|

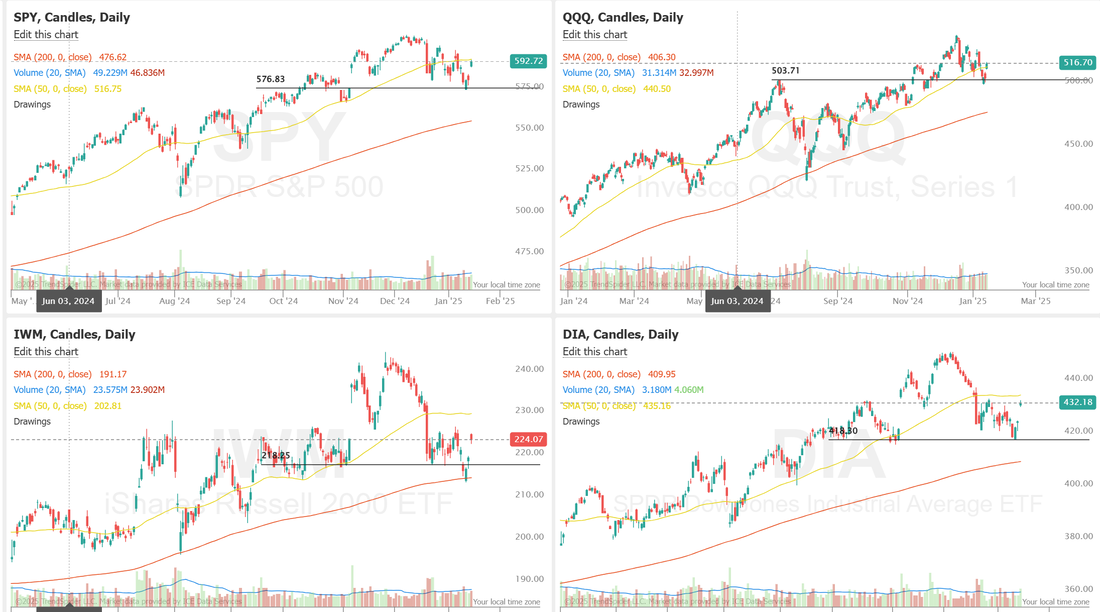

Welcome to Thursday traders! We made it through PPI and CPI and what a few days it's been. I'm incredibly happy and relieved with our results from yesterday. Yes, I deployed almost $45,000 dollars of capital and made $257 dollars profit but I believe your success is ultimately defined by how your bad days go. First a couple comments. #1. It's critical to have multiple strategies going during the day. It's just impossible to know what will hit and what won't. Why try? I'm very proud of the multiple layers of setups we run each day. It certainly saved us yesterday. #2. We do have $5,600 of potential profits awaiting us today from our rolled calls so our efforts from yesterday may not be fully realized until this afternoon. #3. We are working very hard to focus on "consistency over profits". In other words, lets make consistent results a priority over killing it profit-wise. Yesterday was a good example of that. Basically I was wrong on a couple of our intitial setups. We had enough flexibility that it still ended up o.k.. #4. Part of this is working on setups that are less "binary". Most trades, regardless of setup are binary. They either work or they don't. Our SPX and NDX setups technically didn't work yesterday but it still worked out. Flexible, more foregiving setups are what we want and that's what we seem to be getting with our "Three phase" 0DTE entries. Here's our results from yesterday. We do have jobless claims to watch this morning. March S&P 500 E-Mini futures (ESH25) are up +0.31%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.49% this morning, signaling further gains on Wall Street as cooling U.S. core inflation bolstered expectations of Federal Reserve easing this year, while investors awaited a fresh batch of U.S. economic data and quarterly reports from more big banks. Market sentiment also got a boost after Taiwan Semiconductor Manufacturing Co. (TSM), the main chipmaker to Apple and Nvidia, reported a record quarterly profit and provided strong Q1 revenue guidance. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended sharply higher, with the S&P 500 and Nasdaq 100 posting 1-week highs and the Dow notching a 2-1/2 week high. Megacap technology stocks gained ground, with Tesla (TSLA) surging more than +8% to lead gainers in the S&P 500 and Nasdaq 100 and Nvidia (NVDA) advancing over +3%. Also, Intuitive Surgical (ISRG) climbed more than +7% after the healthcare equipment company reported stronger-than-expected preliminary Q4 revenue. In addition, Goldman Sachs (GS) rose more than +6% and was the top percentage gainer on the Dow after reporting upbeat Q4 results. On the bearish side, Vericel (VCEL) fell over -1% after the company issued below-consensus Q4 revenue guidance. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices increased +0.4% m/m in December, in line with expectations. On an annual basis, headline inflation rose to +2.9% in December from +2.7% in November, in line with expectations. Also, the December core CPI, which excludes volatile food and fuel prices, unexpectedly eased to +3.2% y/y from +3.3% y/y in November, better than expectations of no change at +3.3% y/y. In addition, the Empire State manufacturing index unexpectedly fell to an 8-month low of -12.60 in January, weaker than expectations of 2.70. Richmond Fed President Thomas Barkin said Wednesday that the fresh consumer-price data “continues the story we’ve been on, which is that inflation is coming down toward target,” but added that “there’s still work to do.” Also, New York Fed President John Williams said, “The process of disinflation remains in train. But we are still not at our 2% goal, and it will take more time until we can achieve that on a sustained basis.” In addition, Chicago Fed President Austan Goolsbee said that “the trend continues to be improvement in inflation” and expressed confidence that the Fed can curb price growth without causing an economic downturn. “For the Fed, this is certainly not enough to prompt a January cut,” said Seema Shah, chief global strategist at Principal Asset Management. “But, if [yesterday’s] print were accompanied by another soft CPI print next month plus a weakening in payrolls, then a March rate cut may even be back on the table.” Meanwhile, U.S. rate futures have priced in a 97.3% probability of no rate change and a 2.7% chance of a 25 basis point rate cut at the January FOMC meeting. However, swap traders have returned to fully pricing in a Fed rate cut by July following the U.S. inflation report. The Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity in the U.S. grew “slightly to moderately” in late November and December. The Fed’s districts reported that consumer spending rose moderately, employment edged higher on balance, and prices increased “modestly overall.” “More contacts were optimistic about the outlook for 2025 than were pessimistic about it, though contacts in several districts expressed concerns that changes in immigration and tariff policy could negatively affect the economy,” according to the Beige Book. Today, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that December Retail Sales will stand at +0.6% m/m, compared to the November figure of +0.7% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.2% m/m in November. Economists expect the December figure to be +0.5% m/m. The U.S. Philadelphia Fed Manufacturing Index will be released today. Economists foresee this figure to stand at -5.2 in January, compared to last month’s value of -16.4. U.S. Export and Import Price Indexes will be reported today. Economists forecast the export price index to be +0.2% m/m and the import price index to be -0.1% m/m in December, compared to the previous figures of 0.0% m/m and +0.1% m/m, respectively. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure to arrive at 210K, compared to last week’s number of 201K. In addition, market participants will be anticipating a speech from New York Fed President John Williams. On the earnings front, major U.S. banks such as Bank of America (BAC) and Morgan Stanley (MS) are set to release their quarterly results today. UnitedHealth (UNH), U.S. Bancorp (USB), PNC Financial (PNC), and JB Hunt (JBHT) are other prominent companies scheduled to deliver their quarterly updates today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.654%, up +0.02%. Let's take a look at the technicals. With yesterdays big move we are back to a bullish technical picture. Albeit very slight. The "line in the sand" (see charts) of support I've been watching has held. The IWM and DIA were the big winners yesterday. My lean or bias today: Today is a tough one. We've had two days of extreme bullishness. We've been bouncing off the top Bollinger band like a race car banging off the rev limiter. Are we overstreched to the upside? Maybe. Is this the start of a new bullish trend? Maybe. Futures right now are not too helpful. If jobless claims and retail sales numbers can create even the smallest bit of weakness in the futures I think we are at best flat and probably retrace today. I'll positioning for a slight retrace today. We already have the starting point for most of our trades today. UNH earnings trade should finish today. We already have our scalps setup for today with a short /MNQ and /NQ cover. A 1HTE may be tricky today but we'll try. A possible re-set on our MU trade which I'm still underwater on. A new entry on X. Our SPX and NDX 0DTE's are already working with our rolled calls from yesterday. We'll add to these today. Let's take a look at our key, intra-day levels. /ES: There may be a bit of confirmation bias in my thinking today but the 2hr. chart sure looks like it wants to roll over. 6036 is the new resistance level with 5947 now support. This is my target for today. It's the high vol node zone and PoC as well as VWAP on the 2hr. chart. /NQ: The Nasdaq is a bit stronger than SPX coming into this mornings session. 21,562 is first resistance with a secondary one at 21,699. Support is also down on the high value node and PoC of 21,343. BTC: We'll need to see what the pricing looks like this morning in Kalshi but I'm doubtful we will have very good risk/reward today for any 1HTE's. 103,145 is resistance with 98,241 the first support level and 96,279 next. I would look to initiate another long BTC swing trade at the second level but otherwise we may sit out any bitcoin trades today. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |