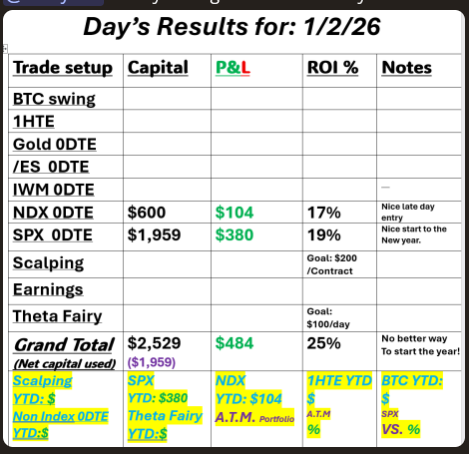

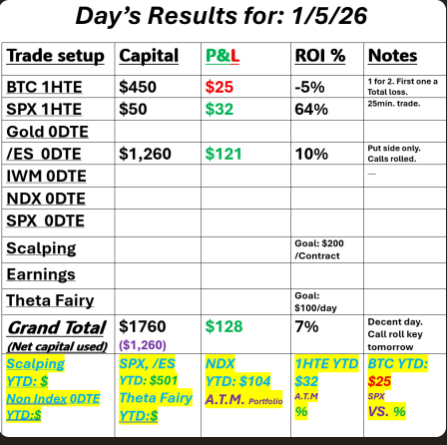

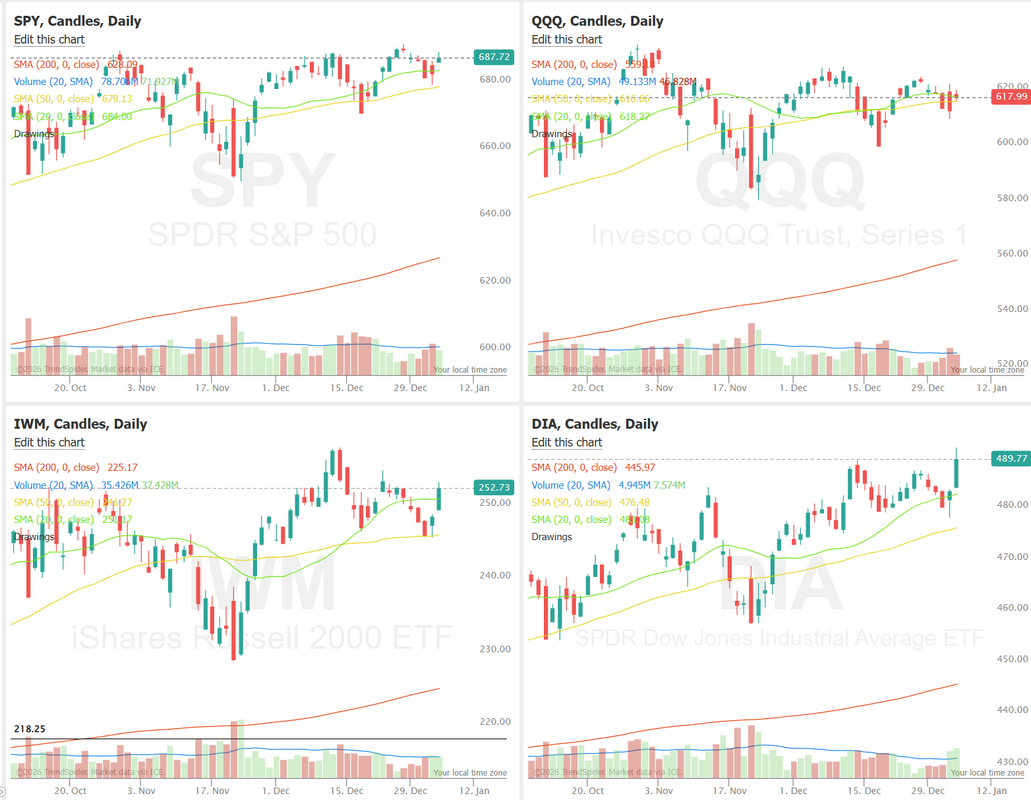

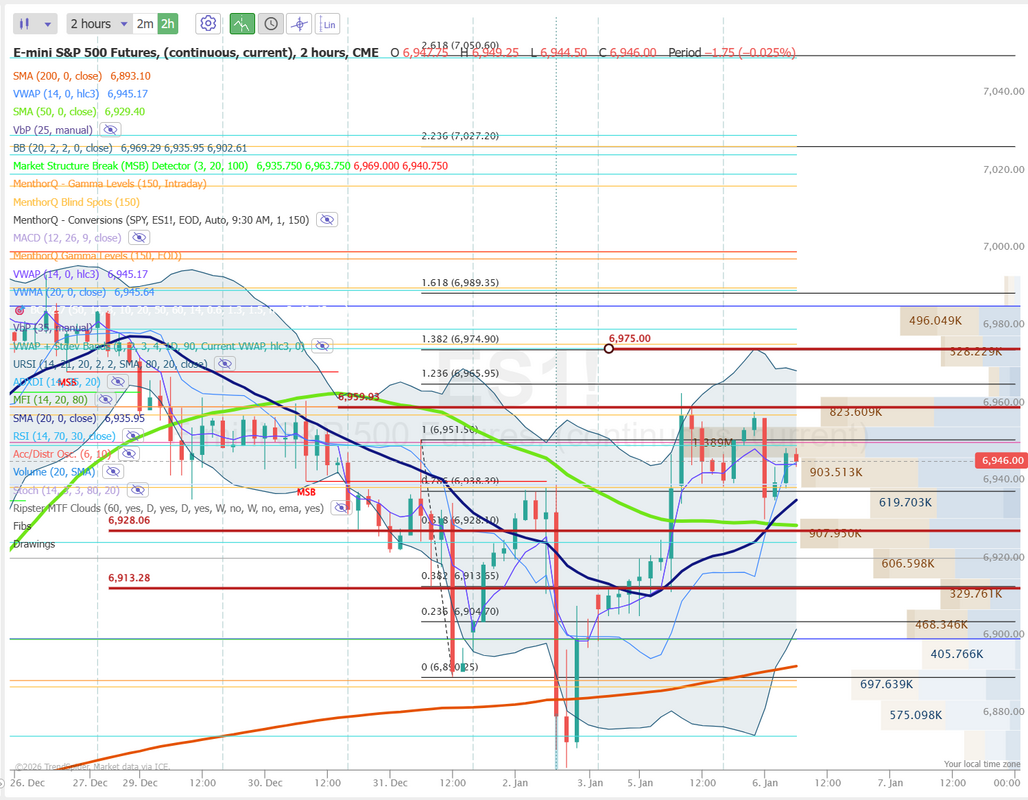

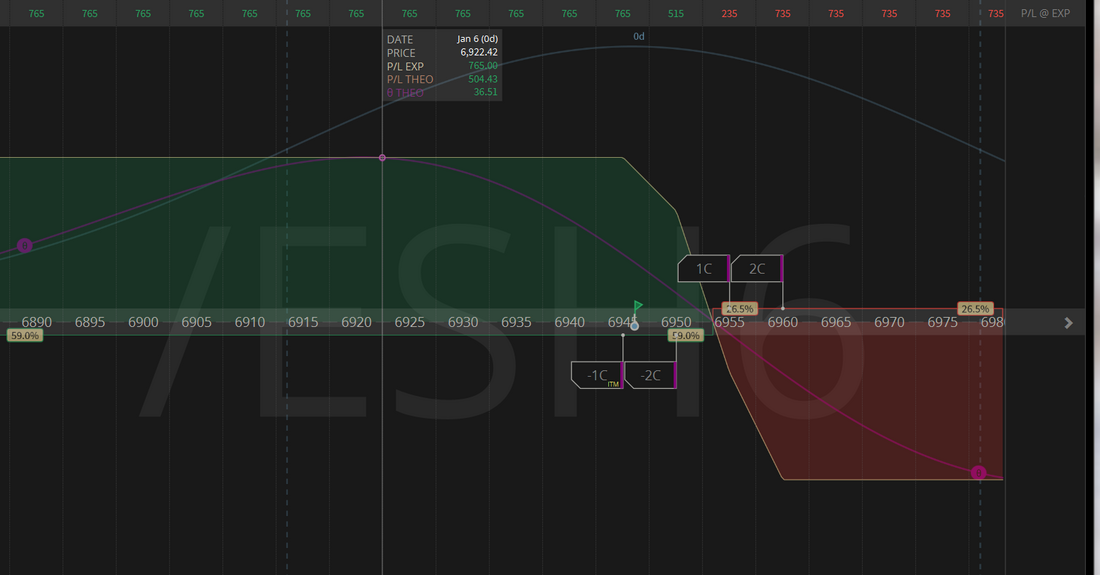

Back to normal?Welcome back folks. Holidays are over. Markets are back to normal (whatever that is). We've had a decent start to the year. Here's a look at Monday and yesterdays results. Let's take a look at the markets. The DOW had a banner day and the IWM was strong as well. The SPY and QQQ are still coiling for the next move. March S&P 500 E-Mini futures (ESH26) are down -0.06%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.07% this morning, taking a breather after the AI-driven rally seen in the first trading days of 2026. Higher bond yields today are weighing on stock index futures. The 10-year T-note yield rose two basis points to 4.19%. Investors look ahead to a slew of key U.S. economic data this week for more clues on the monetary policy outlook. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green, with the Dow notching a new all-time high. Energy stocks rallied after President Trump proposed a U.S.-led effort to revive Venezuela’s oil industry, with Valero Energy (VLO) surging over +9% to lead gainers in the S&P 500 and Chevron (CVX) climbing more than +5% to lead gainers in the Dow. Also, most chip stocks advanced, with KLA Corp. (KLAC) rising over +6% and Applied Materials (AMAT) gaining more than +5%. In addition, International Business Machines (IBM) rose more than +1% after Jefferies upgraded the stock to Buy from Hold with a price target of $360. On the bearish side, Versant Media Group (VSNT) plunged over -13% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company was spun off from Comcast Corp. Economic data released on Monday showed that the U.S. December ISM manufacturing index unexpectedly fell to 47.9, weaker than expectations of 48.3. This marked the lowest reading of the year and the 10th consecutive month of contraction in the factory sector. “A continuation of soft data would likely reinforce expectations of a more dovish Federal Reserve stance in 2026, with markets currently pricing in two rate cuts by the end of the year,” said Naga’s Frank Walbaum. Minneapolis Fed President Neel Kashkari said on Monday that interest rates may now be near a neutral level for the U.S. economy, leaving incoming data to steer the central bank’s next moves. Meanwhile, U.S. rate futures have priced in an 83.9% probability of no rate change and a 16.1% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Today, investors will focus on the U.S. S&P Global Composite PMI, set to be released in a couple of hours. Economists forecast that the final December figure will be unrevised at 53.0. The U.S. S&P Global Services PMI will also be released today. Economists expect the final December figure to be unrevised at 52.9. In addition, market participants will be looking toward a speech from Richmond Fed President Tom Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.189%, up +0.50%. The SPX is grinding sideways after a mild pullback, and short-term volatility dynamics are showing a notable shift. The Volatility Risk Premium has climbed back into positive territory at 2.6%, placing implied volatility in the overvalued zone relative to realized moves and sitting in the 71st percentile of its 3-month range. That typically reflects a market where options are being priced for more movement than the index is currently delivering. In the near term, this kind of elevated IV relative to realized volatility can act as a stabilizer for price action, as dealers tend to lean into volatility selling and dampen swings. However, if SPX breaks out of its current consolidation, the VRP can compress quickly. For now, the setup points to a short-term environment where choppy but controlled price action may persist until a catalyst forces volatility to reprice. QQQ is hovering in the middle of its 20-day swing range, with the model showing a risk trigger at ~586 and an upper band near ~650. With price currently drifting sideways below the midpoint of the range, the options landscape suggests a market that hasn’t committed to a breakout or breakdown. The strong historical hit rates 85% for upper-band touches and 100% for lower-band touches highlight how responsive QQQ tends to be when momentum expands. In the short term, traders may view the clustering of candles around the mid-range as a sign of compression, where the next decisive move could come once volatility picks up. For now, the model points to a waiting game: watching whether QQQ gravitates upward toward the upper-band magnet or slides back toward the risk trigger if weakness builds. PMI should be the driver this morning. Can it unleash a move in the SPY/QQQ? It's been over a week of coiling. Let's look at the intraday levels on /ES for today. 6959, 6975 are resistance levels for this morning. 6928, 6913 are support. We've got a call side entry already open this morning on /ES. I'll wait for PMI to see if we get an early driver before looking to enter anything else. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |