|

Welcome to Thursday traders! We made it through PPI and CPI and what a few days it's been. I'm incredibly happy and relieved with our results from yesterday. Yes, I deployed almost $45,000 dollars of capital and made $257 dollars profit but I believe your success is ultimately defined by how your bad days go. First a couple comments. #1. It's critical to have multiple strategies going during the day. It's just impossible to know what will hit and what won't. Why try? I'm very proud of the multiple layers of setups we run each day. It certainly saved us yesterday. #2. We do have $5,600 of potential profits awaiting us today from our rolled calls so our efforts from yesterday may not be fully realized until this afternoon. #3. We are working very hard to focus on "consistency over profits". In other words, lets make consistent results a priority over killing it profit-wise. Yesterday was a good example of that. Basically I was wrong on a couple of our intitial setups. We had enough flexibility that it still ended up o.k.. #4. Part of this is working on setups that are less "binary". Most trades, regardless of setup are binary. They either work or they don't. Our SPX and NDX setups technically didn't work yesterday but it still worked out. Flexible, more foregiving setups are what we want and that's what we seem to be getting with our "Three phase" 0DTE entries. Here's our results from yesterday. We do have jobless claims to watch this morning. March S&P 500 E-Mini futures (ESH25) are up +0.31%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.49% this morning, signaling further gains on Wall Street as cooling U.S. core inflation bolstered expectations of Federal Reserve easing this year, while investors awaited a fresh batch of U.S. economic data and quarterly reports from more big banks. Market sentiment also got a boost after Taiwan Semiconductor Manufacturing Co. (TSM), the main chipmaker to Apple and Nvidia, reported a record quarterly profit and provided strong Q1 revenue guidance. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended sharply higher, with the S&P 500 and Nasdaq 100 posting 1-week highs and the Dow notching a 2-1/2 week high. Megacap technology stocks gained ground, with Tesla (TSLA) surging more than +8% to lead gainers in the S&P 500 and Nasdaq 100 and Nvidia (NVDA) advancing over +3%. Also, Intuitive Surgical (ISRG) climbed more than +7% after the healthcare equipment company reported stronger-than-expected preliminary Q4 revenue. In addition, Goldman Sachs (GS) rose more than +6% and was the top percentage gainer on the Dow after reporting upbeat Q4 results. On the bearish side, Vericel (VCEL) fell over -1% after the company issued below-consensus Q4 revenue guidance. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices increased +0.4% m/m in December, in line with expectations. On an annual basis, headline inflation rose to +2.9% in December from +2.7% in November, in line with expectations. Also, the December core CPI, which excludes volatile food and fuel prices, unexpectedly eased to +3.2% y/y from +3.3% y/y in November, better than expectations of no change at +3.3% y/y. In addition, the Empire State manufacturing index unexpectedly fell to an 8-month low of -12.60 in January, weaker than expectations of 2.70. Richmond Fed President Thomas Barkin said Wednesday that the fresh consumer-price data “continues the story we’ve been on, which is that inflation is coming down toward target,” but added that “there’s still work to do.” Also, New York Fed President John Williams said, “The process of disinflation remains in train. But we are still not at our 2% goal, and it will take more time until we can achieve that on a sustained basis.” In addition, Chicago Fed President Austan Goolsbee said that “the trend continues to be improvement in inflation” and expressed confidence that the Fed can curb price growth without causing an economic downturn. “For the Fed, this is certainly not enough to prompt a January cut,” said Seema Shah, chief global strategist at Principal Asset Management. “But, if [yesterday’s] print were accompanied by another soft CPI print next month plus a weakening in payrolls, then a March rate cut may even be back on the table.” Meanwhile, U.S. rate futures have priced in a 97.3% probability of no rate change and a 2.7% chance of a 25 basis point rate cut at the January FOMC meeting. However, swap traders have returned to fully pricing in a Fed rate cut by July following the U.S. inflation report. The Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity in the U.S. grew “slightly to moderately” in late November and December. The Fed’s districts reported that consumer spending rose moderately, employment edged higher on balance, and prices increased “modestly overall.” “More contacts were optimistic about the outlook for 2025 than were pessimistic about it, though contacts in several districts expressed concerns that changes in immigration and tariff policy could negatively affect the economy,” according to the Beige Book. Today, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that December Retail Sales will stand at +0.6% m/m, compared to the November figure of +0.7% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.2% m/m in November. Economists expect the December figure to be +0.5% m/m. The U.S. Philadelphia Fed Manufacturing Index will be released today. Economists foresee this figure to stand at -5.2 in January, compared to last month’s value of -16.4. U.S. Export and Import Price Indexes will be reported today. Economists forecast the export price index to be +0.2% m/m and the import price index to be -0.1% m/m in December, compared to the previous figures of 0.0% m/m and +0.1% m/m, respectively. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure to arrive at 210K, compared to last week’s number of 201K. In addition, market participants will be anticipating a speech from New York Fed President John Williams. On the earnings front, major U.S. banks such as Bank of America (BAC) and Morgan Stanley (MS) are set to release their quarterly results today. UnitedHealth (UNH), U.S. Bancorp (USB), PNC Financial (PNC), and JB Hunt (JBHT) are other prominent companies scheduled to deliver their quarterly updates today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.654%, up +0.02%. Let's take a look at the technicals. With yesterdays big move we are back to a bullish technical picture. Albeit very slight. The "line in the sand" (see charts) of support I've been watching has held. The IWM and DIA were the big winners yesterday. My lean or bias today: Today is a tough one. We've had two days of extreme bullishness. We've been bouncing off the top Bollinger band like a race car banging off the rev limiter. Are we overstreched to the upside? Maybe. Is this the start of a new bullish trend? Maybe. Futures right now are not too helpful. If jobless claims and retail sales numbers can create even the smallest bit of weakness in the futures I think we are at best flat and probably retrace today. I'll positioning for a slight retrace today. We already have the starting point for most of our trades today. UNH earnings trade should finish today. We already have our scalps setup for today with a short /MNQ and /NQ cover. A 1HTE may be tricky today but we'll try. A possible re-set on our MU trade which I'm still underwater on. A new entry on X. Our SPX and NDX 0DTE's are already working with our rolled calls from yesterday. We'll add to these today. Let's take a look at our key, intra-day levels. /ES: There may be a bit of confirmation bias in my thinking today but the 2hr. chart sure looks like it wants to roll over. 6036 is the new resistance level with 5947 now support. This is my target for today. It's the high vol node zone and PoC as well as VWAP on the 2hr. chart. /NQ: The Nasdaq is a bit stronger than SPX coming into this mornings session. 21,562 is first resistance with a secondary one at 21,699. Support is also down on the high value node and PoC of 21,343. BTC: We'll need to see what the pricing looks like this morning in Kalshi but I'm doubtful we will have very good risk/reward today for any 1HTE's. 103,145 is resistance with 98,241 the first support level and 96,279 next. I would look to initiate another long BTC swing trade at the second level but otherwise we may sit out any bitcoin trades today. I'll see you all in the live trading room shortly!

0 Comments

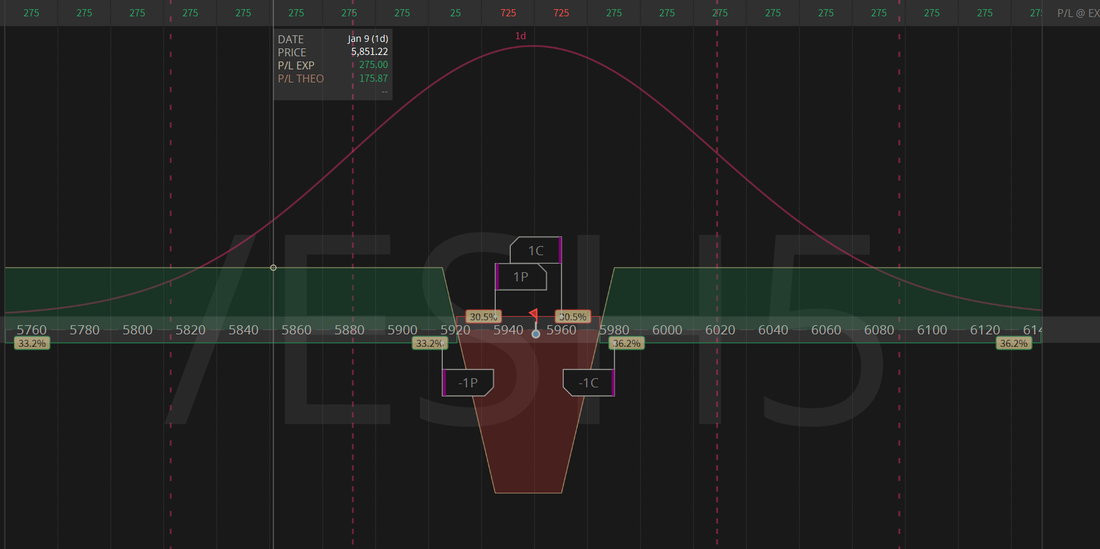

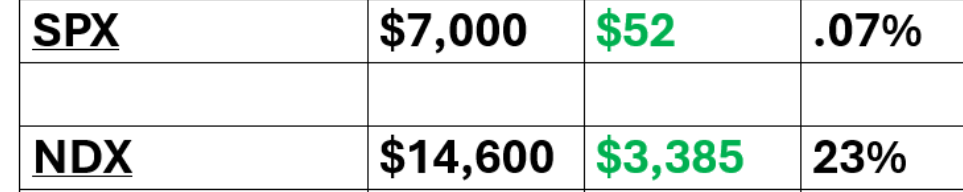

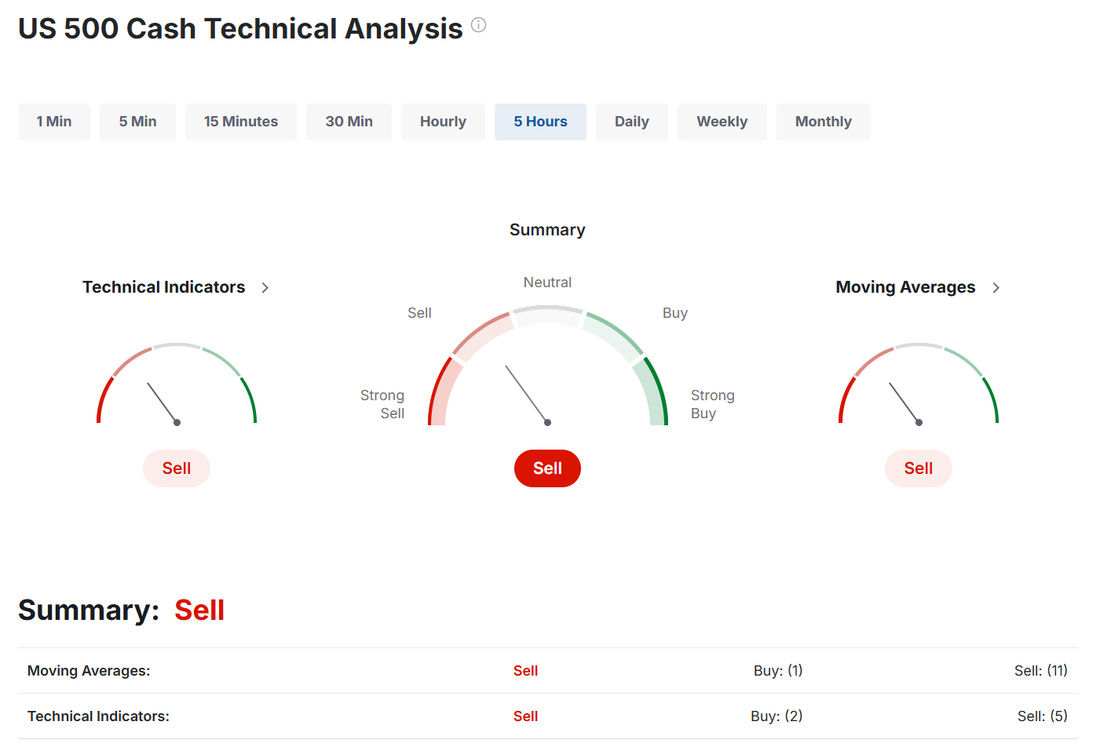

Welcome back traders! CPI today. Yesterday was a tremendous success for us. Not because we made money. Sure, that's important (Duh), but more so because we (specifically I because I've been the one off lately) followed our "rules of engagement" and did what we thought was right, regardless of profit or loss. We executed out plan and let the results be what they will be. Often in the trading room I'll state one of my favorite trading mantras. "You're in a trade. The underlying is moving around. That movement is either helpiing or hurting you. If it's helping you the best thing to do is sit on your hands. If it's hurting you, do something about it." Every trader has to follow a "gameplan" or trade methodology to be successful. Shooting from the hip may work for a while but ultimately will let you down. We'll talk about this in our live zoom today. Develop a system then follow it...regardless of the result. "Trade to trade well" as we say and let the results be what they will be. It's hard. Focusing on the process rather than the outcome (profit or loss). Here are our results from yesterday. I also want to give a shout out to our A.T.M. program. We don't talk about it much but I'm super proud of it. It's a longer term, passive, asset allocation investment program. Trading is great but investing is a good balance. We also know that putting our life savings into trading doesn't make sense. The last down year we had was 2022 and while the market lost money, we killed it in our A.T.M. (Asymmetric Trade Management) portfolio. I believe we have the same chance this year. If you want to be in a position to make money as markets fall this may be something to look at. March S&P 500 E-Mini futures (ESH25) are trending up +0.16% this morning as investors looked ahead to key U.S. inflation data and earnings reports from some of the biggest U.S. banks. In yesterday’s trading session, Wall Street’s major indexes closed mixed. United Rentals (URI) climbed nearly +6% and was the top percentage gainer on the S&P 500 after acquiring H&E Equipment Services for $3.4 billion in cash. Also, Atlassian (TEAM) advanced more than +4% and was the top percentage gainer on the Nasdaq 100 after it announced price increases for its data center products. In addition, KB Home (KBH) gained over +4% after the homebuilder posted upbeat Q4 results and issued solid FY25 guidance. On the bearish side, Eli Lilly (LLY) slumped more than -6% and was the top percentage loser on the S&P 500 after providing a below-consensus Q4 revenue forecast. Economic data released on Tuesday showed that the U.S. producer price index for final demand rose +0.2% m/m and +3.3% y/y in December, weaker than expectations of +0.4% m/m and +3.5% y/y. Also, the core PPI, which excludes volatile food and energy costs, was unchanged m/m and rose +3.5% y/y in December, weaker than expectations of +0.3% m/m and +3.8% y/y. “While the wholesale price data does not necessarily translate directly into consumer price data, it was encouraging to see the PPI Index come in well below expectations,” said Charlie Ripley, senior investment strategist at Allianz Investment Management. Meanwhile, the fourth-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Citigroup (C), slated to report their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will provide clues on the path of Fed rates over the next few months. Economists, on average, forecast that the U.S. December CPI will come in at +0.4% m/m and +2.9% y/y, compared to the previous numbers of +0.3% m/m and +2.7% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.3% y/y in December, matching November’s figures. “[Today’s] CPI report may be the most important inflation reading in recent memory, as it will fuel the market’s Fed-obsessed sentiment. A strong inflation number adds to this idea of no cuts in 2025, and potentially even a rate hike, while a weak inflation data point may help to calm the market’s Fed fears,” said Chris Brigati at SWBC. A survey conducted by 22V Research showed that 47% of investors anticipate a “risk-off” market response to the CPI report, 29% believe it will be “risk-on,” and 24% said it will be “mixed/negligible.” The Empire State Manufacturing Index will be reported today. Economists expect this figure to stand at 2.70 in January, compared to 0.20 in December. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -3.500M, compared to last week’s value of -0.959M. In addition, market participants will be looking toward speeches from Richmond Fed President Thomas Barkin, Minneapolis Fed President Neel Kashkari, New York Fed President John Williams, and Chicago Fed President Austan Goolsbee. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. U.S. rate futures have priced in a 97.3% probability of no rate change and a 2.7% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.774%, down -0.29%. /ES 7DTE "Market crash, Hedge, Long Vega, Daily cash flow setup. MU?, LEVI?, UNH, GME, /ZN, 1HTE (maybe), 0DTE's, Scalping Using the /MNQ, /NQ, QQQ's. CPI is out in 5 min. as I type so we'll have an updated look at the price action this morning. Currently the technicals aren't showing us much. Maybe, very appropriately we have a neutral rating to start the day. We are still stuck in a fairly wide trading range. We are keen to get a long position established in the 10 yr. bonds. Today may be that day for us. PPI yesterday was better than expected. Markets popped on the news but couldn't really hold the gains. CPI is now out with favorable results as well. Futures are popping once again. Will it hold today? Our "rules based approach" today will be tested and I"m optimistic it will yield us some good resuts. I look forward to seeing you all in the live trading room shortly!

Welcome to PPI Tuesday! Well...most of our traders had a very solid day yesterday. I did as well...until the last 15 mins. of the day! We have an approach and goal of exiting our trades with lower capture rates. Not going for a full profit and raising our consistency. Most of our trading members followed those rules and booked a nice profit. I let a $900 profit on NDX slip to a loss. My bad. I'll work harder on following our rules today. Here's my results from yesterday. We did have a good day on 1HTE and Scalping as well as a profitable Theta Fairy. Today is PPI day with tomorrow giving us CPI so the next two days we will focus on flexibility and patience. My lean or bias of Neutral yesterday was spot on but I carry no bias going into today or tomorrow. I also try to NOT look at levels on days like this as the algos will drive us. We have a modified, long Vega Theta fairy working this morning going into PPI and I'll work around that today. We didn't get to all our pairs trades yesterday so we'll get those done today. ALTR, ASUR, FTAI, CRGY, SUM, SKIL, CTGO, GCBD, ICFI, PACS, QTTB, TREE. We have our Theta fairy to work today. A possibel bond /ZN entry. /NG, Possible MSTR take profit or addition. 1HTE, 0DTE's. PPI is incoming! Lets see where it takes us. See you all in the trading room shortly.

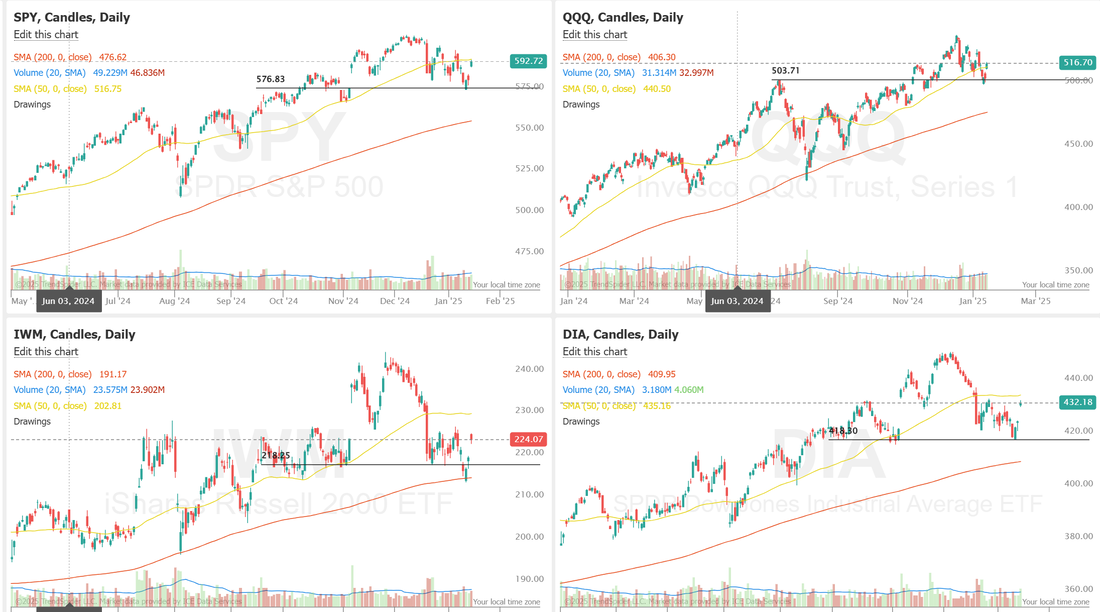

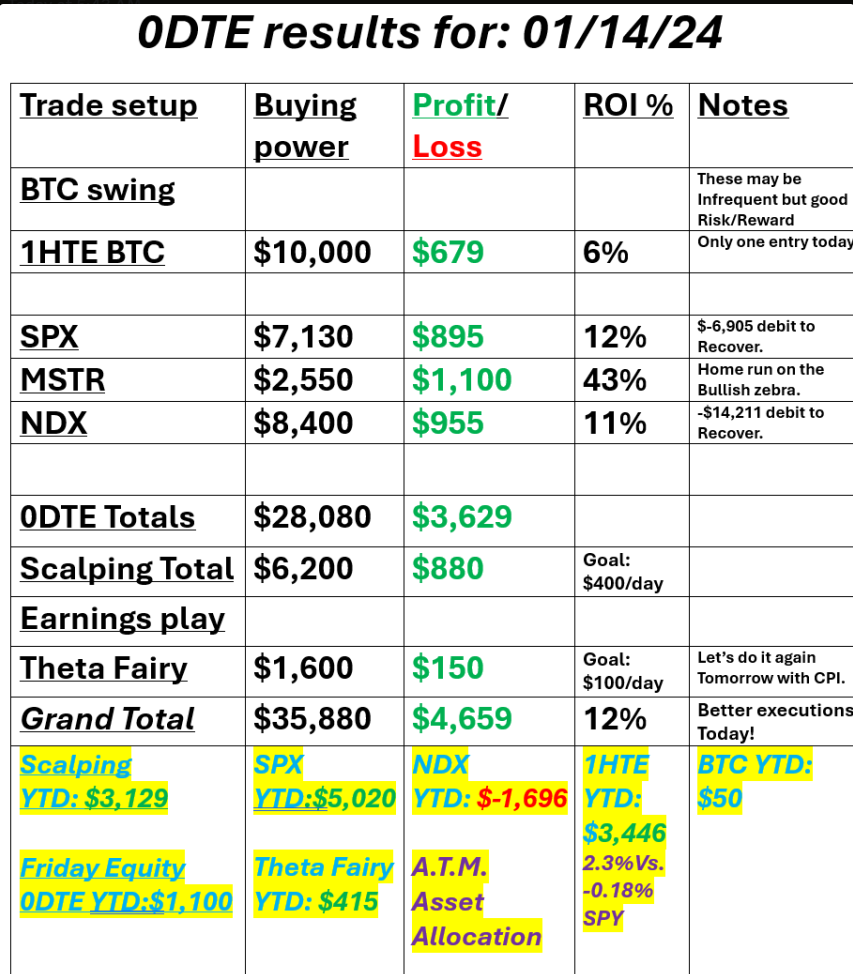

Welcome back traders to, what seems to be a rarity lately, a full trading week. We had a really nice finish to our week last Friday. Our MSTR 0DTE that we had rolled from the previous week didn't hit the profit zone so we'll continue working that this week but overall it was a nice day or results. See our numbers below: This week it's all about inflation. We've got PPI then CPI numbers coming out Tues. and Weds. which should be the main drivers of market movement. March S&P 500 E-Mini futures (ESH25) are down -0.83%, and March Nasdaq 100 E-Mini futures (NQH25) are down -1.26% this morning while Treasury yields continued to rise as investors trimmed bets on Federal Reserve interest rate cuts following Friday’s strong payroll data. Market participants now look ahead to key U.S. inflation data, remarks from Federal Reserve officials, and the start of the fourth-quarter earnings season later in the week. In Friday’s trading session, Wall Street’s major equity averages closed sharply lower, with the benchmark S&P 500 and blue-chip Dow dropping to 2-month lows and the tech-heavy Nasdaq 100 falling to a 6-week low. Constellation Brands (STZ) tumbled over -17% and was the top percentage loser on the S&P 500 after the company posted downbeat FQ3 results and provided a soft FY25 comparable EPS forecast. Also, ON Semiconductor (ON) slumped more than -7% and was the top percentage loser on the Nasdaq 100 after Truist Securities downgraded the stock to Hold from Buy. In addition, Advanced Micro Devices (AMD) slid over -4% after Goldman Sachs downgraded the stock to Neutral from Buy. On the bullish side, Walgreens Boots Alliance (WBA) soared more than +27% and was the top percentage gainer on the S&P 500 after reporting better-than-expected FQ1 results. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls jumped by 256K in December, topping the consensus estimate of 164K. Also, the U.S. December unemployment rate unexpectedly ticked down to 4.1%, stronger than expectations of no change at 4.2%. In addition, the University of Michigan’s U.S. consumer sentiment index unexpectedly fell to 73.2 in January, weaker than expectations of no change at 74.0. At the same time, U.S. average hourly earnings came in at +0.3% m/m and +3.9% y/y in December, compared to expectations of +0.3% m/m and +4.0% y/y. “The surprisingly strong jobs report certainly isn’t going to make the Fed less hawkish,” said Ellen Zentner at Morgan Stanley Wealth Management. “All eyes will now turn to [this week’s] inflation data, but even a downside surprise in those numbers probably won’t be enough to get the Fed to cut rates any time soon.” Meanwhile, U.S. rate futures have priced in a 97.3% chance of no rate change and a 2.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. The strong U.S. jobs report led traders to reduce their bets on Fed rate cuts to less than 30 basis points by December this year. The fourth-quarter earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Citigroup (C) set to release their earnings reports on Wednesday, followed by Bank of America (BAC) and Morgan Stanley (MS) on Thursday. UnitedHealth (UNH), Taiwan Semiconductor Manufacturing Company (TSM), and Schlumberger (SLB) are among other major names scheduled to deliver quarterly updates during the week. On the economic data front, the U.S. consumer inflation report for December will be the main highlight this week. Also, market watchers will be keeping an eye on other economic data releases, including the U.S. PPI, the Core PPI, Retail Sales, Core Retail Sales, the Philadelphia Fed Manufacturing Index, the NY Empire State Manufacturing Index, Crude Oil Inventories, the Export Price Index, the Import Price Index, Initial Jobless Claims, Business Inventories, Building Permits (preliminary), Housing Starts, Industrial Production, and Manufacturing Production. In addition, Fed officials may provide insights on the monetary policy outlook before the blackout period preceding the late-January meeting. Kansas City Fed President Jeffrey Schmid, New York Fed President John Williams, Richmond Fed President Thomas Barkin, Minneapolis Fed President Neel Kashkari, and Chicago Fed President Austan Goolsbee will be making appearances throughout the week. The Fed will also release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.795%, up +0.44%. Let's take a look at the state of the markets. The SPY emerged as the strongest among the major indexes this week, closing at $580.49 (-1.92%) and settling at the lower boundary of its falling wedge. Should the price move lower in the coming week, the anchored VWAP from the August 5th low, along with the largest volume node within this range, sits just below as a critical support level to watch. While QQQ experienced a larger decline than the SPY this week, it maintains the most constructive technical setup, closing just above the lower boundary of its descending channel at $507.19 (-2.20%). Should the price break below the channel in the coming sessions, the anchored VWAP from August 5th, currently positioned at $489.57, will serve as a critical support level. IWM stood out as the weakest among the major indexes, decisively breaking down from its ascending channel to close at $216.83 (-3.41%). After attempting to hold the August 5th anchored VWAP, this critical level was definitively breached on Thursday. With a significant volume shelf positioned just above the current price, any future strength is likely to face considerable resistance at that level, around $221. With all the weakness we are seeing, the I.V. is still too low (IMHO) for the normal weekly credit trades we generally put on. I'd like to see it consistently up above 18+. Let's take a look at the market technicals. No big surprise here. Technicals are flashing bearish. Let's look at the overall health of the major indices. We've had a "line in the sand" drawn for some time. We broke below that on IWM Friday and the other indices are sitting right on top of it. We aren't in a bear market...yet, but if we lose these levels it certainly looks possible. My lean of bias today: I'm neutral. Futures have trended down all night and are still down as I type but starting to move back up. The market doesn't have any major news catalysts today and I believe it's waiting for the two big inflation shoes to drop on Tues. and Weds. with PPI then CPI. Current systematic equity positioning is at the 90th percentile, indicating high equity exposure. This could result in limited upside potential, elevated risk levels, and an increased likelihood of market reversal If $IWM loses 216 this week.. game over for bulls 200ema re test + uptrend support retest Not looking good for bulls if we do not reclaim now US stocks are extremely expensive, and guess what? The great majority believes the stock market will be up in a year. What a terrible combination. The last time we had exactly the same combination? It was right before the dot-com bubble burst. Spread between S&P 500’s forward earnings yield and 10y Treasury yield has reached new 23-year low. At some point I want to get long the 10yr. but when? Trade docket today: A whole new batch of pairs trades. ALTR, ASUR, FTAI, CRGY, SUM, SKIL, CTGO, GCBC, ICFI, PACS, QTTB, TREE. We locked in profit last night on /NG and are working new positions today. /ES Thetafairy is still working and not quite to the profit zone. BTC long swing trade started, LEVI? and MSTR for our main, longer term trade this week and 1HTE and 0DTE's. Let's take a look at our intra-day levels today: /ES: There are several ways you can look at /ES. One view is that, for the first time during this current selloff, we are moving into an oversold technical situation AND, we are sitting on some substantive support. The other view, of course, is that we may lose this level and then there is nothing but downside coming. I don't think it's worth even taking a stab at guessing until Weds. after we've gotten PPI and CPI numbers. Current resistance is all the way up at 5925 with support at a close 5808. /NQ: Similar situation. Very close to a key support level. Resistance is now at 21,119 with support at a very close 20,693. BTC: We started a bullish swing trade last night on Bitcoin and may DCA some more into it today. Resistance is 94,262 with support at 90,310. Let's look at the expected moves for the week: 1.7% expected move in the SPY. QQQ's lookinf for a 2.2% move. I look forward to seeing you all in the live trading room this morning. We are already off to a nice start with my net liq up $1,475 dollars on the Nat gas trade and Theta fairy getting clost to a take profit.

Welcome to Friday traders! Equities were closed yesterday so we took advantage of that late Weds. to setup our 0DTE's for today. The core of what we will be trading today is already in place. Let's take a look at the four 0DTE's and modified Theta fair we already have working. We have a long I.C. setup working for the modified Theta fairy. This takes care of the long vol part. Then we have our /ES 0DTE cover. This has about $600 of potential profit in it. That is combined with a long /ES call. Which I have 1,700 of buying power tied up in. This is a 5DTE. Our NDX 0DTE portion looks like this and has either $700 or $2,700 profit potential, depending on which profit zone it lands in. Adding in the 5DTE portion the NDX looks like this. Both the /ES and NDX have a bullish bias. Our other two 0DTE's are from last weeks MSTR and TSLA setups that we needed to roll. They look like this. Theres a chance we can get a take profit order in right away on the TSLA. We're still just outside the profit target on MSTR. That will most likely change today (for better or worse) so expect either a take profit or adjust order later in the day. As mentioned, the trade docket for today is largely set with the modified Theta fairy, The /ES 0DTE. The NDX 0DTE. The MSTR 0DTE and the TSLA 0DTE. This should give us plenty of potential and plenty to work on today. Todays analysis is not much analysis. We have NFP out this morning and that should be the big driver for today. Many times NFP is a bigger mover than CPI or even FOMC Powell days so I don't try to find levels or create bias. We'll just trade what we see. March S&P 500 E-Mini futures (ESH25) are trending down -0.01% this morning as investors adopted a cautious stance ahead of the all-important U.S. jobs report that will help shape the outlook for interest rates. In Wednesday’s trading session, Wall Street’s major indexes ended mixed. eBay (EBAY) surged nearly +10% and was the top percentage gainer on the S&P 500 after Meta Platforms proposed publishing eBay’s listings on Facebook Marketplace to comply with a European Union antitrust order. Also, GE HealthCare Technologies (GEHC) climbed more than +3% and was the top percentage gainer on the Nasdaq 100 after Jeffries upgraded the stock to Buy from Hold with a price target of $103. In addition, Maplebear (CART) gained over +4% after S&P Dow Jones Indices announced that the stock would be added to the S&P MidCap 400 Index next week. On the bearish side, Edison International (EIX) slumped over -10% and was the top percentage loser on the S&P 500 after its Californian subsidiary shut off power to customers due to wildfires. Also, Advanced Micro Devices (AMD) slid over -4% after HSBC downgraded the stock to Reduce from Buy with a $110 price target. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 122K in December, down from 146K in November and missing the consensus estimate of 139K. Also, U.S. consumer credit unexpectedly fell -$7.49B in November, weaker than the expected +$10.30B increase and marking the largest decline in 15 months. At the same time, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -10K to a 10-1/2 month low of 201K, compared with the 214K expected. The minutes of the Federal Open Market Committee’s December 17-18 meeting, released Wednesday, revealed that officials embraced a new approach to rate-cutting in light of heightened inflation risks, opting to proceed more cautiously in the coming months. “Participants indicated that the committee was at or near the point at which it would be appropriate to slow the pace of policy easing,” according to the FOMC minutes. “Almost all participants judged that upside risks to the inflation outlook had increased. As reasons for this judgment, participants cited recent stronger-than-expected readings on inflation and the likely effects of potential changes in trade and immigration policy,” the minutes said. Philadelphia Fed President Patrick Harker stated on Thursday that policymakers are on track to reduce interest rates this year, but the precise timing “will be fully dependent upon the incoming data.” Also, Boston Fed President Susan Collins said a more gradual approach to adjusting interest rates is warranted now as officials face “considerable uncertainty” regarding the economic outlook. In addition, Fed Governor Michelle Bowman said she sees lingering inflation risks and that policymakers should be cautious with additional interest rate cuts. Finally, Fed Governor Christopher Waller said on Wednesday, “The extent of further easing will depend on what the data tell us about progress toward 2% inflation, but my bottom-line message is that I believe more cuts will be appropriate.” Meanwhile, U.S. rate futures have priced in a 93.1% probability of no rate change and a 6.9% chance of a 25 basis point rate cut at the January FOMC meeting. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that December Nonfarm Payrolls will come in at 164K, compared to November’s figure of 227K. A survey conducted by 22V Research showed that the majority of investors are monitoring payrolls more closely than usual. 40% of the respondents expect key U.S. jobs data to be “risk-off,” 34% anticipate it will be “mixed/negligible,” and only 26% foresee “risk-on.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect December figures to be +0.3% m/m and +4.0% y/y, compared to the previous numbers of +0.4% m/m and +4.0% y/y. The U.S. Unemployment Rate will be reported today. Economists foresee this figure to remain steady at 4.2% in December. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists forecast the preliminary January figure to be 74.0, unchanged from last month. “Investors will want to see a return to Goldilocks data, consistent with a cooling labor market to help temper the recent spike in yields and help stocks stabilize,” said Tom Essaye at The Sevens Report. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.690%, up +0.19%. There is still a bit of a bearish bias holding in this market. Even with the weakness, we continue to sit in a pocket of consolidation on most of the indices. I look forward to finishing the week strong. We've got five trade to focus on today. I'll see you all in the trading room shortly.

Welcome back traders! Well...yesterday reminded me on Queen Elizabeths, Annus Horribilis statement. I was looking for a more neutral day yesterday and that was certainly NOT the case. The current word of the day (week/year...maybe?) is "Tariff(s)". Most (myself included) thought they were just a bluff and bargining tool for Pres. elect Trump. Well...doesn't look like it. The market is bracing for them to show up the first day of taking office. It put my /ES and NDX trades deep in the hole. Down about -$8,960 on my /ES and -$12,226 on NDX. so I've got some work to do in the next 8 days which is where my adjustments take me. Scalping worked well and we had one 1HTE that just missed that wiped out about $1,400 of gains. Ah...such was the day. Today is a new start. Let's see if we can get some green today. Here's an overview of my day yesterday. We may be able to get a take profit on our TSLA roll today which would be a step in the right direction. Let's take a look at the changes in the marketplace. Probably not a surprise that technicals are now firmly bearish. As bad as yesterday felt, in the moment, we are still stuck inside a large consolidation zone. It would just be guessing at this point to try to determine a directional bias. If we broke the support lines drawn on the charts that would get me onboard the "bearish train" but right now is just a lot of churn. Intra-day it feels big but big picture not much is happening. March S&P 500 E-Mini futures (ESH25) are trending down -0.27% this morning as investors weighed concerns over U.S. tariffs while awaiting the Federal Reserve’s December meeting minutes, comments from a Fed official, and a fresh batch of U.S. economic data. S&P 500 futures reversed early gains and turned lower after CNN reported that President-elect Donald Trump is contemplating declaring a national economic emergency to provide legal justification for a large swath of universal tariffs on allies and adversaries. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Palantir Technologies (PLTR) slumped over -7% and was the top percentage loser on the S&P 500 after Cathie Wood’s ARK Invest ETFs sold $15 million worth of the stock on Monday. Also, MicroStrategy (MSTR) plunged nearly -10% and was the top percentage loser on the Nasdaq 100 after the price of Bitcoin dropped more than -5%. In addition, Tesla (TSLA) slid over -4% after BofA downgraded the stock to Neutral from Buy. On the bullish side, Moderna (MRNA) surged more than +11% and was the top percentage gainer on the S&P 500 as vaccine makers rallied amid a rising spate of flu and COVID-19 cases across the U.S. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings unexpectedly rose to a 6-month high of 8.098M in November, stronger than expectations of 7.730M. Also, the U.S. ISM services PMI advanced to 54.1 in December, beating the 53.5 consensus. In addition, the U.S. November trade deficit widened to -$78.20B from -$73.60B in October (revised from -$73.80B), though it was smaller than the expected deficit of -$78.30B. Richmond Fed President Thomas Barkin said on Tuesday that the central bank is “highly committed” to a 2% inflation target, and should price pressures persist, the Fed will need to adopt a tougher stance on interest rates. Also, Atlanta Fed President Raphael Bostic stated in a podcast recorded on December 9th and released Tuesday that policymakers should proceed carefully due to uneven progress in reducing inflation. “The Fed will likely switch from cutting interest rates at every decision, as they did between September and December, to pausing in between rate cuts in 2025,” said Bill Adams at Comerica Bank. U.S. rate futures have priced in a 95.2% probability of no rate change and a 4.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Meanwhile, the U.S. stock markets and the federal government will be closed on Thursday in observance of the National Day of Mourning for former President Jimmy Carter. Also, the bond market will close at 2 p.m. Eastern Time on Thursday, per the recommendation of the Securities Industry and Financial Markets Association. The closures follow a long-standing American tradition where financial institutions halt operations after the death of a president. Today, market watchers will closely monitor the publication of the Federal Reserve’s minutes from the December 17-18 meeting. The report will provide additional insight into officials’ perspectives on the paths of the economy, interest rates, and inflation in the coming years. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the December ADP Nonfarm Employment Change will stand at 139K, compared to the November figure of 146K. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 214K, compared to last week’s number of 211K. U.S. Consumer Credit data will be reported today. Economists foresee this figure to stand at $10.30B in November, compared to the previous figure of $19.24B. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -1.800M, compared to last week’s value of -1.178M. In addition, market participants will be looking toward a speech from Fed Governor Christopher Waller. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.679%, down -0.13%. My lean or bias yesterday of neutral was just a tad (or a lot!) off. We have FOMC minutes out today. I don't expect a big shock with that but you never know. I have to stick with neutral bias again today. Until we get a break one direction or the other its just guessing here. Trade docket today, and probably for the next 8 days will be focused on our /ES and NDX trades. We need to cashflow them every day to recover our debits from yesterday. Scalping continues to present some nice opportunities and we may benefit again today from that. Spread between S&P 500’s forward earnings yield and 10y Treasury yield has reached new 23-year low. I've traded for near 40 years now. I don't remember ever seeing this. Volume continues to dry up. It certainly looks like the bulls are running out of gas here. Another potential warning sign. All of 2024, the percentage of S&P 500 stocks trading above their 200-day SMA remained in a very predictable range. Last month, we broke that range to the downside. Let's take a look at the intra-day levels for our 0DTE's. /ES: 5977 is new resistance now with 6021 following. 5925 is new support with 5889 next. /NQ: with all the movement yesterday our levels haven't changed. 21,564 is still resistance and 21,222, while close, remains a support level. BTC: Bitcoin got whacked yesterday along with equities. It's amazing how correlated it is. We haven't had an opportunity to get a BTC swing trade working yet. We may be getting into that buy range soon. 98,226 is first resistance with 101,040 next. 94,203 is first support with 92,448 next. It currently looks a bit tough to get a 1HTE working but we'll continue to monitor it as the day progresses. See you all in zoom shortly. Let's set an audacious goal of getting some green today...as hard as they may seem after yesterday.

Welcome to Tuesday! We had another really solid day yesterday. We over achieved on our $1,000/day goal. This I.V. enviroment is still in the dumps. (see below) Until we can get some sustained downard movement, not a one or two day selloff but a real, sustainable downtrend, I don't see stand alone credit trades working very consistently. Until then we'll continue to use debit trades to anchor our positions and then trade around them if required. Our results from yesterday exceeded our goals. It was a good day and, so far this year its been a good year. I've added in a column in our P/L matrix for our A.T.M. portfolio as well for this year. I'll update those results monthly. Here's a look at our day yesterday. Let's take a look at the markets current status. Buy mode is still holding on. I honestly don't read much into the chart levels today. For bulls there's some good signs in the SPY and QQQ's both holding above their 50DMA. IWM and DIA aren't going up be at least they are holding their own at these levels. There's no real trend at the moment. Docket 10:00 ET US ISM Manufacturing PMI for December Median Forecast: 48.2 | Prior: 48.4 | Range: 49.7 / 46.9 Manufacturing Prices Paid Median Forecast: 51.4 | Prior: 50.3 | Range: 53.7 / 51 Speakers 11:00 ET Fed’s Barkin gives keynote remarks at an event hosted by the Maryland Bankers Association, in participation with the Maryland Association of CPAs, Maryland Chamber of Commerce, Maryland Realtors, and Maryland Retailers Alliance. Text and Q&A expected ECB’s Lane participates in a panel on “Geopolitical Fragmentation” hosted by the American Finance Association at the annual meeting of the American Economic Association/Allied Social Science Associations in San Francisco. March S&P 500 E-Mini futures (ESH25) are up +0.09%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.08% this morning as investors geared up for the latest reading on U.S. job openings while also awaiting remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching 1-week highs. Chip stocks rallied after Nvidia’s assembly partner Foxconn reported record quarterly revenue driven by strong demand for AI infrastructure, with Micron Technology (MU) surging over +10% to lead gainers in the S&P 500 and Nvidia (NVDA) rising more than +3% to lead gainers in the Dow. Also, MicroStrategy (MSTR) climbed over +11% and was the top percentage gainer on the Nasdaq 100 after the price of Bitcoin hit a two-week high, and the company said it had bought 1,070 Bitcoin last Monday and Tuesday. In addition, Paycor HCM (PYCR) soared more than +23% after Bloomberg reported that Paychex is in advanced talks to acquire the company. On the bearish side, Palantir Technologies (PLTR) slumped nearly -5% after Morgan Stanley assumed coverage of the stock with an Underweight rating and a price target of $60. Economic data released on Monday showed that the U.S. December S&P Global services PMI was revised downward to 56.8 from the preliminary reading of 58.5. Also, U.S. factory orders fell -0.4% m/m in November, weaker than expectations of -0.3% m/m. Fed Governor Lisa Cook stated on Monday that policymakers can proceed more cautiously with further interest rate cuts, citing a robust labor market and lingering inflation pressures. “Over time, I still think it will likely be appropriate to move the policy rate toward a more neutral stance,” Cook said. U.S. rate futures have priced in a 90.9% probability of no rate change and a 9.1% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. Meanwhile, investors are still dealing with the possibility of escalating trade tensions after Donald Trump denied a report suggesting he might ease plans for comprehensive tariffs upon his return to the White House. Today, all eyes are on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the November JOLTs Job Openings will arrive at 7.730M, compared to the October figure of 7.744M. Investors will also focus on the U.S. ISM Services PMI, which stood at 52.1 in November. Economists expect the December figure to be 53.5. U.S. Trade Balance data will be released today as well. Economists foresee this figure to stand at -$78.30B in November, compared to the previous value of -$73.80B. In addition, market participants will be anticipating a speech from Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.628%, up +0.26%. My bias or lean today is not very meaningful. It just looks like a chop zone to me. Until we can gain some momentum one way or the other is just going to chop in this large zone we are currently in. I'll go with a Neutral rating for today even though futures are up and technicals are bullish. Let's take a look at the intra-day levels for our 0DTE's today. Yesterdays levels were pretty spot on for us. /ES: Did I mention chop zone? We have some good levels today and we started an /ES 0DTE yesterday that we will build on today. It looks very promissing and I believe we will be doing more 1DTE's at the end of our days which will turn into the anchor positon for our 0DTE's the next day. 6039 is the first resistance with 6058 being the next. 5999 is support with 5967 next. /NQ: our Nasdaq levels havent changed at all since late yesterday. 21,746 is first resistance and we are pushing on it as I type. 21,937 is next. 21,562 is first support and 21,426 is next. BTC: Our Bitcoin levels adjusted just a bit. 103,707 is now resistance....toying with ATH's. 101,083 is support with 99,415 next. We have a 1HTE exipiring in 28 min. (as I type) that should yield us a $652 profit. I'll see you all in the trading room. I'm really liking the numbers on our "1DTE into 0DTE" approach. I think it should yield us some nice potential today.

Welcome to a new week traders! I hope you all had a great weekend. Our family sent the last week up at our cabin and while we had a lot of fun activities, it was spending time with loved ones that was most meaningful. We are a little depressed now. Thanksgiving though New years is our favorite time of year. I hope all is well with you all! We had a pretty solid day Friday. We waited quite a while into the day before starting our 0DTE's and then we waited even longer to add to them. Did it cost us premium? Absolutely! Did it give us more visability and an easier day? Yes. We've tried to actually LOWER our income goals for this year. It should be (obviously) easier to obtain and take less capital commited on a daily basis. If we can average a $1,000 a day profit this year I think most of our traders will be happy with our program. Here's our results from this past Friday. Let's take a look at the markets to start off another holiday shortened week. I've talked alot about the "cliff" that we were sitting on and how the bulls really needed to defend those levels. They did that and then so on Friday and it looks like the futures are implying a continuation of that bullish rebound today. We've got the SPY and QQQ both back above their 50DMA now and the DIA and IWM still look week but seem to have stopped their slide and are at least consolidating. March S&P 500 E-Mini futures (ESH25) are up +0.45%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.71% this morning, pointing to a strong opening on Wall Street, while investors looked ahead to the publication of the minutes of the Federal Reserve’s latest policy meeting, comments from Federal Reserve officials, and a raft of U.S. labor market data. Technology stocks led the gains in U.S. equity futures as spending plans by Microsoft highlighted the continued demand for artificial intelligence infrastructure, with chip heavyweights Nvidia (NVDA) and Advanced Micro Devices (AMD) rising over +2% in pre-market trading. In Friday’s trading session, Wall Street’s major equity averages closed in the green. Megacap technology stocks advanced, with Tesla (TSLA) climbing over +8%. Also, chip stocks gained ground, with ARM Holdings (ARM) surging more than +10% and Nvidia (NVDA) rising over +4%. In addition, Block (SQ) advanced more than +6% after Raymond James upgraded the stock to Outperform from Market Perform with a $115 price target. On the bearish side, U.S. Steel (X) slumped over -6% after U.S. President Joe Biden blocked the $14.1 billion sale of the company to Japan’s Nippon Steel. Economic data released on Friday showed that the U.S. ISM manufacturing PMI unexpectedly rose to a 9-month high of 49.3 in December, stronger than expectations of a decline to 48.2. Richmond Fed President Thomas Barkin said Friday that he still sees upside risks to inflation and growth, which positions him in the camp of “wanting rates to stay restrictive for longer.” Also, San Francisco Fed President Mary Daly said on Saturday that although there has been considerable progress in reducing inflationary pressures over the past two years, inflation remains “uncomfortably above our target.” In addition, Fed Governor Adriana Kugler said, “Obviously our job is not done. We’re not at 2% yet, so we’re definitely aiming still to get there, and we know the job is not done.” U.S. rate futures have priced in a 90.9% probability of no rate change and a 9.1% chance of a 25 basis point rate cut at January’s monetary policy meeting. Meanwhile, the U.S. stock markets and the federal government will be closed on Thursday in observance of the National Day of Mourning for former President Jimmy Carter. Also, the bond market will close at 2 p.m. Eastern Time on Thursday, per the recommendation of the Securities Industry and Financial Markets Association. The closures follow a long-standing American tradition where financial institutions halt operations after the death of a president. Market watchers will be closely following the U.S. Nonfarm Payrolls report for December this week. Other noteworthy data releases include the U.S. JOLTs Job Openings, the ISM Non-Manufacturing PMI, Exports, Imports, Trade Balance, ADP Nonfarm Employment Change, Initial Jobless Claims, Crude Oil Inventories, Consumer Credit, Average Hourly Earnings, the Unemployment Rate, and the University of Michigan’s Consumer Sentiment Index (preliminary). Also, investors will closely monitor the release of the Federal Reserve’s minutes from the December 17-18 meeting on Wednesday, which might offer insights into how various policymakers view the impact of Trump’s proposed policies on the economy and how this could influence the outlook for interest rates. In addition, Fed Governor Lisa Cook, Richmond Fed President Thomas Barkin, Fed Governor Christopher Waller, Philadelphia Fed President Patrick Harker, Kansas City Fed President Jeffrey Schmid, and Fed Governor Michelle Bowman will be making appearances this week. Today, investors will focus on the U.S. S&P Global Services PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the final December figure will be 58.5, compared to November’s figure of 56.1. U.S. Factory Orders data will also be released today. Economists forecast this figure to be -0.3% m/m in November, compared to the previous number of +0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.622%, up +0.59%. Let's take a little bigger view of the markets over the last year. The SPY emerged as the top dollar gainer in 2024, adding an impressive $113.41 per share to close the year at $586.02 (+23.99%). However, Q4 delivered the most modest gains of the year, with the index advancing just +2.2%. December stood out as one of only three red months in 2024, alongside October and April, tempering what was otherwise a standout year for the ETF. The QQQ delivered the highest percentage returns in 2024, climbing $109.78 per share to close the year at $511.23 (+27.05%). Unlike the SPY, which struggled in Q4, the tech-heavy index regained momentum, adding an impressive +4.80% for the quarter. December, while relatively flat, managed to close in positive territory, securing an impressive nine months of gains for the year. IWM delivered the most modest returns among the major indexes in 2024, rising just $21.41 per share to close the year at $220.95 (+10.73%). Q4 proved turbulent for small caps, marked by new all-time highs followed by an equally sharp sell-off, ultimately eking out a minimal +0.35% quarterly gain. December capped off the year as its worst month, erasing November’s gains with an -8.81% decline. My bias today is bullish. We may actually get a retrace from the futures which are up strong this morning but the critical support levels from last week certainly seem to be doing their job. Trade docket for today contains /NG, MSTR, TSLA, SPY 4DTE, 1HTE's and 0DTE's. Let's take a look at the new intra-day levels for our 1HTE's and 0DTE's. /ES: There a couple big, key levels of support/resistance. 6035, which we are pushing up against right now is the first key resistance with 6100 being both a really key resistance both in terms of the mental focus on that nice round number as well as the fact that it goes back one full month as a barrier to future moves higher. 6000 is first support with 5966 following that. /NQ: 21,747 is first resistance with 21,934 above that. 21,562 is first support with 21,420 following that. BTC: Bitcoin is starting to wake up a bit from its range of last week. We just scored our first 1HTE win this morning of $610 profit and I think we should be able to get some more working today. 100,879 is a key resistance with 102,833 following that. 96,729 is the support level I'm watching. We had a good week last week with a couple of successful Theta fairys. It's so hard to tell what the I.V. will look like in this shortened week but we should have a few opportunites to get some more working. I'll see you all in our zoom feed shortly!

Welcome back to Friday! It feels like this week has flown by. It's definately a net postive to have breaks in your trading schedule. Yesterday was quite the roller coaster. Before we talk about our results lets focus on the price action. It may certainly seem as though the erradic movement of yesterday was atypical, I would suggest it was very typical of a neutral techincal rated day when we were sitting right at critical support levels. Most of you who have traded with my for a while know, I'm not a fan of neutral rating technical days. They are almost exclusively erradic and incredibly hard to read. That coupled with the fact that the markets are just hanging on it critical support levels and well...it made for an especially tricky day. As far as our results, I'm pleased we were able to pull a profit on the day, even if it was slight. One key point I continue to make in our trading room is, "differsify your postions". The only reason I can think of to NOT do both SPX and NDX setups together is you purposely want to concentrate risk. That can be a valid rational, at times. The NDX has more profit potential and the SPX is generally easier to trade so selecting only one seems to make sense, however, concentrating your risk will create uneven results. Take the last two trading days for example. Tues. saw the NDX profit explode while the SPX did little. Yesterday saw the SPX profit hit for a home run and the NDX lost. Lack of buying power is NOT an issue or impediment to doing both as we've talked about the ability to use the XSP instead of the SPX and the /MNQ instead of NDX to potentially reduce your buying power requirements by 90% O.K. on to our results from yesterday. Let's take a look at the market as we get ready to finish off the week. We have an ever so slight sell rating to start the day. When I say we are quickly approaching some very key support levels, this is what I mean. With all our major indices pushing below their 50DMA and key, critical support areas hovering just below current prices it becomes critical for the bulls to hold here. Any further weakness could trigger significant downside price action. March S&P 500 E-Mini futures (ESH25) are trending up +0.29% this morning, indicating an attempt by the benchmark index to snap a five-session losing streak, while investors awaited U.S. manufacturing data and remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended lower. Tesla (TSLA) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the EV giant reported weaker-than-expected Q4 vehicle deliveries and posted a fall in annual deliveries for the first time in over a decade. Also, Apple (AAPL) slid more than -2% after Reuters reported that the tech giant was offering rare discounts on several iPhone models in China due to rising competition from domestic rivals. In addition, SoFi Technologies (SOFI) dropped over -8% after Keefe Bruyette downgraded the stock to Underperform from Market Perform with a price target of $8. On the bullish side, Constellation Energy (CEG) climbed more than +8% and was the top percentage gainer on the Nasdaq 100 after announcing it has secured two contracts with the U.S. government to supply over $1 billion in electricity and services. Also, chip stocks advanced, with ARM Holdings (ARM) and Micron Technology (MU) gaining over +3%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -9K to an 8-month low of 211K, compared with the 222K expected. Also, the U.S. December S&P Global manufacturing PMI was revised upward to 49.4, beating the consensus of 48.3. In addition, U.S. construction spending was unchanged m/m in November, weaker than expectations of +0.3% m/m. “The claims data are consistent with a labor market that is strong enough to allow the Federal Reserve to proceed with rate cuts at a more measured pace in 2025,” said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics. Meanwhile, U.S. rate futures have priced in an 88.8% probability of no rate change and an 11.2% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. Today, all eyes are focused on the U.S. ISM Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the December ISM manufacturing PMI will be 48.2, compared to November’s figure of 48.4. Also, market participants will be looking toward a speech from Richmond Fed President Tom Barkin. On the political front, investors will be monitoring the U.S. House Speaker vote later today to see if Mike Johnson will retain his position. Republican infighting over his reelection might spell trouble for Trump’s agenda, according to Tom Essaye, founder of the Sevens Report. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.553%, down -0.48%. Trade docket today: Manufacturing PMI and FED Barkin speaking today should be the main news catalysts to drive price action Docket 10:00 ET US ISM Manufacturing PMI for December Median Forecast: 48.2 | Prior: 48.4 | Range: 49.7 / 46.9 Manufacturing Prices Paid Median Forecast: 51.4 | Prior: 50.3 | Range: 53.7 / 51 Speakers 11:00 ET Fed’s Barkin gives keynote remarks at an event hosted by the Maryland Bankers Association, in participation with the Maryland Association of CPAs, Maryland Chamber of Commerce, Maryland Realtors, and Maryland Retailers Alliance. Text and Q&A expected ECB’s Lane participates in a panel on “Geopolitical Fragmentation” hosted by the American Finance Association at the annual meeting of the American Economic Association/Allied Social Science Associations in San Francisco. These happen a bit into the trading day. I don't think there is any rush to get trades started BEFORE these two events. Patience is key today. My plan today is to continue working our long /MNQ scalp which produced for us yesterday and focus on our two 0DTE's. Bitcoin price action is pretty dead at the moment and doesn't look to provide good 1HTE or swing setups for the day so I'll probably skip them. My lean or bias for the day is more neutral. Futures are up currently, as I type but I don't see much upside in this market at present and while we may get some weakness again today, I don't see up breaking major support levels...at least not yet. Let's take a look at our intra-day levels: /ES; The price action for the last month has been erradic, to say the least. It is however creating lower lows and lower highs. The once mighty 6000 support leve is now more of a resistance zone. 5996 is current resistance wth 5887 acting as new support. /NQ: 21511 is resistance with 21039 acting as support. It's a wide, 500+ point chop zone at this time. This means we could see a 250+ point upswing and then a 250+ downswing and it wouldn't be that meaningful in the big picture. That's a big range. BTC: Bitcoins range is exactly the same as yesterday at 99,008 resistance and 94,326 support. As I mentioned above, I believe I'll be skipping any BTC trade setups today unless we get some movement. The current risk/reward isn't very favorable. I'll see you all in the live trading room shortly. Let's make some green to close out the week!

Welcome back traders! I hope everyone had a great New Years day off! It's always a good thing to take breaks from your trading routine and "sharpen the saw" a bit. We had an amazing day on Tues. Our ratio trades worked out well. In addition to the 1HTE's we've introduced on Bitcoin well be adding directional trades to BTC as well to our daily setups. These will be largely 0DTE or day trade setups but done on a swing trade basis. This, along with our Friday equity 0DTE opportunities should give us plenty of opportunities to hit our goal of $250,000+profit this year. You can, of course, track our progress here in the blog on a daily basis. Here are our results from Tues. I start this new trading year with a good spirit and a lot of hope for the potential that we have. The market has done something it rarely does. It's booked two consecutive years of 20%+ gains. That's rare and when it does happen we usually have a bit of a let down the following year. That could be potentially a great thing for us. Down or even flat markets tend to have better I.V. than upward trending ones. Let's take a look at the markets before we start our trading day. Tuesdays weakness has brought us to the edge of a cliff. The SPY now joins the IWM and DIA below their 50DMA's. The QQQ's are just holding on. You can see that all four indices are sitting on major consolidation zones. If we lose these levels we could get some significant downside. Technicals have moved back to a neutral rating which seems appropriate for where we are sitting. A move higher off these consolidated levels would be bullish and a move below would trigger big potential bearish signs. March S&P 500 E-Mini futures (ESH25) are up +0.56%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.73% this morning as trading resumed after the New Year’s Day holiday, with investors awaiting a new batch of U.S. economic data. Technology stocks led the gains in U.S. equity futures, signaling a rebound on Wall Street following a four-day losing streak that marked the end of 2024. Treasury yields fell on the first trading day of the new year, boosting investors’ risk appetite. In Tuesday’s trading session, Wall Street’s major indexes closed in the red, with the benchmark S&P 500 and the tech-heavy Nasdaq 100 dropping to 1-week lows. Tesla (TSLA) slid over -3% and was the top percentage loser on the S&P 500 after announcing a recall of 77,713 vehicles in China due to software issues and possibly faulty driver airbags. Also, chip stocks retreated, with Nvidia (NVDA) falling more than -2% to lead losers in the Dow and Micron Technology (MU) dropping over -1%. In addition, Sangamo Therapeutics (SGMO) plummeted about -56% after Pfizer terminated its collaboration and license agreement with the company to develop a novel gene therapy for hemophilia A. On the bullish side, U.S. Steel (X) surged more than +9% after the Washington Post reported that Nippon Steel proposed giving the U.S. government a veto over output cuts as part of a final effort to secure approval for its planned merger. Economic data released on Tuesday showed that the U.S. October S&P/CS HPI Composite - 20 n.s.a. eased to +4.2% y/y from +4.6% y/y in September, stronger than expectations of +4.1% y/y. “There’s no Santa Claus rally this week, but investors received the gift of gains in 2024. [It] was a massive year for equity gains driven by a trifecta of the AI explosion, a slew of Fed interest rate cuts, and a robust U.S. economy,” said Greg Bassuk, chief executive officer at AXS Investments. Market participants are entering the new year with several challenges, chief among them inflation and the Federal Reserve’s reaction to it, particularly after Chair Jerome Powell indicated there would be fewer interest rate cuts ahead. The markets are currently pricing in about 50 basis points of additional interest rate cuts from the Fed this year. Another question is how the pro-growth policies of President-elect Donald Trump will impact consumer prices and federal finances. The growth outlook in Europe and China will be on investors’ radar as well. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the final December figure will be 48.3, compared to November’s figure of 49.7. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 222K, compared to last week’s number of 219K. U.S. Construction Spending data will be reported today. Economists foresee this figure to come in at +0.3% m/m in November, compared to the previous number of +0.4% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -2.400M, compared to last week’s value of -4.237M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.534%, down -0.94%. PMI and Jobless claims should be the news catalysts that drive the market today. Futures are up with strong moves as I type. I'd be slightly bullish today with my bias or lean. Our trade docket for today and tomorrow is very straightforward. /MNQ and /NQ for our scalping program. /ES thetafairy. Possibly Bitcoin for a swing trade. 1HTE BTC trades. 0DTE on both SPX and NDX. Our goal, as always, is to put us in a position to make at least $1,000 profit per day. Let's take a look at the intra-day levels for our 0DTE's today: Because of the neutral technical rating today levels get expanded. /ES resistance is now at 6025 with support still holding at the same level it's been at for some time. 5920. Levels have not changed for /NQ. 21716 is still working as resistance with 21215 working as support We've had some good success with our 1HTE Bitcoin trades. BTC certainly has enough movement in it at the momement that is could make for a nice, intra-day swing trade opportunity as well. We will be adding these trades to our mix, when appropriate setups present themselves. For today it looks like 99,080 is resistance with 94,326 working as new support. We're currently in the 2nd month (heading into the thrid) above the 125 year resistance trendline. The last time this happened was September 1929. Every time the recession indicator has been in this position the stock market has rolled over. $DJI We've only violated the 125 year Dow Jones trendline once before in 1929. It did not end well...keep an eye on the Dow. As it goes, so goes the markets? Let's have a great day folks. I'll see you all in the live trading room chat in a bit. I look forward to trading with you today.

|

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |