|

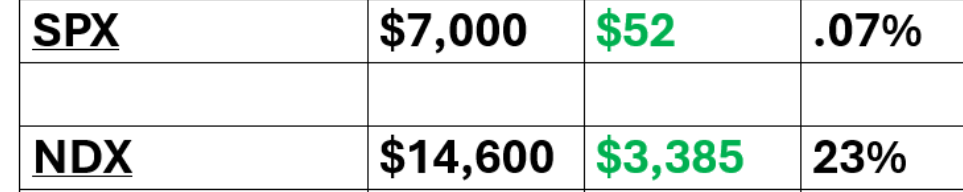

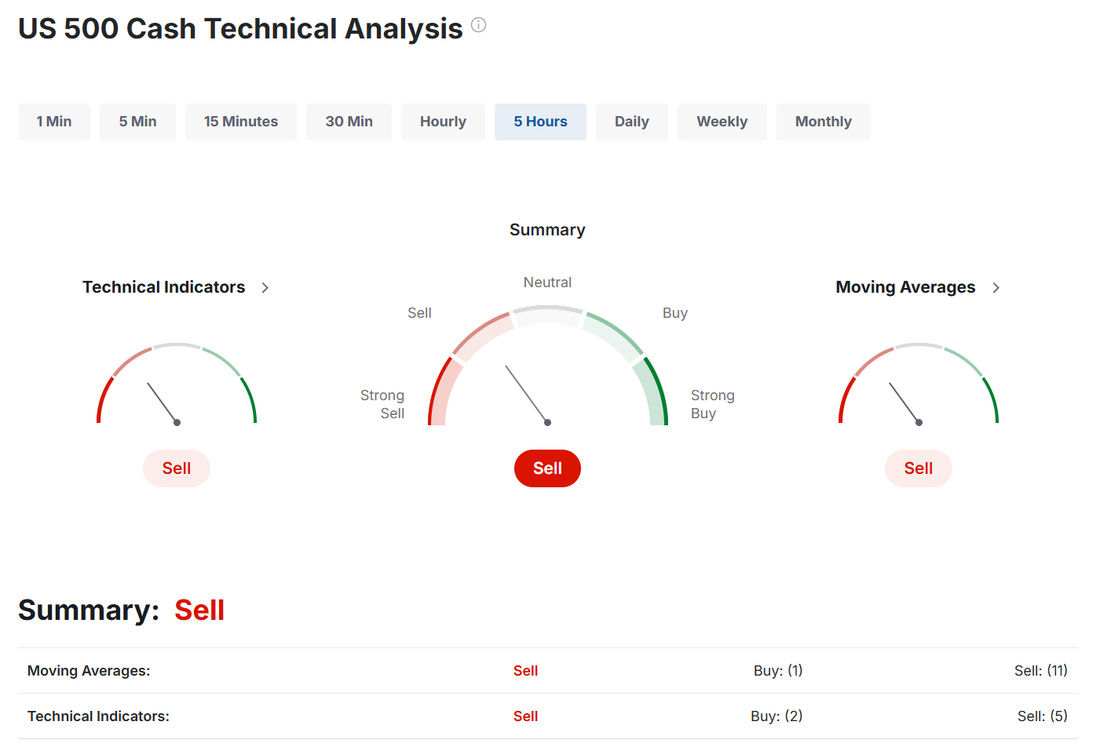

Welcome back to Friday! It feels like this week has flown by. It's definately a net postive to have breaks in your trading schedule. Yesterday was quite the roller coaster. Before we talk about our results lets focus on the price action. It may certainly seem as though the erradic movement of yesterday was atypical, I would suggest it was very typical of a neutral techincal rated day when we were sitting right at critical support levels. Most of you who have traded with my for a while know, I'm not a fan of neutral rating technical days. They are almost exclusively erradic and incredibly hard to read. That coupled with the fact that the markets are just hanging on it critical support levels and well...it made for an especially tricky day. As far as our results, I'm pleased we were able to pull a profit on the day, even if it was slight. One key point I continue to make in our trading room is, "differsify your postions". The only reason I can think of to NOT do both SPX and NDX setups together is you purposely want to concentrate risk. That can be a valid rational, at times. The NDX has more profit potential and the SPX is generally easier to trade so selecting only one seems to make sense, however, concentrating your risk will create uneven results. Take the last two trading days for example. Tues. saw the NDX profit explode while the SPX did little. Yesterday saw the SPX profit hit for a home run and the NDX lost. Lack of buying power is NOT an issue or impediment to doing both as we've talked about the ability to use the XSP instead of the SPX and the /MNQ instead of NDX to potentially reduce your buying power requirements by 90% O.K. on to our results from yesterday. Let's take a look at the market as we get ready to finish off the week. We have an ever so slight sell rating to start the day. When I say we are quickly approaching some very key support levels, this is what I mean. With all our major indices pushing below their 50DMA and key, critical support areas hovering just below current prices it becomes critical for the bulls to hold here. Any further weakness could trigger significant downside price action. March S&P 500 E-Mini futures (ESH25) are trending up +0.29% this morning, indicating an attempt by the benchmark index to snap a five-session losing streak, while investors awaited U.S. manufacturing data and remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended lower. Tesla (TSLA) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the EV giant reported weaker-than-expected Q4 vehicle deliveries and posted a fall in annual deliveries for the first time in over a decade. Also, Apple (AAPL) slid more than -2% after Reuters reported that the tech giant was offering rare discounts on several iPhone models in China due to rising competition from domestic rivals. In addition, SoFi Technologies (SOFI) dropped over -8% after Keefe Bruyette downgraded the stock to Underperform from Market Perform with a price target of $8. On the bullish side, Constellation Energy (CEG) climbed more than +8% and was the top percentage gainer on the Nasdaq 100 after announcing it has secured two contracts with the U.S. government to supply over $1 billion in electricity and services. Also, chip stocks advanced, with ARM Holdings (ARM) and Micron Technology (MU) gaining over +3%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -9K to an 8-month low of 211K, compared with the 222K expected. Also, the U.S. December S&P Global manufacturing PMI was revised upward to 49.4, beating the consensus of 48.3. In addition, U.S. construction spending was unchanged m/m in November, weaker than expectations of +0.3% m/m. “The claims data are consistent with a labor market that is strong enough to allow the Federal Reserve to proceed with rate cuts at a more measured pace in 2025,” said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics. Meanwhile, U.S. rate futures have priced in an 88.8% probability of no rate change and an 11.2% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. Today, all eyes are focused on the U.S. ISM Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the December ISM manufacturing PMI will be 48.2, compared to November’s figure of 48.4. Also, market participants will be looking toward a speech from Richmond Fed President Tom Barkin. On the political front, investors will be monitoring the U.S. House Speaker vote later today to see if Mike Johnson will retain his position. Republican infighting over his reelection might spell trouble for Trump’s agenda, according to Tom Essaye, founder of the Sevens Report. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.553%, down -0.48%. Trade docket today: Manufacturing PMI and FED Barkin speaking today should be the main news catalysts to drive price action Docket 10:00 ET US ISM Manufacturing PMI for December Median Forecast: 48.2 | Prior: 48.4 | Range: 49.7 / 46.9 Manufacturing Prices Paid Median Forecast: 51.4 | Prior: 50.3 | Range: 53.7 / 51 Speakers 11:00 ET Fed’s Barkin gives keynote remarks at an event hosted by the Maryland Bankers Association, in participation with the Maryland Association of CPAs, Maryland Chamber of Commerce, Maryland Realtors, and Maryland Retailers Alliance. Text and Q&A expected ECB’s Lane participates in a panel on “Geopolitical Fragmentation” hosted by the American Finance Association at the annual meeting of the American Economic Association/Allied Social Science Associations in San Francisco. These happen a bit into the trading day. I don't think there is any rush to get trades started BEFORE these two events. Patience is key today. My plan today is to continue working our long /MNQ scalp which produced for us yesterday and focus on our two 0DTE's. Bitcoin price action is pretty dead at the moment and doesn't look to provide good 1HTE or swing setups for the day so I'll probably skip them. My lean or bias for the day is more neutral. Futures are up currently, as I type but I don't see much upside in this market at present and while we may get some weakness again today, I don't see up breaking major support levels...at least not yet. Let's take a look at our intra-day levels: /ES; The price action for the last month has been erradic, to say the least. It is however creating lower lows and lower highs. The once mighty 6000 support leve is now more of a resistance zone. 5996 is current resistance wth 5887 acting as new support. /NQ: 21511 is resistance with 21039 acting as support. It's a wide, 500+ point chop zone at this time. This means we could see a 250+ point upswing and then a 250+ downswing and it wouldn't be that meaningful in the big picture. That's a big range. BTC: Bitcoins range is exactly the same as yesterday at 99,008 resistance and 94,326 support. As I mentioned above, I believe I'll be skipping any BTC trade setups today unless we get some movement. The current risk/reward isn't very favorable. I'll see you all in the live trading room shortly. Let's make some green to close out the week!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |