|

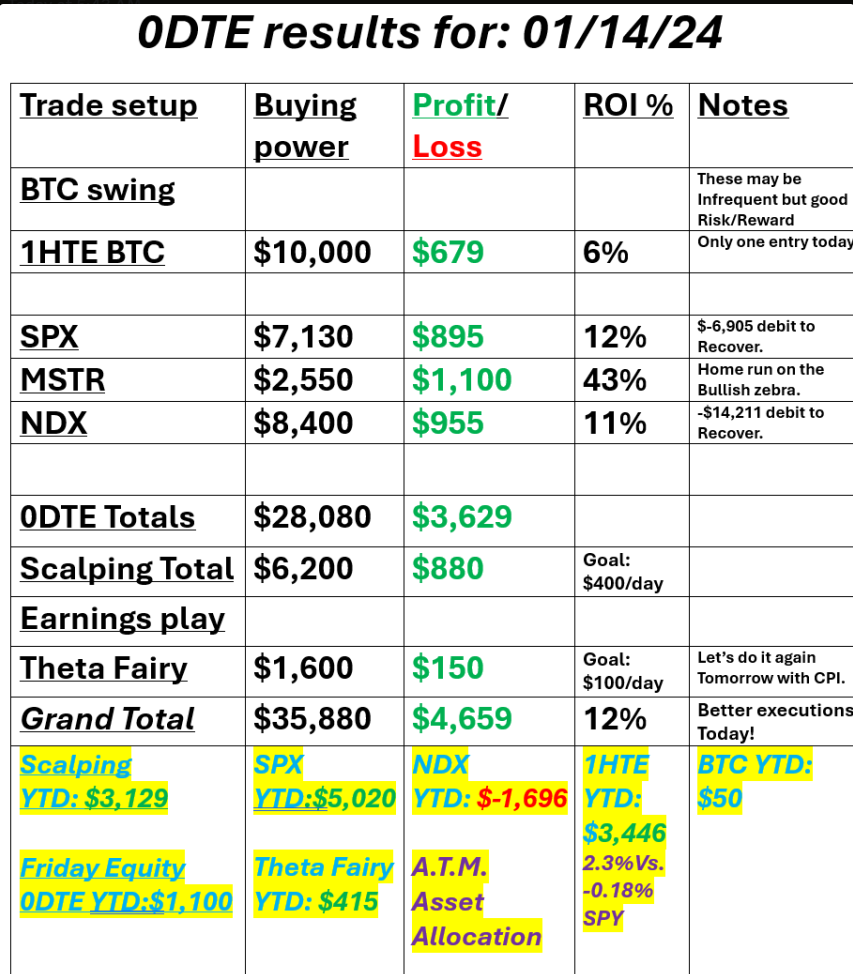

Welcome back traders! CPI today. Yesterday was a tremendous success for us. Not because we made money. Sure, that's important (Duh), but more so because we (specifically I because I've been the one off lately) followed our "rules of engagement" and did what we thought was right, regardless of profit or loss. We executed out plan and let the results be what they will be. Often in the trading room I'll state one of my favorite trading mantras. "You're in a trade. The underlying is moving around. That movement is either helpiing or hurting you. If it's helping you the best thing to do is sit on your hands. If it's hurting you, do something about it." Every trader has to follow a "gameplan" or trade methodology to be successful. Shooting from the hip may work for a while but ultimately will let you down. We'll talk about this in our live zoom today. Develop a system then follow it...regardless of the result. "Trade to trade well" as we say and let the results be what they will be. It's hard. Focusing on the process rather than the outcome (profit or loss). Here are our results from yesterday. I also want to give a shout out to our A.T.M. program. We don't talk about it much but I'm super proud of it. It's a longer term, passive, asset allocation investment program. Trading is great but investing is a good balance. We also know that putting our life savings into trading doesn't make sense. The last down year we had was 2022 and while the market lost money, we killed it in our A.T.M. (Asymmetric Trade Management) portfolio. I believe we have the same chance this year. If you want to be in a position to make money as markets fall this may be something to look at. March S&P 500 E-Mini futures (ESH25) are trending up +0.16% this morning as investors looked ahead to key U.S. inflation data and earnings reports from some of the biggest U.S. banks. In yesterday’s trading session, Wall Street’s major indexes closed mixed. United Rentals (URI) climbed nearly +6% and was the top percentage gainer on the S&P 500 after acquiring H&E Equipment Services for $3.4 billion in cash. Also, Atlassian (TEAM) advanced more than +4% and was the top percentage gainer on the Nasdaq 100 after it announced price increases for its data center products. In addition, KB Home (KBH) gained over +4% after the homebuilder posted upbeat Q4 results and issued solid FY25 guidance. On the bearish side, Eli Lilly (LLY) slumped more than -6% and was the top percentage loser on the S&P 500 after providing a below-consensus Q4 revenue forecast. Economic data released on Tuesday showed that the U.S. producer price index for final demand rose +0.2% m/m and +3.3% y/y in December, weaker than expectations of +0.4% m/m and +3.5% y/y. Also, the core PPI, which excludes volatile food and energy costs, was unchanged m/m and rose +3.5% y/y in December, weaker than expectations of +0.3% m/m and +3.8% y/y. “While the wholesale price data does not necessarily translate directly into consumer price data, it was encouraging to see the PPI Index come in well below expectations,” said Charlie Ripley, senior investment strategist at Allianz Investment Management. Meanwhile, the fourth-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Citigroup (C), slated to report their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will provide clues on the path of Fed rates over the next few months. Economists, on average, forecast that the U.S. December CPI will come in at +0.4% m/m and +2.9% y/y, compared to the previous numbers of +0.3% m/m and +2.7% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.3% y/y in December, matching November’s figures. “[Today’s] CPI report may be the most important inflation reading in recent memory, as it will fuel the market’s Fed-obsessed sentiment. A strong inflation number adds to this idea of no cuts in 2025, and potentially even a rate hike, while a weak inflation data point may help to calm the market’s Fed fears,” said Chris Brigati at SWBC. A survey conducted by 22V Research showed that 47% of investors anticipate a “risk-off” market response to the CPI report, 29% believe it will be “risk-on,” and 24% said it will be “mixed/negligible.” The Empire State Manufacturing Index will be reported today. Economists expect this figure to stand at 2.70 in January, compared to 0.20 in December. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -3.500M, compared to last week’s value of -0.959M. In addition, market participants will be looking toward speeches from Richmond Fed President Thomas Barkin, Minneapolis Fed President Neel Kashkari, New York Fed President John Williams, and Chicago Fed President Austan Goolsbee. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. U.S. rate futures have priced in a 97.3% probability of no rate change and a 2.7% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.774%, down -0.29%. /ES 7DTE "Market crash, Hedge, Long Vega, Daily cash flow setup. MU?, LEVI?, UNH, GME, /ZN, 1HTE (maybe), 0DTE's, Scalping Using the /MNQ, /NQ, QQQ's. CPI is out in 5 min. as I type so we'll have an updated look at the price action this morning. Currently the technicals aren't showing us much. Maybe, very appropriately we have a neutral rating to start the day. We are still stuck in a fairly wide trading range. We are keen to get a long position established in the 10 yr. bonds. Today may be that day for us. PPI yesterday was better than expected. Markets popped on the news but couldn't really hold the gains. CPI is now out with favorable results as well. Futures are popping once again. Will it hold today? Our "rules based approach" today will be tested and I"m optimistic it will yield us some good resuts. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |