|

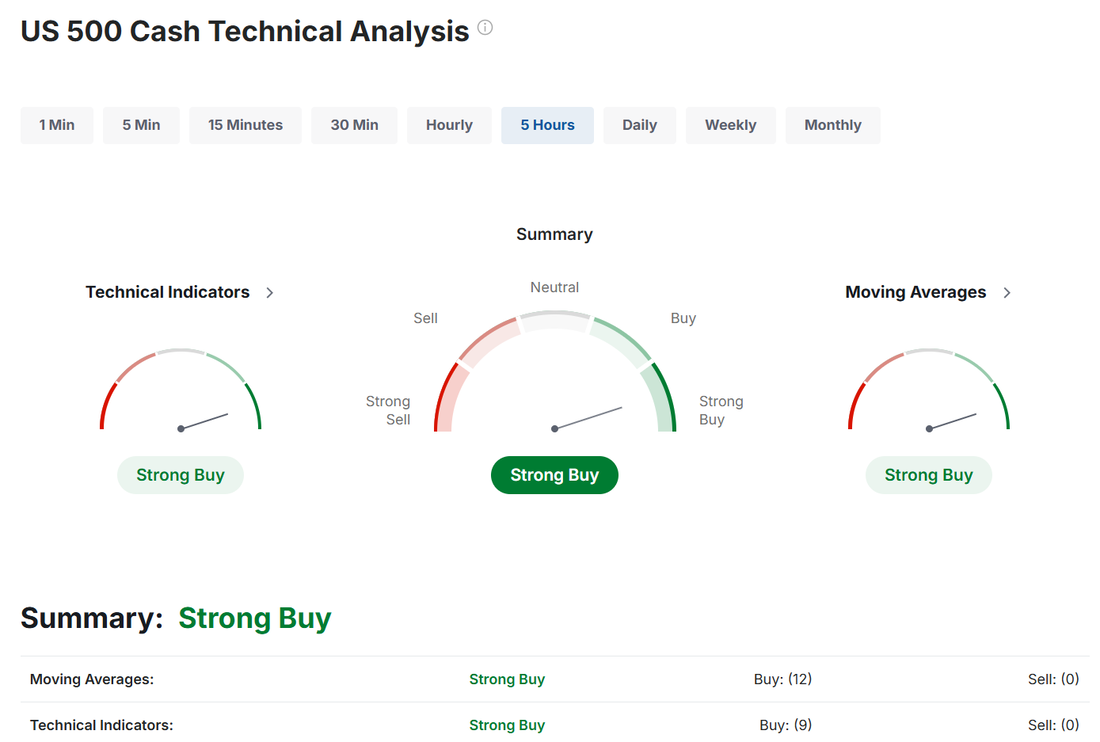

Welcome back traders! We had an epic day yesterday. Our Nat gas trade looks like it will finish out with about $4,000 in profit and our 1HTE's killed it yesterday. When these hit they hit harder than any thing else that we trade. Where else can you get 15% return potential in 20 mins. time? Scalping continues to perform. We are right on track for our $100,000 yearly income goal. Here's our results below. Let's take a look at the markets: Bullish price action continues to build. While we still churn inside a wide chop zone, there were some significant achievments yesterday. Three of the four major indices are now firmly above their 50DMA with the IWM close. March Nasdaq 100 E-Mini futures (NQH25) are trending up +0.82% this morning as optimism over more artificial intelligence spending under Donald Trump and strong quarterly results from Netflix boosted sentiment. U.S. President Donald Trump announced Tuesday billions of dollars in private-sector investments aimed at building artificial intelligence infrastructure in the United States. OpenAI, SoftBank, and Oracle announced plans to create a new company, named Stargate, which will develop “the physical and virtual infrastructure to power the next generation of AI,” including data centers around the country. The companies will initially invest $100 billion in the project, with additional firms expected to join the venture, bringing total investment in the program up to $500 billion over the coming years. The project is expected to create over 100,000 jobs, with construction already in progress in Texas. “We’re starting off with tremendous investment coming into our country at levels that nobody’s really ever seen before,” Trump said at the White House. Netflix (NFLX) surged over +14% in pre-market trading after the streaming giant reported stronger-than-expected Q4 results, raised its 2025 revenue guidance, and announced a $15 billion boost to its share repurchase program. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green, with the S&P 500 notching a 1-month high, the Dow notching a 5-week high, and the Nasdaq 100 notching a 2-week high. Vistra Corp. (VST) surged over +8% and was the top percentage gainer on the S&P 500 after Evercore ISI resumed coverage of the stock with an Outperform rating and a price target of $202. Also, 3M Company (MMM) climbed more than +4% and was the top percentage gainer on the Dow after the industrial conglomerate posted better-than-expected Q4 adjusted EPS. In addition, Moderna (MRNA) gained over +5% after the drugmaker secured a $590 million government contract to accelerate the development of its bird flu vaccine. On the bearish side, Walgreens Boots Alliance (WBA) slumped more than -9% and was the top percentage loser on the S&P 500 after the U.S. Justice Department sued the company for allegedly contributing to the opioid crisis. Also, Apple (AAPL) slid over -3% and was the top percentage loser on the Dow after Jefferies downgraded the stock to Underperform from Hold with a price target of $200.75. “For the first time this year, bulls have some momentum to work with,” said Chris Larkin at E*Trade from Morgan Stanley. “Stocks are coming off their biggest up week in more than two months, as traders embraced cooler-than-expected inflation data and strong earnings from big banks. With a light economic calendar this week, earnings may dictate whether the S&P 500 can post back-to-back up weeks for the first time since early December.” The fourth-quarter earnings season is gathering pace, with investors awaiting reports from notable companies today, including Procter & Gamble (PG), Johnson & Johnson (JNJ), Abbott Laboratories (ABT), Kinder Morgan (KMI), and Travelers (TRV). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the December figure to be -0.1% m/m, compared to the previous number of +0.3% m/m. U.S. rate futures have priced in a 99.5% probability of no rate change at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.570%, down -0.09%. Another busy day for us. /MNQ scalping. /NG, ASUR, DJT, LRN, NFLX, QTTB, UAL, AA, UNP, GE, AAPL, MRK, CRNX, JSPR, MNRO, VALU, LENZ, AROC, CDRE, FET, GME. Let's take a look at our intra-day levels: /ES: New levels today are 6131 resistance with 6079 support. /NQ: 22,067 is new resistance with 21,781 support. BTC: Bitcoin is in play! Our 1HTE's yesterday were epic. Levels are about the same as yesterday. $109,935 resistance with $102,072 acting as support. My lean or bias today continues to be bullish but with a small caveat. Futures are up sharply, largely attributable to the blow out NFLX earnings. I think there's a decent chance we retrace some today but I still think we finish green. See you all in the trading room shortly. No Zoom today as I've got an eye appointment. That also means probably no QQQ scalps today. I'll focus on our /MNQ setup.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |