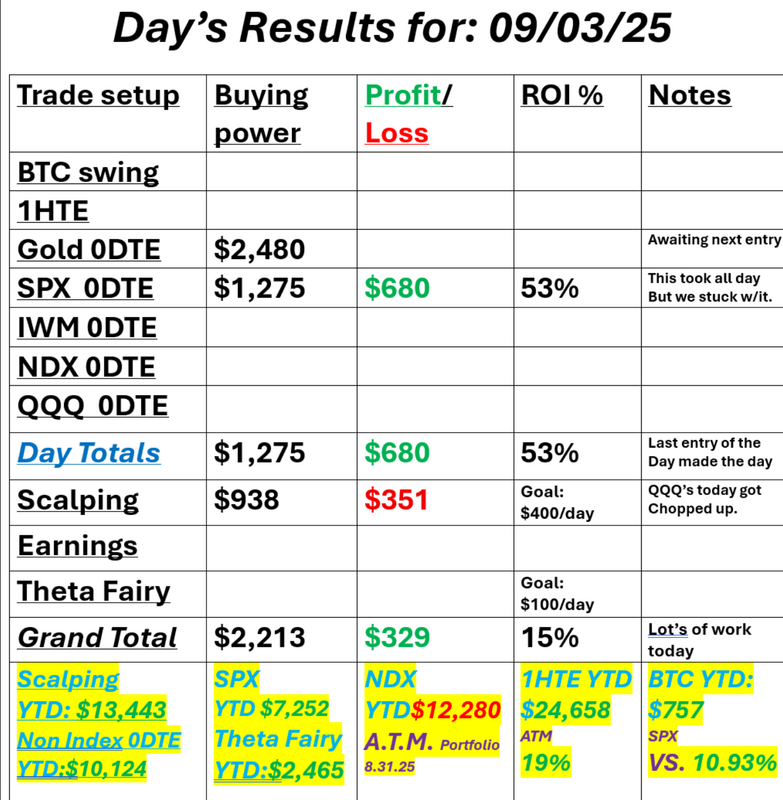

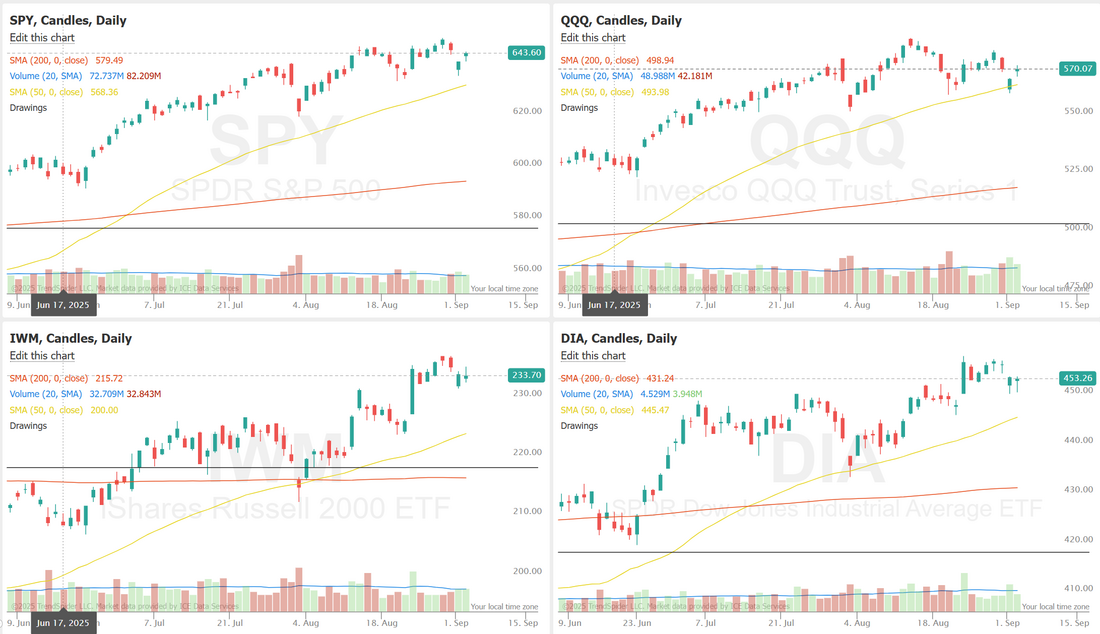

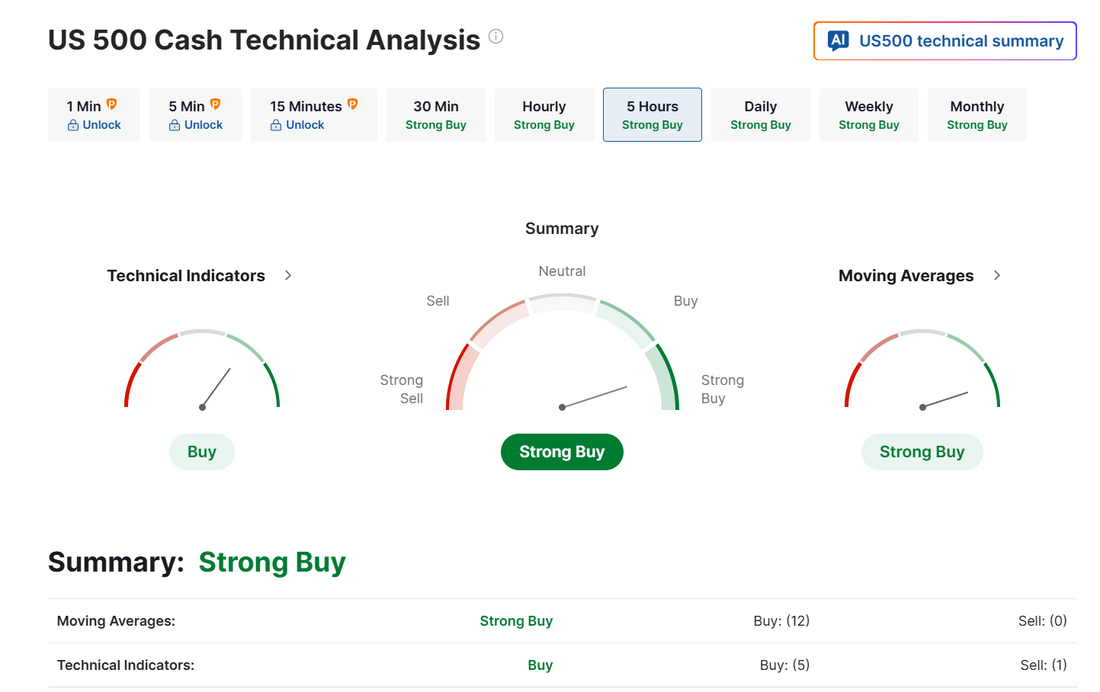

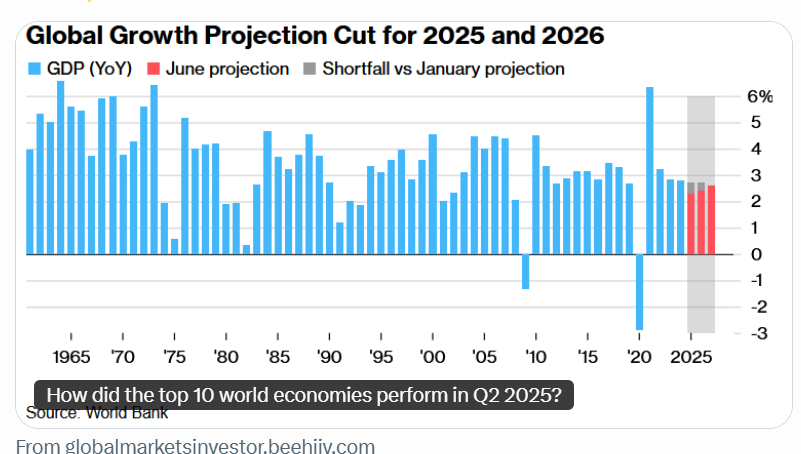

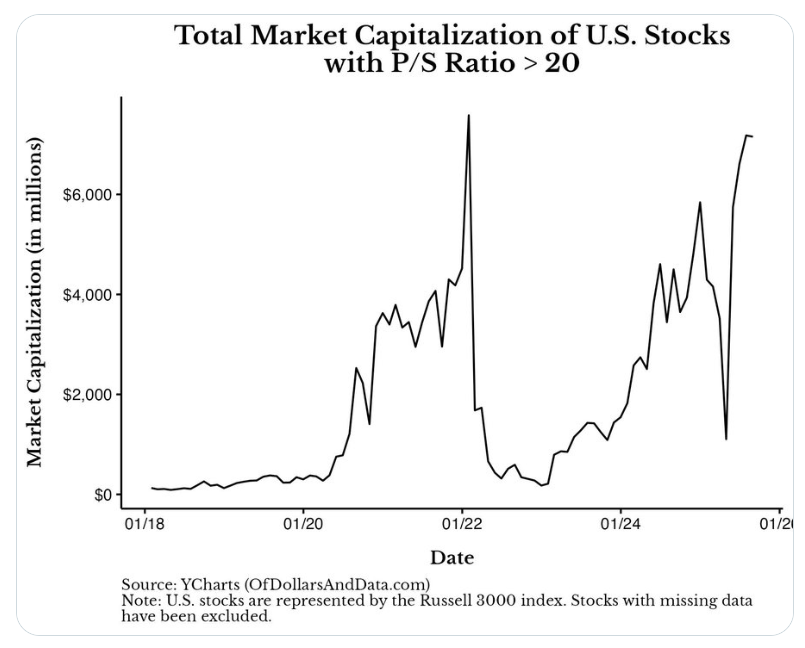

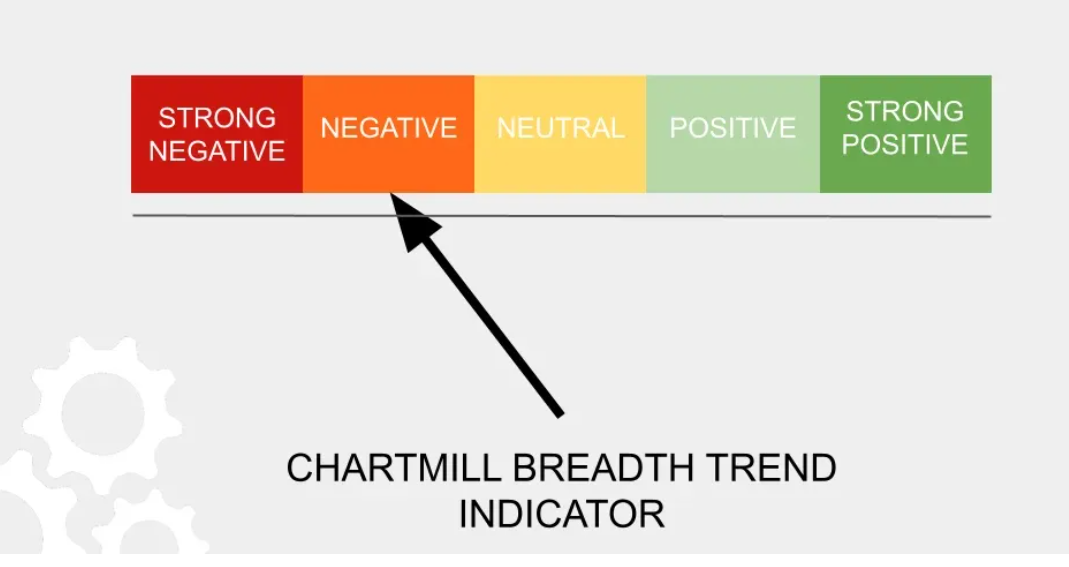

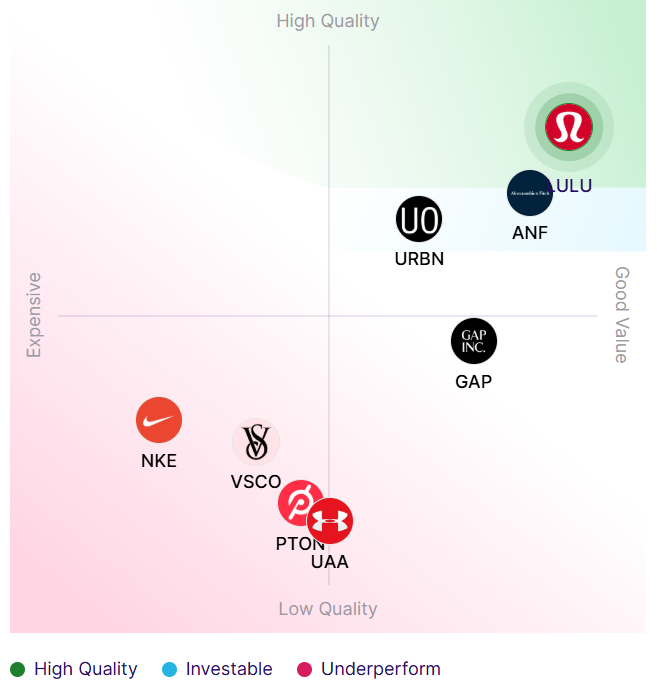

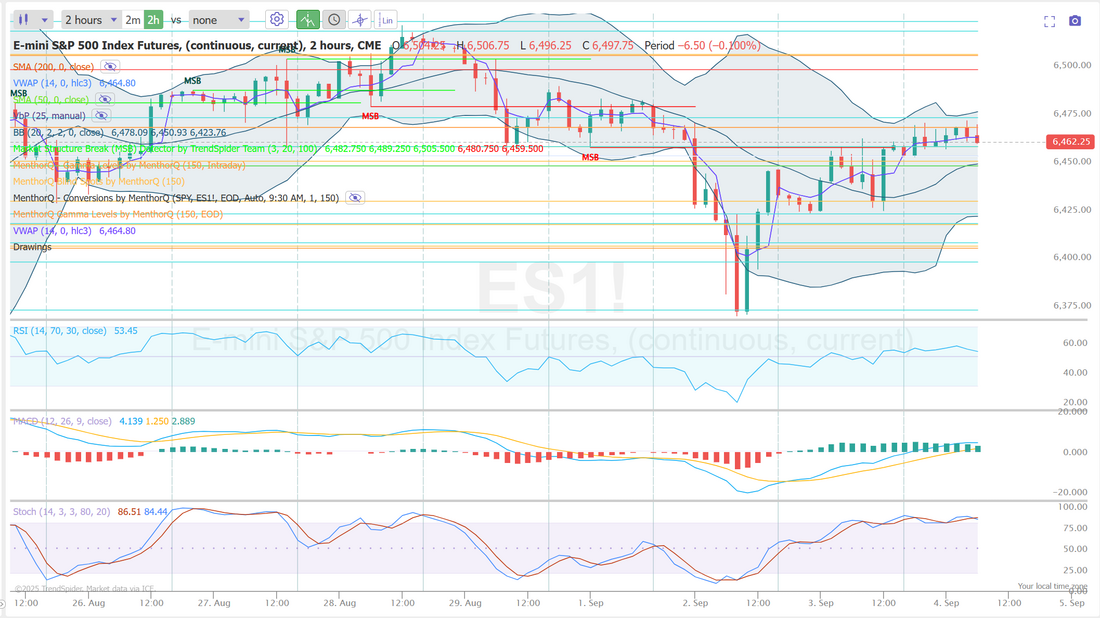

Ratio trade review todayWe had a good training session yesterday on the H.E.A.T. approach and we'll follow it up today with a review of the ratio trades. We had an O.K. day yesterday. I should have held off on scalping as it was just a chop fest. Our SPX was just O.K. most of the day. I think we had 6 total entries throughout the day and four were losers but the last setup really paid off. Here's a look at the day. Let's take a look at the markets. We continue to be stalled out here. We need a catalyst to either get us to new ATH's or really get a bearish move entrenched. Technicals are bullish. September S&P 500 E-Mini futures (ESU25) are up +0.19%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.33% this morning as Treasury yields extended their decline after the latest jobs report made it all but certain that the Federal Reserve will cut interest rates this month. Investors now await a fresh batch of U.S. economic data, comments from Fed officials, and an earnings report from semiconductor and software giant Broadcom. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Alphabet (GOOGL) jumped over +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after a judge ruled in an antitrust case that Google won’t be forced to sell its Chrome browser. Also, Apple (AAPL) rose more than +3% and was the top percentage gainer on the Dow after a court ruling allowed Alphabet to maintain an agreement under which Google pays Apple more than $20 billion annually to remain the default search engine on the Safari browser. In addition, The Campbell’s Company (CPB) climbed over +7% after the packaged food maker posted better-than-expected FQ4 adjusted EPS. On the bearish side, Dollar Tree (DLTR) slumped more than -8% and was the top percentage loser on the S&P 500 after the discount retailer issued disappointing Q3 guidance. A Labor Department report released on Wednesday showed that U.S. JOLTs job openings fell to a 10-month low of 7.181 million in July, weaker than expectations of 7.380 million. Also, U.S. factory orders fell -1.3% m/m in July, in line with expectations. “[The JOLTs report] does confirm the slowing pace of hirings being seen in a variety of stats in the aggregate, but something we’re well aware of — and why the Fed is cutting rates by 25 basis points in two weeks,” said Peter Boockvar at The Boock Report. Fed Governor Christopher Waller said on Wednesday that the central bank should start cutting interest rates this month and proceed with multiple reductions in the months ahead, noting that officials may debate the exact pace of easing. Also, Minneapolis Fed President Neel Kashkari said, “Inflation is still too high, but at the same time, the labor market is showing some signs of cooling, so it’s, we’re getting into a tricky position now for the Fed.” At the same time, St. Louis Fed President Alberto Musalem said, “The current modestly restrictive setting of the policy rate is consistent with today’s full-employment labor market and core inflation nearly one percentage point above the Fed’s 2% target.” In addition, Atlanta Fed President Raphael Bostic reiterated that he views one rate cut as appropriate for this year, though he noted that could change depending on the trajectory of inflation and the labor market. U.S. rate futures have priced in a 97.6% chance of a 25 basis point rate cut and a 2.4% chance of no rate change at the Fed’s monetary policy committee meeting later this month. Meanwhile, the Fed said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity showed “little or no change” in recent weeks. “Across districts, contacts reported flat to declining consumer spending because, for many households, wages were failing to keep up with rising prices,” according to the Beige Book. The report also said that every region reported price increases, with 10 of the 12 citing “moderate or modest” inflation and two noting “strong input price growth.” “Nearly all districts noted tariff-related price increases, with contacts from many districts reporting that tariffs were especially impactful on the prices of inputs,” according to the report. Today, investors will monitor earnings reports from several high-profile companies, with Broadcom (AVGO), Copart (CPRT), Lululemon Athletica (LULU), and Samsara (IOT) set to release their quarterly results. On the economic data front, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the August ADP Nonfarm Employment Change will stand at 73K, compared to the July figure of 104K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the August ISM services index to be 50.9 and the S&P Global services PMI to be 55.3, compared to the previous values of 50.1 and 55.7, respectively. U.S. Unit Labor Costs and Nonfarm Productivity data will be released today. Economists forecast final Q2 Unit Labor Costs to rise +1.2% q/q and Nonfarm Productivity to rise +2.8% q/q, compared to the first-quarter numbers of +6.9% q/q and -1.8% q/q, respectively. U.S. Trade Balance data will come in today. Economists anticipate the trade deficit will widen to -$77.70 billion in July from -$60.20 billion in June. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 230K, compared to last week’s number of 229K. In addition, market participants will be anticipating speeches from New York Fed President John Williams and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.193%, down -0.43%. The Conference Board LEI index has dropped in 38 of the last 41 months to its lowest in 11 years. In July, the LEI flashed a recession signal. Versus the Coincident Economic Index (CEI), it’s now at the weakest since 2008 How does this end well? Trade docket today: We've got a focus on our LULU trade after the close as it reports earnings. Just a small 249% I.V.! SPX 0DTE with /MNQ scalping today. Market breadth slipped notably on September 2, 2025, with just 27.3% of stocks advancing against 70.6% declining. This marks a sharp deterioration from Friday’s more balanced session (39.2% advancers), and resembles the weak structure seen on August 25. The number of new highs fell to 2.8%, while new lows stayed modest at 1.1%, suggesting limited leadership at the top. Short-term momentum clearly faltered: only 56% of stocks remain above their 20-day SMA, down sharply from nearly 75% just a week ago. While the 50-, 100-, and 200-day readings (63.9%, 71.2%, and 59.3% respectively) still show longer-term support, the steady erosion at the shorter time frames hints at increasing fragility. Forward-looking indicators turned less favorable as well. The weekly advance/decline balance slipped to 40.7% vs. 57.7% decliners, a noticeable reversal compared to last week’s strong weekly breadth. Monthly and 3-month measures still lean constructive, but they are gradually softening, particularly on the monthly side where advancing breadth fell back to 65% from over 75% at the end of August. Compared with the previous breadth update, the data confirm that Friday’s bounce was only temporary. Weakness has reasserted itself, especially at the short-term level, with fewer stocks managing to hold above their faster-moving averages. The underlying trend is therefore tilting back toward the negative side. Current breadth trend rating: 2 (negative). On the topic of LULU. If nothing else, we are in the company of the great Michael Burry who has a large call option position on LULU ahead of earnings. This is a quality company compared to it's peers. The SPX option score chart as of September 3, 2025, shows that the index continues to hold near the upper end of its recent range, with spot prices consolidating around the 6,350–6,450 zone. The option score, however, highlights a volatile short-term sentiment, swinging between stronger readings and sudden dips, suggesting traders are actively repositioning. In the immediate term, the score’s recovery off recent lows points to stabilizing sentiment, but the repeated fluctuations hint at caution. Near-term momentum will likely depend on whether the index can maintain strength above the recent high range or if pressure from option flows sparks another short-lived pullback. My bias or lean yesterday was looking for a retrace, which we got but we did power into the close to erase most of the damage. Futures are up this morning but once again, I think we get a muted day. I'm more neutral today. Let's take a look at the intra-day levels. Some have gotten more pronounced after yesterday's bound trading. Levels are clustered tightly. 6470, 6475, 6481, 6489, 6499 are resistance zones. 6459, 6452, 6448, 6432, 6424 are support zones. I look forward to trading with you all and reviewing the ratio trades training today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |