|

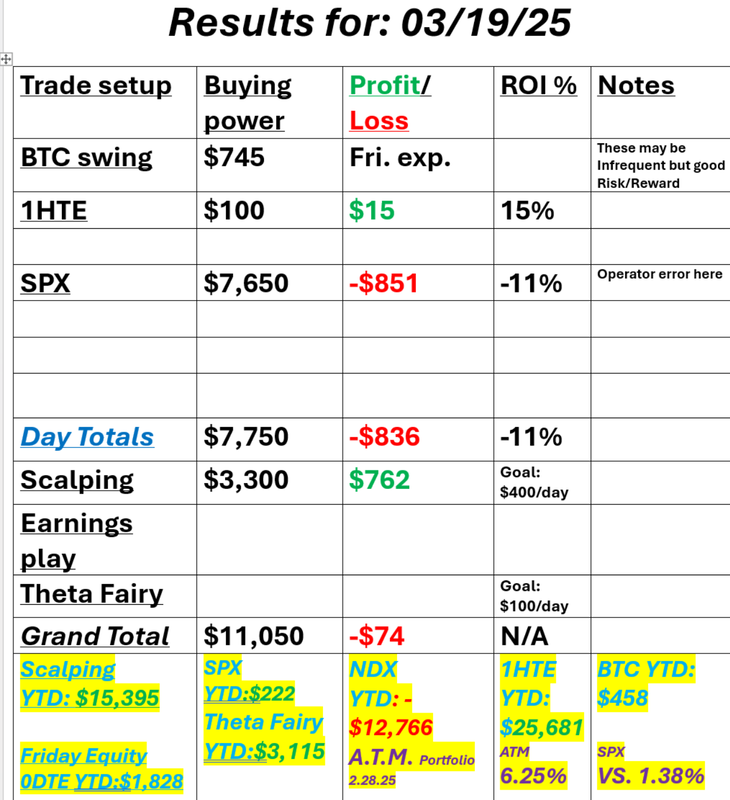

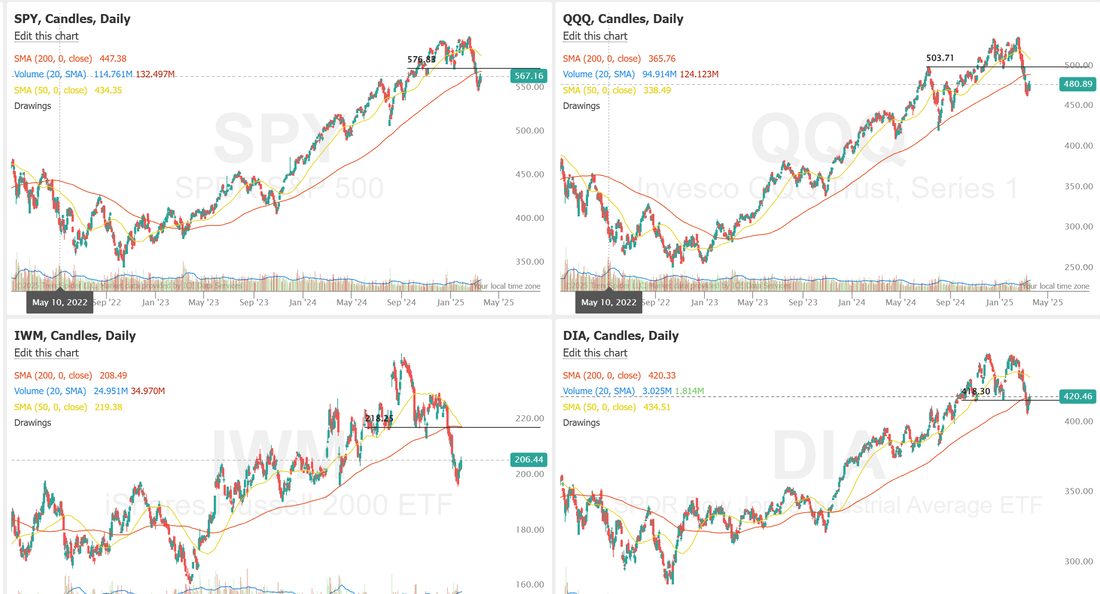

Welcome back traders! FOMC has come and gone and it did NOT disappoint! We had a great day scalping. I'll say this again. You don't need to do every strategy in the world, every day but...#1. You should have them in your bag of tricks. #2. That gives you the ability to pull out different approaches on different days. There's never a guarantee of profits but on days like yesterday, scalping should be a priority. If you're looking for movement, FOMC will usually deliver. I completely ruined a perfect setup in our 0DTE. It was absolutely fine and I rolled up puts at the last moment. That was a mistake. I'll try to do better today. Our risk management was still on point and I guess, if we are not going to make money on a given day we should at least set a goal to not lose. Here's a look at my day: Let's take a look at the markets: With the push up yesterday and the retrace in the futures this morning, we are back to a neutral rating. I quoted an interesting result yesterday that of the last 10 FOMC days, 80% of the time whatever the move on the day, it retraced the next. That statistic looks to improve today as we're getting a retrace in the futures. While the SPY is getting closer to its 200DMA we are still clearly in a bearish stance. All the major indices are in the red YTD. The DIA appears to be having to best support right now. My bias or lean today is bearish. We are below key moving averages. Overhead resistance is heavy, Economic and Geopolitical headwinds persist and again...80% of the time after FOMC, we retrace that days move. If you're bullish here it's probably more of a "gut feeling" vs. any actual technical of fundamental analysis. March S&P 500 E-Mini futures (ESH25) are down -0.43%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.60% this morning, tracking losses in European equities after ECB President Christine Lagarde stated that U.S. tariffs heightened uncertainty over the economic outlook. Stock futures initially moved higher after the Federal Reserve indicated there remains scope to lower interest rates later this year, as any tariff-driven rise in inflation is expected to be temporary. However, concerns remain that U.S. President Donald Trump will keep raising trade tariffs, which could dampen economic growth and drive inflation. Investors now await a flurry of U.S. economic data and earnings reports from several high-profile companies. As widely expected, the Federal Reserve kept interest rates unchanged yesterday. The Federal Open Market Committee voted to maintain the federal funds rate in a range of 4.25%-4.50% for the second consecutive meeting. In a post-meeting statement, officials said that “uncertainty around the economic outlook has increased.” Also, the Fed said that, starting in April, it would further slow the pace at which it is shrinking its balance sheet. In addition, the Fed’s updated Summary of Economic Projections showed that officials anticipate a half percentage point of rate cuts in 2025, implying two quarter-percentage-point reductions, unchanged from their December forecast. At a press conference, Fed Chair Jerome Powell acknowledged the considerable uncertainty stemming from President Donald Trump’s significant policy changes but reiterated that the central bank is in no rush to adjust interest rates. “Inflation has started to move up,” he said, “we think partly in response to tariffs. And there may be a delay in further progress over the course of this year.” However, the Fed chief noted that his baseline expectation is that any inflation increase driven by tariffs will be “transitory.” “The Fed indirectly cut rates [yesterday] by taking action to reduce the pace of runoff of its Treasury holdings. This paves the way for the Fed to eliminate runoff by summer, and, with any luck, inflation data will be in place where reducing the Federal Funds rate will be the obvious choice,” said Jamie Cox at Harris Financial Group. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Boeing (BA) climbed over +6% and was the top percentage gainer on the S&P 500 and Dow after CFO Brian West stated that the plane maker’s cash burn was slowing and provided a positive outlook on the company’s business. Also, Tesla (TSLA) rose more than +4% after the EV maker received California’s approval to begin carrying passengers in its vehicles. In addition, Signet Jewelers (SIG) soared over +17% after the world’s largest diamond jewelry retailer posted upbeat Q4 results and gave strong Q1 revenue guidance. On the bearish side, Gilead Sciences (GILD) fell more than -2% after the Wall Street Journal reported that the Health and Human Services Department plans to significantly cut the federal government’s funding for domestic HIV prevention. Meanwhile, U.S. rate futures have priced in an 83.3% probability of no rate change and a 16.7% chance of a 25 basis point rate cut at the next central bank meeting in May. Today, memory and storage products maker Micron Technology (MU), apparel giant Nike (NKE), and economic bellwether FedEx (FDX), along with other notable companies like Accenture (ACN), Lennar (LEN), and Darden Restaurants (DRI), are slated to release their quarterly results. On the economic data front, all eyes are on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the March Philly Fed manufacturing index will stand at 8.8, compared to last month’s value of 18.1. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 224K, compared to last week’s number of 220K. U.S. Existing Home Sales data will be reported today. Economists foresee this figure coming in at 3.95M in February, compared to 4.08M in January. U.S. Current Account data will come in today. Economists estimate this figure will stand at -$330.0B in the fourth quarter, compared to -$310.9B in the third quarter. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the February figure to be -0.2% m/m, compared to the previous number of -0.3% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.217%, down -0.92%. Jobless claims are the only pre-planned news catalysts for the day that may move the markets. Trade docket for today: Overnight Vampire trade should be a viable entry for this afternoon. NKE, MU, FDX earnings trades. We'll start our Friday Equity 0DTE this afternoon with TSLA, 1HTE BTC trades, 0DTE SPX, Scalping today probably using the same approach that worked so well for us yesterday. Let's look at our intra-day levels: /ES: 5677 is the first resistance zone with 5718 next. I'm most interested in 5619 level. It's the first support level but it's also PoC on the 2hr. chart. It could be a magnet today. 5579 support is below that. BTC: Bitcoin continues to not want to offer us much in terms of great setups. We've had success every day this week with our 1HTE's but the low probabilites meant we position sized way down. to small trade sizes. Remember; There is NO RISK in a trade. The risk lies in the trader. We control how much we risk. I'm not sure todays price action will be any better but we'll stick with our 1HTE's today and maybe switch to a 0DTE if neccessary. The challenge right now is that BTC is sitting just above its 200 period M.A. on the 2hr. chart. This is the demacation point for today. Above could be bullish. Below bearish. That level is 85,176. 87,652 is resistance and 83,658 is support. Lot's of good trade opportunities for us today as well as some good conversations and trainings. I want to explore the thought process behind looking at the probabilites of a trade working vs. the potential profit. It should make for some good converstion around the pros and cons of different setups. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |