|

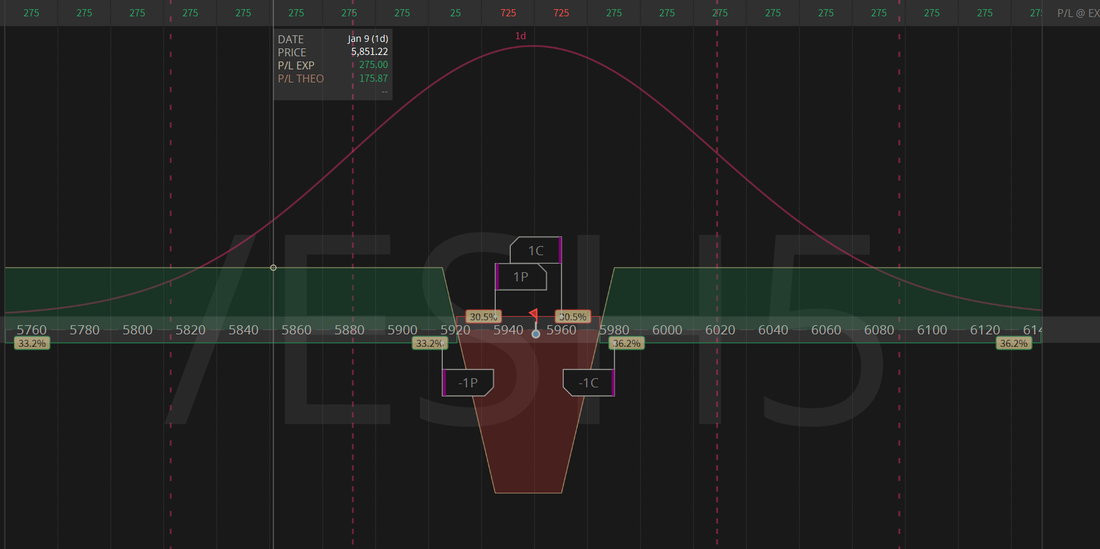

Welcome to Friday traders! Equities were closed yesterday so we took advantage of that late Weds. to setup our 0DTE's for today. The core of what we will be trading today is already in place. Let's take a look at the four 0DTE's and modified Theta fair we already have working. We have a long I.C. setup working for the modified Theta fairy. This takes care of the long vol part. Then we have our /ES 0DTE cover. This has about $600 of potential profit in it. That is combined with a long /ES call. Which I have 1,700 of buying power tied up in. This is a 5DTE. Our NDX 0DTE portion looks like this and has either $700 or $2,700 profit potential, depending on which profit zone it lands in. Adding in the 5DTE portion the NDX looks like this. Both the /ES and NDX have a bullish bias. Our other two 0DTE's are from last weeks MSTR and TSLA setups that we needed to roll. They look like this. Theres a chance we can get a take profit order in right away on the TSLA. We're still just outside the profit target on MSTR. That will most likely change today (for better or worse) so expect either a take profit or adjust order later in the day. As mentioned, the trade docket for today is largely set with the modified Theta fairy, The /ES 0DTE. The NDX 0DTE. The MSTR 0DTE and the TSLA 0DTE. This should give us plenty of potential and plenty to work on today. Todays analysis is not much analysis. We have NFP out this morning and that should be the big driver for today. Many times NFP is a bigger mover than CPI or even FOMC Powell days so I don't try to find levels or create bias. We'll just trade what we see. March S&P 500 E-Mini futures (ESH25) are trending down -0.01% this morning as investors adopted a cautious stance ahead of the all-important U.S. jobs report that will help shape the outlook for interest rates. In Wednesday’s trading session, Wall Street’s major indexes ended mixed. eBay (EBAY) surged nearly +10% and was the top percentage gainer on the S&P 500 after Meta Platforms proposed publishing eBay’s listings on Facebook Marketplace to comply with a European Union antitrust order. Also, GE HealthCare Technologies (GEHC) climbed more than +3% and was the top percentage gainer on the Nasdaq 100 after Jeffries upgraded the stock to Buy from Hold with a price target of $103. In addition, Maplebear (CART) gained over +4% after S&P Dow Jones Indices announced that the stock would be added to the S&P MidCap 400 Index next week. On the bearish side, Edison International (EIX) slumped over -10% and was the top percentage loser on the S&P 500 after its Californian subsidiary shut off power to customers due to wildfires. Also, Advanced Micro Devices (AMD) slid over -4% after HSBC downgraded the stock to Reduce from Buy with a $110 price target. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 122K in December, down from 146K in November and missing the consensus estimate of 139K. Also, U.S. consumer credit unexpectedly fell -$7.49B in November, weaker than the expected +$10.30B increase and marking the largest decline in 15 months. At the same time, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -10K to a 10-1/2 month low of 201K, compared with the 214K expected. The minutes of the Federal Open Market Committee’s December 17-18 meeting, released Wednesday, revealed that officials embraced a new approach to rate-cutting in light of heightened inflation risks, opting to proceed more cautiously in the coming months. “Participants indicated that the committee was at or near the point at which it would be appropriate to slow the pace of policy easing,” according to the FOMC minutes. “Almost all participants judged that upside risks to the inflation outlook had increased. As reasons for this judgment, participants cited recent stronger-than-expected readings on inflation and the likely effects of potential changes in trade and immigration policy,” the minutes said. Philadelphia Fed President Patrick Harker stated on Thursday that policymakers are on track to reduce interest rates this year, but the precise timing “will be fully dependent upon the incoming data.” Also, Boston Fed President Susan Collins said a more gradual approach to adjusting interest rates is warranted now as officials face “considerable uncertainty” regarding the economic outlook. In addition, Fed Governor Michelle Bowman said she sees lingering inflation risks and that policymakers should be cautious with additional interest rate cuts. Finally, Fed Governor Christopher Waller said on Wednesday, “The extent of further easing will depend on what the data tell us about progress toward 2% inflation, but my bottom-line message is that I believe more cuts will be appropriate.” Meanwhile, U.S. rate futures have priced in a 93.1% probability of no rate change and a 6.9% chance of a 25 basis point rate cut at the January FOMC meeting. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that December Nonfarm Payrolls will come in at 164K, compared to November’s figure of 227K. A survey conducted by 22V Research showed that the majority of investors are monitoring payrolls more closely than usual. 40% of the respondents expect key U.S. jobs data to be “risk-off,” 34% anticipate it will be “mixed/negligible,” and only 26% foresee “risk-on.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect December figures to be +0.3% m/m and +4.0% y/y, compared to the previous numbers of +0.4% m/m and +4.0% y/y. The U.S. Unemployment Rate will be reported today. Economists foresee this figure to remain steady at 4.2% in December. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists forecast the preliminary January figure to be 74.0, unchanged from last month. “Investors will want to see a return to Goldilocks data, consistent with a cooling labor market to help temper the recent spike in yields and help stocks stabilize,” said Tom Essaye at The Sevens Report. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.690%, up +0.19%. There is still a bit of a bearish bias holding in this market. Even with the weakness, we continue to sit in a pocket of consolidation on most of the indices. I look forward to finishing the week strong. We've got five trade to focus on today. I'll see you all in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |