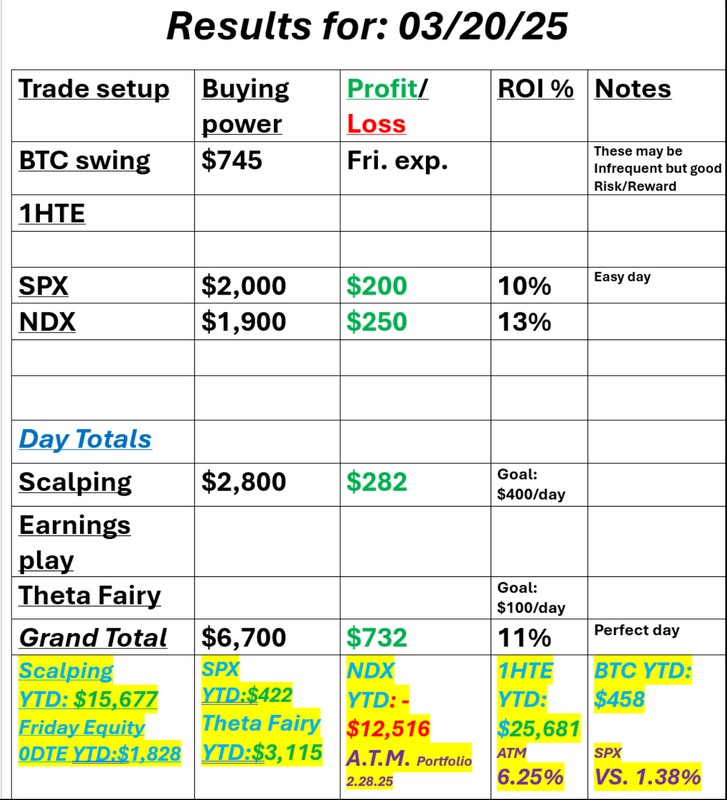

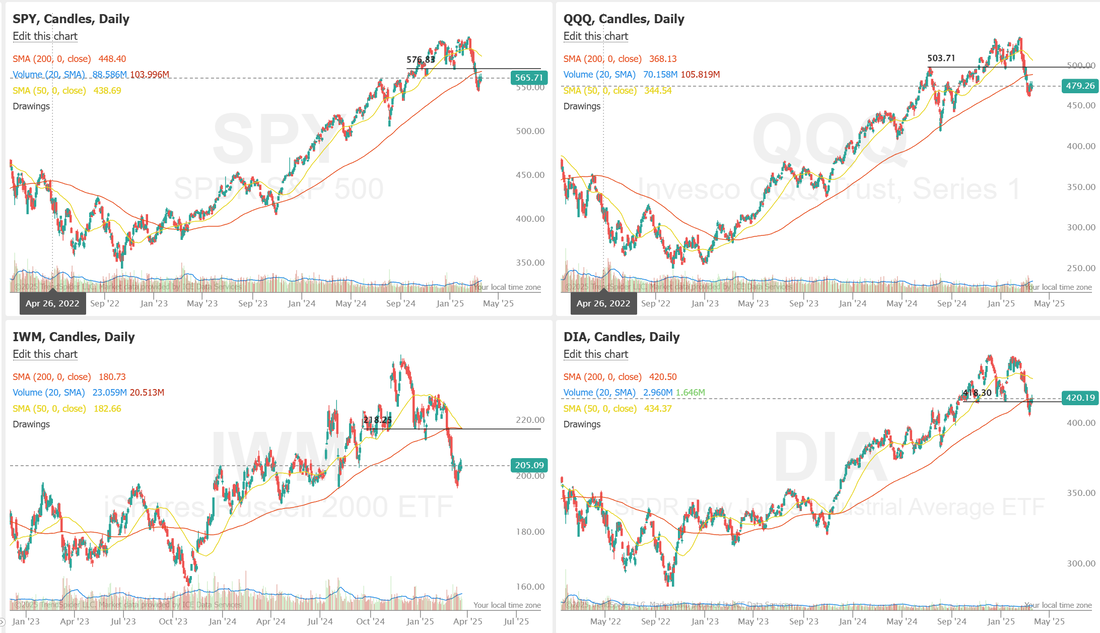

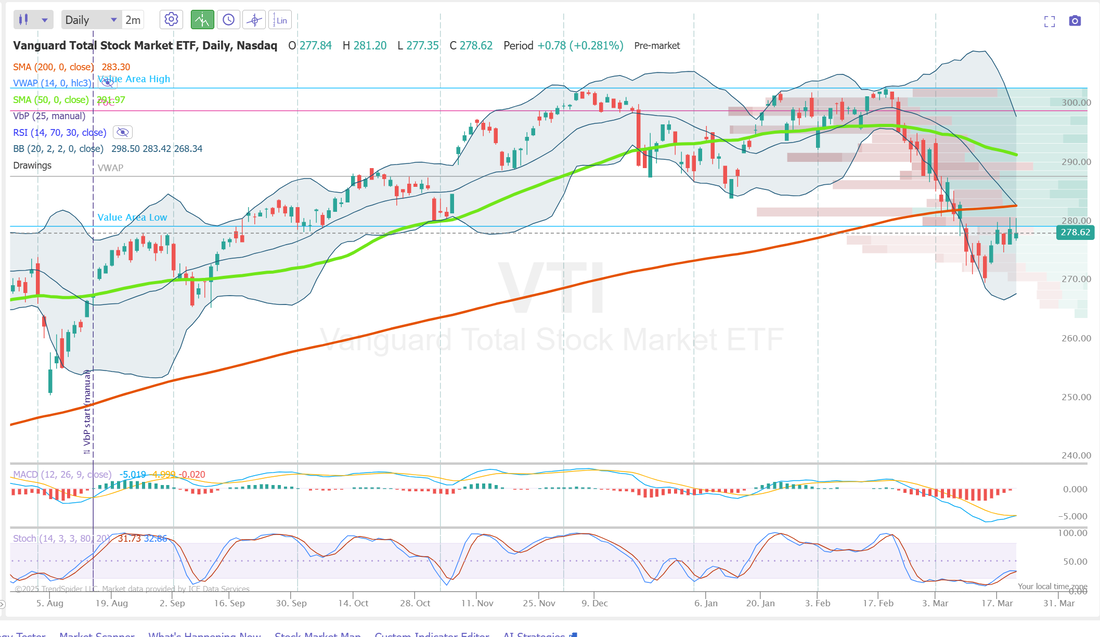

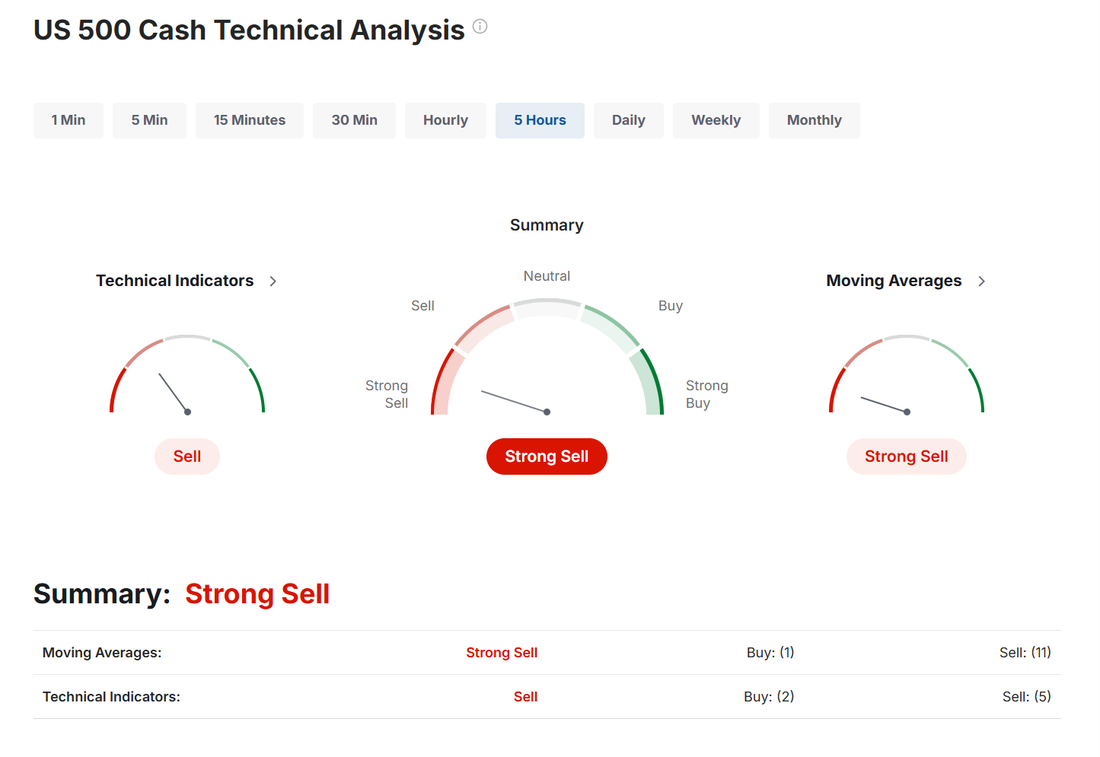

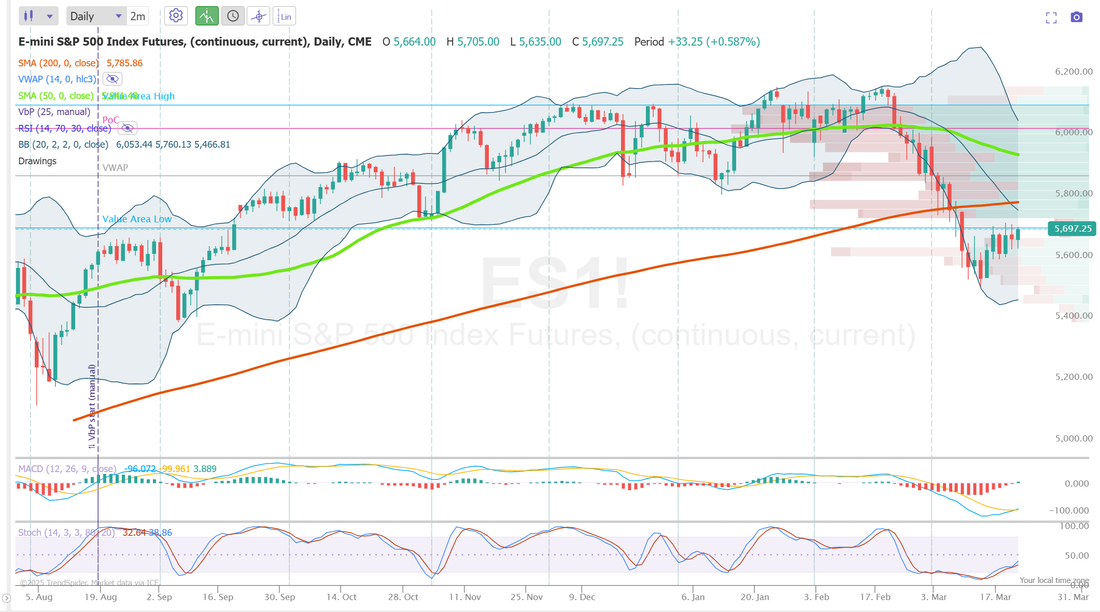

The perfect day.Welcome back traders. Happy Friday. I've been thinking alot after the close yesterday and even as I woke up this morning about the concept or idea of a "perfect day" as a trader. What does it look like? It will obviously be different from individual to individual. The easy, knee-jerk answer is "I made a lot of money!". Making money is certainly part of it. We should enjoy trading but we wouldn't do it without the potential for financial reward however, there is so much more that could/should go into creating a "perfect day" Efficiency is important. We've had plenty of $30,000 profit days but we also used $250,000 of capital. Consistency is important. Nothing is guaranteed but it would be nice to have some expectations of profit on a regular basis. The amount of profit is important as well. We'd love to make $5,000/day but do we really need to? Is that a viable, sustainable goal? Our results yesterday had me asking myself these questions. Initially I was "O.K." with our day. We didn't get rich but we didn't lose however, after thinking about it I believe that our day yesterday was close to "perfect". We were particularly efficient with our deployment of capital. Sitting on almost 80% of our cash. Could we have put more of it to work? Sure but it wouldn't have been great on the reward part of the risk/reward ratio. We made $700 dollars. Did we want more? Sure! Who doesn't? $700 dollars a day, if you can generate it consistenly adds up nicely of a years time. It was a boring day. We joked we could have taken not one but two naps and not missed anything! We want boring! Sitting in a casino for six hours a day, sweating and pulling out our hair is not a sustainable business. We never once worried about our risk getting out of control. I use a simple gut check each day to know immediately if I did a good job that day. "Did I enjoy myself?" If I feel like I've just been through the ringer then, no matter how much I made (or lost) it wasn't a good day. I hope you've got a plan in place that gives you lots of "perfect days". That's what we all strive for. Here's a look at our day: Let's take a look at the markets. We expected a retrace yesterday and that's what we got. It's always easier to trade well when the market does what you expect it to. The overall trend is still obviously bearish however, the bulls are trying! The VTI has spent the last fourdays trying to shake off the bearishness and push higher. No luck so far but, it's trying. Technicals continue to be bearish. Frankly, there's just not a lot to be bullish about. Earnings yesterday were bad and added to the Tariff concerns. We currently have an earnings trade on FDX. While our trade looks solid, the stock is getting whacked. FedEx is a harbinger of the economy and what it's telling us is not good. March S&P 500 E-Mini futures (ESH25) are down -0.35%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.42% this morning as concerns over U.S. tariffs and weak corporate earnings weighed on sentiment. Investors are facing an increasingly uncertain outlook for the global economy amid concerns over the impact of U.S. tariffs. U.S. President Donald Trump said on Sunday that both reciprocal tariffs and specific additional sector-based tariffs would take effect on April 2nd, posing a significant risk to the global economy. Investors also digested some disappointing corporate earnings reports. FedEx (FDX) slumped over -6% in pre-market trading after the shipping giant, which is considered an economic barometer, reported weaker-than-expected FQ3 adjusted EPS and cut its full-year guidance. Also, Nike (NKE) slid more than -4% in pre-market trading after the sportswear giant warned of further declines in revenue and profitability in the current quarter under its turnaround strategy, with the growing trade war adding to uncertainty. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Accenture (ACN) slumped over -7% and was the top percentage loser on the S&P 500 after its chief executive stated that federal spending cuts were beginning to affect the company’s revenue. Also, Microchip Technology (MCHP) slid more than -6% and was the top percentage loser on the Nasdaq 100 after the struggling semiconductor company announced that it had hired Macquarie Group to assist in selling its wafer fabrication plant in Arizona and launched an underwritten public offering of $1.35 billion in depositary shares. In addition, Rivian Automotive (RIVN) fell over -4% after Piper Sandler downgraded the stock to Neutral from Overweight. On the bullish side, Darden Restaurants (DRI) climbed over +5% and was the top percentage gainer on the S&P 500 after the Olive Garden owner provided solid FY25 comparable sales guidance. Economic data released on Thursday showed that the U.S. Philly Fed manufacturing index came in at 12.5 in March, stronger than expectations of 8.8. Also, U.S. February existing home sales unexpectedly rose +4.2% m/m to 4.26M, stronger than expectations of 3.95M. In addition, the number of Americans filing for initial jobless claims in the past week rose +2K to 223K, compared with the 224K expected. At the same time, the Conference Board’s leading economic index for the U.S. fell -0.3% m/m in February, weaker than expectations of -0.2% m/m. Meanwhile, Wall Street is bracing for a quarterly event known as “triple-witching,” during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their positions or initiate new ones. About $4.5 trillion worth of options tied to individual stocks, indexes, and exchange-traded funds are set to mature today, according to an estimate from Citigroup. The U.S. economic data slate is empty on Friday. However, investors will focus on a speech from New York Fed President John Williams. U.S. rate futures have priced in an 83.8% probability of no rate change and a 16.2% chance of a 25 basis point rate cut at the next FOMC meeting in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.221%, down -0.28%. It's triple witching today with $4.5 trillion (that's with a T!) of expirations rolling off today. It could be a volatile one. My bias today is every so slightly bearish. As I said, the bulls are trying but they appear to be outmatched at the present. We have a busy day lined up. Our overnight Vampire trade expires at the open and that looks set to drop $300 profit in our pocket, right off the bat. Nice start to the day. BITO additional cash flow. FDX, MU, NKE are all earnings trades we put on yesterday. They all look set to profit today but we may also be able to add the other side to each of these and turn them into 0DTE's. TSLA is our designated equity 0DTE. /GC possible 0DTE day trade. SPX and possibly NDX 0DTE's. I'm not holding my breath on 1HTE BTC setups today. Scalping could be QQQ's today. Our short /MNQ, /NQ's have worked well the last couple days. The word recession is getting more and more play. 8 times it fell this hard. 8 times we had a recession. It's the Conference Board Leading Indicators divided by Lagging Indicators. All 8 times it fell 10.6% or more, which is the current decline, we were in recession at that very moment. Recession right now. Let's look at the /ES intra-day levels for todays 0DTE trading. I'll skip BTC since it's been tough the last few days and NDX because that will be a late day entry IF we trade it. On a daily chart the /ES actually looks a bit bullish! At least it's trying. It's tried pushing higher the last 6 trading days. It's still below the 200DMA and we are no longer in the oversold zone it's going to need some assistance to go higher. It's not just going to happen. On the 2hr. chart there are a couple key levels for me today. 5729 is the first resistance. It's also the 200 period M.A. 5770 is the next resistance. That aligns with the high value node area. 5675 is first support and rests just above the 50 period M.A.. 5618 is the next. I got the info on the Costa Rica Investment property yesterday. I'll put up a video on the youtube channel this weekend with the details and the term sheet and post the link in discord for those who expressed an interest. See you all in the live trading room shortly! Bottom line: Develop a plan. Here's our saying from the trading room, "You develop your Rules. You practice your Rules. You revise your Rules. You practice your new Rules. You follow your Rules. You Rule. “Own your trade”.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |