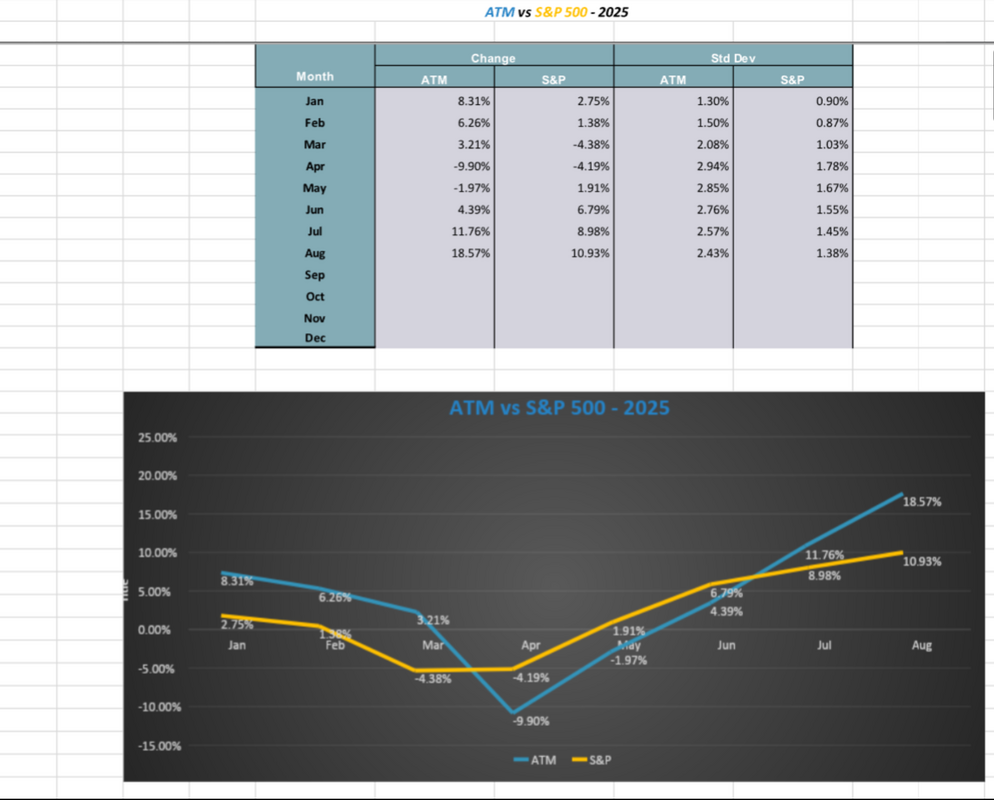

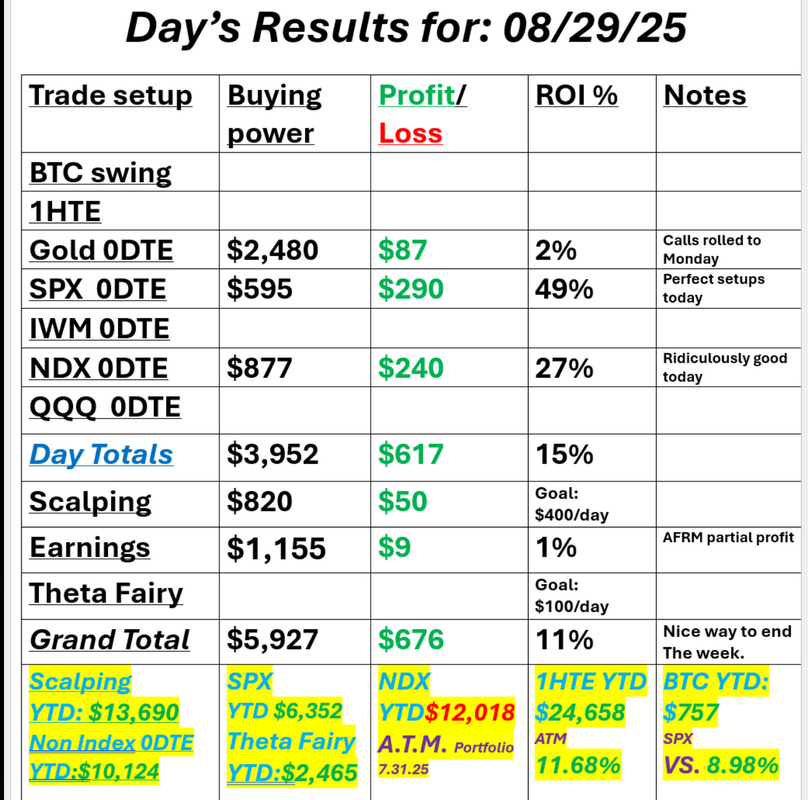

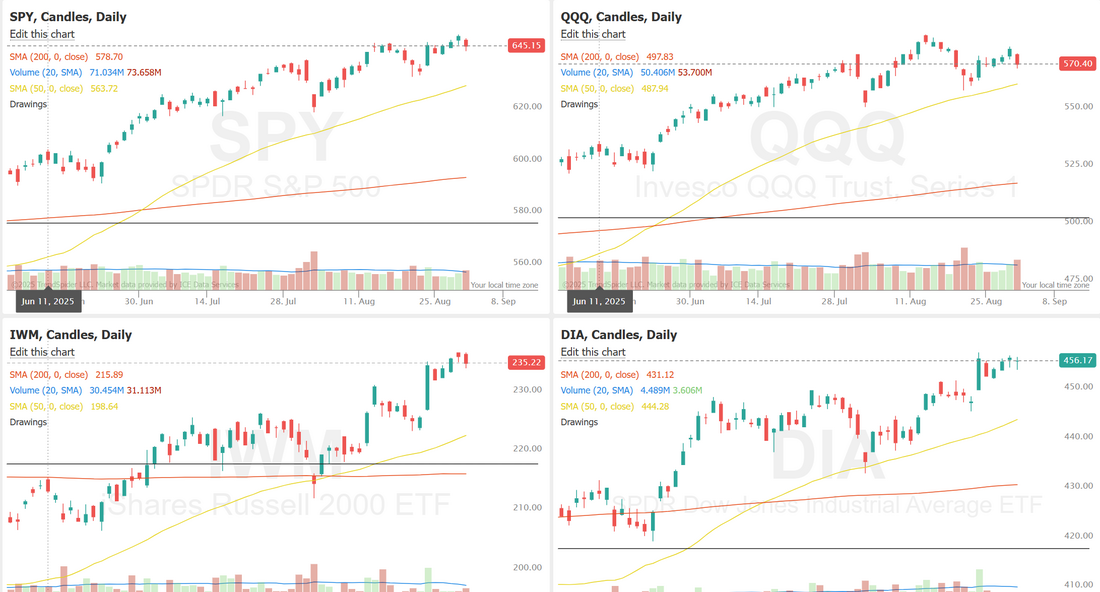

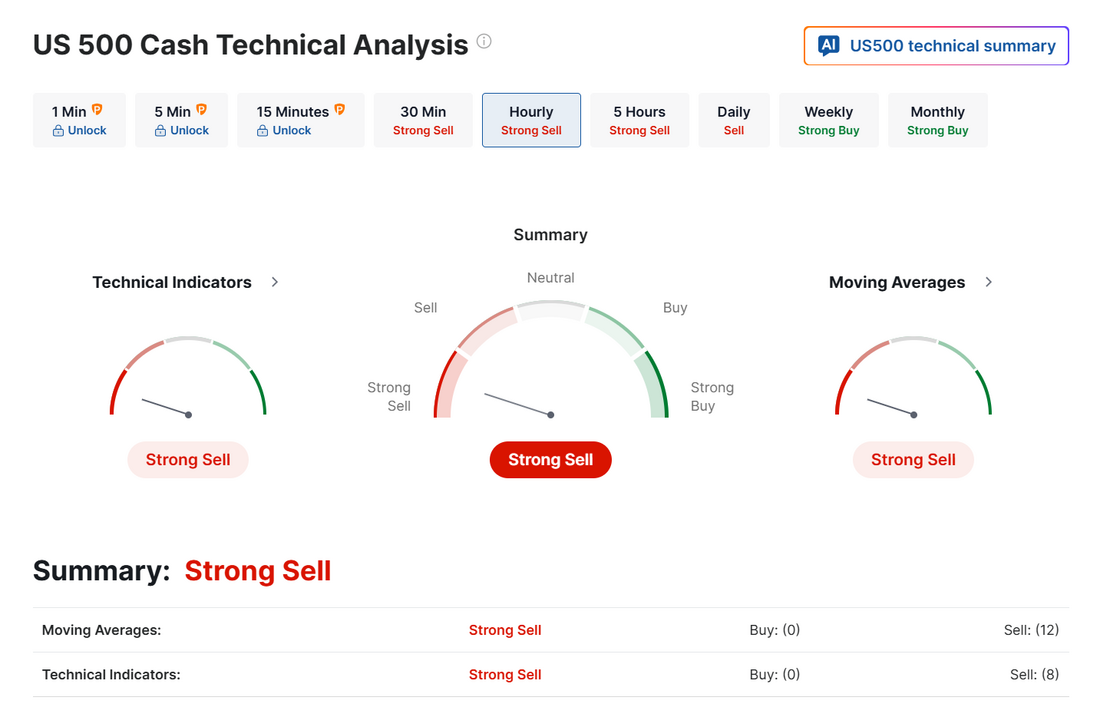

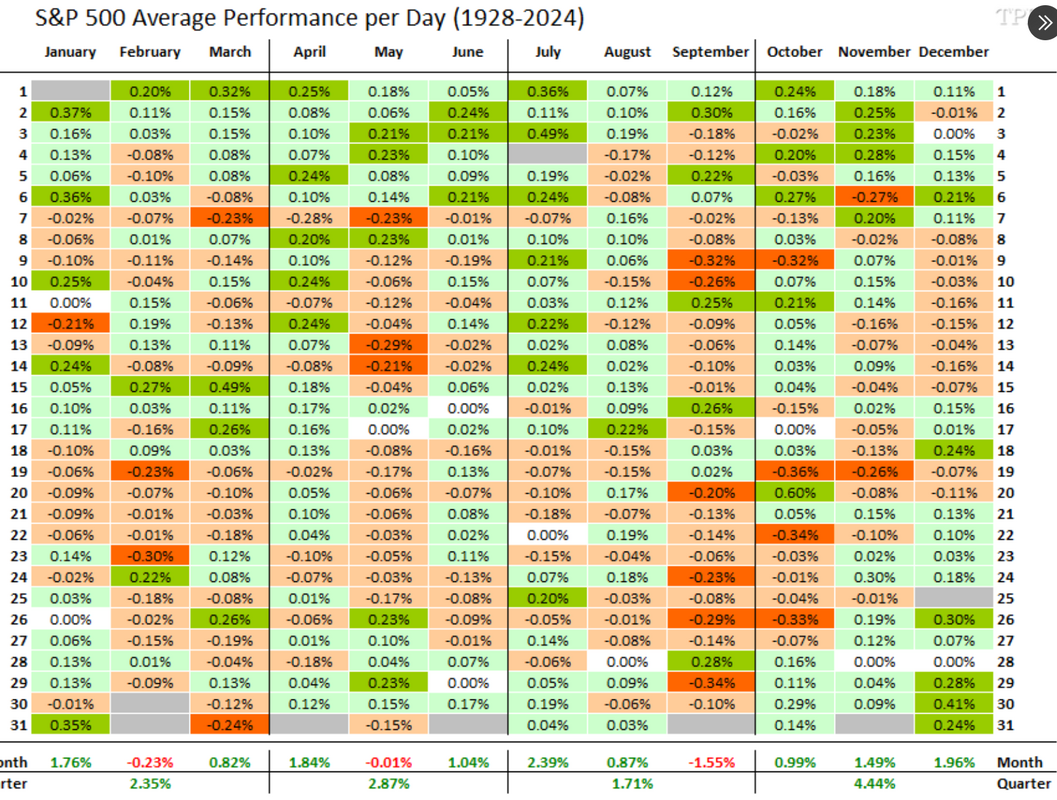

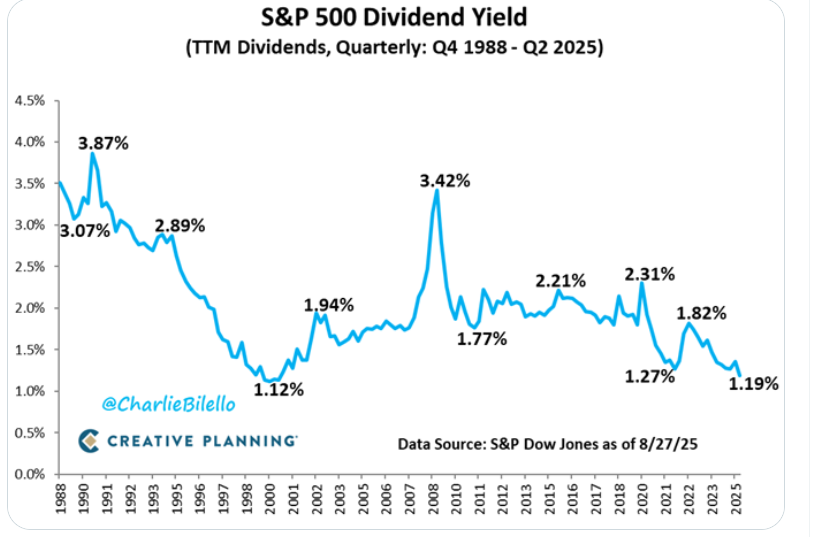

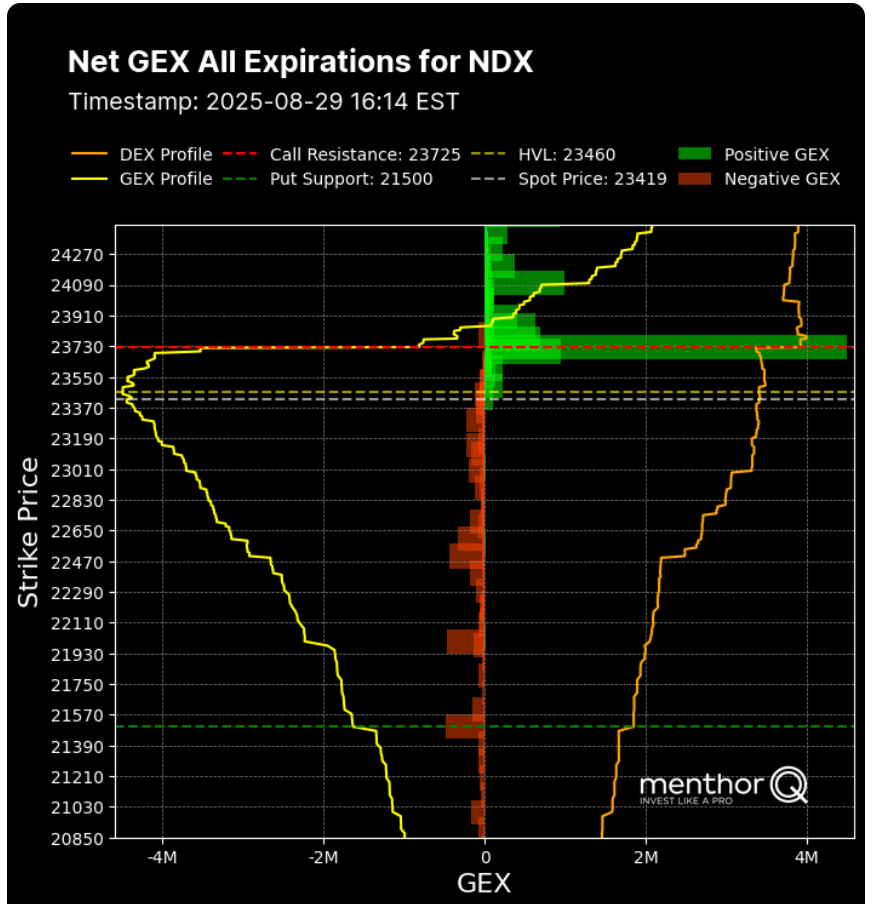

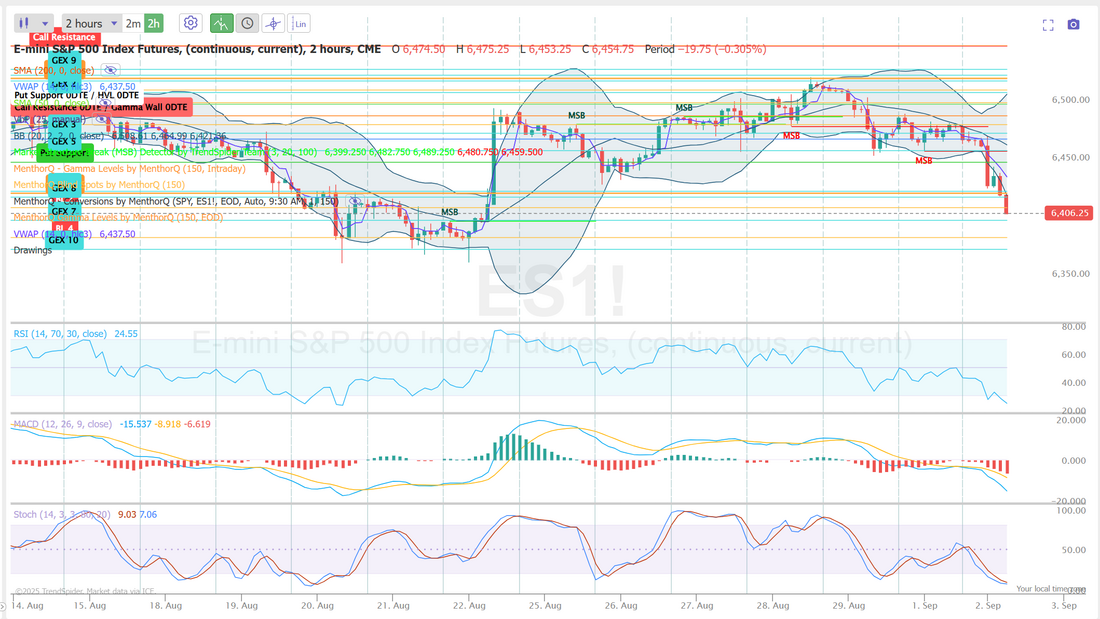

NFP and LULU are this weeks focusWelcome back to a holiday shortened trading week. NFP on Friday is the main focus this week and LULU earnings on Thursday are in focus for us. We had a good day Friday with the exception of our gold trade. Gold continues to push to new ATH's. We'll keep chasing it. Our ATM portfolio continues to perform well and sits at new ATH's. Here's a look at it's performance YTD. At the start of this year I expressed the opinion that, after two strong years the market would have a muted return potential and that we had a great shot at outperforming it, once again. I'm not sure if we'll get to our 30+% ROI goal but we are making good progress. Here's a look at our Friday results. I'm also excited about tomorrow's zoom session and training segment on H.E.A.T.. I know it will be helpful to our members in building portfolios and trade setups. Let's take a look at the markets. Is the rollover finally here? Technicals have turned negative. September is not a great month for the market. The S&P 500's Dividend Yield has moved down to 1.19%, the lowest level since 2000. September S&P 500 E-Mini futures (ESU25) are down -0.75%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.95% this morning as Treasury yields climbed after cash trading resumed following the Labor Day holiday. This week, investors look ahead to remarks from Federal Reserve officials, earnings reports from several high-profile companies, as well as a slew of U.S. economic data, with a particular focus on Friday’s nonfarm payrolls report. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Marvell Technology (MRVL) tumbled over -18% and was the top percentage loser on the Nasdaq 100 after the chip designer provided tepid Q3 revenue guidance. Also, Dell Technologies (DELL) slid more than -8% and was the top percentage loser on the S&P 500 after reporting a slowdown in AI server orders in Q2 and a weaker-than-expected operating margin in its infrastructure unit. In addition, Caterpillar (CAT) fell over -3% and was the top percentage loser on the Dow after warning that it expects a larger-than-anticipated net tariff impact of up to $1.8 billion this year. On the bullish side, Autodesk (ADSK) climbed over +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q2 results and issued above-consensus Q3 guidance. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.3% m/m and +2.9% y/y in July, in line with expectations. Also, U.S. July personal spending climbed +0.5% m/m, in line with expectations, and personal income rose +0.4% m/m, in line with expectations. In addition, the U.S. Chicago PMI fell to 41.5 in August, weaker than expectations of 46.6. Finally, the University of Michigan’s U.S. August consumer sentiment index was unexpectedly revised lower to 58.2, weaker than expectations of no change at 58.6. “The good news is, in-line expectations likely keep the status quo intact, which leaves a Fed rate cut in play for September. The bad news is, inflation is continuing to inch higher, which isn’t really the environment the Fed likely wants to cut in,” said Bret Kenwell at eToro. San Francisco Fed President Mary Daly indicated on Friday that officials are likely to be ready to cut interest rates soon, noting that inflation pressures from tariffs will probably be temporary. “It will soon be time to recalibrate policy to better match our economy,” Daly wrote in a brief social media post. U.S. rate futures have priced in a 91.8% chance of a 25 basis point rate cut and an 8.2% chance of no rate change at the September FOMC meeting. Following Friday’s selloff in tech stocks on Wall Street, the record-breaking stock rally now faces a critical test this month, with jobs data, inflation numbers, and the Fed’s rate decision all scheduled in the coming weeks. Tariff tensions and uncertainty over the Fed’s independence are further adding to risks in September, which has historically been the weakest month of the year for U.S. markets. In this holiday-shortened week, the U.S. August Nonfarm Payrolls report will be the main highlight. The report will serve as a key consideration for Fed officials ahead of their September policy meeting, with many analysts anticipating that August payrolls will confirm a slowdown in U.S. job creation. Ahead of the key jobs report, additional insights into the health of the U.S. labor market will come from the JOLTs Job Openings, ADP Nonfarm Employment Change, and Initial Jobless Claims. Other noteworthy data releases include the U.S. Trade Balance, Factory Orders, Nonfarm Productivity, Unit Labor Costs, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, Average Hourly Earnings, and the Unemployment Rate. Investors will hear perspectives from St. Louis Fed President Alberto Musalem, Minneapolis Fed President Neel Kashkari, New York Fed President John Williams, and Chicago Fed President Austan Goolsbee throughout the week. The Fed will also release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In addition, several high-profile companies, including Broadcom (AVGO), Salesforce (CRM), Zscaler (ZS), Hewlett Packard Enterprise (HPE), Dollar Tree (DLTR), and Lululemon Athletica (LULU), are scheduled to report their quarterly results this week. Meanwhile, market participants will also be watching the U.S. administration’s next steps after a federal appeals court ruled on Friday that most of President Trump’s global tariffs were illegal, stating he exceeded his authority by enacting them through an emergency law. However, the judges allowed the tariffs to remain in effect while the case proceeds. Today, investors will focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI, set to be released in a couple of hours. Economists expect the August ISM manufacturing index to be 49.0 and the S&P Global manufacturing PMI to be 53.3, compared to the previous values of 48.0 and 49.8, respectively. U.S. Construction Spending data will also be released today. Economists forecast the July figure at -0.1% m/m, compared to -0.4% m/m in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.283%, up +0.87%. The SPX chart with option score dynamics suggests a market currently consolidating near recent highs while option activity points to short-term indecision. Spot prices are holding steady above 6400 after a strong rally, but the option score has dipped from peak levels, reflecting reduced conviction among derivatives traders. This kind of divergence often implies that while price remains firm, positioning is becoming more cautious. In the near term, traders may want to watch whether option score stabilizes back toward higher readings, which could support further upside momentum, or if it slips lower, potentially signaling a period of choppier price action. The NDX options positioning chart shows that the index is currently trading near 23,419, with a strong cluster of positive gamma exposure (GEX) concentrated just above the current spot price, particularly around the 23,600–23,700 range. This suggests dealers may help dampen volatility as long as the index remains in this zone. The put support sits much lower at 21,500, forming a potential downside anchor, while the call resistance level at 23,725 marks the upper bound that could act as a near-term ceiling. With the High Volatility Level (HVL) at 23,460, the market is hovering just below this pivot point, making short-term moves around this threshold key to watch. In the short term, traders may focus on whether NDX can sustain momentum toward the 23,725 resistance zone, as failure to do so could trigger mean reversion closer to HVL or even lower toward the mid-23,000s. Conversely, a decisive move above resistance would suggest that option flows could flip more supportive of continuation higher. Trade docket today: I'll continue to work the Gold trade. SPX 0DTE and possible scalping on /MNQ. Futures are already down -300 points so we may have missed the big moves today. We'll also add a call side to our LULU trade before earnings Thurs. Let's look at the new intra-day levels today for /ES. 6420, 6424, 6438, are the closest resistance zones. 6400 is a big support with 6385, 6375 up next. Below 6375 we could get some nice downside action! We can always hope! I look forward to seeing you all in the live trading room shortly!

0 Comments

|

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |