|

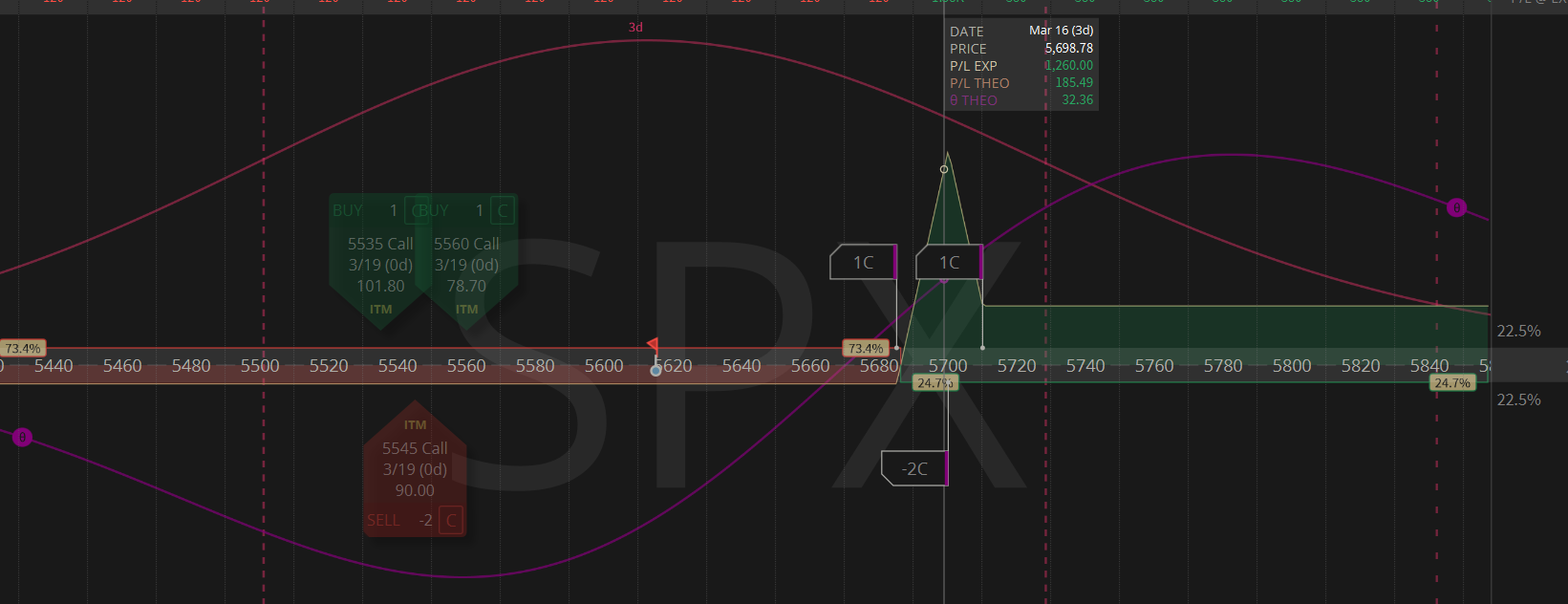

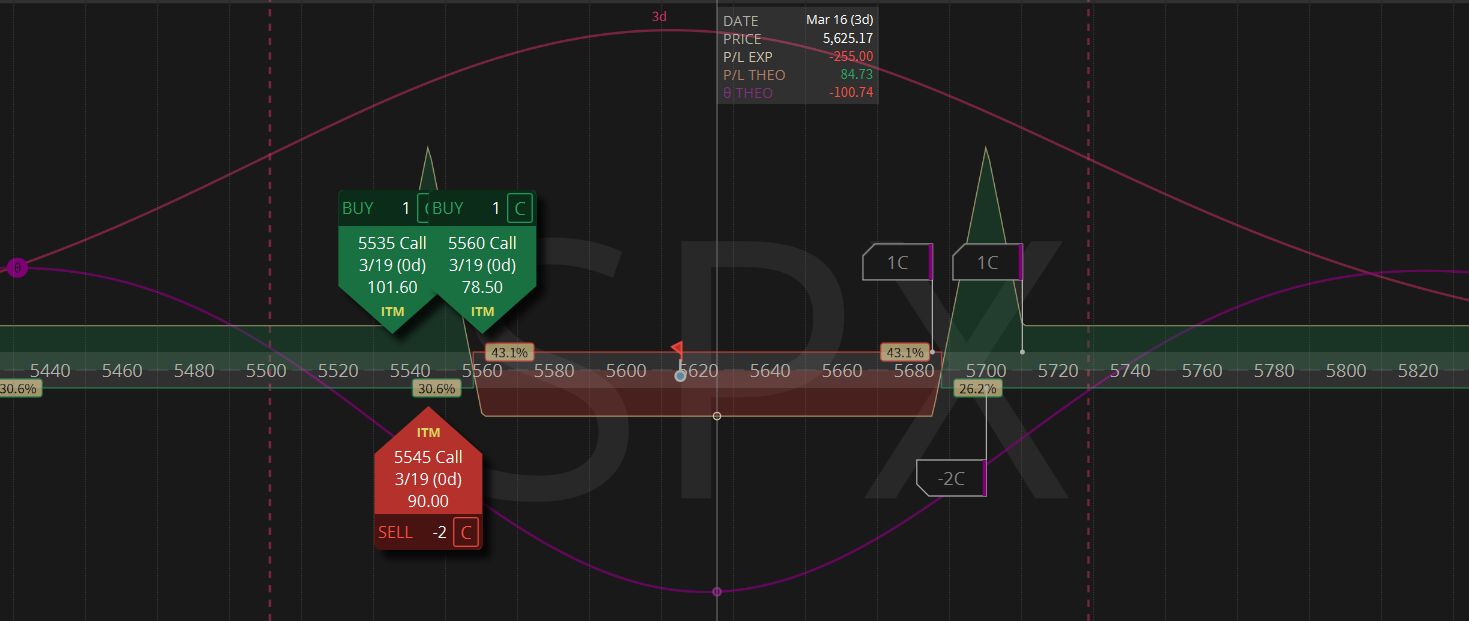

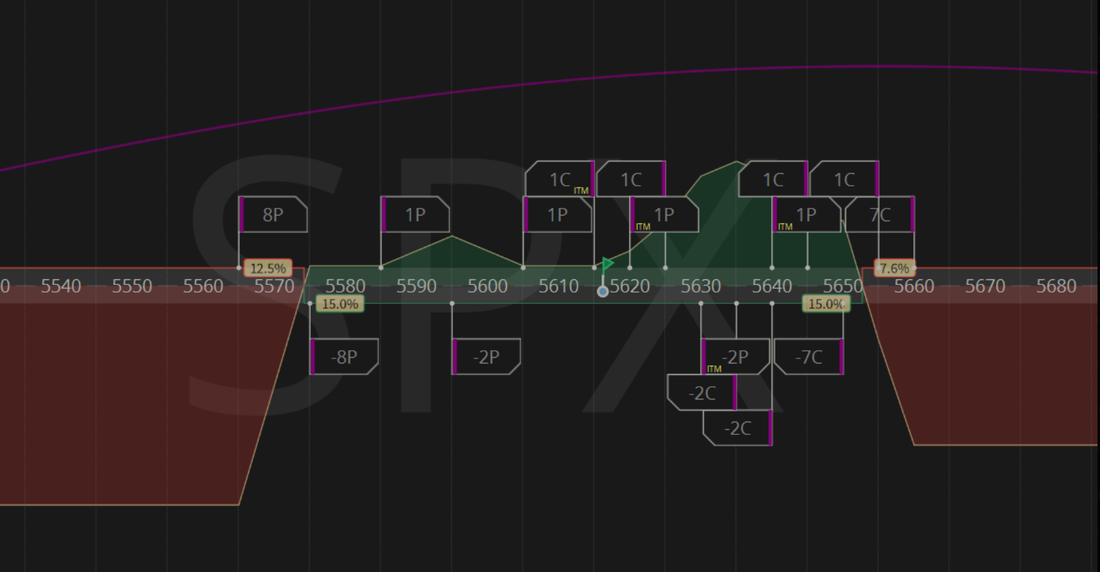

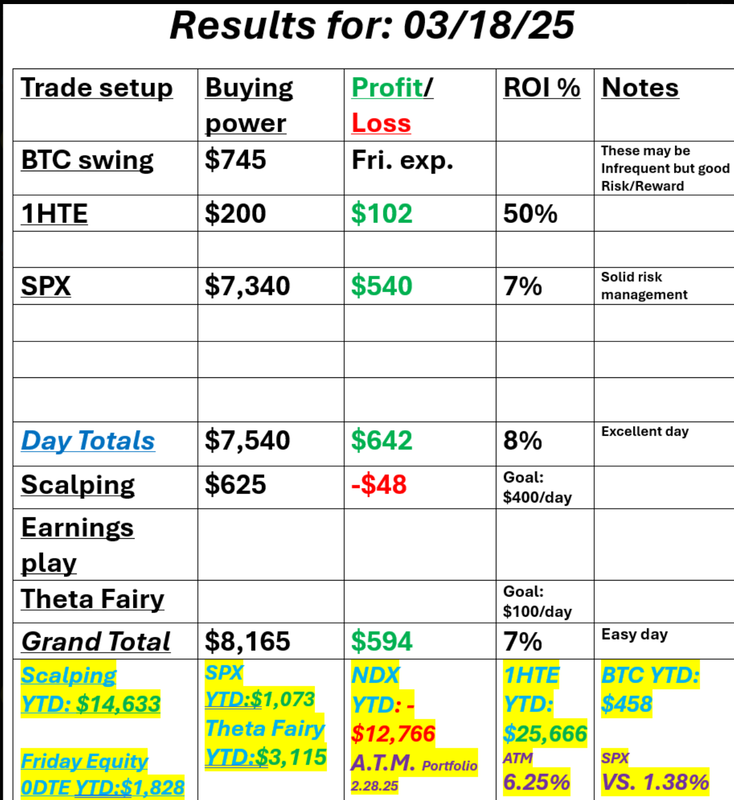

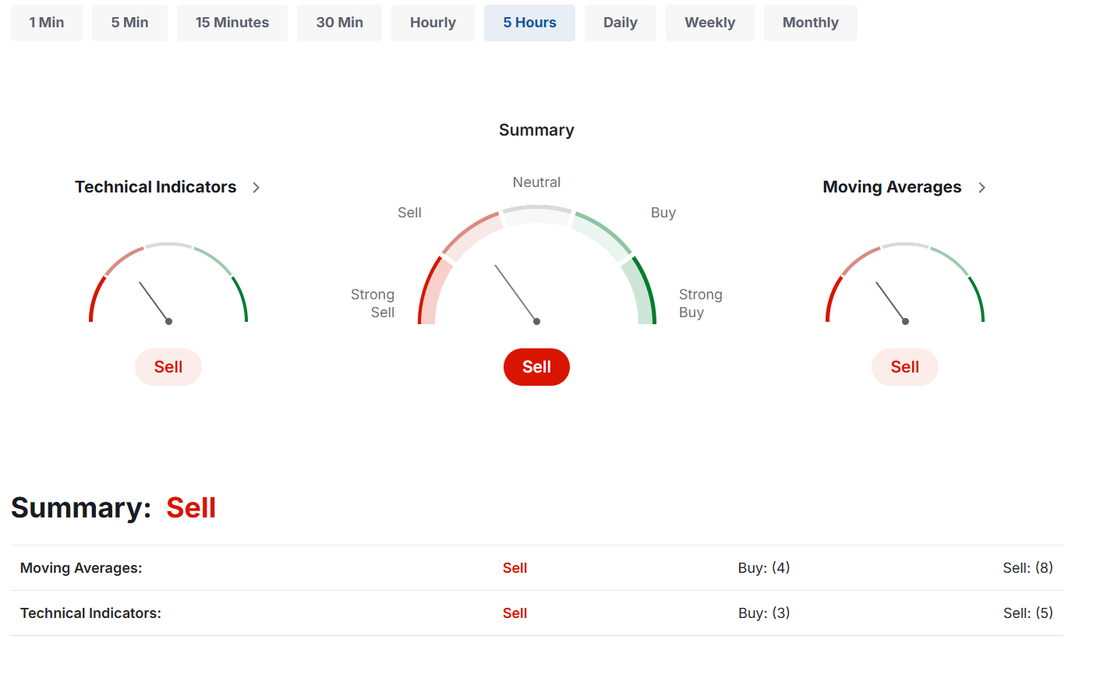

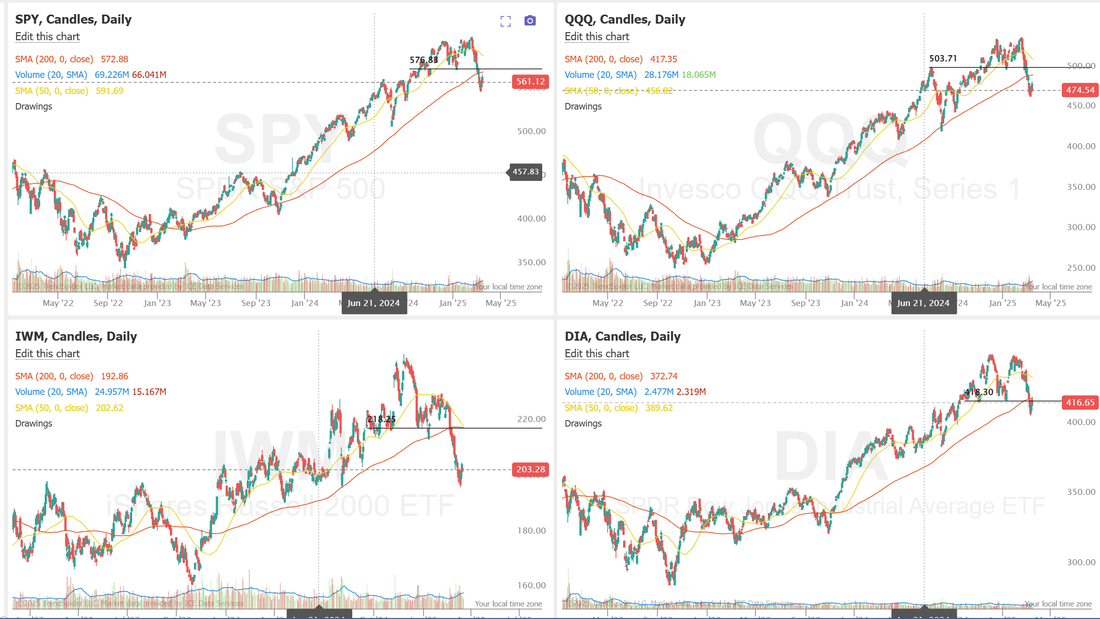

Welcome back traders! Welcome to FOMC day for those that celebrate it! As traders, we just want movement and FOMC days usually delivers. We've already got our first tiny position working We'll come out of the gate adding the put side. And then work to fill in the "valley of death" as the day progresses towards Powells testimony. We had a picture perfect day yesterday. Not because we made maximum profits. In fact, we ended up in the lowest profit range. No, it was picture perfect because it was an easy day. You could have napped most of our day. Good risk management. Good captial deployment and no nail biting! Prioritizing risk management over profits continues to feel good and not stressing about your trades is a "payoff" just as much as a cash profit. Take a look at our days results: March S&P 500 E-Mini futures (ESH25) are up +0.21%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.22% this morning, pointing to a slightly higher open on Wall Street as investors await the Federal Reserve’s policy decision and Chair Jerome Powell’s comments. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed lower. The Magnificent Seven stocks sank, with Tesla (TSLA) sliding over -5% and Meta Platforms (META) falling more than -3%. Also, travel stocks retreated on economic concerns, with Royal Caribbean Cruises (RCL) slumping over -7% and Norwegian Cruise Line Holdings (NCLH) dropping more than -4%. In addition, Bakkt Holdings (BKKT) plummeted over -27% after Bank of America and Webull Pay announced they would not renew their commercial agreements with the company. On the bullish side, Harrow Health (HROW) surged more than +15% after the company reported better-than-expected preliminary Q4 revenue. Economic data released on Tuesday showed that U.S. housing starts rose +11.2% m/m to 1.501M in February, stronger than expectations of 1.380M. Also, U.S. February building permits, a proxy for future construction, fell -1.2% m/m to 1.456M, stronger than expectations of 1.450M. In addition, U.S. industrial production advanced +0.7% m/m in February, stronger than expectations of +0.2% m/m, while manufacturing production gained +0.9% m/m, stronger than expectations of +0.3% m/m. At the same time, the U.S. February import price index unexpectedly rose +0.4% m/m, stronger than expectations of -0.1% m/m. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. The Federal Open Market Committee is widely expected to hold the Fed funds rate steady at 4.25% to 4.50%. Market watchers will closely follow Chair Jerome Powell’s post-policy meeting press conference and the central bank’s quarterly “dot plot” in its Summary of Economic Projections for clues on the path ahead. For now, Fed officials have indicated they are in a wait-and-see mode as they look for further progress on inflation and more clarity on the economic impact of President Trump’s policies. “The ongoing trade tensions and tariff implementations under President Trump’s administration have introduced significant uncertainty,” said Jay Woods at Freedom Capital Markets. “Investors are eager to understand how these policies are influencing the Fed’s economic outlook, especially concerning inflation and growth projections.” A survey conducted by 22V Research showed that investors are monitoring the March Fed meeting more closely than the previous three meetings. “Our survey respondents lean risk-off vs risk-on (34% vs 27%, respectively). We also asked what people think the other respondents expect, and more investors expect a risk-on reaction than people thought,” said Dennis DeBusschere, founder of 22V. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, which is set to be released in a couple of hours. Economists expect this figure to be 0.800M, compared to last week’s value of 1.448M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.291%, up +0.23%. The focus today is not so much on the FEDs rate policy but Powells testimony and forward looking comments. Trumps tariffs and economic policies could weigh on the economy. Will that give Powell more leeway to cuts rates at the next FED meeting? While there is little to no expectation of a rate cut happening today, the question of how many future cuts we get this year (estimates range from zero to three) may become more transparent today. I don't lay out a lean or bias on FOMC days and I don't give intra-day levels either. There will, most likely, be a flurry and volume spike at the release of the minutes but it will be Powells testimony and something (who knows what?) that the algos will grab onto and likely get the indices moving. It's going to take us where it takes us. Our Job today it to not create any pre concieved ideas or bias and simply trade what the market gives us. These are usually pretty solid days for us. Bearish mode is still hanging in there as we start the day: Could Powells testimony be enough to get us back to the 200DMA's? There a ways up there but it's possible. All the major indices are down on the year with the market briefly hitting -10%+ for a formal declaration of a "bear" market. While markets are losing our A.T.M. (Asymmetric trade management) asset allocation model portfolio continues to shine. A portfolio that can make money when markets drop is just the ticket for this kind of investing enviroment. Trade docket for today will focus on Scalping, most likely with the /MNQ, /NQ today. 1HTE BTC trades and our main focus on SPX 0DTE. Our chances for a $1,000+ day are usually pretty good on FOMC days. I'll see you all in the live trading room shortly and we'll continue to build up our SPX setup for the day.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |