|

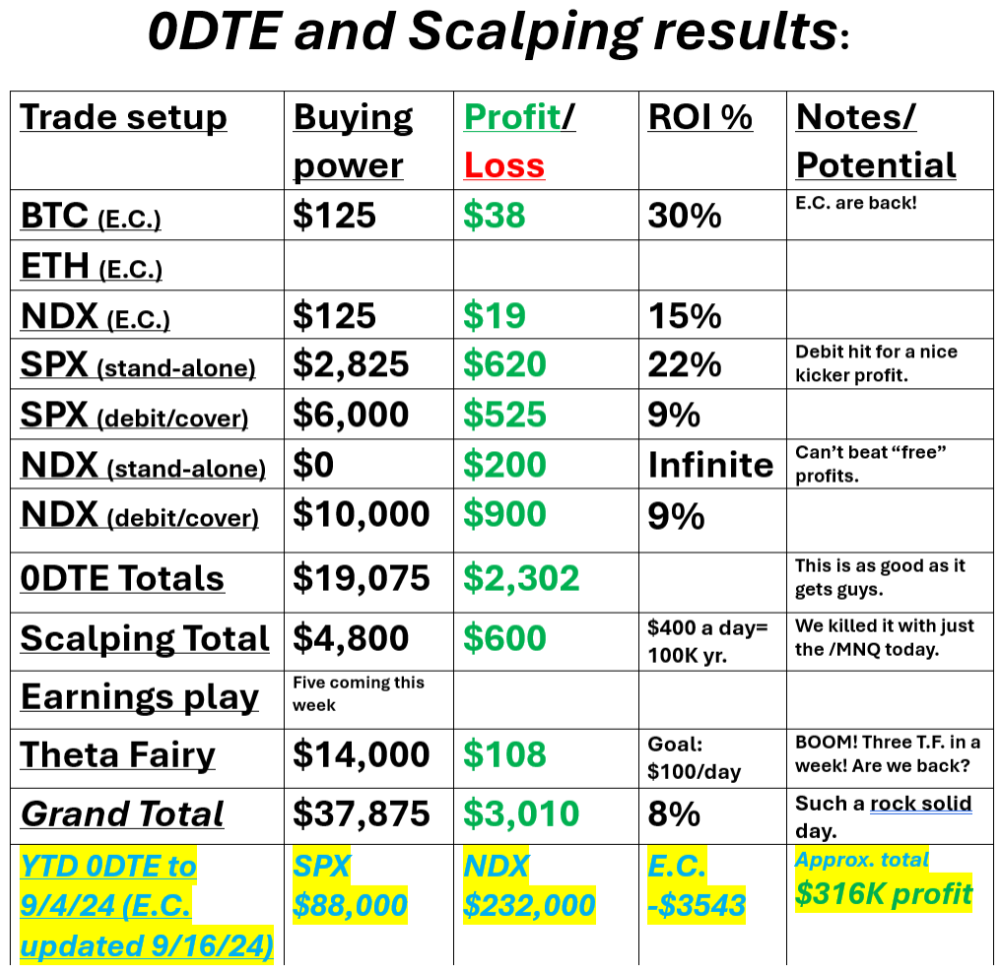

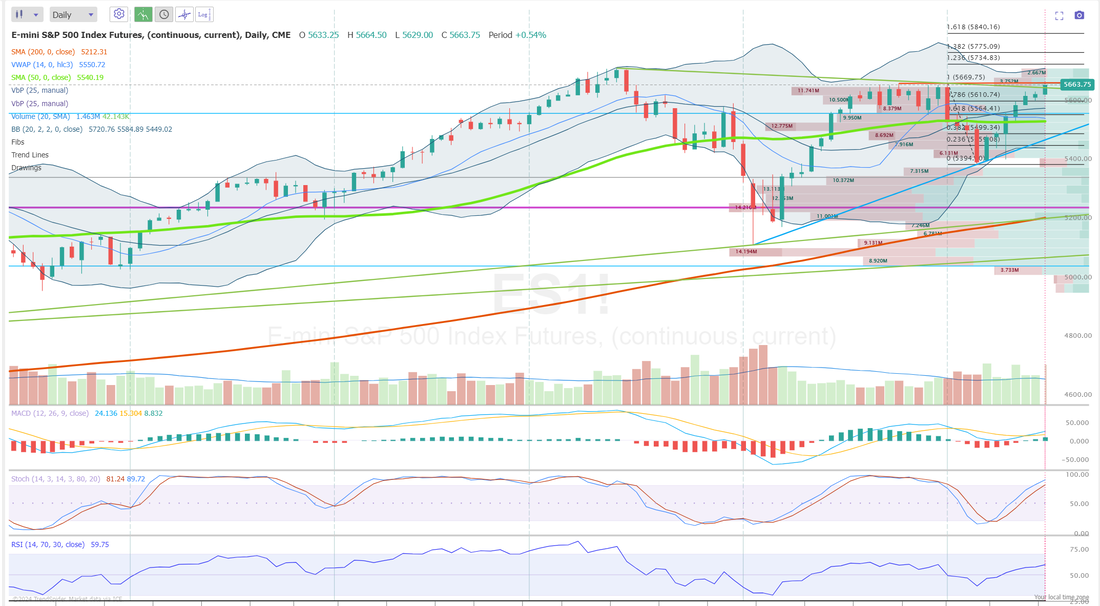

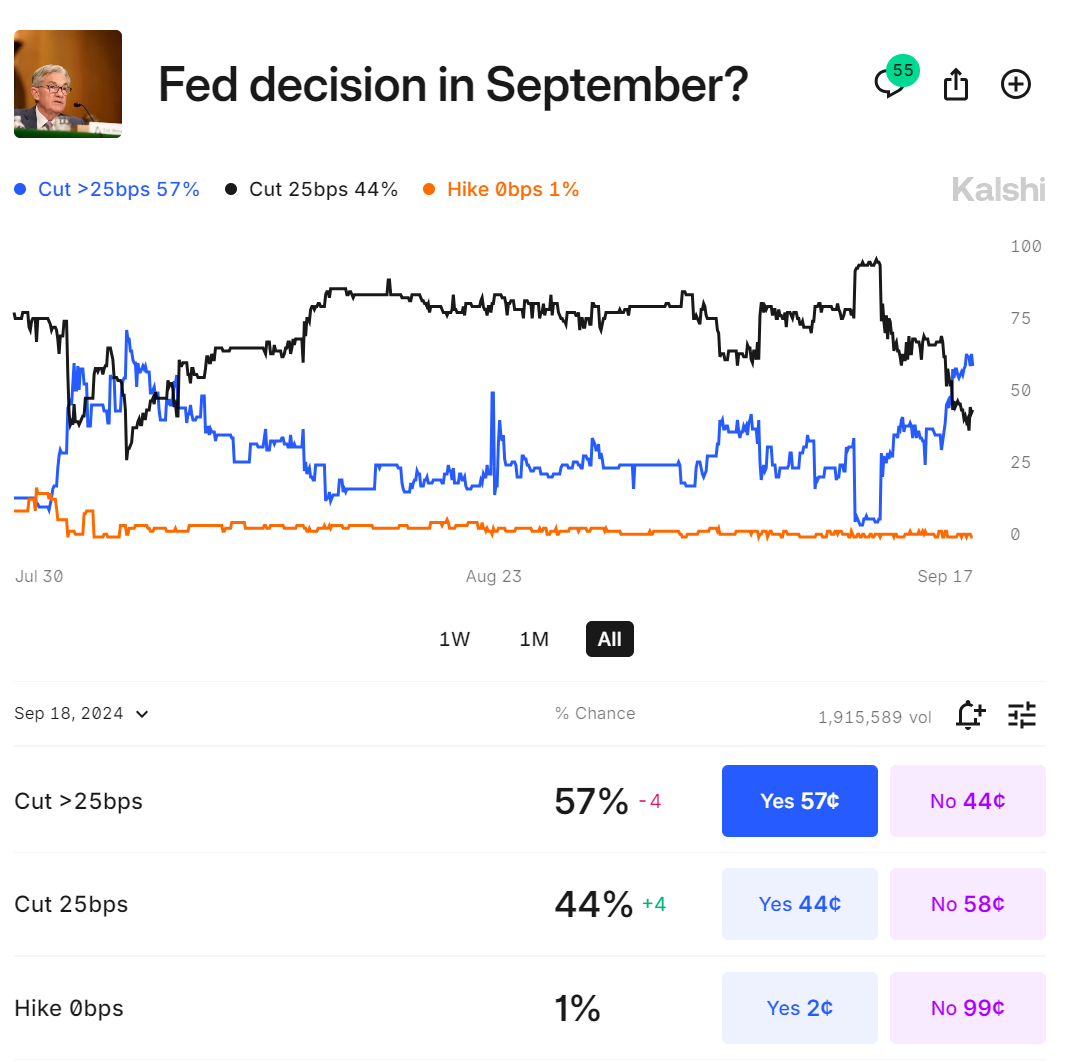

We had a perfect day yesterday. Sometimes it just falls your way. Everything we touched worked. We had an above avg. profit day with scalping and we got another Theta Fairy profit . Our results are below: Let's take a look at the state of the markets: Technicals are still flashing bullish. All the major indices are now above their 50DMA. The one week heat map is showing a lot of green My lean for today is bullish. The fact that all the major indices we trade and track are above their 50DMA means bullishness to me. Let's take a look at the intra-day price action of the three indices we day trade: /ES: Their are two key levels for me today on /ES. 5673 is heavy resistance. If bulls can break through that it could be clear sailing to a new ATH. 5543 is the big support of the 50DMA. If bears can break below that we could see some bearish retracement take place. Between these two levels it's just chop. /NQ: I've got a similar approach to the /NQ today. Above 19677 and bulls could get some momentum. Below 19399 bears could build some downside. Everything in between is just chop. BTC: Two key levels for Bitcoin. 60,816 is resistance and 57,465 is support. Trade docket today: GIS, DRI, MU are potential earnings plays today. /ES (theta fairy), /MNQ (QQQ) scalping, IWM, QQQ, Up to seven 0DTE setups today. September S&P 500 E-Mini futures (ESU24) are trending up +0.30% this morning as investors geared up for the start of the Federal Reserve’s two-day policy meeting while also awaiting a fresh batch of U.S. economic data, with particular attention on the retail sales report. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Intel (INTC) advanced over +6% and was the top percentage gainer on all three major Wall Street averages after Bloomberg News reported that the chipmaker had officially qualified for up to $3.5 billion in federal grants to make semiconductors for the Pentagon. Also, Oracle (ORCL) climbed more than +5% after Melius Research upgraded the stock to Buy from Hold with a price target of $210. In addition, Charles Schwab (SCHW) gained over +2% after the online brokerage reported that new brokerage accounts in August increased +4% y/y to 324,000 and said it anticipates Q3 revenue to climb by up to 3% compared to Q2. On the bearish side, Apple (AAPL) fell more than -2% and was the top percentage loser on the Dow after a TF International Securities analyst said that demand for the company’s iPhone 16 Pro series was lower than expected. Also, chip stocks lost ground, with Arm (ARM) slumping over -6% to lead losers in the Nasdaq 100 and Micron Technology (MU) sliding more than -4%. Economic data released on Monday showed that the NY Empire State manufacturing index rose to a 2-1/3 year high of 11.50 in September, stronger than expectations of -4.10. The Federal Reserve kicks off its two-day meeting later in the day. Fed officials are widely anticipated to lower interest rates for the first time in four years, with anxious investors discussing whether policymakers will consider a quarter-point cut sufficient for an economy showing signs of slowing or whether they will decide on a half-point reduction instead. Investor attention will also be on the central bank’s quarterly “dot plot” in its Summary of Economic Projections and Chair Jerome Powell’s post-decision press conference. Meanwhile, U.S. rate futures have priced in a 33.0% chance of a 25 basis point rate cut and a 67.0% chance of a 50 basis point rate cut on Wednesday. On the economic data front, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that August Retail Sales will stand at -0.2% m/m, compared to the July figure of +1.0% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.4% m/m in July. Economists foresee the August figure to be +0.2% m/m. U.S. Industrial Production data will be reported today as well. Economists forecast this figure to come in at +0.2% m/m in August, compared to -0.6% m/m in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.613%, down -0.31%. The big question is, what size rate cut do we get come Weds.? I doubted a 50 basis cut was in the cards but futures are favoring it and Kalsi odds are favoring it as well. See below: Regardless...Weds. is going to be a day built for traders. We'll have our trigger fingers ready! Let's have a great day folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |