|

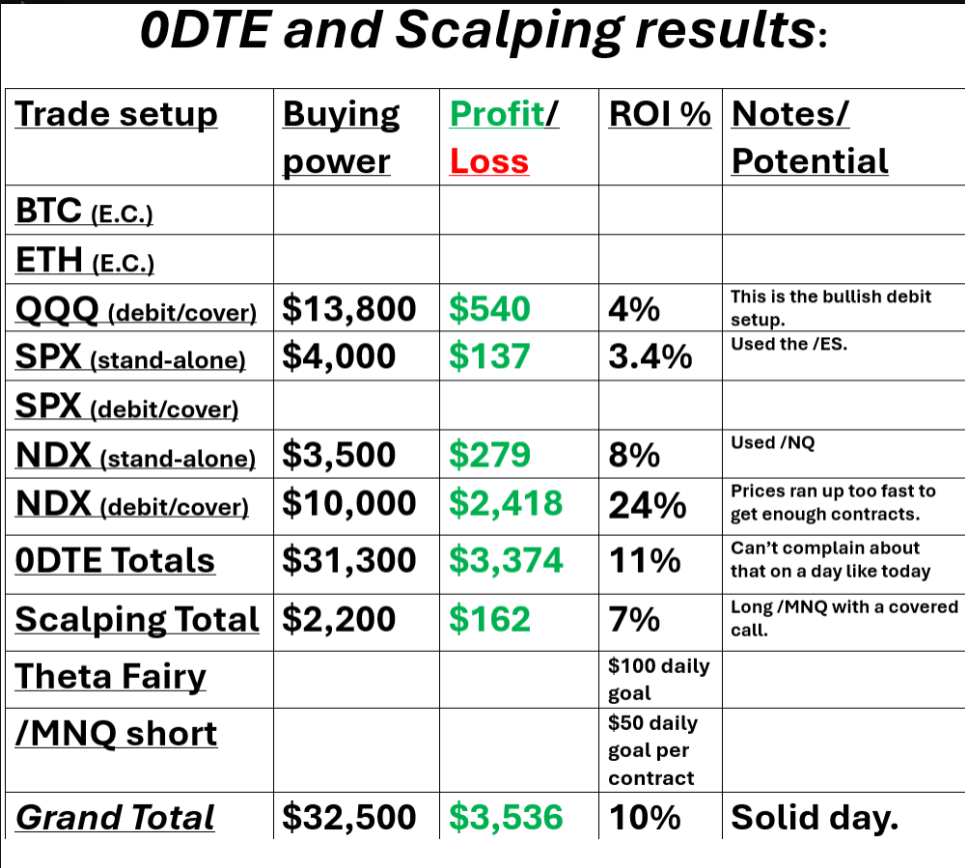

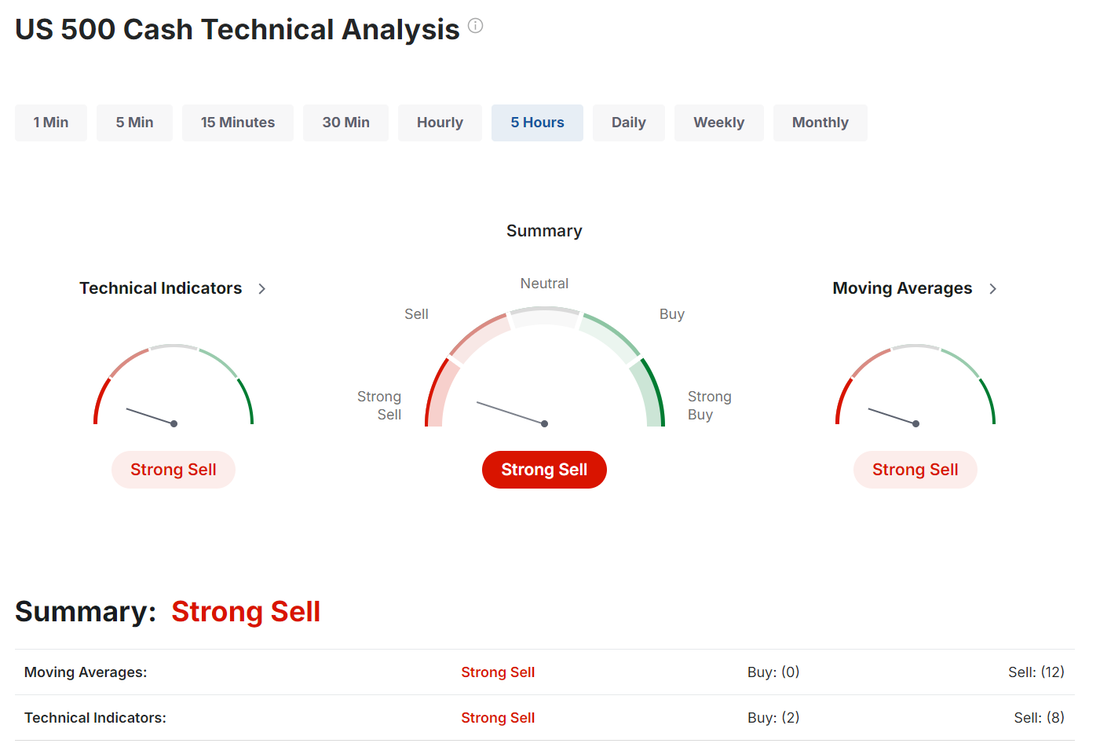

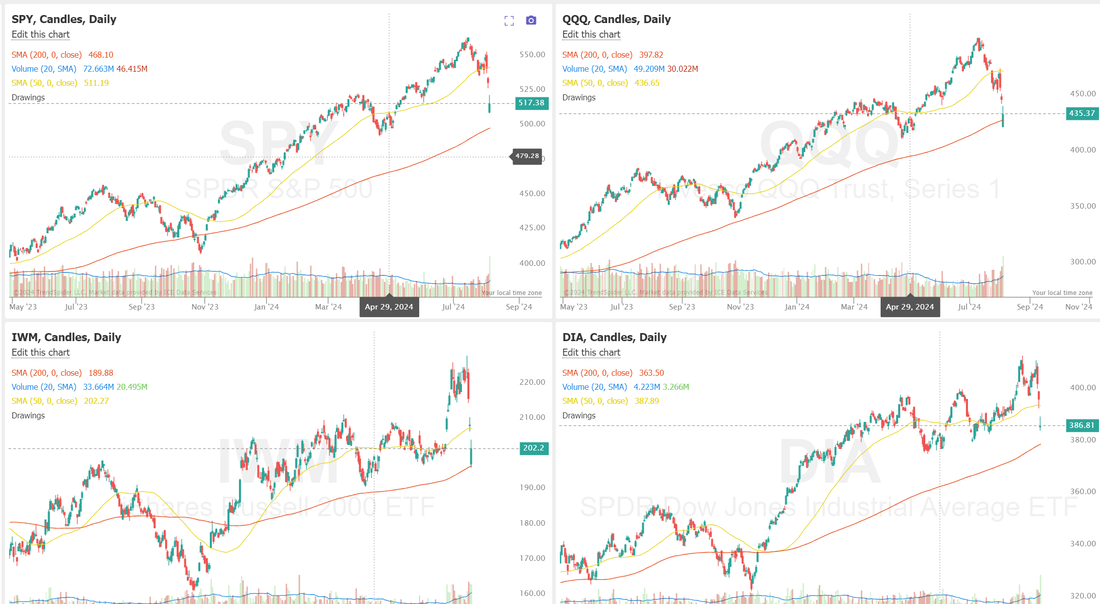

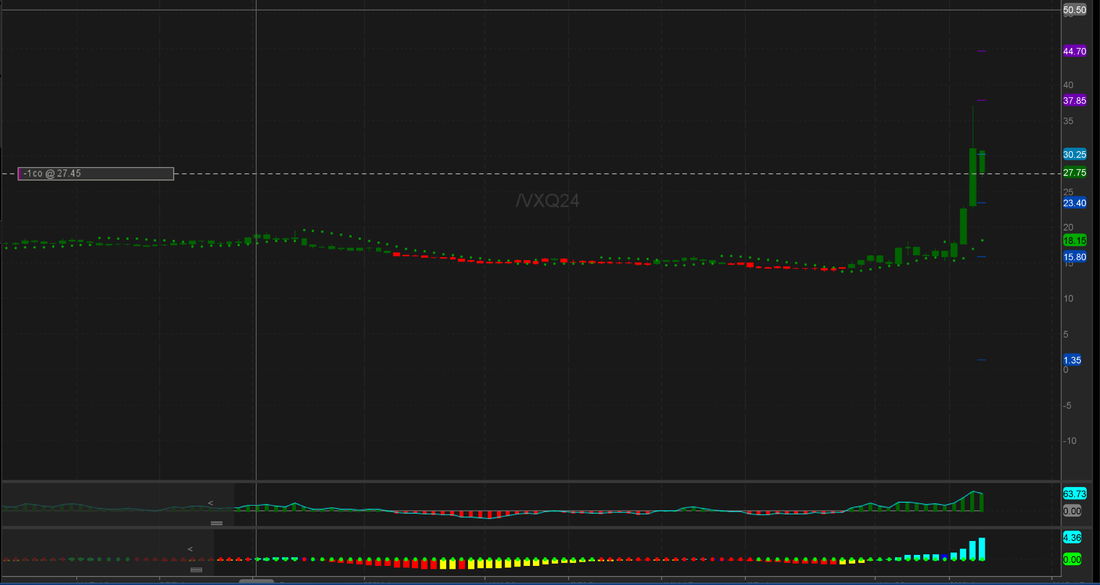

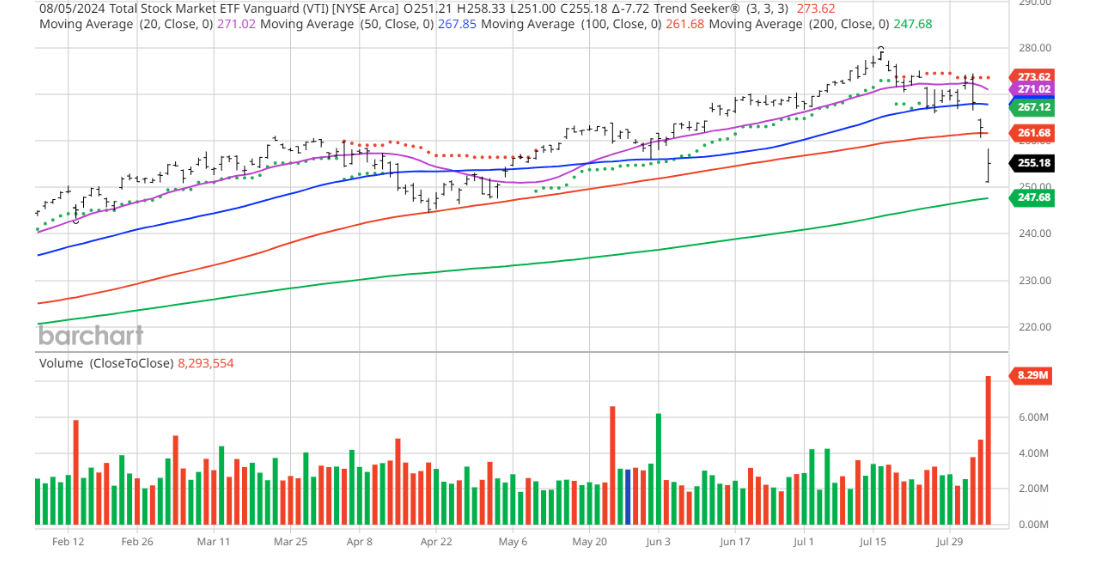

Another day. Another 500 point slide in the NDX! We've been so well posiitoned for this slide that it's actually been a drag on our portfolio over the last month as the market pushed to new highs. No longer. We have scored big on these downturns. Yesterday was a tad bit disappointing to me as the NDX ran back up too quick and I couldn't get enough buying power put to use but....you never know what to expect on days like this so having a bunch of dry powder makes sense. Here's a look at our days results. September S&P 500 E-Mini futures (ESU24) are up +0.55%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.56% this morning, signaling a partial rebound from yesterday’s dramatic selloff as a hotter-than-expected ISM services report and comments from Federal Reserve officials eased fears of a recession, while investors looked ahead to a fresh batch of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes closed lower, with the benchmark S&P 500 and tech-heavy Nasdaq 100 falling to 3-month lows and the blue-chip Dow dropping to a 7-week low. Nvidia (NVDA) slumped over -6% after The Information reported that the company’s upcoming artificial intelligence chips will be delayed by three months or more due to design flaws. Also, megacap technology stocks lost ground, with Amazon.com (AMZN) sliding more than -4% and Microsoft (MSFT) falling over -3%. In addition, Apple (AAPL) dropped more than -4% after Berkshire Hathaway reduced its stake in the iPhone maker by nearly 50% in the second quarter. On the bullish side, Kellanova (K) surged over +16% and was the top percentage gainer on the S&P 500 after Reuters reported that candy giant Mars was exploring an acquisition of the company. Economic data on Monday showed that the U.S. ISM services index rose to 51.4 in July, stronger than expectations of 51.0. At the same time, the U.S. S&P Global services PMI unexpectedly fell to 55.0 in July’s final estimate from the mid-month reading of 56.0 and 55.3 in June. Chicago Fed President Austan Goolsbee reiterated on Monday that the central bank’s role is not to react to one month of weaker labor data, adding that markets are much more volatile than Fed actions. Goolsbee noted that there are cautionary signs, such as the increase in consumer delinquencies, but economic growth continues at a “fairly steady level.” “As you see jobs numbers come in weaker than expected but not looking yet like recession, I do think you want to be forward-looking of where the economy is headed for making the decisions,” Goolsbee said. Separately, San Francisco Fed President Mary Daly stated that the labor market is softening and indicated the Fed should start reducing interest rates in the upcoming quarters, yet she refrained from concluding that the labor market has begun to weaken significantly. “We have now confirmed that the labor market is slowing, and it is extremely important that we not let it slow so much that it tips itself into a downturn,” she said. Daly stressed that the timing and magnitude of rate cuts will “depend a lot on the incoming information.” Meanwhile, U.S. rate futures have priced in a 22.5% chance of a 25 basis point rate cut and a 77.5% chance of a 50 basis point rate cut at the next FOMC meeting in September. In other news, the Federal Reserve’s Senior Loan Officer Opinion Survey, released on Monday, showed that a smaller share of U.S. banks reported tighter credit standards in the second quarter. The net share of U.S. banks that tightened standards on commercial and industrial loans for mid-sized and large businesses dropped to 7.9%, the lowest since 2022, down from 15.6% in the previous report. Banks generally tightened lending standards for consumers, particularly for subprime credit card and subprime auto loans, the Fed said. Second-quarter earnings season continues in full flow, with investors awaiting fresh reports from notable companies today, including Amgen (AMGN), Caterpillar (CAT), Uber Technologies (UBER), Airbnb (ABNB), Duke Energy (DUK), and Super Micro Computer (SMCI). On the economic data front, investors will likely focus on U.S. Trade Balance data, set to be released in a couple of hours. Economists foresee this figure to stand at -$72.50B in June, compared to the previous figure of -$75.10B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.833%, up +1.41%. Sell signals abound right now. More important, the IWM and QQQ's are threatening to break below their 200DMA. That would be very bearish. My bias today is neutral. Futures are up and we may get (probably will get) more big swings today but I think the panic selling is over yet buyers are not excited to come rushing in. For our trade docket today we are going to continue what has been so successful for us over the last three trading days of chaos. I'll continue to scalp with the /MNQ futures and covers. I may take advantage of the potential pop on the open with NVDA to close it and reset it later this week. I'm going to work a cover on the bullish QQQ debit/0DTE. A cover on the bearish NDX debit/0DTE and a stand alone NDX as well as a stand alone SPX 0DTE. Once price action calms down we'll return to our normally scheduled trading. I did put on a short VIX position yesterday. This is a $5,600 position and it's completely directional. There are no options on it. I believe we retrace back down to the $20 dollar range. That would be an approx. $7,0000 dollar profit. Shorting spiked I.V. has always been a huge success for me. Unfortunately we don't get spikes like this very often. We have a great trade called the VTI swing trade. We didn't get one on this last month because the sell signal hit so quickly but I like to use the VTI to gauge overall market health. You can see that not only are we in full sell mode but it's happening on increasing red volume. Intra-day levels: /ES; Just a couple key levels for me today. 5306 is first big resistance and the 5398 which is 50 period M.A. on the 2 hr. chart. 5190 is the key support level. Below that we open up a lot more downside. /NQ; 18,441 is first resistance. 18711 is 50 period M.A. Bulls need to clear that level. 18023 is first support with 17582 next. Below that is more downside. Bitcoin; BTC has gotten pretty hammered, in case you hadn't heard. It's sitting right now on its 200DMA. I'm going to let this one sort itself out before doing more trades on it. We've had some really good days lately as the market churns and drops. We'll stick to what's been working for us and focus mainly on our 0DTE's today. Stay sharp folks.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |