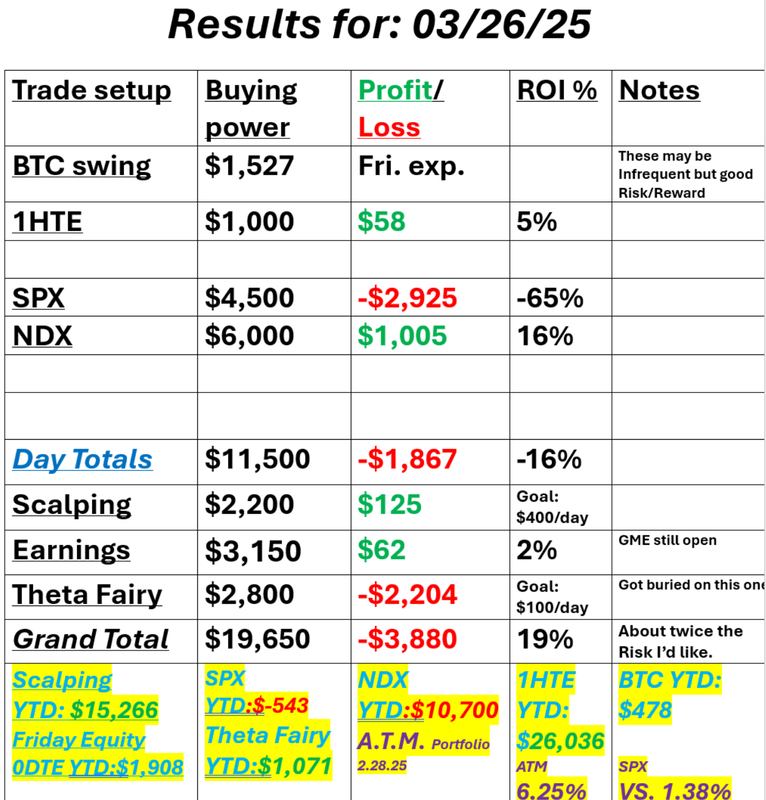

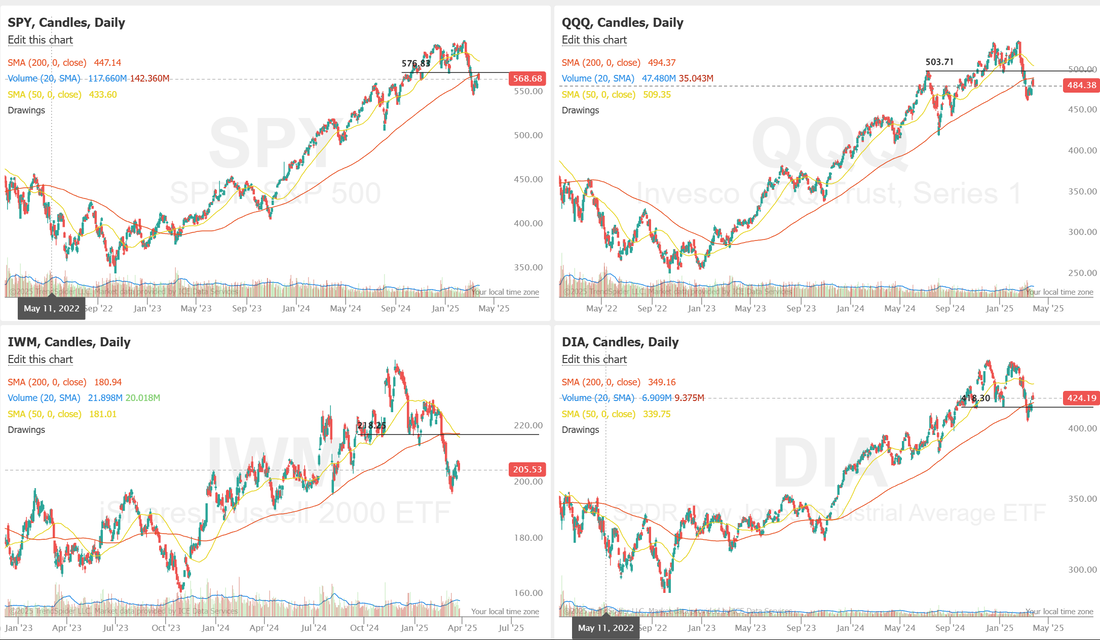

Risk of ruinWelcome back traders! This week is going by fast. Yesterday was a losing day for me overall. That's fine...it happens. It will happen again. That's how trading works. No trader makes money every day but...one thing we discussed yesterday in the trading room was, how much loss is too much? Risk of ruin is an important topic for traders to understand. Generally it focuses on how much risk will wipe you out. How much risk will blow up your trading account. That's important to know if you are trading a small amount. Say 2-5K. I prefer to use to to gauge how much risk (or loss) is acceptable. 2% of your account is the general rule. I lost almost 4% yesterday so that's about twice as much risk as I should have allowed. I'll work harder today to keep that in check. Here's my results from yesterday. Fortunately for us our Asset allocation portfolio just keeps kicking butt. The A.T.M. program is just killing the market this year and maybe more importantly, it's passive. Set it in the morning and forget it. I'm very excited to see what our year end result will be. We'll update the Monthly figures next week. If you'd like a passive approach that is crushing it right now come check it out. Let's take a look at the markets: Yesterdays sell off took the wind out of the bulls sails. We didn't last long above the 200DMA. Only the DIA remains bullish. une S&P 500 E-Mini futures (ESM25) are down -0.01%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.04% this morning as investors weigh U.S. President Donald Trump’s announcement of a 25% tariff on automotive imports. President Trump signed a proclamation on Wednesday to impose a 25% tariff on auto imports. The auto tariffs are set to take effect at 12:01 a.m. Washington time on April 3rd, initially applying to fully assembled vehicles. By May 3rd, the scope will widen to cover key automobile parts such as engines, transmissions, powertrain components, and electrical systems, with the possibility of further expansion if needed, according to the proclamation. As a result, shares of legacy automakers slumped in pre-market trading, with General Motors (GM) sliding over -5% and Ford Motor (F) falling nearly -3%. Investors now await a fresh batch of U.S. economic data, including the third estimate of fourth-quarter GDP and jobless claims figures, as well as comments from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indexes closed in the red. The Magnificent Seven stocks sank, with Nvidia (NVDA) slumping over -5% to lead losers in the Dow and Tesla (TSLA) sliding more than -5%. Also, chip stocks retreated, with Arm Holdings (ARM) dropping over -7% to lead losers in the Nasdaq 100 and Advanced Micro Devices (AMD) falling more than -4%. In addition, AI infrastructure stocks plunged after TD Cowen said that Microsoft abandoned more data center projects in the U.S. and Europe, with Super Micro Computer (SMCI) slumping over -8% to lead losers in the S&P 500. On the bullish side, Cintas (CTAS) climbed more than +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat FQ3 results and raised its full-year EPS guidance. “Uncertainty on the tariff front remains ridiculously high, leaving it incredibly tough for businesses or consumers to plan more than about a day into the future, and still making it nigh-on impossible for market participants to price risk,” said Michael Brown, a strategist at Pepperstone Group Ltd. Economic data released on Wednesday showed that U.S. durable goods orders unexpectedly rose +0.9% m/m in February, stronger than expectations of -1.1% m/m, while core durable goods orders, which exclude transportation, advanced +0.7% m/m, stronger than expectations of +0.2% m/m. Minneapolis Fed President Neel Kashkari said on Wednesday that unpredictable fiscal policies under President Donald Trump’s administration are clouding the central bank’s economic outlook. He noted that the Fed should “just sit where we are for an extended period of time until we get clarity.” Also, St. Louis Fed President Alberto Musalem said it’s uncertain whether the impact of tariffs will be temporary and warned that secondary effects might prompt policymakers to keep interest rates unchanged for longer. Meanwhile, U.S. rate futures have priced in a 90.4% probability of no rate change and a 9.6% chance of a 25 basis point rate cut at May’s monetary policy meeting. Today, all eyes are on the Commerce Department’s final estimate of gross domestic product, which is set to be released in a couple of hours. Economists expect the U.S. economy to expand at an annual rate of 2.3% in the fourth quarter, in line with initial estimates. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 225K, compared to last week’s number of 223K. U.S. Pending Home Sales data will be reported today. Economists foresee the February figure coming in at +0.9% m/m, compared to the previous figure of -4.6% m/m. U.S. Wholesale Inventories data will be released today as well. Economists forecast the preliminary February figure at +0.7% m/m, compared to +0.8% m/m in January. In addition, market participants will be looking toward a speech from Richmond Fed President Thomas Barkin. On the earnings front, fitness apparel maker Lululemon Athletica (LULU) is set to report its Q4 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.392%, up +1.24%. There's a fair amount of "chat" out there today that could trigger some moves: Docket 08:30 ET US GDP Q3 Final GDP QoQ – Forecast: 2.3% | Prior: 2.3% | Range: 2.6% / 1.3% Price Index – Forecast: 2.4% | Prior: 2.4% | Range: 2.5% . 2.4% Core PCE – Forecast: 2.7% | Prior: 2.7% | Range: 2.8% / 2.6% US Weekly Initial & Weekly Jobless Claims Initial Claims – Forecast: 225k | Prior: 223k | Range: 240k / 215k Continued Claims – Forecast: 1.885M | Prior: 1.892M | Range: 1.91M / 1.866M 11:30 ET US sells $75 bln 4-Week Bills Speakers 09:00 ET ECB’s de Guindos speaks in a conversation with IIF Managing Director and Chief Economist Marcello Estevão at the 2025 IIF European Summit – Europe at a Crossroads: a Time to Act for Competitiveness and Growth 12:15 ET ECB’s Wunsch speaks in Brussels (same event as above) 12:45 ET ECB’s Escriva speaks in Brussels (same event) 14:40 ET ECB’s Schnabel delivers the “Mais Lecture 2025: Financial literacy and monetary policy transmission” in London. 16:30 ET Fed’ Barkin gives a lecture at Washington and Lee University, followed by an audience Q&A. Text and Q&A are expected. Fed’s Collins speaks in a fireside chat on the economic outlook and monetary policy in Boston. No text is expected, but there will be a Q&A Trade docket today: We didn't get the CPER/USO pair trade initiated yesterday. /MNQ scalp, /ES, We should be able to get a take profit on our GME position today. 1HTE BTC, SPX/NDX 0DTE, LULU earnings trade. My bias or lean today: Brearish. I was bullish yesterday. I thought the bulls would be able to hold the 200DMA. That clearly didn't happen. If your a bull don't despair. Recapturing the loss of something as technically big as the 200DMA rarely happens in a day. Somtimes it can take weeks however, The bears didn't do the bulls any favors yesterday. With "tariff talk" hanging over the markets at least through April 4th (and probably much, much longer) there's enough uncertainty that the bulls will need some sort of a white knight to show up and give a helping hand. Goldman Sachs calls buying the S&P 500 after a 5% dip one of the market's most reliable short-term signals—and this month, it fired again. We ran the backtest: buy SPY when price drops 5% from 50-day highs and exit three months later. Over the last 20 years, this strategy has delivered: Position win rate: 72%

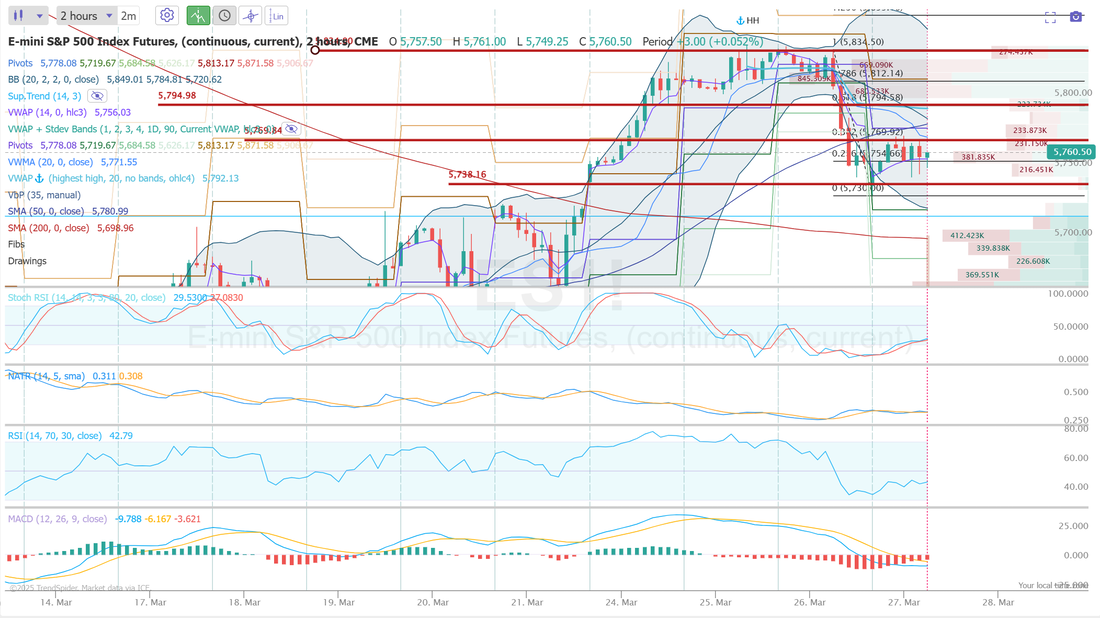

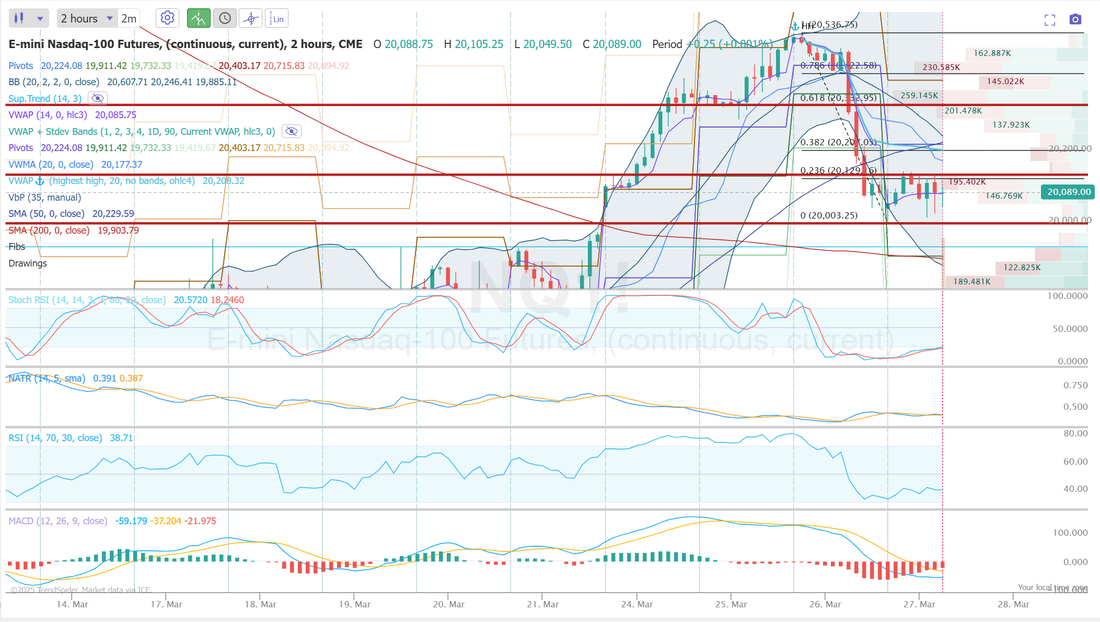

Let's take a look at intra-day levels: /ES: 5769 is the first hurdle for bulls. If they can get above that then 5794 comes into play. 5738 is support. /NQ: 20,137 is the first hurdle. 20,335 is a quite a bit higher as the next. 20,003 is support. BTC: Bitcoin continues to offer little in the way of a good risk/reward for our 1HTE's. We've have winners every day but they've been small. 87,673 is first resistance with 88,764 next. 85,782 is support. We'll continue to trade small today. I'll see you all shortly in the live trading room. Let's make it a green day!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |