|

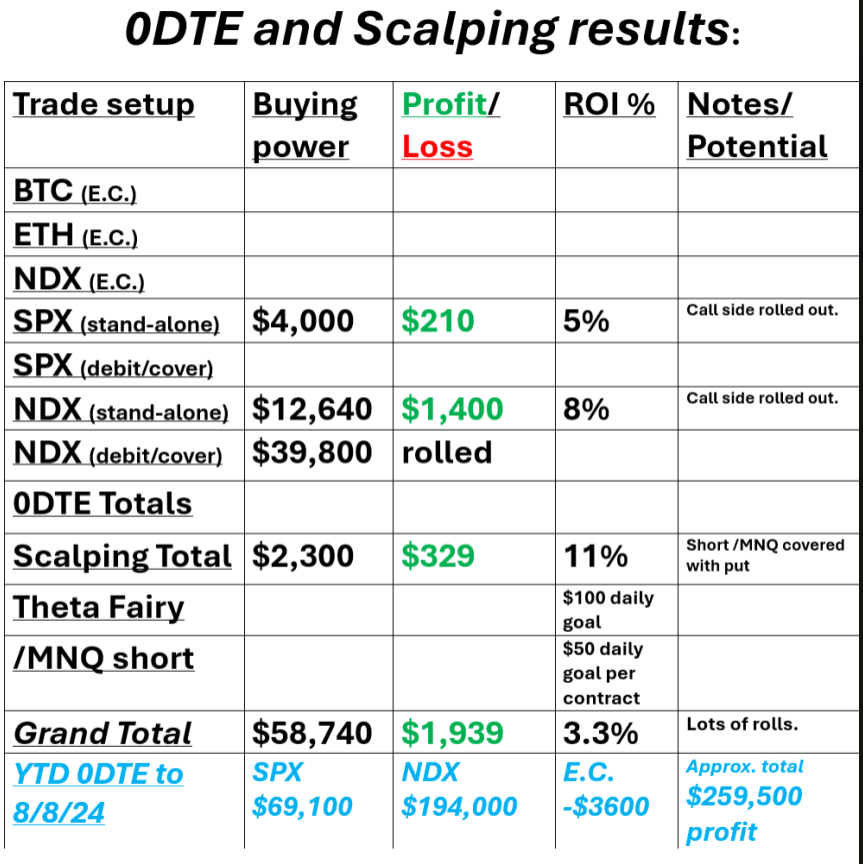

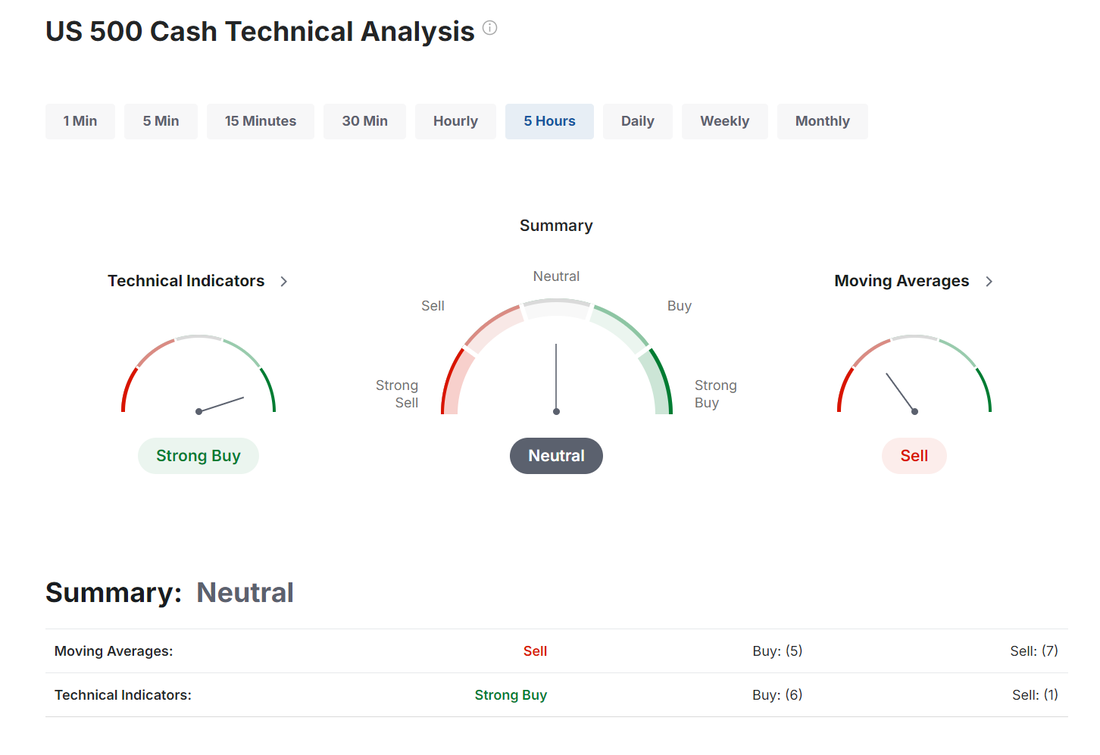

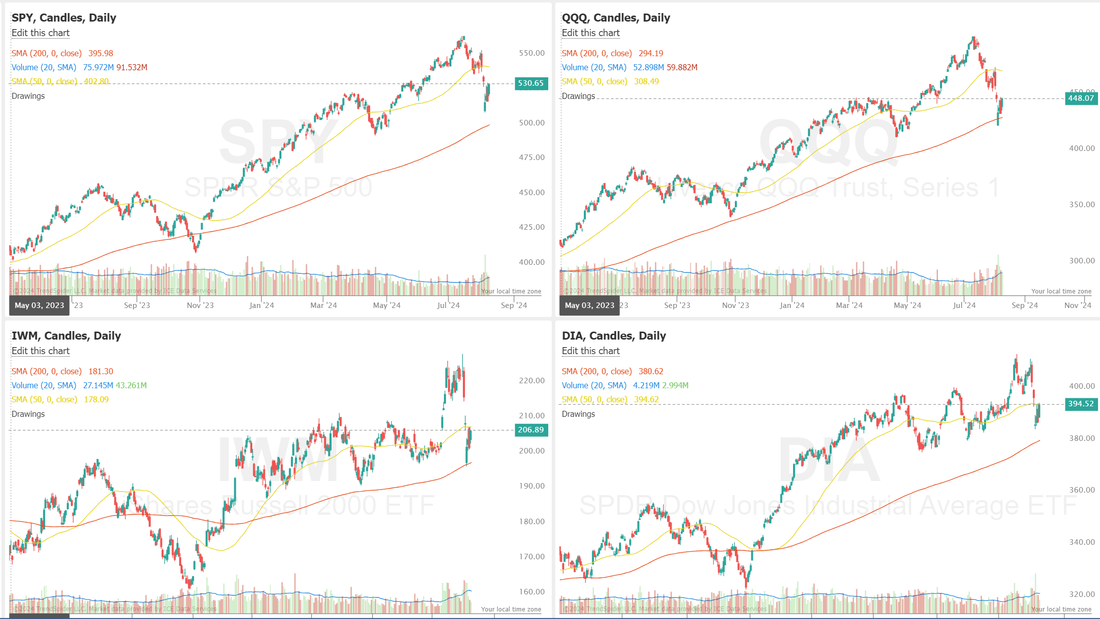

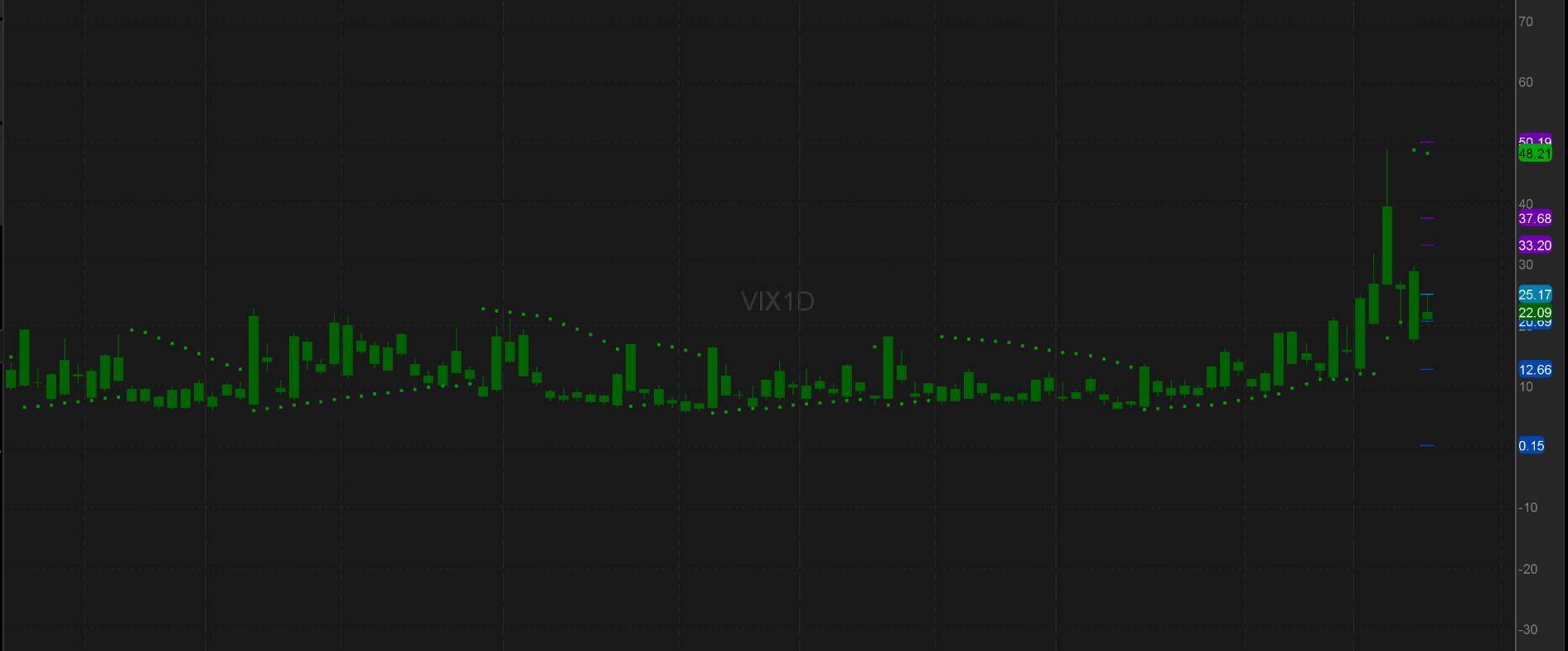

Welcome back folks! Last trading day of the week! We don't have much planned news items today to act as catalysts. Futures are flat to slightly down as I type. I didn't have the greatest of days yesterday but I made the most of what I had. Here's my results below: Yesterdays rebound was enough to move us off of a neutral rating but this "buy" signal is pretty darn weak. Futures aren't telling us much. They've been up and down overnight. Up this morning and now slightly red so, who knows for today? Essentially yesterdays rally just brought us back to previous consolidation zones. September S&P 500 E-Mini futures (ESU24) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.42% this morning, building on yesterday’s sharp gains after U.S. labor market data helped alleviate concerns about a significant economic slowdown, while investors awaited a new batch of U.S. economic data due next week to reinforce signs of resilience in the world’s largest economy. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Parker-Hannifin (PH) surged over +10% after the company posted upbeat Q4 results and provided a strong FY25 adjusted EPS forecast. Also, chip stocks gained ground, with Arm (ARM) climbing more than +10% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) rising over +8%. In addition, Eli Lilly (LLY) advanced more than +9% after the drugmaker reported stronger-than-expected Q2 results and raised its full-year guidance. On the bearish side, McKesson (MCK) plunged over -11% and was the top percentage loser on the S&P 500 after the drug distributor reported weaker-than-expected Q1 revenue. Also, Monster Beverage (MNST) slumped more than -10% and was the top percentage loser on the Nasdaq 100 after reporting weaker-than-expected Q2 results and warning of declining demand. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell by -17K to 233K, less than the 241K consensus and down from 250K in the prior week (revised from 249K). Also, U.S. wholesale inventories increased by +0.2% m/m in June, in line with expectations. “[Thursday’s] jobless claims data may ease some of the concerns raised by last week’s soft jobs report,” said Chris Larkin at E*Trade from Morgan Stanley. “But with inflation data due out next week and the stock market still working through its biggest pullback of the year, it’s unclear how much this will move the sentiment needle.” Kansas City Fed President Jeffrey Schmid indicated Thursday that he is not prepared to endorse a reduction in interest rates with inflation above target and the labor market remaining healthy, albeit showing some signs of cooling. “We are close, but we are still not quite there,” Schmid said. U.S. rate futures have priced in a 45.5% probability of a 25 basis point rate cut and a 54.5% chance of a 50 basis point rate cut at September’s policy meeting. Note: The market is pricing in a greater chance of a 50 basis cut over a 25 basis cut. I really think it's going to be dissapointed here! The U.S. economic data slate is empty on Friday. Meanwhile, attention will now shift to the U.S. consumer price inflation report and retail sales figures for July, scheduled for release next week, with investors looking for signs of a soft landing. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.959%, down -0.96%. My bias today is bearish. No news catalysts today. Back to substantive resistance zones. I just don't see the catalysts in place to continue yesterdays push up. Our trade docket for today is light as it is most Fridays. I'll continue to work our scalps using the /MNQ. DELL, NVDA and of course, our 0DTE's. Volatility is starting to come back down to normal levels. I think we'll have a good shot at returning to our normal schedule of trading next week. Let's take a look at a couple key levels on the indices: /ES; Looking at the daily chart, there are two key levels for me. 5414 to the upside. 5305 to the downside. Between here is just meaningless chop to me. Above 5414 could signal a bullish breakout and below 5305 could lead to substantial downside. /NQ; The two key levels for me are 18788 resistence and 18300 support. Between these levels is not significant to me. Above 18788 could signal a bullish breakout. Below 18300 could provide above average downside potential. Bitcoin; BTC had a monster, 6,000 point pop yesterday. That 200DMA held (and I should have believed in it more and gone long) 63,600 is the next upward target. We did get long a super small ETH position in our trading room. Let's have a good day folks. It's always nice to go into the weekend, happy with your results. We've got a lot of rolled calls today that look good now but it's a long time before expiration!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |