|

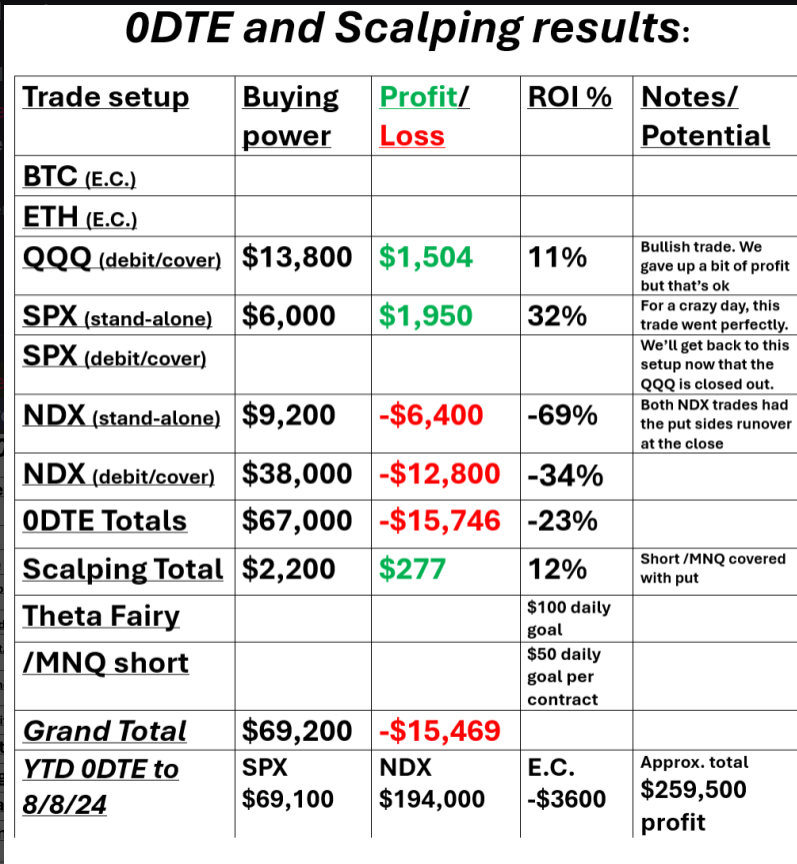

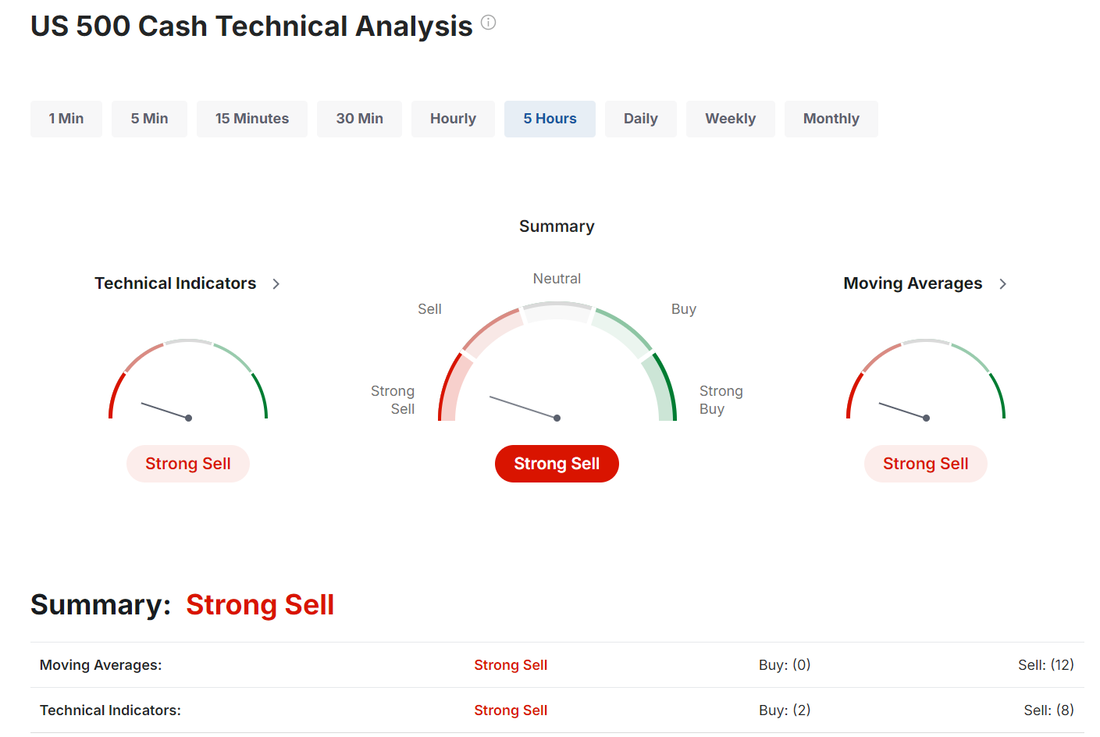

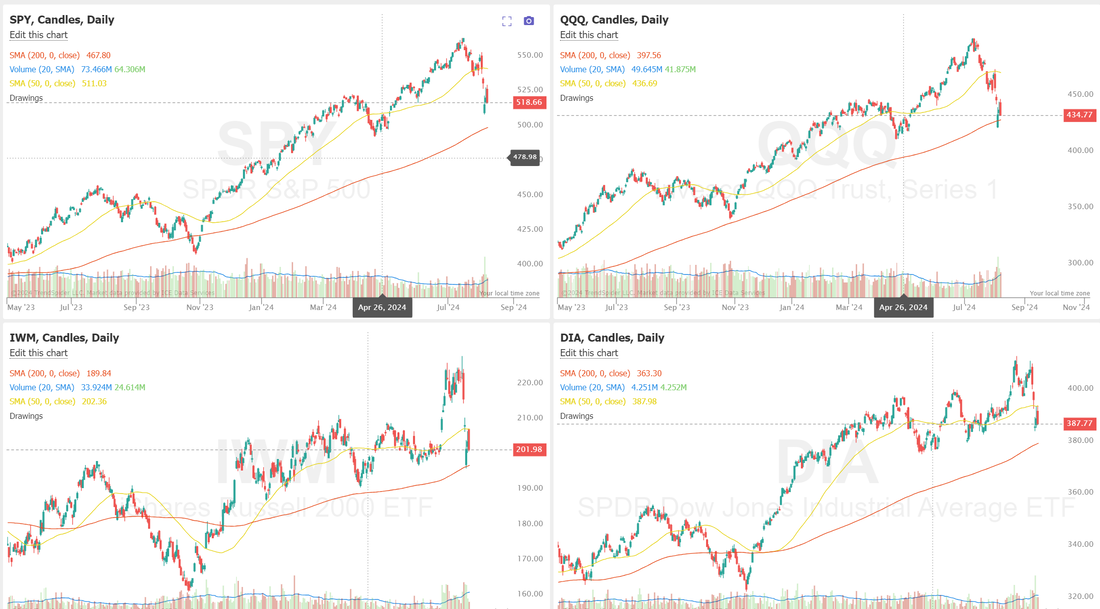

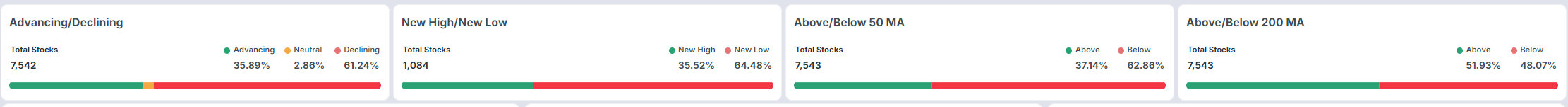

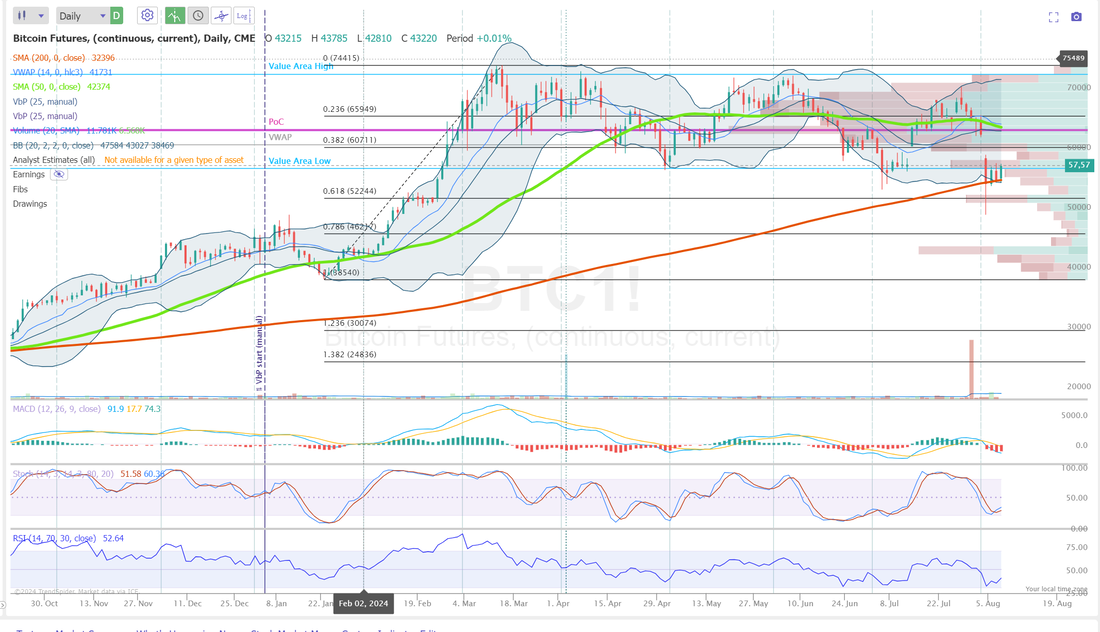

Welcome back to Thursdays trading session! Yesterday was a losing day for me but I fought it right down to the wire. You'll see my capital allocation was almost double a normal day. We've got Jobless claims today which should be our driver today so I won't pick a bias today. Let's just trade what we see. I also think I'll wait a bit longer into the day to start our 0DTE setups. Heavens knows we aren't lacking for premium right now so I think giving up a couple hours of Theta for the greater transparency makes sense. It certainly would have helped me yesterday. Here's a look at my results. A couple of notes. I've added a running tally of our 0DTE results YTD into the P/L matrix. I'll update this about once a week. Also, we've still got 18 days to go in our NDX put debit cover 0DTE. There is $36,000 of profit potential in that setup so we'll need to keep working the covers (even though they didn't work yesterday) to try to bring that trade home. As you can see, we've got almost $16,000 of unrealized profits in the NDX debit 0DTE with 20K still left of ext. Getting that 20K into our pockets would be helpful after yesterdays loss. Also, yesterdays result is another good lesson in the importance of consistency. At the end of the day I was pleased to "only" be down what I was. It could have been much worse but...we also started the day with approx. 16K of profit potential so it really was a 30K swing in net liq. That's a dangerous game to play, the woulda, coulda, shoulda but, it's point is still valid. Let's take a look at the markets. No surprise, we swing back to sell mode after yesterdays give back. The "buy the dip" appears to now be "sell the rip". Any push up gets knocked back down. Good news...bad news. The good news is all the indices we trade are still firmly above their 200DMA. The bad news? They are also all below their 50DMA now. Most of the market internals still look weak September S&P 500 E-Mini futures (ESU24) are down -0.10%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.03% this morning as market participants geared up for U.S. weekly jobless claims data and the next round of quarterly results while also awaiting remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indices closed lower. Super Micro Computer (SMCI) tumbled over -20% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the artificial intelligence server company reported weaker-than-expected Q4 adjusted EPS. Also, Airbnb (ABNB) plunged more than -13% after the company reported mixed Q2 results, issued below-consensus Q3 revenue guidance, and warned of slowing demand from U.S. vacationers. In addition, Charles River Laboratories (CRL) slumped over -12% after lowering its FY24 guidance. On the bullish side, Fortinet (FTNT) surged more than +25% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the cybersecurity firm posted upbeat Q2 results, offered solid Q3 guidance, and lifted its full-year revenue forecast. Also, Axon Enterprise (AXON) advanced over +18% after the company reported better-than-expected Q2 results and raised its FY24 revenue guidance. Economic data on Wednesday showed that U.S. consumer credit increased by +$8.93B in June, weaker than expectations of +$9.80B. Meanwhile, U.S. rate futures have priced in a 27.5% chance of a 25 basis point rate cut and a 72.5% probability of a 50 basis point rate cut at the September FOMC meeting. On the earnings front, notable companies like Eli Lilly (LLY), Gilead Sciences (GILD), Datadog (DDOG), Expedia (EXPE), The Trade Desk (TTD), Take-Two Interactive (TTWO), Paramount Global (PARA), and Capri Holdings (CPRI) are slated to release their quarterly results today. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, set to be released in a couple of hours. Economists estimate this figure to come in at 241K, compared to last week’s number of 249K. U.S. Wholesale Inventories data will be reported today as well. Economists expect June’s figure to be +0.2% m/m, compared to +0.6% m/m in May. In addition, market participants will be looking toward a speech from Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.913%, down -1.34%. Lets take a look at some key levels on the indices starting with the /ES. 5272 is the first bullish target. That's the PoC (purple line). 5118 is the next support level down. A break of either of these zones could free up some big additional movement. On the /NQ; 19584 is the 50DMA and the primary target for bulls. 17890 is a critical support fib line. We are just above that as I type. The next level down would be the 200DMA. Below that? Look out. BTC: The absolute key level for bitcoin is that red line. The 200DMA. It's been support now for four trading days straight. We haven't traded BTC all week although we are dollar cost averaging into a long ETH setup in our trading room. Our trade docket for today: DELL, DIA ( I got assigned long shares here so I'll be unwinding that today), IWM (I also got assigned long shares here. I'll be unwinding that. Note: We have traded this IWM setup every week for 5+ years. This will be the first recorded loss we've taken. Perfect records never last but it was a nice run.),NVDA, Scalping /MNQ, ODTE's on SPX debit. SPX stand alone, NDX debit, NDX stand alone. Good luck out there today folks. Step one, I believe, is to see what jobless claims does to the futures. Then...be patient. I don't think there is any need to rush into postions today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |