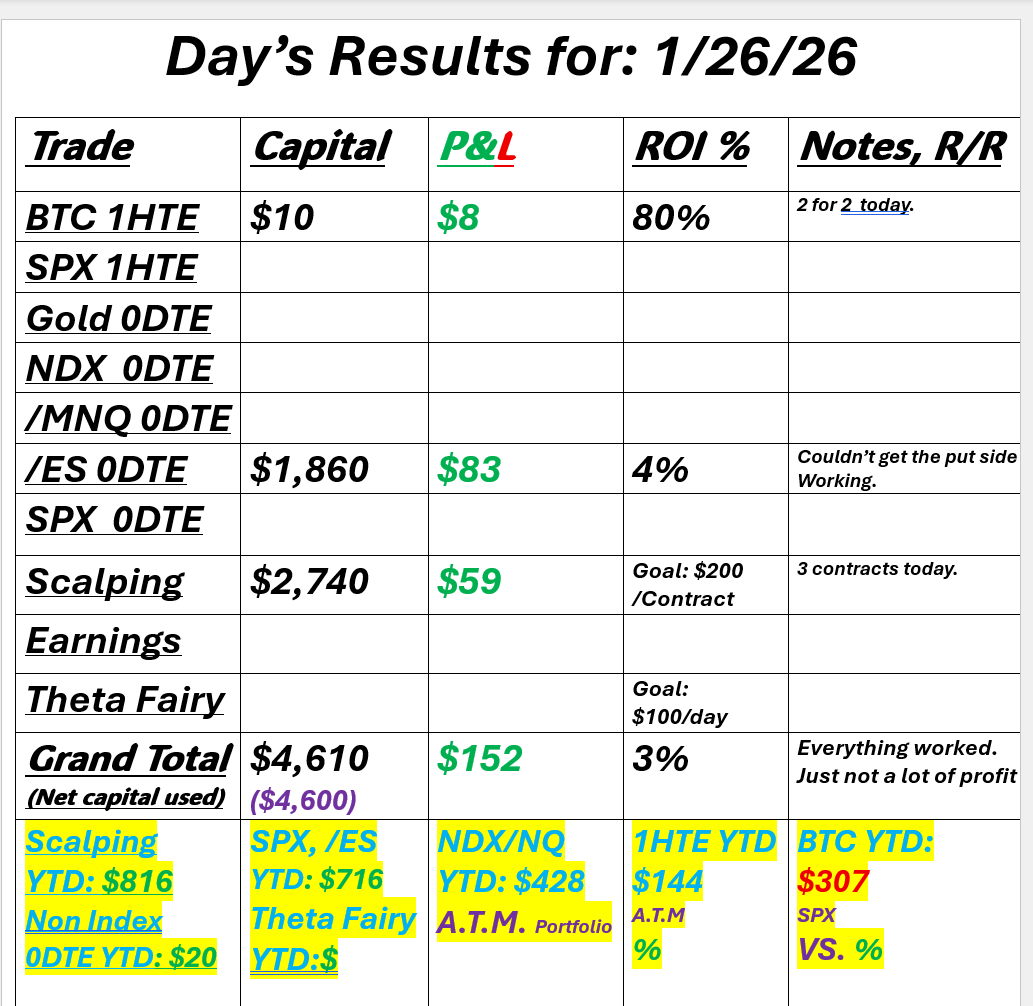

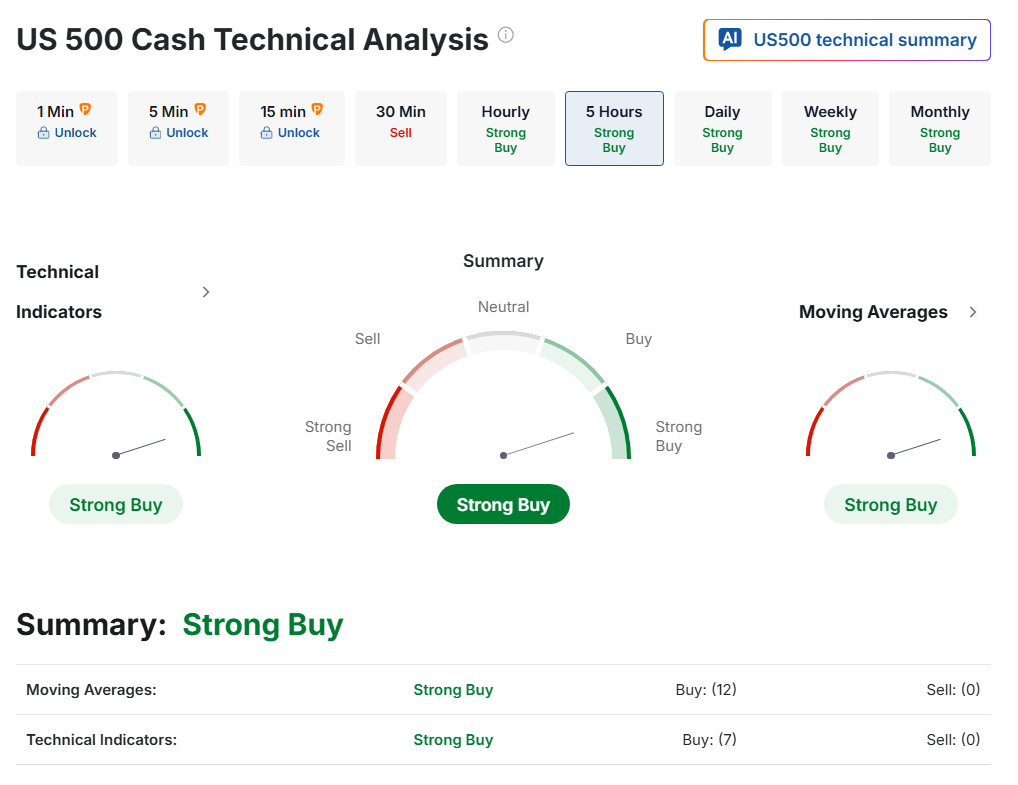

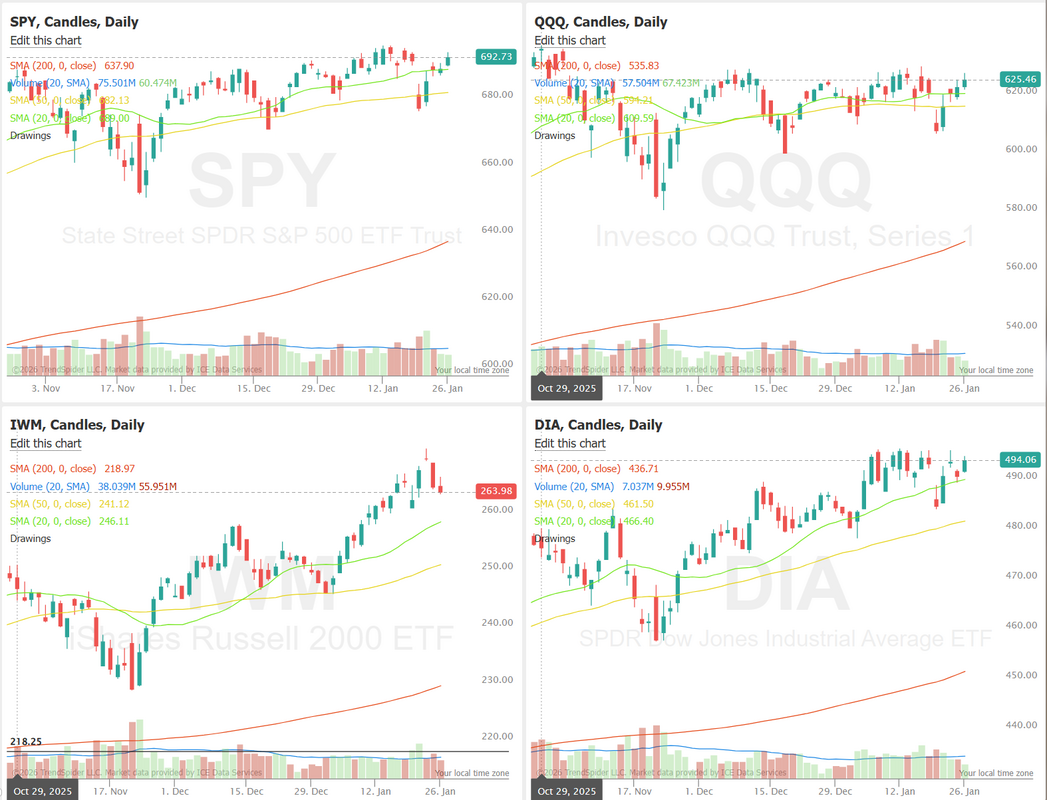

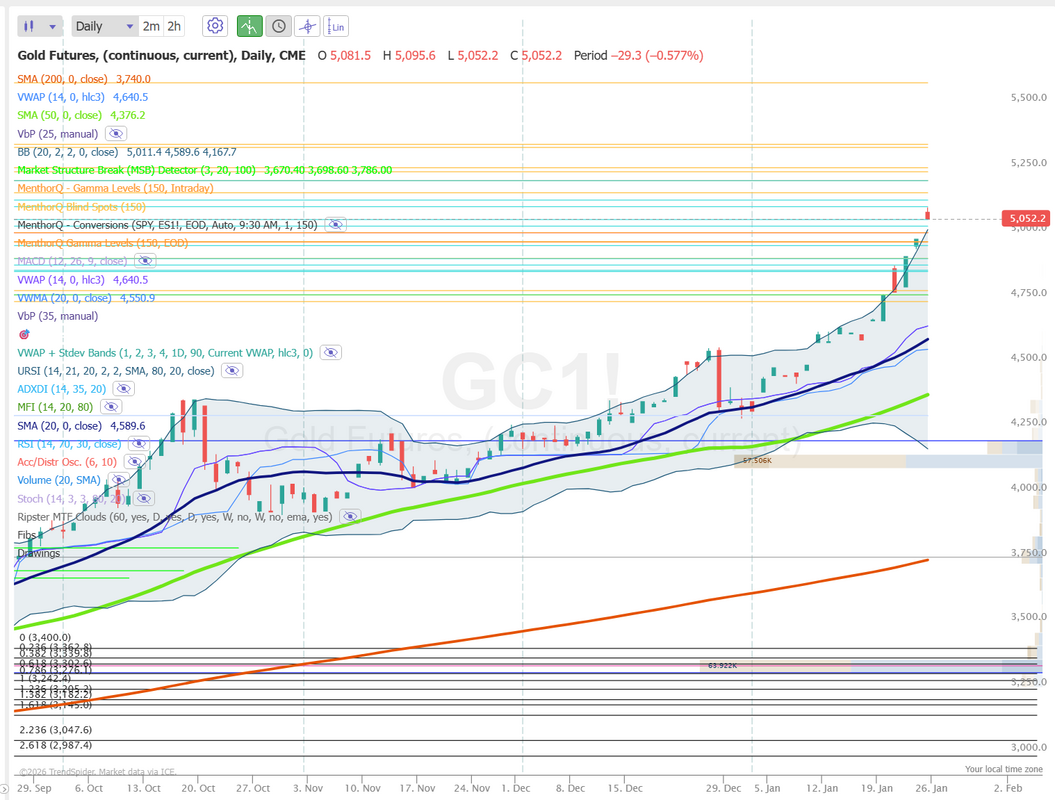

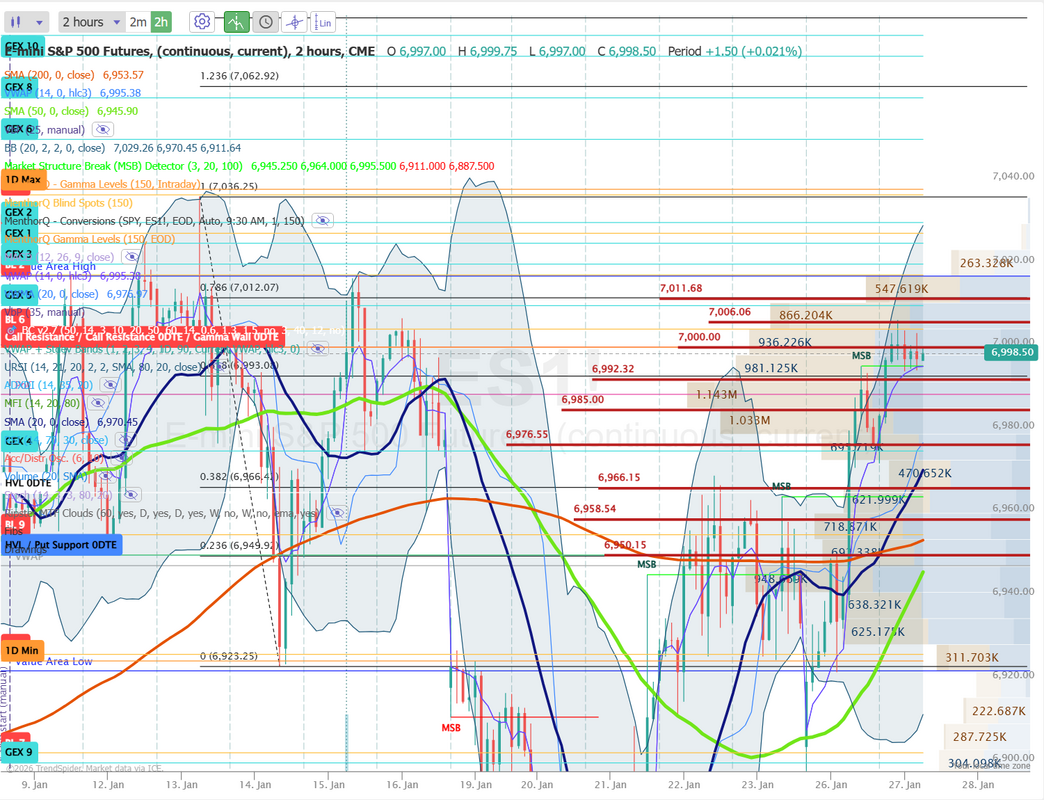

How big of a deal is Iran?Welcome back, traders! Does it seem like we've got more geopolitical headlines now than ever? I'm waiting for the Iran situation to resolve...whatever that means. Trump said we've sent naval vessels to the region. The question is, do we use them? Our question, of course, is how this affects the markets. We had a "perfect" day yesterday, meaning everything we touched worked. They just didn't yield much in terms of actual profit. That's all right. I can't get upset anytime we make money. Would we have liked more? Sure. I was very focused yesterday on putting on a silver reversal trade. We were patient and waited for the setup. We nailed the entry time and then wham!...margin requirements shot up threefold. I'll try again today with gold. Here's a look at the day. Let's take a look at the markets. Technicals are still locked in buy mode. We do have a bit of a reversal on the interest sensitive IWM (we've got a trade on that in the ATM portfolio) but otherwise we are attempting to push those ATH's. $SPY volume closed the cash session near 54M. That’s not “extremely low volume”. The higher it gets in price, the volume drops. When $SPY traded in the 80s and 90s in Oct of 2008, we’d see 500M days often. Under 40M volume for $SPY catches my attention. Volume is low, though. At some point, all bulls get exhausted. March S&P 500 E-Mini futures (ESH26) are up +0.26%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.60% this morning, buoyed by gains in technology stocks, while investors await the start of the Federal Reserve’s two-day policy meeting, as well as a new round of U.S. economic data and corporate earnings reports. Futures on the Nasdaq 100 outperformed as chip stocks advanced in pre-market trading, led by a more than +5% gain in Micron Technology (MU) after the company said it will invest an additional $24 billion in Singapore over the next decade to expand manufacturing capacity amid an AI-driven memory chip shortage. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Most members of the Magnificent Seven stocks advanced, with Apple (AAPL) rising nearly +3% and Meta Platforms (META) gaining more than +2%. Also, Arista Networks (ANET) climbed over +5% and was the top percentage gainer on the S&P 500 after Wells Fargo analyst Aaron Rakers said he sees Microsoft’s launch of its second-generation Maia 200 AI chips as a “derivative positive” for the company. In addition, Baker Hughes (BKR) rose over +4% after the company posted better-than-expected Q4 results and said it plans to double its data center equipment order target to $3 billion over three years. On the bearish side, Revolution Medicines (RVMD) plunged over -16% after The Wall Street Journal reported that Merck is no longer in talks to acquire the company. Economic data released on Monday showed that U.S. durable goods orders climbed +5.3% m/m in November, stronger than expectations of +3.1% m/m, and core durable goods orders, which exclude transportation, rose +0.5% m/m, stronger than expectations of +0.3% m/m. On the trade front, President Trump on Monday threatened to raise tariffs on goods imported from South Korea to 25% from 15%, citing what he described as the failure of the country’s legislature to formalize the trade deal agreed last year. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 3.50% to 3.75% following three consecutive cuts at the end of 2025. Investors will closely watch Chair Jerome Powell’s post-policy meeting press conference for any signals on when rates could be cut again. “We expect Fed Chair Jerome Powell to emphasize that future rate moves will depend on how the economic data evolve,” HSBC economists said in a note. U.S. rate futures currently fully price in a 25-basis-point rate cut in July, with a meaningful chance of another reduction by year-end. Fourth-quarter corporate earnings season is in full swing, with investors looking ahead to fresh reports from prominent companies today, including UnitedHealth Group (UNH), RTX Corporation (RTX), Boeing (BA), NextEra Energy (NEE), Texas Instruments (TXN), Union Pacific (UNP), HCA Healthcare (HCA), Northrop Grumman (NOC), United Parcel Service (UPS), and Seagate Technology Holdings (STX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the January CB Consumer Confidence index will stand at 90.6, compared to last month’s figure of 89.1. The U.S. S&P/CS HPI Composite - 20 n.s.a. will also be reported today. Economists expect the November figure to ease to +1.2% y/y from +1.3% y/y in October. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -5 in January, compared to the previous value of -7. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.223%, up +0.21%. SPX remains in a short-term uptrend, holding near recent highs after a shallow pullback, but the option score has cooled into the low-to-mid range, signaling less supportive near-term options dynamics. This combination often points to slower upside follow-through unless participation or volatility re-expands. In the very short term, price holding above the recent consolidation lows keeps the trend intact, while failure to reclaim momentum quickly could invite range-bound trade or a brief mean-reversion move. Tactically, this is a spot where price strength needs confirmation from improving option conditions; otherwise, patience around support and reaction levels may matter more than chasing extensions. QQQ’s 1-month skew remains modestly call-biased, with the risk reversal sitting near the middle of its recent range and a 3-month percentile around the low-50s. From a q-option perspective, this suggests upside participation is still being favored, but without the kind of aggressive call demand that typically signals crowded bullish positioning. In practice, options markets appear to be pricing balanced outcomes: some willingness to pay for upside exposure, while still maintaining protection against pullbacks. This configuration often aligns with a market that expects continued grind higher, but with enough uncertainty to keep downside insurance relevant rather than dismissed. Let's take a look at our intraday levels for both gold and /ES. We'll try again for a 0DTE on Gold. It's been quite a run but we did get a pause yesterday. On /ES I'm watching 7000, 7006, 7011, 7017 are resistance levels with 6992, 6985, 6976, 6966 are support. I'll see you all in the live trading room shortly. Let's see what we can get going with Gold, /ES, /MNQ and possibly some 1HTE's on BTC.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |