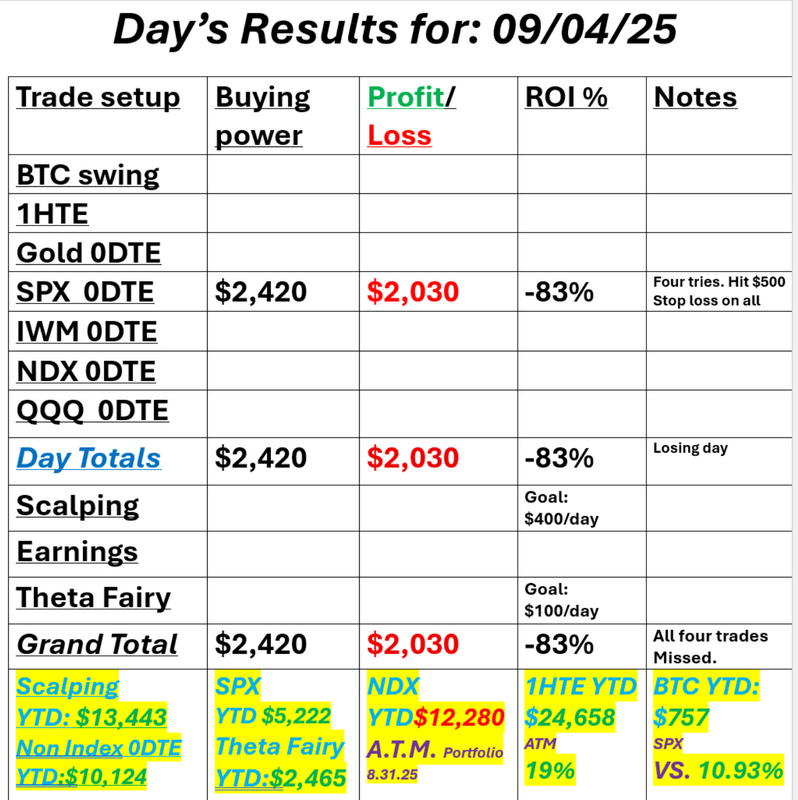

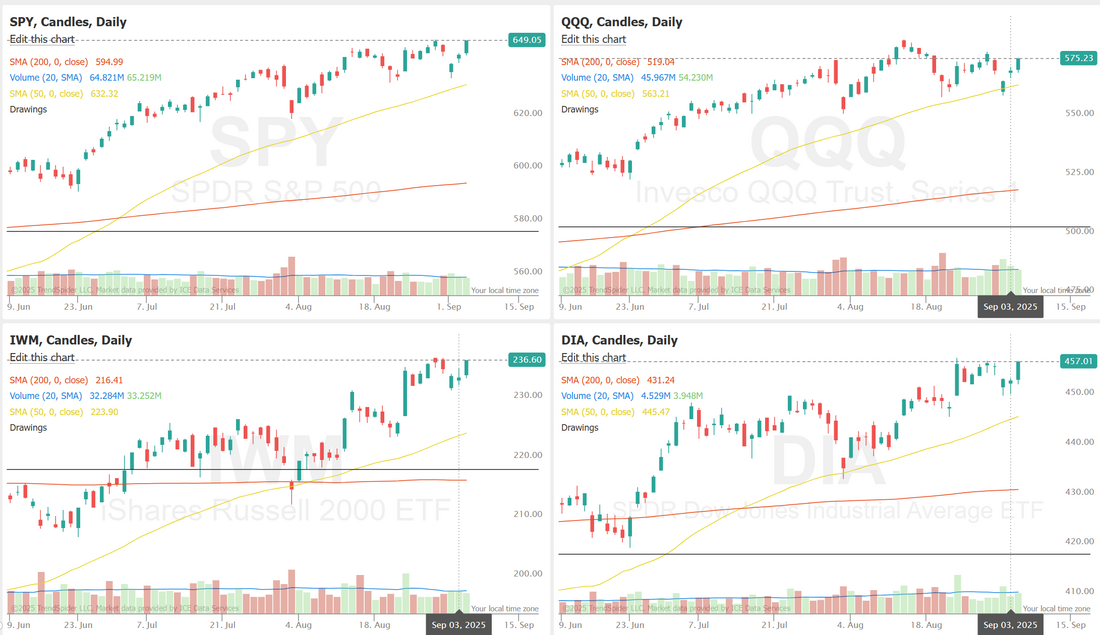

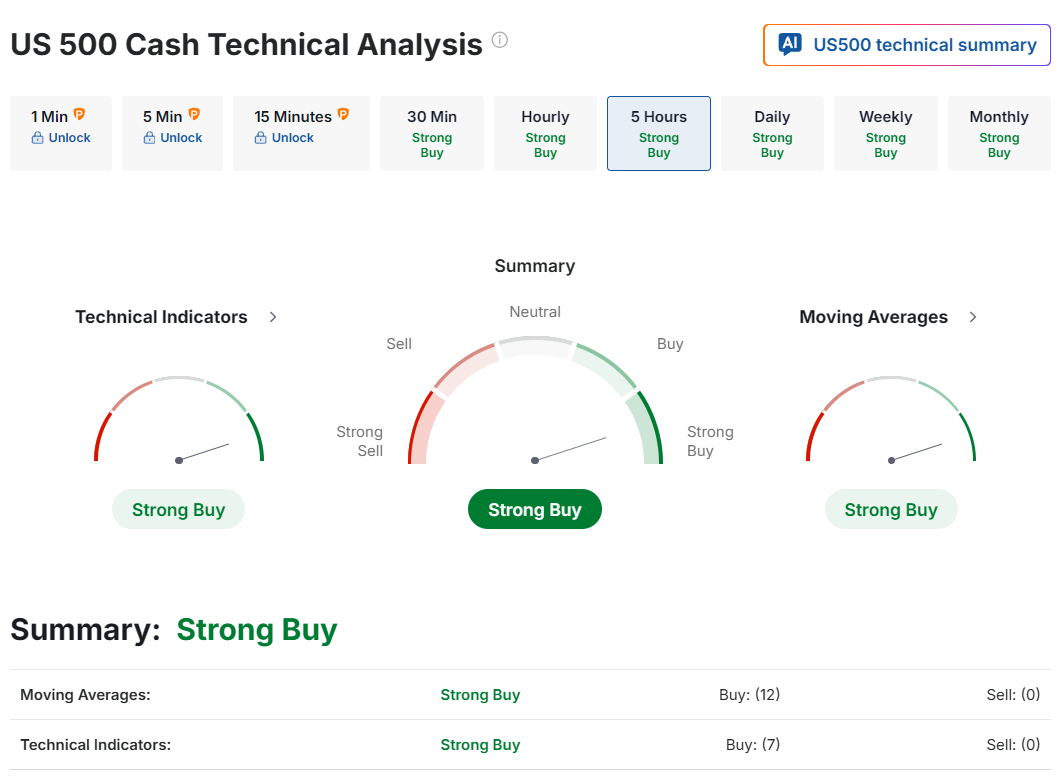

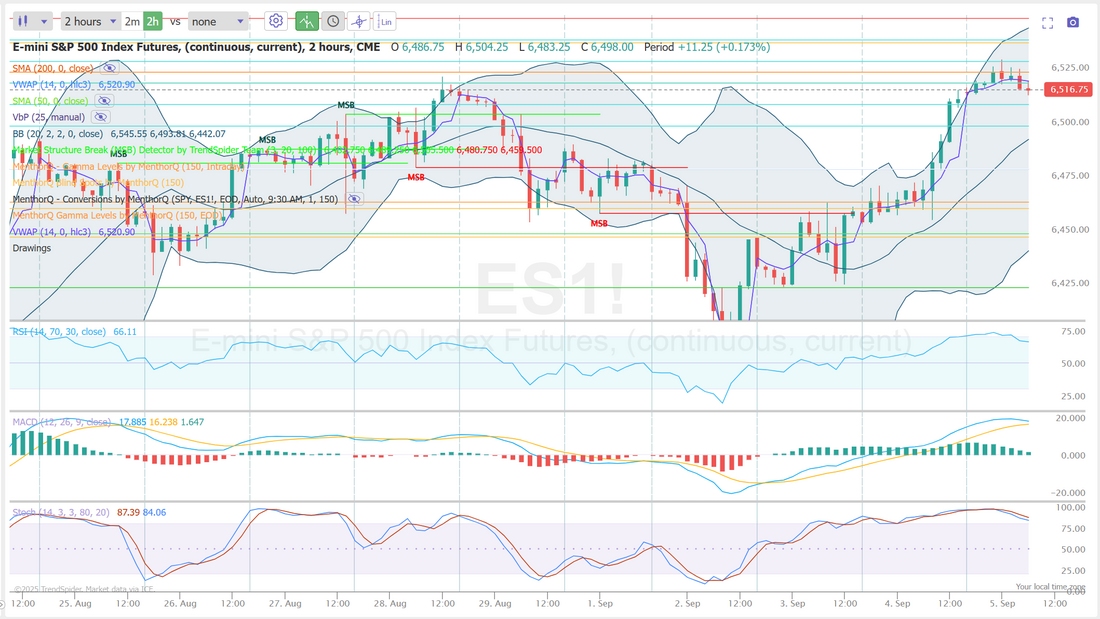

Bulls are back?The last two trading days have had a strong finish to the end of the trading sessions. Are the bulls back? Most of the indices are back to ATH levels. The Nasdaq being the slight laggard. It certainly looks like the bulls are back. NFP is out this morning and should be our main driver for the day. I had a bad day yesterday. We try to keep our risk to $500 dollars on each SPX setup and I went through four setups in the day, hitting the stop loss on all of them. Looking for a retrace that never came. I'm going to extend my wait time in the morning before jumping in. Let's see if we can get a trend to establish before getting in. Our LULU trade looks doomed as well. I was truly hopeful that earnings would show a turn around. The results were in line with expectations but the market doesn't like what it's seeing. Time to cut that trade and wait for a better entry. Here's a look at my day yesterday. Let's take a look at the markets. Those ATH's look like they are going to become new ATH's. September S&P 500 E-Mini futures (ESU25) are trending up +0.18% this morning as optimism grows that the U.S. payrolls report will pave the way for the Federal Reserve to resume cutting interest rates later this month. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. T. Rowe Price Group (TROW) climbed over +5% and was the top percentage gainer on the S&P 500 after Goldman Sachs announced plans to invest up to $1 billion in the company and partner with the asset manager to sell private-market products to retail investors. Also, most chip stocks gained ground, with Micron Technology (MU) rising more than +4% to lead gainers in the Nasdaq 100 and KLA Corp. (KLAC) advancing over +3%. In addition, Amazon.com (AMZN) rose over +4% and was the top percentage gainer on the Dow after announcing several positive business updates, including a new partnership for its Project Kuiper and favorable news regarding its investment in AI startup Anthropic. On the bearish side, Salesforce (CRM) slid more than -4% and was the top percentage loser on the Dow after the cloud software company provided disappointing Q3 guidance. The ADP National Employment report released on Thursday showed that U.S. private nonfarm payrolls rose by 54K in August, weaker than expectations of 73K. Also, the number of Americans filing for initial jobless claims in the past week rose by +8K to a 10-week high of 237K, compared with the 230K expected. At the same time, U.S. Q2 nonfarm productivity was revised upward to +3.3% q/q, stronger than expectations of +2.8% q/q, while unit labor costs were revised lower to +1.0% q/q, weaker than expectations of +1.2% q/q. In addition, the U.S. ISM services index rose to 52.0 in August, stronger than expectations of 50.9. “The Federal Reserve’s free pass on the labor market has ended. You can expect the Fed to tilt its balance of risks to cut rates in September,” said Jamie Cox at Harris Financial Group. New York Fed President John Williams stated on Thursday that his forecast is that it will “become appropriate” to lower interest rates “over time,” while refraining from specifying the timing or pace of the reductions. Also, Chicago Fed President Austan Goolsbee said he is uncertain whether a rate cut will be appropriate at the Fed’s upcoming meeting, citing ongoing uncertainty over how much tariffs might accelerate inflation and how much they might be weighing on the labor market. “It’s a live meeting for me, but I haven’t, I haven’t made-up my mind on that,” Goolsbee said. Meanwhile, U.S. rate futures have priced in a 99.4% probability of a 25 basis point rate cut at September’s monetary policy meeting. In tariff news, U.S. President Donald Trump said on Thursday he would impose tariffs on semiconductor imports “very shortly” but exempt goods from companies like Apple that have pledged to increase their U.S. investments. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. The report will serve as a key consideration for Fed officials ahead of their September policy meeting. Economists, on average, forecast that August Nonfarm Payrolls will come in at 75K, compared to the July figure of 73K. A survey conducted by 22V Research revealed that investor attention has shifted sharply to payrolls after last month’s weak figure and large revisions. According to the tally, 36% of respondents expect a “risk-off” market reaction to the key jobs report, 35% anticipate a “mixed/negligible” response, and 29% expect “risk-on.” “The most relevant question for the August payrolls report is: did June see the bottoming for job creation or is there still further downside yet to be realized?” said Vail Hartman at BMO Capital Markets. “In the event that Friday’s data shows an improvement from the recent lull in hiring, then the Fed would have grounds for a patient approach to rate cuts over the balance of the year. Conversely, if NFP disappoints, the Fed could choose to express its dovishness by dropping the year-end dot in the SEP, signaling that it expects to cut in October and December,” he said. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect August figures to be +0.3% m/m and +3.7% y/y, compared to the previous numbers of +0.3% m/m and +3.9% y/y. The U.S. Unemployment Rate will be reported today as well. Economists forecast that the August figure will creep up a tick to 4.3%, the highest level since 2021, from 4.2% in the prior month. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.158%, down -0.43%. Bullish technical bias is getting stronger. Sole focus today is LULU and SPX. Scalping /MNQ or QQQ if we get a trend move. Let's look at our intra-day levels on /ES. 6525, 6531, 6539, 6550 are resistance zones. 6510, 6500, 6481, 6464 are support. 6481 is a big level. If bears can break that then 6464 is next on the list and below that the bears have room to run. Let's finish the week with some green! Focus on SPX today. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |