|

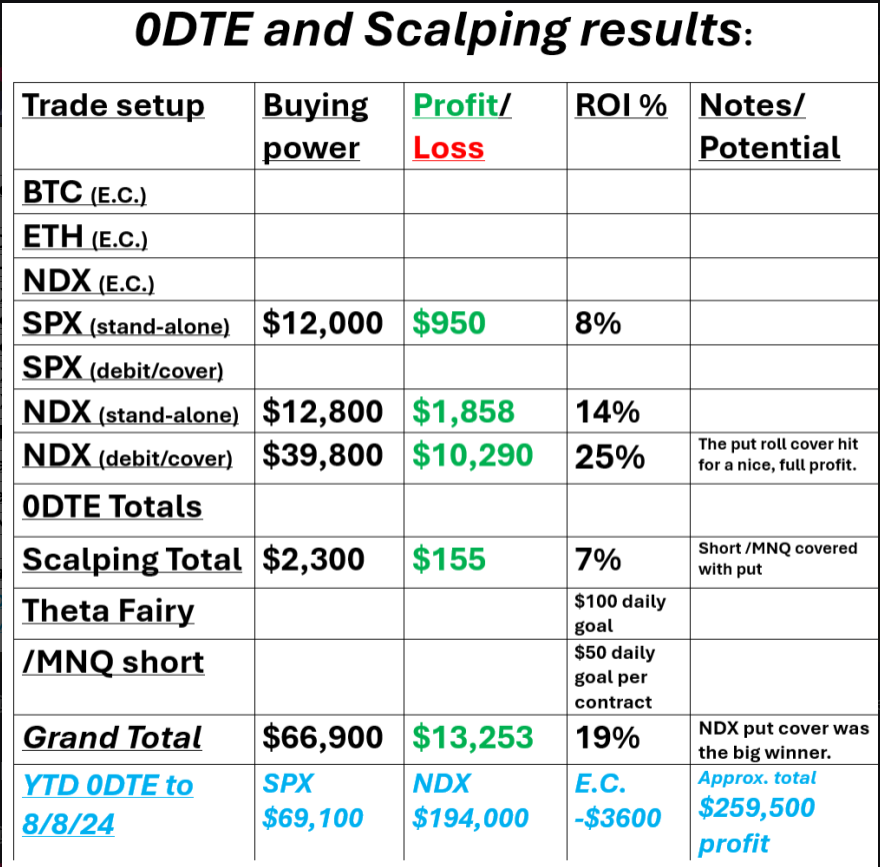

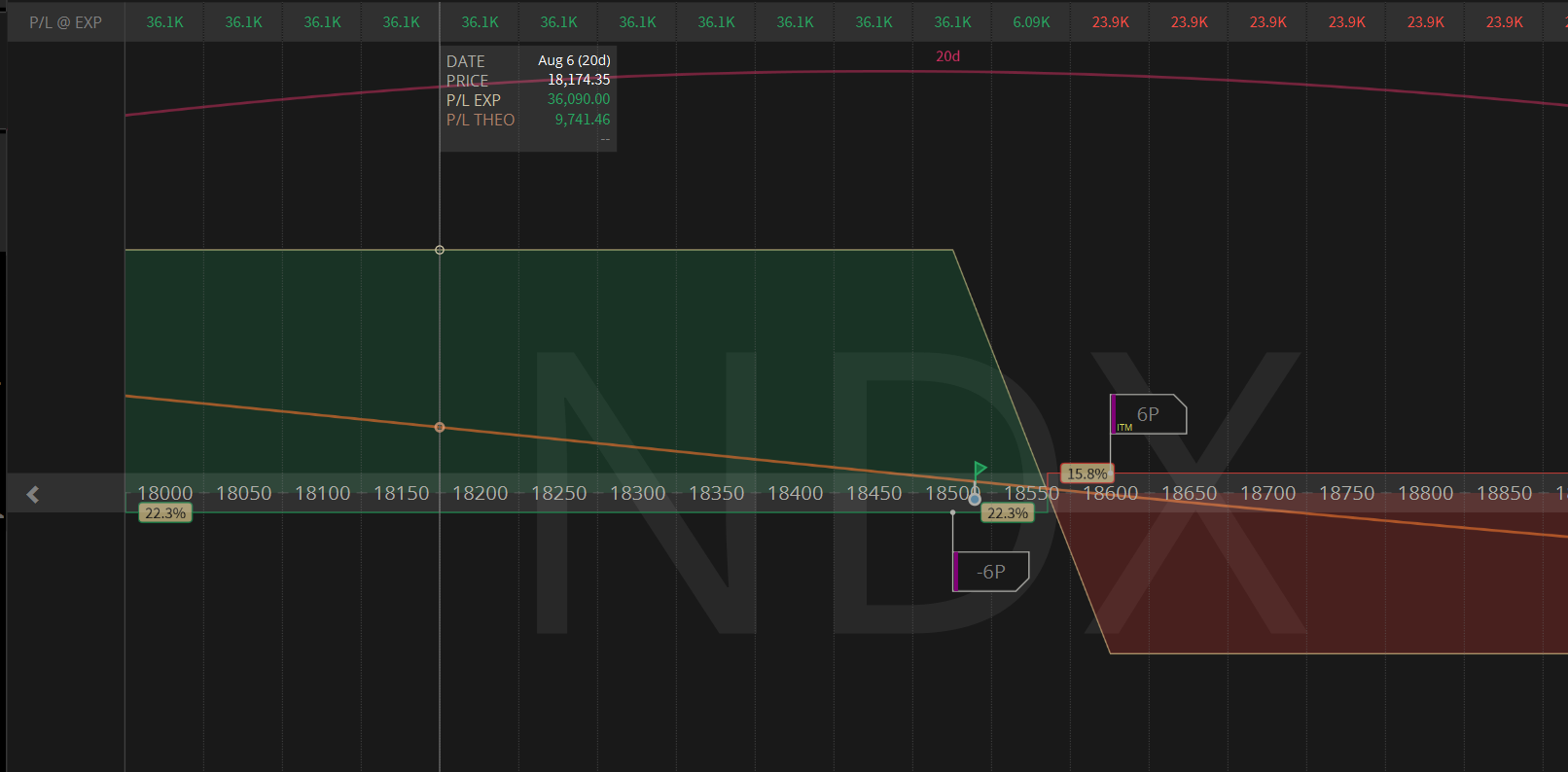

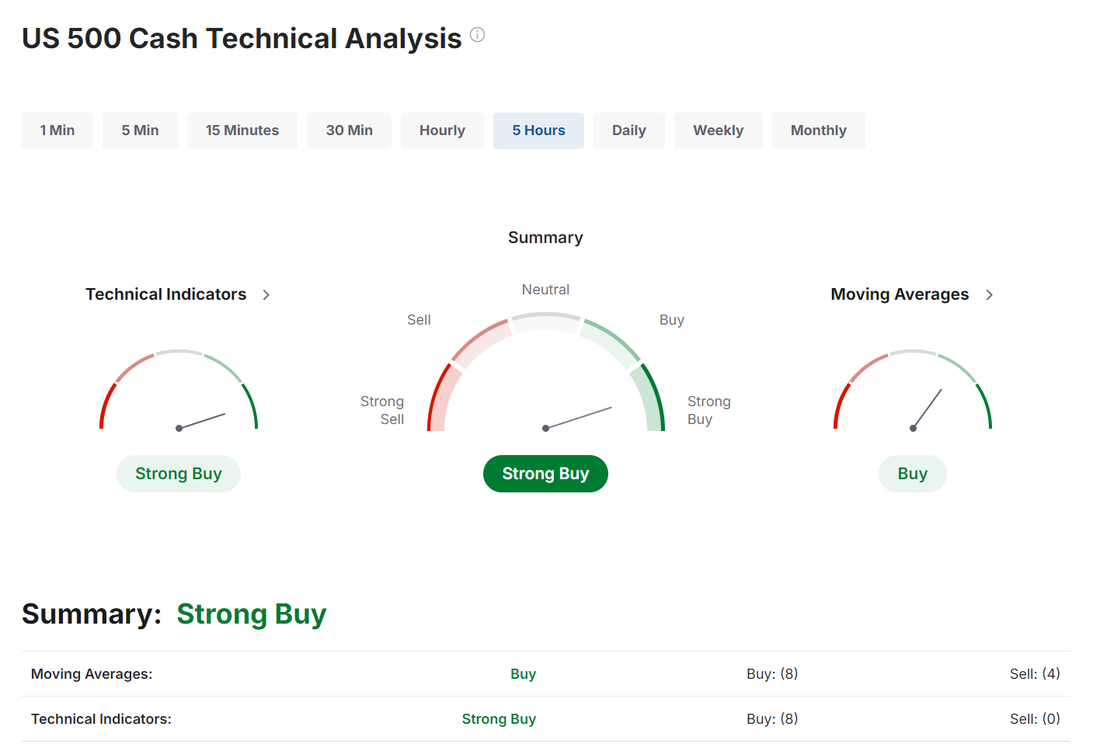

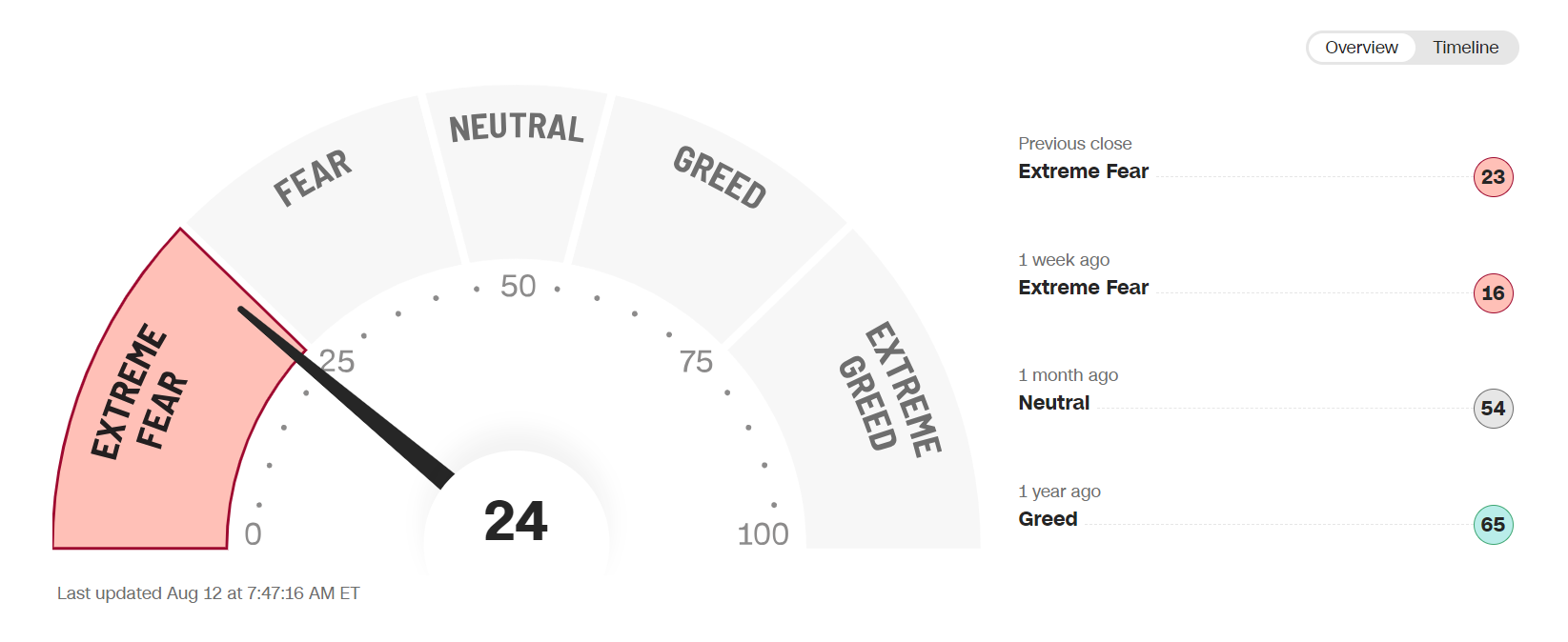

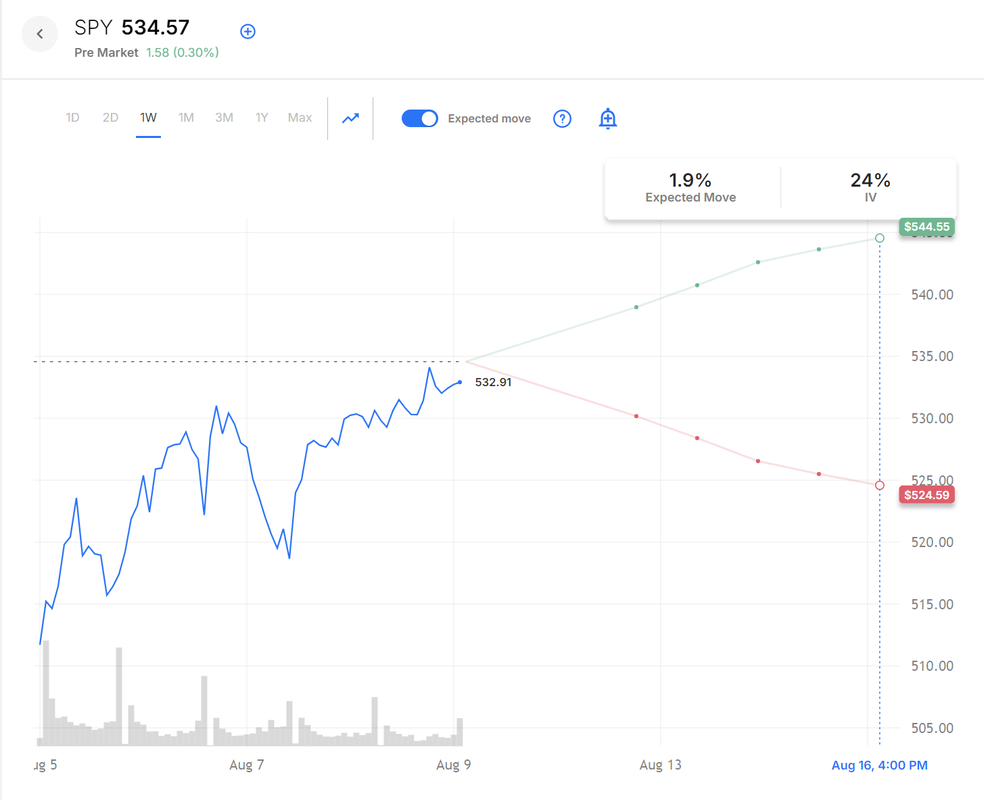

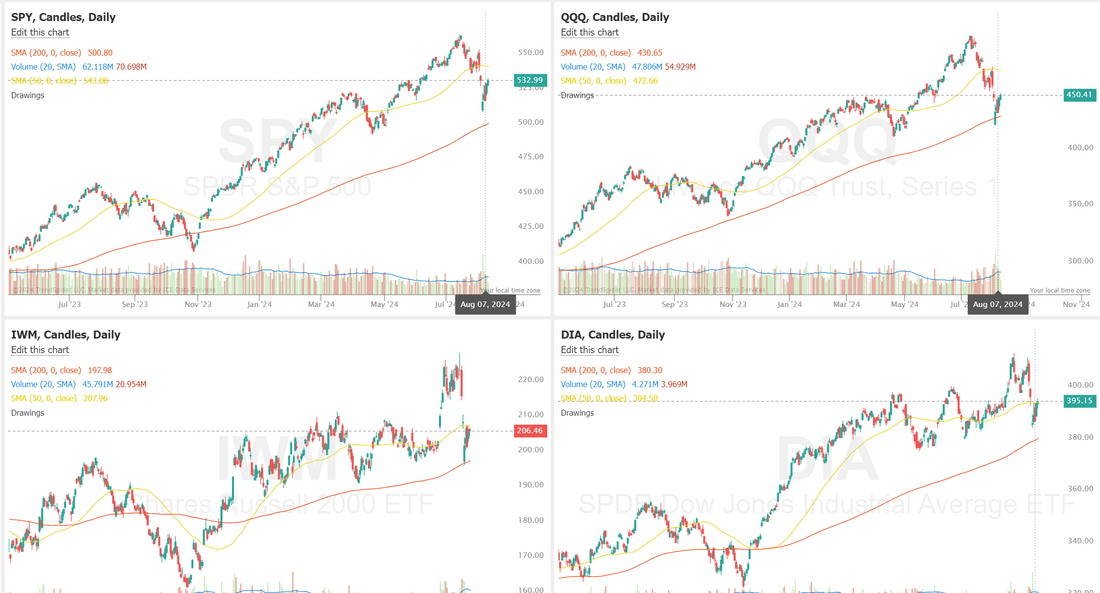

Welcome back traders. We had a nice finish to the week last Friday with our NDX debit 0DTE cover hitting for a full profit. Here's our results. I has set an aggressive goal to see if we could get to $300,000 of total profit on our 0DTE's by the end of the month. That's a lot but if we can get the NDX debit to finish in the profit zone we should be close. We've got CPI this week. I believe that will cement our near term direction, either up or down. We've got two weeks to continue to work this I.V. has fallen back into its more normal range. Take a look at the VIX1D. Technicals are flashing a moderate buy signal. The fear and greed index is flashing buy signals as well Let's take a look at the expected moves for the SPY and QQQ this week. This past week we saw a rotation out of the defensive sectors and back into the "risk on" stocks. September S&P 500 E-Mini futures (ESU24) are up +0.10%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.21% this morning as investors looked ahead to the release of U.S. inflation data, quarterly earnings reports from retail heavyweights, and remarks from Federal Reserve officials. In Friday’s trading session, Wall Street’s major averages closed higher. Akamai Technologies (AKAM) climbed over +10% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results. Also, Trade Desk (TTD) surged more than +12% and was the top percentage gainer on the Nasdaq 100 after the company reported strong Q2 results and provided above-consensus Q3 revenue and adjusted EBITDA guidance. In addition, Expedia (EXPE) gained over +10% after the online travel company reported better-than-expected Q2 results. On the bearish side, Insulet (PODD) slumped more than -8% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q2 adjusted EPS. Also, Intel (INTC) slid over -3% and was the top percentage loser on the Dow and Nasdaq 100 after Moody’s Ratings downgraded Intel’s senior unsecured debt rating to Baa1 from A3 and revised its outlook to negative from stable. “Even if that nerve-racking event is over, we learned how sensitive markets now are to cooler US economic data, how broad-reaching the impact of the yen carry trade can be, and how conditioned investors are to expect rate cuts as the salve for every scrape,” said Liz Young Thomas at SoFi. Boston Fed President Susan Collins stated in an interview with the Providence Journal on Friday that the U.S. central bank might start lowering interest rates soon if inflation maintains its downward trajectory amid a robust labor market. “If the data continue the way that I expect, I do believe that it will be appropriate soon to begin adjusting policy and easing how restrictive the policy is,” Collins said. “My outlook is for continued gradual reduction back to our 2% target amid a healthy labor market.” At the same time, Fed Governor Michelle Bowman said Saturday that she continues to see upside risks for inflation and continued strength in the labor market. “The progress in lowering inflation during May and June is a welcome development, but inflation is still uncomfortably above the committee’s 2% goal,” Bowman said. “I will remain cautious in my approach to considering adjustments to the current stance of policy.” Meanwhile, U.S. rate futures have priced in a 51.5% chance of a 25 basis point rate cut and a 48.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. Second-quarter earnings season winds down, but several notable companies are due to report this week, including Walmart (WMT), Home Depot (HD), Cisco (CSCO), Barrick Gold (GOLD), Deere (DE), Applied Materials (AMAT), and Sun Life Financial (SLF). On the economic data front, the U.S. consumer inflation report for July will be the main highlight in the coming week. Also, market participants will be monitoring a spate of other economic data releases, including the U.S. Core CPI, PPI, Core PPI, Retail Sales, Core Retail Sales, Crude Oil Inventories, Export Price Index, Import Price Index, Initial Jobless Claims, NY Empire State Manufacturing Index, Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Building Permits (preliminary), Housing Starts, and Michigan Consumer Sentiment Index (preliminary). In addition, Atlanta Fed President Raphael Bostic, St. Louis Fed President Alberto Musalem, Philadelphia Fed President Patrick Harker, and Chicago Fed President Austan Goolsbee will be making appearances this week. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.953%, up +0.23%. Price action, while being very active, has simply taken most of the indices back to previous consolidation zones. We are still waiting for a new trend to develop. Let's take a look at some key levels for our 0DTE entries today. /ES: 5402 is the first key resistance level. 5440 is the 200 period M.A. on a 2 hr. chart. Above that sits the PoC. Those are some (usually) stiff resistance areas. 5363 is first support and 5322 is the next. /NQ; There are a couple key levels I'm watching. 18772 is first resistance. If we can break above that we could have clear sailing all the way up to 19025 which is the 200 Period M.A. on the 2 hr. chart. On the downside, the first target is 18569. Below that is the 50 period M.A. on the 2 hr. chart. 18401. My lean today is bullish. I'm going to simply fall in line with the technicals today. Our trade docket for today: Scalping with /MNQ. ETH crypto add. FSLR, WYNN, UPST, ORCL, IWM, CCL, NVDA, PLTR, PYPL, SHOP, META?, Bonds, Oil, Gold, DIA ladders. 0DTE's. We are back to a more "normal" Monday trading day. PPI and CPI should be the big catalyst's this week so keep an eye on them.

Have a great day folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |