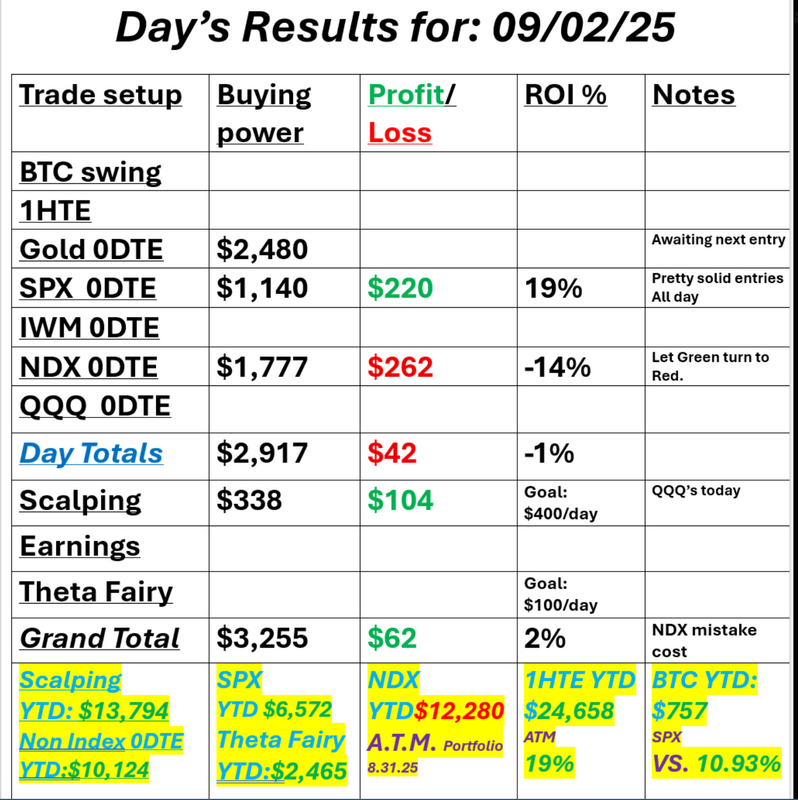

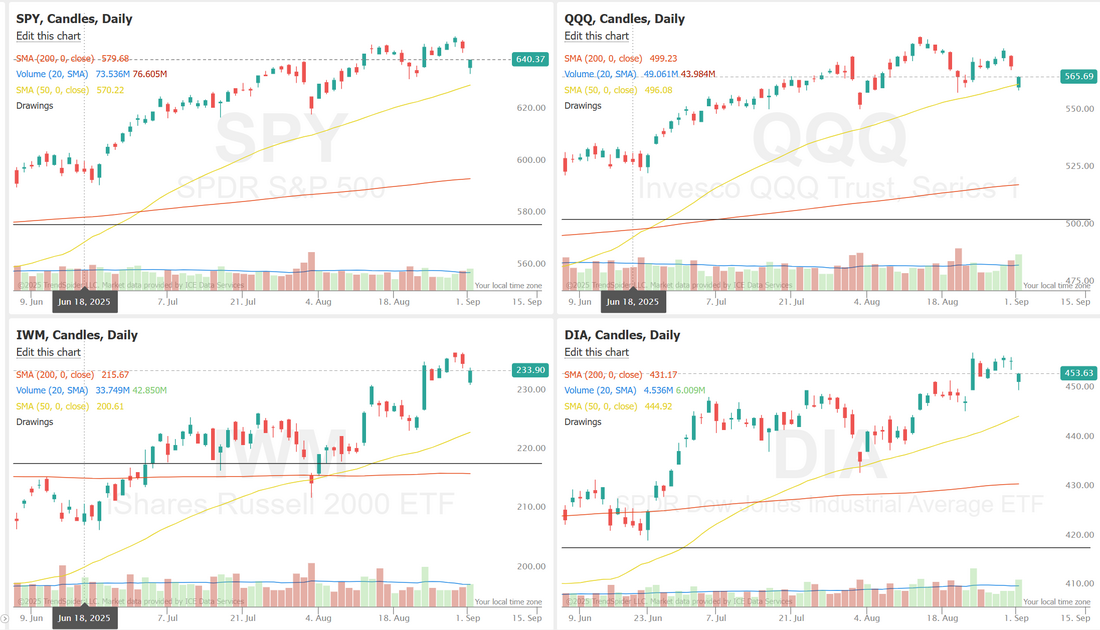

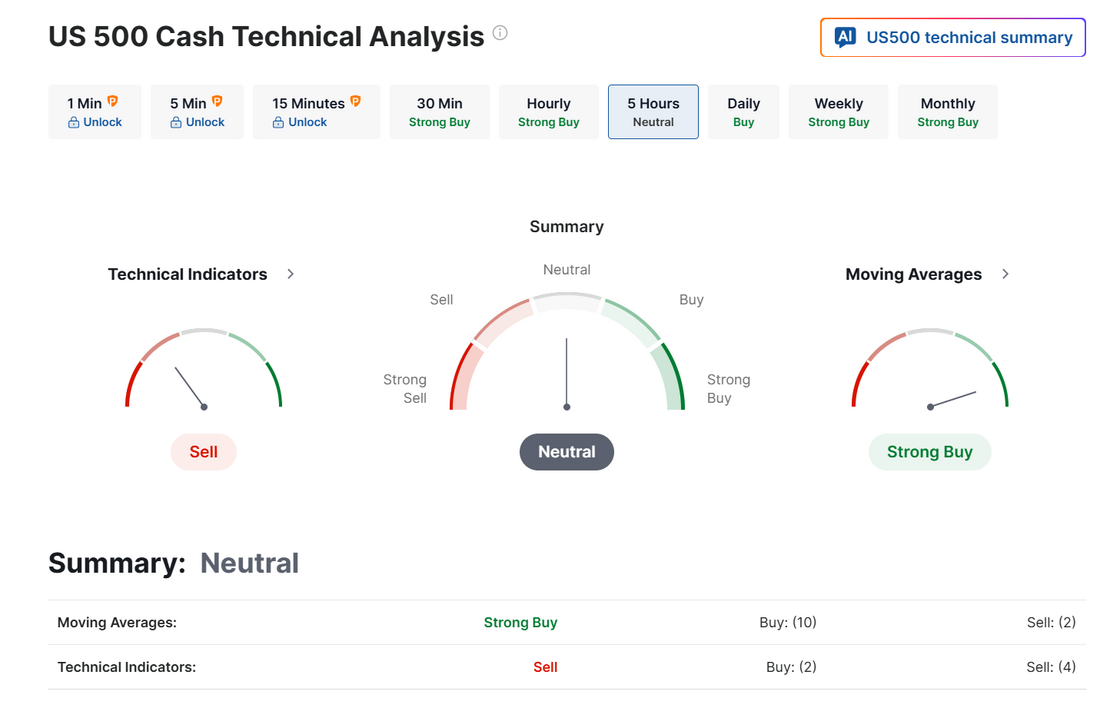

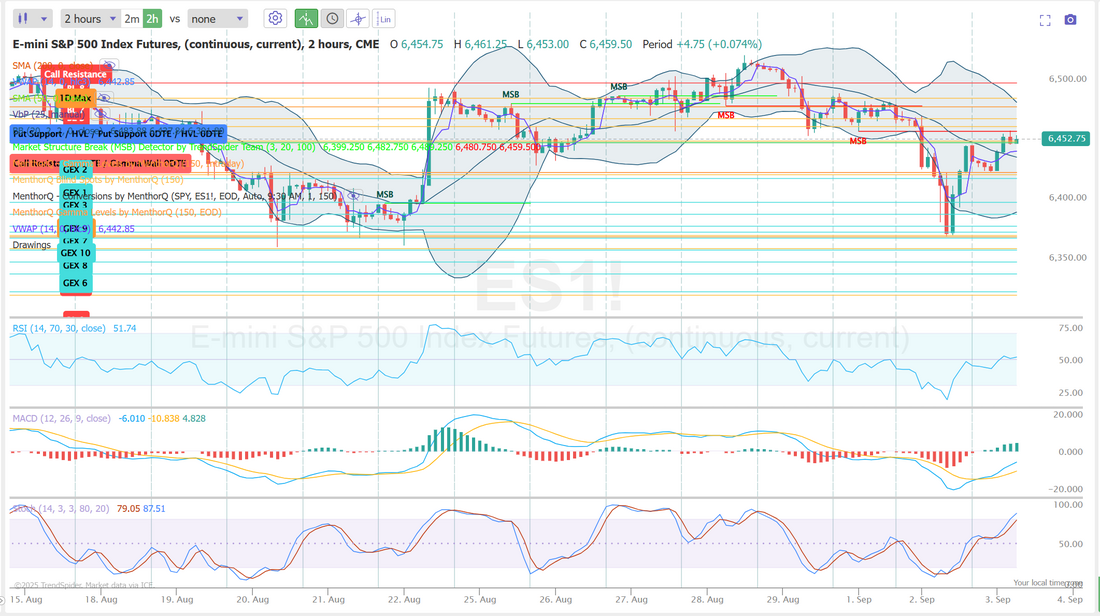

GOOG reprieve saves the market? Google squeaked out a nice antitrust victory late yesterday that could have been costly, if lost. That pushed both GOOG and AAPL ( a secondary benefactor) up and with it, the futures markets. Is it enough to stop the bearish momentum that was building? We'll see. Today could be telling. If we give up the futures gains then I think it's right back to more bearish action. We had a mixed day yesterday. We are still waiting on Gold to level out. It keeps hitting new ATH's. With the dollar continuing to fall it may be a while. My NDX was profitable and I just didn't pull it fast enough. That was operator error on my part. I scalped with the QQQ's yesterday and that may be a good approach again today. Our ATM portfolio hit another ATH. Here's a look at my day. Let's take a look at the markets. Even though the trend was bearish yesterday, the market fought back going into the close. We're sitting on a neutral rating to start the morning. That means we can get anything. Futures are still up near their highs of the morning. September Nasdaq 100 E-Mini futures (NQU25) are trending up +0.69% this morning, buoyed by a jump in Alphabet stock following a ruling that Google won’t be forced to sell its Chrome browser, while investors await the latest reading on U.S. job openings. Alphabet (GOOGL) jumped over +5% in pre-market trading after Google escaped major antitrust penalties for its conduct in the U.S. internet search market. A U.S. district judge permitted the tech giant to retain its Chrome browser and maintain an agreement under which Google pays Apple more than $20 billion annually to remain the default search engine on the Safari browser. Apple (AAPL) also benefited from the ruling, with the stock up over +2% in pre-market trading. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. The Magnificent Seven stocks fell, with Nvidia (NVDA) sliding nearly -2% and Amazon.com (AMZN) dropping more than -1%. Also, chip stocks lost ground, weighed down by a more than -3% decline in Lam Research (LRCX) after Morgan Stanley downgraded the stock to Underweight from Equal Weight with a price target of $92. In addition, Kraft Heinz (KHC) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the packaged-food company announced plans to split into two separate companies. On the bullish side, Ulta Beauty (ULTA) rose more than +8% and was the top percentage gainer on the S&P 500 after Barclays raised its price target on the stock to $617 from $589. Economic data released on Tuesday showed that the U.S. ISM manufacturing index rose to 48.7 in August, weaker than expectations of 49.0. Also, the U.S. August S&P Global manufacturing PMI was unexpectedly revised lower to 53.0, weaker than expectations of no change at 53.3. In addition, U.S. construction spending fell -0.1% m/m in July, in line with expectations. “The ISM manufacturing report indicated that companies are largely managing headcount rather than actively hiring. This may be a clue ahead of Friday’s jobs numbers. New jobs are likely slowing, but meaningful revisions to data over the prior months could mean that the report, good or bad, may not influence investors much,” said Scott Helfstein at Global X. Meanwhile, U.S. President Donald Trump said on Tuesday that his administration would seek an expedited Supreme Court ruling in an effort to overturn a federal court decision that found many of his tariffs were illegally imposed. Today, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the July JOLTs Job Openings will arrive at 7.380 million, compared to the June figure of 7.437 million. U.S. Factory Orders data will also be released today. Economists expect this figure to drop -1.3% m/m in July following a -4.8% m/m slump in June. In addition, market participants will parse comments today from St. Louis Fed President Alberto Musalem and Minneapolis Fed President Neel Kashkari. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. On the earnings front, notable companies like Salesforce (CRM), Figma (FIG), Hewlett Packard Enterprise (HPE), and Dollar Tree (DLTR) are slated to release their quarterly results today. U.S. rate futures have priced in a 91.7% probability of a 25 basis point rate cut and an 8.3% chance of no rate change at the conclusion of the Fed’s September meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.291%, up +0.33%. Trade docket today: Focus on SPX and either the /MNQ for scalping or possibly back to the QQQ's...depending on how much movement we get. My lean or bias today is still a bit bearish. Futures are up solidly on the strength of GOOG and AAPL and that may be enough to push us higher but the short term trend is bearish and I think there's a good chance we give up some of these gains. Let's look at the intra-day levels on /ES that I'll be focusing on today. There are a lot of tight levels today. 6459, 6463, 6469, 6480, 6488 are resistance levels with 6441, 6425, 6419, 6399 working as support. We'll have a training today on the H.E.A.T. approach to trading and investing around the 2:00PM EDT hour. Make sure to tune in! I'll see you all shortly in the live trading room and zoom feed.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |