|

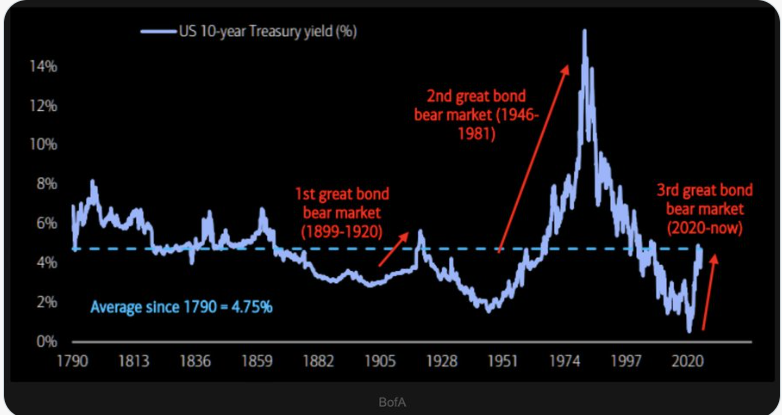

Welcome back traders to ANOTHER holiday shortened trading week. I have to say, I don't mind the break. We didn't get out of the house yesterday because it was crazy cold but it was nice, regardless. We had a fantastic day Friday. It doesn't look like it on paper but our net liq was up 4K, largely on our Nat gas profits. We also started the day in a $2,600 hole from the Vampire trade. Our diversified approach with butterflies and scalps made up for it. I've also been pleased with our Friday equity 0DTE's. They don't add much to the profit equation but they've been pretty consistant and add some always needed diversification. Here's a look at our Friday results. President-elect Trump is now officially President Trump. The executive orders are already flying. It allowed us enough premium to get a nice Theta fairy setup last night. It's not quite to our take profit target this morning but it looks solid. We still need a much higher VIX than we have to hope for daily setups but if we can grab a few here and there and bring in an extra $10,000 in yearly income from them I think most of us would still be happy. Speaking of Trump; I'm not an expert on politics but I do know this...if we as a people unite with a singular goal of improving all of our lots in life, we will be more successful than if we go it alone. I'm grateful every day for all our trading members and our collaborative effort to help each other profit. I'm very optimistic about 2025. Markets are looking higher this morning. Let's take a look at the technicals. Bullish sentiment starts of the week. While the rebound of the last four trading session looks real and our critical support lines held, all it's really done is keep us inside the current "chop zone". In fact, if you pull out a bit farther on the chart, we are still making lower lows and lower highs...the very definition of a down trend. It's hard to make much of our current levels other than our critical support area (black lines) seems strong. he SPY ETF had a strong week fueled by CPI and PPI, and managed to close just shy of this month’s high at $597.58 (+2.93%) Our ‘RSI, MACD Confluence’ custom indicator, which uses candle coloring to visualize RSI and MACD strength, shows momentum has swung back in the bulls favor for the first time since all-time highs. How do we know? Friday’s daily candle has turned green. The QQQ ETF closed the week at $521.74 (+2.87%), showing slight lag in bullish momentum compared to its peers. Our ‘RSI, MACD Confluence’ indicator printed a neutral (white) candle on Friday, signaling that momentum isn’t fully aligned yet. While RSI closed above 50, the MACD has yet to cross above its signal line. The IWM led the pack this week, closing strong at $225.46 (+3.95%). Price gapped above a key High Volume Node (HVN) and came within earshot of its monthly high. The ‘RSI,MACD Confluence‘ indicator confirmed bullish momentum with a green candle, signaling alignment in both RSI and MACD. Nothing special or exciting I.V. wise in this shortened trading week. We will work to get our weekly SPY/QQQ trades going today but the IWM may give us our best "bang for our buck". My lean or bias today: Ever so slightly bullish. Yes, futures are up and yes, technicals are bullish. I'm not sure how much upside we have here and a slight retrace after the excitement of the inauguration wouldn't be a surprise. Trade docket could be busy today: Our Theta fairy (/ES) is still working and open. /ZN, IBIT, /ZW, /SI, /MNQ, SPY/QQQ/IWM 3DTE's, 1HTE, 0DTE's, Scalping with /MNQ,/NQ,QQQ. NFLX, UAL, JNJ, HAL potential earnings trades. MU re-entry and DJT? Current systematic equity positioning is at the 90th percentile, indicating high equity exposure. This could result in limited upside potential, elevated risk levels, and an increased likelihood of market reversal U.S. Treasuries are entering the 6th year of the 3rd Great Bond Bear Market of the last 240 years! The last two lasted 21 years and 35 years, respectively. Let's take a look at our intra-day levels for our 0DTE setups. /ES: Levels are coiled tightly. 6058 is the first resistance. We are sitting right on it as I type. 6078 and 6098 are next. 6046 is first support with 6027 next. /NQ: 21,757 is first resistance. 21,828 is next. Support is 21,524. BTC: Wild ride for Bitcoin yesterday and into today. I probably missed some nice swing trades yesterday by simply not paying attention. After hitting a new ATH it retraced and now it's bouncing back. The new ATH has really stretched the resistance level to a nice round $110,000. First suppor is close at $101,943 with the next level down at $98,241. We've got a jam packed day of potential trades ahead of us. I'm excited to get back after it with all of you. See you shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |