|

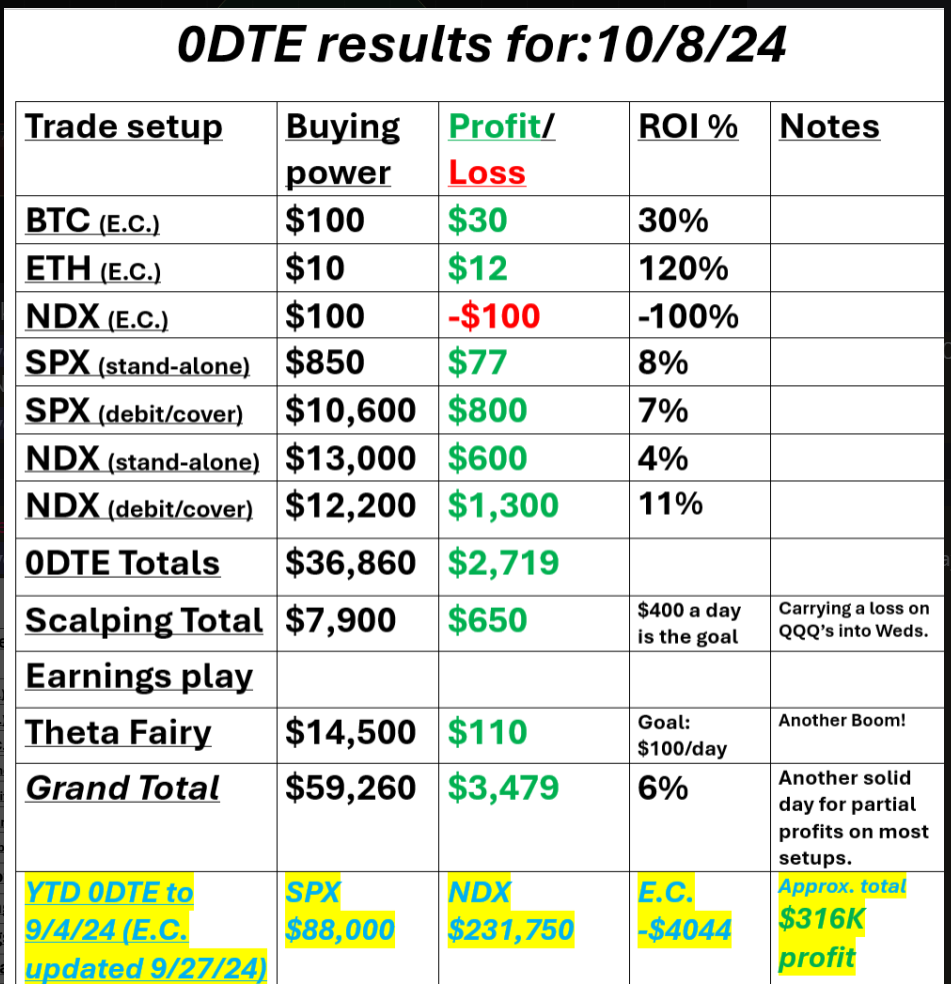

Welcome to Wedsnesday! FOMC minutes today and CPI/PPI coming up later this week. We had a really solid day yesterday. I say that because the trend was NOT my friend yesterday. I kept looking for a retrace that never materialized. That said, I continued to "trade scared" and booked profits when I could, even if they were smaller capture rates than we would like. It worked and we had another bang up day. See our results below. We've gotten used to having the daily Theta fairys back. Last night the entry wasn't there. We may have some opportunities with CPI and PPI the next couple days. Let's take a look at the markets: As is usually the case, the neutral rating for yesterday didn't last long. We are now back to bullish bias. In terms of directional bias however, we are still stuck in a pinching wedge channel. The breakout is coming. We just don't know when or in what direction. December S&P 500 E-Mini futures (ESZ24) are trending down -0.02% this morning as market participants awaited the Federal Reserve’s September meeting minutes and remarks from Fed officials. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Palo Alto Networks (PANW) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after Exane BNP Paribas initiated coverage of the stock with an Outperform rating and a price target of $410. Also, megacap technology stocks advanced, with Netflix (NFLX) rising more than +2% and Microsoft (MSFT) gaining over +1%. In addition, Nvidia (NVDA) rose more than +4% after Hon Hai announced it is constructing the world’s largest facility to manufacture Nvidia’s GB200 AI chips. On the bearish side, Roblox (RBLX) fell over -2% after Hindenburg Research revealed a short position in the gaming platform. Economic data released on Tuesday showed that the U.S. trade deficit fell to -$70.40B in August from -$78.90B in July (revised from -$78.80B), marking the smallest deficit in five months. Fed Governor Adriana Kugler said Tuesday that the U.S. central bank should maintain its focus on returning inflation to its 2% target, albeit with a “balanced approach” that prevents an “undesirable” slowdown in employment growth and economic expansion. Also, Atlanta Fed President Raphael Bostic said the Fed must balance competing risks considering how fast it will continue to reduce interest rates in the coming months. “I’m still laser-focused on the inflation target and making sure that we get that to target,” Bostic said. In addition, Boston Fed President Susan Collins remarked that rate cuts should be careful and data-driven. Meanwhile, U.S. rate futures have priced in an 86.7% chance of a 25 basis point rate cut and a 13.3% chance of no rate change at the next central bank meeting in November. Today, investors will closely monitor the release of the Federal Reserve’s minutes from the September meeting, which may provide further insights into how policymakers are thinking about the future pace of easing. Also, market participants will be looking toward a batch of speeches from Fed officials Bostic, Logan, Goolsbee, Barkin, Williams, Jefferson, Collins, and Daly. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data, which is set to be released in a couple of hours. Economists estimate this figure to be 2.000M, compared to last week’s value of 3.889M. U.S. Wholesale Inventories data will be reported today as well. Economists anticipate the August figure to be +0.2% m/m, the same as in July. The focus remains on the September reading of the U.S. Consumer Price Index, scheduled for release on Thursday, which is expected to show a decline in inflation to +2.3% y/y from +2.5% y/y in August. Third-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM) and Wells Fargo (WFC) set to report their quarterly results. The S&P 500’s estimated earnings growth rate is 5%, based on estimates from LSEG. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.020%, down -0.40%. My directional bias is bullish today. I don't think the FOMC minutes are going to tip the apple cart over today. It should be just what the market is expecting. We'll see if I'm right. Trade docket for today: /ES (theta fairy) later tonight or very early in the A.M. right before CPI data release. /MNQ,/NQ,QQQ scalping., /ETH, /LE, /MCL, /NG, /SI, DAL, DPZ, 0DTE's. No levels for me today. FOMC minutes release should NOT be a big catalyst BUT...you never know so we'll wait until later today to execute the bulk of our 0DTE setups.

I pulled another $1,500 profit out of my account yesterday as I've been doing for the past three weeks. It's so comforting to know when you get $30,000 of bills pouring in you can handle it with just a few weeks of trading profits. I'm super grateful for trading and especially grateful to our trading community that we've built. You folks are awesome. See you all in the live zoom shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |