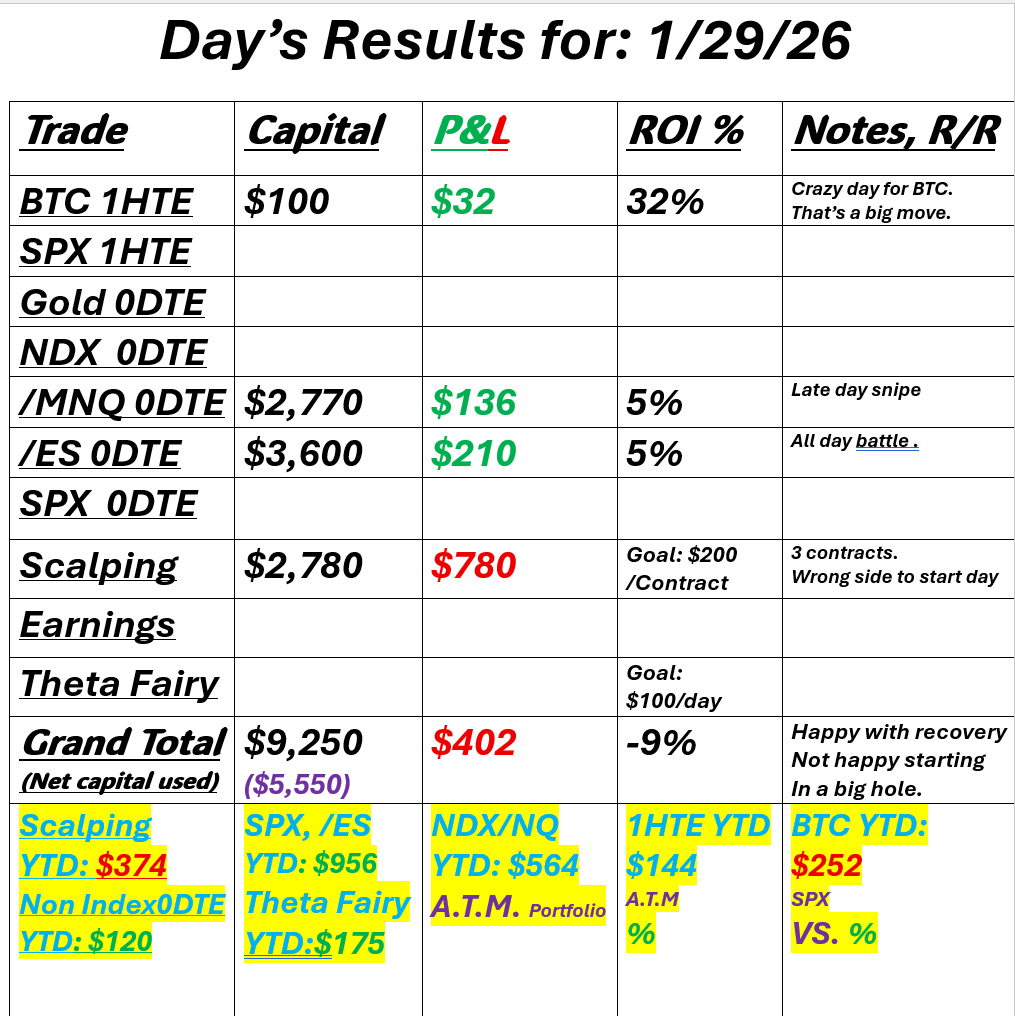

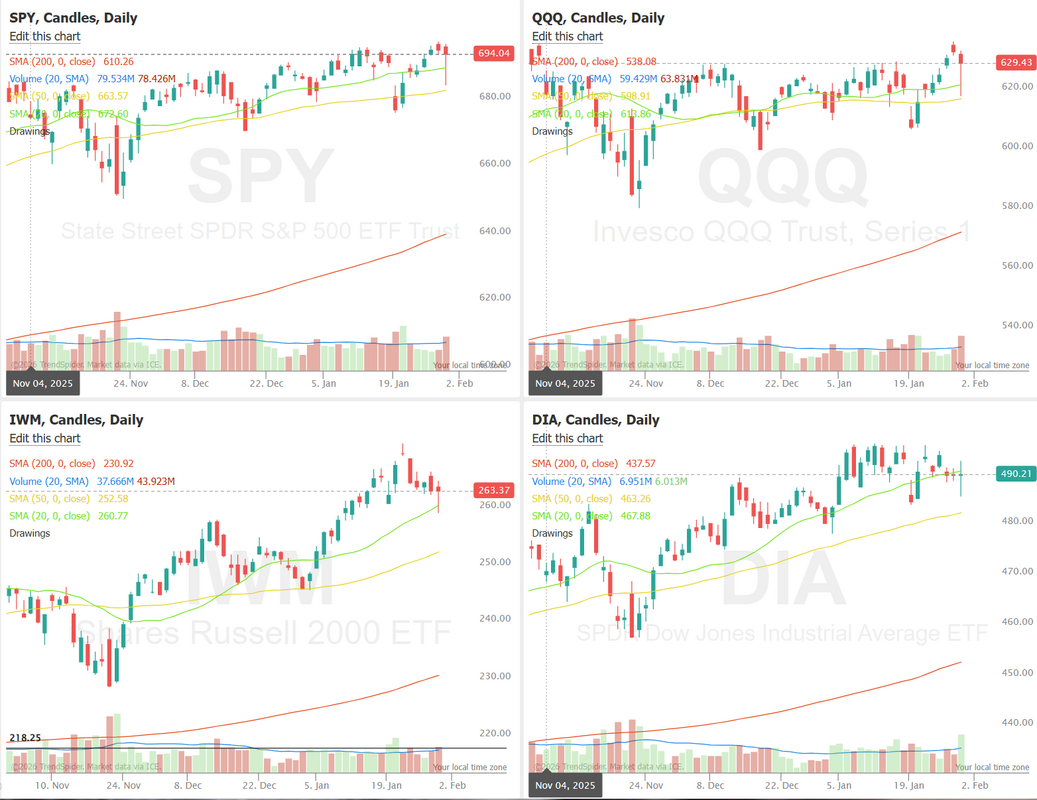

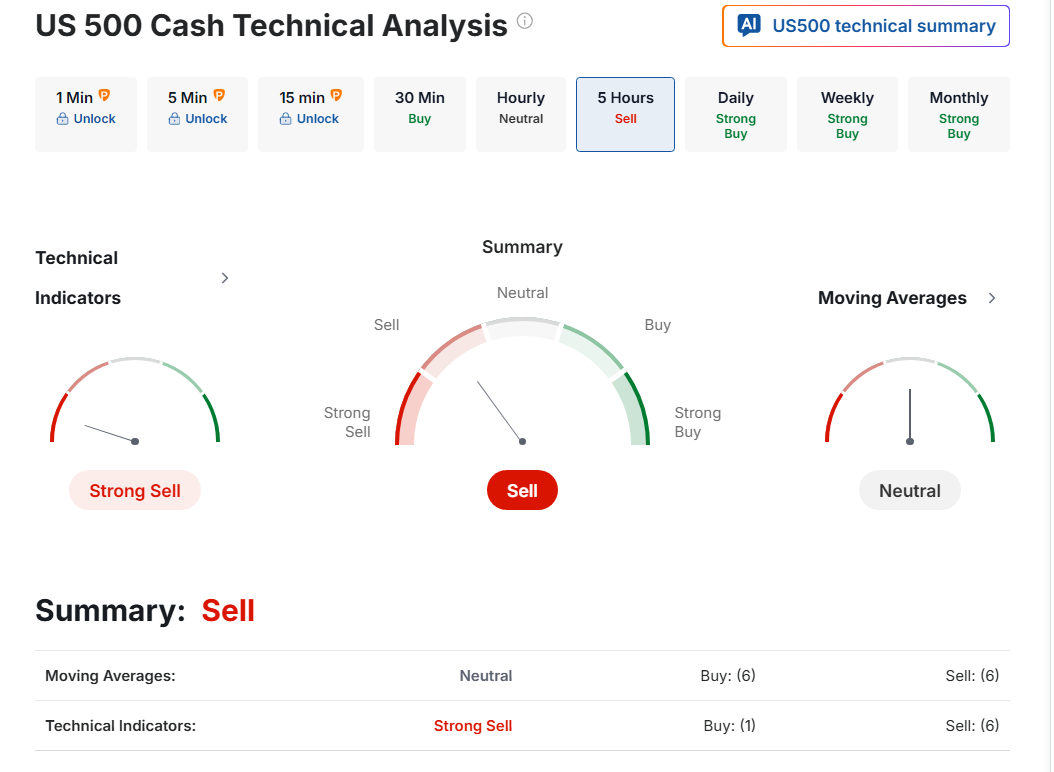

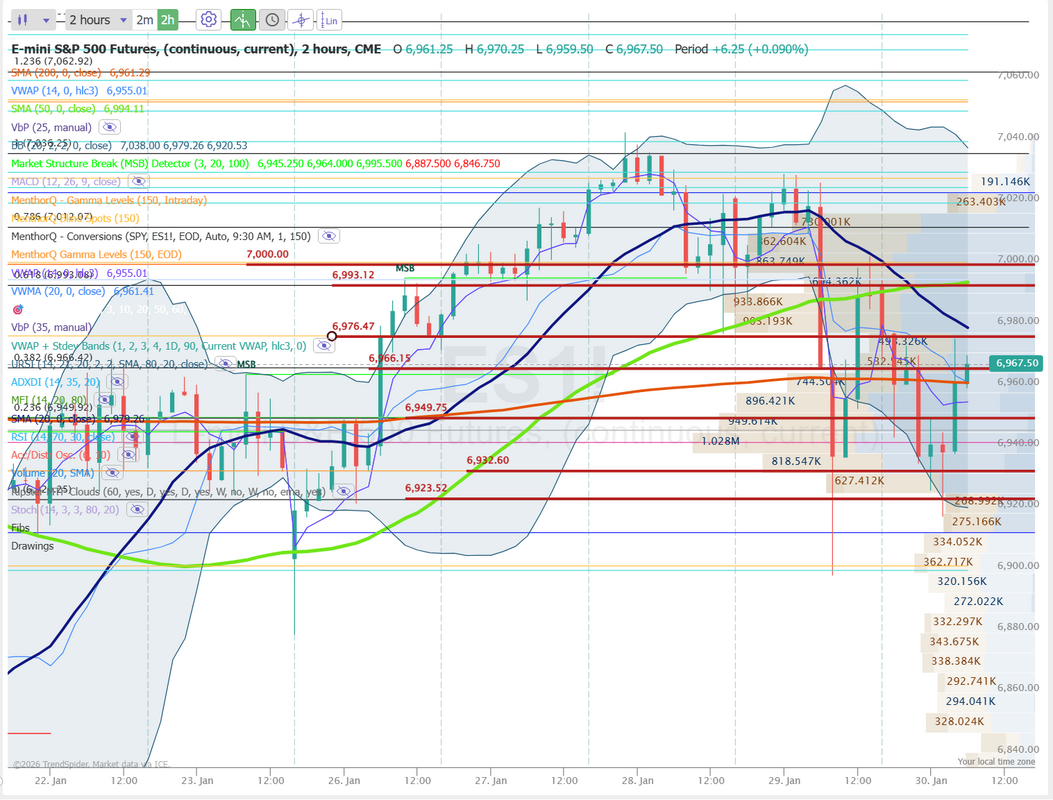

Was that a flush I heard?That was a pretty big flush to start the day yesterday. We usually love these days. Unfortunately, I already had two bullish trades on when it happened! That put me in a big hole that I had to spend the rest of the day trying to dig out of. I made some solid progress, but not all the way to an overall green day. Here's a look at the battlefield for me yesterday. I'm super happy with our ability to climb back (at one point, I was down $2,300), but still frustrating to start in a hole like that. Let's take a look at the markets. Most of yesterday morning's flush was absorbed later in the day. In spite of how red the candles were yesterday those long tails are a bullish sign. We've got a slight sell signal technically to start the day. Most of the major averages were able to claw back above their respective 50DMA yesterday so it will be interesting to see if buyers set in and "buy the dip" today like they have for, what seems like forever. The "buy the dip" trade has been remarkably reliable. Is today another opportunity to establish longs? For trade setups today, I've got a couple of ideas. #1. The 1HTE BTC early day setups don't look great right now. We may get something there later in the day. #2. I'd like to start our 0DTE off with Gold, then into /NQ. and possibly /RTY as well. #3. Scalping could offer up some good opportunities today as well. Let's take a look at the intraday /ES levels. 6966 seems to be the current inflection point. Above that, 6976, 6993, and 7000 are working as resistance levels. 6949, 6932, 6923 are support levels. March S&P 500 E-Mini futures (ESH26) are down -0.40%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.47% this morning after U.S. President Donald Trump nominated Kevin Warsh as the next Federal Reserve chair. “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is “central casting,” and he will never let you down,” Trump said on Truth Social. U.S. equity futures and Treasuries pared earlier losses following the announcement, with investors weighing how aggressively Warsh might cut interest rates. Earlier on Friday, Bloomberg reported that the Trump administration is preparing for the president to nominate Warsh as the next Fed chair. Warsh, who served as a policymaker from 2006 to 2011, frequently highlighted inflation risks even as others focused on supporting growth and employment during the financial crisis. In yesterday’s trading session, Wall Street’s major indices closed mixed. Microsoft (MSFT) plunged about -10% and was the top percentage loser on the Dow after the technology behemoth’s spending climbed to a record high and cloud sales growth slowed in FQ2, fueling concerns that it may take longer than anticipated for the company’s AI investments to pay off. Also, Las Vegas Sands (LVS) tumbled more than -13% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q4 Macau profit. In addition, United Rentals (URI) slumped over -12% after the equipment rental company posted downbeat Q4 results. On the bullish side, Meta Platforms (META) surged over +10% and was the top percentage gainer on the Nasdaq 100 after the social media giant posted upbeat Q4 results and issued strong Q1 revenue guidance. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell by -1K to 209K, compared with the 206K expected. Also, U.S. Q3 nonfarm productivity and unit labor costs were unrevised at +4.9% q/q and -1.9% q/q, respectively, in line with expectations. In addition, the U.S. November trade deficit widened to -$56.8 billion, weaker than expectations of -$43.4 billion. Finally, U.S. factory orders rose +2.7% m/m in November, stronger than expectations of +1.7% m/m. Meanwhile, President Trump and Senate Democrats have struck a tentative agreement to avert a U.S. government shutdown, as the White House continues talks with Democrats over imposing new limits on immigration raids that have sparked a national outcry. In tariff news, President Trump on Thursday threatened to slap Canada with a 50% tariff on any aircraft sold in the U.S. and also signed an executive order that would impose tariffs on goods from countries that sell or supply oil to Cuba. Today, investors will focus on the U.S. Producer Price Index for December, which is set to be released in a couple of hours. The December reading was originally scheduled for release on January 14th, but was delayed due to the fallout from the longest-ever government shutdown. Economists, on average, forecast that the U.S. December PPI will stand at +0.2% m/m and +2.7% y/y, compared to the previous figures of +0.2% m/m and +3.0% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect December figures to be +0.2% m/m and +2.9% y/y, compared to November’s numbers of no change m/m and +3.0% y/y. The U.S. Chicago PMI will be released today as well. Economists forecast the January figure at 43.5, the same as in December. In addition, market participants will be anticipating speeches from Fed Vice Chair for Supervision Michelle Bowman and St. Louis Fed President Alberto Musalem. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), American Express (AXP), Verizon (VZ), and SoFi Technologies (SOFI) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. U.S. rate futures have priced in an 82.6% probability of no rate change and a 17.4% chance of a 25 basis point rate cut at the next central bank meeting in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.251%, up +0.54%. Yesterdays price action presented ample opportunities and today could be similar. Let's see if we can capitalize on them and finish the week strong! See you all shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |