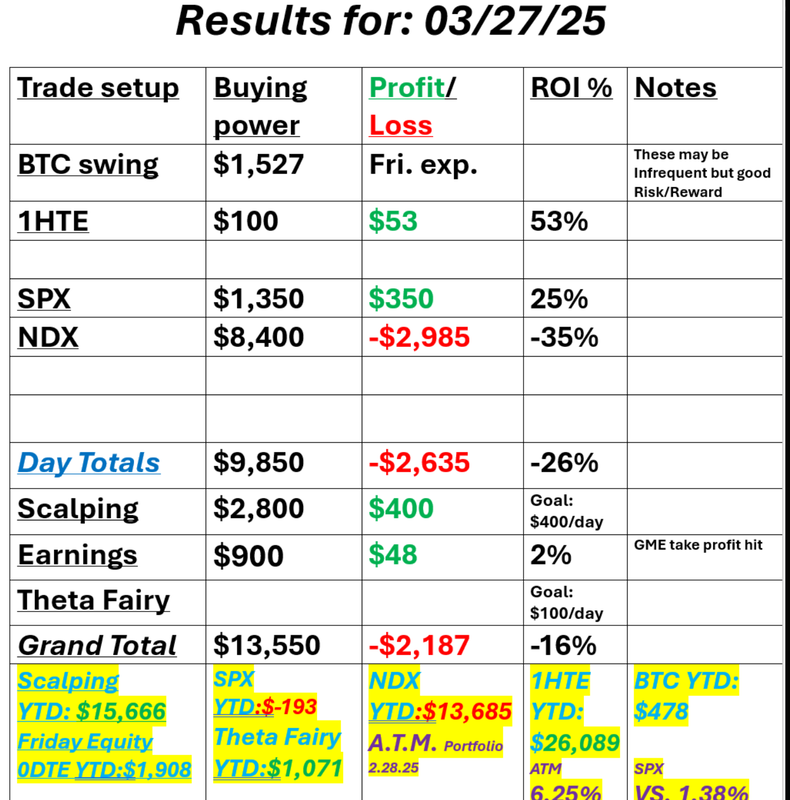

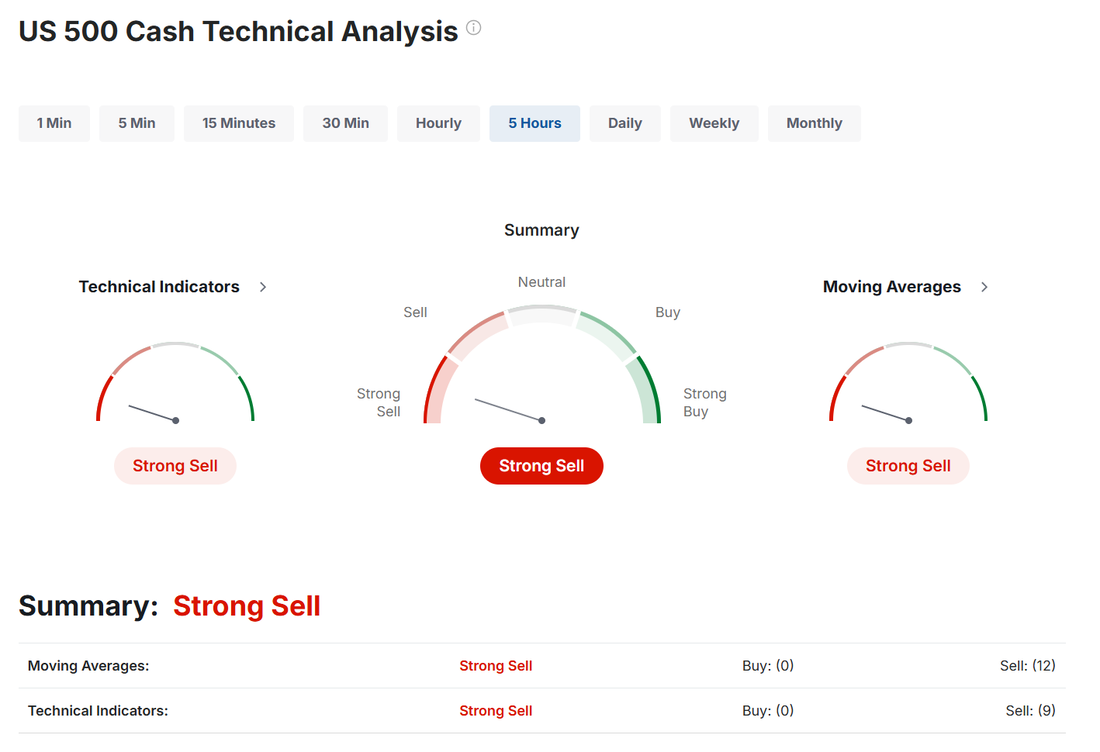

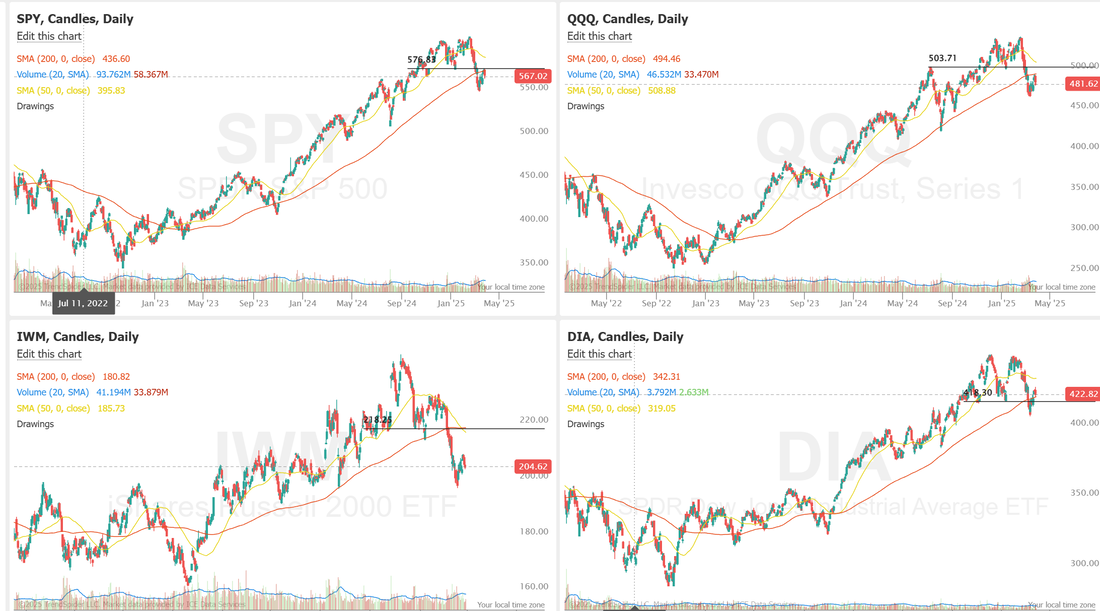

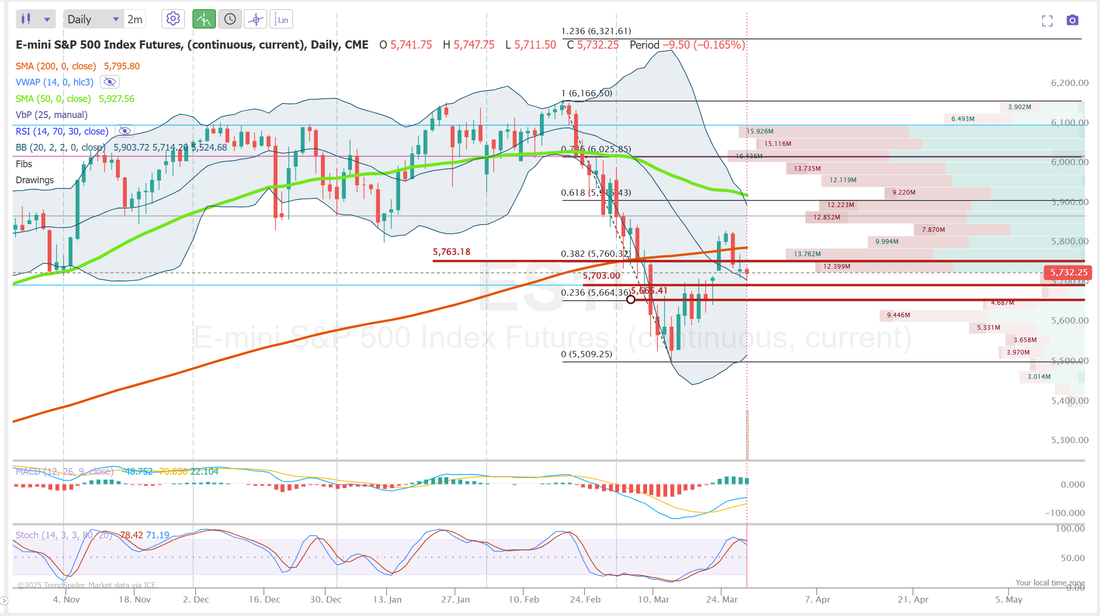

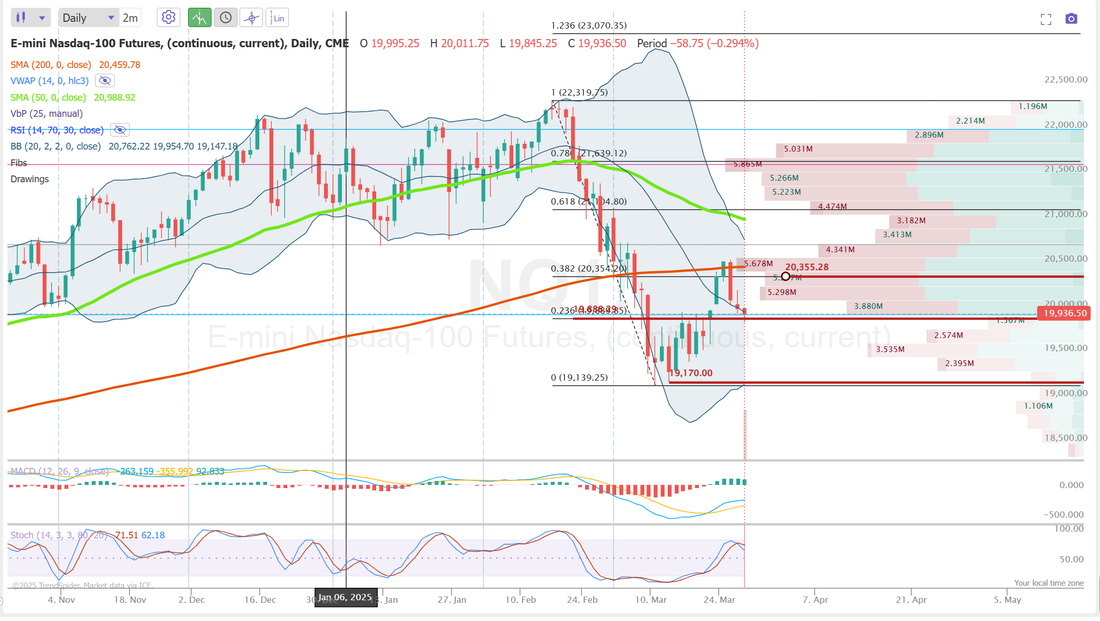

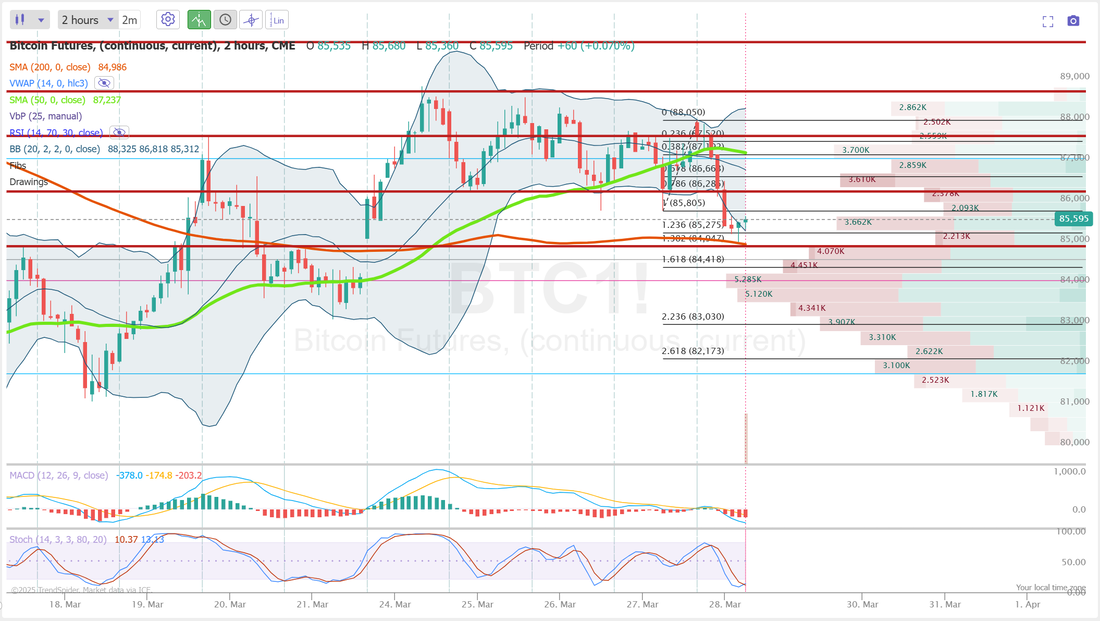

Inflation dayGood Friday to you all! PCE numbers are out this morning. The FED's favorite inflation gauge could set the tone for todays trading session. We had another losing day yesterday. Two days in a row for me. That's rare but it still doesn't make it feel any better. Waiting longer for entries seems to be the key. Let's see if I can do better today. Fortunatley our ATM portfolio continues to crank our profits as the market continues to drop. Here's a look at my day yesterday: We'll update the monthy YTD results on our ATM portfolio Next Tues. Let's take a look at the markets: Techncally we're still in sell mode. That likey won't change unless the indices can reclaim the 200DMA. That seems to be a big task. Not a lot to see on the indices. They aren't continuing the big bearish move is started a few weeks ago but it's also not reclaiming the 200DMA. We seem to be in a bit of a waiting game right now. une S&P 500 E-Mini futures (ESM25) are down -0.20%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.32% this morning as market participants remain cautious amid uncertainty surrounding U.S. tariffs while also awaiting the release of the Federal Reserve’s first-line inflation gauge. Investors have been paring back risk ahead of April 2nd, when U.S. President Donald Trump is set to unveil so-called “reciprocal tariffs” that risk escalating the trade war and hurting the global economy. Deutsche Bank analysts said in a note that there are indications investors are growing more worried about the possibility of stagflation in the U.S. due to tariffs. In yesterday’s trading session, Wall Street’s major indices ended lower. Automakers sank after U.S. President Donald Trump imposed a 25% tariff on auto imports starting next week, with General Motors (GM) slumping over -7% to lead losers in the S&P 500 and Ford Motor (F) falling more than -3%. Also, AppLovin (APP) plummeted over -20% and was the top percentage loser on the Nasdaq 100 after Muddy Waters Research issued a short report against the company. In addition, Advanced Micro Devices (AMD) slid more than -3% after Jefferies downgraded the stock to Hold from Buy. On the bullish side, Dollar Tree (DLTR) surged over +11% and was the top percentage gainer on the S&P 500, adding to Wednesday’s +3% gain after selling its Family Dollar business to Brigade Capital Management and Macellum Capital Management for about $1 billion. The U.S. Bureau of Economic Analysis said Thursday that the Q4 GDP growth estimate was revised upward to +2.4% (q/q annualized) in its final print, stronger than expectations of no change at +2.3%. Also, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -1K to 224K, compared with the 225K expected. In addition, U.S. pending home sales rose +2.0% m/m in February, stronger than expectations of +0.9% m/m. “The monthly jobs report may paint a different picture, but [yesterday’s] jobless claims number suggests the labor market is still on solid ground. For markets, though, the question is whether anything will be able to rise above the noise of the tariff story,” said Chris Larkin at E*Trade from Morgan Stanley. “In the near-term, the most likely scenario is more choppy trading,” he added. Richmond Fed President Tom Barkin said on Thursday that swift policy changes by the Trump administration have created “a sense of instability” among businesses, and the accompanying fall in sentiment could “quiet demand.” With a robust labor market and inflation still running high, the Fed’s “moderately restrictive” stance is a “good place to be,” Barkin noted. Also, Boston Fed President Susan Collins said it seems “inevitable” that tariffs will fuel inflation, at least in the short term, adding that holding interest rates steady for an extended period is likely appropriate. Meanwhile, U.S. rate futures have priced in an 88.4% chance of no rate change and an 11.6% chance of a 25 basis point rate cut at the May FOMC meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.7% y/y in February, compared to the previous figures of +0.3% m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate February Personal Spending to be +0.5% m/m and Personal Income to be +0.4% m/m, compared to January’s figures of -0.2% m/m and +0.9% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure at 57.9 in March, compared to 64.7 in February. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.339%, down -0.69%. My lean or bias today is more neutral. PCE could be a catalyst today. Technicals are bearish, Futures are down as I type this but I will go out on a limb and say that if PCE comes in just right, the markets may bounce today. Don't be surprised if we are up later in the day. Trade docket for today:I'll continue to cash flow my long /MNQ scalp. BITO coming to another end of a successful week. We'll either take an assignment there or roll. LULU earnings trade. 1HTE BTC. This continue to be challenging so I'll continue to trade small. 0DTE on SPX, NDX. Let's take a look at the intra-day levels: /ES: I'm working off the 1day chart today to filter out some chop. 5763 is resistance. Above that, the bulls may have another shot at this. 5703 is support. I think things start getting ugly...again if we lose this level. 5666 is the next level down. /NQ: Same goes for the NASDAQ. Upside resistance is all the way up at 20,355. Plenty of upside room for bulls to work. Resistance is right at 19,888. If we lose that level we could see a fall to 19,170. Lot's of room to run, up and down. Today could be a key day for /NQ. BTC: Bitcoin continue to consolidate in a tight zone which makes our 1HTE's tough. 86,313 is near term resistance with 84,946 acting as support. As I said...tight range. Let's book some profit today...for a change! See you all in the live trading room. Let's finish the week strong.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |