|

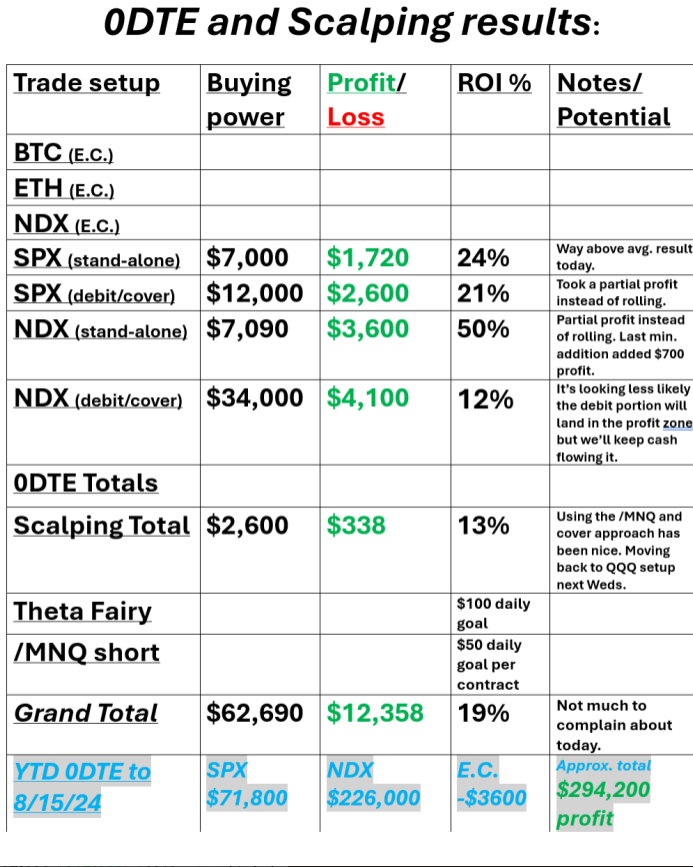

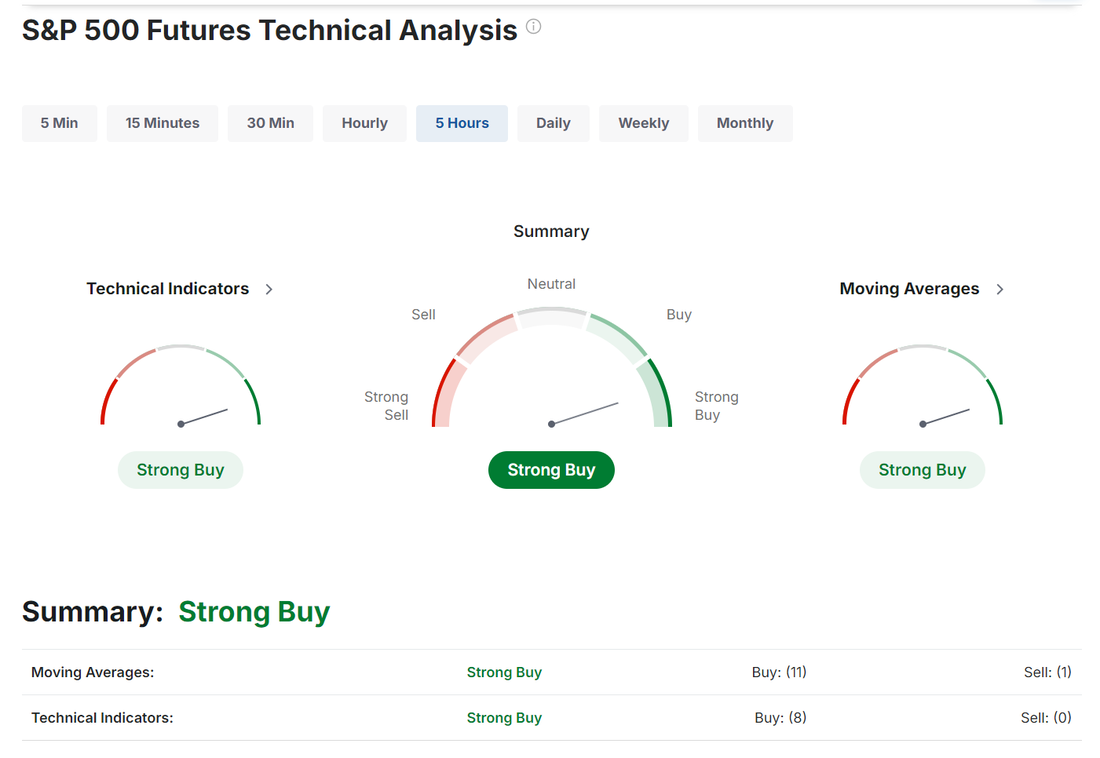

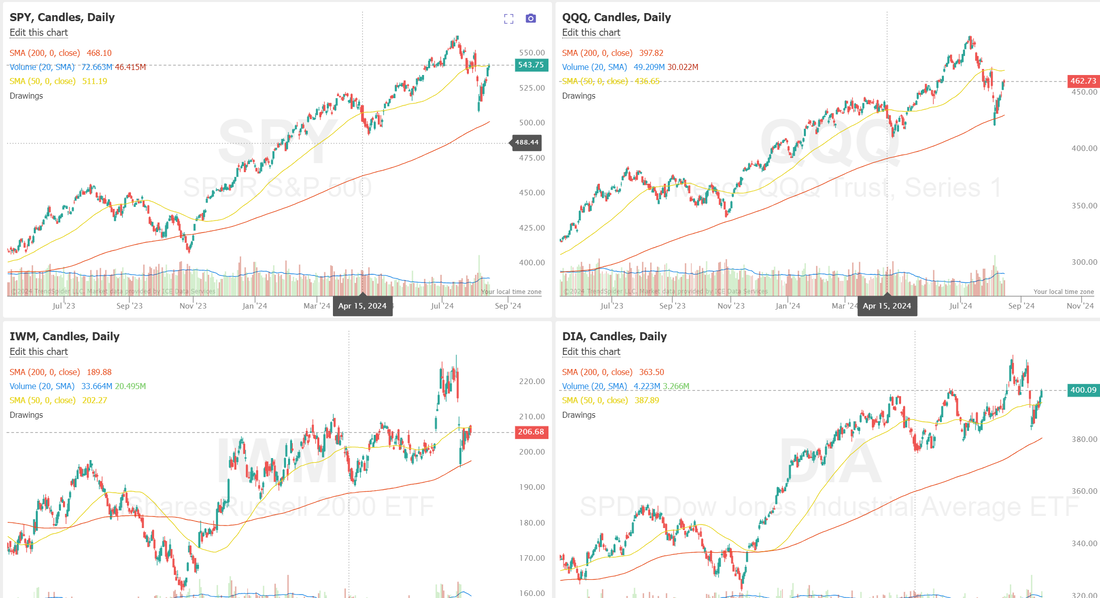

Welcome back traders. We had a solid day yesterday even though my prediction of a "trend" day couldn't have been more wrong. It was another day of ups and downs but the range was pretty confined and we were able to scale fairly well. We left some money on the table by closing a few legs down at way less than full profit capture but, nevertheless, it was a great day. Our results are below: One item of note. Our NDX put debit setup still has 11 days before expiration and while it's been a great cash flow machine, it's looking less likely it will hit for a profit. We only show realized gains and losses on the matrix above. It would be a 24K loss if that debit doesn't land in the profit zone and once that's realized (either profit or loss) I'll post it, however, our YTD 0DTE profit DOES reflect the current unrealized loss on that position. I'm just proud of our 0DTE results. I don't know if we'll be able to get to our $300,000 profit target by the end of this month IF the NDX debit doesn't hit but we'll certainly try! Let's take a look at the markets: Buy signals continue to hold tight. September S&P 500 E-Mini futures (ESU24) are up +0.01%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.15% this morning as investors awaited a flurry of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from retail giant Walmart. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the benchmark S&P 500, blue-chip Dow, and tech-heavy Nasdaq 100 posting 1-1/2 week highs. Kellanova (K) climbed over +7% and was the top percentage gainer on the S&P 500 after Mars agreed to acquire the company for $83.50 a share in a deal valued at about $36 billion. Also, Cardinal Health (CAH) gained more than +3% after the company posted upbeat Q4 results and boosted its FY25 adjusted EPS guidance. In addition, Illumina (ILMN) rose over +2% after TD Cowen upgraded the stock to Buy from Hold with a price target of $144. On the bearish side, Alphabet (GOOGL) fell more than -2% after Bloomberg News reported that the U.S. Department of Justice is considering several options to break up Google following a landmark court ruling that the company monopolized the online search market. The Labor Department’s report on Wednesday showed consumer prices increased +0.2% m/m in July, in line with expectations. On an annual basis, headline inflation eased to +2.9% in July from +3.0% in June, better than expectations of no change at +3.0% and the smallest year-over-year increase since March 2021. In addition, the core CPI, which excludes volatile food and fuel prices, eased to +3.2% y/y in July from +3.3% y/y in June, in line with expectations and the smallest annual increase in 3-1/4 years. “It may not have been as cool as [Tuesday’s] PPI, but [Wednesday’s] as-expected CPI likely will not rock the boat,” said Chris Larkin at E*Trade from Morgan Stanley. “Now the primary question is whether the Fed will cut rates by 25 or 50 basis points next month. If most of the data over the next five weeks points to a slowing economy, the Fed may cut more aggressively.” Atlanta Fed President Raphael Bostic told the Financial Times in an interview released on Thursday that he is open to a rate cut in September, noting that the central bank cannot “afford to be late” in easing monetary policy. “I’m open to something happening in terms of us moving before the fourth quarter,” Bostic told the newspaper. Meanwhile, U.S. rate futures have priced in a 64.5% chance of a 25 basis point rate cut and a 35.5% probability of a 50 basis point rate cut at the next FOMC meeting in September. On the earnings front, notable companies like Walmart (WMT), Applied Materials (AMAT), Deere (DE), and Tapestry (TPR) are slated to release their quarterly results today. On the economic data front, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that July Retail Sales will stand at +0.4% m/m, compared to the June figure of 0.0% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.4% m/m in June. Economists foresee the July figure to be +0.1% m/m. The U.S. Philadelphia Fed Manufacturing Index will be reported today. Economists foresee this figure to stand at 5.4 in August, compared to the previous value of 13.9. U.S. Industrial Production and Manufacturing Production data will be closely monitored today. Economists forecast July Industrial Production to be at -0.3% m/m and July Manufacturing Production to stand at -0.2% m/m, compared to the June numbers of +0.6% m/m and +0.4% m/m, respectively. U.S. Export and Import Price Indexes for July will come in today. Economists anticipate the export price index to be 0.0% m/m and the import price index to be -0.1% m/m, compared to the previous figures of -0.5% m/m and 0.0% m/m, respectively. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 236K, compared to last week’s value of 233K. In addition, market participants will be looking toward speeches from St. Louis Fed President Alberto Musalem and Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.850%, up +0.63%. Some important levels were hit yesterday. The SPY, DIA and IWM all held above their 50DMA. QQQ's are still the weakest. Retail sales, Jobless claims and Industrial production should be the news catalysts today. Assuming they don't rock the boat I'm starting the day with a bullish bias. Our trade docket for today: BABA, AMAT, /MCL, /ZN, DELL, DJT, DIA, FSLR, NEM, IWM, /MNQ scalp, 0DTE's. Let's take a look at a couple key levels for me today; /ES; Very tight range pattern today. 5491 and 5520 are the next two resistance levels bulls need to break through. 5469 and 5452 are the support areas. /NQ; We find a similar pattern in the Nasdaq. 19208 is the first resistance. 19310 is the next. 19049 is first support. 18942 is the next. Let's have a great day folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |