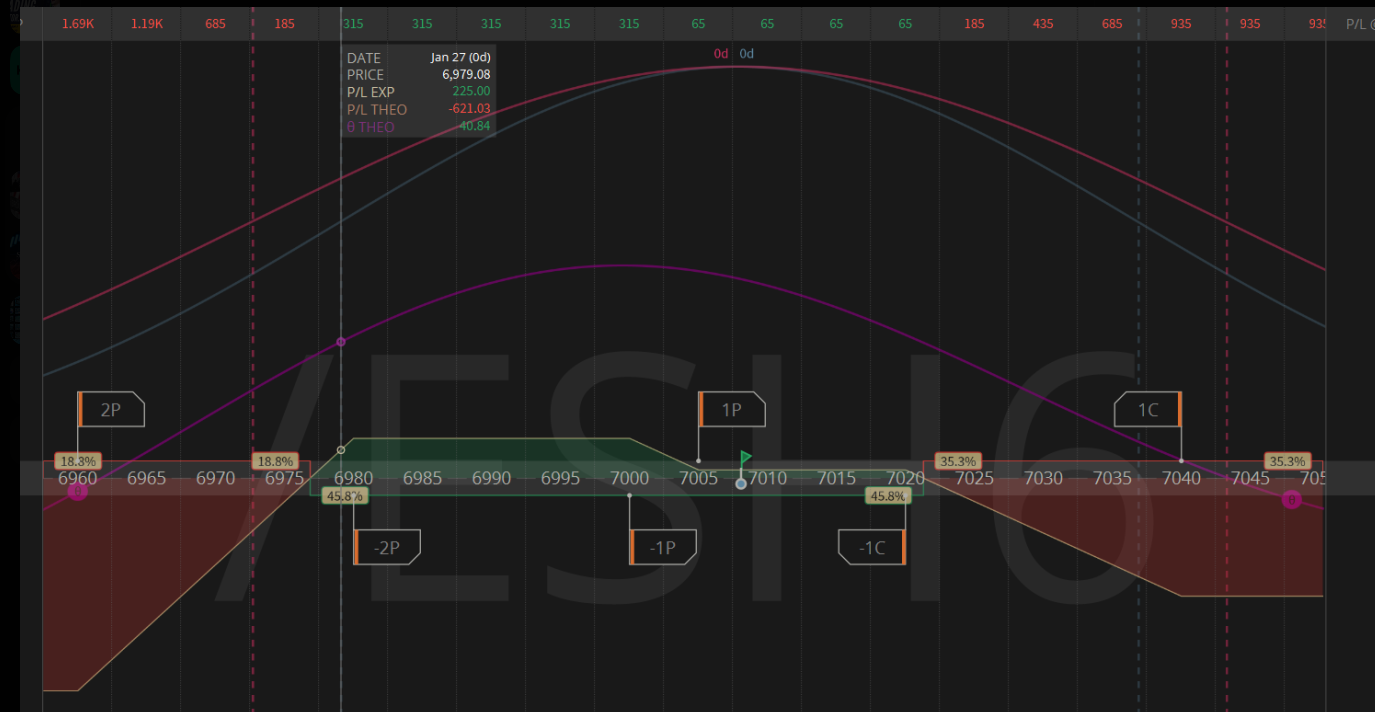

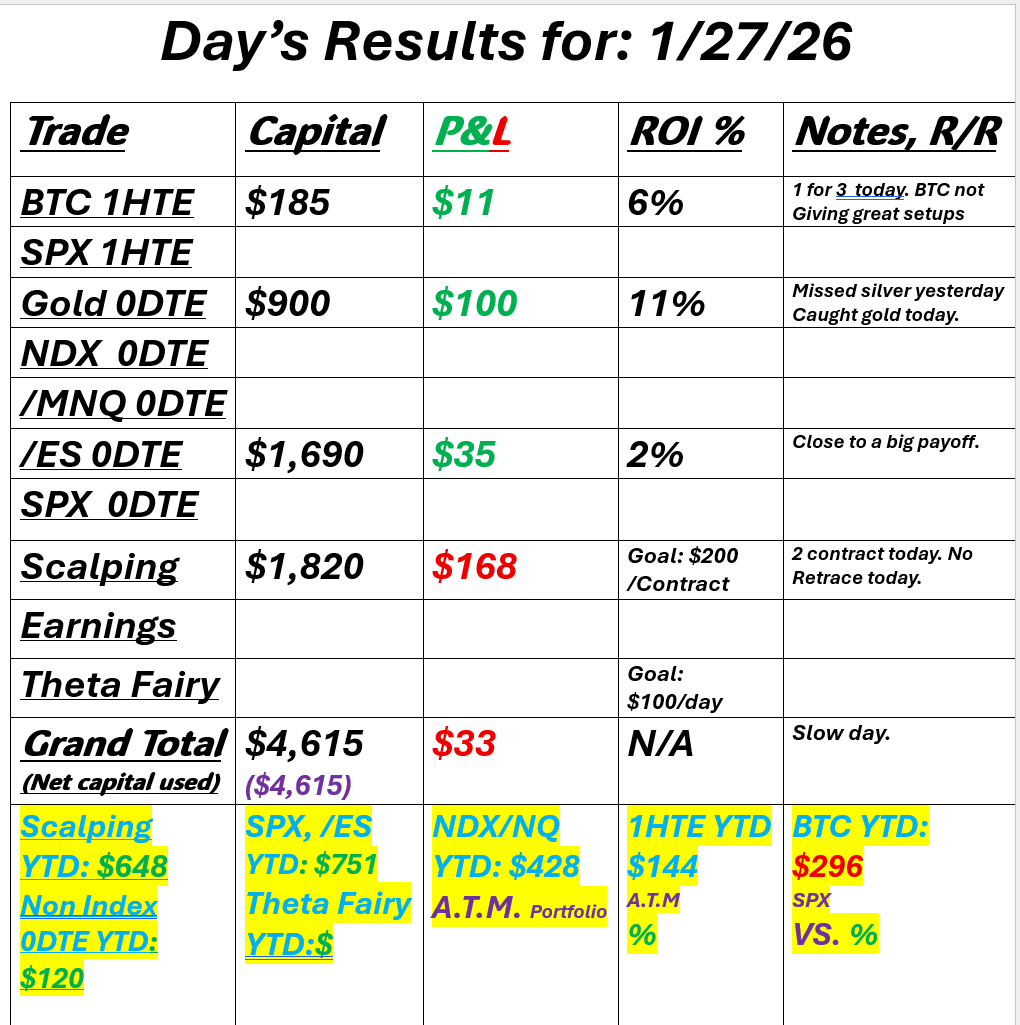

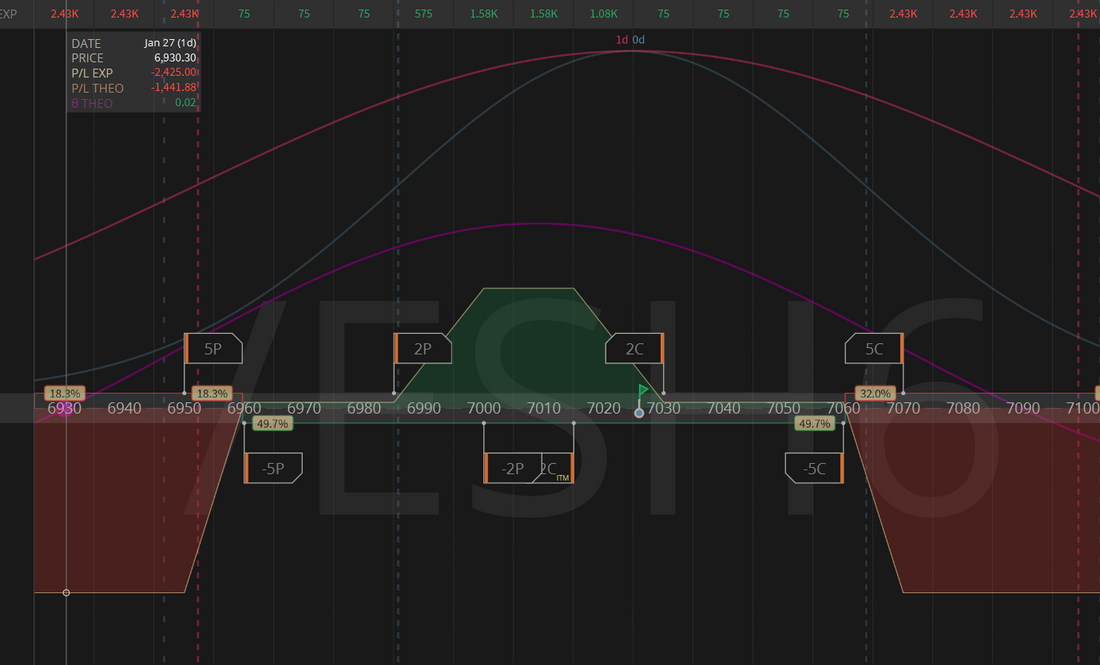

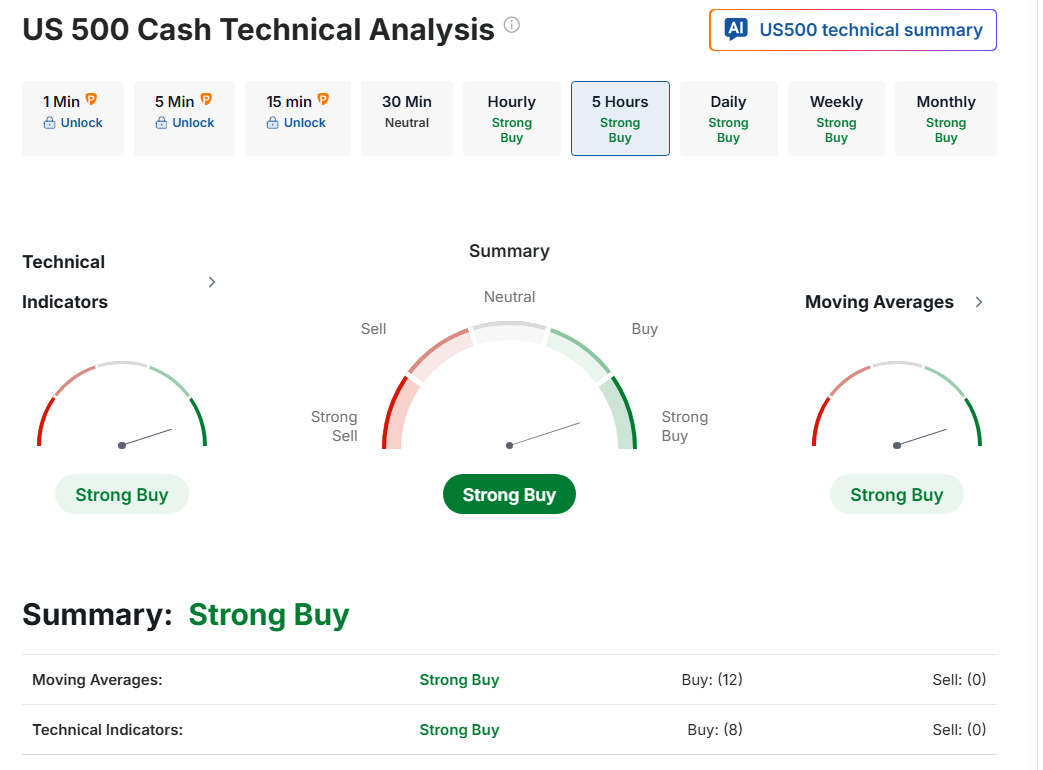

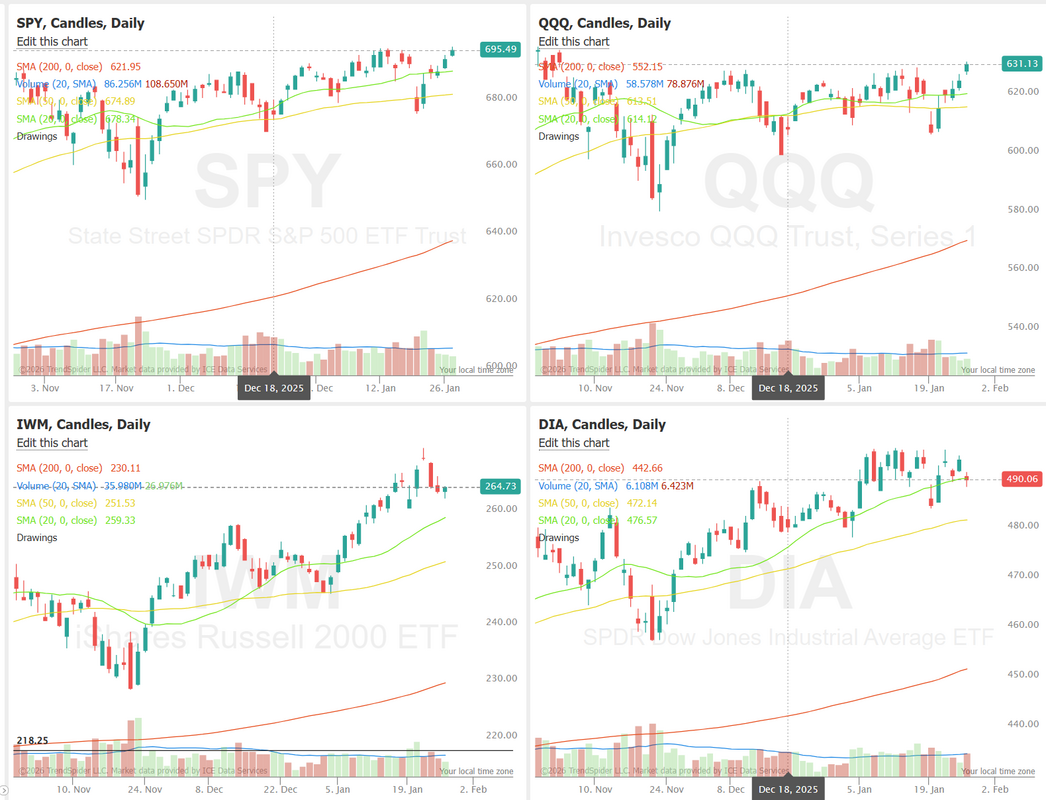

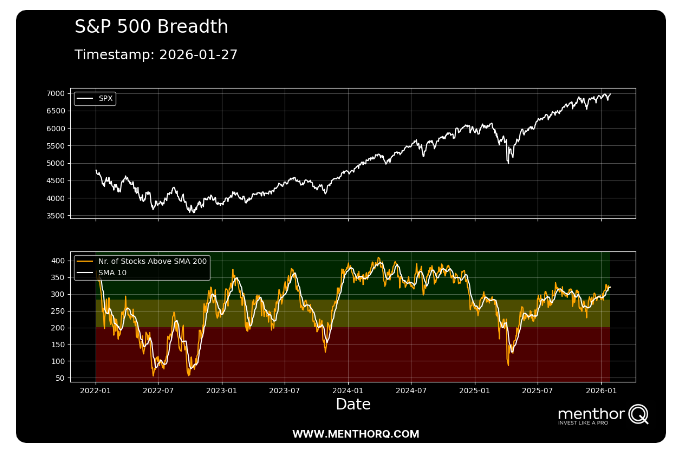

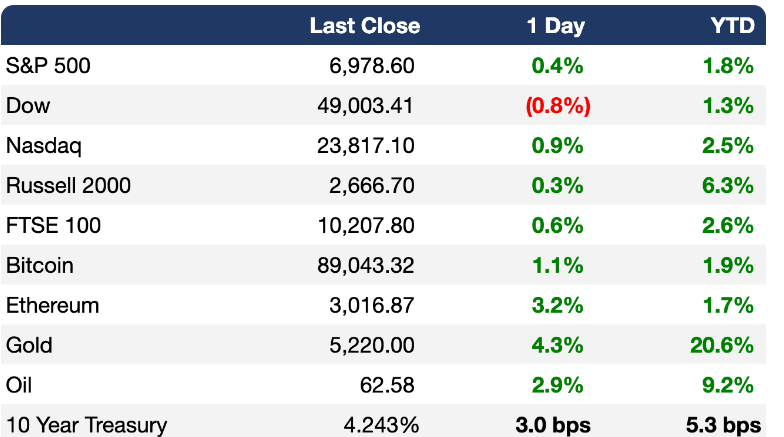

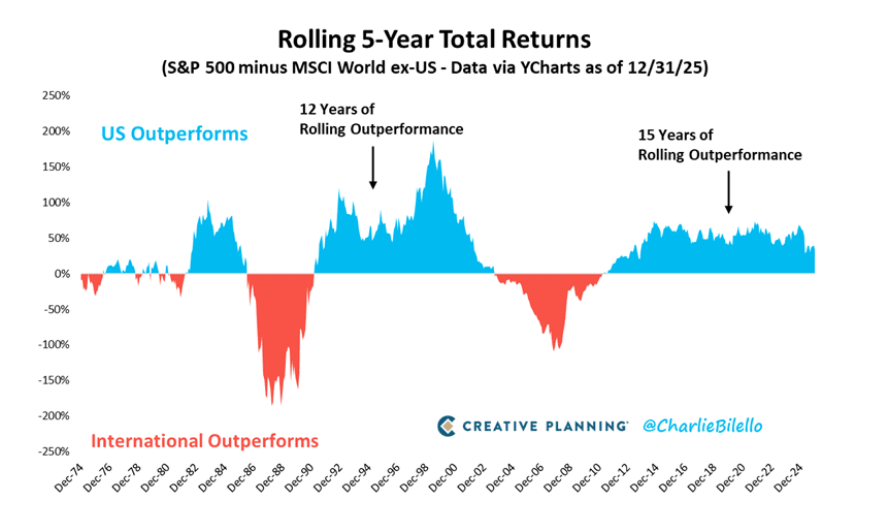

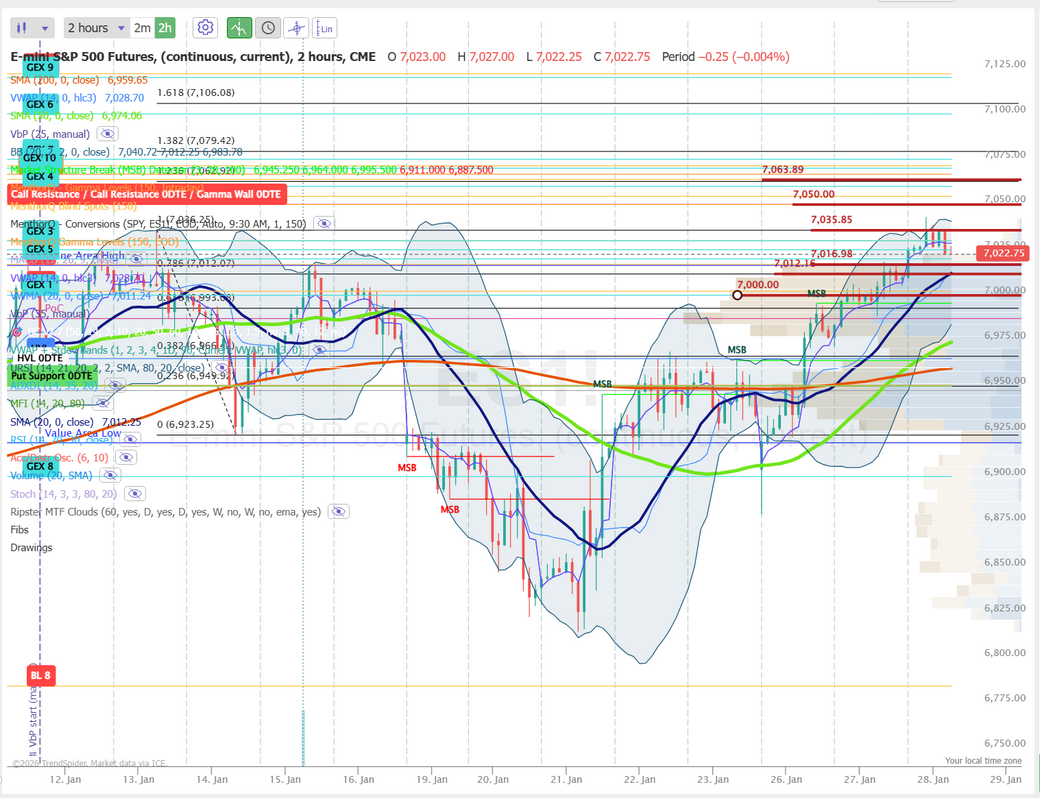

Trading and fishing=Same thing?Yesterday was a low vol, low premium day (more on that in a bit). We talk a lot about trading and fishing being similar. Many times you just don't know if there are any fish in the pond and you just need to cast your line and hope something hits. If there are fish and you catch a big one it's because you had the foresight to cast that line. If nothing hits it fills like a waste of time but to use a cross metaphor, you can't hit the ball unless you step up to the plate. Such have been the last couple days for us. We've had success. They've been profitable days but not profits we can brag about. Look at our /ES 0DTE from yesterday. I had $1820 capital in it with $315 max profit potential. This would be a 17% ROI in one day, and we consider that a home run. Unfortunately, the retrace didn't come, and we made $35 dollars. Still green. Still profitable, but not what we wanted. Scalping was the same. Looking for a retrace that just never came. Ultimately, though, these are the types of setups we like. They yield a great reward IF they hit, but risk little if they miss. Today we have FOMC. As such, we've already got our morning trade working with a modified Theta fairy. We'll target this setup until we get our desired profit or until just before the FOMC drop. Gold is continuing to push and we may be able to get another 0DTE working on that today. Yesterdays worked well. Let's take a look at the markets. Technicals remain bullish going into FOMC today. SPY hit a another new ATH. IWM and DIA are in a holding pattern. QQQ is not far behind the SPY with three strong bullish days in a row. March Nasdaq 100 E-Mini futures (NQH26) are trending up +0.88% this morning as a sharp increase in orders at ASML provided fresh momentum to the AI trade. U.S.-listed shares of ASML Holding (ASML) climbed over +6% in pre-market trading after the Dutch chip-equipment maker reported Q4 net bookings that were nearly double analysts’ forecasts and said it expects solid sales growth this year. Chip stocks rallied in pre-market trading following ASML’s results, with Intel (INTC) rising over +6% and Micron Technology (MU) gaining more than +4%. News that China had begun approving purchases of Nvidia’s H200 AI chip by Alibaba and other firms also lifted sentiment. Investors now look ahead to the Federal Reserve’s interest rate decision and U.S. megacap tech earnings. In yesterday’s trading session, Wall Street’s major indexes closed mixed, with the S&P 500 notching a new record high. Corning (GLW) jumped over +15% and was the top percentage gainer on the S&P 500 after the company announced a multiyear deal worth up to $6 billion to supply Meta Platforms with materials for data center construction. Also, chip stocks climbed, with Micron Technology (MU) rising more than +5% after the company said it will invest an additional $24 billion in Singapore over the next decade to expand its manufacturing capacity. In addition, General Motors (GM) advanced over +8% after the automaker posted better-than-expected Q4 adjusted EPS and provided solid FY26 adjusted EPS guidance. On the bearish side, UnitedHealth Group (UNH) cratered more than -19% and was the top percentage loser on the Dow after the insurer projected a drop in 2026 revenue and as the U.S. government proposed keeping payments to private Medicare plans almost flat next year. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to an 11-1/2-year low of 84.5 in January, weaker than expectations of 90.6. Also, the U.S. November S&P/CS HPI Composite - 20 n.s.a. rose +1.4% y/y, stronger than expectations of +1.2% y/y. In addition, the U.S. Richmond Fed manufacturing index rose to -6 in January, slightly weaker than expectations of -5. “Given this latest data, expect the unemployment rate to rise. This will weigh on retail sales in [the] coming months,” said Jeff Roach at LPL Financial. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 3.50% to 3.75% following three consecutive cuts at the end of 2025. This is likely to intensify President Trump’s frustration, as he is pushing for interest rates to be cut. Investors will closely watch Chair Jerome Powell’s post-policy meeting press conference for any signals on when rates could be cut again. “We expect Fed Chair Jerome Powell to emphasize that future rate moves will depend on how the economic data evolve,” HSBC economists said in a note. U.S. rate futures currently fully price in a 25-basis-point rate cut in July, with a meaningful chance of another reduction by the end of the year. Fourth-quarter corporate earnings season kicks into full gear. Investors will be closely monitoring earnings reports today from a trio of the Magnificent Seven companies—Microsoft (MSFT), Meta Platforms (META), and Tesla (TSLA). The Magnificent Seven companies are expected to deliver 20% profit growth in Q4, which would be the slowest pace since early 2023, adding pressure on the members of the group to demonstrate that the massive capital expenditures they’ve committed are beginning to generate more meaningful returns. Prominent companies like Lam Research (LRCX), International Business Machines (IBM), GE Vernova (GEV), AT&T (T), ServiceNow (NOW), and Starbucks (SBUX) are also scheduled to release their quarterly results today. On the economic data front, investors will focus on the EIA’s weekly crude oil inventories report, set to be released in a couple of hours. Economists expect this figure to be -0.2 million barrels, compared to last week’s value of 3.6 million barrels. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.248%, up +0.59%. In the very short term, SPX remains in a constructive trend, but breadth is sending a more nuanced message. The index itself is holding near recent highs, while the number of stocks above their 200-day moving average has rebounded into the mid-to-upper range rather than pushing into extreme participation. That suggests underlying support is improving, but not yet at “all-clear” levels. Tactically, continued strength in breadth above its rising short-term average would favor consolidation-to-higher behavior, while any rollover in participation back toward the mid-zone could signal a pause or shallow pullback rather than outright trend damage. Near-term price action is likely to be dictated by whether breadth can expand meaningfully from here or stalls as SPX tests overhead levels. Gold continues to "outshine" all others. It might be time to start looking for non US asset allocations to your long term portfolios. Todays training session will focus on the three stages of development for trades. Taken from the book " Mastering the Mental game of trading". Join us early today for this as we await Powells testimony. On FOMC days, I don't like to try to get too specific on a trend bias or levels, as the Algos are going to do what they like with whatever Powell says. We want to stay open-minded and reactive. That being said, we can look at the major support/resistance levels going into today. 7035, 7050, and 7063 all appear to be major resistance levels. 7017, 7012, and 7000 are support levels. I look forward to seeing you all in the live trading room shortly. We should have a good training today and FOMC is always exciting.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |