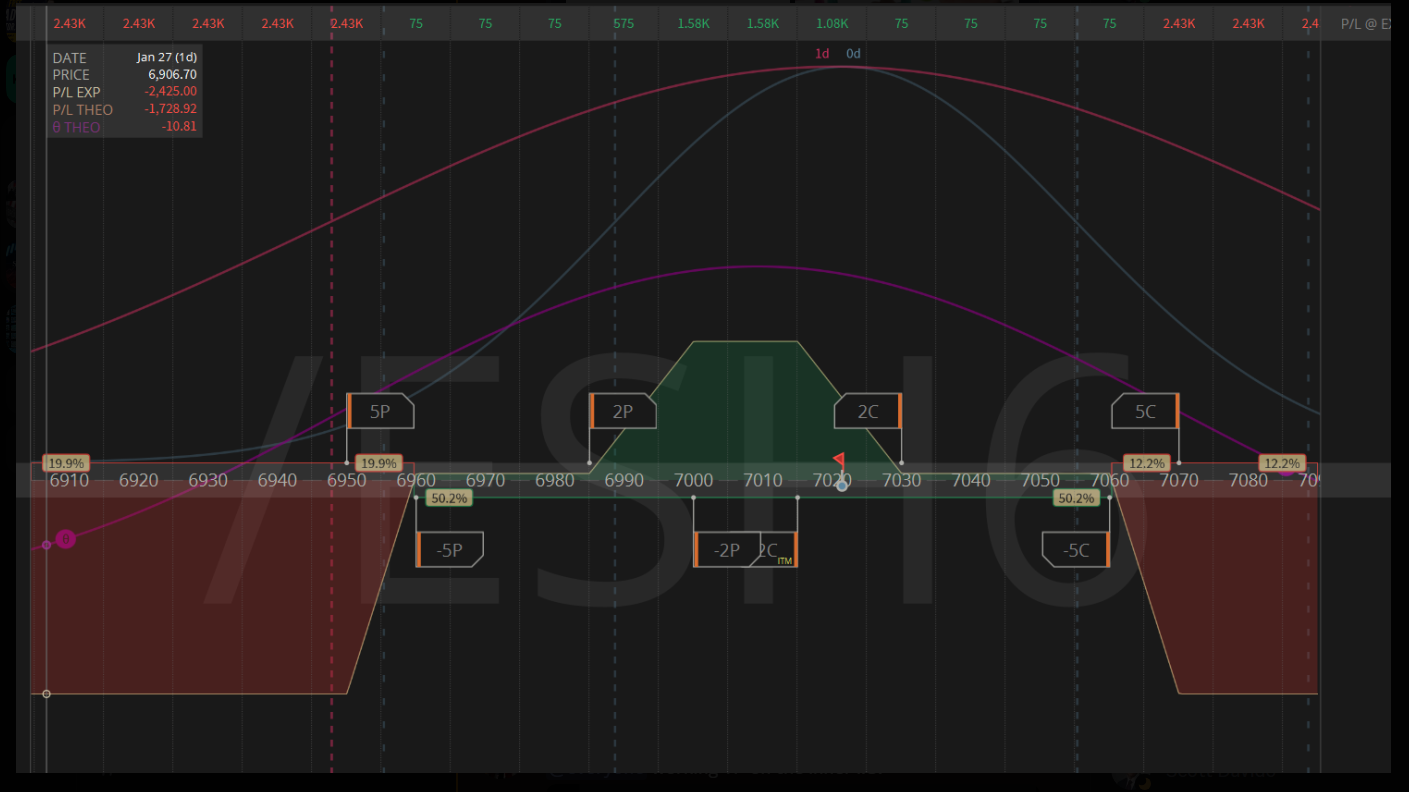

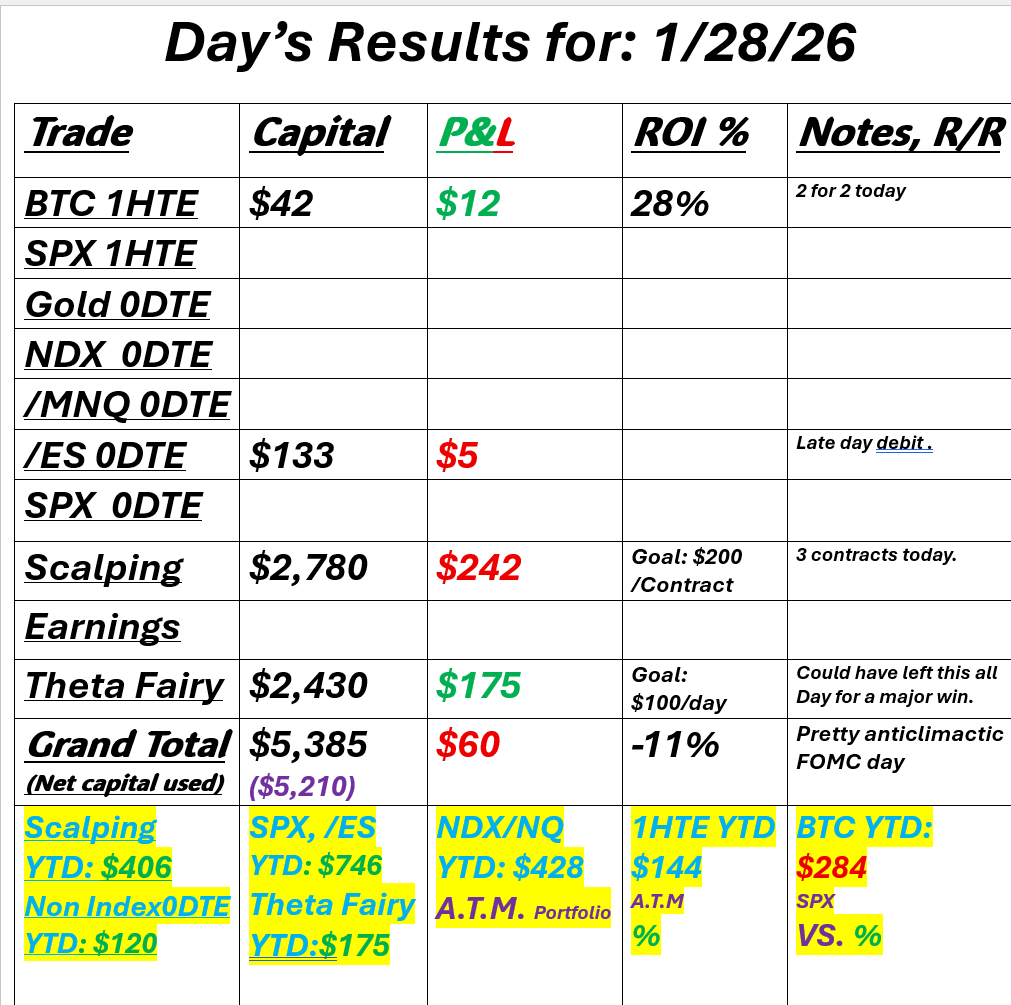

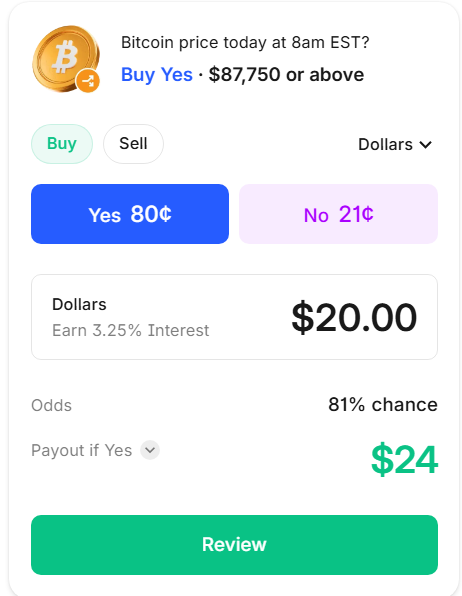

FOMC day was a bit tame.We usually look forward to FOMC day with anticipation of some nice moves that we can potentially capture. That certainly wasn't the case yesterday. Talk about a dud of a day. We pulled a nice profit on our first Theta fairy of the year but we could have just let it sit all day and scored a massive win. It's been a while since we had an FOMC day like this. It really was a day of no opportunity. I got chopped up on scalps with 3 contracts. Here's a look at my day. We've already got our day started with a 1HTE on BTC and a 0DTE on /ES Speaking of 0DTE's... I'll share some news on this. Credit Matthew Tuttle. effectively getting pulled deeper into the “0DTE world” — not with daily expirations yet, but with a major step in that direction: Monday and Wednesday expirations layered on top of the already-dominant Friday weeklies. MIAX has flagged AAPL, AMZN, AVGO, GOOGL, META, MSFT, NVDA, TSLA — and IBIT as Qualifying Securities for these new Monday/Wednesday short-dated listings, with the first expirations hitting Feb 2 and Feb 4. Here’s why this matters: this isn’t about “more products.” It’s about how markets trade now. 0DTE options already became the center of gravity in major indices — in some months, 0DTE has been more than 60% of S&P 500 options volume. Exchanges don’t expand expirations because it’s fun… they do it because demand is pulling the whole ecosystem toward shorter, cheaper, more frequent hedging and speculation. The SEC filings around these Monday/Wednesday expirations basically admit the direction of travel: expand short-term series in the most liquid names, then broaden over time. The real punchline: this is a preview of “0DTE on anything with liquid weeklies” Once you give the market Monday and Wednesday expirations in the biggest tickers on earth, you’re training investors to think in daily decision loops. Today it’s M/W/F. Tomorrow it’s every day for anything with enough volume and tight spreads. That’s the product roadmap hiding in plain sight. And if you’re an investor (not a day trader), there’s a way to look at this that’s almost the opposite of the usual “0DTE panic” narrative… The edge: why 0DTE covered calls can be structurally better than weekly/monthly overwrites The biggest advantage of 0DTE covered calls is simple: you can stop giving away the overnight return stream. Traditional overwrite strategies (weekly/monthly/quarterly) force you into a bad tradeoff:

0DTE flips the control back to you. With Monday/Wednesday expirations added to Friday weeklies, you can run an overwrite that’s closer to:

In plain English: you get to separate “owning” from “renting.”

The trap: perils of weekly/monthly/quarterly overwrite strategies (the stuff nobody puts in the brochure) 1) You’re short volatility at the worst times (whether you realize it or not). Weekly/monthly calls span macro landmines: CPI, FOMC weeks, tariff headlines, geopolitics, CEO “surprises,” regulatory shocks, and of course earnings season. You’re often collecting a known, limited premium while underwriting unknown, unlimited path dependency. 2) The income looks stable… until it isn’t. Overwrite performance can look “smooth” in calm regimes, then suddenly lag badly when markets trend higher or gap violently. The strategy doesn’t just cap upside — it can change your whole return profile at exactly the wrong moment (when dispersion and upside volatility return). 3) You create a “decision vacuum.” A monthly overwrite is basically saying: “I’m making one decision for the next 30–90 days.” That’s fine in a sleepy market. It’s terrible in a market like 2026 where the regime can flip in 48 hours. 4) You’re not just selling calls — you’re selling timing. Earnings don’t hit at noon. Policy headlines don’t wait for your roll date. Weekly/monthly overwrites force you to be short optionality during the periods where optionality is most valuable. The new playbook Starting Feb 2, the practical shift is this: three expirations a week creates three “clean decision points.” A disciplined investor can now ask, every day:

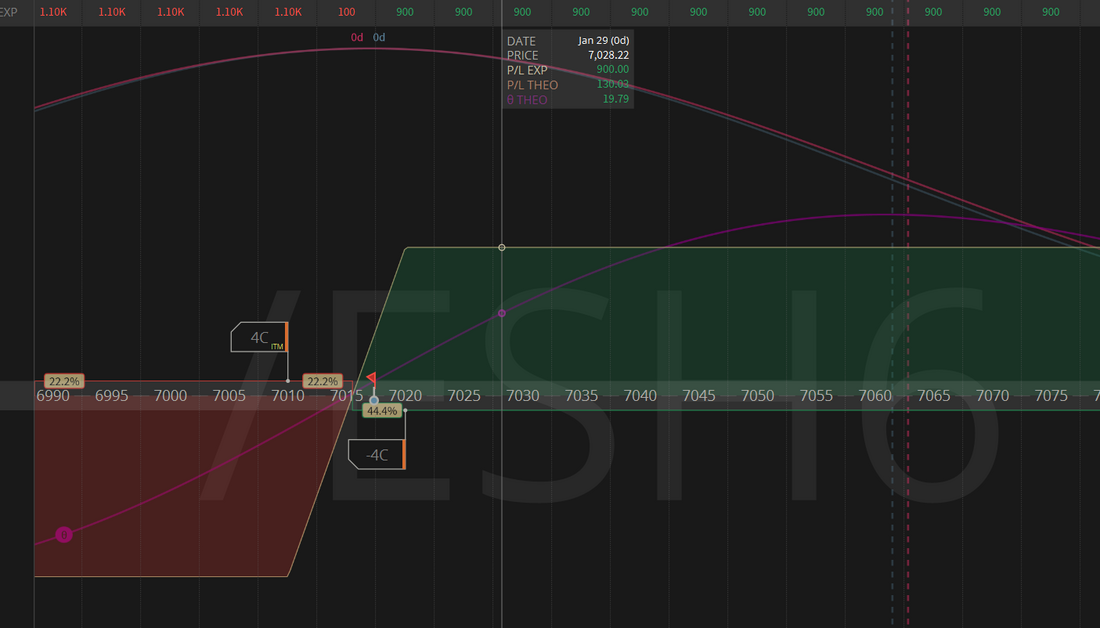

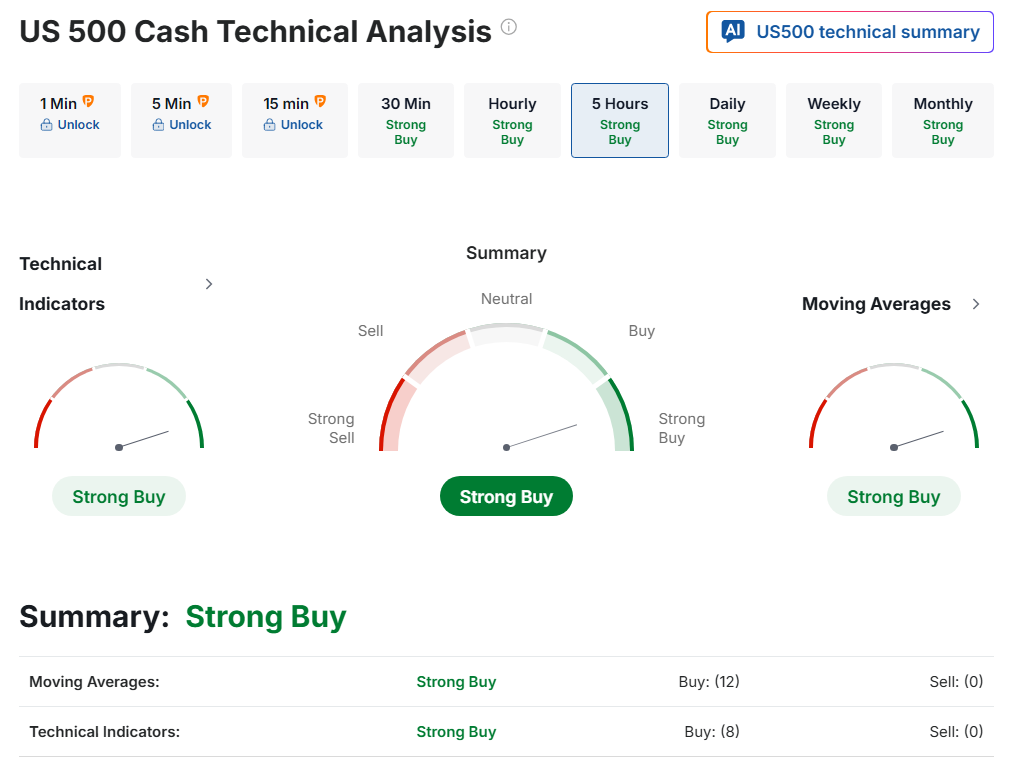

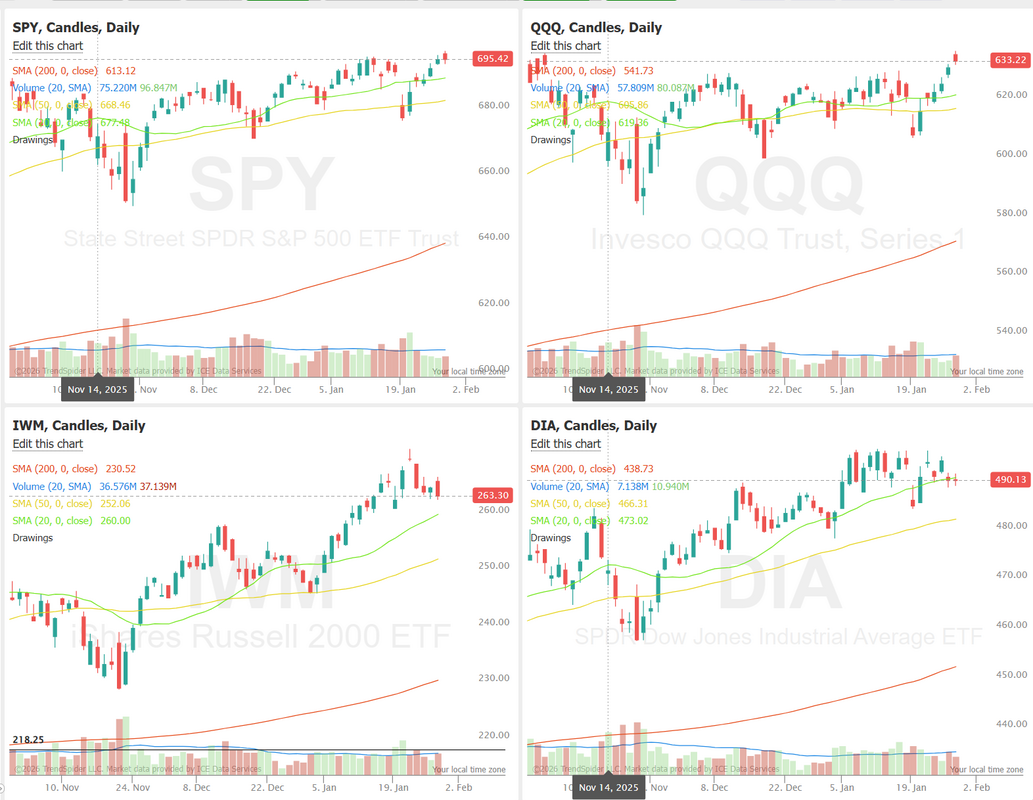

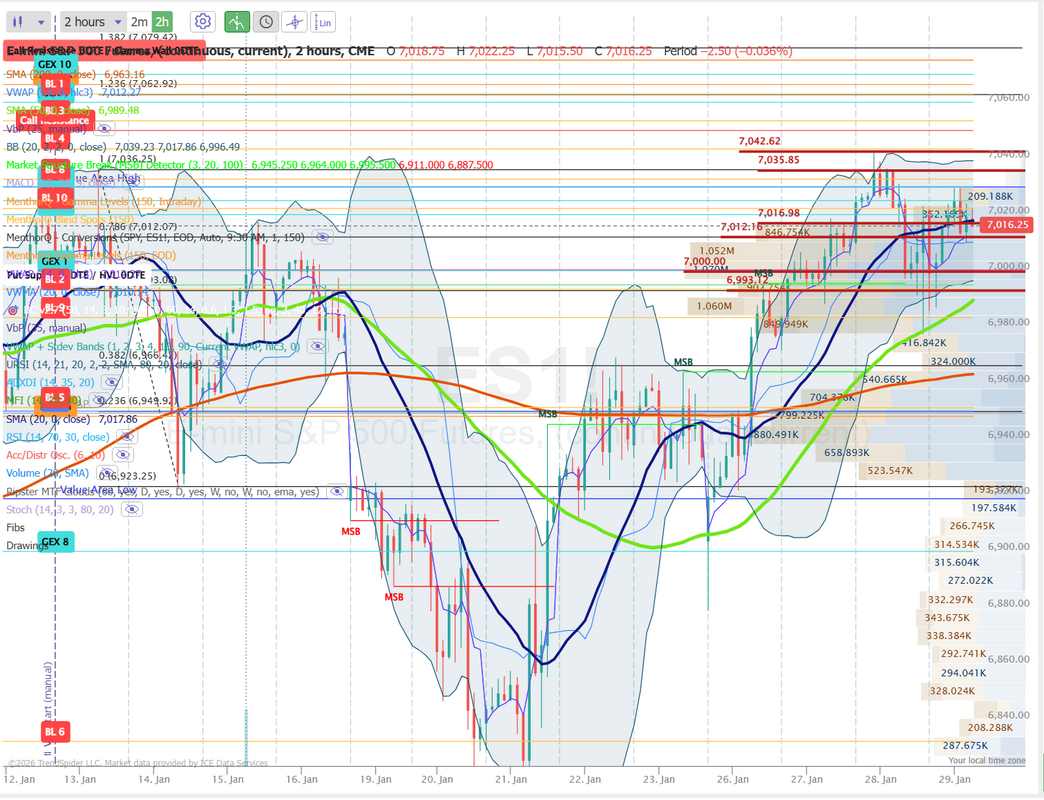

That is a very different mindset from “sell the monthly and forget it.” Quick reality check (important to say out loud) 0DTE covered calls are not magic. The premium is smaller, turnover is higher, and execution matters (spreads, liquidity, assignment mechanics, taxes, and transaction costs). Also: the closer you sell to the money, the more you’re basically trading away your upside. The “edge” isn’t the existence of 0DTE — it’s having the discretion to only sell when the compensation is worth the cap. Bottom line Feb 2 isn’t just a calendar tweak. It’s a signal. The options market is moving from “weekly hedging” to “daily positioning” — first in the biggest stocks and the biggest crypto proxy, and then outward from there. If you’ve been running call overwrite strategies the same way for years — weekly, monthly, quarterly, set it and forget it — this is your wake-up call: the game is shifting toward daily choice, daily risk management, and daily pricing of optionality. And the investors who adapt early won’t just “collect premium.” They’ll preserve the upside windows that actually move portfolios. Let's take a look at the markets: The bullish bias continues to hold tight. This question now is, how much juice do the bulls still have? We continue to play the weakness in the IWM in our ATM portfolio. Today we'll finish part two on the PPC. (Performance process cycle). This is another good one. Please join us on our live zoom feed. SPX continues to grind higher toward recent highs, but the volatility backdrop is becoming less supportive in the very short term. The volatility risk premium remains positive at ~0.9%, signaling implied volatility is still priced above realized levels, though it has been compressing and sits near the middle of its recent range. That setup often aligns with steady price action rather than sharp upside acceleration. Near-term, price strength is intact, but momentum looks more incremental, with pullbacks being shallow rather than impulsive. If volatility continues to drift lower, the index may stay supported but could see slower follow-through unless a new catalyst emerges. As always, this is market observation only and not financial advice. QQQ’s 1-month skew is showing a clear call bias, but it sits in the lower end of its recent range with a 3-month percentile near 19%, suggesting upside demand exists without extreme positioning. The 25-day risk reversal remains above its recent lows, indicating calls are still being favored over puts, yet the lack of extension toward prior highs points to measured optimism rather than aggressive chasing. In the short term, this skew profile typically aligns with continued upside follow-through or consolidation, while leaving room for skew to expand if momentum accelerates. At the same time, muted skew extremes suggest downside hedging demand is contained for now. Let's take a look at our intraday levels. As I mentioned yesterday, I'd desperately love to get another gold 0DTE working, but the price has pushed so much that we don't have the strikes on the options chain to work with. That may change today, so stay posted in the chat room. On the /ES . We already have a bullish position on. 7029, 7035, 7042 are resistance levels. 7011, 7000, and 6993 are support levels. March S&P 500 E-Mini futures (ESH26) are up +0.17%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.19% this morning as investors digest earnings reports from big U.S. tech companies. Technology stocks led the gains in U.S. equity futures as the sector’s megacaps ramped up spending to expand the infrastructure underpinning AI. Meta Platforms said it plans to invest up to $135 billion this year, well above expectations. Meta Platforms (META) climbed over +7% in pre-market trading after the social media giant posted upbeat Q4 results and issued strong Q1 revenue guidance. Also, Tesla (TSLA) gained more than +3% in pre-market trading after the EV maker reported better-than-expected Q4 results and said it would invest $2 billion in xAI. At the same time, Microsoft (MSFT) slumped over -6% in pre-market trading after the technology behemoth’s spending climbed to a record high and cloud sales growth slowed in FQ2, fueling concerns that it may take longer than anticipated for the company’s AI investments to pay off. Investors now await a fresh batch of U.S. economic data and a raft of corporate earnings reports, with a particular focus on results from Magnificent Seven member Apple. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended mixed. Seagate Technology Holdings (STX) jumped over +19% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the hard-disk-drive maker posted upbeat FQ2 results, issued above-consensus FQ3 guidance, and CEO Dave Mosley highlighted a spike in demand from AI data centers. Also, Texas Instruments (TXN) surged more than +9% after the semiconductor company provided solid Q1 guidance. In addition, F5 Inc. (FFIV) climbed over +8% after the cloud software company reported stronger-than-expected FQ1 results and raised its full-year guidance. On the bearish side, Carvana (CVNA) plunged over -14% and was the top percentage loser on the S&P 500 after activist short seller Gotham City Research released a detailed report on the company, raising concerns that its earnings were “overstated.” As widely expected, the Federal Reserve left interest rates unchanged yesterday. The Federal Open Market Committee voted 10-2 to keep the federal funds rate in a range of 3.50%-3.75%. Governors Christopher Waller and Stephen Miran dissented in favor of a quarter-point cut. In a post-meeting statement, officials said “job gains have remained low, and the unemployment rate has shown some signs of stabilization.” Policymakers also removed language referring to heightened downside risks to employment that had appeared in the previous three statements. At a press conference, Fed Chair Jerome Powell highlighted a “clear improvement” in expectations for the U.S. economy in the year ahead. “The outlook for economic activity has improved, clearly improved since the last meeting, and that should matter for labor demand and for employment over time,” Powell said. He demurred when asked what it would take for the Fed to cut again. “The Fed song remains the same — lower interest rates may be coming, but investors will have to remain patient,” said Ellen Zentner at Morgan Stanley Wealth Management. “With signs of stabilization in the labor market and inflation holding steady, the Fed is in a position to play the wait-and-see game.” Meanwhile, U.S. rate futures have priced in an 86.5% chance of no rate change and a 13.5% chance of a 25 basis point rate cut at the next FOMC meeting in March. Fourth-quarter corporate earnings season continues in full flow, and investors look forward to fresh reports from high-profile companies today, including Apple (AAPL), Visa (V), Mastercard (MA), Caterpillar (CAT), Thermo Fisher Scientific (TMO), KLA Corp. (KLAC), Lockheed Martin (LMT), and Altria (MO). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 206K, compared to last week’s number of 200K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast final Q3 Unit Labor Costs to drop -1.9% q/q and Nonfarm Productivity to rise +4.9% q/q, compared to the revised second-quarter numbers of -2.9% q/q and +4.1% q/q, respectively. U.S. Trade Balance data will be released today. Economists anticipate that the trade deficit will widen to -$43.4 billion in November from -$29.4 billion in October. U.S. Factory Orders data will come in today. Economists expect this figure to rise +1.7% m/m in November, following a -1.3% m/m drop in October. U.S. Wholesale Inventories data will be released today as well. Economists forecast that the final November figure will come in at +0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.260%, up +0.21%. I'll see you all shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |