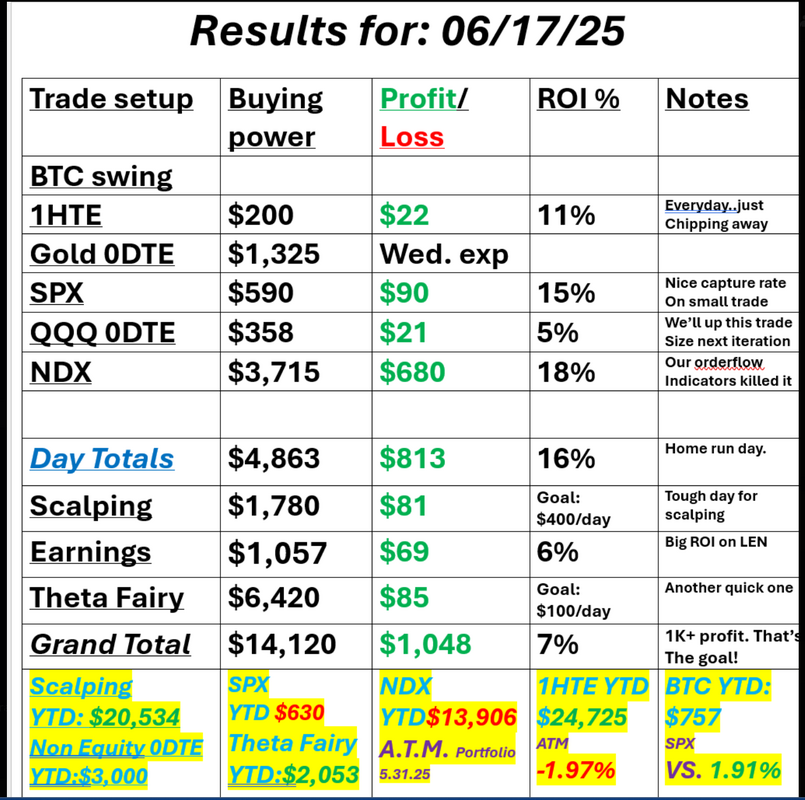

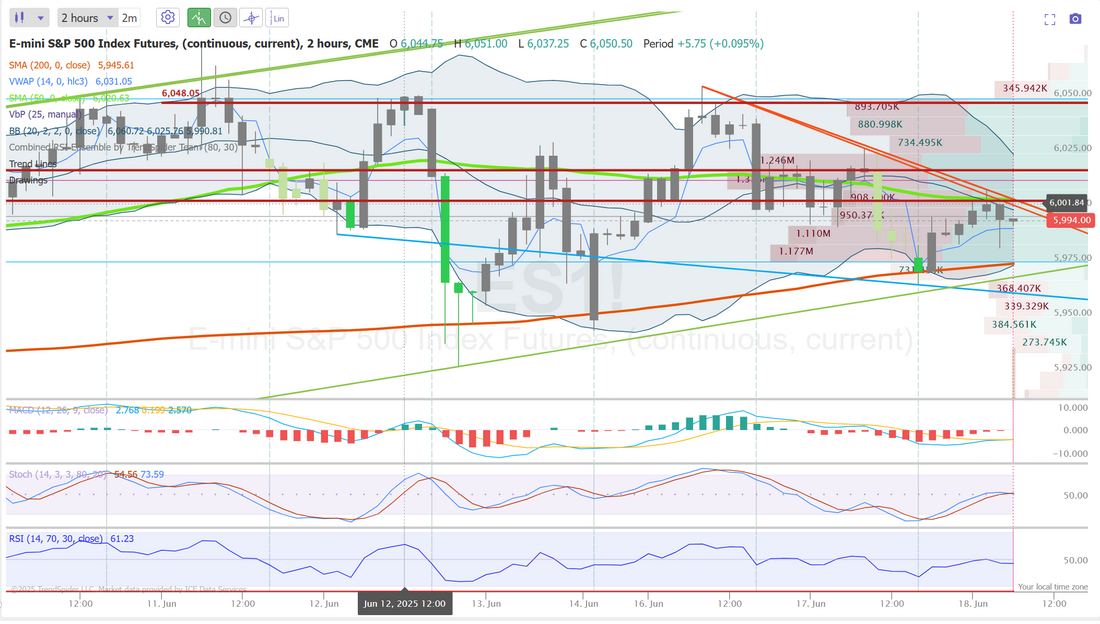

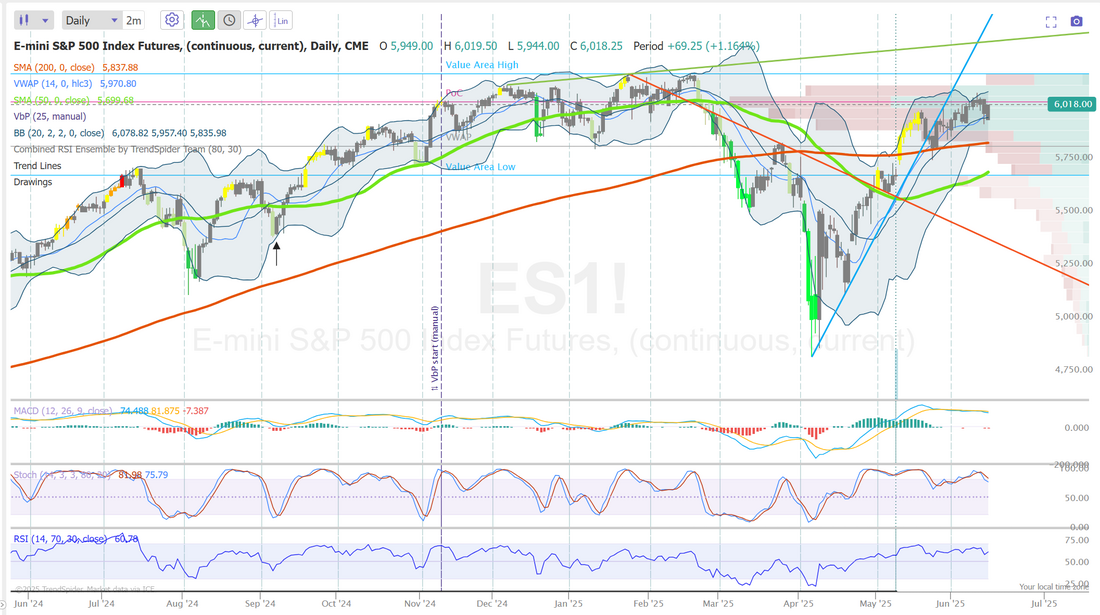

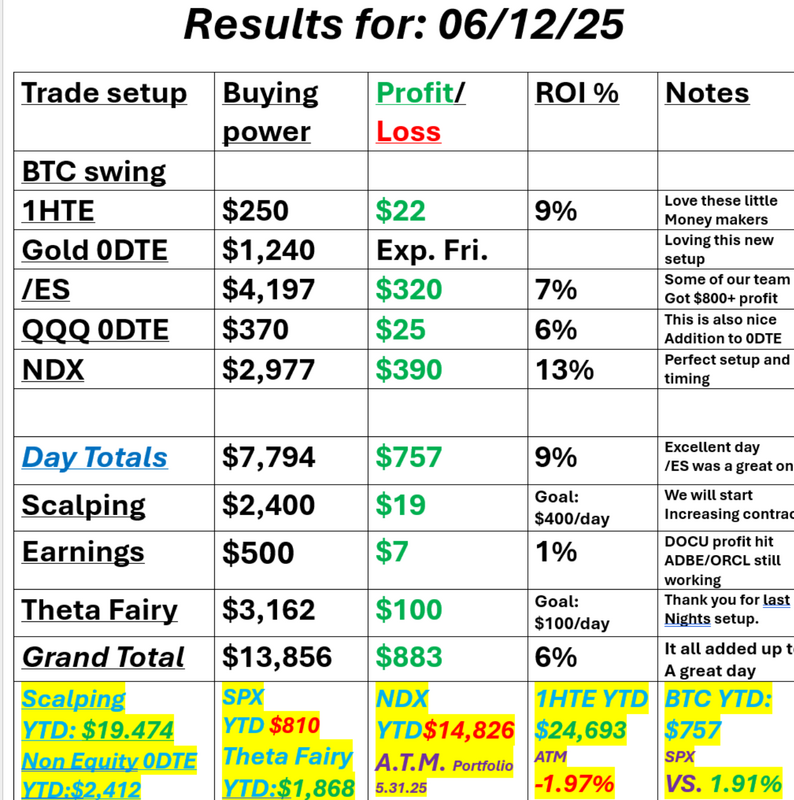

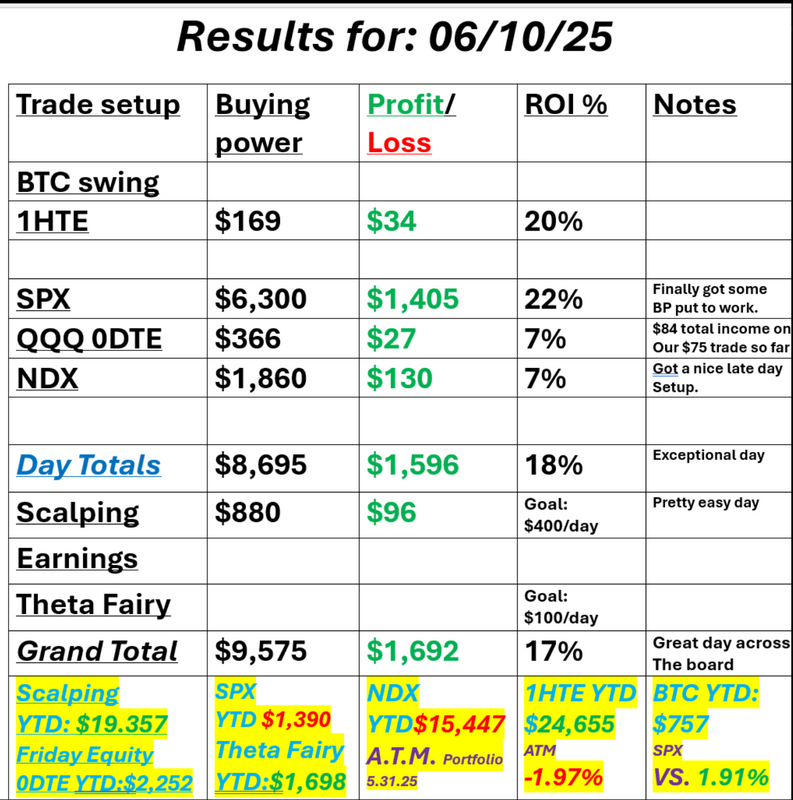

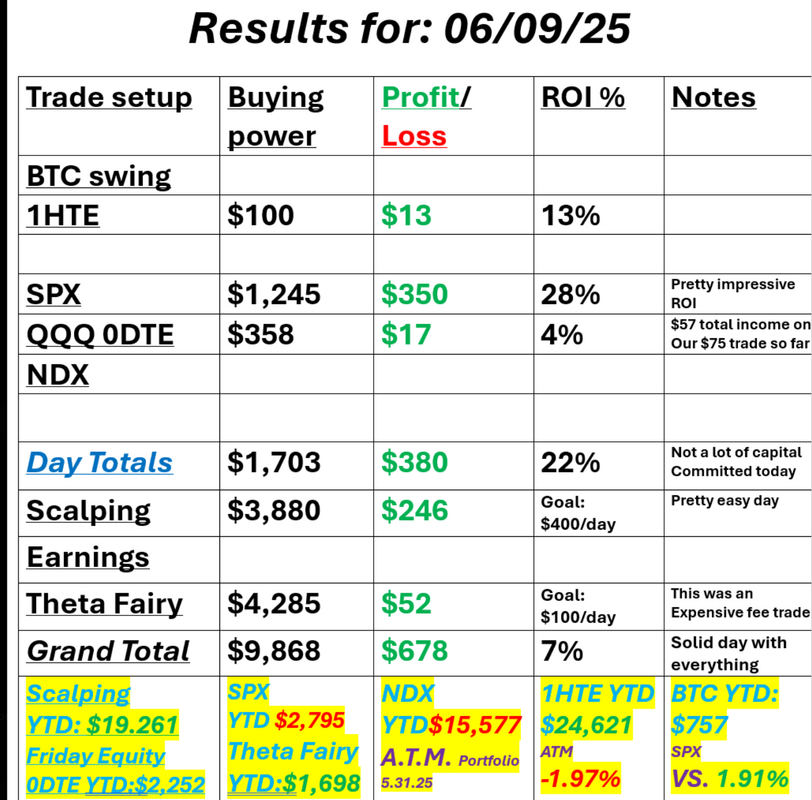

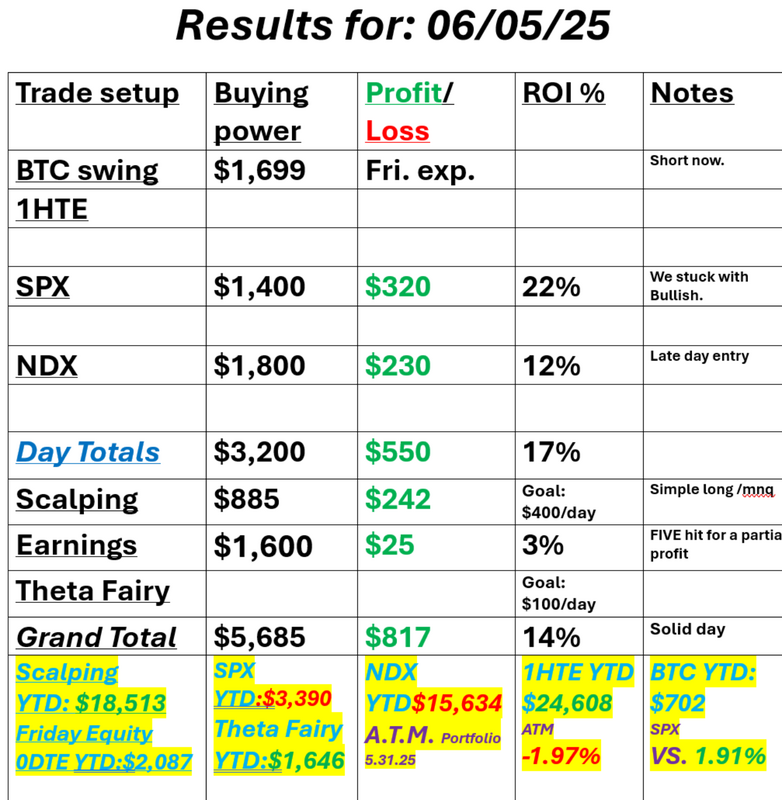

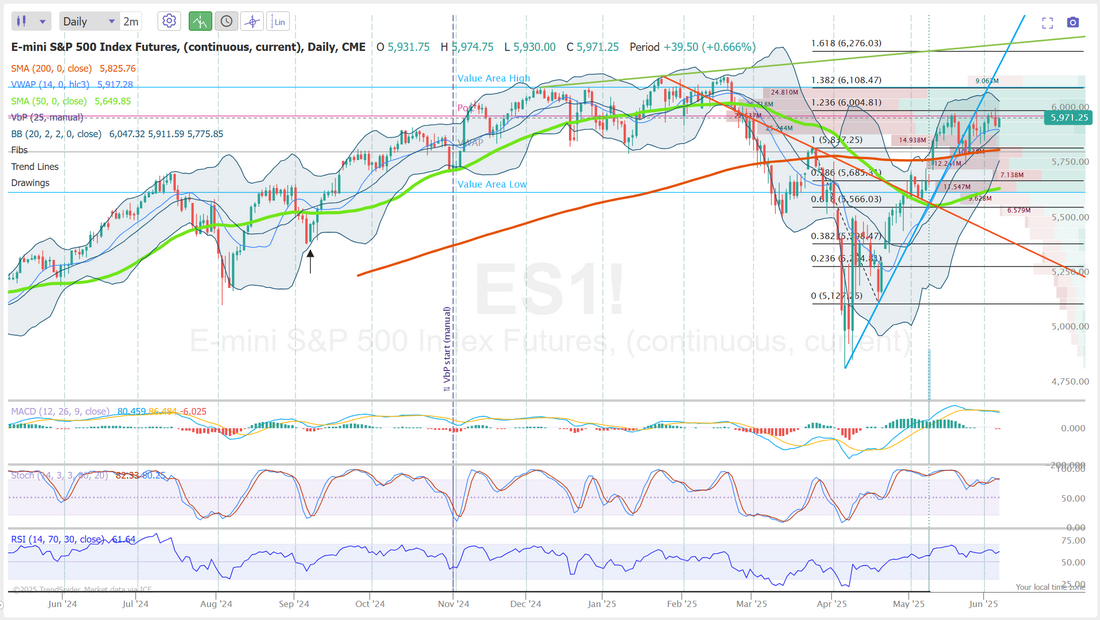

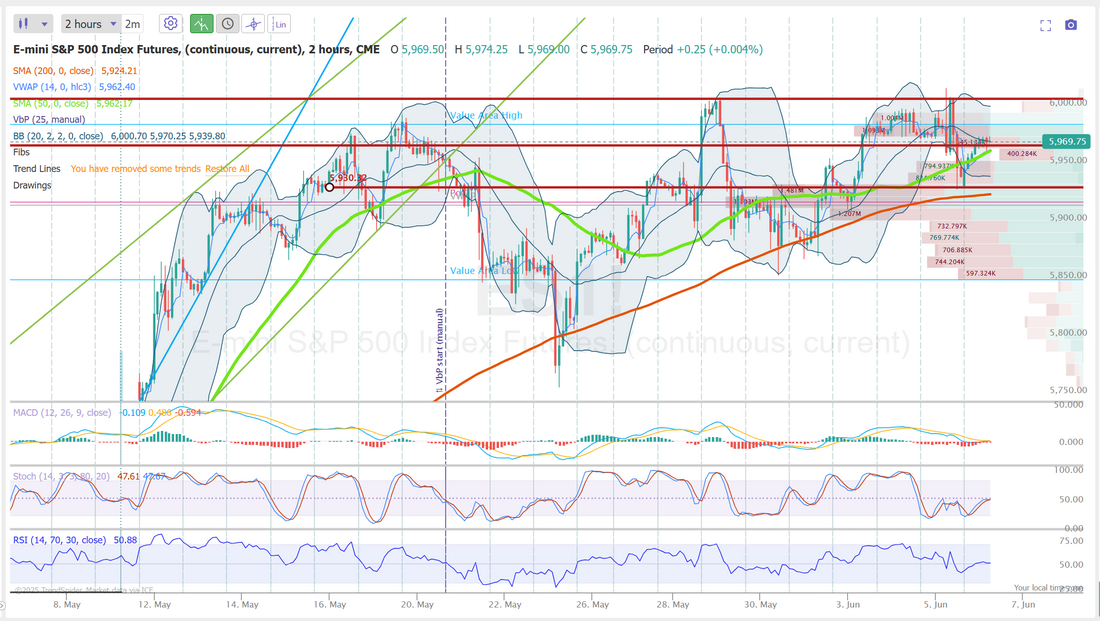

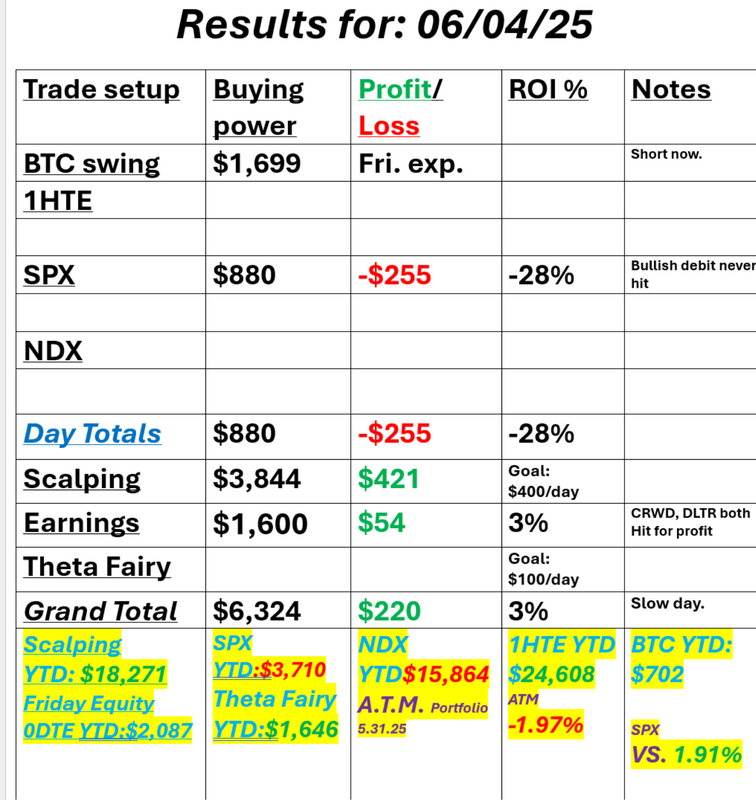

More mechanical = less emotionsTheirs two camps on trading approach. Mechanical and discretionary. Mechanical is simply having a set of triggers and rules that dictate action. There is no emotion or thought that goes into your actions. Discretionary is all "gut". It's just you "thinking" what's right and jumping on it. I prefer to use both. Admittedly some of recent good results were discretionary setups. Situations where I said, "look, I don't see anything definitive here. I'm going to take a stab at this setup and manage with a tight stop if I'm wrong." Yesterday started off that way. No real signals. I told everyone to be patient and maybe something would appear. Late in the day we got that with the NDX. Our daily zoom feed from our scalping room is invaluable. It gave us a perfect setup and we were able to get our $1,000+ profit day after all. What was the signal? The exponential Stoc turned up. The Squeeze indicator fired buy. The Parabolic Sar flipped bullish as well as the Supertrend indicator. The current high candle got taken out and our audible order flow tracker was all buys. It was an automatic long. No thinking. No emotion. Just pull the trigger. The more you can implement mechanical entries into your trading, the less emotional you'll be and the better your results will be. Work to add as many mechanical triggers as you can to your trading. It will help you establish a stoic equanimity in your trading. Here's a look at our results from yesterday: une S&P 500 E-Mini futures (ESM25) are up +0.20%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.33% this morning, pointing to a slightly higher open on Wall Street after yesterday’s drop, while investors await the Federal Reserve’s policy decision and updated projections, as well as Chair Jerome Powell’s remarks. Investors also await updates on whether the U.S. plans to become directly involved in the conflict in the Middle East. The conflict between Israel and Iran entered a sixth day on Wednesday, showing no signs of easing. Reuters reported that U.S. President Donald Trump and his team were weighing several options, including joining Israel in strikes against Iranian nuclear facilities. President Trump demanded Iran’s unconditional surrender on Tuesday and threatened a potential strike against the country’s leader. Iran’s Supreme Leader rejected President Trump’s demand for unconditional surrender in a statement read by a television presenter on Wednesday, warning that U.S. military action would have “serious and irreparable consequences.” In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Solar stocks cratered after Senate Republicans outlined revisions to President Trump’s tax-and-spending bill that would phase out solar, wind, and energy tax credits by 2028, with Sunrun (RUN) plummeting over -40%, and Enphase Energy (ENPH) tumbling more than -23% to lead losers in the S&P 500. Also, Lennar (LEN) slumped over -4% after the homebuilder posted weaker-than-expected FQ2 adjusted EPS. In addition, T-Mobile US (TMUS) slid over -4% after Bloomberg reported that shareholder SoftBank Group sold 21.5 million shares of the wireless network operator to finance its AI initiatives. On the bullish side, Jabil Circuit (JBL) climbed more than +8% and was the top percentage gainer on the S&P 500 after the supplier of electronic parts posted upbeat FQ3 results and raised its full-year revenue guidance. Economic data released on Tuesday showed that U.S. retail sales slumped -0.9% m/m in May, weaker than expectations of -0.5% m/m, while core retail sales, which exclude motor vehicles and parts, unexpectedly fell -0.3% m/m, weaker than expectations of +0.2% m/m. Also, U.S. May industrial production fell -0.2% m/m, weaker than expectations of no change m/m, while manufacturing production rose +0.1% m/m, in line with expectations. In addition, the U.S. import price index was unchanged m/m in May, stronger than expectations of -0.2% m/m. “Investors should still expect some volatility in economic data due to lingering effects of trade policy. The economy and the consumer are holding up for now, but there are signs of vulnerability. That could present risks in the second half of the year — particularly if we see a further slowdown in jobs or spending,” said Bret Kenwell at eToro. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for hints on what could ultimately prompt the central bank to make a move on interest rates and when that might happen. The Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates, will also be closely watched. Economists expect the Fed’s rate forecasts to remain largely unchanged – two cuts this year, followed by additional policy rate reductions in 2026. A survey conducted by 22V Research showed that the current tariff environment would lead to 25 basis points of cuts this year. “Investors believe that if the dot plot stays at two cuts, it will be because the inflation forecast doesn’t move up,” said Dennis DeBusschere, founder of 22V. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 246K, compared to last week’s number of 248K. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists forecast May Building Permits at 1.420M and Housing Starts at 1.350M, compared to the prior figures of 1.422M and 1.361M, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists foresee this figure standing at -2.300M, compared to last week’s value of -3.644M. Meanwhile, the U.S. stock markets will be closed tomorrow in observance of the Juneteenth federal holiday. The markets will reopen on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.385%, down -0.11%. Trade docket for today is a bit different. With Thurs. being a holiday we'll get our Overnight Vampire trade started today. We have a Gold 0DTE today as well as a QQQ 0DTE. I'll also attempt to get three SPX 0DTE's working today. One at the open that is high theta and low prob. low risk that we can hopefully be able to take off in a couple hours. Another right before the FOMC min. release that we'll take back off right after the release and finally a third one after Powell starts speaking. ORCL will get some work. ACN, KR, KMX earnings trades. On FOMC days I don't provide a bias or levels as the algos will determine where we go today and we just need to remain flexible. There are a couple key levels I would keep and eye on, notwithstanding. 6003, 6017, 6047 are resistance levels. 5975 is support. Lot's to work on today. I'll see you all in the live trading room shortly.

0 Comments

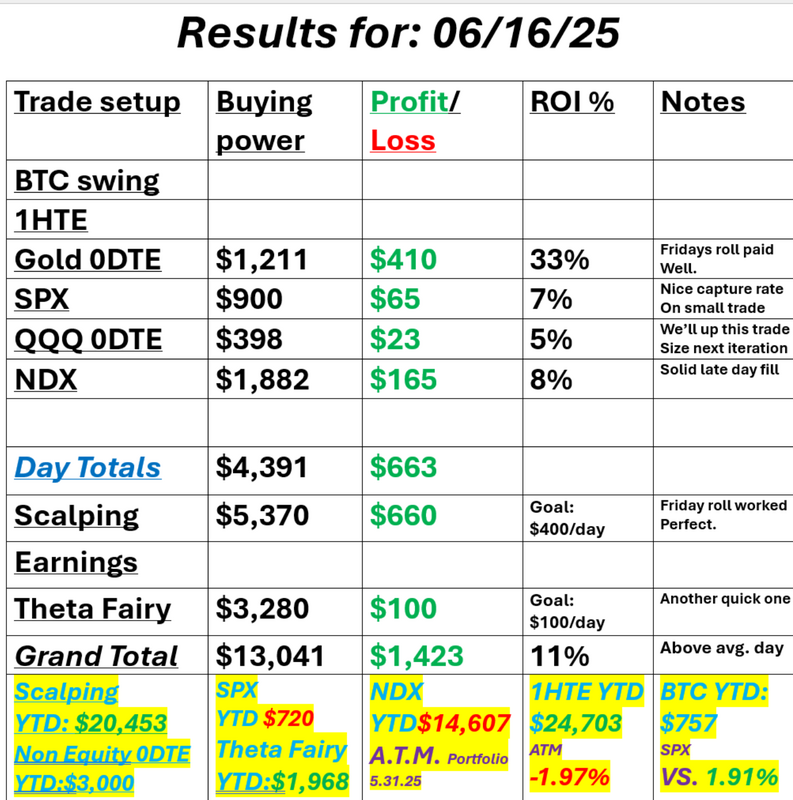

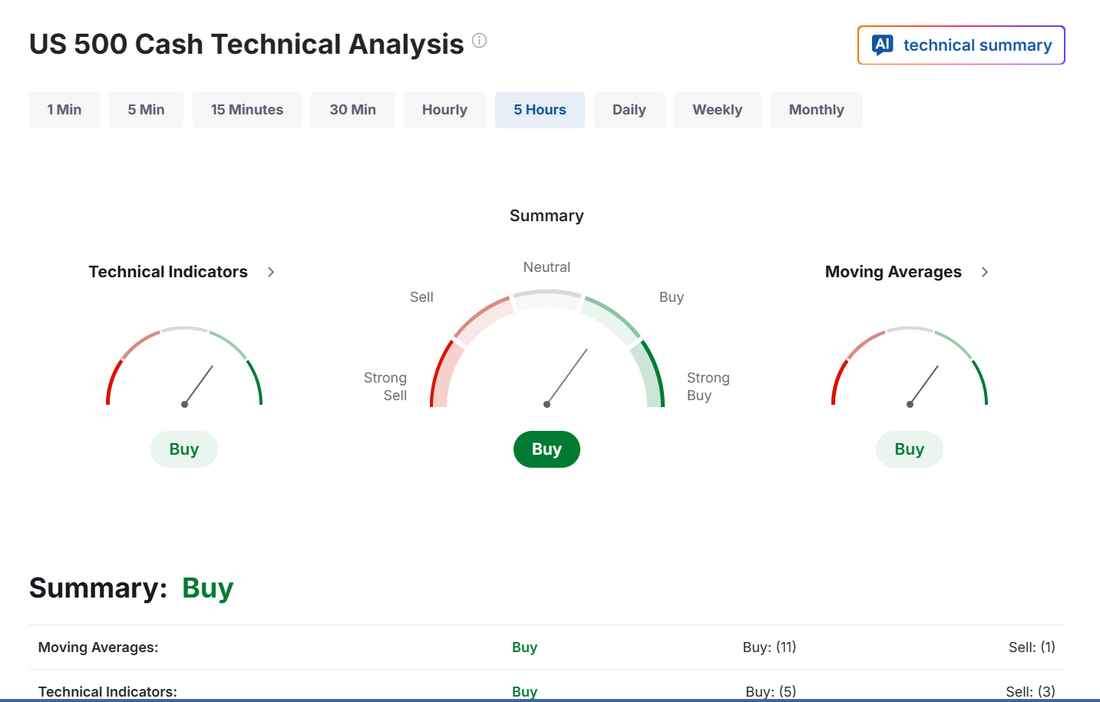

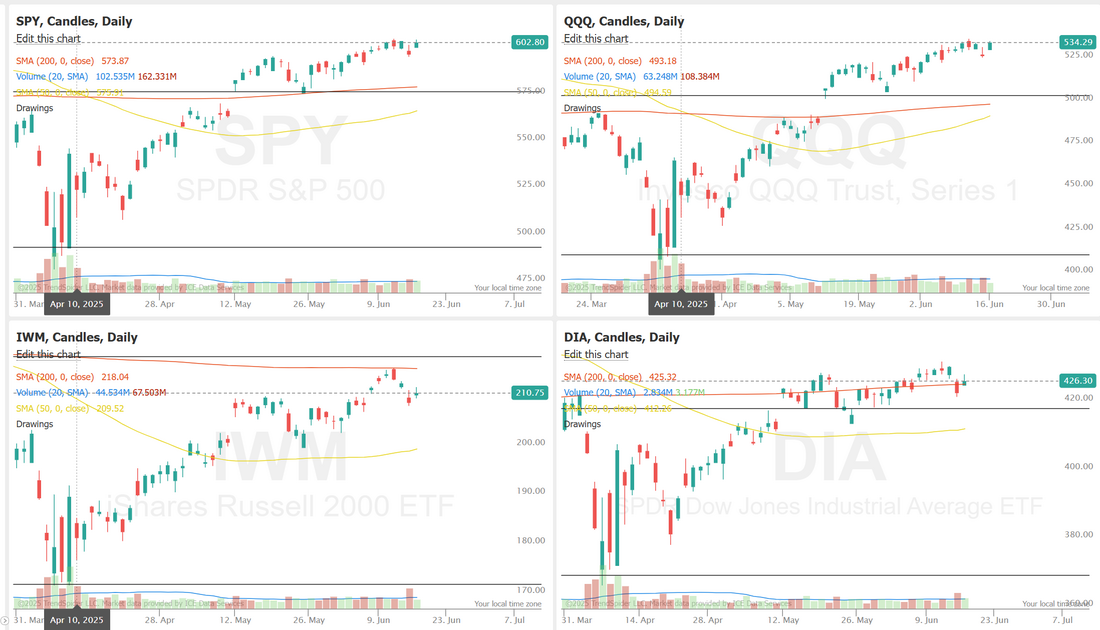

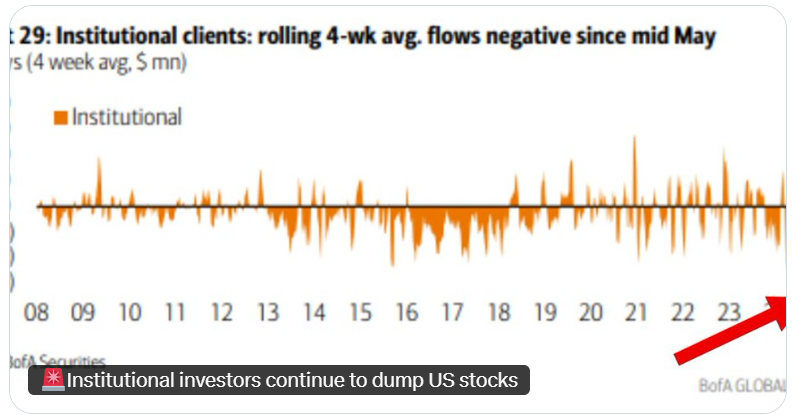

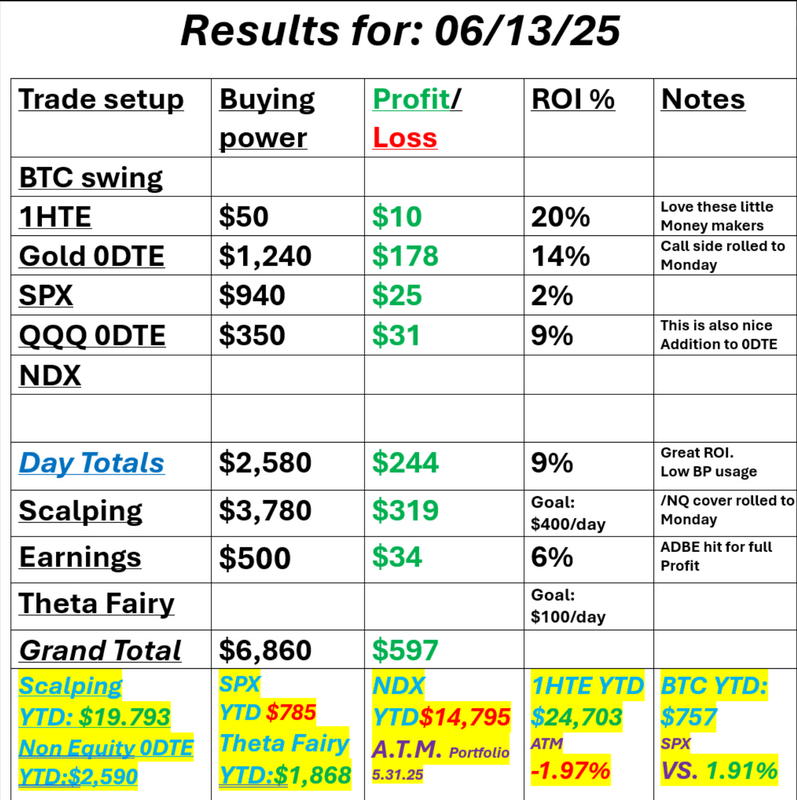

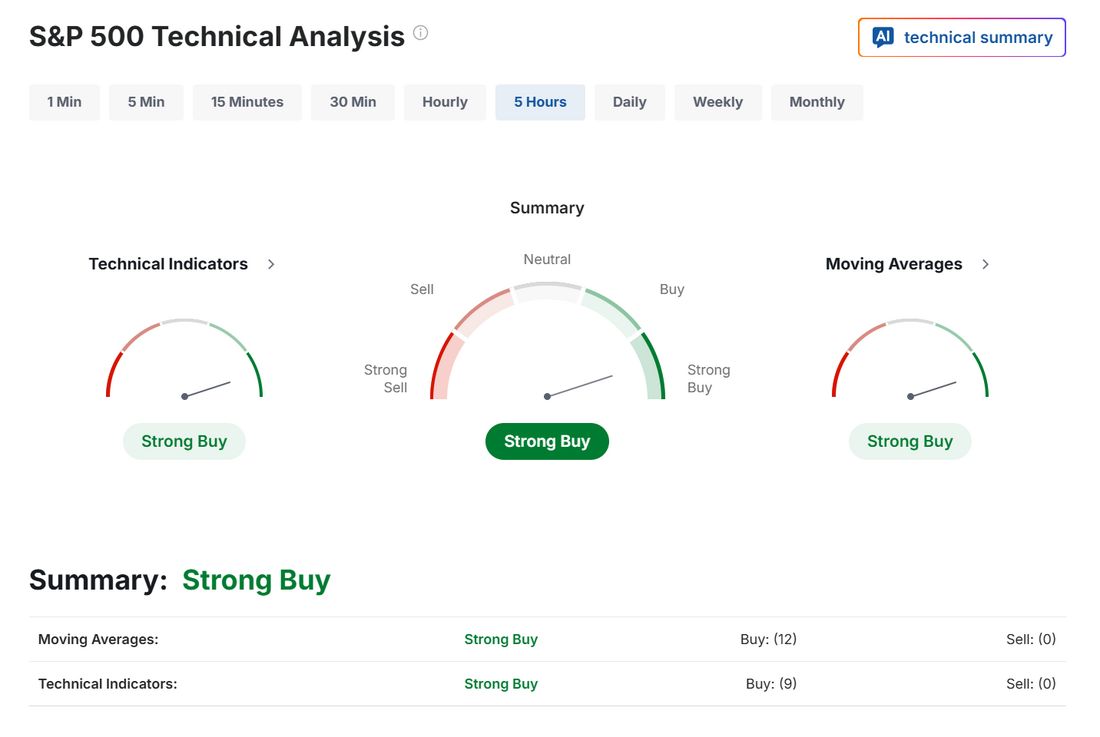

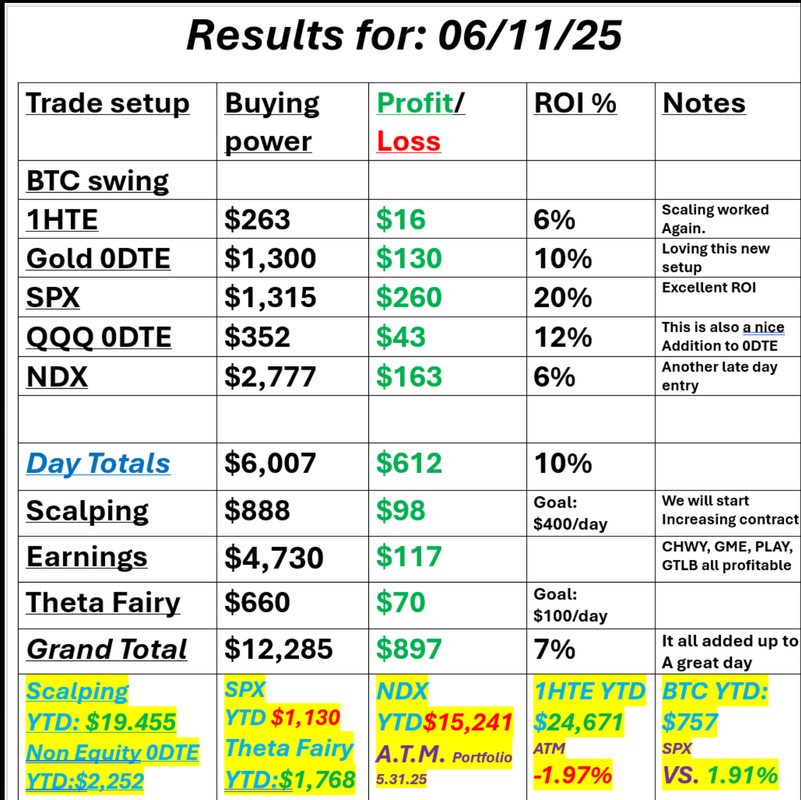

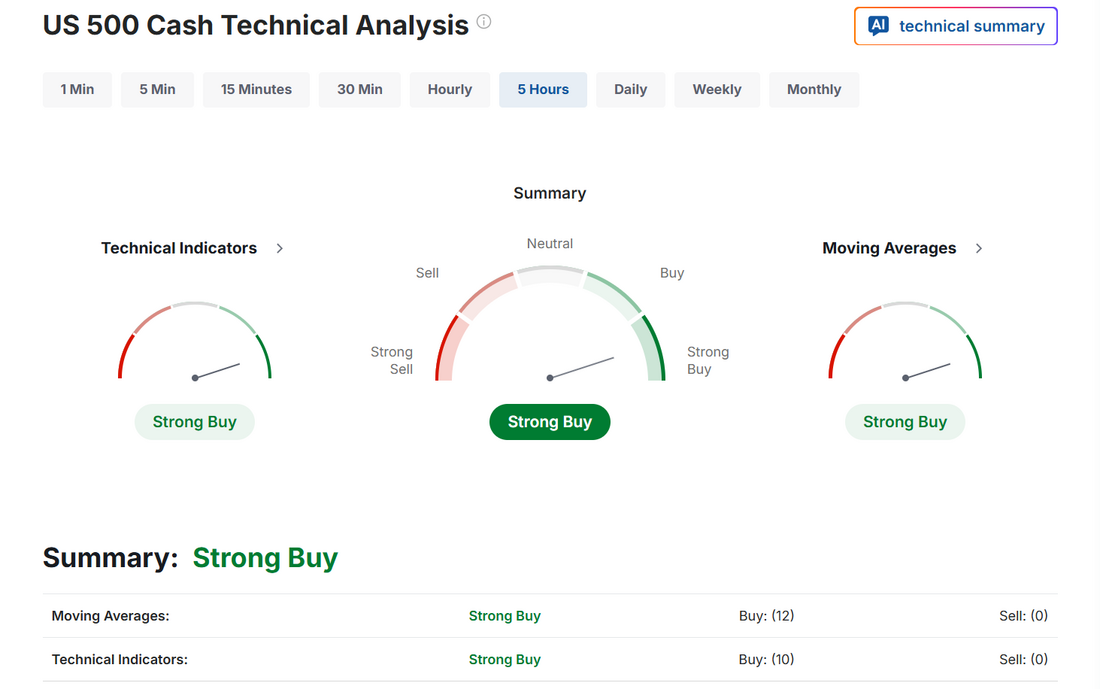

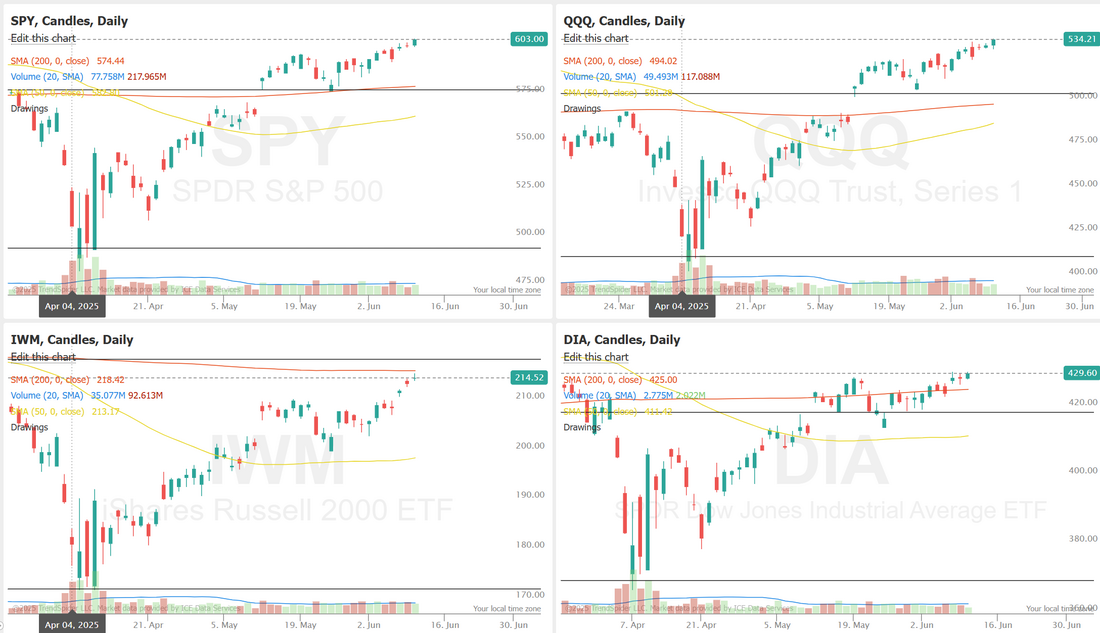

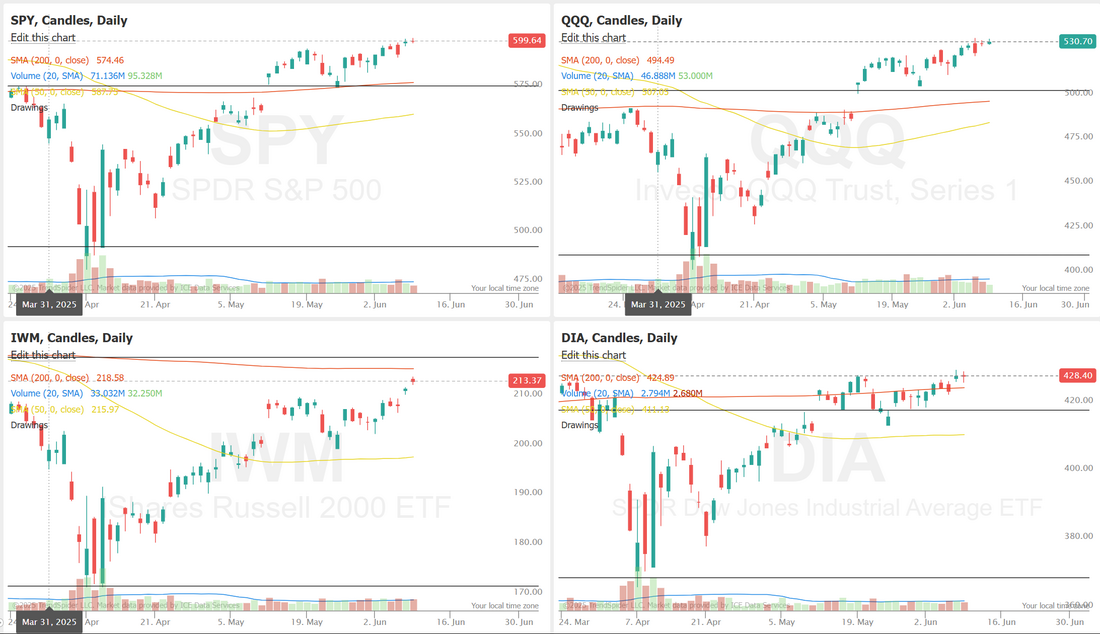

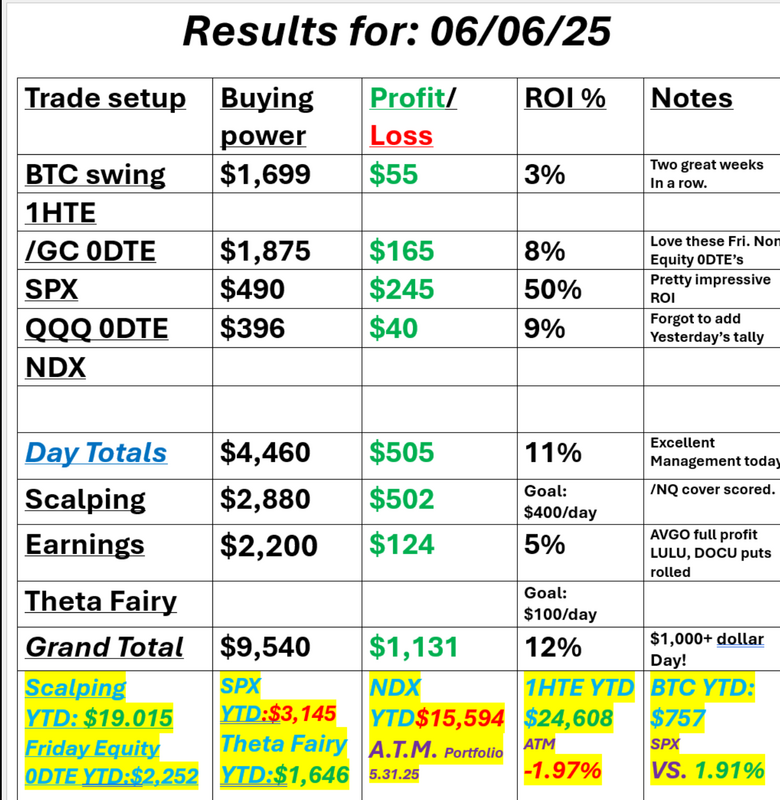

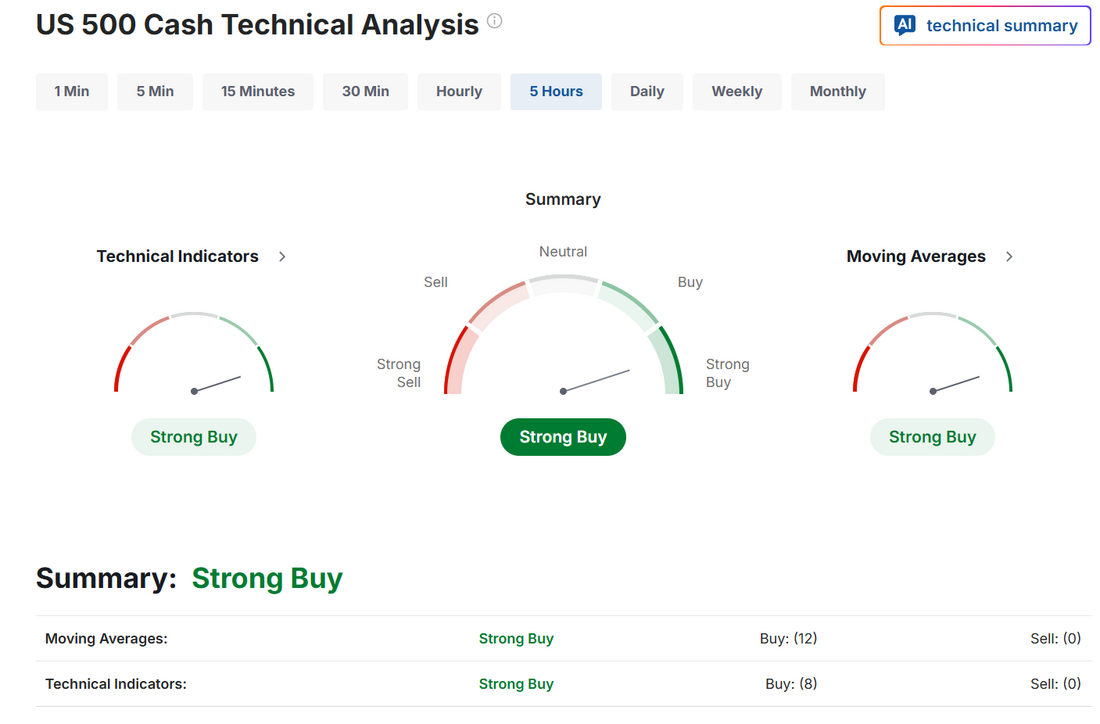

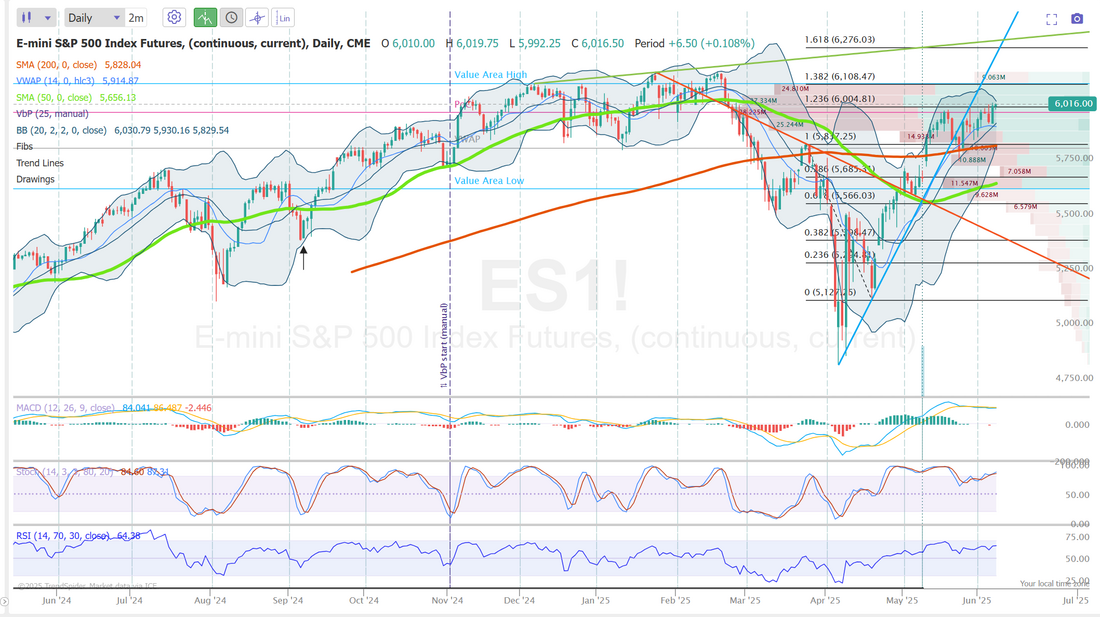

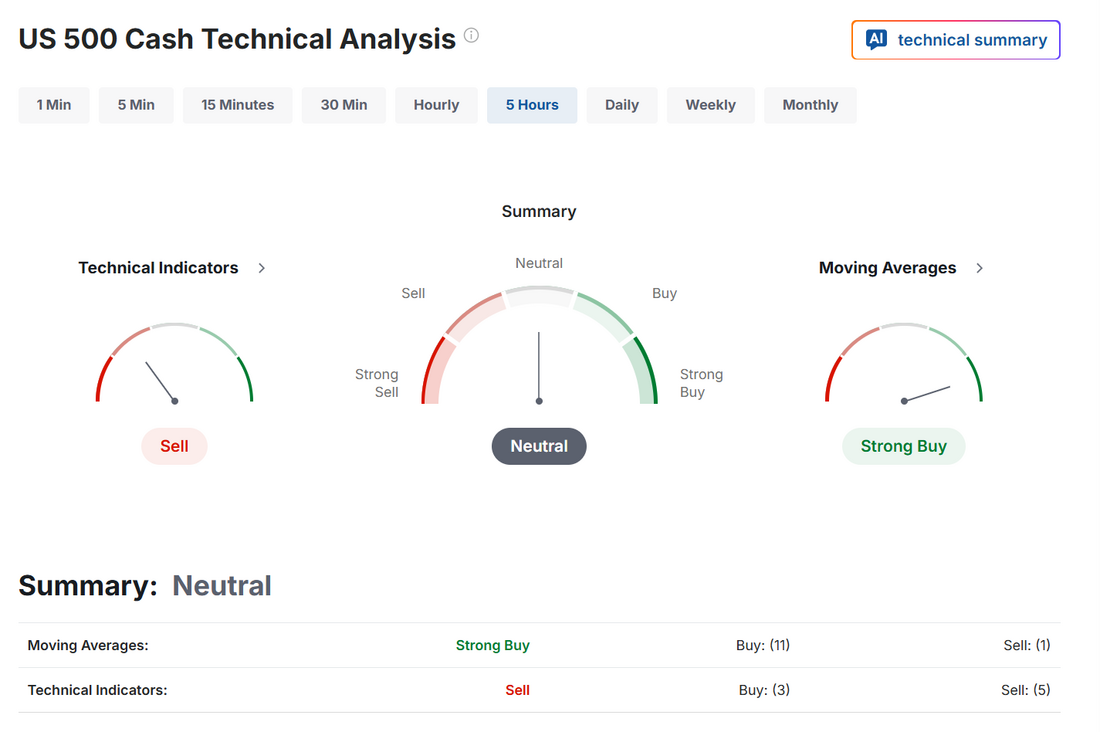

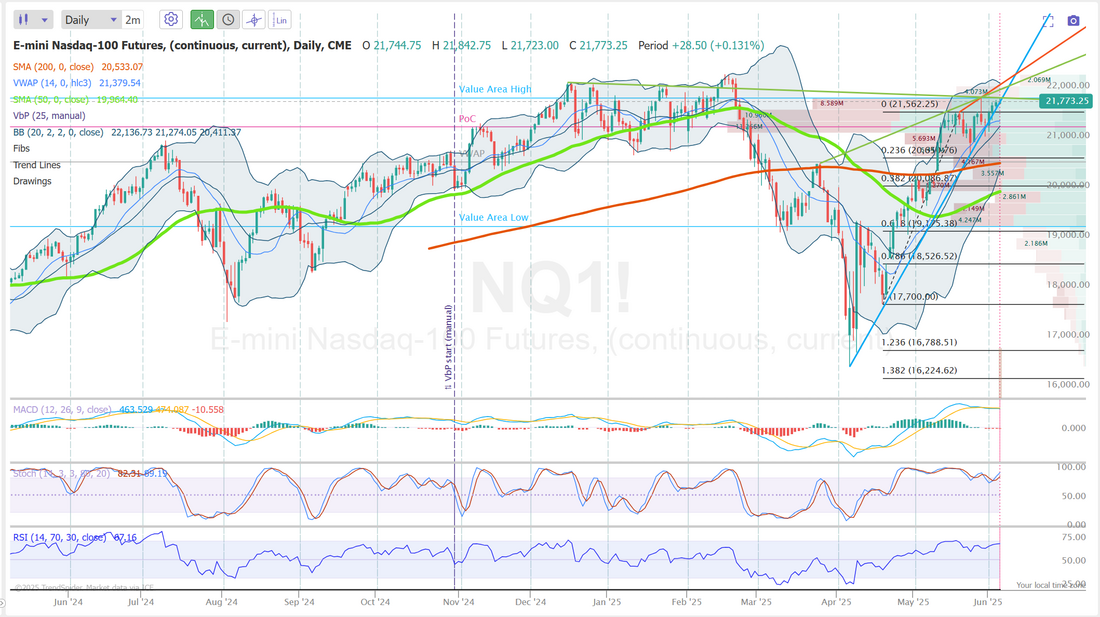

Planted seeds brought fruitWe had an excellent day yesterday and most of it was from trades we setup last Friday. We timed the rebound just right. Here's a look at our day: As the war drags on we'll see if the market fatigues or shrugs it off. FOMC is coming into focus and that should keep traders focus for the next couple days. Let's look at the markets. Still holding to a slight bullish bias. We find ourselves right back to the upper resistance band that we've been hitting up against for a while. My lean or bias today is more neutral, which probably means no debit entries. Trade docket for today: /MNQ scalp. LEN earnings. QQQ 0DTE. 1HTE BTC entry. SPX 0DTE, PX, SLP, UNFI long pair replacements. une S&P 500 E-Mini futures (ESM25) are trending down -0.46% this morning as the Israel-Iran conflict entered its fifth day, dimming investors’ hopes for a quick de-escalation between the two nations. Risk sentiment deteriorated after U.S. President Donald Trump called for the evacuation of Tehran, in comments that clashed with earlier optimism that Israel-Iran tensions would not escalate into a broader conflict. As Israel and Iran continued to trade missile strikes, President Trump abruptly ended his G-7 visit but stated that his return to Washington “has nothing to do with” a ceasefire. Trump said in a social media post on Tuesday that he had not contacted Iran for peace talks “in any way, shape or form.” “The degree of uncertainty is very high. So far, the market hasn’t captured an escalation of the conflict. Now we’re sailing in the fog,” said Laurent Lamagnere, head of development at AlphaValue. Investors also await the start of the Federal Reserve’s two-day policy meeting and a slew of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Chip stocks rallied, with Advanced Micro Devices (AMD) surging over +8% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) climbing more than +5%. Also, Roku (ROKU) gained over +10% after announcing an exclusive partnership with Amazon.com, enabling advertisers to tap into the largest authenticated Connected TV footprint in the U.S. through Amazon DSP. In addition, EchoStar (SATS) soared more than +49% after Bloomberg reported that U.S. President Trump stepped in to help settle the dispute between the FCC and the company regarding its spectrum licenses. On the bearish side, Sarepta Therapeutics (SRPT) cratered over -42% after suspending shipments of Elevidys for infusions in non-ambulatory patients following the death of a second patient from acute liver failure. Economic data released on Monday showed that the Empire State manufacturing index unexpectedly fell to -16.00 in June, weaker than expectations of -5.90. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate on hold in a range of 4.25% to 4.50% on Wednesday. Investors will follow Chair Jerome Powell’s post-policy meeting press conference for hints on what could ultimately prompt the central bank to make a move on interest rates and when that might happen. The Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates, will also be closely watched. “[Powell] may describe recent inflation developments as encouraging, but also downplay their relevance given uncertainty ahead due to tariffs, fiscal policy, and the recent spike in the oil price due to geopolitical developments,” said David Doyle at Macquarie Group. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that May Retail Sales will stand at -0.5% m/m, compared to the April figure of +0.1% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.1% m/m in April. Economists expect the May figure to be +0.2% m/m. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists expect May Industrial Production to be unchanged m/m and Manufacturing Production to be +0.1% m/m, compared to the April figures of unchanged m/m and -0.4% m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be -0.1% m/m and the import price index to be -0.2% m/m in May, compared to the previous figures of +0.1% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.427%, down -0.52%. Institutional investors have been selling US stocks almost every week in 2025: Professional investors sold $4.2 BILLION in US equities in the first week of June. The 4-week average of selling reached $2.0 billion. They continue to dump stocks Let's take a look at the key intra-day levels I'll be watching today: The 6000-6003 area continues to be a key support level. Below that and bears could build momentum. 6017 is the first resistance. If bulls can clear that 6048 could be the next upward target. I look forward to seeing you all in the live trading room shortly!

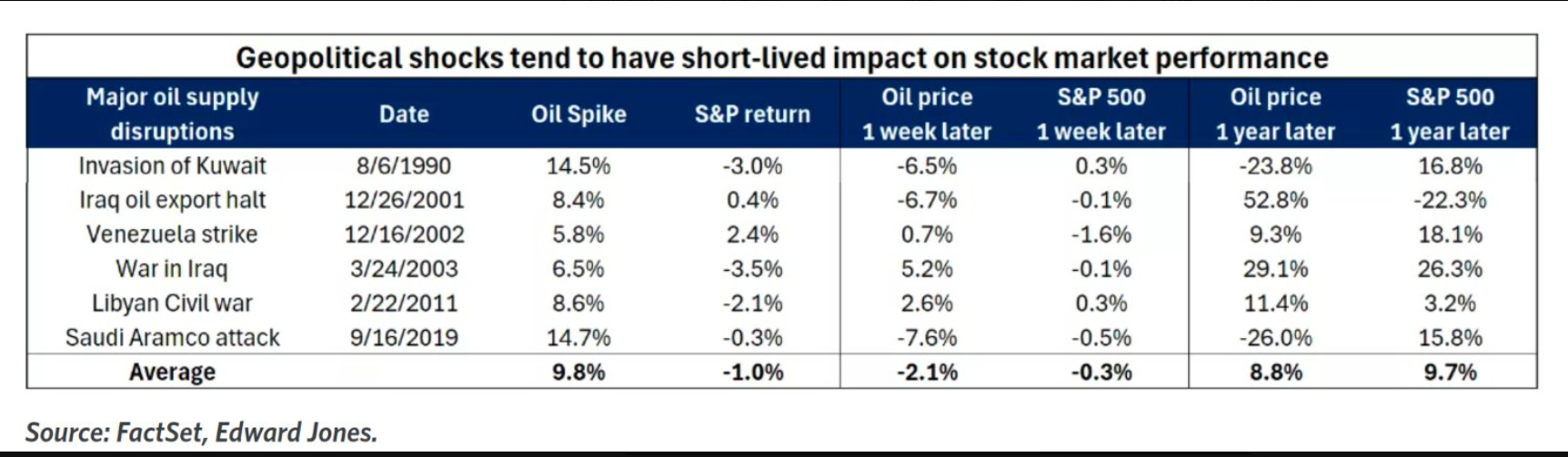

When bombs drop, markets pop...eventually.Welcome back to another holiday shortened trading week. It's been quite the year what with markets starting off with a correction. Then liberation day and tariffs. Now with the Iran/Israel war. We did well on Friday playing the rebound and we are already set for a good day today, having rolled a bullish /NQ scalp and a bearish /GC gold play to today. Those alone could give us our $1,000+ profit goal for the day. We also got a killer Theta fairy on last night, We started with the put side and it moved so fast we hit our take profit level before we could even get the call side on! I talked a lot of Friday about the undercut setup and we certainly took it to heart and have jumped all over it. Geo political events usually have little effect on markets, in the longer term. These are generally buying opportunities.

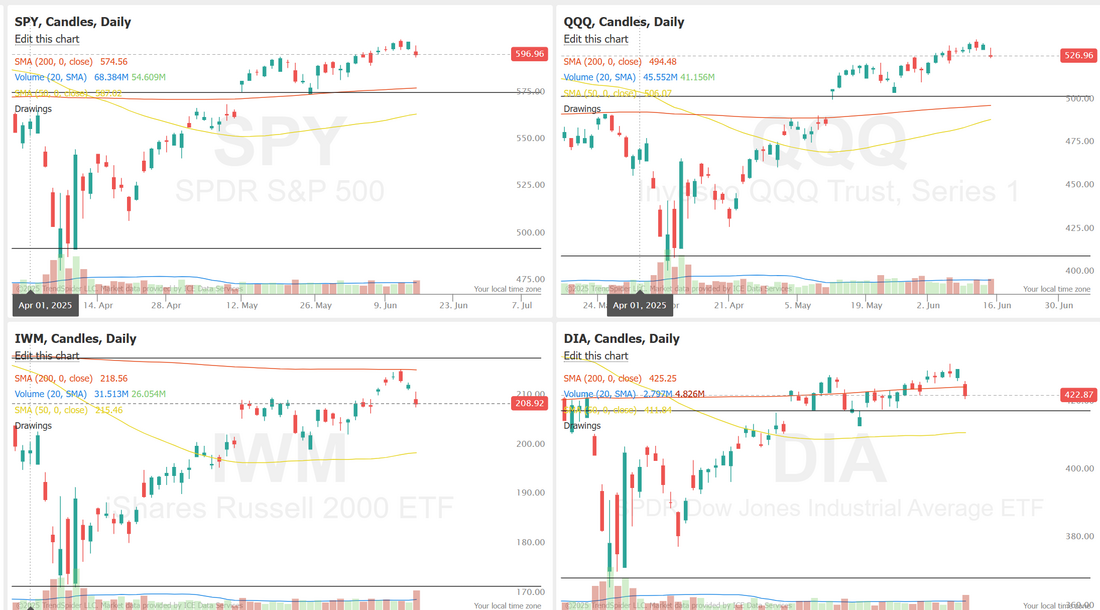

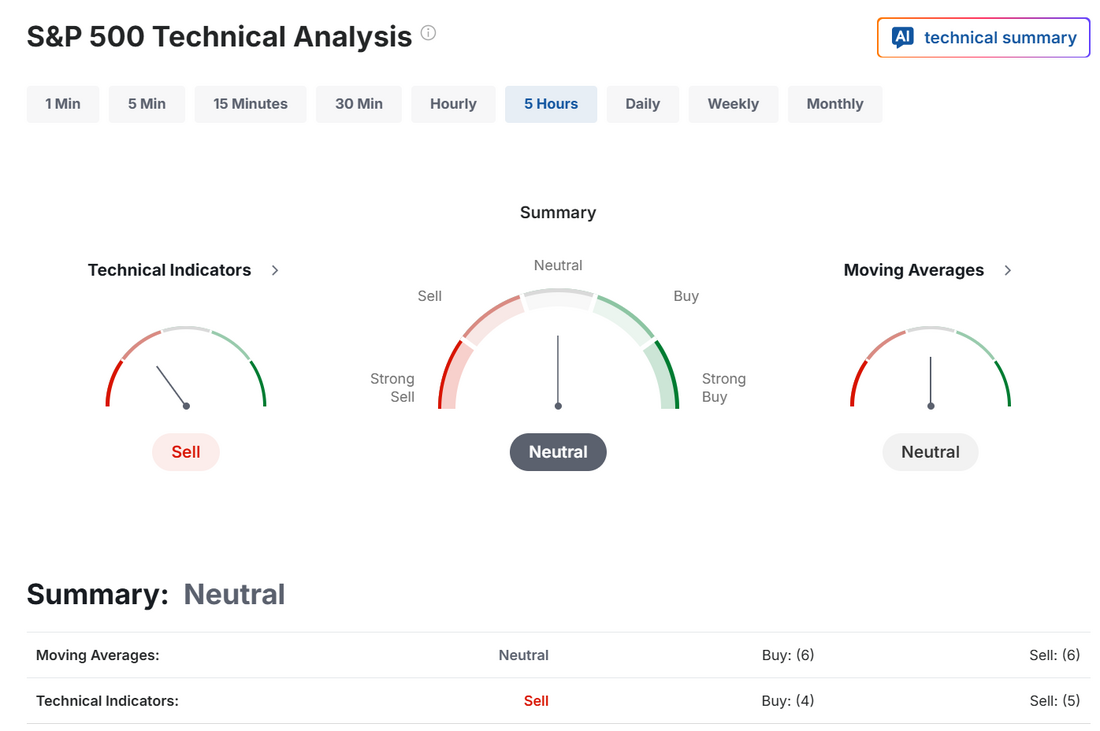

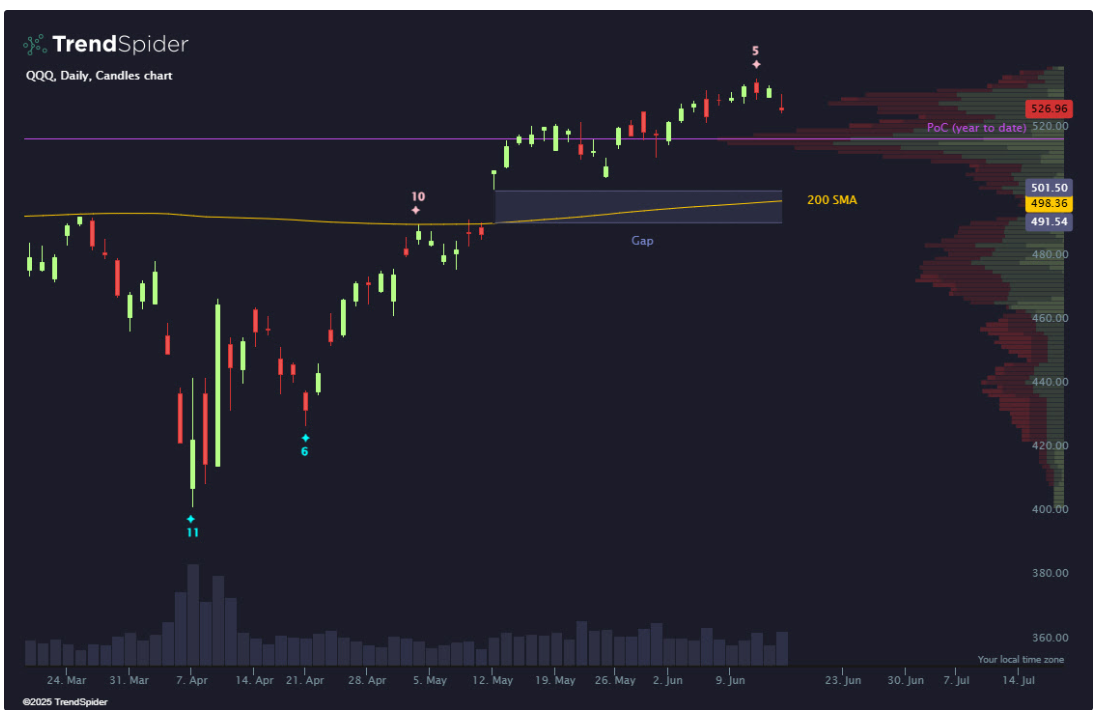

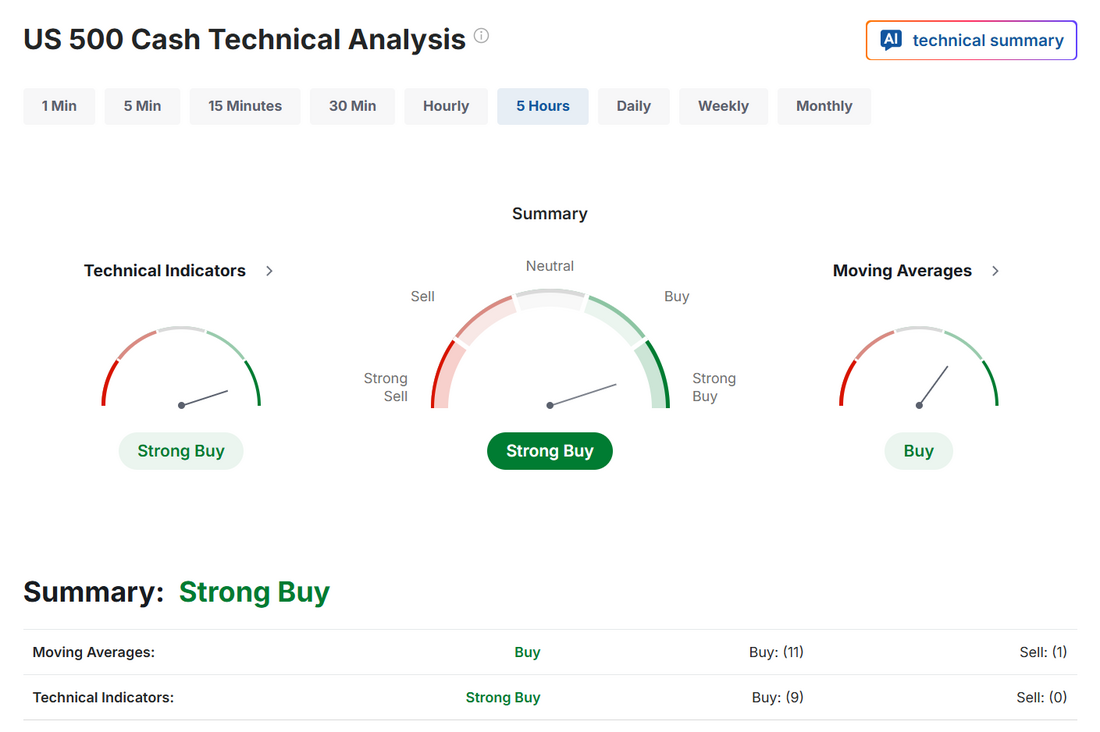

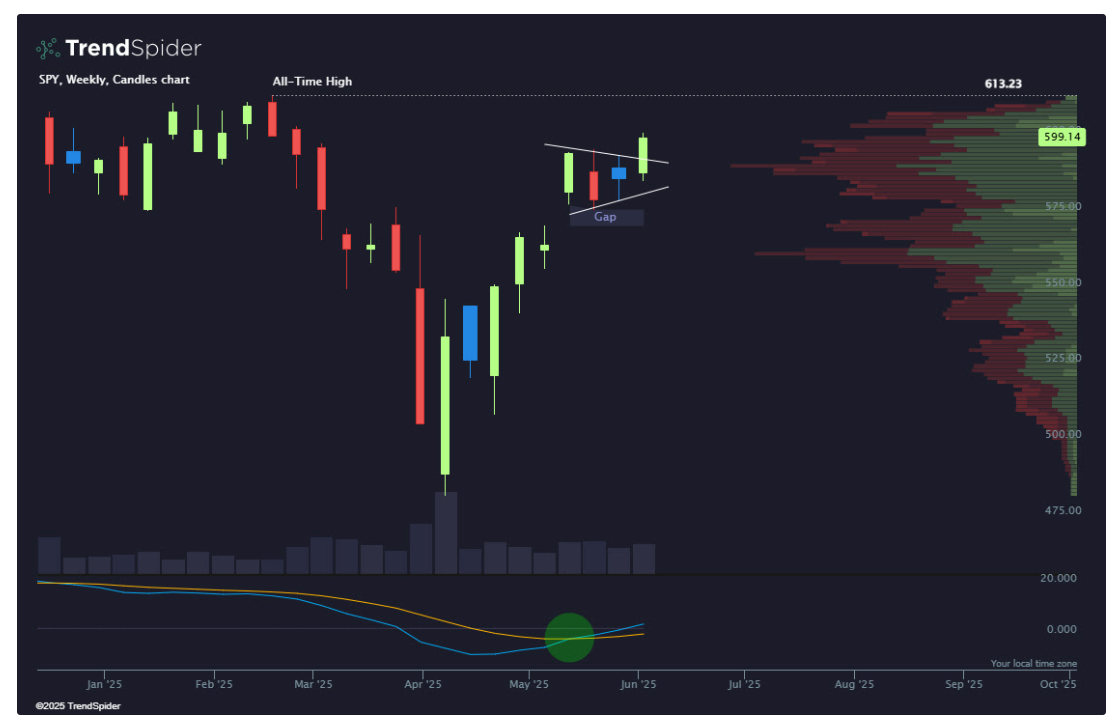

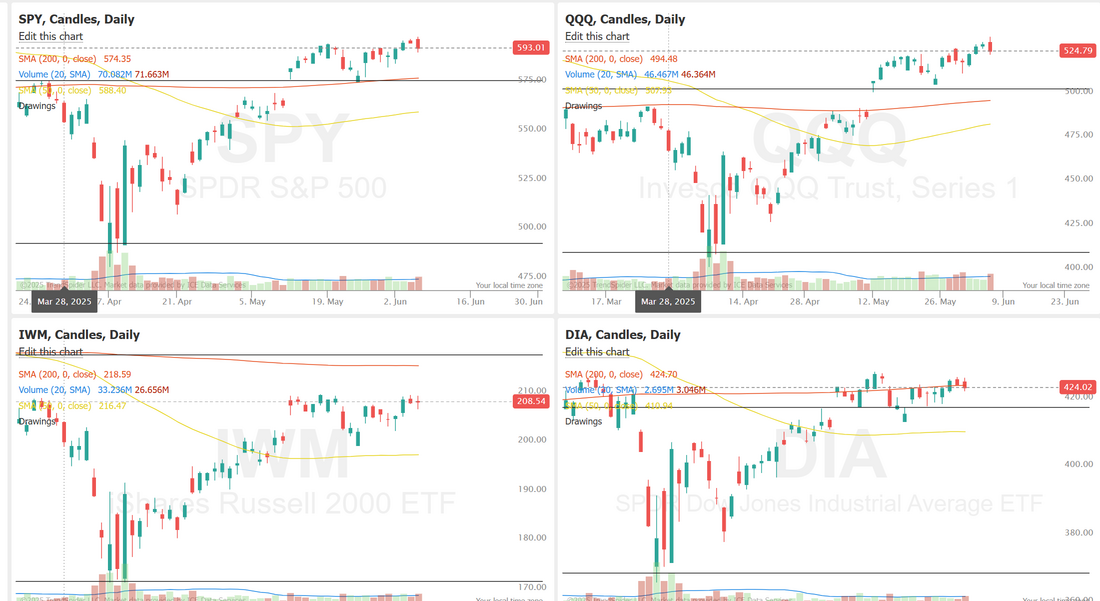

I've said this over and over. THE MARKET DOES NOT CARE ABOUT WARS! It cares greatly about uncertainty. Uncertainty is the boogie man to the stock market. It can deal with recessions, pandemics, wars, etc. It's the uncertainty of the future that it hates. We are set up for a banner day today but that is largely due to staring down the barrel of some scary news on Friday. We traded small on Friday as I thought that was appropriate. Here's a look at our day: Let's take a look at the markets. Indices are rolling over but we don't quite have a solid sell signal yet. Technicals this morning are back to neutral bias as it appears Israel will have largely accomplished it's mission to "de-nuke" Iran. SPY closed the week lower at $597.00 (-0.34%) as geopolitical tensions escalated with the outbreak of conflict between Israel and Iran. The recent peak coincided with a signal from TrendSpider CEO Dan Ushman’s custom QX QSB Score Markers Indicator, which integrates data from 14 technical indicators to identify overbought and oversold conditions. With 8 of the 14 signaling oversold territory, traders should watch closely to see if the high-volume node below can provide meaningful support. QQQ also ended the week in the red at $526.96 (-0.56%), but with a bit more optimistic signal from the QX QSB Score Markers Indicator. Only 5 of the 14 component indicators registered overbought conditions, suggesting tech may be showing relatively stronger momentum. Still, with global tensions elevated and a gap aligning with the 200-day SMA just below, bears could find an opening to press the index lower. Small caps took the hardest hit this week, with IWM closing at $208.89 (-1.41%). The index was firmly rejected at the 200-day SMA, coinciding with a 9-handle on the QX QSB Score Markers Indicator, making it the most bearish signal among the major indexes. With price now testing its YTD volume point of control, it’s up to the bulls to put in another higher low and flip prior resistance into support. Let's take a look at the daily on /ES. It still looks a little like a roll over to me. Just too early to tell. My lean or bias today is bullish. This was largely establish last Friday as we set up a bearish Gold trade and a bullish /NQ scalp. Trade docket for today: Most of our heavy hitter setups for today were put in place last Friday. We are already cash flowing this morning with a nice Theta fairy entry last night. It hit our profit target so fast we couldn't get the call side on. Our /GC, gold trade looks great this morning as we were looking for a pullback. We'll work to get a put side added today. Our bullish /NQ scalp looks set to be our biggest winner today. GNE DCA. LULU needs a bit more work. ORCL will also be worked again today. Our QQQ 0DTE will start us off today. We may also get a 1HTE BTC working today. We have one earnings play today in LEN. une S&P 500 E-Mini futures (ESM25) are up +0.40%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.45% this morning, signaling a partial rebound from Friday’s sell-off on Wall Street as investors dialed back some risk-off positioning sparked by the hostilities between Israel and Iran. Investors continued to keep a close eye on tensions between Israel and Iran, which showed no signs of easing. Iranian missiles hit Israel’s Tel Aviv and the port city of Haifa before dawn on Monday, marking the latest in a series of tit-for-tat attacks that began last week. Iran also warned that it may close the Strait of Hormuz, a key chokepoint for global oil shipments. Still, investors stepped in to buy the dip on Monday, expecting the conflict would be unlikely to draw in more parties. This week, investors look ahead to the Federal Reserve’s interest rate decision as well as a fresh batch of U.S. economic data, with a particular focus on the retail sales report. In Friday’s trading session, Wall Street’s major equity averages closed lower. Most of the Magnificent Seven stocks retreated amid risk-off sentiment, with Nvidia (NVDA) falling over -2% and Apple (AAPL) dropping more than -1%. Also, airline stocks lost ground as the jump in oil prices sparked concerns about rising fuel costs, with American Airlines Group (AAL) and United Airlines Holdings (UAL) sliding over -4%. In addition, Visa (V) and Mastercard (MA) slumped more than -4% after the Wall Street Journal reported that major retailers, including Amazon and Walmart, are exploring ways to use or issue stablecoins to bypass credit card fees. On the bullish side, RH (RH) climbed over +6% after the luxury furniture company maintained its full-year guidance. Economic data released on Friday showed that the preliminary University of Michigan’s U.S. consumer sentiment index rose to 60.5 in June, stronger than expectations of 53.5. Also, the University of Michigan’s U.S. June year-ahead inflation expectations fell to 5.1% from 6.6% in May, better than expectations of 6.4%, while 5-year implied inflation expectations edged down to 4.1% from 4.2% in May, in line with expectations. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage in this holiday-shortened week. The central bank is widely expected to keep the Fed funds rate on hold in a range of 4.25% to 4.50%. Focus will center on any indications of when policymakers might lower interest rates. Recent softer-than-expected consumer and producer inflation data led many market participants to bring forward their expectations for the next rate cut. Market watchers will closely monitor the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates. “The Fed will continue to prioritize the risk of higher inflation expectations, but as the unemployment rate moves further from the full employment rate level, they will pivot toward supporting the economy and labor market,” according to Scott Anderson, chief U.S. economist at BMO Capital Markets. Investors will also focus on a spate of economic data releases this week. The retail sales report for May will be the main highlight, as it will serve as another gauge of the economy’s health. Wells Fargo’s team of economists stated that the report is expected to indicate “the consumer has yet to run out of steam.” Other noteworthy data releases include U.S. Industrial Production, Manufacturing Production, the Export Price Index, the Import Price Index, Business Inventories, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, Crude Oil Inventories, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. In addition, several notable companies like homebuilder Lennar (LEN), accounting firm Accenture (ACN), grocery chain Kroger (KR), and online used car seller CarMax (KMX) are scheduled to release their quarterly results this week. Investors are also watching the G7 summit for potential responses to global flashpoints, including the conflict in the Middle East, the war in Ukraine, and ongoing trade tensions. Meanwhile, the U.S. stock markets will be closed on Thursday in observance of the Juneteenth federal holiday. The markets will reopen on Friday. Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists foresee this figure coming in at -5.90 in June, compared to -9.20 in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.432%, up +0.18%. I look forward to seeing you all in the live trading room shortly. Most of our work was put in on Friday. Today we just need to harvest it.

Does Crisis = Opportunity?Good Friday to you all! I've got two big topics I want to discuss this morning. What is your personal view of crisis moments and who are you aligned with for trading? #1. What is your view of crisis? Is it, like the Chinese symbol implies, an opportunity? Or is it just something that freaks you out? We got an amazing undercut and rally pattern last night (more on that pattern in a min.) That set us up for a great overnight trade on our patented Theta fairy and a long /MNQ options scalp to the upside. I was so excited. It was a once in about 8 month opportunity that we rarely get. It would have been awesome if it wasn't for the fact that I spent 4 hours (yes four full hours) talking one of our trading members off the ledge. He was literally out of his mind with fear. He was convinced that Iran was going to retaliate with nukes (not in the future but last night). That gold was going to $5000/oz. and that WWIII was starting. I told him that scenario was physically impossible. (I'm pretty sure you need to possess nukes before you can fire them, right?) He then said it was. I said it wasn't and this 7 yr. old conversation continued. Yes they can. No they can't. He was literally out of his mind. I couldn't help but wonder, what is it that can make two people look at the same situation and one sees' opportunity and the other sees the end of existence? How you view things really does affect what results you get. #2. I also want to talk about who you are aligned with for trading purposes. Firstly, you absolutely should and can align yourself with a team of traders. Please don't trade alone. There are too many advantages to trading as a team and having that support. When you do align with a team ask yourself this. Do you show you real, live trades or is it just education? Do they provide 24/7 hand holding? Do they have a professional trader to can talk to at any time? I see a lot of education out there. I also see some trade alert services that give no support and just text out trade ideas that you are supposed to just blindly follow. I don't know of many services that started building you trade ideas before the open and continued to trade through the night last night. We did and it's put money in our members pockets that otherwise wouldn't be there. I'm not excited about spending four hours with you individually each day to keep you from taking a ride on the crazy train but I will and clearly do! I don't think you'll find a more valuable trading room that what we've built right here. Undercut & Rally Patterns — Weaponizing the Shakeout What Is an Undercut & Rally? At its core, an undercut and rally (U&R) is a shakeout reversal. Price undercuts a key prior low or major moving average, triggering stops and panic selling, only to reverse higher, trapping shorts and reenergizing bulls. It’s a setup rooted in deception and asymmetric psychology:

The U&R is your chance to buy fear — with a defined stop and explosive upside. Why U&Rs Work

3 Types of Undercut & Rallies 1. Key Low U&R

2. Moving Average U&R

3. Double U&R

une S&P 500 E-Mini futures (ESM25) are down -1.18%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.46% this morning, pointing to a sharply lower open on Wall Street as sentiment took a hit following Israel’s attack on Iran’s nuclear and military facilities. Israel carried out a broad attack on Iran’s nuclear facilities, ballistic-missile sites, and military leadership on Friday. Israel reportedly killed the head of the Islamic Revolutionary Guard Corps and hit dozens of targets in a major escalation that could ignite a wider conflict in the Middle East. The strikes came after Iran announced Thursday that it would soon open a third uranium-enrichment site. The United States said it played no role in the operation. The attack unsettled markets and drove investors toward safe-haven assets. Israeli Prime Minister Benjamin Netanyahu confirmed that a military operation against Iran had started and would continue “as many days as it takes.” Iran pledged to retaliate against Israel and potentially U.S. assets in the Middle East. At the same time, U.S. President Donald Trump urged Iran to strike a deal “before it is too late.” In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Oracle (ORCL) jumped over +13% and was the top percentage gainer on the S&P 500 after the IT giant posted better-than-expected FQ4 results and said it expects its cloud infrastructure growth rate to surge to more than 70% in FY26. Also, Datadog (DDOG) rose more than +3% and was the top percentage gainer on the Nasdaq 100 after Wolfe Research upgraded the stock to Outperform from Peer Perform with a $150 price target. In addition, Cardinal Health (CAH) gained over +4% after the medical distributor raised its full-year adjusted EPS guidance. On the bearish side, Boeing (BA) slid more than -4% and was the top percentage loser on the S&P 500 and Dow after an Air India-operated Boeing 787 Dreamliner carrying more than 200 people crashed near the airport in Ahmedabad, a city in western India. Economic data released on Thursday showed that the U.S. producer price index for final demand came in at +0.1% m/m and +2.6% y/y in May, compared to expectations of +0.2% m/m and +2.6% y/y. Also, the core PPI, which excludes volatile food and energy costs, arrived at +0.1% m/m and +3.0% y/y in May, better than expectations of +0.3% m/m and +3.1% y/y. In addition, the number of Americans filing for initial jobless claims remained at an 8-month high of 248K last week, compared with the 242K expected. “For the second day in a row, inflation data came in lower than expected, and this gives the Fed room to sit on their hands,” said Chris Zaccarelli at Northlight Asset Management. “As long as inflation isn’t increasing – or even better, is decreasing – the Fed can be patient and wait for more information on how the new tariffs and trade negotiations are going to impact the price stability part of their dual mandate later this year.” Meanwhile, U.S. rate futures have priced in a 97.2% chance of no rate change at next week’s FOMC meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary June figure will stand at 53.5, compared to 52.2 in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.340%, down -0.37%. All that worry. All that concern and it's barely moved our technicals. Trade docket today: We've already booked our profit on our Theta fairy! Looking for a possible BA 0DTE. /GC (Gold) 0DTE, /MNQ scalp continues from last night. Looking for more upside. ADBE, LULU, ORCL all are expiring today. QQQ 0DTE and SPX 0DTE. I'll try another 1HTE BTC trade this morning as well. Level's today are easy. Above 6003 is bullish. Boom! There you go. Let's keep the party from last night going! See you all in the live trading room shortly!

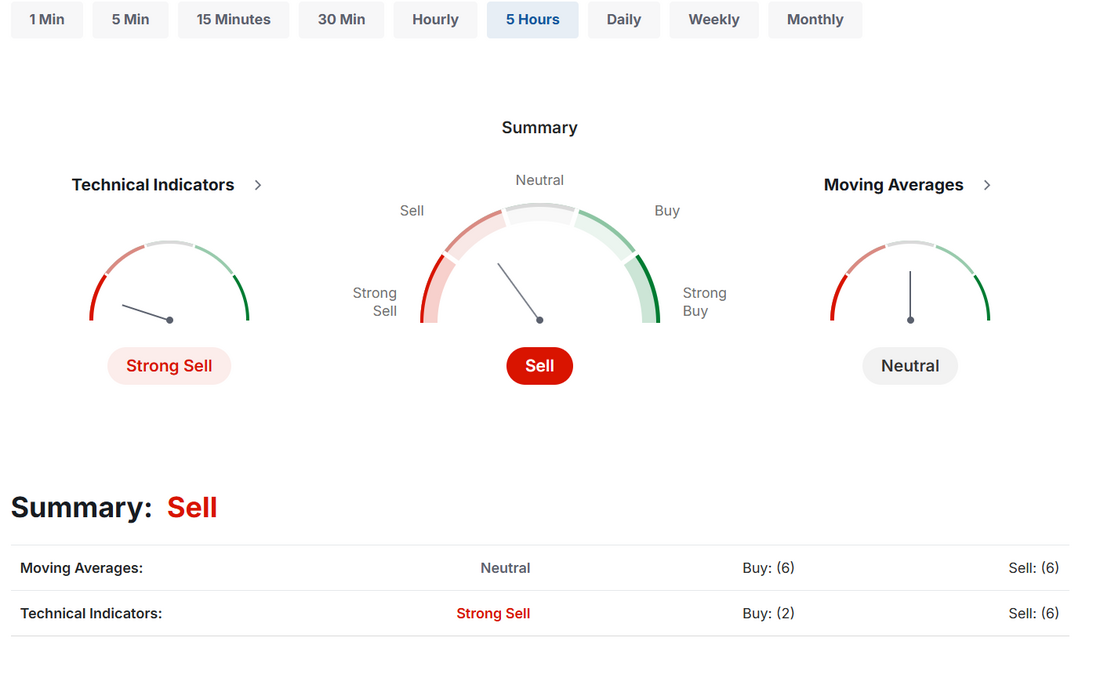

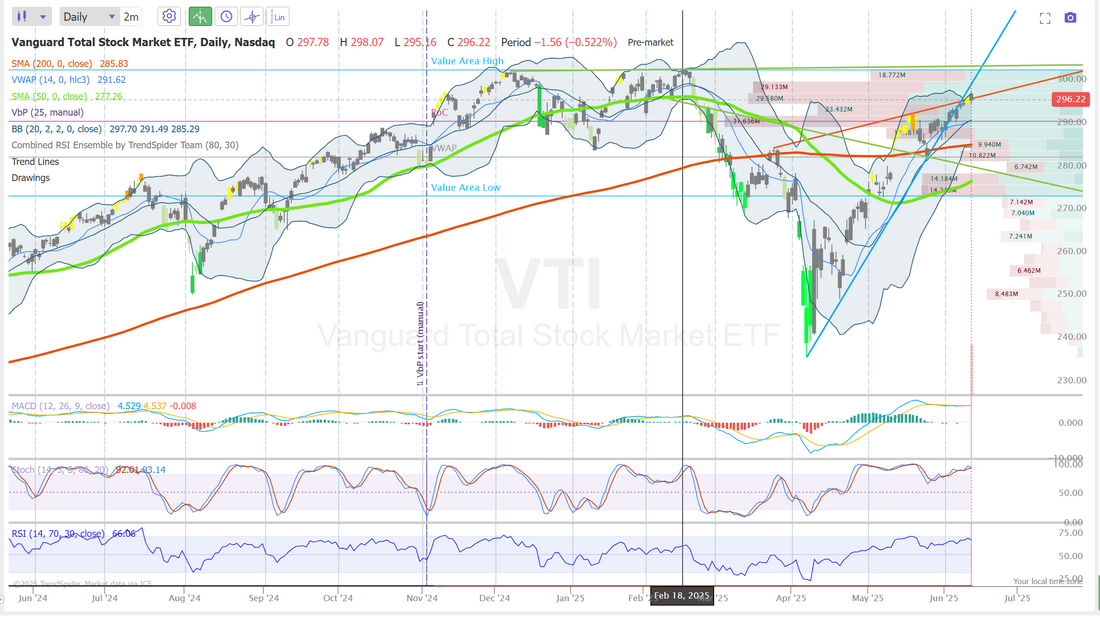

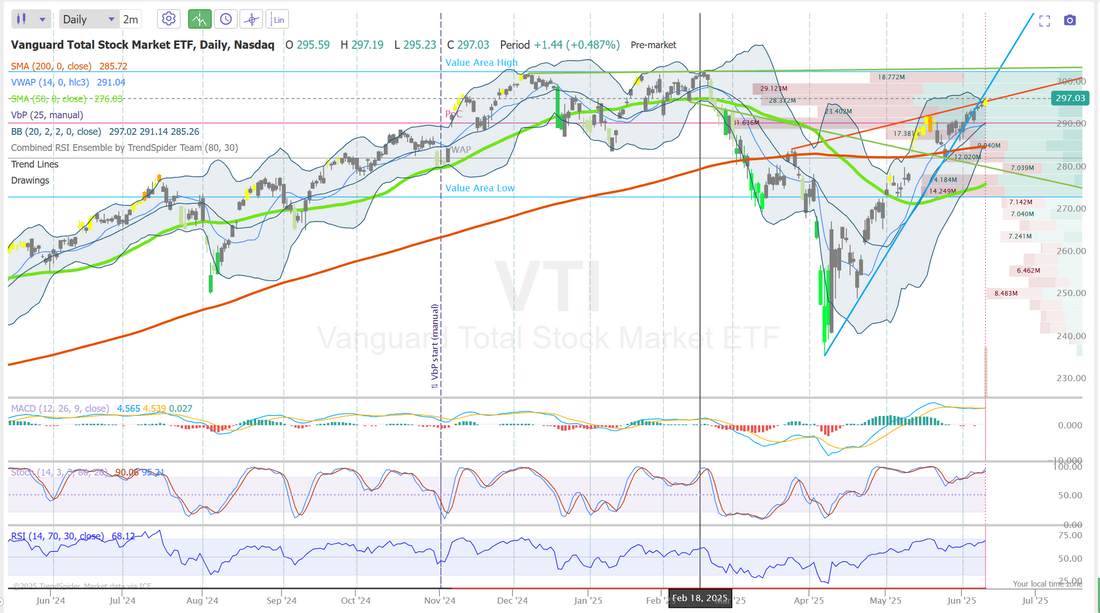

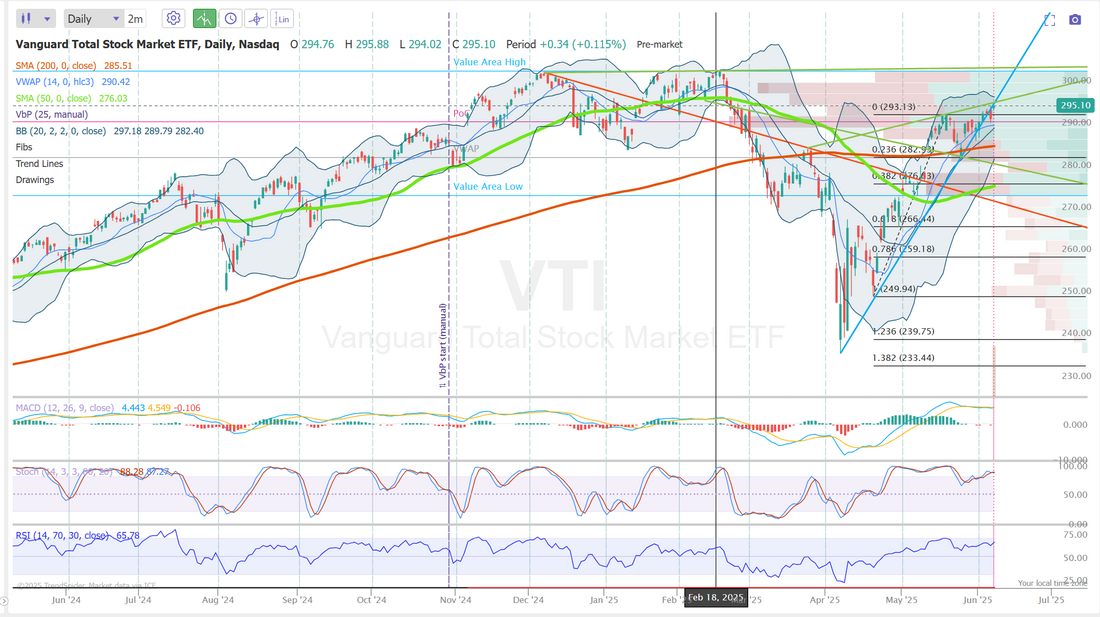

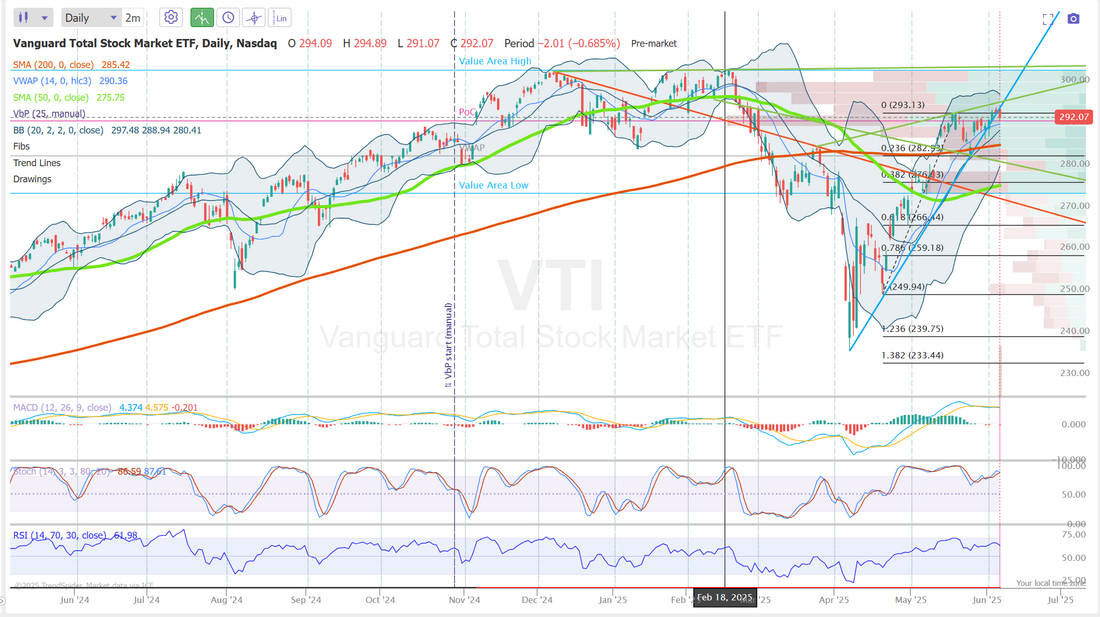

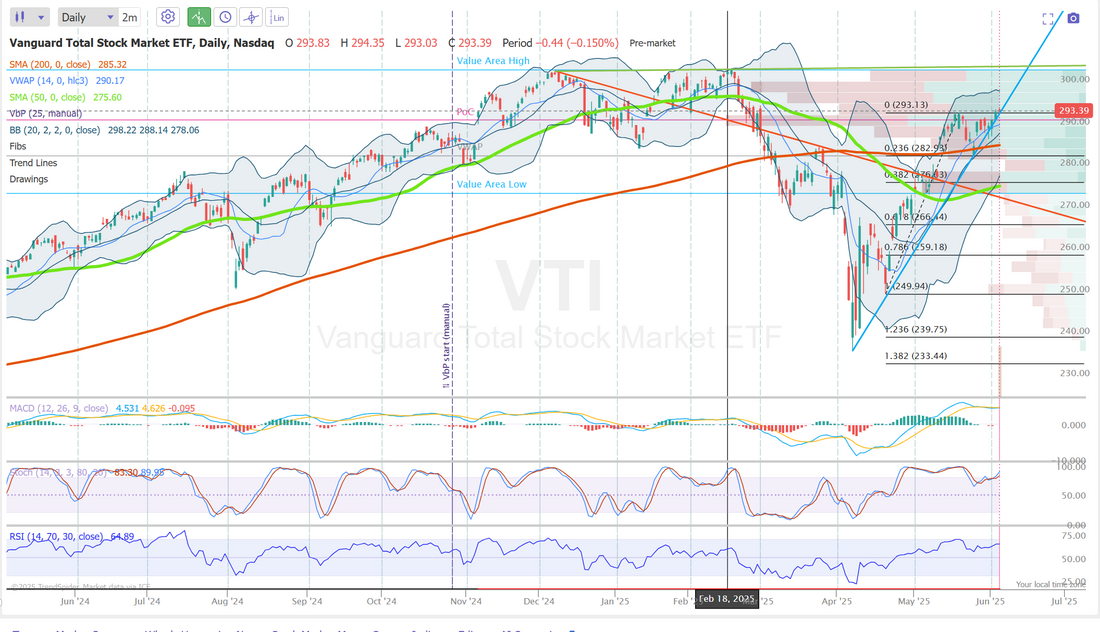

I feel better bearishThe market sold off a bit yesterday and futures are down this morning pre-PPI release. That's flipped our technical picture to a bit of a sell signal and you know what? That's great! I've talked a lot about epiphanies you get as you learn to trade. The concept of shorting is a big one. The idea that you can make money when stuff falls. From a traders perspective we always prefer down markets. The moves are generally bigger (stairs up elevator down anyone?) It's way easier to find overpriced stocks to short than it is to find the next "Ten bagger". Premium is better for option sellers. The key is to have the bulk of our Assets in a hedge fund environment like our ATM asset allocation model. PPI will lead the way today. I don't imagine it will be much different than CPI yesterday. The main question is, do we roll over today. The key 6003 level on /ES is back in play. We had an incredible day yesterday. It never really seemed like it! We just chipped away and chipped away and at the end of the day we had 13 trades under our belt and it all added up to a great result. Every trade matters. See our results below: une S&P 500 E-Mini futures (ESM25) are down -0.35%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.30% this morning as concerns around U.S. trade policy and escalating geopolitical tensions weighed on sentiment, while investors awaited the release of crucial producer inflation data. U.S. President Donald Trump heightened trade uncertainty with comments that he plans to impose unilateral tariffs on dozens of U.S. trading partners within two weeks. “We’re going to be sending letters out in about a week and a half, two weeks, to countries telling them what the deal is, like I did with the EU,” Trump said late Wednesday. An escalation of tensions in the Middle East also weighed on investors’ risk appetite. CBS reported that U.S. officials have been told Israel is fully prepared to launch an operation into Iran, prompting the U.S. to evacuate non-essential embassy staff from Iraq. Iran threatened to strike not only Israeli targets but also U.S. bases in the region if attacked. In yesterday’s trading session, Wall Street’s major indices closed lower. Most of the Magnificent Seven stocks retreated, with Amazon.com (AMZN) falling more than -2% and Apple (AAPL) dropping over -1%. Also, U.S. steel stocks slumped after the U.S. and Mexico closed in on a deal to remove tariffs on some steel imports, with Cleveland-Cliffs (CLF) sliding more than -8% and Nucor (NUE) dropping over -6%. In addition, Lockheed Martin (LMT) fell more than -4% after the U.S. Air Force reduced its F-35 aircraft request to Congress by half. On the bullish side, Warner Bros. Discovery (WBD) climbed +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after it said it may repurchase more of its bonds than the $14.6 billion announced for buyback on Monday. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices rose +0.1% m/m in May, weaker than expectations of +0.2% m/m. On an annual basis, headline inflation picked up to +2.4% in May from +2.3% in April, weaker than expectations of +2.5%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.1% m/m and +2.8% y/y in May, weaker than expectations of +0.3% m/m and +2.9% y/y. “The tariffs aren’t filtering through to Main Street as feared. This is good news for the White House, Wall Street, and Jerome Powell. The Fed’s tone could soften next week because we’ve probably seen peak hawkishness, especially with other central banks cutting,” said David Russell at TradeStation. Meanwhile, U.S. rate futures have priced in a 100% chance of no rate change at next week’s FOMC meeting. Money markets are currently pricing in roughly two Fed rate cuts by the end of 2025, with the first anticipated in October. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. May PPI will stand at +0.2% m/m and +2.6% y/y, compared to the previous figures of -0.5% m/m and +2.4% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect May figures to be +0.3% m/m and +3.1% y/y, compared to April’s numbers of -0.4% m/m and +3.1% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 242K, compared to 247K last week. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ2 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.402%, down -0.20%. As I mentioned, technicals are rolling over a bit here. It's now a full blown sell signal...yet, but we can hope! Taking a look at VTI there are a couple key areas of focus for me. #1 We are back down below the upward trend line. #2. We are also sitting right on the current resistance line. #3. Stoch and RSI are looking overbought. It's too early to call for a rollover but it's looking more and more likely. Another busy day today: We are working a /ES trade that has about $447 risk for a $1,100 potential profit. We'll keep working it today. DOCU possible call side. LULU additional work. ORCL take profit. ADBE earnings play. QQQ 0DTE as well as a potential SPX 0DTE, depending on the outcome of the /ES trade. I'll continue scalping with /MNQ futures contracts. 1HTE BTC trade. With PPI this morning we'll not start with any lean or bias and we'll trade off pivot points again.

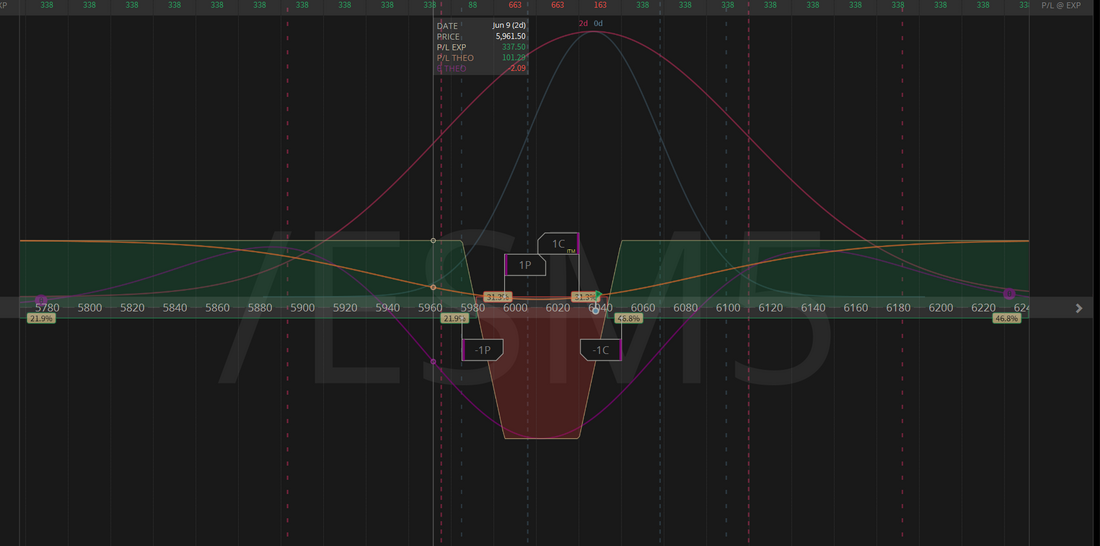

I'll see you all in the live trading room soon! B.P. + Risk/Reward = Dollar profitThere are so many components that interact to produce a good, bad or indifferent result with each trade. While there is plenty of discussion on building good risk/reward ratios, it can ultimately be the B.P. (buying power) you use (or don't use) that makes you happy at the end of the day. I was enthralled by a trader I only knew through another trader friend of mine who would consistently put up $100,000+ profit months, trading his own money. I was less impressed when I found out he was trading 5.4 million dollars! What does all this mean? Well...if you have been keeping track of our daily performance over that last few weeks, you've noticed that every single day has been profitable. Almost every single trade we were doing worked but...They were small trades BP wise. Some days our max BP used was less than 3K. It's tough to meet our daily income goal of $1,000 dollars on that small amount of BP. We were finally able to get so good BP usage yesterday and it resulted in a great day. See our results below: ADTV (Avg. daily trading volume) is speaking....volumes.As you know, I've been suspect of this last months rally. There's several macro reasons why I have doubts but the low daily volume speaks...volumes, I believe. We have techs only that have really carried us higher. Little overall participation and, as I said, super low volume. Do I thing we are going to roll over and start a new downtrend? No. That's too early to call but it is concerning. CPI today and PPI tomorrow, as well as China developments should be our drivers. We still carry a negative Delta in our ATM portfolio. June S&P 500 E-Mini futures (ESM25) are trending down -0.14% this morning after the U.S. and China agreed on a framework to ease trade tensions, but investors were left disappointed by the lack of details, with the focus now shifting to the release of key U.S. inflation data. Representatives from the countries said the framework would effectively reinstate a pact they reached in Switzerland last month, a deal in which both sides reduced tariffs and which was partly based on Beijing’s pledge to speed up critical mineral-export licenses while the negotiations continue. Little detail from the talks was disclosed, but U.S. negotiators said they “absolutely expect” that issues concerning shipments of rare earth minerals and magnets will be resolved through the framework’s implementation. “The two largest economies in the world have reached a handshake for a framework,” U.S. Commerce Secretary Howard Lutnick said Tuesday after two days of talks in London. “We’re going to start to implement that framework upon the approval of President Trump, and the Chinese will get their President Xi’s approval, and that’s the process.” Lutnick later told The Wall Street Journal that he anticipates Trump will approve the agreement as early as Wednesday or Thursday. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Chip stocks advanced, with Intel (INTC) climbing over +7% to lead gainers in the S&P 500 and Nasdaq 100, and KLA Corp. (KLAC) gaining more than +3%. Also, Tesla (TSLA) rose over +5% after executives, including CEO Elon Musk, shared a video of one of its vehicles driving in Austin without anyone behind the wheel, suggesting the company is nearing the launch of its robotaxi service in the Texas capital. In addition, Insmed (INSM) soared more than +28% after the company announced positive top-line results from a Phase 2 trial evaluating the efficacy and safety of treprostinil palmitil inhalation powder. On the bearish side, JM Smucker (SJM) plunged over -15% and was the top percentage loser on the S&P 500 after the maker of Jif peanut butter and Folger’s coffee issued below-consensus FY26 adjusted EPS guidance. Meanwhile, a federal appeals court on Tuesday approved the Trump administration’s request to keep sweeping tariffs in effect but agreed to expedite its review of the case this summer. In other tariff news, Bloomberg reported that the U.S. and Mexico are nearing an agreement that would eliminate President Trump’s 50% tariffs on steel imports up to a specified volume. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will be scrutinized for any indications that Trump’s tariffs are feeding through into prices. Economists, on average, forecast that the U.S. May CPI will come in at +0.2% m/m and +2.5% y/y, compared to the previous numbers of +0.2% m/m and +2.3% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +2.9% y/y in May, compared to the April figures of +0.2% m/m and +2.8% y/y. A survey conducted by 22V Research revealed that 42% of investors expect the market reaction to the CPI report to be “risk-on,” 33% said “mixed,” and 25% said “risk-off.” This marks the first time the reaction has favored risk-on since August 2024, according to 22V. “The combination of the May inflation figures and upcoming Treasury supply will provide investors tradable events and add to the market’s collective understanding of the early fallout from the trade war as well as demand for U.S. debt in the current environment,” said Ian Lyngen at BMO Capital Markets. U.S. rate futures have priced in a 99.9% probability of no rate change at next week’s policy meeting. On the earnings front, cloud services giant Oracle (ORCL) is set to report its FQ4 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.495%, up +0.49%. I've got no lean or bias today. CPI should guide us into the trading day. We've got one of our favorite setups already working this morning. The long Iron condor. It's always nice to be in a position to profit from big, wild, unpredictable swings. We'll likely add to this trade today to work out the "valley of death" component. It's another fairly heavy trading day. ADBE and ORCL are new earnings setups. We have our /ES 0DTE. A gold (/GC) 0DTE and will have an SPX 0DTE all working today. CHWY, GME and GTLB should all be take profit trades for us today. A possible add to our LULU trade. PLAY should be a take profit as well. Will continue to work the 0DTE part of our QQQ trade. Scalping continues to work best with the /MNQ futures. Once we get a breakout move we can get back to the QQQ's. Let's look at the markets: Bullish bias is holding into the CPI release. We continue to edge higher. We are really due a breakout. Up or down, I don't know but these tight candles and low volume mean somethings coming. I won't publish intra-day levels today or tomorrow with CPI and PPI likely leading the way. We'll trade off pivot points today which have been amazingly accurate for us. I've added a new indicator to our technical analysis today which is a blended RSI. It uses four different RSI timeframes, all combined to give a pretty darn accurate signal of when the market s in a buy, sell or caution zone. Note the Green, Red and yellow highlights. Just one more tool in our tool box. What is the new tool telling us about the broad market? Well, remember, it's only one tool. As always, we will use it in combination with all our other tools but looking at the VTI we start to get some caution signs. We are stuck below the current uptrend line. MACD is rolling over. Stoc is way overbought. RSI is in overbought zone and the combined RSI signal is yellow. CPI and PPI tomorrow will give us more guidance but don't be surprised if all this...including the super low volume, triggers a reversal. Busy day again today. We should be booking profits on our earnings trades from yesterday right out of the gate this morning. I've also got some training to share with you all this morning on predicting the future and the travails that come with that. I look forward to seeing you all in the live trading room. Yesterday was a blow out success. Let's see if we can get close to our $1,000 profit goal again today.

Earnings dayWe've got some of our favorite earnings plays coming up today with GME, PLAY, GTLB and CHWY. We'll be working those today. We had a really solid day yesterday. We didn't quite make our $1,000/day profit goal on our day trades but with our ATM portfolio addition it was a monster day. All these little trades add up. Here's a look at our day: Speaking of our ATM portfolio, I want to review it again. It's a "hidden gem" of our program. We don't talk about it much. It just sits in the background and churns out results. ATM stands for Asymmetric trade management. It has a dual-fold mandate to #1. Beat the unmanaged SP500 results, because if you can't do that then you might as well put your money in the SPY and call it a day. #2. Do it with less volatility. We endeavor to accomplish both of these lofty goals with a "hedge fund like" approach. We always have bullish AND bearish trades working simultaneously. Generally we carry an overall negative delta on the portfolio so as to benefit if markets drop. We carry long and short positions to balance volatility. Cash flow makes up about 70% of our returns. When markets go sideways or down it's great for our model. The results speak for themselves: 2021 54.50% return vs. 26.89% for SP500. 2022 22.6% return vs. -18.1% loss for SP500. (Our portfolio outperforms best when the markets are down) 2023 1.42% return vs. 22.57% for SP500 (Our last month through away a very good year. We made changes and learned from that mistake) 2024 10.36% return vs. 20.18% SP500 (A good year but it's hard to beat the index when you are attempting to take LESS risk and the market just goes up and up) 2025. So far this year we are neck and neck with the market. Both our portfolio and the SP500 are essentially flat, however, we had 20% expected return built up in extrinsic that has a high probability of coming in over the next three months. The market is currently up 2%. We have 20% return we should collect in the next three months. That's 10X of 1000% more than the market. I think we have a good shot at a 40% ROI year in 2025! Our four year average return has been 26% with no down years and we are on pace to TRIPLE our money in 5 years. That's not too shabby. If you'd like to see how we structure our portfolio and participate or simply want to protect your money against another 2022 crash, you can check it out for free below: My lean or bias yesterday was bullish and that's how we played it. It took a bit but that's eventually how the day worked out. My lean today is bullish as well. That's how all the technicals are set up and we are above some key support zones on /ES. June S&P 500 E-Mini futures (ESM25) are up +0.03%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.05% this morning as trade talks between the U.S. and China extended into a second day, with investors cautiously awaiting the outcome. While the first day of trade negotiations on Monday yielded no breakthrough, U.S. officials had expressed optimism that the two sides could ease tensions over shipments of technology and rare earth elements. U.S. Commerce Secretary Howard Lutnick said talks between Washington and Beijing were “fruitful,” and Treasury Secretary Scott Bessent described them as a “good meeting.” “We are doing well with China. China’s not easy,” U.S. President Donald Trump told reporters at the White House on Monday. “I’m only getting good reports.” In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Chip stocks gained ground, with Advanced Micro Devices (AMD) and Arm Holdings (ARM) climbing over +4%. Also, Tesla (TSLA) advanced more than +4% after U.S. President Trump reaffirmed his intention to end the spat with CEO Elon Musk, stating he would keep Starlink internet service at the White House and wished his billionaire backer “very well.” In addition, Goodyear Tire & Rubber (GT) surged over +10% after BNP Paribas Exane upgraded the stock to Outperform from Neutral with a price target of $15. On the bearish side, Intuitive Surgical (ISRG) slumped more than -5% after Deutsche Bank downgraded the stock to Sell from Hold with a price target of $440. Economic data released on Monday showed that U.S. Wholesale Inventories rose +0.2% m/m in April, compared with the flat preliminary reading and +0.4% m/m in March. “Markets have moved higher on tariff postponement and the perception that they will be more moderate than initially announced. We expect markets to remain headline-sensitive, as trade deals take time to negotiate and unsettling tariff news is likely to cause noticeable volatility,” said Richard Saperstein at Treasury Partners. Meanwhile, market watchers are keenly awaiting the U.S. consumer inflation report for May, scheduled for release on Wednesday. The report will be scrutinized for any indications that Trump’s tariffs are feeding through into prices. Barclays economists said in a note that they anticipate the inflation data will show “the first signs of tariff-related price pressures.” The CPI is expected to increase to +2.5% y/y from +2.3% y/y in April, while the core CPI, which excludes volatile food and fuel prices, is expected to increase to +2.9% y/y from +2.8% y/y in April. U.S. rate futures have priced in a 99.9% chance of no rate change at next week’s FOMC meeting. Despite President Trump’s push to pressure U.S. central bankers into swiftly lowering interest rates, Fed Chair Jerome Powell and his colleagues have signaled they have time to evaluate the impact of trade policy on the economy, inflation, and employment. Today, investors will likely focus on an earnings report from GameStop (GME) as the video-game retailer ventures into the cryptocurrency space. The company, which ignited the meme stock craze in 2021 with its meteoric rise, announced in late May that it had purchased $500 million in bitcoin. As its retail video game business struggles, GameStop is looking to follow the playbook of Strategy (MSTR) and other firms shifting their business models toward bitcoin accumulation. The U.S. economic data slate is empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.453%, down -0.67%. Trade docket for today is fairly busy. We have a Theta fairy that already logged a take profit this morning. Our modified versions (switching from a strangle to credit spreads) has worked in this new market environment but they are very expensive. My take profit hit at $120 dollars and I only netted $52 after fees and commissions. We'll continue to work on this setup to improve costs. DOCU may get an addition or possible take profit today. GNE pair trade DCA. QQQ 0DTE trade. I'll likely stick with /MNQ for scalping. That's been working well for us lately. GME, PLAY, GTLB and CHWY earnings trades. We'll give another 1HTE BTC trade a go this morning. SPX 0DTE focus. Let's take a look at the markets. Technicals are solidly bullish. However, the break out is not really breaking out! I'm sure CPI and PPI may give us more clarity in the next couple days. Let's take a look at our intra-day /ES levels. Levels are slightly different from yesterday. 6041 is now resistance with 5997 working as support. I look forward to seeing you all in the live trading room shortly!

One big deal is all we need.Welcome back traders to a new week. China/USA talks are in focus today. We'll also get CPI and PPI later this week. I feel like one "real" deal. An agreement with China would , of course, be huge. We had a solid day on Friday. Nothing really hit big but it all added up at the end of the day for a $1,000+ profit result. Here's a look at our results below: Let's take a look at the markets to start the week. Fridays push higher was enough to get our technicals back into bullish mode. Futures are flat to slightly up this morning. The indices are stretching for some fresh air up above this level. Can it stretch it out today? We keep waiting for a breakout. June S&P 500 E-Mini futures (ESM25) are up +0.08%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.01% this morning, pointing to a muted open on Wall Street as investors turn their attention to talks between the U.S. and China in London, and also await the release of key U.S. inflation data later in the week. Top officials from the U.S. and China meet in London today for talks that investors hope will signal progress toward easing trade tensions between the world’s two largest economies. The talks come after a call between U.S. President Donald Trump and Chinese leader Xi Jinping last week, in which the two agreed to resume discussions on tariffs following a temporary truce reached in mid-May. “The meeting should go very well,” Trump wrote on Truth Social on Saturday. The U.S. president told reporters on Friday that negotiations with Beijing were “very far advanced.” In Friday’s trading session, Wall Street’s major equity averages ended in the green, with the benchmark S&P 500 notching a 3-1/2 month high and the blue-chip Dow posting a 3-month high. The Magnificent Seven stocks advanced, with Alphabet (GOOGL) rising over +3% and Amazon.com (AMZN) gaining more than +2%. Also, chip stocks gained ground, with Marvell Technology (MRVL) climbing nearly +5% and Micron Technology (MU) rising over +2%. In addition, Tesla (TSLA) gained more than +3% after CEO Elon Musk indicated he would ease tensions with President Trump following Thursday’s heated spat. On the bearish side, Lululemon Athletica (LULU) tumbled over -19% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the retailer cut its full-year EPS guidance. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose 139K in May, stronger than expectations of 126K. Also, U.S. May average hourly earnings rose +0.4% m/m and +3.9% y/y, stronger than expectations of +0.3% m/m and +3.7% y/y. In addition, the U.S. unemployment rate was unchanged at 4.2% in May, in line with expectations. Finally, U.S. consumer credit rose $17.87B in April, stronger than expectations of $11.30B. “While [the labor market] may not be firing on all cylinders, it’s far from showing signs of a major breakdown. [Friday’s] solid labor report buys the Fed more time, but Chair Jerome Powell may have a hard time justifying a restrictive rate policy should inflation continue lower,” said Bret Kenwell at eToro. Philadelphia Fed President Patrick Harker said on Friday that there may be a path to cutting rates in the second half of the year, but reiterated that officials should hold steady for now and wait for uncertainty to subside. “For now, I am strongly of the belief we sit here, let some of this uncertainty resolve itself,” he said. U.S. rate futures have priced in a 99.9% probability of no rate change at next week’s monetary policy meeting. The U.S. consumer inflation report for May will be the main highlight this week. The report will be scrutinized for any indications that Trump’s tariffs are feeding through into prices. Barclays economists said in a note that they anticipate the inflation data will show “the first signs of tariff-related price pressures.” They expect upward price pressures on “a wide range of core goods categories,” such as apparel, household furnishings, new vehicles, and other goods. Also, investors will be keeping an eye on other economic data releases, including the U.S. PPI, the Core PPI, Initial Jobless Claims, Crude Oil Inventories, and the University of Michigan’s Consumer Sentiment Index (preliminary). Market participants will also focus on earnings reports from several notable companies, with Adobe (ADBE), Oracle (ORCL), Chewy (CHWY), and GameStop (GME) scheduled to release their quarterly results this week. U.S. central bankers are in a media blackout period before the June 17-18 policy meeting, so they are prohibited from making public comments this week. Despite President Trump’s push to pressure central bankers into swiftly cutting interest rates, Fed Chair Jerome Powell and his colleagues have signaled they have time to evaluate the effects of trade policy on the economy, inflation, and employment. Meanwhile, Apple (AAPL) kicks off its annual Worldwide Developers Conference today in Cupertino, California. The event is expected to feature the company’s new products, services, and partnerships. Today, investors will also focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final April figure to be unchanged m/m, compared to +0.4% m/m in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.483%, down -0.69%. SPY closed the week at $599.14 (+1.66%), with bulls firmly in control above the bullish gap and continuing to press through resistance. The index managed to push through last week’s inside candle and close above a high-volume node, which had previously acted as resistance. With that area of high activity now below the current price, downside conviction from bears looks increasingly limited. The tech-heavy QQQ ETF closed the week at $529.92 (+2.08%), shrugging off the Tesla and Trump drama. While it lacked the inside weekly candle breakout, it was fueled by a bullish weekly MACD cross and managed to fly right through resistance at its high-volume node. As it breaks through an ascending triangle, QQQ now sits within 2% of a new all-time high. The IWM small-cap ETF outpaced the large-caps for a change, ending the week at $211.90 (+3.32%). The index broke out of a weekly inside candle and is now driving into a low-volume node, where price tends to move quickly through. With the high-volume node resistance cleared, the next key target appears to be the year-to-date high. Let's take a look at the expected ranges for the week. Once again, we see that the delta between SPY and QQQ is just not enough to merit adding the NDX to our 0DTE mix. My lean or bias today is bullish. Friday was a solid bullish day and the charts look closer and closer to lifting off. Premium is not horrible but also not great so a combination of debit and credits legs could work well today. Today we'll work the call sides of our DOCU and LULU trades. JACK and GNE pairs trade work. Adding another QQQ 0DTE cover to our 4DTE . We have started our day scalping with a long /MNQ. SPX 0DTE. Earnings this week will focus on GME, PLAY, GTLB, CHWY, ADBE, ORCL. BITO may be skipped today. We should be able to get some 1HTE BTC trades on this morning. Let's take a look at some intra-day levels. Looking at the daily chart, this market really wants to go higher but it's just not got a lot of gas in the tank. It's trying. With trade talk and CPI/PPI this week, maybe everything falls into place for a bull push? VTI is getting tantalizingly close to getting back above its upward trend line. Looking at the /ES intra-day levels. We've got some new levels for today! Finally. 6025 is our new resistance and above would be very bullish for me. 5989 is support and while falling below it wouldn't trigger some massive bearishness, for me. I'll see you all in the live trading room shortly!

The inevitable inevitably happenedWell, who say this coming? Everyone? Two Alphas with hard charging styles. The blowup seems like a guarantee but oh my, this is insane. If these two were my brothers my dad would be putting both of them over a knee! I have to say that I was really looking forward to seeing both Trump and Elon work some magic. Who doesn't want secure boarders and lower deficits? How about lower pharma costs? Who doesn't want to see Government spending slashed? It doesn't look like were getting any of it. This doesn't mean we can't profit for this melee. We've been shorting (selling calls) on TSLA for a while because, well...the company is in trouble. Profits are dropping. Market share is waning. Sales are plummeting. None of those fundamentals seemed to matter. Elon's talk of getting back to work and robo taxis pushed the stock continually higher. We've had to roll the calls out and up several times. Now we have the same (non-fundamental) reasons to trigger a big selloff. (50 point drop as I type this). Now we will be rolling puts out and down to eventually match our very profitable call side. Crazy times for sure but it doesn't mean we can't profit. Our day yesterday worked for us. We started the day with a begrudgingly bullish stance because that's what our system said to do. It worked out and our key for success yesterday was pulling profits early. Let's take a look at the "new" market. Finally some movement. With the selloff late yesterday we move back to a neutral rating and I feel a lot more comfortable with that. It's harder to trade, for sure but I just wasn't buying the bullish breakout thesis. The "stall" continues. We haven't rolled over enough to get a real sell signal and we just can't break out above this current level to get a new bullish trend. The VTI is a perfect example of what a neutral rating day looks like. No real sell or buy signal here. My bias or lean today is bullish. Futures are up and yesterdays selloff was just a silly, knee jerk reaction. Trade docket is a bit busy today for a Friday: /GC (Gold) 0DTE. We'll work the put side of this today. AVGO, DOCU, LULU are all earnings trades we'll finish working today. The DOCU and LULU were tight trades with lower probabilities so we planned to work them a bit more today. That may or may not take up our buying power for an SPX 0DTE. BITO will need to either be rolled for more income of let it go at a full profit. We'll decide on that as the day progresses. Our QQQ trade will get a 0DTE cash flow component again today. We'll look to stick with the /MNQ for scalping. That's been working well for us lately. Let's take a look at the /ES intra-day levels. On the daily chart you can see it's trying to roll over. We are below the uptrend line. Technicals are not hooking to sell side yet but are close. Essentially we are still stuck in the same zone we've been in for three weeks now. On an intra-day basis using the 2 hr. chart we are right back to our old stomping grounds. 6003 is resistance and that is what I think would be the launching pad for the bulls. They almost cleared it yesterday before all the drama unfolded. 5967 is a key support. We are just up above it now as I type. Below that comes 5929. NFP is out in a few min. and that should give us more guidance on how the day starts. I'm very happy with our day yesterday because we did things that didn't feel comfortable, I.E. starting bullish because that's what our system said to do even though I wasn't feeling it. Pulling our trades early to lock in gains. In hindsight it would have been ugly if we had continued to hold. Let's see what we can accomplish today.

I look forward to seeing you all in the live trading room shortly! Well...nevermind.Yesterday I said that I was a reluctant bull. All our technicals were bullish. The current trend is up. It looked (especially on the /NQ) that we were finally ready to break out of this nearly three week consolidation and push higher. I wasn't really feeling it BUT you need to trade with a system and not your gut. I tried a couple bullish debit spreads on SPX. One worked a bit and one didn't so I really just treaded water yesterday. It was a green day when all was said and done but not by much. With the flat day yesterday our levels and technicals are EXACTLY the same today as they were yesterday. Can the bulls break out today? We've got US trade balance and Jobless claim numbers out early and they may give us some guidance but I'm not holding my breath. I'll likely start today with a tight Iron fly, chicken Iron condor or some small, asymmetric setup. Here's my results from yesterday. June S&P 500 E-Mini futures (ESM25) are up +0.02%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.10% this morning, pointing to a muted open on Wall Street, while investors await a fresh batch of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from semiconductor and software giant Broadcom. Some positive corporate news is supporting stock index futures, with MongoDB (MDB) surging over +14% in pre-market trading after the database company posted upbeat Q1 results, raised its full-year guidance, and boosted its share buyback program. Also, Five Below (FIVE) climbed more than +5% in pre-market trading after the specialty discount retailer reported forecast-beating Q1 results and issued solid Q2 guidance. However, gains in U.S. equity futures are limited amid investor caution ahead of Friday’s payrolls data. Also, trade uncertainty persists as the Trump administration’s deadline for countries to submit their “best offers” for trade deals has passed without any notable developments. In yesterday’s trading session, Wall Street’s major indexes ended mixed. ON Semiconductor (ON) climbed over +6% and was the top percentage gainer on the S&P 500, extending Tuesday’s gains after the semiconductor firm’s CEO Hassan El-Khoury said he sees early signs of a broad-based recovery in demand. Also, homebuilder stocks advanced after the benchmark 10-year T-note yield slumped, with DR Horton (DHI) rising more than +4% and Lennar (LEN) gaining over +3%. In addition, Guidewire Software (GWRE) surged over +16% after the insurance-software provider posted upbeat FQ3 results and raised its full-year revenue guidance. On the bearish side, Dollar Tree (DLTR) slid more than -8% and was the top percentage loser on the S&P 500 after the discount retailer warned that new U.S. tariffs could slash its Q2 profit by 45% to 50%. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 37K in May, weaker than expectations of 111K and the smallest increase in more than two years. Also, the U.S. ISM services index unexpectedly fell to 49.9 in May, weaker than expectations of 52.0. “Markets are likely to view this through the lens of disappointment on the real growth side,” said Florian Ielpo at Lombard Odier Investment Managers. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity declined slightly in recent weeks, signaling that tariffs and heightened uncertainty are hurting the economy. “All districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions,” according to the Beige Book. The report stated that consumer spending either declined slightly or showed no change across most districts, while prices rose at a “moderate” pace. Most regions described employment as “flat,” while wages continued to grow at a “modest” pace. The report said the outlook remained “slightly pessimistic and uncertain, on balance.” U.S. rate futures have priced in a 95.6% probability of no rate change and a 4.4% chance of a 25 basis point rate cut at June’s monetary policy meeting. Today, investors will monitor earnings reports from several high-profile companies, with Broadcom (AVGO), Lululemon Athletica (LULU), and Samsara (IOT) slated to release their quarterly results. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 236K, compared to last week’s number of 240K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast Q1 Unit Labor Costs to be +5.7% q/q and Nonfarm Productivity to be -0.8% q/q, compared to the fourth-quarter numbers of +2.0% q/q and +1.7% q/q, respectively. U.S. Trade Balance data will be released today as well. Economists expect the trade deficit to narrow to -$67.60B in April from -$140.50B in March. In addition, market participants will parse comments today from Fed Governor Adriana Kugler, Kansas City Fed President Jeff Schmid, and Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.343%, down -0.44%. I won't bother to repost the technicals for today because they are exactly the same as yesterday! Just scroll down. The /ES seems trapped between 6003 and 5966. Trade docket for today: AVGO, LULU, DOCU earnings plays. These are usually pretty good tickers for us. FIVE was our earnings trade from yesterday. It's a 15DTE so we'll likely continue to work it today. SPX 0DTE focus. /MNQ scalping. We'll also look at a week long spec trade using the QQQ's. I don't have a bias or lean today. Until we can definitively break out of this 5966/6003 /ES range it looks like a dead market. There are some differences in the outlook, depending on what index you use. The /ES is now down below the upper trend line (blue line). Seems to be topping out. Technicals are mixed. The /NQ is stronger. It continues to hug the upward moving trend line. Technicals are all bullish. It's really close to breaking out. VTI seems like it wants to break out as well but just can't build enough momentum. Where we go today is anybody's guess. We'll see what everyone thinks in the live trading room shortly!

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |