this is indeed a new support or still a resistance zone. My lean or bias is bullish. We've started our scalping room off with a long /MNQ which I would like to hold for a while and cash flow against it. While recapturing the 200DMA is very bullish, it doesn't usually happen in one trading session. It can take weeks to solidify. Trade docket for today: F is about done. We've rung all the profits we can out of this setup. We'll book profit on it and focus our ITM cover efforts on our earnings trade from yesterday, KBH. QQQ,/MNQ scalping. We'll try to cover QTTB again today. Look for a late day setup on Nat gas which will become our main 0DTE for tomorrow. We have DLTR, GME and CHWY earnings setups as well as our 1HTE BTC trades and the SPX 0DTE. I'll skip the NDX today to have more buying power available for the Nat gas and SPX setups. I promised the group more Theta fairys this week and I'll try my best this afternoon to keep that promise. June S&P 500 E-Mini futures (ESM25) are down -0.11%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.19% this morning, pointing to a slightly lower open on Wall Street after yesterday’s rally, while investors await a raft of U.S. economic data as well as remarks from Federal Reserve officials. Tariffs have remained in focus for investors, with U.S. equities rallying on Monday amid optimism over more targeted U.S. levies. U.S. President Donald Trump on Monday twice indicated that trading partners could be granted exemptions or reductions from his “reciprocal” tariffs. However, the U.S. president also stated that he will soon impose tariffs on automobiles and pharmaceuticals, and later added that levies on lumber and semiconductors will be introduced further down the line. “So we’ll be announcing some of these things in the very near future, not the long future, the very near future,” Trump said. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher, with the S&P 500, Dow, and Nasdaq 100 notching 2-week highs. The Magnificent Seven stocks rallied, with Tesla (TSLA) surging over +11% to lead gainers in the S&P 500 and Nasdaq 100 and Nvidia (NVDA) rising more than +3%. Also, chip stocks gained ground, with Advanced Micro Devices (AMD) climbing nearly +7% and NXP Semiconductors (NXPI) rising more than +5%. In addition, Azek (AZEK) jumped over +17% after James Hardie Industries agreed to acquire the manufacturer of outdoor living products in a cash and stock deal valued at $8.75 billion. On the bearish side, Lockheed Martin (LMT) fell more than -1% after Melius Research and BofA downgraded the stock. “Stocks look to continue to rally from oversold levels, and any reduction in potential tariff impacts will be an upward catalyst. I believe we have seen the worst of the market’s pullback, though we will continue to see increased volatility at the beginning of next month based on the outcome of President Trump’s tariff policies,” said Ivan Feinseth at Tigress Financial Partners. Economic data released on Monday showed that the U.S. S&P Global manufacturing PMI fell to 49.8 in March, weaker than expectations of 51.9. At the same time, the U.S. March S&P Global services PMI rose to 54.3, stronger than expectations of 51.2. Atlanta Fed President Raphael Bostic said on Monday that he now sees just one interest rate cut this year, down from his previous forecast of two reductions, as tariff hikes are slowing progress on disinflation. “I moved to one mainly because I think we’re going to see inflation be very bumpy and not move dramatically and in a clear way to the 2% target,” Bostic said. Meanwhile, U.S. rate futures have priced in an 89.2% probability of no rate change and a 10.8% chance of a 25 basis point rate cut at the next central bank meeting in May. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the March CB Consumer Confidence index will stand at 94.2, compared to last month’s figure of 98.3. Investors will also focus on the U.S. S&P/CS HPI Composite - 20 n.s.a. Economists expect the January figure to be +4.6% y/y, compared to +4.5% y/y in December. U.S. New Home Sales data will be reported today. Economists foresee this figure coming in at 682K in February, compared to 657K in January. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists estimate this figure will stand at 8 in March, compared to the previous value of 6. In addition, market participants will be looking toward speeches from Fed Governor Adriana Kugler and New York Fed President John Williams. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.351%, up +0.46%. Let's take a look at the intra-day levels of /ES and BTC. /ES: As mentioned before...we are back above the 200DMA. Is it up, up and away? On an intra-day basis I'm focused on two key levels. 5828 which is right where we sit as I type, is a key level. It needs to hold for bulls to keep pushing. Resistance is all the way up at the 200 period M.A. on the 4hr. chart. That's at 5889. Lot's of upside today. Support is all the way down at 5726. BTC: My levels for Bitcoin haven't changed from yesterday. That doesn't bod well for good setups today. I look forward to seeing you all again in the live trading room shortly. Also, a big thank you to the fellow trader on twitter (X) that reached out to me yesterday thanking me for the blog. It's free to all and soley a labor of love for me and sometimes I'm not sure anyone cares or reads it! LOL. That was appreciated.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |