|

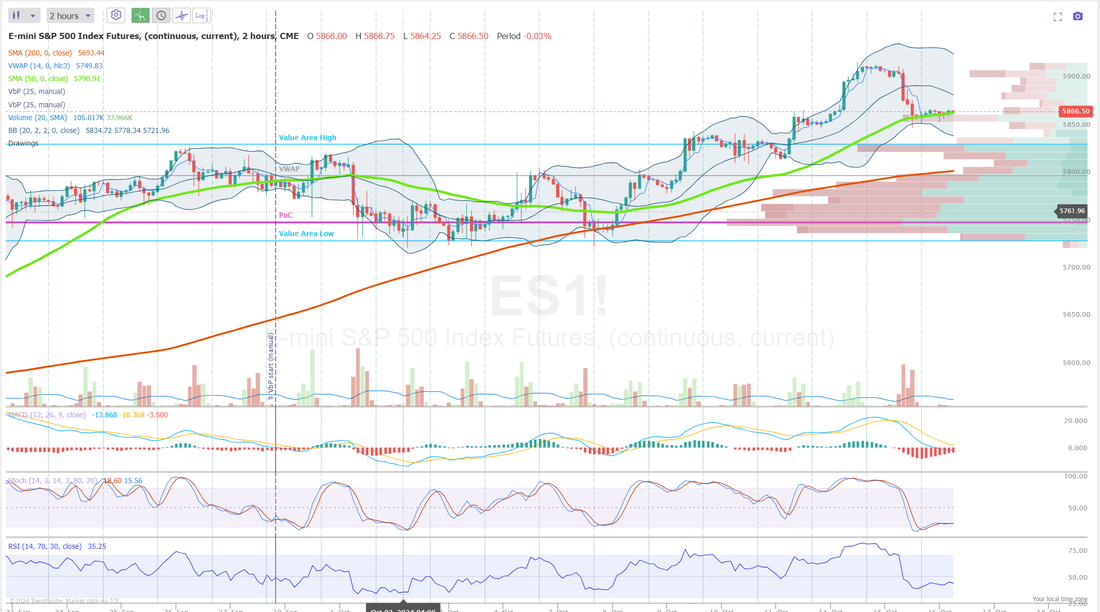

It's Wedsnesday. Welcome back! We had our winning streak broken yesterday. We knew it was coming. We've had such a nice run. Let's see if we can get it re-started today. Here's my results from yesterday. A couple quick comments on the day yesterday. On a bright spot, our altered versions of the Theta fairy have been a great success. We'll see how todays version ends up in about 7 hrs. We made almost $5000 scalping the QQQ's but our /NQ losses overwhelmed that for an overall loss. We've got some bullish scalps setup for today so it may be a possible redemption. We've all been rolling the cover on our SPX debit for days now. Yesterday put us closer to the profit finish line. With over $10,000 of potential profit, getting this trade done and dusted would get us back to our winning ways. This is what it looks like before the open. Markets sold off yesterday. It was about time. Was it a change of direction? Too early to tell, I believe. Technicals were neutral for most of the evening but are now starting to swing back to buy mode. The QQQ's took a beating yesterday but in the big picture view, not much changed in terms of market dynamics. December S&P 500 E-Mini futures (ESZ24) are up +0.03%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.08% this morning, steadying after yesterday’s slump, while investors awaited the next round of corporate earnings. In yesterday’s trading session, Wall Street’s major indexes closed lower. ASML Holding N.V. (ASML) tumbled over -16% and was the top percentage loser on the Nasdaq 100 after reporting weaker-than-expected Q3 bookings and cutting its full-year net sales guidance. Also, chip stocks slumped after Bloomberg reported that the Biden administration is discussing limiting sales of advanced AI chips to certain countries, with KLA Corp. (KLAC) plunging more than -14% to lead losers in the S&P 500 and Nvidia (NVDA) dropping over -4%. In addition, UnitedHealth Group (UNH) slid more than -8% and was the top percentage loser on the Dow after the health insurer cut its FY24 adjusted EPS forecast. On the bullish side, Walgreens Boots Alliance (WBA) surged over +15% and was the top percentage gainer on the S&P 500 after the drugstore operator posted upbeat Q4 results and issued above-consensus FY25 sales guidance. Economic data released on Tuesday showed that the NY Empire State manufacturing index fell to a 5-month low of -11.90 in October, weaker than expectations of 3.40. San Francisco Fed President Mary Daly stated on Tuesday that the U.S. central bank needs to remain watchful as inflation falls and the labor market cools, although she expressed confidence that officials could maintain the current economic expansion on course. Daly noted she would monitor the data to determine the pace of reducing borrowing costs but reiterated that one or two additional rate cuts are probable this year. Also, Atlanta Fed President Raphael Bostic said he anticipates the U.S. economy to slow this year but to remain robust, adding that the downward trajectory for inflation might see some bumps. Meanwhile, U.S. rate futures have priced in a 94.2% chance of a 25 basis point rate cut and a 5.8% chance of no rate change at the next FOMC meeting in November. Third-quarter earnings season is gathering pace, with investors awaiting fresh reports from notable companies today, including Abbott Laboratories (ABT), Morgan Stanley (MS), Prologis (PLD), U.S. Bancorp (USB), CSX (CSX), Kinder Morgan (KMI), and Alcoa (AA). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will focus on U.S. Export and Import Price Indexes for September, set to be released in a couple of hours. Economists anticipate the export price index to be -0.4% m/m and the import price index to be -0.3% m/m, compared to the previous figures of -0.7% m/m and -0.3% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.009%, down -0.65%. We've got Retail sales, Jobless claims, Industrial production, Oil inventory and Nat gas numbers all out tomorrow. That's probably the biggest catalyst we'll get this week. My bias or lean today: Bullish. The question after yesterdays selloff is whether this is the start of a change of direction of a healthy retrace to build a base and go higher. Taking a look at the VTI, it certainly did enough damage that if we get another red day today we could be triggering sell signals but..until that happens I'll stick with my bullish bias. Trade docket today: FANG/OXY, ABT, UAL, CCI:, NFLX, TSM, MS? /ES /MCL, /MNQ,QQQ,/NQ scalping, 0DTE's. Lets look at the intra-day levels for /ES and /NQ. I'll skip BTC today because it's too hard to find a support level right now. /ES; Notice anything interesting with the 2hr. chart? We are pinned to the 50 period M.A. (green line) This 5867 level is the battle line for today. 5913 is resistance and up at our ATH level. 5833 is support and below that is a decent downside potential. We've also got some key levels on the /NQ. 20422 is PoC on the 2hr. chart. Bulls absolutely need to re-take that level. This is very important for future bullish price action. 20245 is also an important support. It's the 200 period M.A. Below that we could get accelerated selling. Let's get our SPX debit to the finish line today and get back to our winning ways. Those days are much more fun!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |