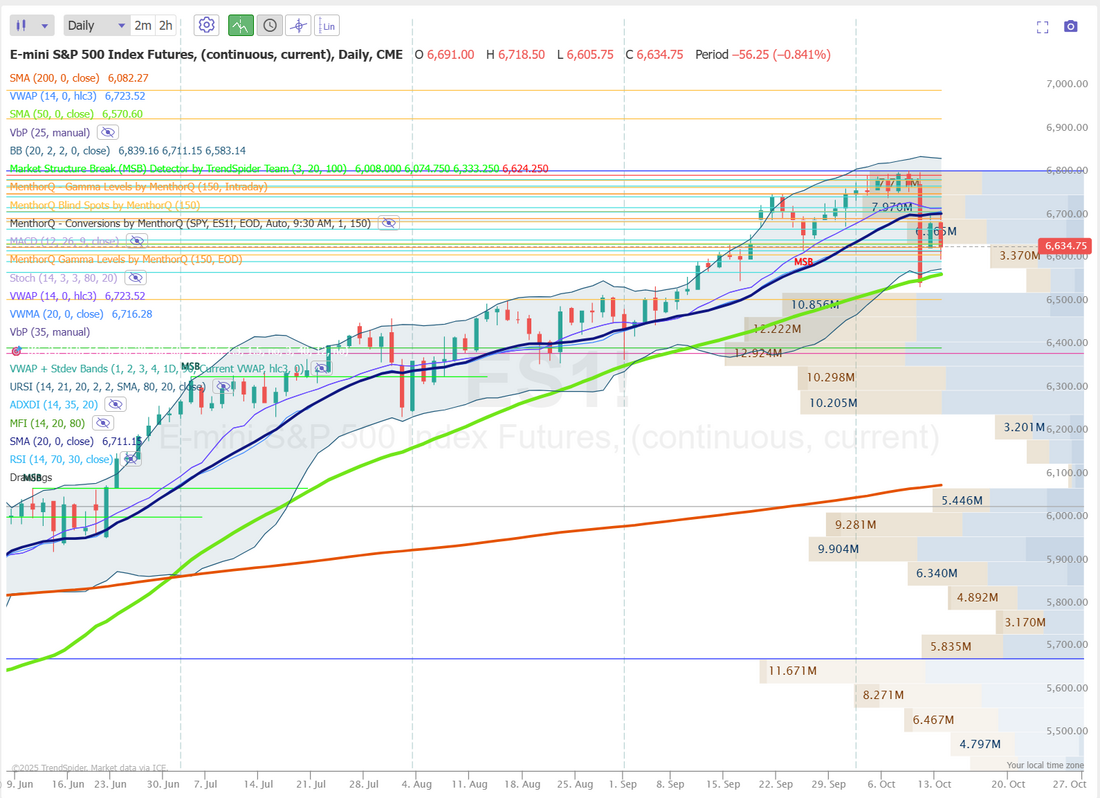

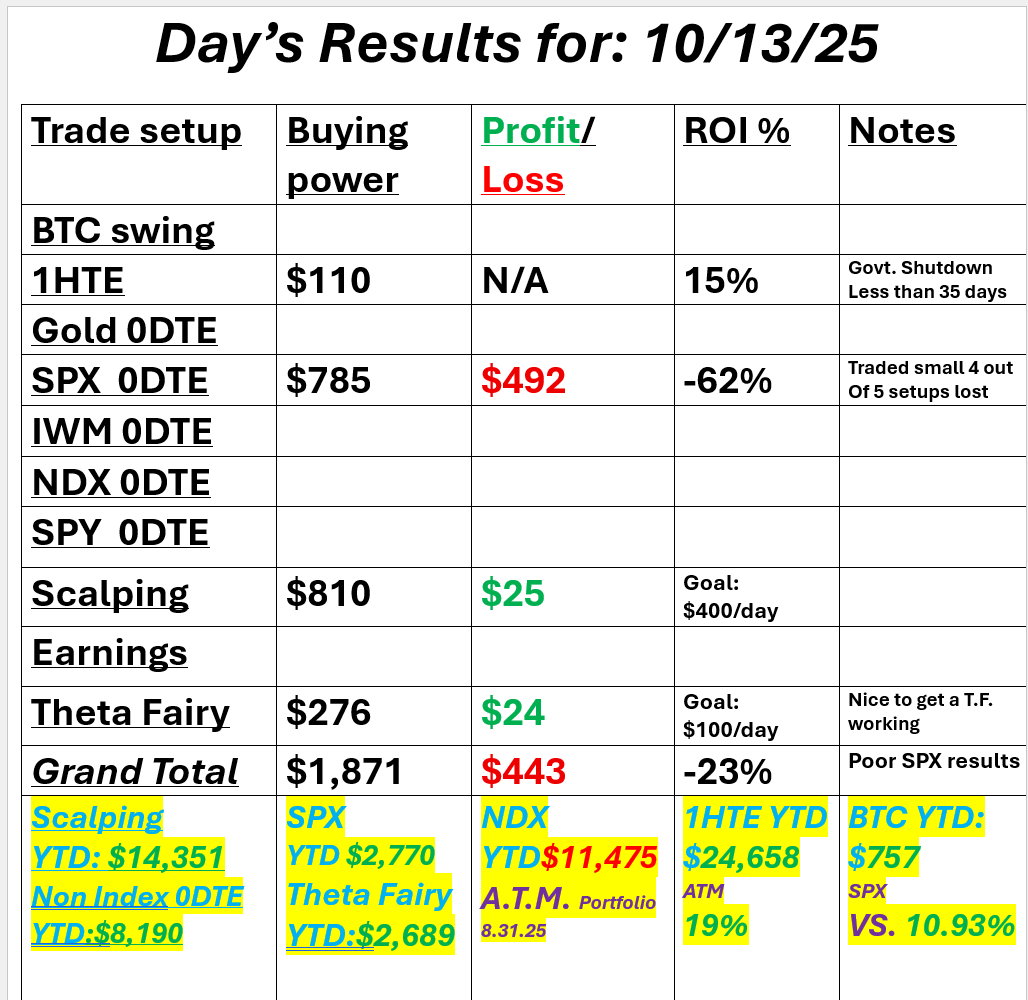

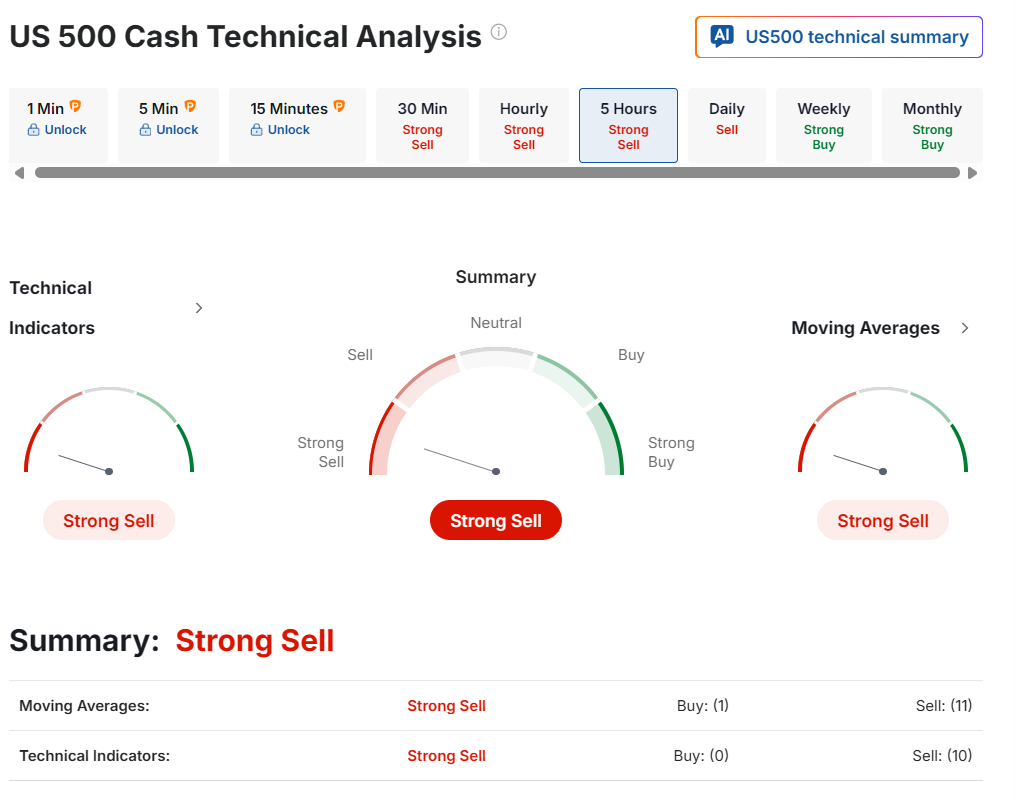

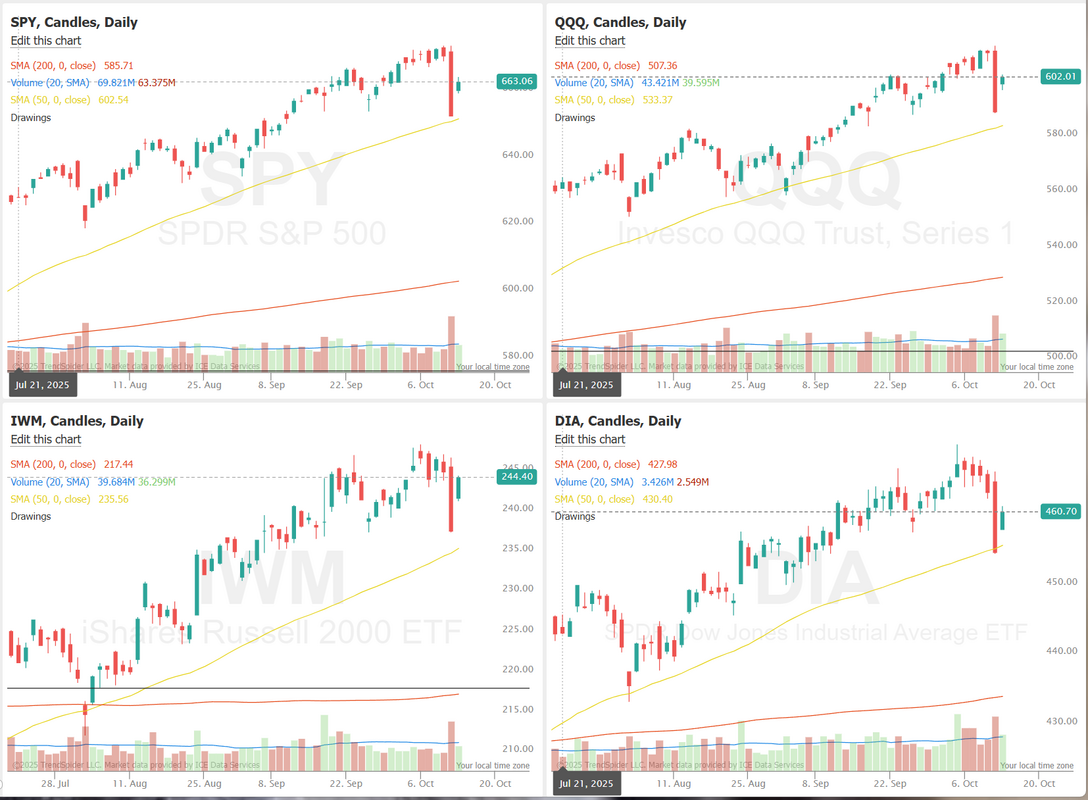

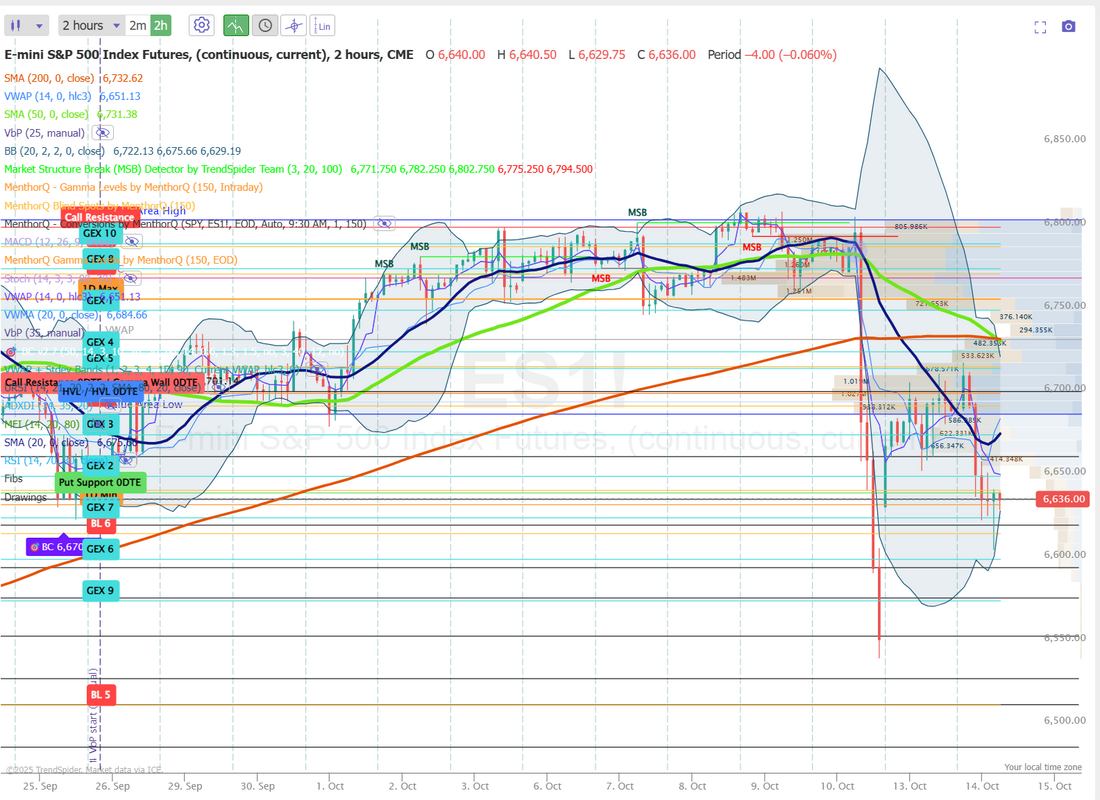

Déjà vu all over again?The crash was starting last Friday. Wait! Monday it was all o.k. again. Today? Well, let's just say it's really starting to feel like the bull has run out of steam. More China trade tensions. Right now from a technical standpoint it's a battle between the 20DMA and the 50DMA. The 20 (blue line) is working as resistance while the 50 (green line) is working as support. I traded as small as I possibly could yesterday but going 1 for 5 on SPX 0DTE setups wasn't good enough to get green on the day. Here's a look at my day: I'll likely trade small again today. Let's look at the current state of the markets: Looks like a weak opening. Futures are set to give back yesterdays gains this morning. December S&P 500 E-Mini futures (ESZ25) are down -1.18%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -1.65% this morning as sentiment weakened after China hit back at the U.S. on shipping. China on Tuesday imposed sanctions on the U.S. units of South Korean shipping giant Hanwha Ocean and warned of additional retaliatory measures against the industry. Organizations and individuals in China are prohibited from conducting any transactions, cooperation, or related activities with these entities, according to a statement from the Chinese Ministry of Commerce. The move rekindled fears that the U.S.-China trade war could flare up again. Investors now await a speech from Federal Reserve Chair Jerome Powell and earnings reports from some of the biggest U.S. banks. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. The Magnificent Seven stocks advanced, with Tesla (TSLA) climbing over +5% and Alphabet (GOOGL) rising more than +3%. Also, Broadcom (AVGO) surged over +9% after announcing a partnership with OpenAI to design and deploy 10 gigawatts of custom AI accelerators. In addition, Bloom Energy (BE) jumped more than +26% after Brookfield Asset Management agreed to invest up to $5 billion to deploy the company’s fuel cells at new data centers that operate AI. On the bearish side, Fastenal (FAST) slumped over -7% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the fastener maker reported weaker-than-expected Q3 EPS. “Investors remain eager for exposure, and if this recovery holds, it will reinforce the idea that retail investors can’t be easily shaken and another reminder that buying the dip continues to work,” said Mark Hackett at Nationwide. Philadelphia Fed President Anna Paulson indicated on Monday that she supports two additional quarter-point rate cuts this year, saying monetary policy should look through the tariff-driven rise in consumer prices. “For me, the bottom line is that I simply don’t see the type of conditions, especially in the labor market, which seem likely to turn tariff-induced price increases into sustained inflation,” Paulson said. U.S. rate futures have priced in a 97.8% probability of a 25 basis point rate cut and a 2.2% chance of no rate change at the conclusion of the Fed’s October meeting. Third-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Citigroup (C), set to report their quarterly results today. Johnson & Johnson (JNJ) and BlackRock (BLK) are other prominent companies scheduled to deliver their quarterly updates today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Investors will also focus on a speech from Fed Chair Jerome Powell. Mr. Powell is set to speak on the economic outlook and monetary policy at the National Association for Business Economics Annual Meeting later today. Also, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Christopher Waller, and Boston Fed President Susan Collins will speak today. Meanwhile, the U.S. government shutdown continues, delaying key economic reports. The shutdown delayed the release of the key U.S. jobs report for September, and the timing of its publication, along with other official economic data, remains unclear. However, the U.S. Bureau of Labor Statistics announced on Friday that it would publish the September inflation report on October 24th, instead of the originally scheduled date of October 15th. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.008%, down -1.21%. The SPX momentum score shows a short-term cooling following last week’s sharp pullback, with the index slipping from recent highs near 6700 before finding some support. Despite the drop, momentum remains positive overall, though it has eased from its peak readings. This suggests that while bullish sentiment has weakened slightly, the broader uptrend is still intact as long as prices hold above recent support zones. In the near term, traders may watch for whether momentum can stabilize and push higher again a sign of renewed strength or if continued softness points to a potential short-term consolidation phase. News catalysts today: Let's look at the intra-day levels on /ES. 6715 (20DMA) is the major resistance. 6575 (50DMA) is major support. 6650, 6662, 6676, 6687, 6701 are the main resistance levels. 6633, 6626, 6614, 6595, 6577 are support zones. My lean or bias today is bullish...not that it means much in this headline driven market. Futures are still down heavily, as I type but there are some buyers out there. It's early but I think the bulls can fight back today. I look forward to seeing you all in the live trading room shortly. A 1DTE setup may be the ticket today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |