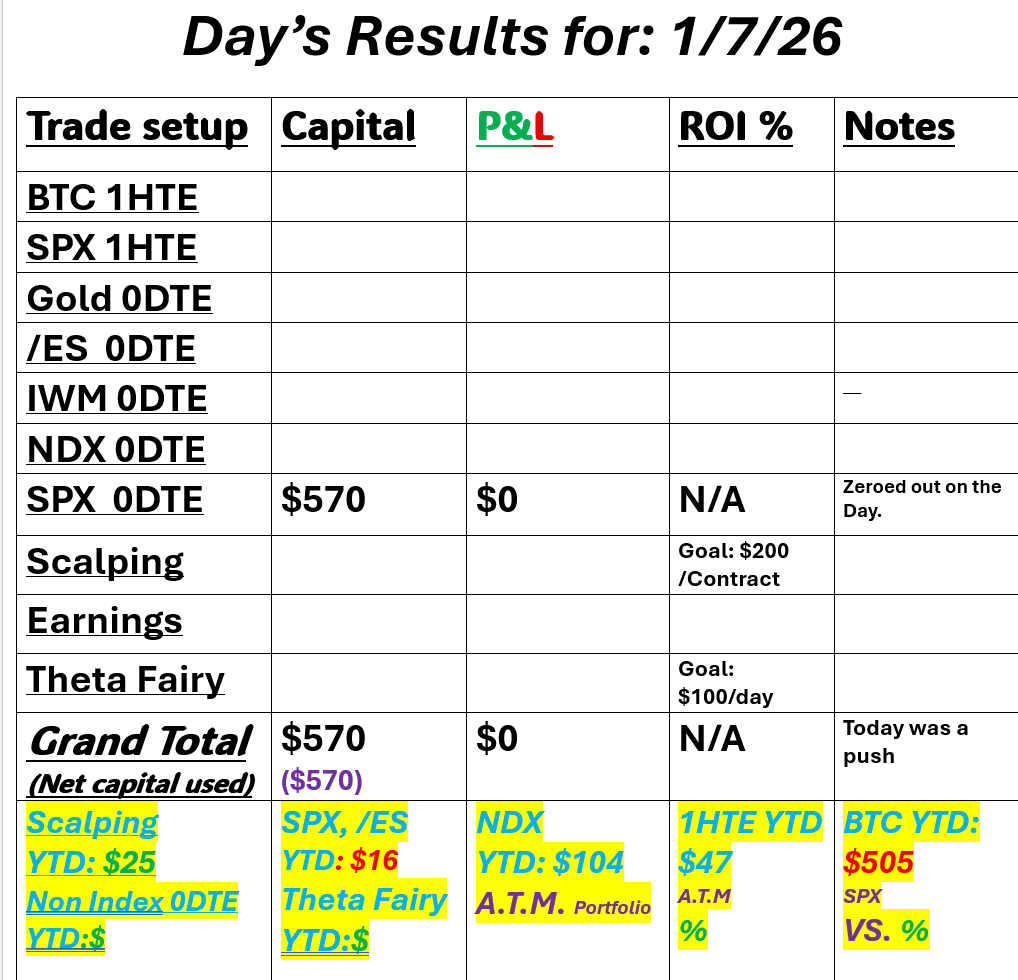

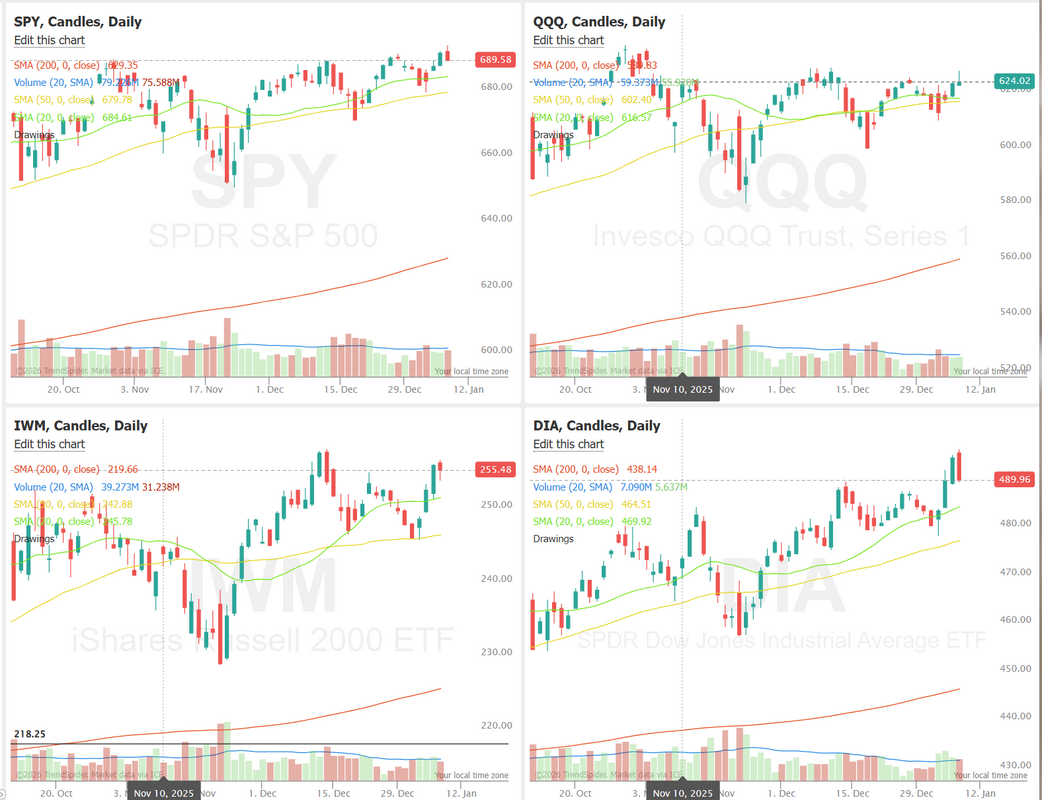

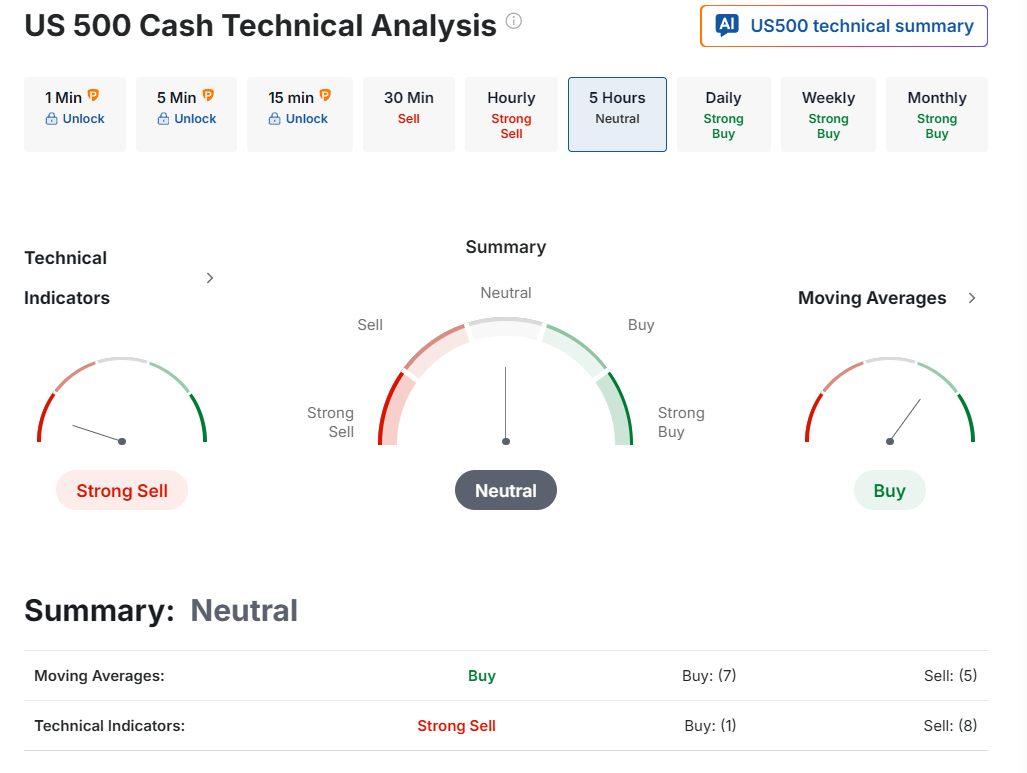

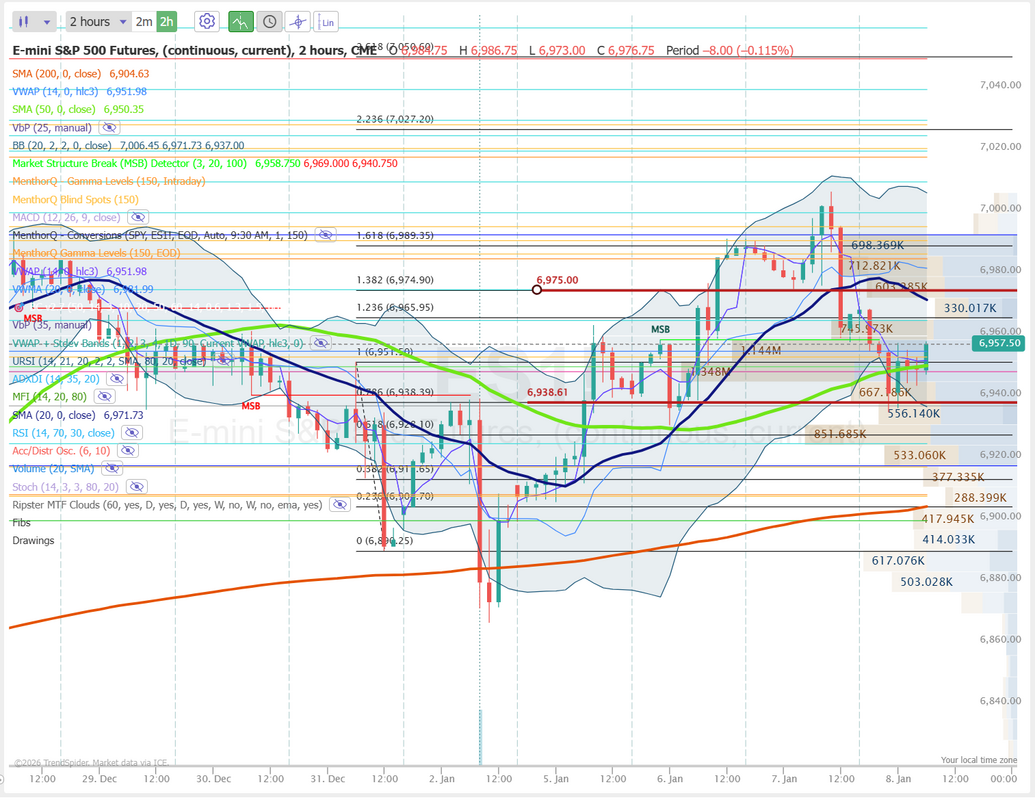

We've got some catalystsVenezuela, Greenland, Trump regulation on defense stocks and institutional RE holdings. Throw in NFP Friday and bank earnings next week… head on a swivel after an amazing start to 26. Oh and the Minnesota news. Oil, Precious metals prices. There's a lot happening right now. Our day yesterday ended up being a push but I'll take it. We have been looking for a retrace and got one yesterday. Had it come earlier in the day it would have been a nice profit. As it was we got out at a break even. Let's take a look at the markets this morning: A bit of a retrace yesterday. Not much but it was there at the end of the day. Weaker technicals this morning with a neutral rating. The SPX continues to grind higher, and the option score has bounced back into the mid-range after briefly dipping last week, suggesting a short-term shift toward steadier sentiment. Price is pressing against recent highs again, and the repeated ability to recover from shallow pullbacks highlights a market still respecting its upward structure. In the near term, the key to watch is whether SPX can hold above the recent cluster of support in the 6,850–6,900 zone; if it does, momentum could stay intact. Conversely, another drop in the option score especially back toward the 0–1 range would signal traders growing more cautious and could indicate choppier action ahead. March S&P 500 E-Mini futures (ESH26) are down -0.19%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.28% this morning, pointing to further losses on Wall Street as investors digest a flurry of announcements from U.S. President Donald Trump on the U.S. housing and defense industries. President Trump announced on Truth Social on Wednesday that he plans to ban large institutional investors from purchasing single-family homes in a bid to lower home prices. Mr. Trump also targeted defense contractors, saying he would prohibit dividend payments and stock buybacks while pledging to cap executives’ pay. Later, the president called for U.S. defense spending to increase to $1.5 trillion in 2027, sending defense stocks soaring in pre-market trading. Investors also weighed the latest U.S. moves on Venezuela, including a plan to take control of the Venezuelan oil industry and the seizure of two tankers. Investors now await a new round of U.S. economic data. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended mixed. Shares of data storage companies retreated, with Western Digital (WDC) slumping over -8% to lead losers in the Nasdaq 100 and Seagate Technology Holdings (STX) falling more than -6%. Also, defense stocks sank after President Trump said he would bar U.S. defense contractors from issuing dividends or buying back their own shares until they invest more in production and research, with Northrop Grumman (NOC) sliding over -5% and Lockheed Martin (LMT) dropping more than -4%. In addition, Apogee Enterprises (APOG) plunged over -13% after the company cut its full-year adjusted EPS guidance. On the bullish side, Intel (INTC) climbed more than +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company unveiled its Core Ultra Series 3 processors, the first consumer chips produced using its 18A manufacturing process. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by +41K in December, weaker than expectations of +49K. Also, the U.S. JOLTs job openings fell to a 14-month low of 7.146 million in November, weaker than expectations of 7.610 million. In addition, U.S. October factory orders fell -1.3% m/m, weaker than expectations of -1.1% m/m. At the same time, the U.S. ISM services index unexpectedly rose to 54.4 in December, stronger than expectations of 52.2. “The November JOLTS data suggests that the labor market continues to gradually soften with fewer job openings than expected and hires falling more than layoffs, but this further cooling seems unlikely to meet the higher bar for another near-term rate cut that was set after the December FOMC meeting,” according to Marco Casiraghi, economist at Evercore ISI. Meanwhile, U.S. rate futures have priced in an 86.2% probability of no rate change and a 13.8% chance of a 25 basis point rate cut at January’s monetary policy meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 213K, compared to last week’s number of 199K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. The preliminary third-quarter figures were originally scheduled for release on November 6th, but were delayed due to the government shutdown. Economists forecast Q3 Unit Labor Costs to be unchanged q/q and Nonfarm Productivity to be +4.9% q/q, compared to the second-quarter numbers of +1.0% q/q and +3.3% q/q, respectively. U.S. Trade Balance data for October will be released today. The data was originally scheduled for release on December 4th, but was delayed due to the fallout from the shutdown. Economists anticipate that the trade deficit will widen to -$58.1 billion from -$52.8 billion in September. U.S. Wholesale Inventories data will come in today. Economists forecast that the final October figure will come in at +0.2% m/m. The Fed’s Consumer Credit report will be released today as well. Economists expect the U.S. Consumer Credit to be $10.1 billion in November, compared to the previous figure of $9.2 billion. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.16%, up +0.02%. Todays training will focus on the BEIC or Break even Iron condor. This is a 0DTE setup that manages each spread independently. We'll set one up this morning on the SPX. You can use the XSP alternatively if you'd like to position size smaller. Let's take a look at the intraday levels: I've got two big levels again today. 6975 as resistance and 6938 as support. We've got some pivot points in-between these levels which I'll line out in our zoom session. I look forward to our training today and I'll see you all shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |