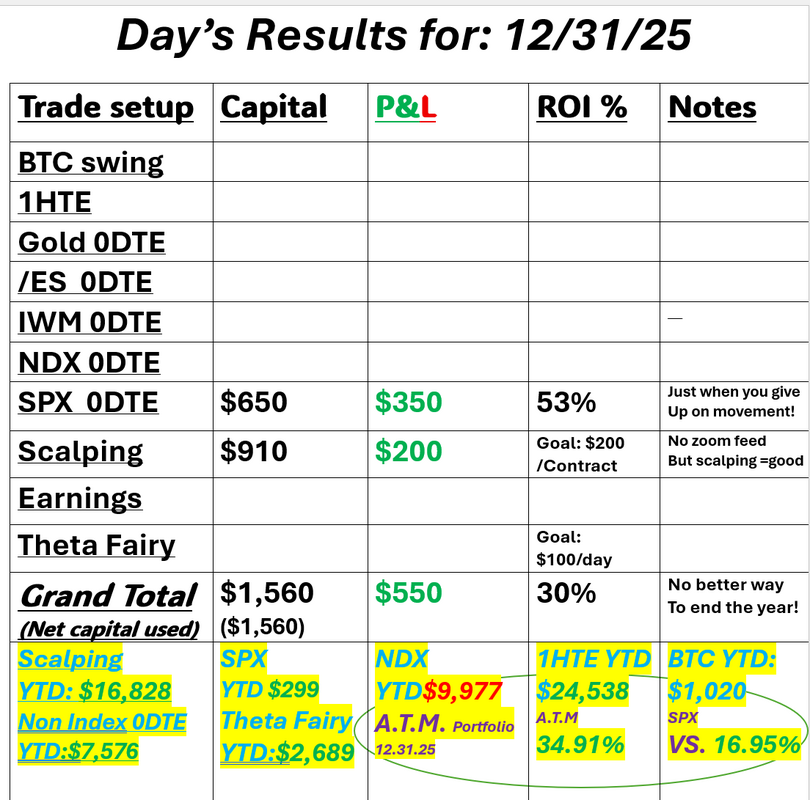

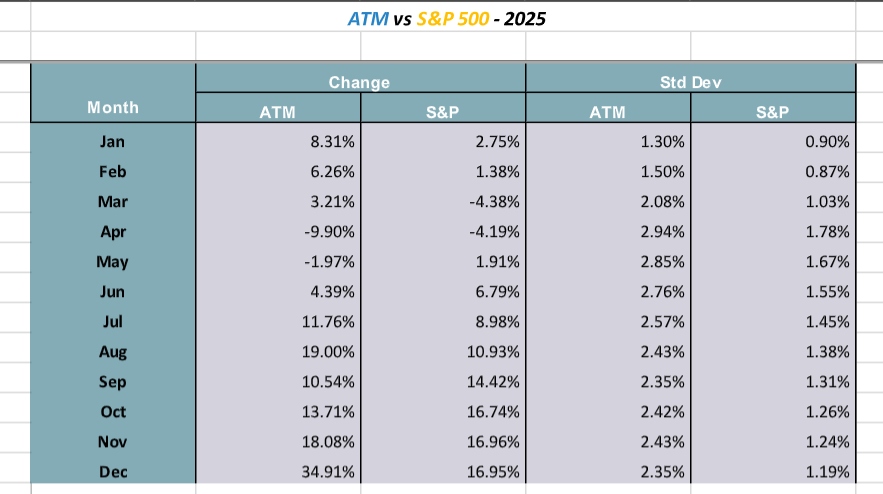

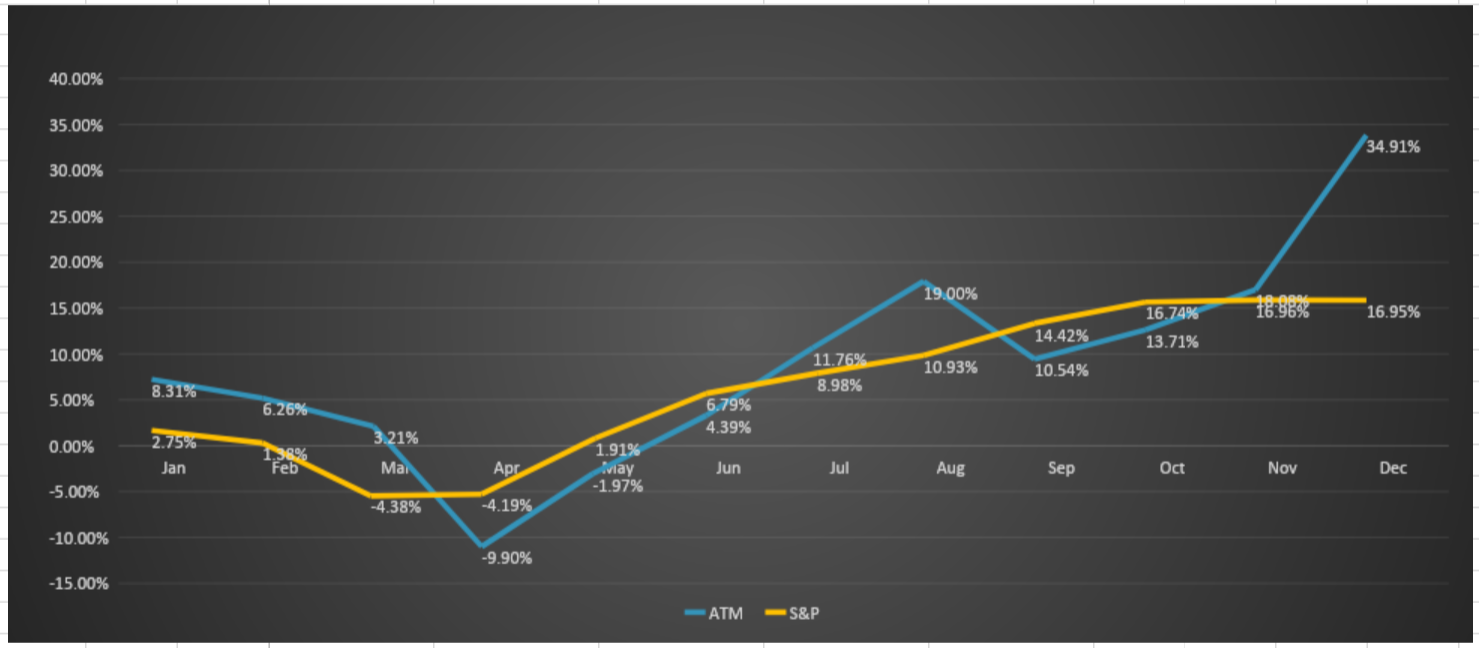

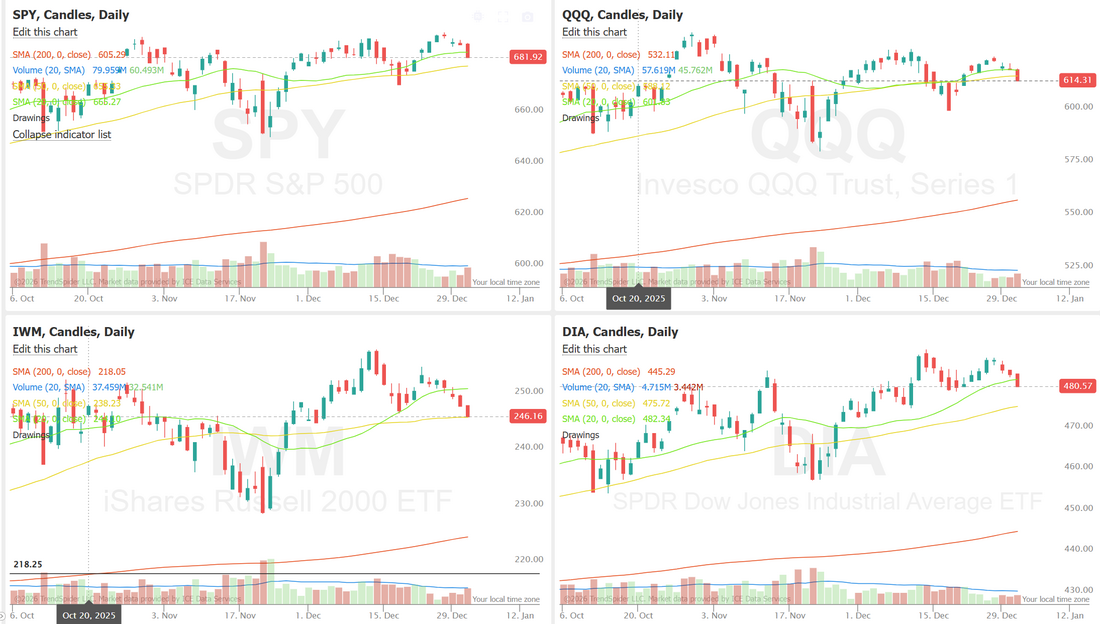

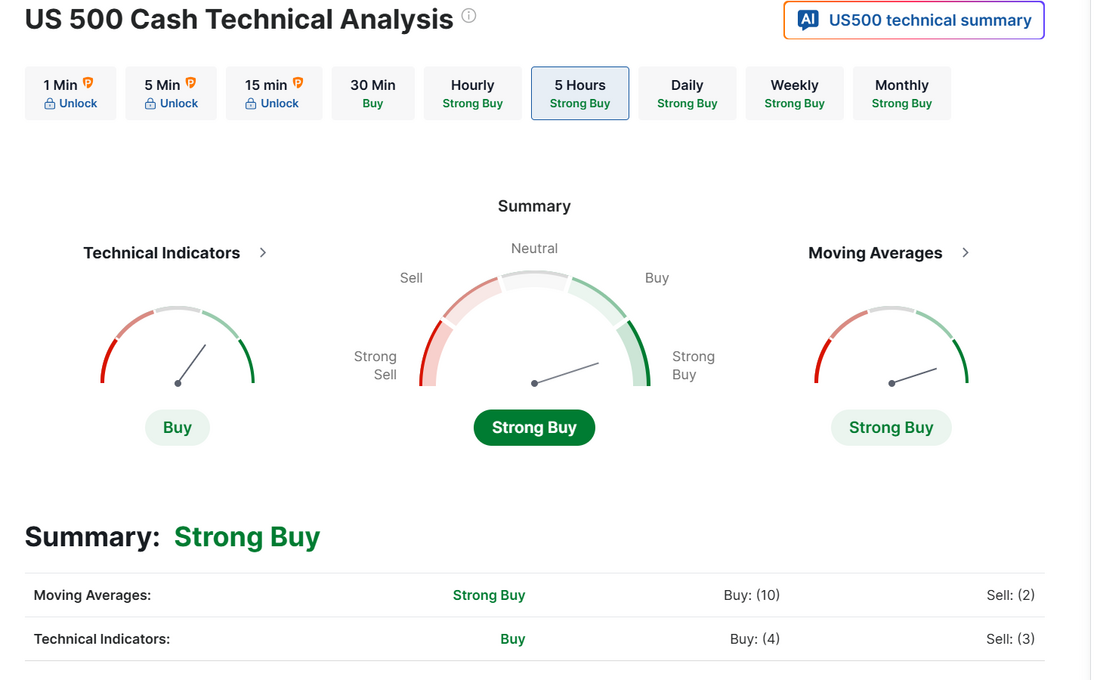

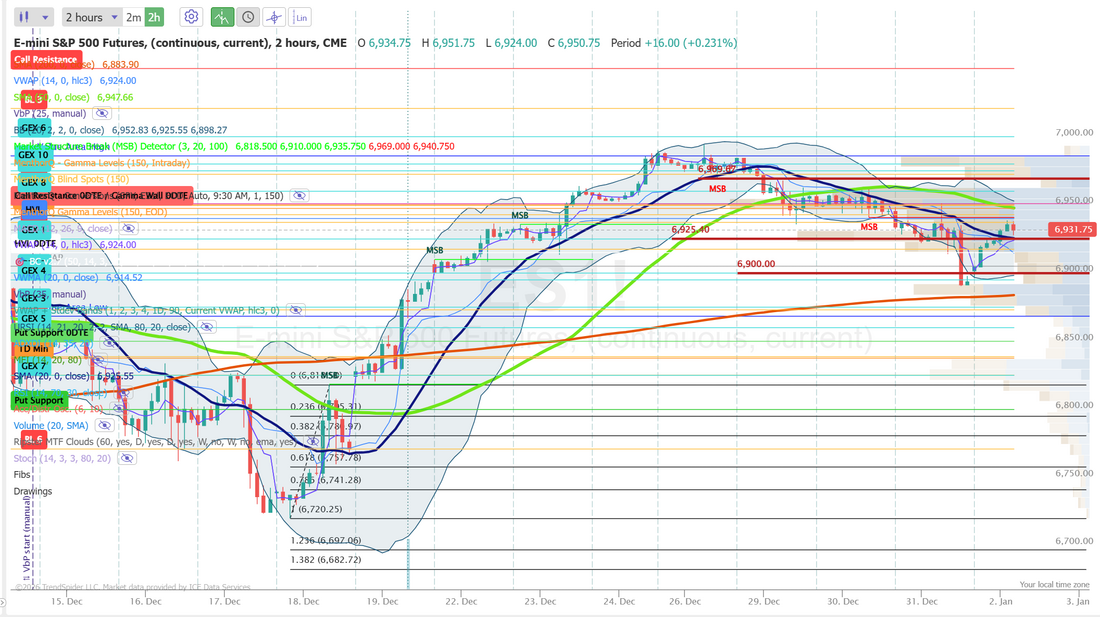

This formula will make you rich!Welcome to the new year, folks! I hope 2025 was what you hoped for in a year gone by. The truth is, it rarely is. Especially for me. We have hopes, wishes, dreams, and aspirations. It's hard for EVERYTHING to fall exactly in line. 2026 is a fresh start. It's a time for New Year's resolutions. As investors and traders, we are always looking to improve. Investing our hard-earned money in the hope that it will generate more money is an amazing concept. It's that very idea that sparked my interest in investing at the age of 15. The challenge is, it's not easy. Many, many people, much smarter than I, have tried and failed. The big news around the trading circle right now is "King Condor" and how he lost 50 million dollars over the Christmas break. Some of his followers lost their life savings following his trades, and a few have set up GoFundMe accounts so they can pay their bills. Look...it's hard. There is a constant battle between risk and reward. Of course, we always want less risk. I still get people asking if FDIC is secure. Are their CDs at the bank "safe"? As far as reward, it's never enough... no matter what it is. We always want more. I think the most important question you can ask yourself is, what is the optimal "best" target rate of return while keeping risk in check? Higher is not necessarily better. Followers of the "King Condor" trades were expecting 15-25% returns a month. Folks!... I don't even need to look at what the strategy is to tell you that it is taking on way too much risk to devote your life savings to! Here's my magic number. Write it down. Think about it. Tell me if you think I'm wrong. 2-3% a month. 24% to 36% a year. Does it sound low? Can't we make that much in a week on 0DTEs? Sure! We have, and we do! We will continue to do so. Good heck, we made 50% return on our SPX 0DTE on Weds! Guess what? You can also lose. I don't think anybody believes day trading is the place to put their life savings. Today's blog is dedicated to our amazing, award-winning (I gave the award), internationally recognized, world renowned (this part is true) A.T.M. portfolio. ATM stands for Asymmetric Trade Management. It's a highly diversified, asset allocation, hedge fund model. It follows a similar setup and structure to the great Matthew Tuttles' H.E.A.T. management approach. I'm proud to say we think very much alike. It's had another banner year. I'll get into the details shortly. First, let's look at our 0DTE results from the last trading day of the year. There are many days I say, "It looks like it's going to be a slow day, but you never know, that's why we show up every day". Weds. was one of those days. Unfortunately, my family and I (and the dogs) are up in the mountains for New years and celebrating our Son's 22nd birthday. The internet is poor, and I only have my laptop, so no scalping Zoom, but it was a rich scalping environment. Hopefully, some of you caught some of the moves. As I mentioned above, today's blog is dedicated to our ATM portfolio, but I want to be clear. I'm a trader at heart. A day trader, to be specific. When I started trading full-time time I needed the ability to make a cash flow every day (Just as you do at a job) so I could feel comfortable that I'd be able to pay my bills each month. Day trading options as a 0DTE wasn't an option. When I started, options expired once a month. Then weekly. Then three times a week. It was at that point that my focus switched to "day trading" with options. Scalping was always my go-to. For 2025, one unit (one /MNQ futures contract) brought in almost 17K in earnings. That means if you scalped 10 units with us last year (approx. 9K in capital), your scalping income could have been nearly $170,000. That's enough for a lot of people to, if not live on, at least make a good dent. Once options went to daily expirations, 0DTEs became an even bigger draw. I love them. I scalp and day trade every day. Rain, shine...if the markets open, I'm trading. Wonderful, but we all know day trading is not for the bulk of your assets. So what's to be done? I would say that if the bulk of investors simply put their life savings in the $SPY and wrote 3-month exp. 10 delta covered calls on it, they would outperform 90% of investors and Wall Street "pros." What would that historically look like? Back test it! It comes out to about 12% a year, on average. return. Is that impressive? Yes! It beats most any other investment option (on a risk-adjusted basis). The great Seth Klarman (one of the heralded titans of Wall Street) averaged 14% since 1982. If your nickname is "The Oracle," you can assume you are pretty good. All hail Warren. He's officially retired now. We are all worse off without him and Charlie to spoon-feed us wisdom. What is Warren's track record? About 19% annually. See, here's the thing. 2% a month (24% a year) will double your money every three years. Start young. Stay out of debt. Consistently add when budgets (and kids' college funds and braces) allow, and 2% a month will make you fabulously wealthy! NO MATTER HOW LITTLE YOU START WITH! That's why we created and made public our ATM asset allocation model 5+ years ago. It's a place to put the bulk of our money. Someplace where we can manage it all in 5 min. of effort each morning. Someplace that doesn't need monitoring during the day. Someplace that has the ability to make money in down markets as well as up. Someplace that has a daily cash flow component. The goal of the program is dual-fold. #1. Beat the returns of the unmanaged SP500. (If we can't do that, what's the point?) #2. Do it with less risk (the key here is making money when the index goes down) For the past five years, we've done just that. Our average return is 27.8% APR vs. the SP500 of 15.96% (with 2022 being a losing year for the market). We've had no down years. That's an alpha of 74%. Not 2-5% better, which would be excellent BTW. 74% better. And mark my words...the market has had three very solid years in a row. Down markets happen, folks. The next one is coming. Will it be this year? Who knows, but I know one is coming. It always is. Down years are where we shine. Here's a look at our results from last year. What's interesting is that the bulk of our year end gain came from our TSLA and LULU positions. These were some of our most hated positions for most of the year. We all know the saying, "buy when the blood runs in the streets" but it's hard to stomach in real life. It works though...eventually. Here's a little secret, though, about our returns. One of our "edges" we use to create Alpha is margin. It has provided us with an infinite return. I.E., borrow at 7-9%. Any excess return above that level is an infinite ROI. Standard margin is 2 to 1. Portfolio margin can be as good as 5 to 1!. Many of our members (most actually) have balances that qualify for portfolio margin. That means the net returns they have been receiving are substantially better than our posted results. Here's an actual example of one of our members who started 2025 with 1million and ended the year with a 741K profit. A return exceeding 70% for the year. This is the best way I know of to assemble a portfolio for the best shot at a good potential return with the lowest risk. If you are earnestly interested in managing your own portfolio with this approach, I'm making an offer to start the new year. I will spend up to one hour with you on a private one-on-one Zoom with you. I'll walk you through our approach. I'll answer all your questions. I promise to give you at least one piece of insight that will help you improve your investing results in 2026. All with no obligation or cost. Click here to set up your free Zoom. Https://TraderVideoConference.com All right. Let's check out the markets: Markets ended the year with a whimper. However, futures are up to start the new year. March S&P 500 E-Mini futures (ESH26) are up +0.63%, and March Nasdaq 100 E-Mini futures (NQH26) are up +1.08% this morning, pointing to a strong start on Wall Street in the first trading session of 2026. Futures on the Nasdaq 100 outperformed amid renewed optimism around AI following a wave of AI-related news from Asia. Chip designer Shanghai Biren Technology Co. jumped in its Hong Kong trading debut. Also, Baidu climbed in Hong Kong after its AI chip unit confidentially filed for an IPO. In addition, DeepSeek released a paper outlining a more efficient method for developing AI. Also supporting the positive sentiment was some relief on the trade front after Washington postponed tariff hikes on upholstered furniture, kitchen cabinets, and vanities, and cut proposed duties on Italian pasta. In Wednesday’s trading session, Wall Street’s three main equity benchmarks ended in the red. Chip stocks fell, with Micron Technology (MU) and KLA Corp. (KLAC) sliding over -2%. Also, the Magnificent Seven stocks lost ground, with Tesla (TSLA) falling more than -1% and Meta Platforms (META) dropping about -0.9%. In addition, GlobalFoundries (GFS) slipped over -3% after Wedbush downgraded the stock to Neutral from Outperform. On the bullish side, Nike (NKE) rose more than +4% and was the top percentage gainer on the S&P 500 and Dow after a regulatory filing showed that CEO Elliott Hill bought nearly $1 million worth of the footwear maker’s shares on Monday. The Labor Department’s report on Wednesday showed that the number of Americans filing for initial jobless claims in the past week fell by -16K to a 1-month low of 199K, compared with the 219K expected. The benchmark S&P 500 and tech-heavy Nasdaq 100 indexes finished 2025 up about +16.4% and +20.2%, respectively, marking double-digit gains for a third straight year—their longest winning streak since 2021. “Describing 2025 as ‘resilient’ might be an understatement. The economy showed remarkable strength by overcoming higher inflation, a slowing labor market, fewer rate cuts than originally expected, and a sharp rise in the effective tariff rate. Despite these challenges, growth remained steady without slipping into recession,” said Adam Turnquist, chief technical strategist for LPL Financial. On the trade front, U.S. President Donald Trump delayed higher tariffs on upholstered furniture, kitchen cabinets, and vanities that were set to take effect on Thursday, citing what the White House described as “productive” trade negotiations. Trump’s proclamation, signed on Wednesday, maintains a 25% tariff on the goods that the president imposed in September. The tariffs would have risen to 30% on upholstered furniture and 50% on kitchen cabinets and vanities. The delay is set for one year. Separately, Italy’s foreign ministry said on Thursday that the U.S. had sharply reduced proposed duties on several Italian pasta makers after reassessing their U.S. activities. Today, investors will focus on the U.S. S&P Global Manufacturing PMI, set to be released in a couple of hours. Economists forecast that the final December figure will be unrevised at 51.8. U.S. rate futures have priced in an 85.1% probability of no rate change and a 14.9% chance of a 25 basis point rate cut at January’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.161%, up +0.27%. Let's look at levels today on /ES. 6960 is still my resistance level with 6925 support needing to hold for the bulls, otherwise we may revisit 6900. As we start the new year I want to express my gratitude for all of you who I've crossed paths with. It has truly been a pleasure to meet so many of you. I've formed some amazing relationships with some. Gained some haters with others but overall, it's been an amazing journey. I look forward to trading with all of you in the new year. Let's take our success'. Our failures. Everything we've learned over the past year and try our best to make this year even better. Happy New year to you all. I hope your celebration was more buoyant than mine! See you in the new year.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |