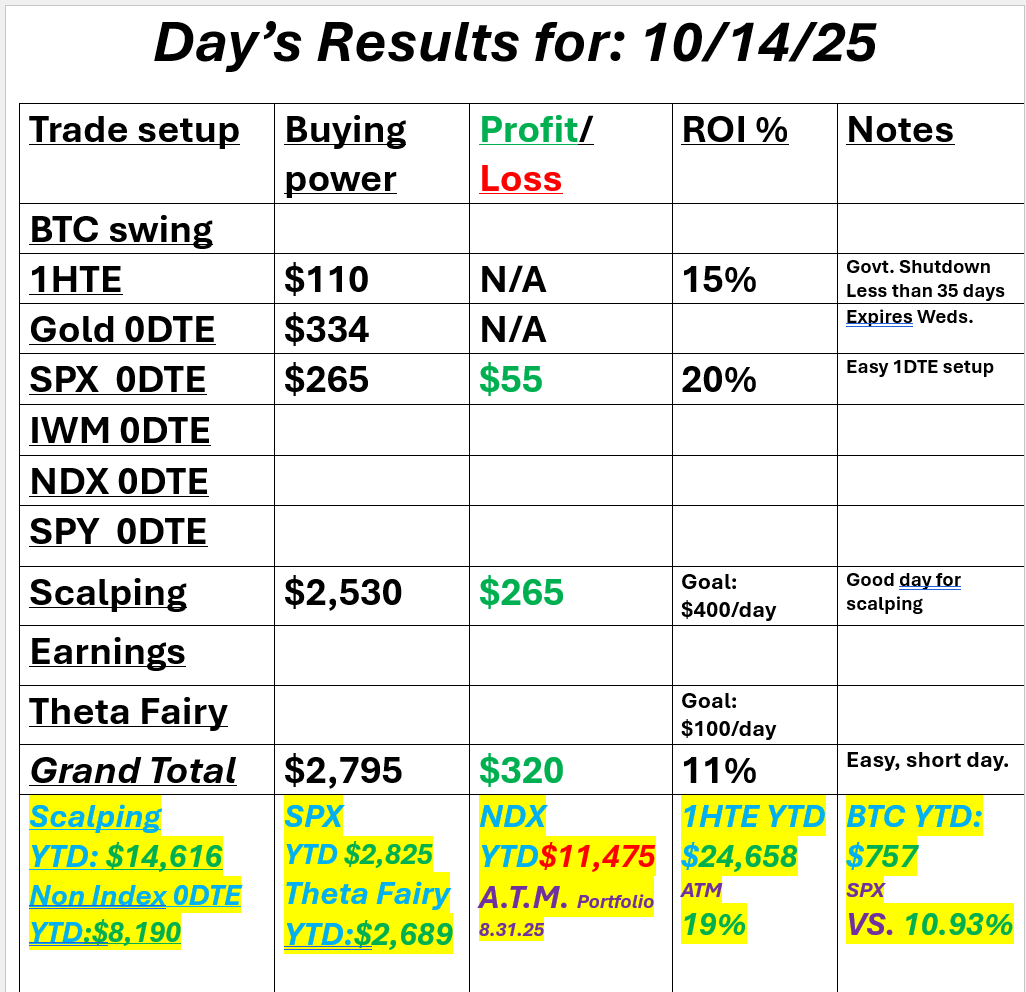

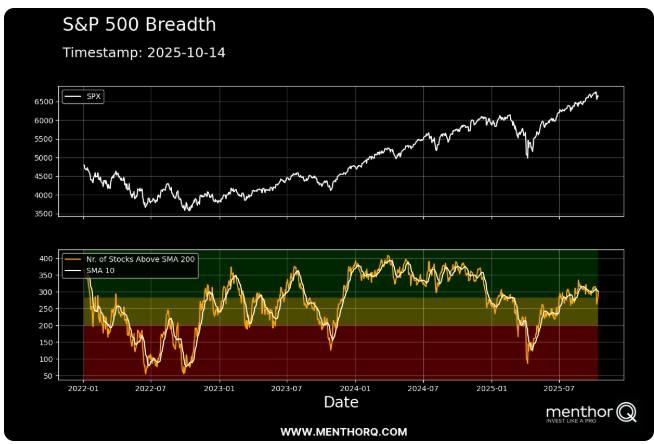

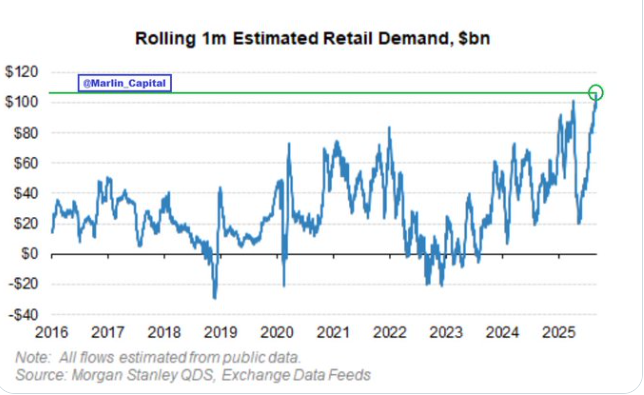

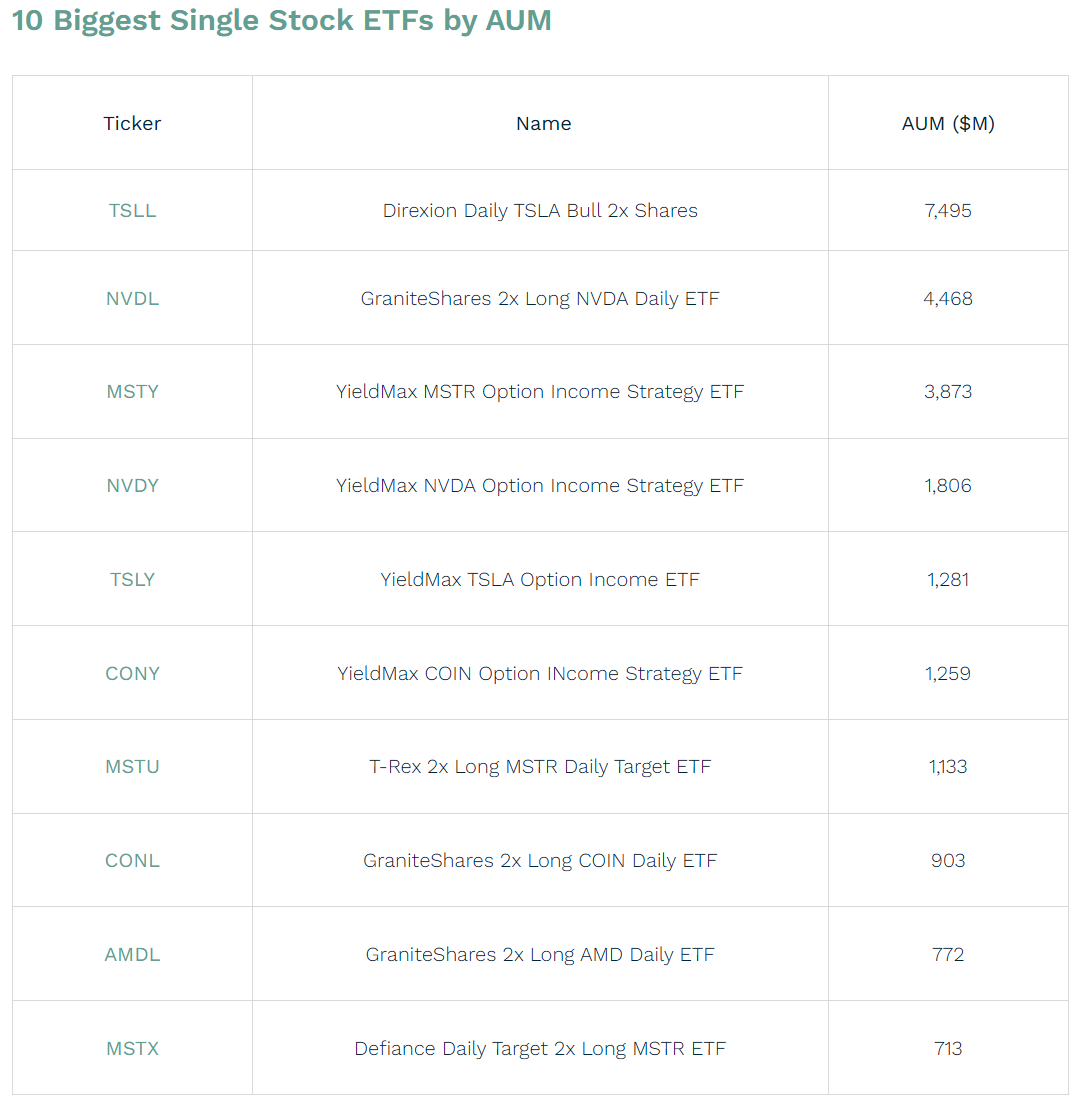

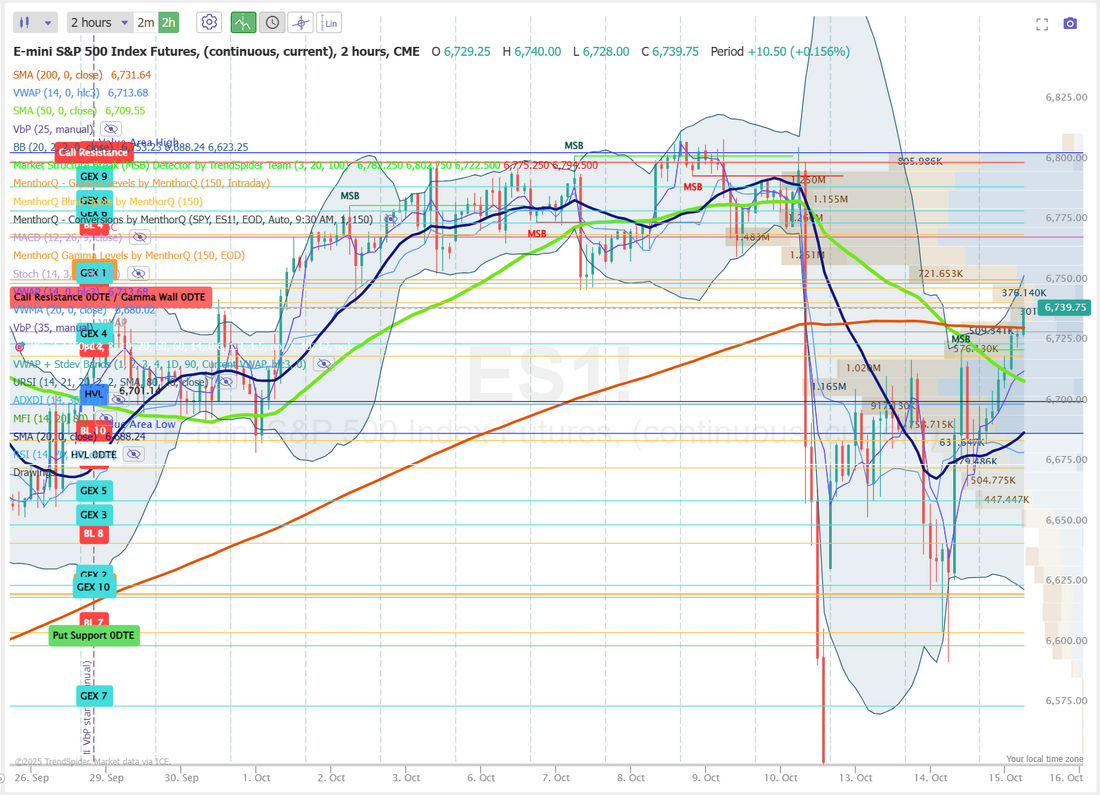

Bulls are tryingIt's been a volatile few days with some big swings, both up and down. Futures were down yesterday morning when I said I was looking for a bullish day. Fortunately that's what we got. It made for a very quick profit for us and we were done early. I was most impressed with the IWM and DIA. They had been crushed and looked really weak. Yesterday was a big save for them. Here's a look at our day yesterday. One of our trading mantras is, "Don't let green turn to red". We had some nice green quickly yesterday and were done in a few short hours. Nice way to end the day. Let's dive into the markets and see if we can make any sense of the current moves. Technicals are back to a strong buy mode. Futures are up strong this morning. The question for the last few days has been is the retrace a "buy the dip" opportunity? It's looking more and more like the answer may be yes. As I mentioned above, After Powell's speech yesterday, there is more excitement for additional rate cuts. That helped the IWM push higher. December S&P 500 E-Mini futures (ESZ25) are trending up +0.63% this morning amid optimism over Federal Reserve interest-rate cuts following dovish comments from Fed Chair Jerome Powell, while investors await quarterly reports from more big banks. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Most members of the Magnificent Seven stocks retreated, with Nvidia (NVDA) falling more than -4% to lead losers in the Dow and Amazon.com (AMZN) dropping over -1%. Also, semiconductor and AI infrastructure stocks slumped, with Arista Networks (ANET) sliding over -5% to lead losers in the S&P 500 and Intel (INTC) falling more than -4%. In addition, Salesforce (CRM) dropped over -3% after Northland Securities downgraded the stock to Market Perform from Outperform. On the bullish side, Wells Fargo (WFC) climbed more than +7% and was the top percentage gainer on the S&P 500 after the lender posted upbeat Q3 results and raised a key profitability metric. Fed Chair Jerome Powell indicated on Tuesday that labor market conditions continue to worsen, reinforcing investors’ expectations for another interest rate cut this month. “The labor market has demonstrated pretty significant downside risks,” Powell said. “The data we got right after the July meeting—which adjusted back all the way through May—showed that the labor market has actually softened pretty considerably, and puts us in a situation where the two risks are closer to being in balance.” Boston Fed President Susan Collins said policymakers should keep lowering interest rates this year to support the labor market. “Even with some additional easing, monetary policy would remain mildly restrictive, which is appropriate for ensuring that inflation resumes its decline once tariff effects filter through the economy,” Collins said. Meanwhile, U.S. rate futures have priced in a 95.7% chance of a 25 basis point rate cut and a 4.3% chance of no rate change at the October FOMC meeting. On the trade front, U.S. President Donald Trump said on Tuesday that Washington was considering ending certain trade relations with China, including the purchase of cooking oil. At the same time, U.S. Trade Representative Jamieson Greer said tensions with China over export controls are likely to ease following talks between officials from both nations. Third-quarter corporate earnings season picks up steam, with investors awaiting reports today from major U.S. banks such as Bank of America (BAC) and Morgan Stanley (MS), as well as notable companies like Abbott Labs (ABT), Progressive (PGR), and United Airlines Holdings (UAL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. On the economic data front, investors will focus on the New York Fed-compiled Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists foresee the October figure coming in at -1.80, compared to -8.70 in September. In light of the government shutdown, the September inflation report will not be released today as originally scheduled. However, the U.S. Bureau of Labor Statistics announced on Friday that it would publish the CPI report on October 24th, making a rare exception to release data during the shutdown. Market participants will also parse comments today from Fed Governor Stephen Miran, Atlanta Fed President Raphael Bostic, Fed Governor Christopher Waller, and Kansas City Fed President Jeff Schmid. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.017%, down -0.20%. The latest move in the S&P 500 breadth chart shows the orange line, representing the number of stocks above their 200-day moving average, turning higher again after a brief dip. This rebound suggests improving participation beneath the surface, with more stocks rejoining the uptrend even as the index consolidates near recent highs. In the short term, this broadening of market strength could help stabilize momentum and support the ongoing rally, especially if the breadth continues to climb toward the upper green zone, where sustained advances have historically gained traction. Monthly RSI on Gold is at it's highest level....ever. QQQ put volume hit a new record last week. For better or worse, Retail investors have become a huge influence in the market against the big players. Retail participation has never been higher. In a continuation of our ETF training, here is a list of the top single stock ETF's. Our focus is generally on TSLL and NVDL. Our training session today will be on The 9 trading sins that guarantee failure. Let's take a look at the intra-day levels this morning. Futures are soaring as we start the day. 6740, 6743, 6750, 6752, 6769 are resistance levels. They are tightly grouped but we are already up 54+ points as I type this. 6730, 6724, 6718, 6700 are support levels. My bias or lean today is bullish. Futures are already up more than the overnight expected move so we may give back some of these gains but I think we still finish green today. I look forward to seeing you all in the live trading room this morning. We've got our GLD 0DTE expiring today so we'll focus on that to start our day. Also remember to tune in at 12:00 MDT for our Jessie Livermore training.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |