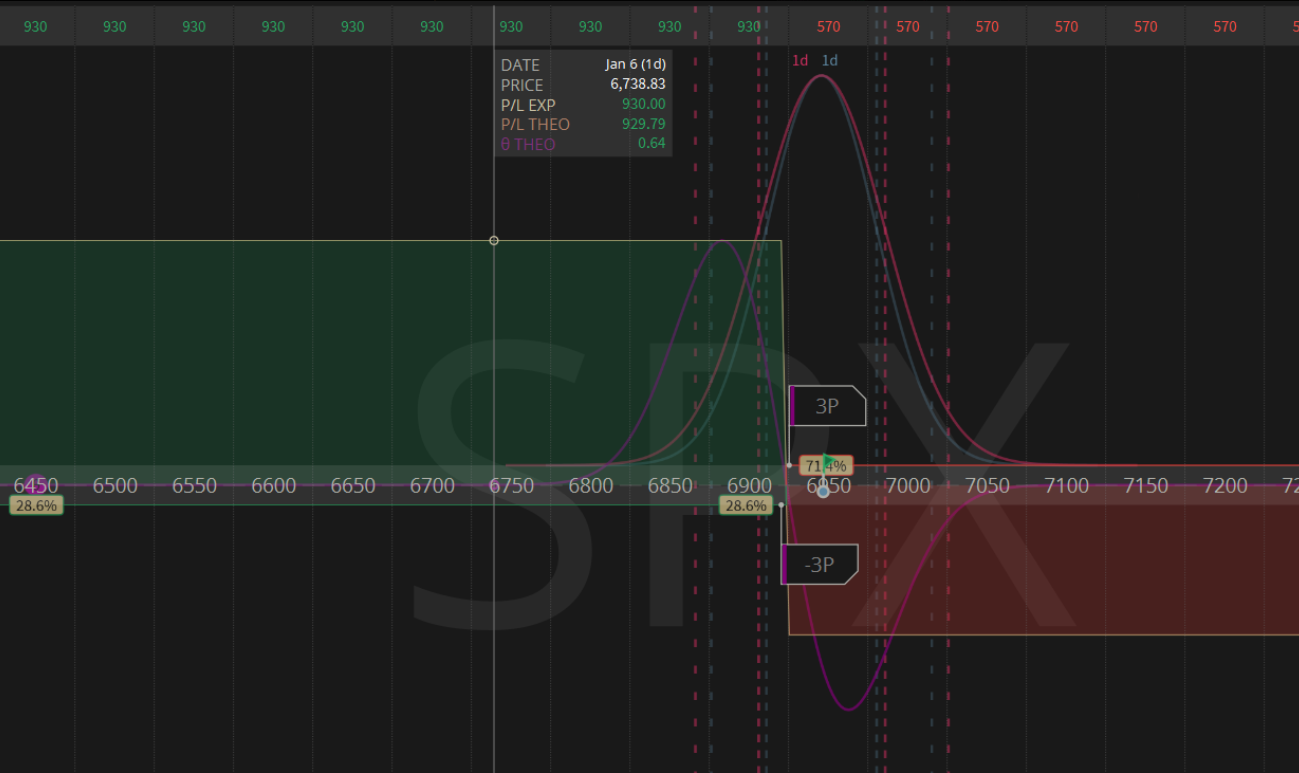

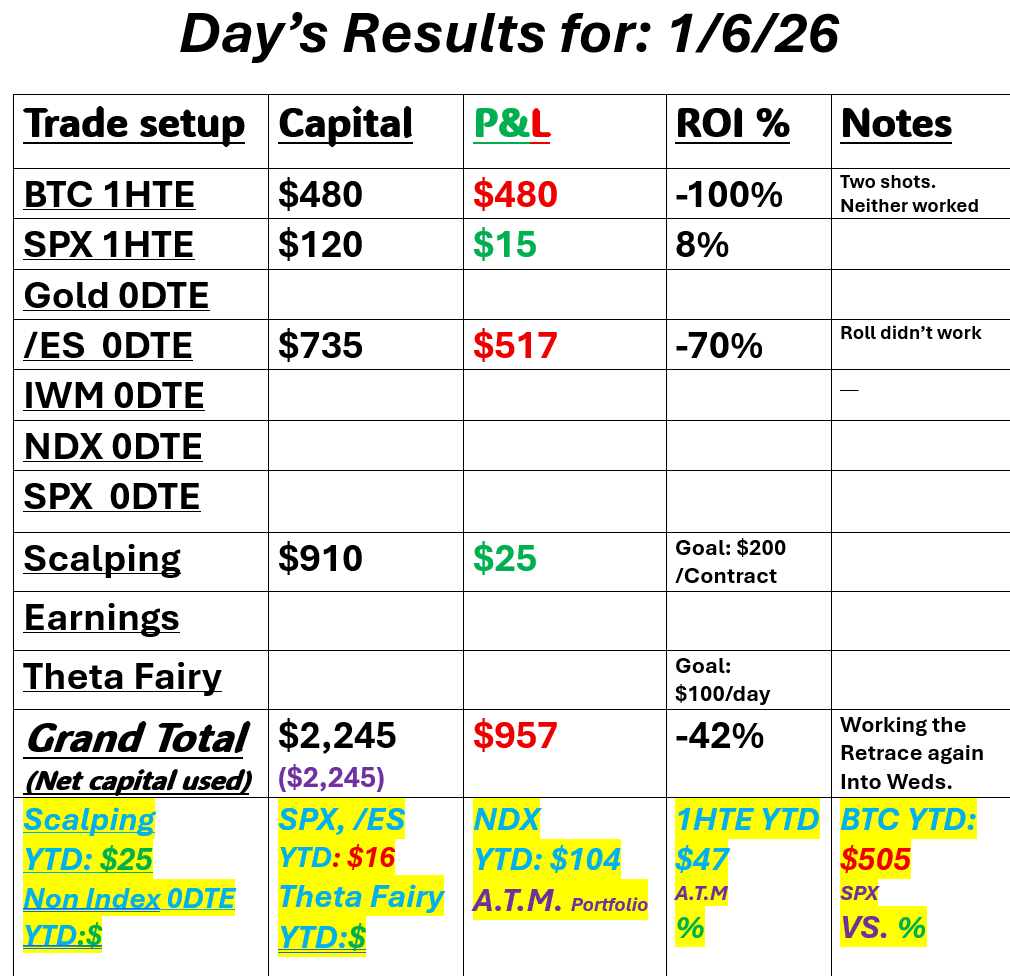

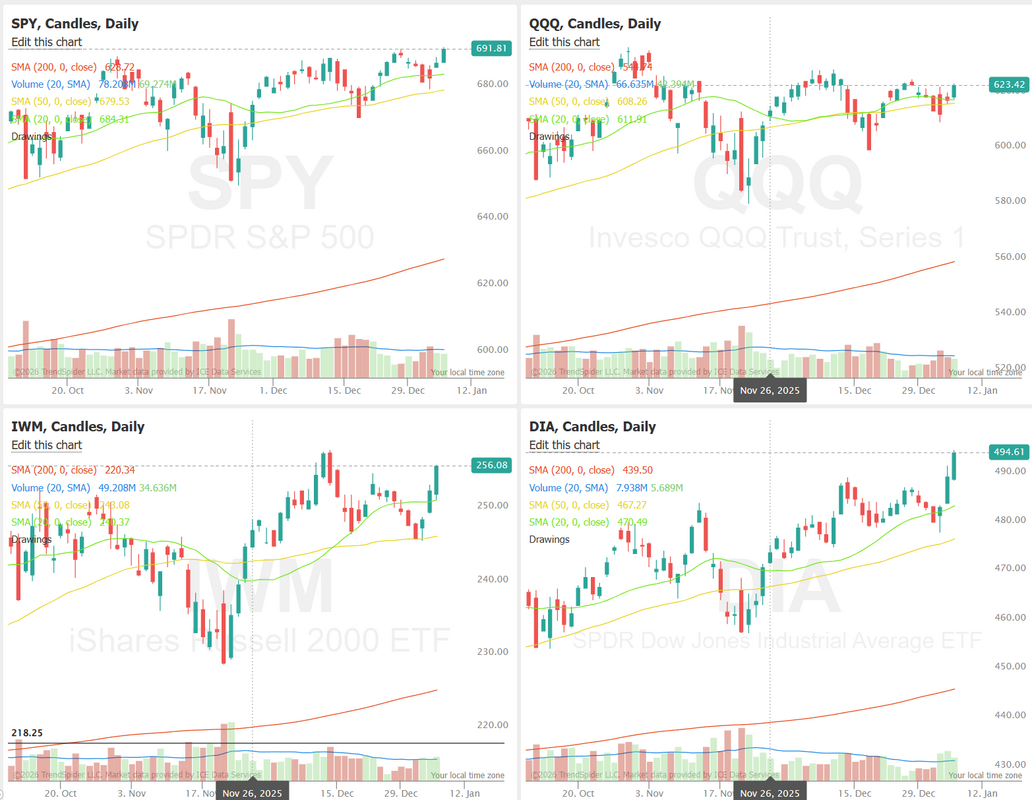

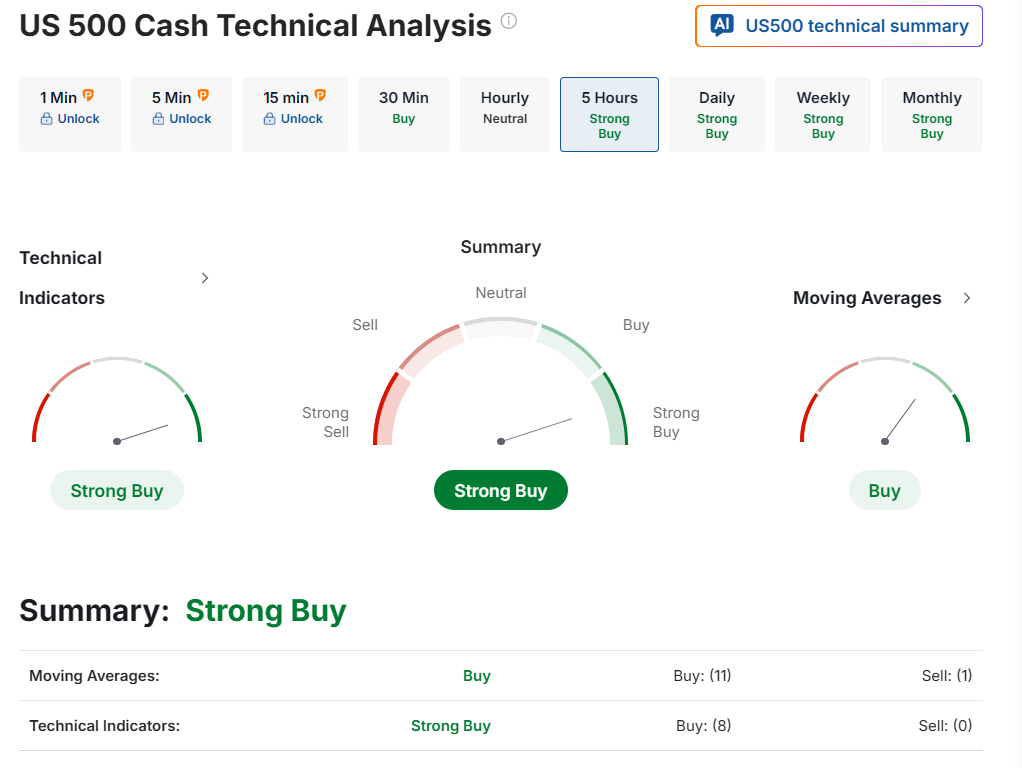

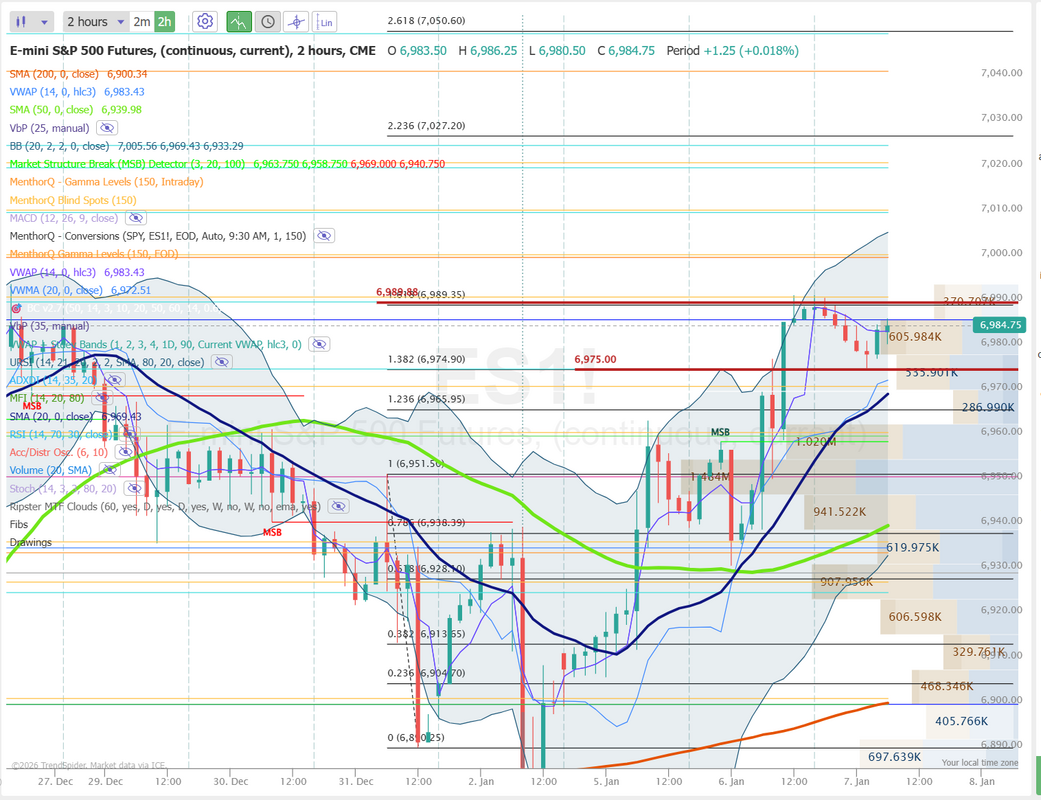

Market divergenceIt's been very interesting to watch the rotation in the market this week. Defense stocks and Oil companies are surging off the Venezuela "situation" while the Mag7 are lagging. SPX and DIA hit new ATH's. Will the Techs drag us back down or will the new leaders continue to pull us up? I've been working a retrace trade all week with no luck. I've rolled it again today to the SPX this time. This is what I'm starting the day with. Here's a look at my day for yesterday. Not much success. Let's take a look at the markets to start the day: As I mentioned, SPX and DIA hit new ATH's. If we are to get a retrace today could be the day. Technicals are still pointing bullish March S&P 500 E-Mini futures (ESH26) are trending down -0.12% this morning as caution prevails ahead of the release of U.S. jobs data that could offer clues on the timing of the Federal Reserve’s next interest rate cut. Lower bond yields today are limiting losses in S&P 500 futures. The 10-year T-note yield fell three basis points to 4.14%. Oil prices fell on Wednesday after U.S. President Donald Trump said Venezuela’s interim authorities would turn over 30 million to 50 million barrels of crude to the U.S., a move seen as adding to an already oversupplied oil market. President Trump said in a Truth Social post that he has directed Energy Secretary Chris Wright to immediately carry out his plan for shipping the oil directly to U.S. docks. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the S&P 500 and Dow notching record highs. Shares of data storage companies rallied, with Sandisk (SNDK) jumping over +27% to lead gainers in the S&P 500 and Western Digital (WDC) climbing more than +16% to lead gainers in the Nasdaq 100. Also, most chip stocks advanced, led by a more than +11% surge in Microchip Technology (MCHP) after it raised its Q3 revenue guidance. In addition, OneStream (OS) soared over +28% after buyout firm Hg Capital agreed to acquire the company for about $6.4 billion in cash. On the bearish side, American International Group (AIG) slumped more than -7% and was the top percentage loser on the S&P 500 after announcing that CEO Peter Zaffino will retire by mid-year and be succeeded by Aon Plc.’s Eric Andersen. Economic data released on Tuesday showed that the U.S. December S&P Global services PMI was revised downward to 52.5 from the preliminary reading of 52.9. Richmond Fed President Tom Barkin said on Tuesday that the outlook for monetary policy remains in a “delicate balance” amid the conflicting pressures from rising unemployment and still-elevated inflation. Barkin added that interest rates are now within the range of estimates for the so-called neutral rate following last year’s policy easing. At the same time, Fed Governor Stephen Miran said the central bank will need to lower interest rates by more than a percentage point this year, arguing that monetary policy is “holding the economy back.” Meanwhile, U.S. rate futures have priced in an 83.9% chance of no rate change and a 16.1% chance of a 25 basis point rate cut at the January FOMC meeting. Today, all eyes are on the U.S. ADP private payrolls report, which is set to be released in a couple of hours. Economists, on average, forecast that the December ADP Nonfarm Employment Change will stand at 49K, compared to the November figure of -32K. The U.S. JOLTs Job Openings figures will also be closely monitored today. Economists anticipate that the November JOLTs Job Openings will arrive at 7.610 million, compared to the October figure of 7.670 million. The U.S. ISM Non-Manufacturing PMI will come in today. Economists expect the December ISM services index to be 52.2, compared to the previous value of 52.6. U.S. Factory Orders data for October will be released today. The report was originally scheduled for release on December 5th, but was delayed due to the fallout from the government shutdown. Economists expect this figure to drop -1.1% m/m in October, following a +0.2% m/m rise in September. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.2 million barrels, compared to last week’s value of -1.9 million barrels. In addition, market participants will be anticipating a speech from Fed Vice Chair for Supervision Michelle Bowman. On the earnings front, Corona beer maker Constellation Brands (STZ), investment bank Jefferies Financial (JEF), and data center operator Applied Digital (APLD) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.141%, down -0.93%. Todays training should be an interesting one. What are the key reasons NOT to trade? We always look to trade. Today we'll talk about when we should just pack it up and come back another day. Come join us in our live zoom session. Let's take a look at the key levels for intraday /ES today. I have two key levels. 6990 on the resistance side and 6975 on the support side. A break above or below those key levels would signal an entry point for me today. Let's see if we can work this bearish debit into the profits today. See you all shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |