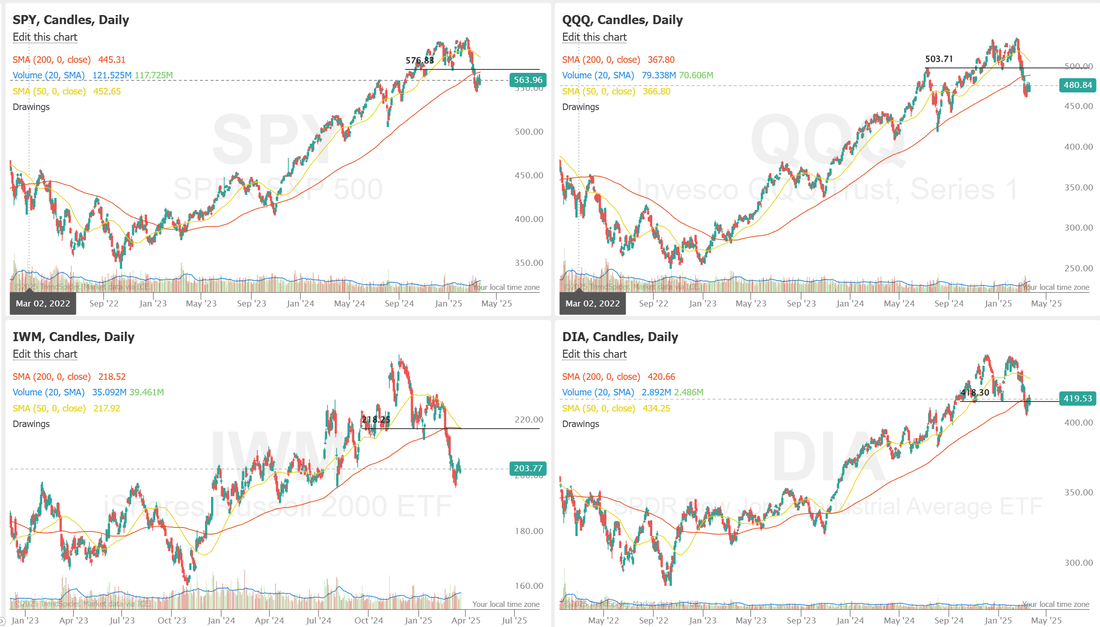

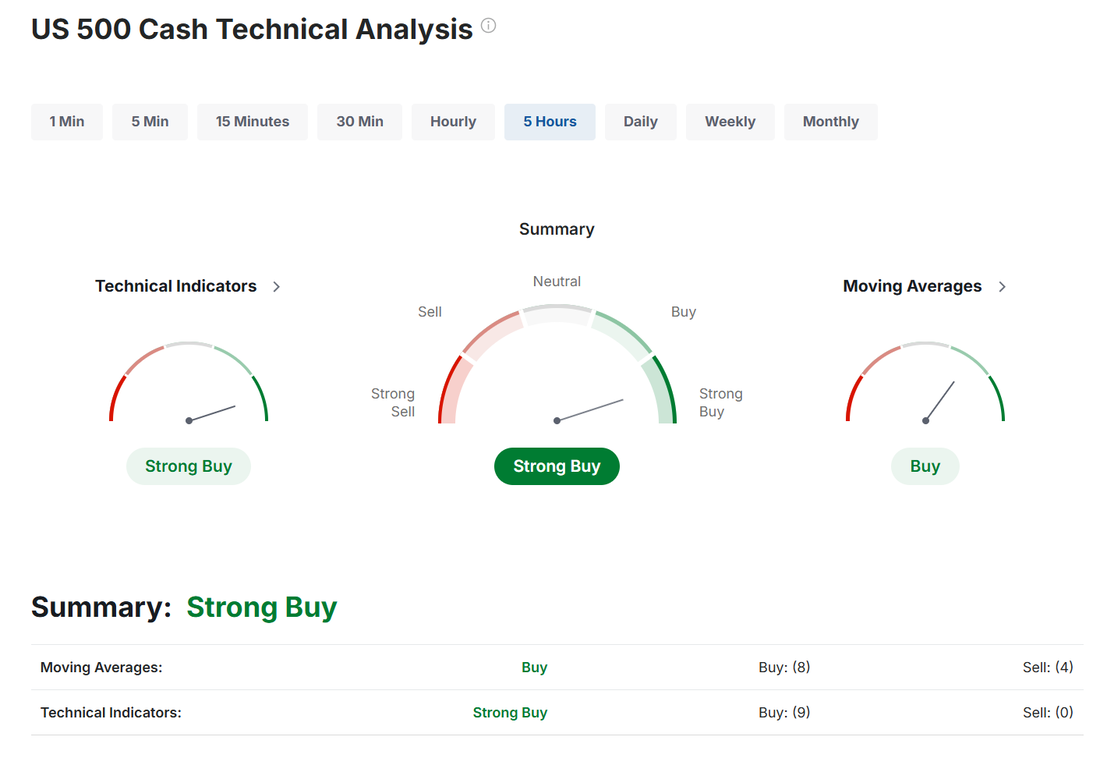

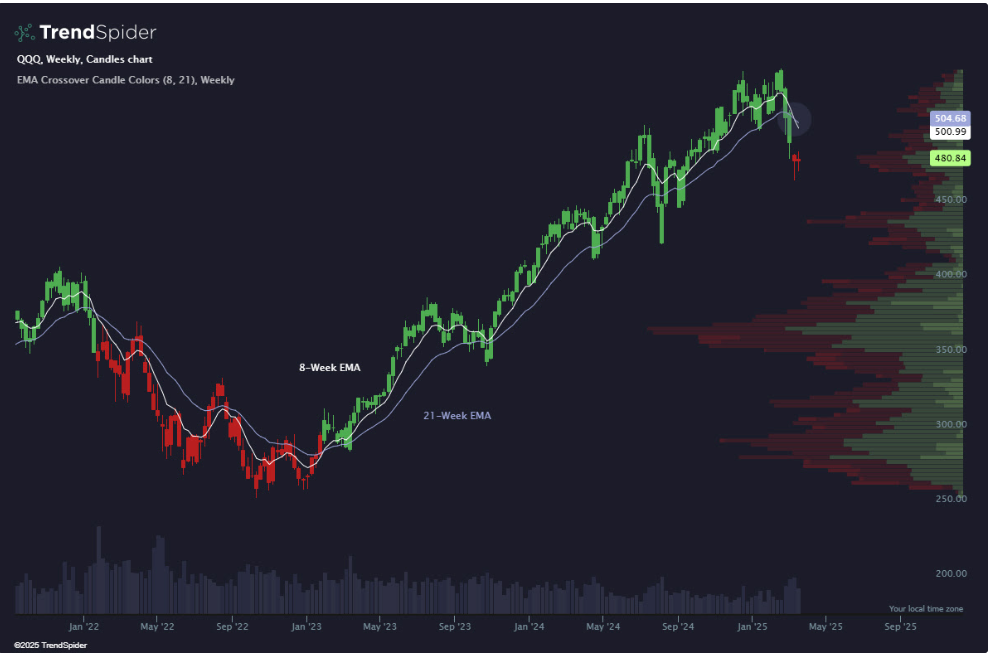

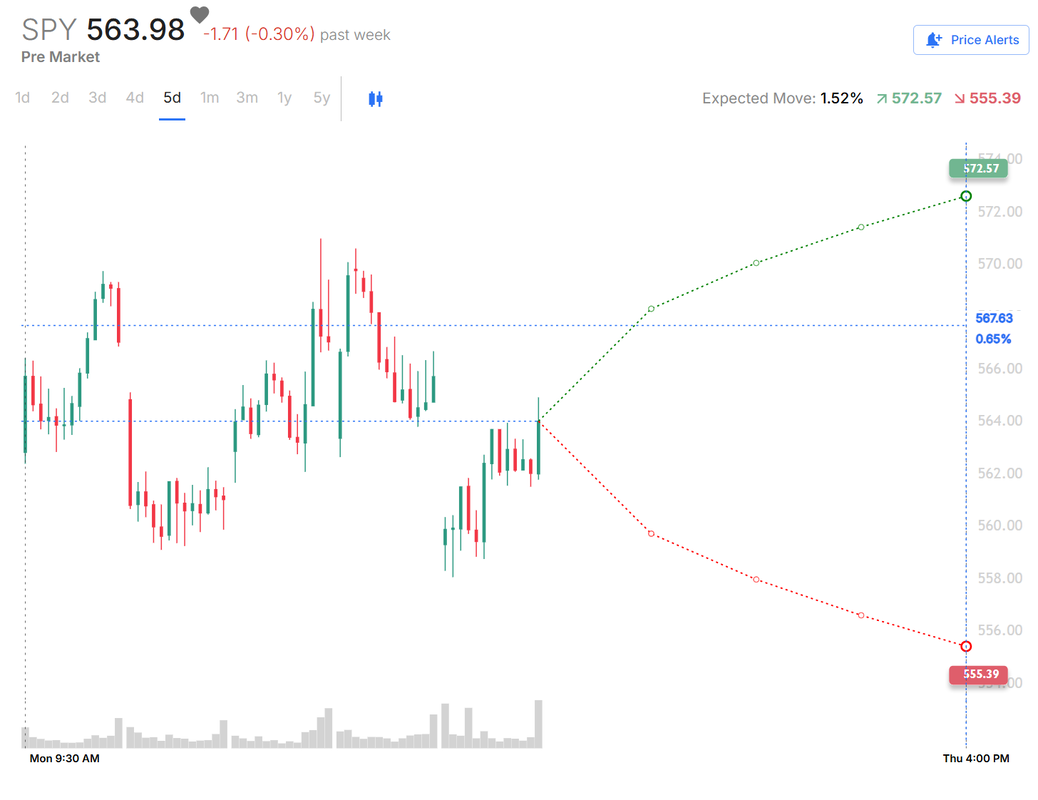

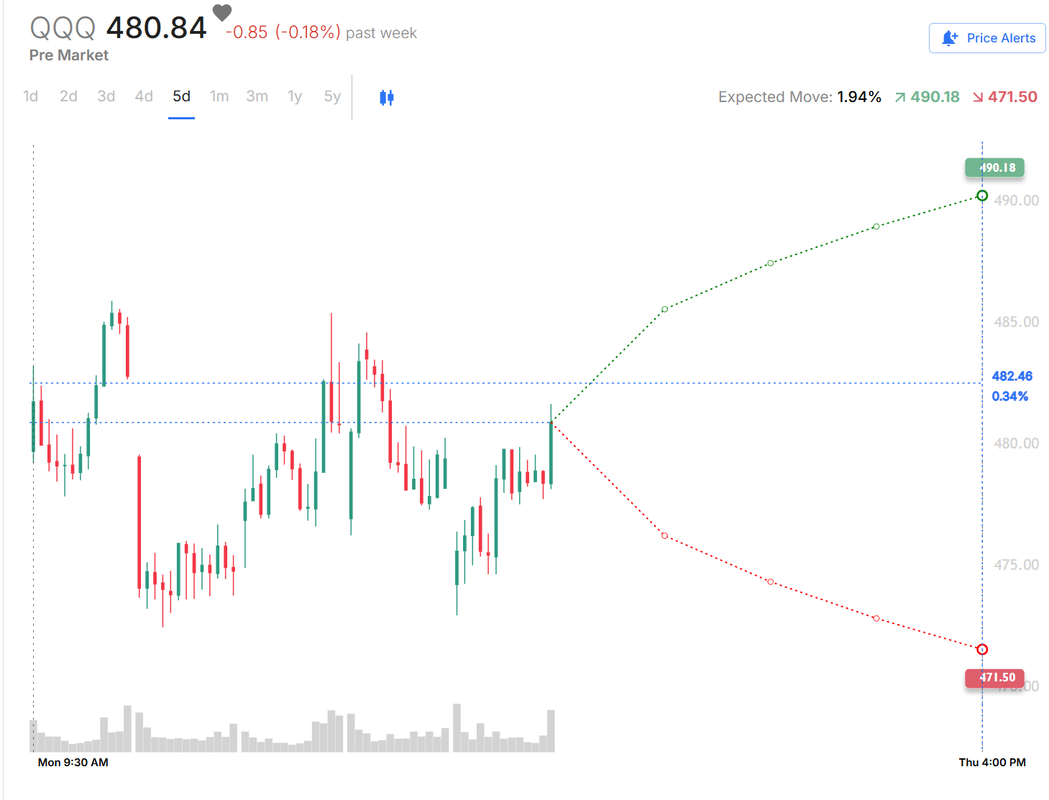

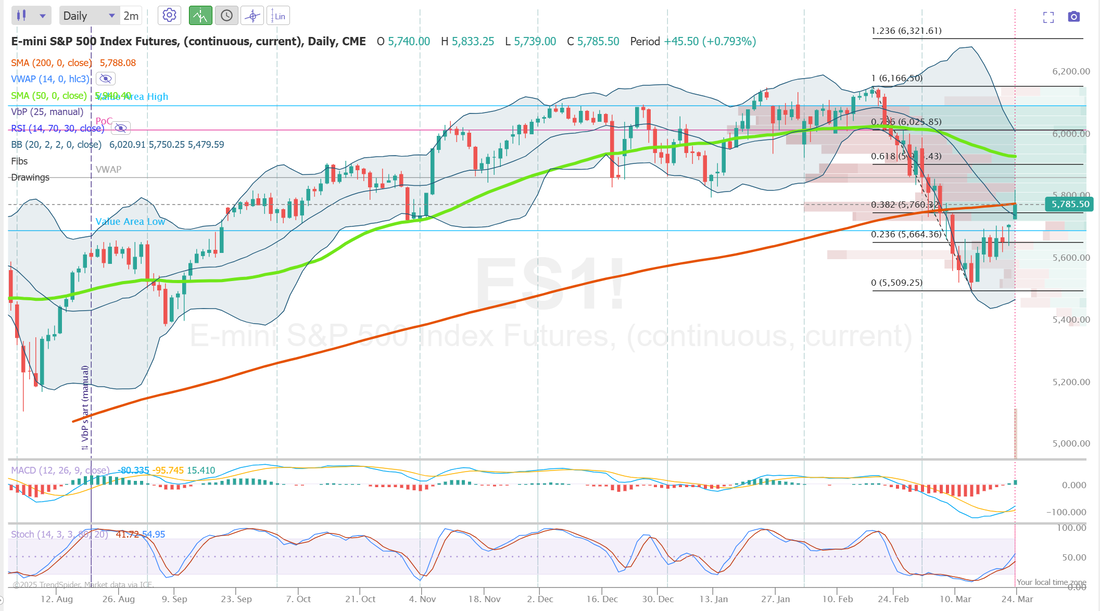

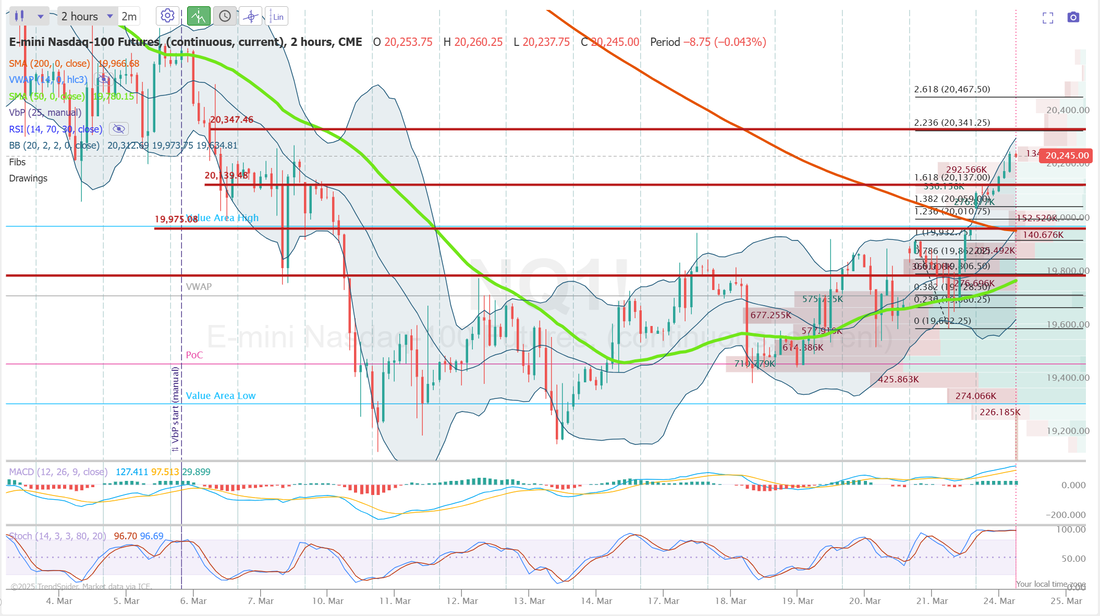

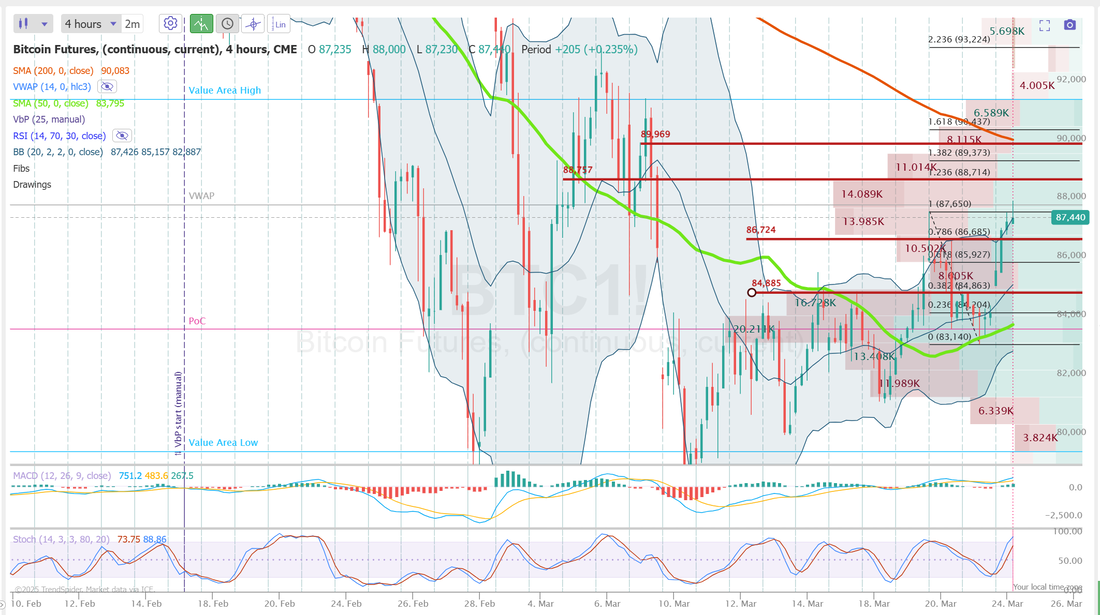

Bulls are back.Welcome back traders! Another new week ahead of us. Are the bulls finally back? They are certainly trying. That pesky 200DMA is a big overhang so we may have a setup today that can be confusing. It certainly looks like a bullish day. Futures are gapping up. Technicals are bullish but... I'm looking for a retrace at some point in the day. Will we retrace and close the gap up zone? Hard to say but I'm probably looking for some bearish setups in todays bullish price action. We did land a nice profit this morning on a Theta fairy so that's a good start to the week. I'm hopeful we can get some additional Theta fairys working this week. We had a solid day Friday. Here's a look at our results: Let's take a look at the markets to start the week. As I mentioned above, the bulls are trying but the 200DMA is a big resistance level. Technicals are back to bullish. Let's see if the bulls can finish strong today and hold that into tomorrow. That will give us a better idea if this bullish move has staying power. June S&P 500 E-Mini futures (ESM25) are up +0.97%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.14% this morning, with investors hopeful that the next wave of U.S. President Donald Trump’s tariffs will be less severe than previously signaled. Sentiment got a boost after Bloomberg reported that the next round of U.S. tariffs, due on April 2nd, is expected to be more targeted than the sweeping measures previously anticipated. Trump will unveil broad reciprocal tariffs on countries or blocs but is expected to exempt certain ones, and for now, the administration does not plan to introduce additional sector-specific tariffs at the same event - contrary to what Trump had previously hinted, the report said. Investor focus this week is on the release of the Federal Reserve’s favorite inflation gauge and other key economic data. In Friday’s trading session, Wall Street’s major equity averages ended in the green. Super Micro Computer (SMCI) climbed over +7% and was the top percentage gainer on the S&P 500 after JPMorgan upgraded the stock to Neutral from Underweight with a price target of $45. Also, the Magnificent Seven stocks gained ground, with Tesla (TSLA) rising more than +5% to lead gainers in the Nasdaq 100 and Apple (AAPL) advancing nearly +2%. In addition, Boeing (BA) rose over +3% and was the top percentage gainer on the Dow after the beleaguered plane maker secured a contract to design and build the U.S.’s next-generation stealth fighter jet. On the bearish side, Micron Technology (MU) slumped more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the largest U.S. maker of computer memory chips offered a weak FQ3 adjusted gross margin forecast. Also, FedEx (FDX) slid over -6% after the shipping giant cut its full-year guidance. Chicago Fed President Austan Goolsbee stated on Friday that hard data continues to indicate a strong economy and reiterated his expectation for rates to come down over the next 12 to 18 months, provided that inflation continues to ease. Also, New York Fed President John Williams said, “The current modestly restrictive stance of the Fed’s monetary policy is entirely appropriate given the solid labor market and inflation still running somewhat above our 2% goal.” Meanwhile, U.S. rate futures have priced in an 85.1% chance of no rate change and a 14.9% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. This week, market participants will closely monitor a slew of U.S. economic data for clues on how the economy is holding up amid President Trump’s recent unpredictable tariff announcements and increased volatility in the U.S. stock market. The February reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as it could offer insights into the interest-rate outlook. Other noteworthy data releases include U.S. GDP (third estimate), the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., New Home Sales, the Richmond Fed Manufacturing Index, Durable Goods Orders, Core Durable Goods Orders, Crude Oil Inventories, Goods Trade Balance, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, and the University of Michigan’s Consumer Sentiment Index. “The macro data seems biased to be weak in the coming weeks, but the PCE inflation data will likely show some stubbornness, remaining a tad elevated,” ING analysts said in a note. Investors will also hear perspectives from several central bankers this week, including Atlanta Fed President Raphael Bostic, Fed Vice Chair for Supervision Michael Barr, Fed Governor Adriana Kugler, New York Fed President John Williams, Minneapolis Fed President Neel Kashkari, and Richmond Fed President Tom Barkin. In addition, notable companies like discount retailer Dollar Tree (DLTR), homebuilder KB Home (KBH), fitness apparel maker Lululemon Athletica (LULU), online pet retailer Chewy (CHWY), and video game retailer and meme stock favorite GameStop (GME) are scheduled to release their quarterly results this week. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the March Manufacturing PMI will come in at 51.9, compared to last month’s value of 52.7. Investors will also focus on the U.S. S&P Global Services PMI, which stood at 51.0 in February. Economists expect the preliminary March figure to be 51.2. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.281%, up +0.68%. Working on some new pairs trades today: ADUS, CMPR, QTTB, WWW, PNC/RJF, NOV/FTI, AAP/LKQ, EXPE/GM, AZO/TSCO, BITO, 1HTE BTC, 0DTE on SPX/NDX, KBH earnings trade. SPY triggered its first weekly bearish 8/21 EMA cross since the October 2023 correction, closing the week at $563.98 (+0.22%). This shift is clearly highlighted by the EMA Crossover Candle Colors Indicator, which paints candles red when the fast EMA crosses below the slow EMA. The last crossover in 2023 turned out to be a head fake, leaving traders now questioning if this is just another false alarm. QQQ ended the week at $480.84 (+0.25%), with its 8/21 EMA cross carrying more weight, considering the last one marked the beginning of a year-long bear market in 2022. With volatility compressed last week and key tech names under pressure, the signal adds to a growing list of warning signs that bearish momentum is brewing. IWM closed the week at $203.79 (+0.46%), outperforming the large caps on a relative basis last week. However, the small-cap index has been a consistent laggard and has given back all of last year’s gains. It is now attempting to catch some support on a high-volume node in the volume profile but has yet to hold any sort of bullish momentum. Let's take a look at the implied moves and I.V. for this week. The numbers are not bad. Let's take a look at the intra-day levels. /ES: The first chart is the daily. We are right at that key 5793 200DMA! It's a big level. Keep a keen focus on that level. 5813 is the next support with 5842 next. 5724 is first support with 5683 next. /NQ: We don't quite have the same strength as /ES. 19975 is key for me. That's the 200 period M.A. on the 2hr. chart. 20136 is next with 20347 above that. My key support target is 19,803. This marks up with the 50 period M.A. on the 2hr. chart. BTC: Bitcoin is popping along with the equity futures. With so much movement I needed to pull out to a 4hr. chart. 88,757 is first resistance with 89,969 next. 86,724 is first support with 84,885 next. I look forward to seeing you all in the live trading room shortly! I've got some more info on the Costa Rica project and a little side mastermind day if you are looking at going down to look at the home.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |