|

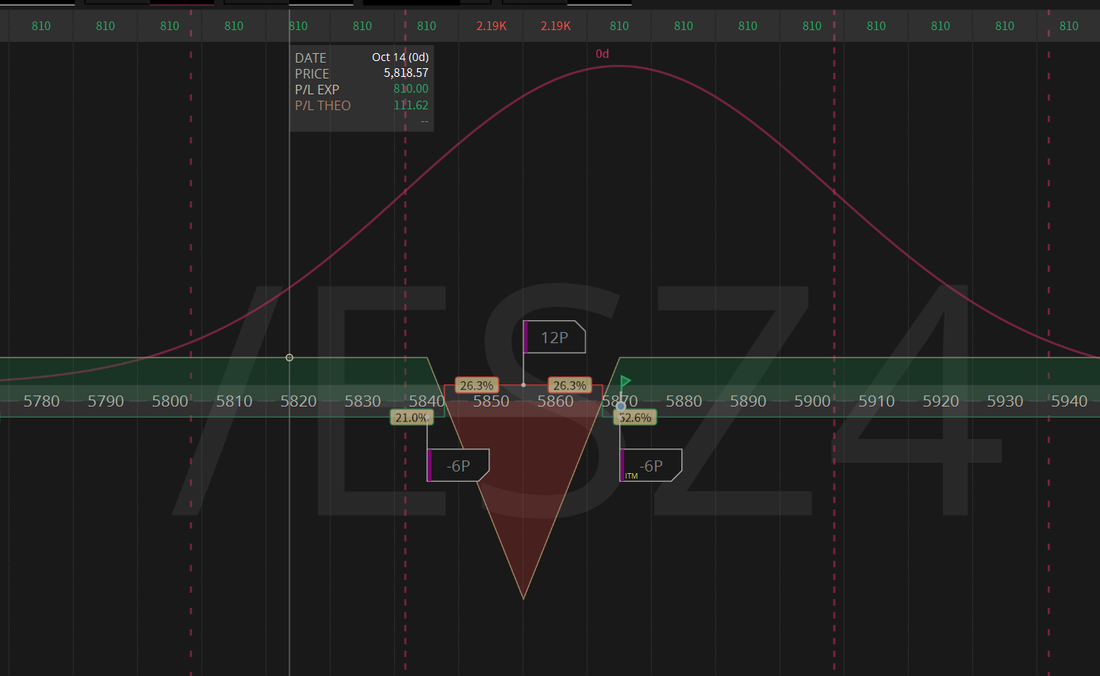

Good morning traders! Welcome back to a new week of trading. We had an incredible day on Friday. See our results below: We've had an incredible run over the last month. It's been well above average. I've tried to keep our three day losing streak from over a month ago in mind and front and center of our trading room. Runs like this never last. We know losses are a part of this game but, it's been nice to have such a profitable run. I've been drawing $1,500-$2,000 of profits out each day to fund some heavy bills I have coming in. It's been nice to be able to do that. We've been "trading scared" for the last few days...taking small profit captures and resetting the trade. It's created more work for us but also allowed us to continue our win streak. Let's take a look at the markets as we start this new week: Buy mode continues to start us off. SPY and DIA are pushing to new highs. IWM is playing catch up and QQQ's continue to channel. I'm waiting on the break out for it. We have a couple interesting setups to start off our day. #1. is our SPX debit cover. The SPX's been strong the last 5 trading days. We keep rolling the cover up and out on this bullish play. We are building a nice potential payout on this. #2. Our /ES Theta fairy replacement for today: This 4K trade has an $800 or 20% profit potential. December S&P 500 E-Mini futures (ESZ24) are up +0.16%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.23% this morning as market participants looked ahead to earnings reports from a stellar lineup of companies, key economic data releases, and comments from Federal Reserve officials. In Friday’s trading session, Wall Street’s major averages closed higher, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs. Fastenal (FAST) surged over +9% and was the top percentage gainer on the Nasdaq 100 after the company reported stronger-than-expected Q3 results. Also, JPMorgan Chase (JPM) advanced more than +4% and was the top percentage gainer on the Dow after the biggest U.S. bank by assets posted upbeat Q3 results and raised its full-year net interest income forecast. In addition, Wells Fargo & Co. (WFC) climbed over +5% after reporting better-than-expected Q3 EPS. On the bearish side, Tesla (TSLA) slid more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after unveiling a prototype of its much-anticipated “Cybercab” robotaxi, which analysts said was “light on details.” Economic data released on Friday showed that the U.S. producer price index for final demand came in at 0.0% m/m and +1.8% y/y in September, compared to expectations of +0.1% m/m and +1.6% y/y. Also, core PPI, which excludes volatile food and energy costs, rose +0.2% m/m and +2.8% y/y in September, compared to expectations of +0.2% m/m and +2.7% y/y. In addition, the University of Michigan’s U.S. October consumer sentiment index unexpectedly fell to 68.9, weaker than expectations of 70.9. Dallas Fed President Lorie Logan reiterated on Friday that interest rates should be lowered gradually to a more normal level. While Logan described the economy as “strong and stable,” she also highlighted “meaningful” risks on the horizon. “It’s really important to look ahead as we chart this path toward neutral, and that we do so in a very gradual way to balance the risks that we have,” Logan said. Meanwhile, U.S. rate futures have priced in an 88.2% probability of a 25 basis point rate cut and an 11.8% chance of no rate change at the November FOMC meeting. Earnings season heats up this week, with results expected from several more big banks, including Goldman Sachs (GS), Bank of America (BAC), Morgan Stanley (MS), and Citigroup (C). Also, notable companies, including Netflix (NFLX), UnitedHealth (UNH), Johnson & Johnson (JNJ), United Airlines (UAL), Abbott Laboratories (ABT), Alcoa (AA), Procter & Gamble (PG), and American Express (AXP), are set to post quarterly results this week. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.2% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. “We expect earnings season to be solid, including the big banks,” said Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management. “Credit card delinquencies are still very low and increased economic activity should drive bank revenues.” Investors will also be monitoring a spate of economic data releases this week, including U.S. Retail Sales, Core Retail Sales, the NY Empire State Manufacturing Index, the Export Price Index, the Import Price Index, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Crude Oil Inventories, Building Permits (preliminary), and Housing Starts. In addition, several Fed officials will be making appearances throughout the week, including Waller, Kashkari, Daly, Kugler, Bostic, and Goolsbee. The U.S. economic data slate is mainly empty on Monday. U.S. bond markets are closed today in observance of the Columbus Day holiday. This week, the SPY closed at a record high of $579.58 (+1.17%), showcasing strength that mirrors a powerful setup from June. The Bollinger Band Width indicator is at its lowest level since that period, with the price consolidating just above a rising 20-day SMA—a technical alignment that previously preceded a 5% rally. QQQ led the indexes this week, closing just shy of its all-time high at $493.36 (+1.24%). Similar to SPY, the Bollinger Bands have tightened to levels unseen since June, and with the price holding steadily above a rising 20-day SMA, this index seems to be setting up for a powerful breakout. IWM closed at $219.15 (+0.96%) after a solid push on Friday, setting the stage for a potentially powerful move next week. Like the SPY and QQQ, IWM’s Bollinger Bands are the tightest they’ve been since the summer, and with the price reclaiming its position above the rising 20-day SMA, this index looks primed for a continuation higher. Let's take a look at the expected moves this week: Range is fairly muted this week. A break out of the QQQ's from it's rangebound zone would help pump that number up. Trend watch is all to the upside: Sector performance shows utilities (the safe haven) getting the most love. My bias to start this week is bullish. That's where all the indicators are pointing. Our trade docket for today: /HG (copper), /ES (inverted Butterfly/ Theta fairy replacement), /MNQ, /NG, QQQ scalping, /MCL, DIA, SPY/QQQ 4DTE, /NG, 0DTE's. Let's take a look at the intra-day 0DTE levels I'm watching. /ES: Sitting at the lofty ATH level. It certainly looks like it wants to keep going. 5900 is my key upward resistance level. 5855 is the key support level. Anything between these two levels is just chop. /NQ: Not quite as stong as the /ES. 20565 is my resistance line with 20426 as support. BTC: Bitcoiin had a strong run to the upside over the weekend. A continuation move above current resistance at 66,000 would be very bullish. Belfow 60623 would be bearish. Our net liq is already off to a good start with all our futures positions helping out. Let's go get it today folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |