|

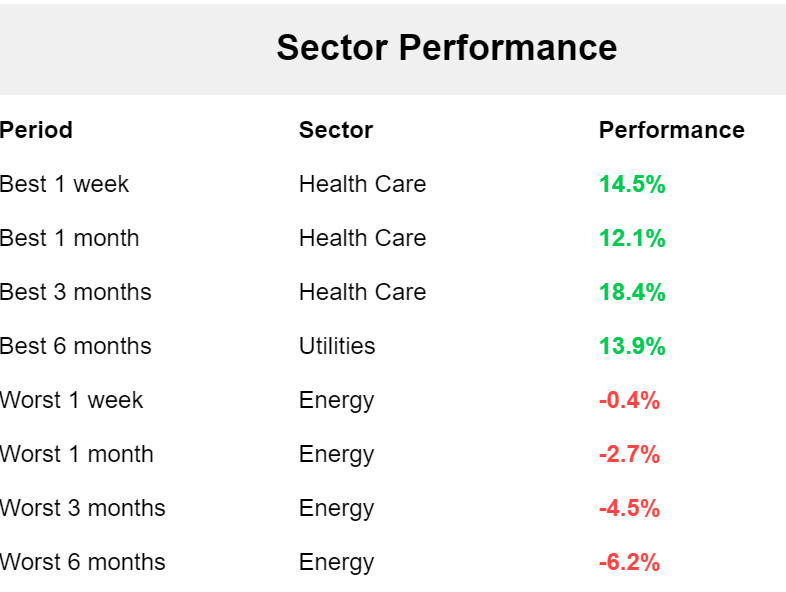

Welcome back traders! A new week and the last trading day of Sept. The wifes already breaking out the Halloween stuff. We had an excellent day Friday. Our event contracts played a big roll in that. Once again, our NDX trades offered the most potential and also the most risk. We had an E.C. NDX trade on that would pay our almost a 300% return if it hit. That allowed us to sit in our other NDX trades until the close. It became a sacrifice to the greater good. See our results below: The markets have had a nice, long run. They are starting to look tired here. Rolling over from a buy mode to an ever so slight sell mode. You can see the trend (bullish) and the length (almost three weeks) of an uptrend but, you can also see it starting to fade. Let's take a look at some of the statistics. The SPY remained the leader this week, surging above a rising 8 EMA and setting yet another new all-time high before closing just lower at $571.47 (+0.61%). Traders will be closely monitoring the $565 level on any pullback, as this former resistance throughout the summer could now serve as support if momentum weakens next week. After weeks of anticipation, QQQ finally managed to fill the July gap but immediately got rejected and closed the week at $486.75 (+0.89%). While the price is powering higher above the 8 EMA, bulls should watch the $489 area closely, as it has served as key resistance since early summer. If the index is to reach new all-time highs soon, it will need to dig in here. Despite a rough start to the week, IWM found support at the 8 EMA, closing just below the large volume nodes and ending the week at $220.33 (-0.59%). Now, the $225 level comes into focus. Having acted as strong resistance since early July, this is the key level the index needs to break through to continue its push higher. Let's look at the expected moves this week: We've got some solid I.V. to work with this week. In fact, we've got a Theta fairy working right now that we put on Sunday evening. I'm not sure how many more we'll get this week but it looks somewhat promising. December S&P 500 E-Mini futures (ESZ24) are down -0.29%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.31% this morning as market participants looked ahead to remarks from Federal Reserve Chair Jerome Powell and other Fed officials as well as a fresh batch of U.S. labor market data, with a particular focus on Friday’s nonfarm payrolls report. In Friday’s trading session, Wall Street’s major averages closed mixed. HP Inc. (HPQ) slumped nearly -4% after Bank of America downgraded the stock to Neutral from Buy. Also, chip stocks lost ground, with Marvell Technology (MRVL) sliding more than -3% to lead losers in the Nasdaq 100 and Applied Materials (AMAT) dropping over -2%. In addition, Costco Wholesale (COST) fell more than -1% after the company reported weaker-than-expected Q4 revenue. On the bullish side, Wynn Resorts (WYNN) climbed over +7% and was the top percentage gainer on the S&P 500 after Morgan Stanley upgraded the stock to Overweight from Equal Weight with a price target of $104. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.1% m/m and +2.7% y/y in August, compared to expectations of +0.2% m/m and +2.7% y/y. Also, U.S. August personal spending rose +0.2% m/m, weaker than expectations of +0.3% m/m, while August personal income grew +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, the University of Michigan U.S. consumer sentiment index was revised upward to a 5-month high of 70.1 in September, stronger than expectations of 69.0. “Add [Friday’s] PCE price index to the list of economic data landing in a sweet spot,” said Chris Larkin, managing director, trading and investing, at E*Trade. “Inflation continues to keep its head down, and while economic growth may be slowing, there’s no indication it’s falling off a cliff.” St. Louis Fed President Alberto Musalem stated on Friday that the U.S. central bank should reduce interest rates “gradually” following what he described as the “strong and clear message” of a half-point interest rate cut, which he endorsed. “For me, it’s about easing off the brake at this stage. It’s about making policy gradually less restrictive,” Musalem said in an interview with the Financial Times. If the economy or the labor market deteriorates more than anticipated, he noted, “a faster pace of rate reductions might be appropriate.” U.S. rate futures have priced in a 58.5% chance of a 25 basis point rate cut and a 41.5% probability of a 50 basis point rate cut at the next central bank meeting in November. In the coming week, the U.S. Nonfarm Payrolls report for September will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including U.S. JOLTs Job Openings, S&P Global Manufacturing PMI, Construction Spending, ISM Manufacturing PMI, ADP Nonfarm Employment Change, Crude Oil Inventories, Initial Jobless Claims, S&P Global Composite PMI, S&P Global Services PMI, Factory Orders, ISM Non-Manufacturing PMI, Average Hourly Earnings, and the Unemployment Rate. Meanwhile, Fed Chairman Jerome Powell is set to deliver a speech at the annual meeting of the National Association for Business Economics in Nashville later today. A host of other Fed officials will also be making appearances throughout the week, including Bowman, Bostic, Cook, Collins, Barkin, and Williams. Several notable companies like Nike (NKE), Carnival (CCL), Paychex (PAYX), McCormick & Company (MKC), and Levi Strauss (LEVI) are slated to release their quarterly results this week. Today, investors will focus on the U.S. Chicago PMI, which is set to be released in a couple of hours. Economists forecast that the Chicago PMI will stand at 46.1 in September, matching last month’s value. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.785%, up +0.89%. My bias or lean today is bearish. I think its about time we start to build on this rollover momentum from Friday. Trade docket for today: /ES (Theta fairy), /MNQ,QQQ scalping. IWM, BB?, FSLR, WYNN, UPST, ORCL, CRM, PYPL, SHOP, SPY/QQQ, 0DTE's I look forward to seeing you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |