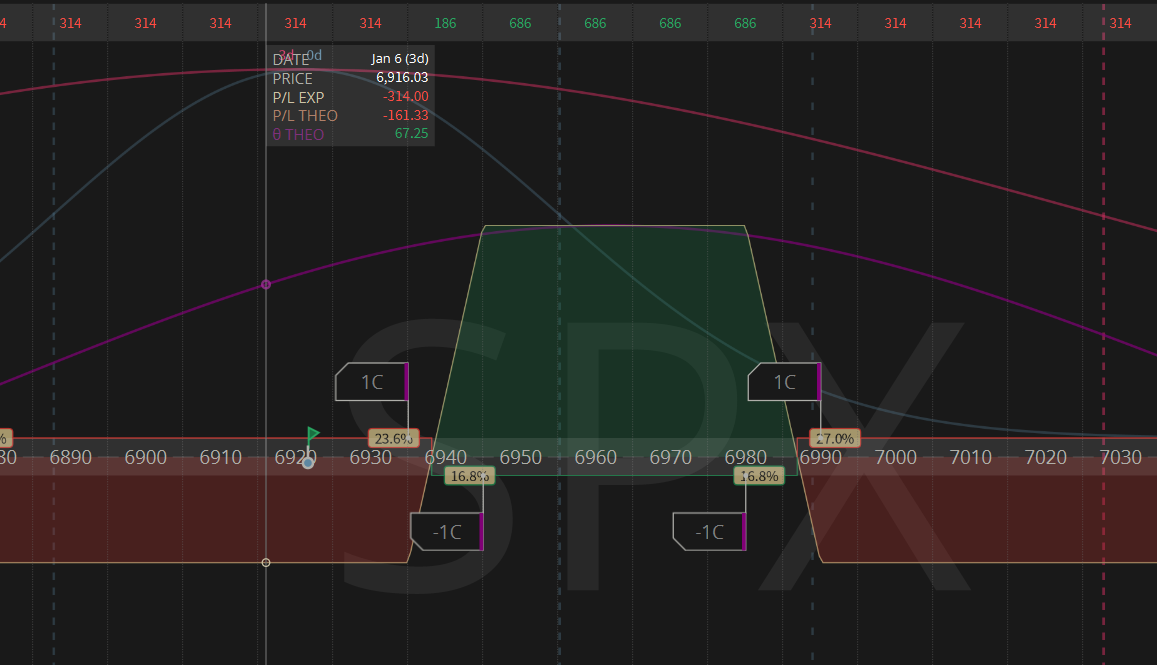

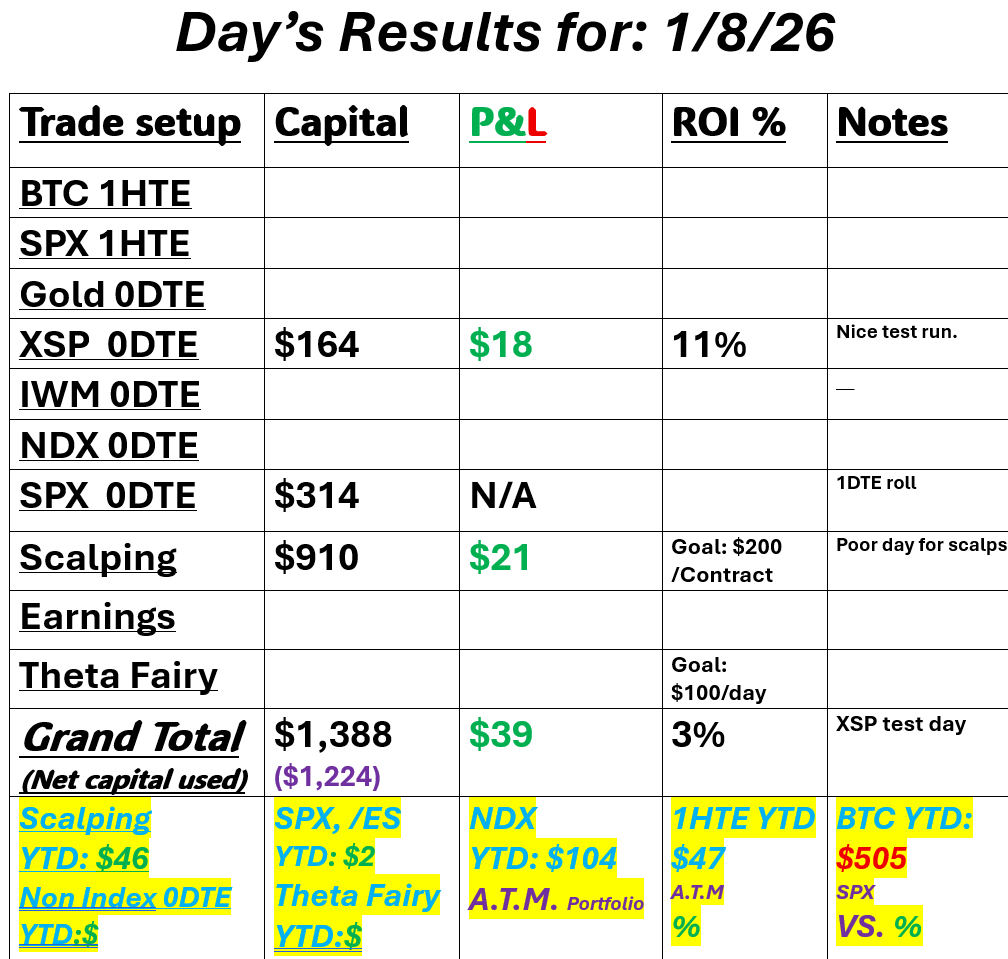

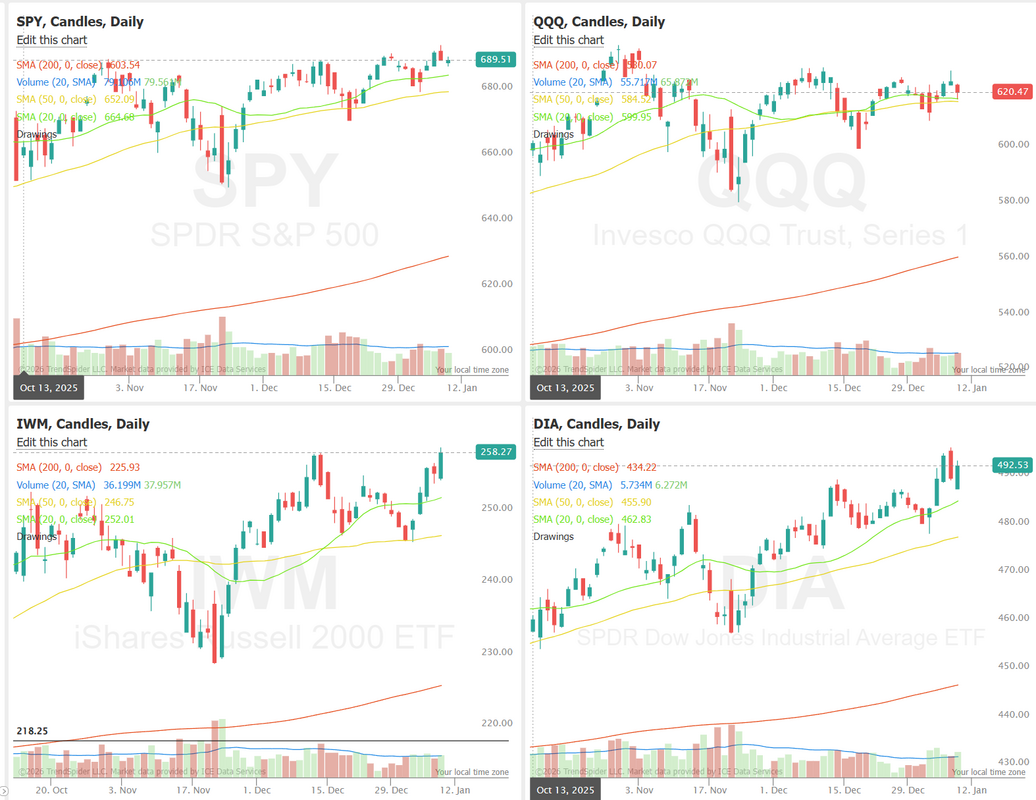

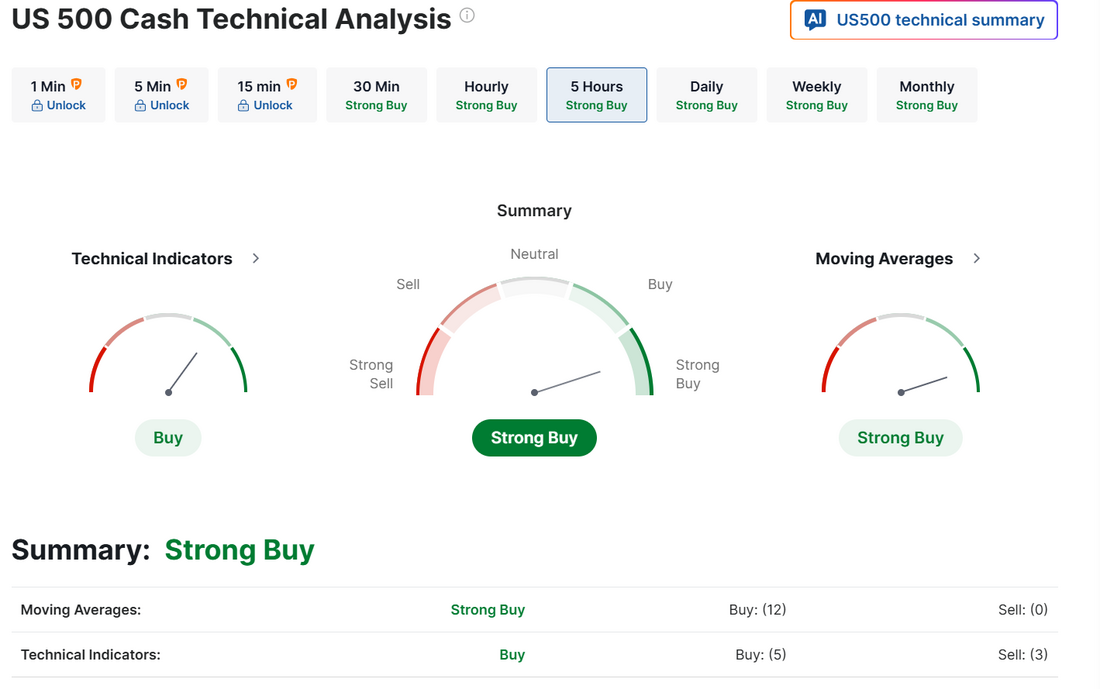

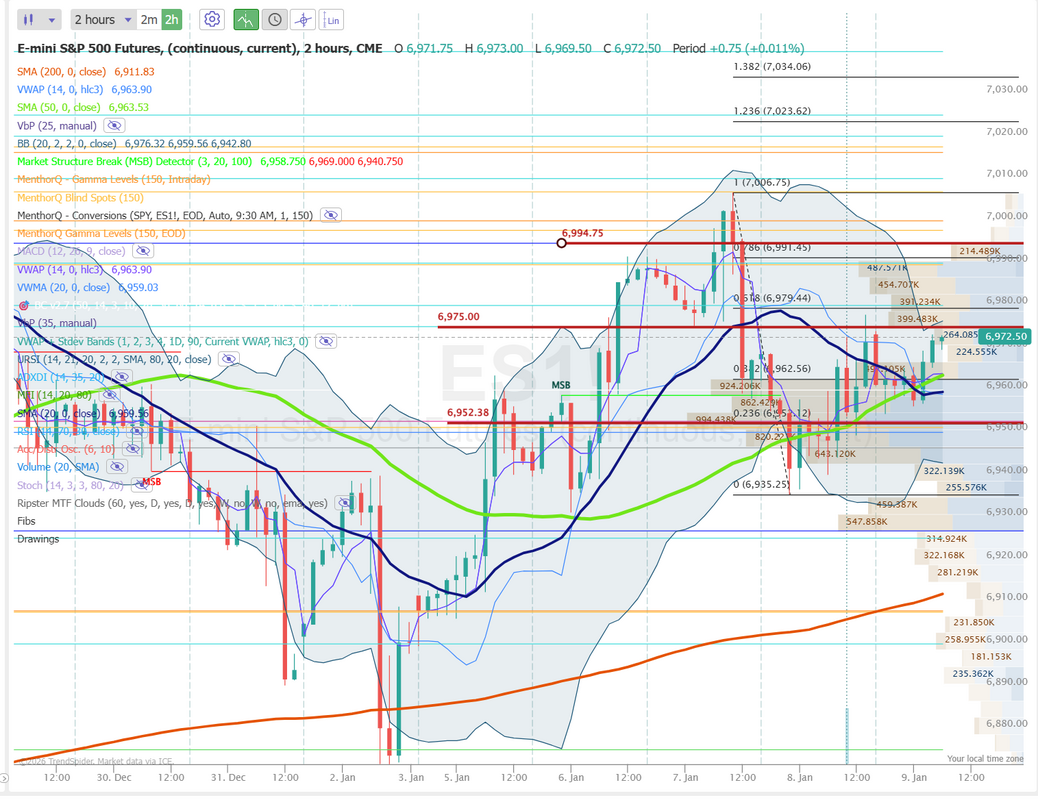

Busy day todayWe've got NFP incoming. A potential ruling on Tariffs. Bank earnings are coming up. The market is coiling and looking ready for a big move. We've got a bullish setup going into the NFP release. We had a nice training yesterday with the break even I.C. strategy and used the XSP for a test. It was an incredibly small test trade so not much cash on the line but the 11% ROI in two hours was right on track. Yesterday wasn't great for scalping but we got a few shots in. Here's a look at our day. Let's take a look at the markets. We continue to coil here. Waiting for the move! Slight bullish bias to start the morning but NFP could alter that. March S&P 500 E-Mini futures (ESH26) are trending up +0.05% this morning as investors await the all-important U.S. payrolls report for more cues on the path of interest rates this year. Market participants also brace for a potential Supreme Court ruling on President Trump’s sweeping tariffs. Hundreds of companies have already queued up, hoping to reclaim their share of the billions of dollars in duties paid to date. “Ahead of payrolls and the possible Supreme Court ruling on ‘Reciprocal Tariffs,’ markets are in cautious mode,” Vishnu Varathan, head of macro research, Asia ex-Japan at Mizuho Securities, wrote in a note. In yesterday’s trading session, Wall Street’s major indices closed mixed. Shares of data storage companies slumped, with Seagate Technology Holdings (STX) sliding over -7% to lead losers in the S&P 500 and Nasdaq 100, and Western Digital (WDC) falling more than -6%. Also, software stocks retreated, with Datadog (DDOG) dropping over -7% and Autodesk (ADSK) slipping more than -5%. In addition, AbbVie (ABBV) fell over -3% after Wolfe Research downgraded the stock to Peer Perform from Outperform. On the bullish side, defense stocks climbed after President Trump called for U.S. military spending to increase to $1.5 trillion in 2027, with AeroVironment (AVAV) rising more than +8% and Huntington Ingalls Industries (HII) gaining over +6%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by +8K to 208K, compared with the 213K expected. Also, U.S. Q3 nonfarm productivity rose +4.9% q/q, in line with expectations, while unit labor costs fell -1.9% q/q, weaker than expectations of no change q/q. In addition, the U.S. October trade deficit unexpectedly narrowed to -$29.4 billion, stronger than expectations of -$58.1 billion and the lowest monthly level since 2009. Finally, U.S. consumer credit rose by $4.23 billion in November, weaker than expectations of $10.1 billion. Fed Governor Stephen Miran said on Thursday that he is looking for 150 basis points of interest rate cuts this year to support the labor market. “I’m looking for about a point and a half of cuts. A lot of that is driven by my view of inflation,” Miran said. “Underlying inflation is running within the noise of our target, and that’s a good indication of where overall inflation is going to be in the medium term.” Meanwhile, U.S. rate futures have priced in an 86.2% chance of no rate change and a 13.8% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that December Nonfarm Payrolls will come in at 66K, compared to the November figure of 64K. “A stronger-than-expected print could trigger a short-term hawkish reaction, particularly with equities at record highs and economic data improving, reducing urgency for the Federal Reserve to commit to further easing,” according to ADSS's Neal Keane. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect the December figures to be +0.3% m/m and +3.6% y/y, compared to +0.1% m/m and +3.5% y/y in November. The U.S. Unemployment Rate will be reported today. Economists anticipate that the December figure will tick down to 4.5% from 4.6% in November. U.S. Building Permits (preliminary) and Housing Starts data for October will be released today. The figures were originally scheduled for release on November 19th, but were delayed due to the fallout from the government shutdown. Notably, the release will also incorporate the September figures. Economists expect October Building Permits to be 1.350 million and Housing Starts to be 1.330 million. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists foresee the preliminary January figure coming in at 53.5, compared to 52.9 in December. In addition, market participants will parse comments today from Minneapolis Fed President Neel Kashkari and Richmond Fed President Tom Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.192%, up +0.17%. I've got a few big levels today with NFP. It's tough to get the finite levels. 6975 is the nearest resistance with the next level all the way up at 6995. 6952 is support. Let's see what the NFP release does to the open. See you all in the live trading room. Let's finish the week strong.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |