|

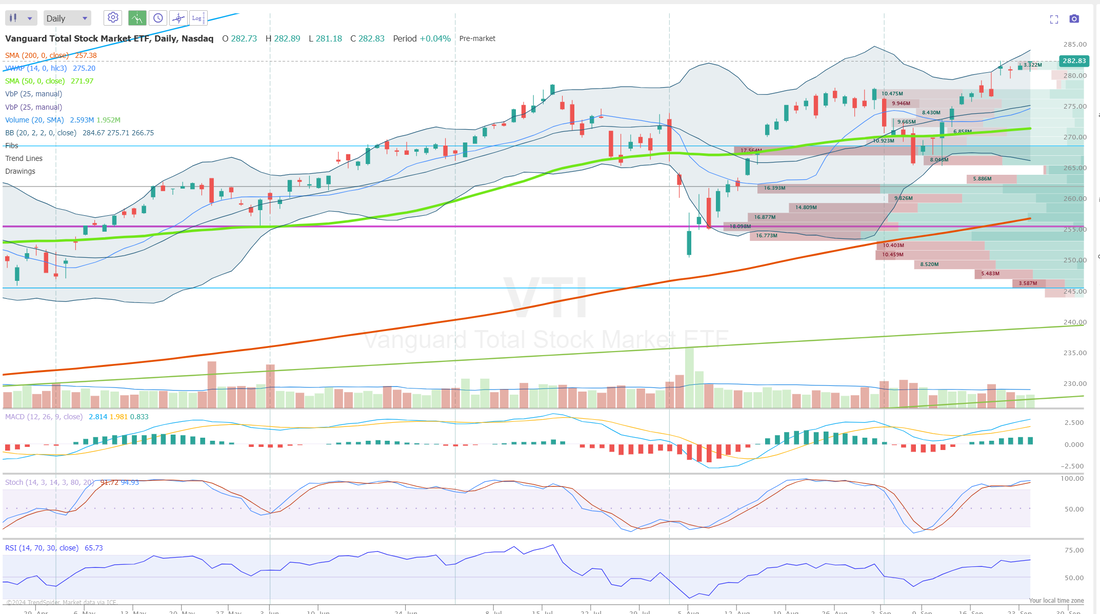

Welcome back traders. Midweek already! We has an 'excellent" day yesterday. We made some great profits on our day trades and our net liq was up. Here's a snapshot of our results. Markets are still tilting bullish However, we are looking to start a bearish hedge soon in our ATM program. Keep your eye on the VTI. It certainly looks top heavy. Once we get some sell signals we'll get a bearish setup working. Markets have been strong but the IWM seems to want to retrace and the QQQ's are still lagging behind. December S&P 500 E-Mini futures (ESZ24) are trending down -0.02% this morning, taking a breather after the benchmark index finished with its 41st record close this year, while investors looked ahead to remarks from a Federal Reserve official as well as an earnings report from semiconductor giant Micron. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs and the tech-heavy Nasdaq 100 posting a 2-1/4 month high. Nvidia (NVDA) climbed about +4% following a report from Barron’s that the company’s chief executive officer, Jensen Huang, was done selling his shares. Also, stocks exposed to China surged after Beijing announced a slew of stimulus measures, with JD.com (JD) soaring more than +13% and PDD Holdings (PDD) advancing over +11% to lead gainers in the Nasdaq 100. In addition, Uber Technologies (UBER) rose more than +3% after Raymond James resumed coverage of the stock with a Strong Buy rating and a price target of $90. On the bearish side, Visa (V) slumped over -5% and was the top percentage loser on the Dow after the U.S. Justice Department filed a lawsuit against the company, alleging that it illegally monopolized the U.S. debit card market. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to 98.7 in September, missing the 103.9 consensus and marking the biggest drop since August 2021. Also, the U.S. July S&P/CS HPI Composite - 20 n.s.a. eased to +5.9% y/y from +6.5% y/y in June, in line with expectations. In addition, the U.S. Richmond Fed manufacturing survey unexpectedly fell to a 4-1/3 year low of -21 in September, weaker than expectations of -13. “We got a little bit of cold water with the consumer confidence number [yesterday morning] that might add to concerns the Fed may have been a little late,” said Michael James, senior vice president of equity trading at Wedbush Securities. Meanwhile, Fed Governor Michelle Bowman stated Tuesday that the central bank should reduce interest rates at a “measured” pace, noting that inflationary risks persist and the labor market has not shown significant weakening. “Turning to the risks to achieving our dual mandate, I continue to see greater risks to price stability, especially while the labor market continues to be near estimates of full employment,” Bowman said. U.S. rate futures have priced in a 41.8% probability of a 25 basis point rate cut and a 58.2% chance of a 50 basis point rate cut at the next FOMC meeting in November. On the earnings front, notable companies like Micron Technology (MU), Cintas (CTAS), and Jefferies Financial (JEF) are set to report their quarterly figures today. On the economic data front, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that August New Home Sales will stand at 699K, compared to the previous figure of 739K. U.S. Building Permits data will also be released today. Economists expect the August figure to be 1.475M, compared to 1.406M in July. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.300M, compared to last week’s value of -1.630M. In addition, market participants will be anticipating a speech from Fed Governor Adriana Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.750%, up +0.32%. My bias or lean today in more neutral. Signals are are still bullish but we look "toppy" here and the volume yesterday was horrible. S&P 500 IS AS EXPENSIVE AS DURING THE DOT-COM BUBBLE 90% of the market sectors have their P/E ratios in the top 25% historically. This is in line with levels seen during the Dot-Com Bubble and before the 2022 bear market. Long-term expected returns are not promising now. I believe the next top will be formed with a classic bearish divergence. This indicates a rally for the SPX of approximately 5.5%, with a top between @ 6,015/30, according to a projection from current RSI(14) levels. If confirmed, a 17% pullback is likely. Dow Jones $DJI has broken through the 125 year resistance trendline. In 1929 it broke through for 1 month before beginning its -90% collapse over the next 3 years None of this implies the markets are getting ready to crash and I'm not prediciting anything! It's just important to look at valuations from time to time and understand we are getting into that "priced to perfection" area. Be prepared. Trade docket for today: Big day with our Nat gas trade. /NG. Working scalps agian starting with /MNQ futures and then moving into QQQ's. I'll look to add some more cash flow to our /ZC corn trade. KBH earnings trade should be profitable for us today. MU earnings and, of course, our seven potential 0DTE's. Let's take a look at some key intra-day levels for 0DTE's. /ES: There's a couple critical levels. 5794 on the upside is close but also substantial resistance. 5800 would be the next resistance level. These are big levels. A break above would be very bullish. 5778 is first support with 5771 being the next. It's also the PoC on the 2 hr. chart. /NQ: 20183 is the first resistance. The Nasdaq has been the laggard in this rally. It needs to break some of these resistance levels to come join the bullish party. 20215 is the big one. This has been a tough level for bulls. A break above would really solidify this rally. 20066 is first support with 20042 being the PoC on the 2hr. chart. A break below that is full on bearish mode for me. Bitcoin has had a nice run. I've got a trade on in our binary brokerage that pays 110% ROI if BTC does NOT finish at an ATH by the end of they year. I don't think it will but if it does my BTC, ETH, POLK would love it. If it doesn't, 110% ROI would help. Levels for BTC today are 65000 on the resistance side and 62750 on the support side. Let's "trade to trade well" folks and let the chips fall where they may! Have a great day.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |